In today’s economy, your credit report is the most important thing that determines whether or not you can get a loan, a credit card, a mortgage, a job, or even a rental agreement. A high credit score not only gets you better loan terms and lower interest rates, but it also shows future lenders, landlords, and employers that you know how to handle money. On the other hand, a bad or wrong credit report can make it harder to get loans, cost you more money to borrow, and hurt your financial health. You need to keep an eye on and improve your credit report on your own because this is very important.

Why you should check your credit report and fix any problems

Your credit report has all the details about your credit history. It has:

- Your name, address, Social Security number, and date of birth are all private information.

- Your credit accounts (like credit cards, mortgages, and auto loans), when you opened them, how much money is in them, and how much credit you have.

- History of Payments: payments that were made on time, payments that were late, and payments that were never made

- Bankruptcies, liens, judgments, and accounts that are in collections are all examples of public records and collections.

- When you apply for a loan, a hard inquiry is made. When you check your background, a soft inquiry is made.

Your credit score could drop by tens of points if this report has even one mistake or missing piece of information. Because of this, you’ll have to pay more interest and be able to borrow less. It may be true that bad things are happening, but they will eventually stop showing up on your credit report. It will be easier to keep track of these things if you know when they will stop being on your report. Most bad things will go away after seven years, and bankruptcies will go away after ten years.

There are a lot of good reasons to look at your credit report and improve it:

- The Federal Reserve says that if your FICO® Score goes up by 20 points, you could save thousands of dollars in interest on your mortgage over its term.

- Credit scores are very important to lenders, so you have a better chance of getting a loan. If your score is higher, it’s easier to get a loan.

- Having a clean credit report makes landlords and employers more likely to hire you or rent to you.

- Peace of Mind: You can save a lot of money if you find out about identity theft or fraud early on.

1. Check your credit report often.

Checking your credit report regularly is the best way to keep your credit in good shape. If you don’t check, mistakes, identity theft, and accounts that aren’t yours can go unnoticed for a long time.

1.1 Get free copies of your credit reports every year

You can get one free credit report a year from each of the three main credit bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com. This is what the Fair Credit Reporting Act (FCRA) says. Do these things:

- Visit AnnualCreditReport.com

- Use your own information to show who you are.

- Pick the report and the office you want to see.

- Download or print each report to keep it safe.

- Space out your requests by four months to keep an eye on your credit all year.

1.2 Sign up for services that keep an eye on your credit all the time.

Free reports are helpful, but they only cover a small part of the year. You can use these credit monitoring services to keep an eye on your credit:

- Every week, Credit Karma gives you free scores from TransUnion and Equifax.

- You get daily updates and alerts about your Experian score from Experian Free Credit Monitoring.

- You have to pay for myFICO to see all three of your FICO® Scores.

Know how much the service will cost and what the terms are. Always use direct bureau services or well-known fintech platforms to lower the risk of scams.

1.3 Set up alerts for fraud and security freezes

If you think someone has stolen your identity, you can ask one credit bureau to put a fraud alert on your credit file. They will tell the other bureaus. A security freeze goes even further by stopping people from opening new accounts or asking for new credit without permission. The law says that both are free.

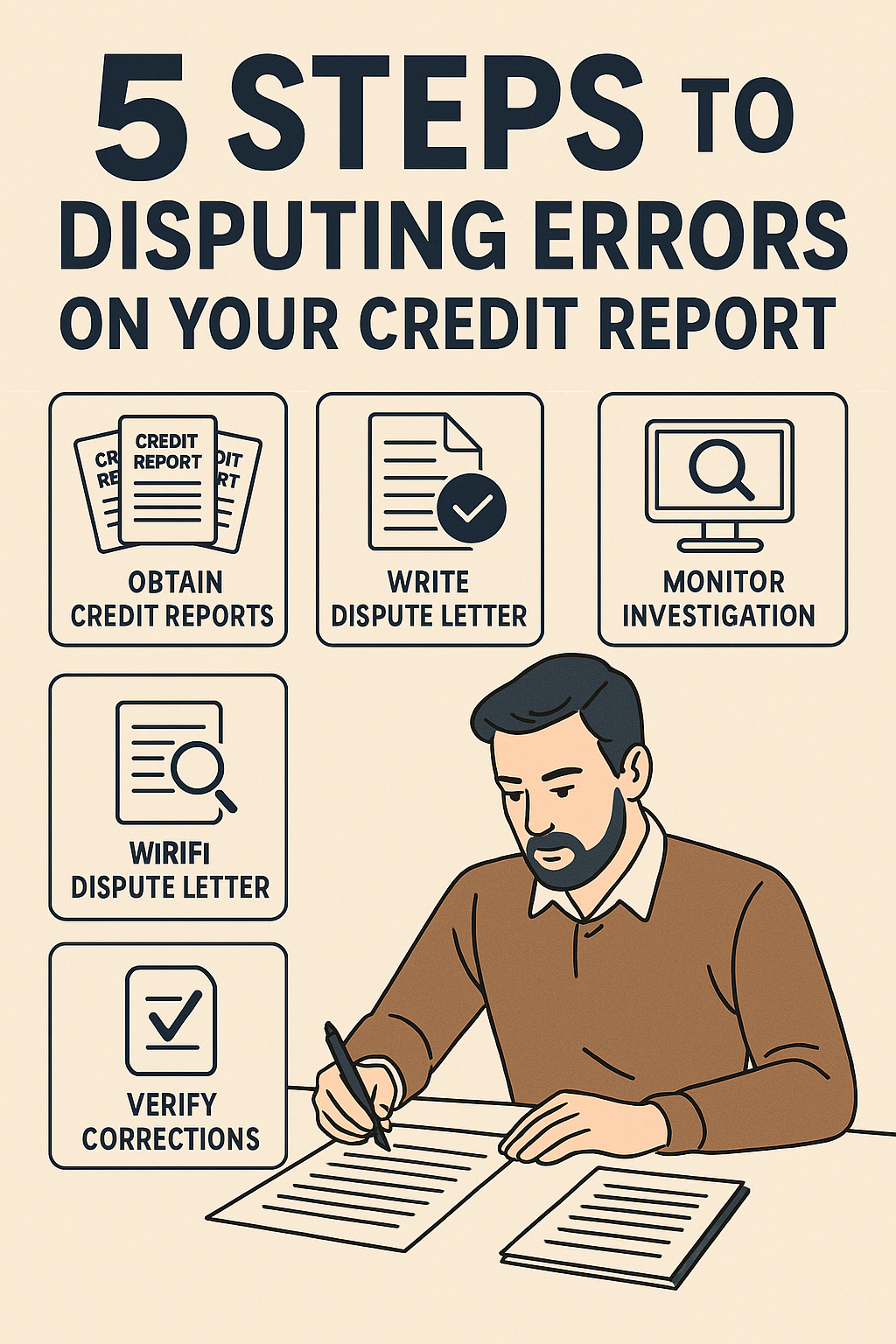

2. Say no and fix the issues Fast

You might not believe it, but mistakes on your credit report happen more often than you think. More than 550,000 people complained to the Consumer Financial Protection Bureau (CFPB) about credit reporting in 2023. Fighting against mistakes can help you get back points you’ve lost and keep problems from happening in the future.

2.1 Look for errors on credit reports

- Names that are spelled wrong or addresses that are wrong are examples of wrong personal information.

- Duplicate Accounts: An account shows up more than once.

- Accounts that are closed are shown as open, or the other way around.

- Things that are more than seven years old don’t need to know about bad news anymore.

- “Unauthorized accounts” are accounts that you didn’t open.

2.2 The Dispute Process: In order:

- Get your ID, bank statements, and other paperwork in order.

- Write a letter saying you don’t agree: Write down each mistake, explain why it’s wrong, and show proof.

- Send it to the Bureau: Use certified mail to send it to Equifax, Experian, or TransUnion and ask for a receipt when it gets there.

- Let them take their time getting back to you: They have 30 days to look into the issue and get back to you. They need to fix things that have been shown to be wrong.

- If the bureau denies your dispute, go straight to the creditor or file a complaint with the CFPB at consumerfinance.gov/complaint.

2.3 Keep track of everything

Keep copies of all letters, confirmation numbers for disputes, and the results of the investigation. If problems come up again, this paperwork can be very useful.

3. Make the ratios of credit use better

Your credit utilization ratio, or the percentage of available credit you are using, is a big part of how credit scoring models work. It’s about 30% of your FICO® Score. If your ratios are lower, it means you’re using credit in a smart way.

3.1 Write down all of your revolving accounts to see how much you use them:

- Lines of credit and credit cards.

- Add Up Your Balances: This is the total amount of money you owe on all of these accounts.

- The limits on your credit tell you how much you can spend in total.

- This formula will tell you how much you are using: (Total Balances ÷ Total Limits) × 100%.

- This ratio should be lower than 30%, but the best score is 10% or less.

3.2 How to Use Less

- Pay your bills on time and often: Pay your bill more than once each billing cycle.

- Request a credit line: If you have more credit available but don’t use it, your ratio goes down.

- Use more than one card to buy things instead of putting all of your credit on one card.

- Don’t Close Unused Cards: Closing cards lowers your total credit limit, which could raise your ratio.

3.3 Personal loans and moving balances

A balance transfer or personal loan with a 0% APR can help you pay off a lot of debt and lower your credit utilization. By looking at the fees and payment terms, you can be sure that the savings are greater than the costs.

4. Keep track of your payments and keep doing so.

Your payment history is the most important thing that goes into your FICO® Score. This makes up about 35% of it. It’s important to be consistent.

4.1 Make Sure Payments Go Through By itself

- Set up automatic payments so that you always pay at least the minimum amount due on each account.

- Align Due Dates: If you can, make sure that the dates you have to pay and the dates you get paid are the same.

- Set up reminders on your phone or email to help you remember important dates and backups.

4.2 Talk about payments that are past due

- Before you pay the creditor, get in touch with them: If you think you’ll be late on a payment because you’re having money problems, let the company know what happened and ask for a good faith adjustment. If you’ve paid on time before, a lot of creditors won’t mark you as late.

- Talk about it and pay for it.Delete: Some debt collectors will close accounts that have been paid off, but you should always get any agreement in writing before you pay.

4.3 Take advantage of “piggybacking”

If you can get permission to use a trusted person’s credit card that they have had for a long time and that is in good shape, it can help you start building a good payment history. This is very helpful for people who don’t have a lot of credit or have only had credit for a short time.

5. Don’t close your old accounts; instead, mix up your credit.

About 10% of your score comes from your credit mix, which is the different types of credit you use. You can show that you can adapt by having a good mix of installment loans (like car loans and mortgages) and revolving credit (like credit cards).

5.1 Keep your accounts open for a long time.

The length of your credit history makes up 15% of your score. Your score could go down if you close old accounts because your average account age goes down. Keep your oldest accounts open, even if you don’t use them very often.

5.2 Add Types of Credit

- Installment Loans: You might want to get a small personal loan to pay off bills or for planned costs.

- Only get new credit cards if you really need them.

- You can mix things up with retail and gas cards, but be careful because some of them have high interest rates.

5.3 Don’t ask questions that don’t need to be asked.

Every hard inquiry can lower your score by a few points, and it will stay on your report for two years. To lessen the effects, don’t ask for new credit all at once. You can use pre-qualification tools to ask questions that won’t hurt your score.

More advice and best practices

- Use these tools to improve your credit: Experian Boost is one of many services that add on-time payments for utilities and phones to your credit report. This could make your score go up right away.

- Check public records often to see if anyone has put a lien or judgment against you. You can either pay them off or take them to court.

- Keep up with changes to the scoring model: FICO and VantageScore change how their algorithms work every now and then. You can find out more about these changes at myFICO.com and VantageScore.com.

- You should use multi-factor authentication on your bank accounts, keep an eye on your Social Security Earnings Statement, and sign up for identity theft protection if you want to.

- If you’re feeling stressed, you can get help from a nonprofit credit counseling agency that the National Foundation for Credit Counseling (NFCC) has approved. You can get one at nfcc.org.

Questions and Answers (FAQs)

1. How often should I check my credit report? You should look at one bureau’s report every four months to make sure you get new information all year long. Sign up for free monitoring services that will send you alerts every day or week.

2. Will checking my own credit report hurt my score? No. Getting soft inquiries, like those from self-checks, won’t change your credit score.

3. How long do bad things stay on my credit report? Most bad things, like collections and late payments, stay on your credit report for seven years. Your report can show bankruptcies for up to ten years, but the length of time depends on how bad they are.

4. Is it possible to delete information that is true but bad? If the law says it can go, negative data that is true must stay. You can ask for goodwill deletions or disagree with them only if they are wrong.

5. What is the difference between a credit check service and a credit score simulator? Credit monitoring services will let you know if anything in your file changes. You can see how things like paying off a credit card could change your score with score simulators.

6. How do a fraud alert and a credit freeze differ from each other? When you get a fraud alert, your file is marked, and creditors have to make sure you are who you say you are before they give you more credit. A freeze stops all new credit activity until you lift it.

7. Should I keep a little money on my card or pay it off every month? Pay off your whole balance every month. Having a low balance doesn’t help your score and costs you more in interest.

8. What should I do if I don’t have any credit? You can get secured credit cards, credit-builder loans from credit unions, or let someone else use an old account.

9. Do student loans make my credit score better or worse? If you pay your student loans on time, your credit score will go up. If you don’t, it will go down. To keep things steady, you might want to set up automatic payments.

10. Do all credit bureaus give you the same score? No, each bureau might give you information that is a little bit different, and the models they use to score are not the same. That’s why you should read all three.

To finish things off

To keep an eye on your credit report and make it better, you need to spend time, pay attention, and make smart choices. Checking your credit regularly, disputing mistakes, optimizing your credit utilization, keeping a perfect payment history, and building a diverse, long-term credit mix are all things you can do to get the best loan offers and improve your financial health. You now have everything you need to build a strong credit profile that will help you reach your financial goals by making it easier to get what you want, lowering costs, and opening doors.

References

- Federal Trade Commission. “Disputing Errors on Credit Reports.” Consumer Information. Available at: https://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- Consumer Financial Protection Bureau. “How do I dispute inaccurate information on my credit report?” CFPB Ask CFPB, March 2025. Available at: https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-inaccurate-information-on-my-credit-report-en-1637/

- AnnualCreditReport.com. “Request Your Free Credit Reports.” Federal law authorized source. Available at: https://www.annualcreditreport.com/index.action

- IdentityTheft.gov. “Report Identity Theft and Create a Recovery Plan.” Federal Trade Commission. Available at: https://www.identitytheft.gov/