When you lose your job, get more medical debt, get divorced, go bankrupt, or miss payments you thought you could catch up on, it can feel like a punch to the gut. But the truth is that credit isn’t permanent, and you can definitely rebuild your credit. You can get back on track with your finances if you are patient, persistent, and use the right credit repair methods.

This guide gives you five useful and powerful tips to help you on your way to recovery. We’ll take you through each step and explain why it’s important, how to do it, and how long it might take. Along the way, you’ll see real-life examples, get advice on how to avoid common mistakes, and celebrate small wins. Are you ready to start? Let’s talk about some things you can do to improve your credit after debt and get back on your feet.

Beginning

Things happen in life. Even the best-planned budget can be thrown off by a sudden medical emergency, a layoff, or an unexpected divorce. Your credit score can drop a lot when these things cause you to miss payments, go into collections, or even file for bankruptcy. And you’re not the only one; millions of Americans have trouble with credit every year. But credit scores aren’t set in stone. It can be discouraging to see that three-digit number go down, but remember that credit is based on what you’ve done in the past, not a permanent judgment of your worth.

Why rebuilding your credit is important:

- Get better interest rates on car loans and mortgages

- Open rental applications with confidence

- Lower premiums on insurance

- Increase your chances of getting a job if employers check your credit

- Make your finances stronger overall

Seeing “poor” or “fair” next to your credit snapshot can hurt your feelings. You might feel bad about yourself, angry, or scared about what will happen next. But getting your credit back is less about being perfect and more about not giving up. Every good choice you make, no matter how small, adds up over time. It’s normal to feel overwhelmed when things don’t go your way. But today is the day to make your first move.

In the next few sections, we’ll talk about five tried-and-true ways to get your credit back on track after bankruptcy, get out of debt, or just get back on your feet after any financial setback. We’ll talk about everything from how to fight mistakes on your credit report to how to use secured credit cards wisely. In the end, you’ll have a clear plan and the confidence to start raising your credit score, one smart step at a time.

1. Look over your credit reports first.

Why this step is so important:

Your credit report is what makes up your credit score. It shows lenders—and you—where you stand. If you have a financial setback, mistakes and old information can stay on your report and lower your score even more. You need to know exactly what’s on your report before you use any tips for getting your money back.

How to put into action:

- Get Your Free Reports:

- You can get one free report from Experian, Equifax, and TransUnion every year by going to AnnualCreditReport.com.

- Get all three reports as PDFs and save them.

- Go over it carefully:

- Personal Information: Make sure your name, address, and Social Security number are all correct.

- Accounts: Make sure the information on your mortgage, auto loan, credit card, and student loan is correct.

- Payment History: Make sure that late payments or defaults are recorded correctly.

- Public Records and Collections: Check for old bankruptcies, liens, or collection accounts that should have gone away by now.

- Disagree with mistakes:

- Use the bureau’s dispute portal or send a letter of disagreement.

- Include proof, like payment receipts, court papers, or letters from creditors.

- Keep track of your disputes; bureaus have 30 days to look into them.

Things you should not do:

- Arguing about entries without proof.

- Not paying attention to small mistakes, like saying “30 days late” when you really paid on time.

- Not following up after filing a complaint.

Realistic time frame:

- 1 to 2 weeks to collect and read reports.

- Credit bureaus have 30 to 45 days to look into your file and make changes.

- Immediate boost: Fixing just one mistake can raise your score by 10 to 20 points right away.

For example:

Maria found two medical collection entries she had already paid off when she filed for bankruptcy in 2019. After she proved those mistakes were wrong, her score went up by 15 points in a month. This gave her the confidence to move on with her credit repair plans.

2. First, make a budget and get your finances in order.

Why this step is so important:

It can feel like running on a treadmill—lots of effort, little progress—if you don’t have a steady plan for your income and expenses. A clear budget keeps your cash flow steady, makes sure you can pay your bills on time, and stops new debts from sneaking in.

How to put into action:

- Keep track of your income and expenses:

- Write down all of your sources of income, such as your salary, side jobs, unemployment benefits, and so on.

- Keep track of all of your monthly costs, such as rent or mortgage, utilities, groceries, transportation, minimum debt payments, and extra spending.

- Put the most important things and debts first:

- Set aside at least half of your income for necessities like housing, food, and utilities.

- Set aside 20% to 30% of your income to pay off debt, focusing on accounts with high interest or that are past due.

- Save the last 20–30% and spend it on things you want.

- Pick a way to budget:

- Zero-based budgeting: Every dollar has a job to do.

- Envelope system: Use cash envelopes for certain categories to keep from spending too much.

- The 50/30/20 rule is a simple way to split your income into needs, wants, and savings/debt.

- Use tools and automations:

- You can use apps like Mint, YNAB (You Need a Budget), or EveryDollar to keep track of your money automatically.

- Set up automatic payments for the least amount of credit you owe to avoid late fees.

Things you should not do:

- Not taking into account variable costs like groceries and gas.

- Thinking of budget categories as “suggestions” instead of strict limits.

- Not having an emergency fund means you have to borrow money when unexpected costs come up.

A realistic timeline:

- 1 to 2 weeks to write your first budget.

- 1 to 3 months to fine-tune it and stick to it, making changes as needed.

- Ongoing: Look at your progress every month and celebrate things like lower debt ratios.

For example:

Sam made changes to his money after losing his job by using a 50/30/20 budget. He cut his dining out budget in half and set up automatic payments for his credit cards. This got rid of late fees and stabilized his account balances within two months, making it possible for him to make regular, on-time payments.

3. Use a secured credit card or credit-builder loan wisely.

Why this step is so important:

35% of your FICO score is based on your payment history. You need new, positive information if your past mistakes erased that history. People who are trying to rebuild their credit should use secured credit cards and credit-builder loans. They send information to the three bureaus and can help raise your score by making small, responsible payments.

A. Secured Credit Card

How it works:

- You put down a security deposit that you can get back (for example, $200 to $500).

- The deposit is the same as your credit limit.

- Use the card like you would any other card, and pay off the balance in full every month.

Steps to put into action:

- Look for a secured card with no annual fee that reports to all three credit bureaus (for example, Discover it® Secured or Capital One Platinum Secured).

- Put money in the account, activate the card, and use it for small, regular expenses like groceries, streaming, and gas.

- Pay the full amount on your statement every month, and if possible, before the statement closing date.

Things you should not do:

- Having a balance that goes beyond a billing cycle (hello, high-interest charges).

- Allowing usage to go over 30% of your secured limit.

- Closing the card too soon; leave it open to build up history.

Time line:

- It takes 1 to 2 months to get into the habit of paying on time.

- It could take 6 to 12 months for your credit score to go up a lot.

B. Loan to Build Credit

How it works:

- Your lender puts the money you borrowed into a savings account that is locked.

- You pay the same amount every month (principal + interest).

- After the loan is paid off, you get the money, and all payments are sent to the credit bureaus.

Steps to put into action:

- Apply at a community bank or credit union that offers credit-builder loans.

- Agree to the terms and make your payments on time.

- See your credit mix get better and your payment history get stronger.

Things you should not do:

- Not making even one monthly payment.

- Getting a loan that is more than you can afford to pay back.

Time frame:

- The loan will be paid off and all payments will be reported in 6 to 12 months.

- 12 to 18 months for positive data to fully affect your score.

For example:

Jasmine opened a $300 secured card to help her pay off her medical bills. She only used it to pay for her monthly streaming subscription. She got her payment history back in six months by paying the bill in full every month. At the same time, she got a $500 credit-builder loan from her credit union, which helped her raise her score by 40 points in one year.

4. Make payments on time and on a regular basis (even small ones count).

Why this step is so important:

Your payment history is the most important thing that affects your credit score, making up 35% of it. Paying your bills on time is the quickest and most dependable way to raise your credit score after you have debt, no matter how big or small your bills are. If you can only afford to make a partial payment on a past-due account, showing that you’re making payments can stop more damage.

How to do it:

- Make a list of all your payment obligations:

- Credit cards, loans, utilities, rent, phone bills, and any other bills that are past due.

- Include accounts that are both current and past due.

- Set Up Payments to Happen Automatically:

- Automate at least the minimum due to make sure you pay on time.

- If you missed a payment or are behind on your bills, call your creditor to set up a partial payment plan.

- Set up payment reminders and alerts:

- Alerts on your calendar or phone 3 to 5 days before the due date.

- Check your online statements every month to make sure your payments are going through.

- Strategically Catch Up on Past-Due Accounts:

- Put the worst first: ratings that are 30 days or more late or accounts in collections that can be negotiated.

- Try to get “paid as agreed” status or have late marks taken off after you bring the account up to date.

Things you should not do:

- Thinking that “minimum payment” means “good for your score.” Paying the minimum is better than being late, but it only makes your debt last longer.

- Not updating autopay when you switch accounts or cards.

- Not paying small bills like utilities on time can hurt your credit score.

A realistic timeline:

- Right away: Making payments on time stops new negative marks.

- 3 to 6 months: Your payment behavior starts to build trust again.

- 9–12 months: Your score may go up a lot, especially if you get rid of any delinquent flags.

For example:

Leo set up autopay for the balances on his other credit cards after he missed two payments. He also worked out a plan to catch up on the older cards. His FICO score went up 50 points in just five months of no late payments, which opened up options for refinancing at a lower interest rate.

5. Don’t ask for too much credit too quickly.

This step is very important for the following reasons:

It might be tempting to open a lot of new accounts to get more credit or to get different sign-up bonuses. But every time you apply for credit, a hard inquiry is made, which lowers your score by 3–5 points. Lenders may see too many inquiries in a short amount of time as a risk and put your recovery on hold.

How to put into action:

- Use applications wisely:

- Only apply for loans or cards that you really need.

- Give priority to secured cards or credit-builder loans that report to all bureaus.

- Plan when to apply:

- If you’re looking for a mortgage or car loan, compare rates over a 14–45 day period. Multiple inquiries during that time count as one.

- Wait at least six months between applying for credit cards.

- Pre-Qualify When You Can:

- A lot of issuers do soft pulls to see if you are likely to get approved.

- This keeps hard inquiries off of your report.

- Pay attention to current accounts:

- Instead of trying to get new credit, focus on paying on time and lowering your utilization.

- One well-managed account is worth more than a bunch of cards that you don’t use.

Things you should not do:

- Applying for every email you get that says you can get a “quick approval” card.

- Not taking advantage of pre-qualification chances.

- Closing old accounts after opening new ones, which makes your credit history shorter.

A realistic timeline:

- Right away: Not answering new inquiries stops your score from going down even more.

- 3 to 6 months: Having a good payment history on your current accounts will help you more than getting new credit.

- 12 months or more: Lenders will notice that you’re getting better because you have fewer inquiries and good payment history.

Example of a case:

Priya got a lot of “pre-approved” offers after she came out of bankruptcy. She made a smart choice by picking one secured card and one credit-builder loan and ignoring the rest. Her credit score went up steadily by 70 points in one year because she didn’t apply for too many cards and only focused on her two accounts. This was much better than her friends who had opened five new cards.

Extra Section: How to Keep Going While Rebuilding Your Credit

It can feel like you’re walking through mud when you try to rebuild your credit. It’s slow, messy, and frustrating. You can turn this journey into a series of small, empowering victories if you have the right mindset and tools.

Accept the Emotional Side:

- Accept your shame and anger: It’s normal to feel bad about things you’ve done in the past. Keep in mind that everyone has problems, and feeling bad about them won’t help you in the future.

- Be patient: fixing your credit takes a long time. You won’t see miracles happen overnight, but small improvements add up.

Changing Your Mindset for Success:

- Celebrate Small Wins: Did you win an argument? This month, did you pay on time? Closed out an account that was late? You should give each of these some credit. Maybe treat yourself to a walk in the park or a cup of coffee.

- Look at mistakes as data: if you mess up, see it as feedback. What stopped you from making your payment on time? Could an alert or automatic payment help next time?

- Picture Your Goals: Imagine the day you get that low-interest mortgage or get approved for a rental. Keeping that picture in the front of your mind keeps you motivated.

Useful Tools for Motivation:

- Credit Monitoring Apps: Services like Credit Karma, Experian’s free plan, or Mint show you how you’re doing in real time and give you badges or congratulations for on-time payments and better scores.

- Habit Trackers: Use apps like Habitica or Streaks to keep track of the days or weeks you make on-time payments or stay below your credit utilization goal.

- Partners in Accountability: Tell a trusted friend or family member about your goals so they can cheer you on and check in on you from time to time.

Things to Celebrate Small Wins:

- Taking out a one-point mistake from your report.

- For the first time in months, the utilization rate fell below 30%.

- Getting back a deposit on a secured card.

- Closing an account that has been paid off in collections.

Be open-minded and forgiving:

Life will throw you curveballs, like getting sick, changing jobs, or having a family emergency. If you make a mistake, go back and read your budget again, argue with the new ones, and make a new promise. A single mistake doesn’t define you. It does.

In the end

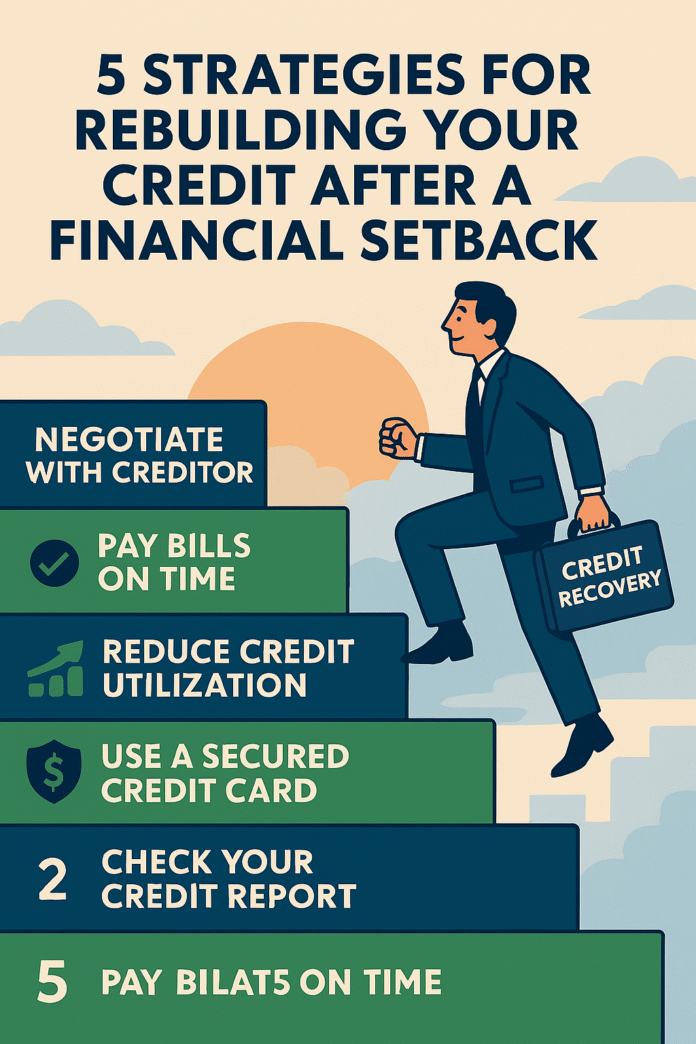

It may seem impossible to get back on your feet after a financial setback, but remember that rebuilding credit is a step-by-step process based on consistent, positive actions. In short, here are your five main ways to fix your credit:

- Check your credit report for mistakes and dispute them

- Make a budget and get your finances back on track

- Use a secured credit card or credit-builder loan wisely.

- Pay on time and consistently, even if it’s just a little bit.

- Don’t ask for too much credit too quickly

Be patient and kind to yourself as you try each strategy. Even the smallest payment made on time or the successful dispute of an error is a step forward. It’s not about being perfect on the road to rebuilding your credit after bankruptcy, heavy debt, or missed payments; it’s about sticking with it.

Take one small step today: get your credit report, make your first budget, or set up that automatic payment. Every decision you make is a building block for your financial stability. Every week and month, you’ll see new wins, big and small, that show you’re on the right track.

Keep in mind that your past doesn’t have to determine your future. Your credit score will get better, and with it, the new chances you deserve. All you need to do is be dedicated, use smart strategies, and have a positive attitude. Start now and walk confidently toward a safer, stronger tomorrow.

Questions that are often asked (FAQ)

1. How long does it take to get your credit back after bankruptcy?

Everyone’s experience with rebuilding credit after bankruptcy is different. If you stick to these tips, you should start to see changes in 6 to 12 months. It may take 2 to 3 years to get a “good” score (above 670), though, depending on where you start and how consistent you are.

2. Should I pay off my old debts or wait?

If you can work out a “pay for delete” deal with the collector, it’s usually best to pay off collections. This means that the collector will take the entry down after you pay. If that’s not possible, paying will still stop more bad reports and may improve your credit over time.

3. Can I fix my credit without getting a credit card?

Yes. Credit-builder loans, becoming an authorized user on someone else’s account, or having your rent and utility payments reported can all help. A secured credit card, on the other hand, speeds up the process because it directly reports good payment behavior.

4. How good of a credit score do I need to buy a house?

Most traditional loans require a score of at least 620–640, but the exact requirements vary by lender. You can get an FHA loan with a down payment of 3.5% and a credit score of at least 580. You should always try to do better than these levels to get better rates.

5. Will late payments always hurt my score?

If you pay your bills on time after that, the effect of late payments on your credit report will get weaker over time, but they will stay on your report for seven years. Paying a late balance as soon as you can and staying up to date will help limit the damage.

6. Will credit counseling help or hurt my credit score?

Credit counseling can help you talk to your creditors, make a plan for paying off your debts, and develop good money habits. Some creditors may note it on your report if you sign up for a formal plan, but it usually helps by making sure you make your payments on time and don’t fall behind again.

A single step is the start of every great journey. It’s time to choose that first step now that you have plans that you can use and the drive to follow through on them. You’re on your way to getting your finances back on track, whether you dispute a mistake or make a budget. Have faith in your ability to rebuild; the choices you make today will affect your creditworthiness in the future. You can do this!