Credit cards are a great way to keep track of your money. If you use them correctly, they can be useful, give you rewards, and help you build a good credit history. But a lot of people, often without realizing it, end up in situations that can lead to more debt, high fees, and damage to their credit scores over time. These mistakes can have very bad effects, even if they only happen once or many times. In this article, we’ll talk about five of the most common credit card mistakes and give you clear, helpful advice on how to avoid them. If you know where mistakes can happen and how to avoid them, you can take control of your money, improve your credit score, and use your credit card as a tool to help you with your finances instead of a source of stress.

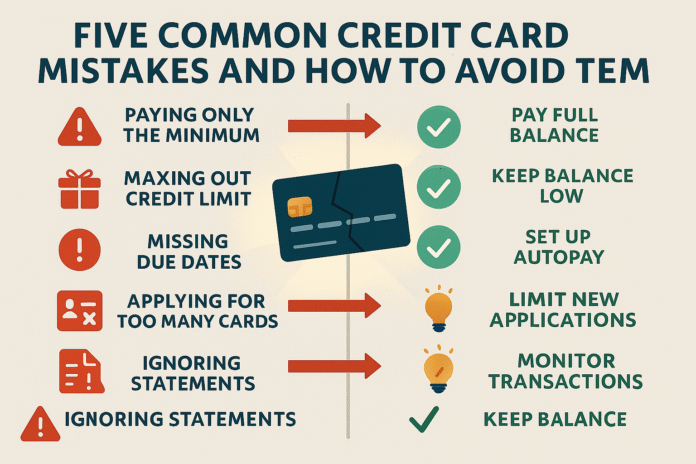

We all know that credit cards can be helpful, but we need to be careful with them. It’s sad that so many people make mistakes like only paying the minimum, maxing out their cards, missing due dates, applying for too many cards at once, or not reading their statements and terms carefully. All of these mistakes will cost you money, from higher interest rates to damage to your credit profile that will last a long time. For example, if you only pay the minimum, you could get stuck in a slow-moving debt spiral because the interest keeps adding up. Using all of your credit, on the other hand, can hurt your credit utilization ratio, which is a big part of your credit score.

This article will give you a lot of information, with clear examples and helpful tips. You will learn how to stop making the minimum payments, how to keep your balances low, how to make sure you never miss a payment, and the best ways to apply for and manage more than one credit card. We’ll also talk about how important it is to read the fine print on your statements and learn the terms of your card that could cost you a lot of money without you even knowing it.

At the end of this talk, you’ll know how to stay away from these common credit card mistakes. This will help you build better credit and make better financial choices. Let’s make your credit card an important part of your financial stability instead of a possible problem.

Mistake #1: Only paying the minimum

One of the most common mistakes people make with credit cards is only paying the minimum each month. The minimum payment is usually a small percentage of what you still owe, between 2% and 4%, or a set dollar amount, whichever is higher. Paying the minimum amount can keep your account in good standing for a short time, but it doesn’t lower your principal balance very much, and it lets interest build up over time, which is even worse.

Why Paying the Minimum Is a Bad Idea

- Making people want to know more: A lot of your balance stays the same if you only pay the minimum. Most credit cards charge interest on your whole balance, and that interest builds up every month, which can make your debt grow quickly. Even if your card has a low interest rate, you’ll end up paying a lot more in interest over time because the principal goes down slowly.

- More time to pay off your debts: Let’s look at a simple example. If you have a card with a $5,000 balance and a 20% annual interest rate, and you only make the minimum payment, you might only have to pay $150 at first, even though the minimum payment is 3% of the balance. The principal amount that goes down is very small because most of that $150 goes to interest. Because of this, it might take years to pay off the full balance, and over time you might end up paying twice or even three times the original amount in interest.

- Cost of Opportunity: You could use the extra cash to pay off the debt itself, or even better, to save or invest. If you only pay the minimum, you might miss out on chances to become financially free sooner.

Paying More vs. Paying Less: A Comparison

Consider these two scenarios with a $5,000 balance and 20% interest:

- Scenario A: You only have to pay $150 each month, which is the least amount.

- In Scenario B, you pay $300 a month, which is twice the minimum.

In Scenario A, a lot of your $150 could go toward interest, and it could take 20 years or more to pay off the rest with a lot of interest added on. In Scenario B, when you pay an extra $150 a month, more of that money goes straight to lowering the principal. This saves you a lot of money on interest and makes it easier to pay back your loan. This example shows that paying the least amount can keep you in debt, but paying more can help you get out of debt faster.

How to Avoid the Minimum Payment Trap

- Make plans for extra payments: Even if you can’t pay off your whole balance right away, try to set aside money for extra payments on top of the minimum. Look at your monthly bills to find ways to save money. You can get more money to pay off your debt right away by cutting back on things like eating out or subscription services that you don’t need.

- For larger amounts, set up payments to happen automatically: You can set up automatic payments with many banks. Instead of letting the system charge you the least amount, set up a fixed payment that is higher than the minimum due. This keeps things the same and stops you from wanting to leave more money in your account.

- Instead of once a month, pay every two weeks: Instead of making one payment every month, you could make two equal payments every two weeks. This can help you pay less interest overall. This method works by making an extra payment each year, which speeds up the payment of the principal.

- Plan for your short-term debt: Make short-term goals that you can actually reach to pay off your credit card debt. Keeping track of how far you’ve come over time can be a big motivator. Make goals for yourself, like paying off a certain amount of the balance, and then give yourself small, inexpensive rewards when you reach them.

- Make good use of unexpected money: You should use extra money you get, like a tax refund, a bonus, or a gift, to pay off your debt instead of buying things you don’t need. Getting extra money is fun, but using it to pay off your debt can help you in the long run.

How to make a budget so you can pay your bills more easily

- Keep an eye on how much you spend: You can keep track of every dollar you spend by using budgeting apps or spreadsheets. You can find ways to save money if you know how you spend it. This will give you more money to pay off extra debt.

- Understand the difference between wants and needs: When you make a budget, split your expenses into two groups: things you need and things you want. If you put your needs before your wants, you’ll have more money to make extra payments that matter.

- Make some small changes to your daily routine: Over time, small changes can lead to big savings. You might want to cook at home more often instead of going out to eat. Or, you could take public transportation instead of paying a lot for rideshare services.

- Change and check things often: You should look at your budget often and change how you pay your bills as your money situation changes. You can lower your debt by being more careful about how you spend your money.

It may take some financial discipline to pay more than the minimum, but the long-term benefits, like getting out of debt faster and saving money on interest, are well worth it. Keep in mind that every extra dollar you put toward your principal balance gets you closer to being debt-free. If you make these extra payments a priority, your credit card can go from being a burden to a tool that helps you improve your financial future.

Mistake #2: Using All of Your Credit Cards

Another common mistake people make with credit cards is not using them to their full potential. This happens when you use up most of your credit. It might be tempting to use up your whole limit if you need money, but doing so can hurt your credit score and your overall financial health a lot.

What it means to know how to use credit

The credit utilization ratio shows you how much of your credit you are using. Most financial experts agree that you should keep your credit utilization below 30% to keep your credit in good shape. When you keep using all of your credit cards, you send a message to lenders that you depend too much on credit, which can have a number of bad effects:

- Damage to Your Credit Score: How much credit you use is one of the most important things that affects your credit score. It usually makes up about 30% of your score. If you use most or all of your available credit, your score will probably go down. This will make it harder to get good interest rates on future loans or even get new credit.

- Interest Rates Go Up: Lenders see a lot of use as a risk. If you need to borrow more money, you might have to pay higher interest rates, which will make it even more expensive to borrow.

- Pressure to Buy: It can feel like you’re in a money crisis when your card is almost full. When people are scared, they often panic and make bad decisions. You might rush to borrow more money or take on debt that you can’t handle, which will make your finances worse.

Why People Often Use Up All of Their Credit Cards

- Not Making a Budget: If you don’t stick to a budget, it’s easy to forget how close you are to your credit limit. If you buy things on a whim or forget to pay your bills, it doesn’t take long to go over the recommended spending limit.

- Costs and emergencies that come up out of the blue: You may need to use your credit card in an emergency. But if you don’t have a backup plan or an emergency fund, these surprise costs could use up all of your credit.

- The cost of living is going up: People sometimes spend more when they have more money because they think that having more credit means they are doing well with their money. If you live like this, you might run out of credit cards.

How to Keep Your Cards from Getting Too Full

- Keep a close eye on how much you spend: Use apps for personal finance or built-in banking tools to see how much money you’re spending right now. Set up alerts that will let you know when you’re getting close to a certain percentage of your credit limit.

- Make a Limit for Yourself: Even if your card has a high credit limit, you might want to set a lower spending limit for yourself. This is your “real” credit limit, so don’t go over it.

- Pay off your debts often: Pay smaller amounts more often throughout the month instead of waiting for your monthly statement. This not only lowers the amount of credit you use, but it also stops you from spending too much money by mistake.

- Make plans for big purchases ahead of time: If you need to buy something big, make sure you have enough credit and think about how the cost will affect your utilization ratio ahead of time.

- Before getting a second card, think about it carefully. You can use your credit more evenly if you have more than one credit card, but you should be careful. Don’t use extra cards to make it okay to spend more than you can pay back.

Other Ways to Make More Money

- Money saved for emergencies: You should put money aside for emergencies so you can pay for things that come up. You can use credit if you have to, but it shouldn’t be your first choice.

- Loans for people: If you keep using your credit cards to pay for bills, you might want to think about getting a personal loan with a lower interest rate to pay off your debt.

- Changes to the budget: Check your spending to see if there are things you can cut back on or get rid of that you don’t need to buy. You can use this to free up credit for emergencies or things you need without having to max out your cards.

A Good Example

Emily’s credit card is now empty because she had to pay for a lot of unexpected medical bills and car repairs. Emily could only charge up to $10,000, but she kept getting bills that were almost that much. This meant that she used 90% of her credit. This hurt her credit score and made it harder for her to get a loan with a lower interest rate when a better chance came up. Emily was able to lower her utilization ratio and slowly rebuild her financial reputation by learning how to keep better track of her spending, set limits for herself, and make regular payments on her balances.

You shouldn’t max out your credit cards if you want to keep your money flexible, build a good credit history, and avoid the stress of having too much debt. You can protect your credit score for future financial opportunities by sticking to a budget, keeping an eye on your spending, and making smart plans.

Mistake number three is not paying on time.

Paying your bills on time is the most important thing you can do to use a credit card responsibly. It’s unfortunate, but missing a payment can have a big effect on your finances, even if you forgot, had technical problems, or were too busy with other things. If you don’t pay on time, you might have to pay a lot of extra fees, higher interest rates, and your credit score could go down.

What Not Paying Really Costs

- Fees and fines for being late: If you don’t pay your credit card bill on time, most companies will charge you a late fee. These fees can be very different from each other, but they all add to your total debt and make it harder to catch up on your payments.

- Higher Interest Rates: If you don’t pay your bill on time, your credit card company may raise your interest rate, sometimes by a lot. This penalty rate can also apply to future balances, which will make your debt even more expensive.

- Your Credit Score Will Drop: Your payment history is one of the most important things that affects your credit score. If you miss a payment, your score will go down. If the late payment is reported, it could stay on your credit report for up to seven years.

- Losing Benefits: Some credit cards give you rewards or cash back as a perk. If you keep missing payments, you could lose these benefits as well as any forgiveness or leniency programs that some issuers offer to responsible users.

Why People Don’t Always Pay on Time

- Not keeping track of your money well: It’s easy to forget about more than one due date if you don’t have a clear way to keep track of them.

- Issues with technology: Sometimes payments are late or don’t go through at all because of problems with online banking systems or misunderstandings with auto-pay setups.

- Costs that come up out of the blue: A big, unplanned expense can throw off your monthly budget and make it hard to save up for your credit card payment.

Things you can do and tools you can use to help you pay on time

- Make payments automatically: Setting up automatic payments for at least the minimum amount due is one of the easiest ways to make sure you never miss a payment. This makes it less likely that you’ll forget something or do something wrong.

- Reminders on your calendar: Set up digital calendars or reminder apps on your phone or computer to remind you a few days before a payment is due. You could set these reminders to go off when you pay your bills.

- Set Due Dates Together: If you can, try to have all of your bills come due on the same day or within a few days of each other. This makes it easier to keep track of all your payments at once instead of having to remember different dates all month long.

- Check your statements often: Make it a habit to check your bank and credit card statements as soon as you get them. This checks to make sure that your auto-pay settings are correct and that you have enough money to pay your next bills.

How to Get Back on Track After Missing a Payment

- Call your issuer right away: Call your credit card company right away if you know you’ve missed a payment. Some issuers will give you a grace period or not charge you a late fee the first time you make a mistake.

- Pay as soon as you can: Paying a late bill as soon as possible will help your credit score. This shows that you really want to catch up, even if you can only pay the minimum at first.

- Check your credit report: Check your credit report often to make sure that late payments are reported correctly. Talk to the right credit bureau if there is a mistake.

A Real-Life Example of How to Get Better

Do you remember Mark? He missed a payment once because he had to work more than he had planned. Mark called his credit card company right away, told them what was going on, and made plans to pay a few days early the next month. He had to pay a small fee, but because he acted quickly, his credit score didn’t get worse in the long run. Mark set up both auto-pay and digital reminders over time to make sure he didn’t make the same mistake again.

If you forget to pay, you could lose a lot of money and hurt your financial stability. Using technology, sticking to a schedule, and talking to your issuer clearly can help you keep your credit score, interest rates, and overall financial health good. This will help you make sure that your payments are always on time.

Mistake #4: Getting a lot of credit cards all at once

It’s easy to apply for more than one credit card at once these days, especially if you see a great deal or signup bonus. But every time you ask for a credit card, it shows up as a “hard inquiry” on your credit report. If you get too many of these in a short amount of time, lenders may think you’re not financially stable.

What Happens When You Try to Get More Than One Credit Card

- Hard Inquiries and Your Credit Score: When you apply for a credit card, the company that issues it does a hard inquiry to find out if you are a good credit risk. A few hard inquiries might not change your score much, but a lot of them in a short amount of time can lower it by a lot. If this happens, lenders may think you’re having trouble with money or that you’re asking for too much credit.

- What the lender thinks: Lenders may not like it when you apply for too many loans, even if your score is good. They might think you’re going to spend too much money, which could make them less likely to give you better credit terms or higher credit limits.

- The urge to spend too much: Having a lot of credit on a few cards can make you feel safe with your money, which can make you spend too much. This kind of behavior not only makes your debt worse, but it also puts your overall financial health at risk.

When It Might Be a Good Idea to Have More Than One Credit Card

- Different needs for money: There are many reasons why having more than one credit card can be useful. You could use a travel rewards card to pay for all of your vacation costs, a cashback card to pay for things you buy every day, and a third card for emergencies. With more than one card, you can keep track of your spending and get the most rewards.

- Different ways to use credit: Having a lot of different credit cards can be useful as long as you use each one responsibly. You shouldn’t just do this on a whim; you should have a plan for it.

How to Space Out Credit Card Applications the Right Way

- Be ready ahead of time: Instead of applying for a lot of cards at once, spread out your applications over a few months or even years. This doesn’t hurt your credit score as much, and it helps you see if each new card is a better fit for your needs.

- Do a lot of research: Before you apply, read reviews, compare fees, rewards, and terms, and make sure the benefits fit with how you spend money. This can help you not apply for cards that won’t help you reach your financial goals.

- Look at your credit report often: Check your credit report after you apply to make sure you didn’t make any changes you didn’t mean to. This way, you can see how each inquiry affects your credit and make sure it stays in good shape.

Things to do instead of applying for too many jobs

- Try to raise your credit score: Instead of getting a lot of credit cards to get more credit, focus on raising your credit score as a whole. If you pay your bills on time and lower your debt, your credit score will go up on its own.

- Think about getting a credit card that requires a security deposit: Secured credit cards can be a good option if you want to improve your credit but aren’t yet eligible for premium cards. There is no chance that they will make too many hard inquiries.

- Use the cards you already have wisely: To keep your current cards in good shape, keep an eye on how much you owe and how you pay them. It might be better to get the most out of your current credit lines than to open a lot of new ones.

A True Story

For example, David asked for four new credit cards in just two months. Not long after that, his credit score went down a lot. Lenders began to pay more attention to his requests. He did get some of the cards, but the new lines of credit had high interest rates because his credit score was low. David knew he had made a mistake, so he decided to stop and fix the accounts he already had. He was able to slowly raise his score and get better terms in the future by spacing out his applications and checking his credit report often.

To keep your finances stable and your credit score high, you should never apply for too many credit cards at once. You can keep your credit in good shape and avoid hard inquiries by planning your credit needs, doing your research, and being smart about how you apply for credit.

Not paying attention to your credit card statements and terms is the fifth mistake.

Your credit card statement is more than just a bill; it’s a full record of what you’ve done and a great way to keep track of your money. Unfortunately, many people don’t read their statements or learn about the terms and conditions of their credit cards. You could make mistakes, get extra fees, and not handle your money well if you don’t pay attention to this.

Why You Should Read Your Statements

- Finding mistakes and fraud: Both the person who might be trying to steal from you and the issuer can make mistakes. You can dispute charges that are wrong, transactions that are the same, or purchases that weren’t authorized if you carefully look over your monthly statements.

- Understanding how fees work: Your card’s terms and conditions list a lot of fees, such as annual fees, fees for transactions made outside the US, and fees for cash advances. You might end up spending more than you planned over time if you don’t know these things.

- Keeping an eye on how much money you spend: Reading your statement often can help you keep track of how you spend your money. You can change your budget if you need to because you can see where your money is going.

Things That People Often Forget

- How to figure out interest: You can better understand the fees on your statement if you know how interest is added to your balance. Things can get confusing and you might make bad payment choices if you don’t know how daily periodic rates and billing cycles work.

- Details about the reward program: Many credit cards give you rewards, cash back, or travel miles, but these programs usually have rules and expiration dates. If you don’t pay attention to these, you could miss out on benefits.

- Changes to the Terms: Credit card companies may change the terms and conditions of your account from time to time. To get the best options, you need to stay up to date on these changes.

Ways to Stay Up to Date

- Set aside time each month: Think of your credit card statement as a required checkup on your finances. Read both your online account and your paper statements carefully once a month.

- Use digital tools: When your terms or spending habits change, a lot of banks will send you digital alerts. These alerts will keep you up to date.

- Learn about: Understand the key terms in your credit card agreement. You can make better choices if you know what terms like “grace period,” “annual percentage rate (APR),” and “balance transfer fee” mean.

- Put it down: Keep a copy of your monthly statements for yourself. This record can help you spot patterns over time and make sure that any differences are looked into right away.

A Story That Isn’t True

Think about Lisa, who didn’t check her monthly statements for a few months. Because she had a subscription she no longer used, she didn’t realize that a charge she didn’t recognize kept showing up on her statement. If she had seen them sooner, she could have avoided paying fees and late fees. Lisa could have saved money and stress if she had taken the time to check her statements on a regular basis. She could have fought the charge and ended her subscription.

If you don’t read and understand your credit card statements and terms, you could lose money and make bad financial decisions. Going over your statements carefully once a month not only keeps your money in order, but it also gives you the power to make smart, proactive choices that keep your wallet safe.

Extra: How to Use Your Credit Card Wisely

Learning and following good credit card habits is the most important thing you can do for your finances. Making healthy habits a part of your daily life can help you avoid mistakes and raise your credit score. Here are some good habits to start:

- Check your accounts often: Regularly check your balance, read your statements, and set alerts for when you spend too much. Regular checks not only keep you up to date, but they also stop surprises.

- Make a budget and stick to it: By making a budget that includes money for paying off debt, saving, and everyday costs, you can keep from going overboard with your spending and maxing out your credit cards.

- Set Up Automatic Payments: Set up automatic payments for at least the minimum amount to avoid late fees. Then, as often as you can, try to pay more. This helps you stay on top of your responsibilities.

- Learn: Keep up with the best credit card deals, changes to the terms, and money management tools. When it comes to using a credit card correctly, knowledge is power.

- Call the company that gave you the card: Don’t be afraid to call your credit card company if you have a question about your statement or if your money is tight. They can offer you choices, sometimes waive fees, and help you with problems that come up out of the blue.

These proactive habits are the first steps to managing your credit better. You can avoid common mistakes and feel better about your money by checking your finances often, sticking to a budget, and keeping up with your finances.

Finally

It’s very important to know about and avoid common credit card mistakes if you want to get your finances in order and keep your credit score high. We talked about five common mistakes people make: only paying the minimum amount, maxing out their credit cards, missing payment due dates, applying for too many credit cards at once, and not reading their credit card statements and terms. If you make any of these mistakes, you could end up paying more fees, going deeper into debt, and hurting your credit score.

The good news is that none of these mistakes can be fixed. You can break bad habits and turn your credit card into an asset instead of a liability if you learn a little and do something about it. Setting up autopay to make sure payments are on time, sticking to a budget to keep your balances low, and checking your statements regularly for mistakes and fee changes are all good things you can do to improve your finances. They all make your credit profile stronger and more trustworthy.

You should really think about how you use your credit cards right now. Consider how you spend your money, look for ways to do better, and promise to make better choices in the future. When you learn, it’s normal to mess up. But if you know what you did wrong and do something about it, your mistakes can help you get closer to being financially free.

Questions and Answers

Q1: What will happen if I don’t pay my credit card bill on time? A: If you don’t pay on time, you might have to pay a late fee and your interest rate might go up for a short time. More importantly, the credit bureaus might find out about the late payment if it is more than 30 days late. This could hurt your credit score for a long time. But you might be able to lessen these effects if you act quickly and call your issuer to make a payment on time. If you have a good payment history, a lot of companies will also let you off the hook for your first mistake.

Q2: How can I check how much credit I’ve used? A: To find out your credit utilization ratio, divide the total amount of credit you have available by the amount of credit you currently have on your credit cards. Your dashboard on most online banking systems has this information. Many free services that check your credit score also include information about your utilization ratios in their reports. You should only use less than 30% of your credit to keep your credit score high.

Q3: Is it bad to close credit cards that are old? A: Closing old credit cards can hurt your credit score because it can lower the amount of credit you have and the length of your credit history. Instead of closing them, think about keeping them open even if you don’t use them often, as long as they don’t charge you yearly fees. You might decide that closing a card with high fees or bad terms is the best thing to do after giving it some thought.

Q4: How many credit cards do I need? A: There isn’t a single number of credit cards that works for everyone. Some people do well with just one well-managed card, while others do better with two or three to get the most rewards and keep track of different kinds of expenses. Being able to keep track of all of your accounts is the most important thing. The most important thing is to only have as many cards as you can keep track of and pay off.

Q5: Is it possible to get lower interest rates on my credit cards? A: Yes, if you have a good payment history and a high credit score, you can often get lower interest rates. You should call the company that gave you the card and ask if they can give you a better deal. It might be helpful to talk about what other companies are offering. If you have a balance, even a 1% to 2% drop can save you a lot of money over time.

Last Thoughts

It will always be hard to avoid making common credit card mistakes. You should be careful, learn, and keep up good habits. Your current and future financial health can be affected by every mistake you make, such as only paying the minimum, maxing out your credit, missing due dates, applying for too many cards at once, or not reading the fine print on your statements. This article tells you how to find and fix these problems.

Keeping an eye on your money, sticking to a well-planned budget, setting up automatic payments, and staying up to date can all help you have a better financial future. Every time you avoid making these mistakes, you get closer to being financially stable and knowing how to handle your credit. It’s not about being perfect; it’s about making small, smart changes that build up over time.

Take a minute to think about how you use your credit cards right now. Find things that need to be fixed and promise to try a new approach this month. You need to be smarter about how you use credit today. Every smart decision you make sets you up for long-term financial success.

Happy credit management, and here’s to a future without the problems that keep you from being financially free!