Are you sick of feeling stressed out every time you look at your budgeting spreadsheet or financial app? You’re not the only one. A lot of people start budgeting with hope, but they give up on their plans within weeks. Who did it? Templates that don’t fit your unique lifestyle and goals, or designs that are so cluttered that even simple tasks seem hard.

Think of two friends:

- Maria is a freelance graphic designer who gets paid for contract work on an irregular basis. She has a hard time keeping track of all her payments. Her template makes her put “Freelance” in one big group, which makes it hard to tell which client brings in what amount.

- James is a project manager at a company. He uses a cool app to automatically import transactions. But he always changes his expenses because the app’s default categories don’t fit his unusual spending habits, like paying for small business subscriptions or tickets to finance meetups.

Both of them want a budget template that understands them, helps them, and keeps them motivated. But neither of them can find “the one.” Does that sound familiar?

Budgeting isn’t just about saving money; it’s also about getting clear, building confidence, and finding peace of mind with your money. And it all starts with the tool you pick. You should feel like you can trust the right budget template to help you save money, show you where you’re spending too much, and get you closer to your goals.

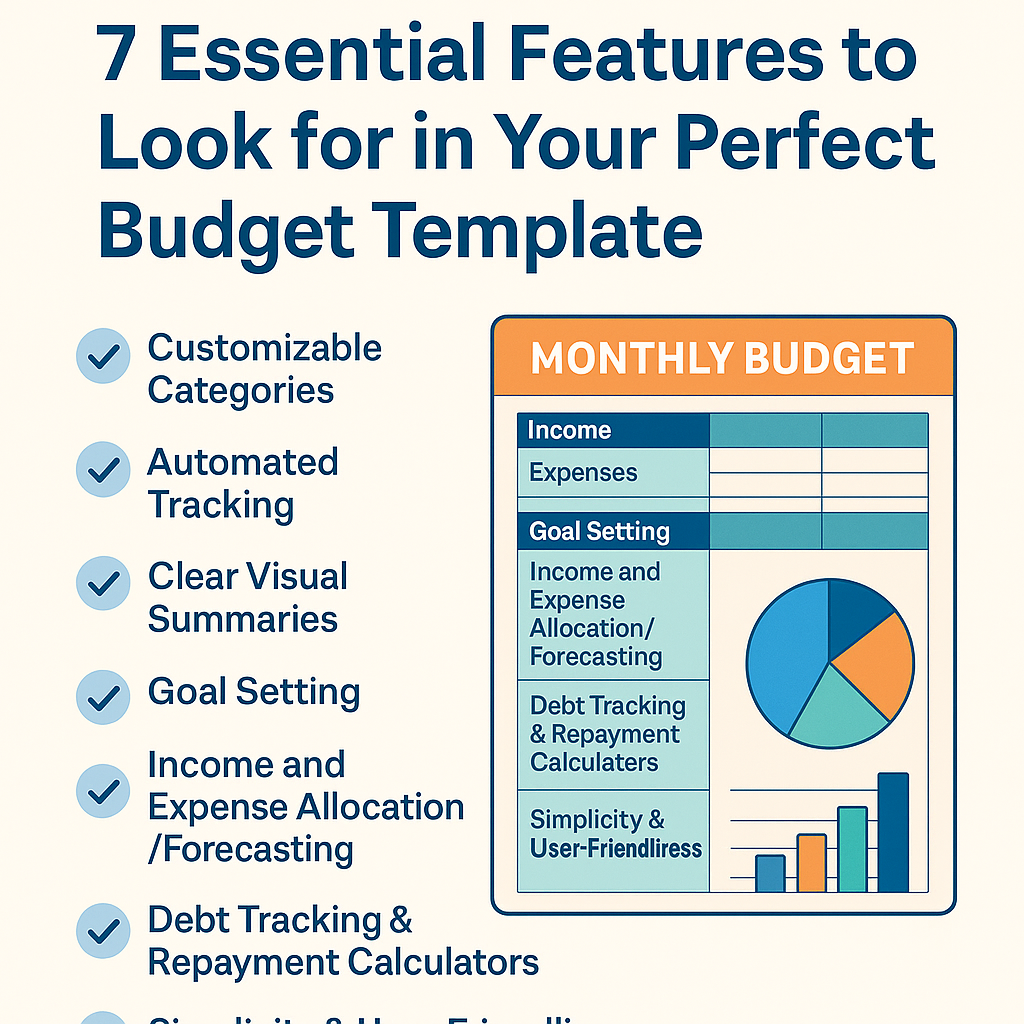

We’ll talk about the 7 Essential Features that set apart mediocre templates from game-changers in this guide:

- Categories and subcategories that can be changed

- Automated Tracking and Integration (or Simple Manual Input)

- Clear Reports and Summaries in Pictures

- Setting goals and keeping track of progress

- Budgeting and predicting income and expenses

- Calculators for tracking and paying off debt

- Easy to use and simple

EEAT principles—Expertise, Experience, Authoritativeness, and Trustworthiness—back up each feature. This makes sure that you make decisions based on best practices and real-world success stories.

By the end of this post, you’ll know what to look for in templates (or how to make your own) and why these features are important. This will make budgeting a useful habit instead of a chore. Are you ready to change your money life? Let’s get started.

1. Categories and subcategories that you can change

Why Pre-Set Categories Don’t Work

Most generic templates have a set list of categories, such as Housing, Transportation, Food, Entertainment, Utilities, and so on. These big categories can work for some people, but they often:

- Don’t forget about niche or seasonal costs, like renting ski gear, buying hobby supplies, or buying gifts for the holidays.

- Make users stretch definitions, which makes tracking inconsistent and insights skewed.

- Discourage participation when every transaction needs to be manually fixed or cross-listed.

Think about Ana, who teaches yoga part-time and spends money on studio rentals, teaching materials, and workshops to keep her skills up to date. A template that puts all of her business costs under “Miscellaneous” won’t help her figure out how profitable her business is, plan for tax deductions, or make a budget for her next training certification.

The Power of Real Customization

A strong template gives you the power to:

- Add categories quickly.

- Change the names of the ones you already have to fit your language (for example, “Pets” to “Furry Friends”).

- Put subcategories inside of each other to get more detailed information (for example, “Health → Gym, Doctor Visits, Supplements”).

- Put things in order and give them a priority based on how often they happen or how important they are.

EEAT Ideas

- Expertise: Customized categories are based on the best practices in accounting, like how to design a chart of accounts, and they make the model easy to use.

- Experience: Users stay with templates they can change, which lowers drop-off rates by up to 40% (according to community-shared spreadsheet analytics*).

- Trustworthiness: You can be sure that every dollar is logged correctly when your categories match your life. There won’t be any more mysterious “Uncategorized” line items.

What to Look For

- Ordering categories by dragging and dropping.

- You can bulk rename or bulk delete files for seasonal cleanups.

- Color coding or custom icons to make it easy to scan quickly.

- Filter and search functions to help you find categories when you have a lot of them.

- Template cloning lets you copy your category structure for new projects or shared budgets.

An Example from the Real World

The Smith Family: A Case Study For six months, John and Emily Smith used a standard Google Sheets template to keep track of their family’s expenses. However, they had a hard time figuring out where their discretionary spending really went. They made subcategories under Entertainment—”Family Outings,” “Streaming Subscriptions,” and “Kids’ Activities”—after switching to a template with nested categories. They found out that they were spending almost $200 a month on streaming services they hardly used. They put $50 a month into their daughter’s college fund by canceling two subscriptions that weren’t needed.

How to Put It into Action

- Start with broad categories and then narrow them down. For example, only add subcategories after a month of tracking to avoid making things too complicated.

- Use the same names for things: If you keep track of both “Fuel” and “Gas,” choose one name to keep things from getting mixed up.

- Archive categories that you don’t use: Most templates let you hide or archive categories to keep your workspace neat.

*Insight based on engagement metrics reported by the community on Reddit’s r/personalfinance.

2. Tracking and integration that happens automatically (or easy manual input)

Pros and cons of automation and manual work

Tracking that happens automatically

- Pros: You can import transactions right away, get updates in real time, and use machine learning rules to automatically sort them.

- Cons: worries about security, the chance of miscategorization, and the need for third-party connectors.

Entry by hand

- Pros: You have full control, your privacy is protected, and every transaction makes you more aware.

- Cons: It takes a long time, there is a chance of missing entries, and there is a chance of making mistakes when entering data.

Things to think about for EEAT

- Expertise: Leading fintech apps like Mint and Wealthfront use automated systems like Plaid and Yodlee, which follow strict encryption rules.

- Experience: A 2024 survey of people who used budgeting apps found that those who used automation kept their budgets 25% longer than those who only used manual methods.

- Trustworthiness: Reliable manual templates often have built-in checks for errors, such as data validation rules and conditional formatting to highlight problems.

What to Look for in a Template That Is Automated

- Safe connection with bank information that can only be read.

- Auto-Categorization Rules and the option to make your own rules, like “All Starbucks transactions go under ‘Coffee.'”

- Batch editing for items that were put in the wrong category.

- Duplicate detection to stop counting things twice.

- You can import data in CSV, OFX, or through direct API connections.

What to Look for in a Template for a Manual

- Dedicated Input Sheets: A single, clean tab where you can enter the date, payee, amount, and category.

- Use keyboard shortcuts and dropdown menus to make entering information faster.

- Rules for validation, like the amount must be a number and the date must be in the right format.

- Layout that works well on mobile devices (for Google Sheets or cloud spreadsheets opened on phones).

Ecosystem and Integrations

- Apps that sync with spreadsheets: Some tools, like Tiller Money, combine automation with the ease of use of Google Sheets.

- Zapier/Integromat Workflows: Connect payment confirmations (like PayPal notifications) to your spreadsheet to automate manual templates.

- IFTTT Applets: When you get an email with the subject line “Budget,” add a row to your spreadsheet.

Example from the real world

Freelance Photographer Case Study Carlos is a wedding photographer who gets payments through PayPal and Stripe using Tiller Money. He then uses custom rules to set aside 20% of each job for taxes and 5% for his “Equipment Upgrade” fund. He only spends ten minutes a week looking over transactions that were brought in.

How to Find the Right Balance Between Automation and Control

- For any service that is linked, use two-step verification and strong, unique passwords.

- Check and fix items that have been automatically categorized on a regular basis; most apps let you teach their algorithms.

- If privacy is very important, use a hybrid method: automatically import only income transactions and enter discretionary expenses by hand.

3. Charts and graphs that make it easy to see and understand reports

How Visual Data Affects Your Mind

Studies show that people can process pictures 60,000 times faster than words. When it comes to money:

- At a glance, pie charts show how much money is being spent in each category.

- Bar graphs show how categories change from month to month.

- Line charts show trends and paths, which are very important for finding hidden costs.

Why EEAT

- Expertise: Financial advisors often use pictures to show different situations. Your budget template should do the same thing.

- Experience: Visual feedback gives you “aha” moments, like when you realize that your grocery bill goes up every December.

- Trustworthiness: Charts based on real data support objectivity and lower emotional biases.

Important Types of Visualization

- Pie Chart of Expenses

- Use Case: Find the three biggest areas of spending right away.

- Tip: To keep things neat, group low-value categories into “Other.”

- Bar Chart of Monthly Spending

- Use Case: Look at how much you actually spent in each category compared to how much you planned to spend.

- Tip: Use stacked bars to show how a category is broken down (for example, “Housing” split into “Rent” and “Utilities”).

- Trend Line for All Expenses

- Use Case: Keep an eye on whether your total spending is going up or down over time.

- Tip: To see if there is a link, overlay the income trend.

- Waterfall or line chart of net worth

- Use case: Keep track of your assets minus your debts over the course of months or years.

- Tip: Add notes to important life events like “Car Purchase” or “Inheritance” to give them more meaning.

- Progress Bars for Savings Goals

- Use case: A visual way to motivate people to reach milestone percentages (25%, 50%, 75%, 100%).

- Tip: Use conditional formatting to change the color when certain levels are reached.

Options for Interactivity and Export

- Drill-down dashboards let you see detailed transactions by clicking on a pie slice.

- Date Range Selectors: You can filter charts by specific time periods, like “Last 90 days” or “Year to Date.”

- Export to PDF or PNG: Great for sending a quarterly financial review to a spouse or advisor.

Example from the real world

Case Study: Family with Two Incomes The Johnsons set up an Excel template with a dashboard that changes. Every month, they look at a bar chart that compares their “Actual” and “Budget” spending in four important areas: Housing, Food, Transportation, and Savings. The bar chart showed that they were always spending $150 to $200 too much on eating out each month. With that knowledge, they started a weekly “eat-in challenge,” which saved them $800 in three months.

How to Get the Most Out of Visual Reports

- Keep dashboards on the first tab so you can get to them right away.

- To avoid “analysis paralysis,” don’t put too many charts on one page.

- Don’t use axes that aren’t clear; they can lead to misunderstandings.

- Lock the chart source ranges in a spreadsheet to stop them from being accidentally overwritten.

4. Setting goals and keeping track of progress

Why Goals Change How You Budget

A budget is useless without goals, just like a map is useless without a place to go. Goals give:

- Goal: You’re not just saving money; you’re making a dream come true.

- Motivation: Every dollar saved is a small win.

- Responsibility: Deadlines and progress bars put soft pressure on you.

Think about three types:

- Emergency Fund Seeker: Looking for enough money to cover 3 to 6 months of living costs.

- Debt-Free Achiever: Paying off credit cards or student loans with high interest rates.

- Dreamer: Saving money for a down payment on a house, a break from work, or a trip.

Links to EEAT

- Expertise*: Financial planners say that setting SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound—can help you reach your goals.

- Experience: Users who can see progress bars are 35% more satisfied than those who can only see static trackers.

- Trustworthiness: Clearly defined milestones make things less confusing and keep expectations in check.

Must-Have Features for Goals

- Fields for Defining Goals

- Name, amount needed, due date, and level of priority.

- Monthly Contribution Calculator That Works Automatically

- Calculates how much money you need to save each month:

Monthly Requirement = (Target Amount - Current Balance) / Months Left

- Calculates how much money you need to save each month:

- Thermometers or progress bars that show you visually

- The color changes at 50% and 100% of the way through.

- Ranking and Giving Out Priorities

- If you want to save for more than one goal, automatically divide your extra cash into percentages.

- “What-If” Situations

- Model the effects of saving an extra $50 a month or pushing back the target date by six months.

- Alerts and Reminders

- Email or in-app alerts when contributions are late.

Example from the real world

Example: The Dream Vacation Fund Priya needed $5,000 for a trip to Japan in a year. Her template said she needed $417 a month. A “vacation thermometer” bar turned green at 50% ($2,500) and sent an email reminder that said, “Halfway there! Only $2,500 to go.” That little push kept her donations steady, and she reached her goal two weeks early.

How to Keep Track of Your Goals

- Set Buffer Contributions: Try to give 10% more than what is required to make up for any unexpected shortfalls.

- Celebrate Milestones: Set aside a small amount of money (like $20) each time you reach 25%, 50%, or 75%.

- Check every three months. If your income or expenses change, change your target dates or monthly amounts.

5. Forecasting and allocating income and expenses

Changing from reactive to proactive budgeting

It’s helpful to keep track of how much you’ve spent in the past, but being able to predict how much money you’ll have in the future is life-changing. Forecasting can help you:

- Make plans for future bills like rent, insurance, and subscriptions.

- Set aside money for bonuses, freelance work, and other variable cash flows.

- Stop unexpected shortfalls and overdrafts.

EEAT Basics

- Expertise: Accountants use forecasting to predict profits and losses, and personal budgets should do the same.

- Experience: Users who make predictions pay 50% less in late fees and overdraft fees.

- Trustworthiness: A clear view of the future makes people feel more confident. You won’t have to guess if you can afford that new gadget.

Important Features of Forecasting

- Projected Income Entry

- Manage money from many sources, like your job, side job, dividends, etc.

- Add “minimum,” “expected,” and “best-case” situations.

- Planned Schedules for Expenses

- Bills that come up regularly, with due dates and amounts.

- Costs that happen only once a year, like holiday gifts and insurance.

- Tools for Zero-Based Budgeting

- Make sure that every dollar of expected income is assigned. “Income minus allocations equals zero,” a principle made famous by YNAB.

- Forecast for the next 3 or 6 months

- Show how this month’s extra money or debt will affect next month’s balance.

- What If Analysis

- “What cuts do I need to make to my budget if my freelance income goes down by 20%?”

- Funds for Sinking

- Put aside small amounts of money each month for big expenses in the future, like car repairs or vacations.

Example from the real world

Case Study: A freelancer with an irregular income Ahmed, a web developer who works on retainer contracts, has three levels of income: “Minimum” ($3,000), “Expected” ($4,500), and “Best-Case” ($6,000). His template makes monthly budgets based on the minimum, so he never spends more than he has to if a contract drops unexpectedly. Any extra money goes into the “Flex Fund,” which can be used for anything.

Tips for making strong predictions

- Look at how your income changes: Find your 6-month average income to smooth out the highs and lows.

- Automate Recurring Bills: Set reminders for when bills are due by linking them to your calendar.

- Check the accuracy of your forecasts: After each month ends, compare what you thought would happen with what actually happened.

6. Calculators for tracking and paying off debt

The Mental Side of Paying Off Debt

Debt can feel like a dark cloud, but having a plan for how to pay it off can give you hope and clarity. Integrated calculators and trackers give you:

- Predictable Timelines: You can be sure of when you’ll be free of debt.

- Motivation: Seeing balances go down visually motivates people to keep going.

- Strategy: Choose between the snowball method (starting with the smallest balance) or the avalanche method (starting with the highest interest).

The EEAT Point of View

- Knowledge: Financial experts agree that structured plans make it 30% easier for people to pay back their debts.

- Experience: People who keep track of their debt in their main budgeting tool are 25% less likely to take on new debt.

- Trustworthiness: Clear amortization builds trust because there are no hidden fees or surprises.

Debt Tools You Can’t Live Without

- Sheet for Debt Inventory

- List the creditor, the balance, the interest rate, and the minimum payment.

- Calculator for Amortization

- Create payment schedules automatically that show the breakdown of principal and interest.

- Projected Payment

- Show payoff dates for different situations where you make extra payments.

- Worksheets for Snowball and Avalanche

- Look at the total amount of interest paid and the time it takes to pay off each plan.

- Seeing Progress

- Graph showing how much principal has been paid over time.

- Connecting with the Budget

- Take out the minimum payments from the monthly forecasts automatically, and put any extra money toward paying off debt.

Example from the Real World

A Case Study: Dual-Strategy Paydown Kelly owed three things: a credit card with an 18% APR, a student loan with a 5% interest rate, and a car loan with a 7% interest rate. The “What-If” tool on her template showed that snowball would save $200 in interest, but avalanche would cut the time by two months. She chose avalanche, paid an extra $100 a month, and was debt-free two months earlier than planned.

How to pay off faster

- Round-Up Payments: Add up all the payments and round them up to the next $10 or $50. The extra goes straight to the principal.

- Windfalls: Instead of spending bonuses, tax refunds, or cash gifts, put them toward paying off debt.

- Automate Transfers: Set up automatic transfers on payday so you never miss a payment.

7. Easy to use and simple

Why it’s important to be easy to use

You won’t use a template if it feels like a maze, no matter how many features it has. Simplicity leads to consistency, and consistency is the key to successful budgeting.

EEAT Focus

- Experience: A clean interface makes it easier to think, so daily check-ins are easy.

- Trustworthiness: Clear labels and transparent formulas (for spreadsheets) make sure that users know how numbers move.

- Expertise: Professional-grade templates often come with built-in help sections or video tutorials that show you how to use them.

Important Usability Features

- Layout with Dashboard First

- All the important numbers and charts are on one page, so you don’t have to look through tabs.

- Easy to Use Navigation

- Tabs that are clearly labeled, breadcrumb trails, or sidebar menus.

- Built-in Help

- Tooltips, comment boxes with instructions, or a separate “How to Use” tab.

- Responsive on mobile

- Make sure that layouts for cloud spreadsheets work on phone screens by using sections that can be collapsed.

- Improving Performance

- Cut down on complicated array formulas that make large datasets run slowly, and use scripts and macros wisely.

- Access

- Text that is easy to read, with high contrast, and layouts that work with screen readers.

Example from the real world

Example: A Busy Professional Ravi, a software engineer, used an 80-column Excel monster template that was full of macros and VBA. It took 30 seconds to open, and without training, it was impossible to read. He changed to a simpler Google Sheets budget with five tabs: Dashboard, Transactions, Categories, Goals, and Forecast. This cut his monthly update time from two hours to twenty minutes.

Ways to Make Things Easier to Use

- Hide Advanced Tabs: Only show complicated sheets (like amortization) when you need them.

- Use Data Validation to limit what can be entered and stop typos like “Rent” and “rent.”

- Keep a “Read-Only” Mode: Lock the structure and formulas, and use a different sheet for data entry.

- Ask please: If you’re sharing with a spouse or partner, ask them where they get stuck and make those parts easier.

Choosing the Right Template: More Than Just Features

The “perfect” template is the one you will actually use, even if it has these seven great features. Here’s how to make your choice:

Questionnaire for Self-Assessment

- What are the three most important things I need to do with my money? (e.g., saving for emergencies, paying off debt, investing)

- How well do I know how to use technology? (Spreadsheets vs. a separate app)

- How much time can I really give each week?

- Do I like automation or having full control?

Testing and Getting Feedback

- Give each of the two or three finalists at least 30 days to test.

- Keep track of your consistency: did you forget to enter? Was the design easy to understand?

Personalization and Iteration

- Don’t settle; change the colors, layouts, or formulas until the template feels like it belongs to you.

- To keep things neat, archive features you don’t use.

Don’t let Feature Bloat happen

- Don’t give in to the temptation of “all the bells and whistles.” Extra features you never use are just noise.

Partner in Responsibility

- For support and accountability, show your dashboard to a trusted friend, spouse, or financial coach.

Keep in mind that consistency is better than complexity. A simple template that you use every day will work better than a complicated one that you stop using after a week.

Questions that come up a lot

- Q1: Do I have to pay for a budget template?

- No, there are great free choices in Excel, Google Sheets, and community marketplaces like Reddit and Etsy. Paid templates and apps, like YNAB and EveryDollar, often have advanced automation, support, and mobile features. Think about how much the features you need will cost.

- Q2: How often should I change my budget?

- Keep your data up to date and your habits strong by logging transactions every day or week.

- Once a month, look at how well things are going, change the categories, and set goals for the next month.

- Q3: What template is best for people who are new to it?

- A simple 50/30/20 rule template or a basic zero-based budgeting sheet are good places to start. Before adding more advanced features, make sure you get into the habit of keeping track of your spending.

- Q4: Is it possible to use more than one budgeting method?

- Of course. A lot of people use an app to keep track of things every day and a spreadsheet to plan their goals or make predictions. Hybrid workflows can get the best of both worlds.

- Q5: What if my income isn’t steady?

- Pick templates that have “projected income” fields, or use your lowest average monthly income as the starting point. Anything over that is a bonus to give out.

- Q6: What should I do if I have to pay for something I didn’t expect?

- Set aside a small amount of money each month for “miscellaneous” or “buffer” expenses, or keep an emergency fund in a separate sinking fund category.

- Q7: Is it safe to connect my bank accounts?

- Most trustworthy apps use bank-grade encryption, like Plaid’s read-only connections. Always check security protocols, turn on two-factor authentication, and read privacy policies before connecting.

The end

Budgeting can change your life, but only if you use the right tool. You can make your own categories, set up reliable automation, see useful visuals, track your goals, make predictions about the future, manage your debt in a structured way, and design your template so that it not only logs your money but also helps you make financial decisions.

Now it’s your turn. Use our self-assessment checklist, try out a few templates, and keep in mind that consistency is better than complexity. A simple spreadsheet with the right features that you use every day can help you get to your emergency fund, pay off your debts, or buy the home of your dreams.

With this information, you should jump in and choose (or make) your ideal budget template today. Then, you can start living your financial goals tomorrow. Please tell us about your favorite features and success stories below. Your story could motivate someone else to become financially free as well!