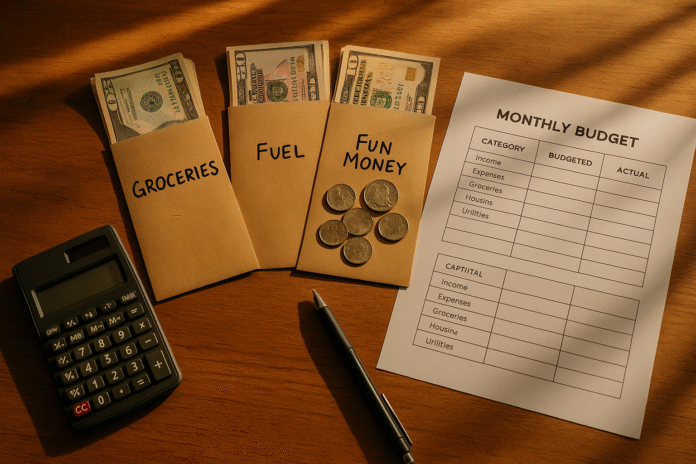

Zero-based budgeting and the cash envelope system are powerful on their own—but together they create a clear, tactile plan you can stick to in the real world. In this guide, you’ll merge them in 12 practical steps, from mapping categories and withdrawing cash to reconciling, adjusting mid-month, and auditing results. If you’ve struggled with “leakage” on groceries, fuel, or takeout, this hybrid keeps every dollar working and every envelope honest. Brief note: this article is educational, not individualized financial advice; adapt amounts and practices to your risk tolerance, local laws, and banking arrangements. In one line, a zero-based budget assigns every unit of income to a job, and cash envelopes add physical guardrails for categories where swiping tends to drift. Here’s a crisp definition for quick reference: A zero-based budget gives every incoming dollar a purpose—spending, saving, or debt—so income minus plan equals zero; cash envelopes allocate part of that plan as physical cash by category to curb overspending.

Fast start (skim list): Decide which categories will be cash-based, assign every dollar on paper, set a safe withdrawal schedule, stuff envelopes with planned denominations, log every purchase at point-of-spend, reconcile weekly, reallocate when needed, secure your cash, coordinate with your household, and run a monthly close-out to iterate.

1. Decide Which Categories Belong in Cash (and Which Stay Digital)

Start by choosing where cash helps behavior most. The envelope method shines in variable, high-temptation categories—groceries, restaurants, fuel, personal spending, home supplies, kids’ activities—where tactile limits reduce “just this once” overshoots. Fixed bills (rent, utilities, insurance) and online obligations (subscriptions, loan payments) stay digital for safety and auditability. Your first 1–2 sentences should answer the sub-intent directly: Put volatile, discretionary categories into envelopes; keep fixed and online categories electronic. Then expand with context: paying with cash increases the “pain of paying,” which can reduce impulse spending, while digital rails remain for automated bills and fraud protections. If you’re new, start with 3–6 envelopes and scale as you gain rhythm. As of now, cash remains commonly used for small, in-person purchases despite overall card growth, which is exactly where envelopes add value.

1.1 Why it matters

- Variable categories are where budgets most often slip—cash sets a visible cap.

- Fixed/online bills benefit from automation and digital records.

- Mixing both respects convenience while adding friction where you want it.

1.2 Mini-checklist

- List all spending categories.

- Mark fixed/online (keep digital).

- Mark variable/temptation (make envelopes).

- Start with 3–6 envelopes; expand later.

Synthesis: Use cash where behavior benefits from tactile guardrails; keep predictable or online payments digital to reduce risk and hassle.

2. Give Every Dollar a Job (Zero-Base Your Month)

The essence of zero-based budgeting is assigning your entire take-home income to categories until nothing is left unplanned. Direct answer: Plan income minus planned outgo to equal zero—on purpose. In practice, total your known income for the coming month (salary, gig pay, benefits, transfers). Then allocate across essentials, debt, savings, and the cash-envelope categories you chose in Step 1. Don’t forget sinking funds for irregulars (car maintenance, school fees, gifts). This approach forces decisions before money leaves your account, eliminating “miscellaneous” drift. Tools like spreadsheets, YNAB, or other budget apps can run the math; “envelope” categories are flagged as cash for later withdrawal and stuffing.

2.1 Numbers & guardrails

- Start needs around 50–60% of take-home; adjust for local cost of living.

- Debt + savings targets: 20–30% combined, even if small at first.

- Envelope share: test 20–40% of total spending in cash; adjust after Month 1.

2.2 Example

If your take-home is $3,500, you might plan $1,950 for needs (mostly digital), $900 envelopes (groceries $500, fuel $200, dining $100, personal $100), $650 debt/savings. Total plan = $3,500; unassigned = $0.

Synthesis: Zero-basing converts guesses into decisions; envelopes become one output of a deliberate plan, not a separate system.

3. Set a Safe Withdrawal Schedule and Envelope Funding Rhythm

To merge both methods smoothly, fund envelopes on a set cadence that matches pay periods and minimizes exposure to loss or fees. Direct answer: Withdraw only what you need for a 1–2-week window and refill on a fixed schedule. Weekly or biweekly stuffing balances convenience and safety; monthly withdrawals can be bulky and riskier to carry. Consider ATM availability, your bank’s daily limits, and any out-of-network charges; if you use an online bank, confirm fee reimbursements and daily withdrawal caps before setting amounts. In the UK and U.S., regulators and central banks have highlighted the ongoing importance of access to cash for budgeting and inclusion, even as digital grows—practically, that means ATM access is still a planning input.

3.1 How to do it

- Sync withdrawal day with payday.

- Decide weekly vs. biweekly stuffing; avoid large monthly hauls.

- Pre-plan denominations (e.g., ask for $20s and $10s).

- Keep a small “change” envelope for odd amounts.

3.2 Mini-checklist

- Verify daily ATM limit and any fees.

- Choose stuffing cadence and calendar it.

- Prepare denomination slip for the teller.

- Transport cash discreetly; go straight home to stuff.

Synthesis: A predictable cadence reduces friction and risk, keeping your hybrid system steady and safe.

4. Plan Denominations and “Stuff the Envelopes” (Tactile Setup)

Answer first: Convert planned amounts into denominations that support real-world prices and tracking. If groceries are $500 for two weeks, pulling 20 × $20 + 2 × $50 might make checkout and change simpler. For fuel at $200, consider 10 × $20. Restaurants at $100 might be 5 × $20 to match typical visits. Write each envelope name and target amount on the front; record the initial balance inside. This tactile ritual is more than ceremony; partitioning money into visible slots increases salience and self-control, which research links to higher savings when funds are separated and made concrete.

4.1 Tools/Examples

- Basic: paper envelopes + pen + ledger lines.

- Upgraded: reusable vinyl envelopes or a binder; cash tray for home.

- Digital assist: note amounts in your spreadsheet/app for parity.

4.2 Mini-checklist

- Write category and target on each envelope.

- Count cash twice; note starting balance.

- Keep a “change” envelope for odd bills/coins.

- Store envelopes in a secure, consistent spot.

Synthesis: Denomination planning makes spending smoother and strengthens the psychological “partition” that curbs leakage.

5. Set Rules for Rollovers, Sinking Funds, and “Change Management”

Direct answer: Decide in advance what happens to leftover cash and coins—before you start. Common options: (a) Rollover to next month’s envelope to smooth volatility; (b) Sweep leftovers to a goal (debt/savings); (c) Split—50% rollover, 50% sweep. Establish “change rules”: coins go into a jar that you roll quarterly; small notes ($1s, $5s) can seed a micro-sinking fund for mini-emergencies (batteries, lightbulbs, school snacks). For true sinking funds (car maintenance, gifts), you can run dedicated envelopes or keep them digital in labeled sub-accounts and only convert to cash when spending is imminent.

5.1 Why it matters

- Pre-defined rules prevent ad-hoc decisions that usually favor spending.

- Rollover stabilizes volatile categories (groceries, fuel).

- Sweeps accelerate priorities (debt snowball, emergency fund).

5.2 Numbers & guardrails

- Choose one default rule (e.g., 50/50 split).

- Cap coin jar before it exceeds $50–$100; deposit periodically.

- If a category exceeds target 3 months in a row, raise the target or adjust habits.

Synthesis: Clear rollover and sweep rules turn leftovers into progress and remove end-of-month guesswork.

6. Handle Online, Recurring, and Card-Only Purchases (Hybrid Hygiene)

Direct answer: Keep fixed bills and card-only transactions digital, but mirror them as “digital envelopes” in your zero-based plan. Many purchases (subscriptions, travel bookings, some pharmacies) require cards or online payments; zero-based budgeting accommodates this by earmarking those dollars in your plan while limiting cash envelopes to in-person, variable spends. If you must buy a “cash category” item online (e.g., grocery delivery), immediately move the equivalent cash from that envelope into a “redeposit” envelope and deposit it on your next bank run. This keeps parity between plan and reality. Behaviorally, cash works because it’s visible; for non-cash categories, you recreate visibility by checking your app/spreadsheet balance before swiping.

6.1 Mini-checklist

- Mark digital-only categories in your plan.

- For online buys of cash items, transfer cash to “redeposit.”

- Reconcile app/spreadsheet to bank weekly.

- Turn on transaction alerts to catch errors.

6.2 Common mistakes

- Treating digital categories as “bottomless.”

- Double-spending by forgetting to remove cash for online equivalents.

- Skipping weekly reconciliation.

Synthesis: Mirror digital bills inside your zero-base and keep cash-digital parity to prevent phantom overspending.

7. Log Every Purchase at Point-of-Spend and Reconcile Weekly

Direct answer: Record each cash purchase on the envelope immediately and reconcile all categories weekly. On the envelope interior, log date, merchant, and amount; update the balance. For cards, capture the receipt or note it in your app/spreadsheet. Weekly, compare (a) envelope balances + (b) digital category balances to your plan. This simple ritual delivers two benefits: early warning on overruns and confidence that your plan reflects reality. If you prefer software, YNAB and similar tools support cash categories; the behavior remains the same—zero-base first, then record religiously.

7.1 Steps (weekly)

- Empty receipts, update logs.

- Count envelopes; note actuals.

- Tally digital categories against statements.

- Note variances; decide reallocations (see Step 8).

7.2 Numbers & guardrails

- Aim for ≤2% variance per category; if higher, review assumptions.

- If you miss logging, recreate from receipts same day—don’t wait.

Synthesis: Logging at the register plus a weekly “close” keeps your hybrid system honest without requiring heroic memory.

8. Make Mid-Cycle Adjustments Without Breaking the System

Direct answer: Reallocate within your plan when facts change—move money, don’t ignore limits. If groceries run hot, you can move $40 from dining or personal to groceries and reflect that change on both the envelopes and your sheet/app. If a true surprise hits (flat tire), you can (a) spend from a sinking fund, (b) reallocate from flexible envelopes, or (c) temporarily pause a discretionary goal. The key is documenting every move so your zero-base still equals zero.

8.1 How to do it

- Hold a 10-minute “huddle” mid-week (solo or with partner).

- Identify any category trending high; choose a source category to cut.

- Move bills between envelopes physically; note the transfer.

- Update your spreadsheet/app to mirror changes.

8.2 Mini case

Mid-month, groceries are down to $60 with 10 days left; dining has $120 unused. You move $80 from dining to groceries: physically shift four $20 bills, reduce dining target to $40, and record both changes.

Synthesis: Adjustments are a feature, not a failure—documented changes keep the plan truthful and stress down.

9. Store, Carry, and Use Cash Safely (Risk, Security, and Local Notes)

Direct answer: Minimize cash-on-person and secure at-home storage; follow common-sense safety and your local norms. Carry only the envelopes you’ll use that day; keep the rest secured at home in a locked drawer or safe. Avoid flashing large amounts; be discreet at checkout. If you live where cash acceptance is fading, keep a fallback card but cap its use to digital categories. Policymakers in multiple regions continue to underscore the role of cash for budgeting and inclusion; practical takeaway: access may vary by area, so factor ATM locations and opening hours into your withdrawal rhythm.

9.1 Mini-checklist

- Carry day-only envelopes; leave others secured.

- Photograph envelope fronts (not cash) for insurance inventory.

- Keep a fallback card only for emergencies or card-only merchants.

- Never leave envelopes in vehicles.

9.2 Region-specific notes

- Some locales have high out-of-network ATM fees or strict daily limits—plan denominations and timing to avoid multiple withdrawals.

- If your country has robust cash access protections (e.g., UK rules on free-to-use withdrawals), use them; if not, pick banks with wide ATM networks or reimbursements. FCA

Synthesis: Treat cash like medicine: carry only what you need, store the rest safely, and respect local access realities.

10. Coordinate With Your Household (Shared Rules, Shared Wins)

Direct answer: Create light coordination rituals so everyone spends from the same plan. Agree on envelope rules (who carries what, how to log, rollover policy) and set a weekly 15-minute budget huddle to review balances, upcoming events, and reallocations. Use visual cues—a whiteboard with envelope targets, or photos of current balances—to keep the team aligned. If teens receive allowances, consider a small “Cash-Plus” setup: half cash for spending, half digital into savings, to teach both tactile control and online literacy.

10.1 Tools/Examples

- Shared spreadsheet or app with read-only access for accountability.

- Envelope “checkout” sheet when someone takes an envelope.

- Family calendar integrated with the budget huddle (birthdays, sports trips).

10.2 Mini-checklist

- Agree on envelope custody and transport.

- Decide a spend-without-text threshold (e.g., >$40 requires a heads-up).

- Celebrate small wins at month-end (leftover sweep, debt paid).

Synthesis: Mild structure—not micromanagement—keeps the hybrid system collaborative and drama-free.

11. Optimize the Hybrid: Digital Proxies, Sub-Accounts, and Apps

Direct answer: Use digital proxies when cash is impractical, without losing zero-based discipline. Some households create sub-accounts (groceries, fuel, fun) with separate debit cards; others use a prepaid card loaded with the month’s “cash” categories. Budget apps like YNAB treat these as categories with balances; you still “stuff,” but with transfers instead of bills. The behavior is the same: fixed plan, visible balances, weekly reconciliation. For small merchants who prefer cash, envelopes remain ideal; for travel or ecommerce, lean on digital proxies to avoid carrying cash across borders or through airports. As of 2024–2025, surveys show cash is still used for a minority share of payments by number (low-to-mid-teens), while cards dominate—hybrids let you ride both rails without losing control.

11.1 Common mistakes

- Replacing envelopes with a single “misc” debit card—visibility disappears.

- Forgetting to cap the proxy card at the envelope amount.

- Skipping weekly reconciliation because “it’s already digital.”

11.2 Mini-checklist

- If using sub-accounts, nickname clearly (e.g., “GROCERIES”).

- Load only the envelope amount; no top-ups without reallocation.

- Keep app categories in sync with balances.

Synthesis: Digital proxies can mimic envelopes; keep the core behaviors—pre-planned caps and frequent check-ins—to retain the benefit.

12. Close the Month: Audit, Learn, and Iterate

Direct answer: Run a structured month-end close to convert experience into better targets. Count each envelope; record actuals; compare to plan; compute variances. For digital categories, export or review statements and reconcile to your app/spreadsheet. Sweep leftovers per Step 5; document any one-offs that distorted the month. Then reset targets: raise categories that exceeded plan for structural reasons (e.g., fuel price increase), and lower categories that consistently under-spend. Finally, write 1–3 specific habit improvements for the next month (e.g., meal plan twice, consolidate errands).

12.1 Numbers & guardrails

- Flag any category with >10% variance for review.

- If total spending beat plan by >3%, consider a 2-week spending freeze next month.

- If debt/savings wins occurred, log milestone dates to maintain motivation.

12.2 Mini case (audit math)

Planned groceries $500, actual $560 (+12%); dining planned $200, actual $110 (–45%). You raise grocery target to $540 and drop dining to $160, net neutral. Leftover $30 rolls to the car maintenance sinking fund.

Synthesis: A short, honest close turns cash-and-zero-base from a budget you “try” into a system you improve.

FAQs

1) What is zero-based budgeting and how do cash envelopes fit in?

A zero-based budget assigns your entire monthly income to categories—spending, saving, and debt—so planned outgo equals income. Cash envelopes are one way to execute some categories; you literally allocate cash by category and stop when the envelope empties. Used together, you decide the jobs in your plan and then enforce limits where drift happens most.

2) Are cash envelopes still relevant now that most payments are digital?

Yes—especially for small, in-person purchases. Central bank surveys show cards dominate overall payments by number, but cash persists in everyday contexts where tactile limits help. If you dislike carrying cash, use digital proxies (sub-accounts or prepaid cards) while keeping zero-based discipline and weekly reconciliation. frbservices.org

3) Does paying with cash actually reduce spending?

Multiple studies in behavioral economics have found that paying by card can increase willingness to pay relative to cash—cash’s salience adds “friction” that curbs impulse buys. That doesn’t mean never use cards; it means envelopes are a smart tool where you want more friction.

4) How many envelopes should I start with?

Most beginners do well with 3–6 envelopes focused on leak-prone categories (groceries, dining, fuel, personal). As you gain confidence, expand to 8–10 if needed, or consolidate with digital proxies if envelopes become cumbersome.

5) What if a “cash” purchase must be made online?

Pay digitally, then remove the equivalent cash from the relevant envelope and move it to a “redeposit” envelope. Deposit on your next bank run. This keeps your plan honest and prevents accidental double-spending.

6) Is it safe to keep cash at home?

Use common sense: limit amounts on hand, secure storage (locked drawer or safe), and don’t carry non-active envelopes. Match your withdrawal cadence to needs (weekly or biweekly) and be discreet. In regions with strong cash-access protections, plan ATM visits around opening hours and safe locations.

7) Which tools work best with this hybrid?

Any spreadsheet plus a simple envelope ledger works. If you prefer software, YNAB supports zero-based budgeting and cash categories, while other apps allow custom categories and manual cash tracking. The tool matters less than sticking to weekly reconciliation and month-end audits.

8) How do I handle coins and small bills?

Create a coin jar and a “change” envelope. Roll coins or deposit when the jar hits a set threshold (e.g., $50). Small bills can seed mini-sinking funds or be swept to savings at month-end (choose one rule and stick to it).

9) Can envelopes help me build emergency savings?

Yes—partitioning and visual cues have been shown to improve savings balances in experiments. You can run a “Buffer” or “Emergency” envelope for small targets while keeping the main emergency fund in a high-yield account.

10) What about fees and ATM limits?

Check your bank’s schedule for daily withdrawal caps and any out-of-network charges; plan denominations and withdrawal cadence accordingly. If possible, choose banks that reimburse ATM fees or offer broad networks to minimize friction.

11) I’m paid irregularly. Can I still use this system?

Yes—set a “True Zero” for the current cash on hand and the income you already have, fund priority envelopes first (groceries, fuel), and delay lower-priority envelopes until income arrives. Re-plan at each deposit and keep envelopes small but frequent.

12) How do I know it’s working?

Within 2–3 cycles, you should see fewer “mystery” expenses, lower variance in variable categories, and smoother cash flow. Track total overspend (goal: ≤2% of plan) and celebrate concrete wins (e.g., $120 leftover swept to debt).

Conclusion

Merging zero-based budgeting with cash envelopes isn’t about nostalgia—it’s about clarity and control. Zero-basing forces you to choose how every dollar works before it leaves your account; envelopes make those choices tangible where human behavior tends to wobble. The 12 steps you’ve followed give you a complete operational cadence: decide envelope scope, assign every dollar, withdraw on a safe rhythm, stuff with smart denominations, set rollover and sweep rules, mirror online transactions, log and reconcile weekly, adjust mid-cycle without guilt, protect and carry cash safely, coordinate with your household, adopt digital proxies where sensible, and audit the month to improve your targets. As payment habits evolve and cards dominate more transactions, this hybrid keeps you fluent in both worlds without sacrificing discipline. Start small—three envelopes, one weekly reconciliation—and let the system teach you what to change. Next step: pick your first 3–6 envelopes and calendar your first stuffing day this week.

References

- “What Is a Zero-Based Budget?” YNAB (You Need A Budget), July 25, 2022. YNAB

- “Zero-Based Budgeting (ZBB): What It Is and How to Use It,” Investopedia, updated 2025. Investopedia

- “Managing Your Money, Part 2” (envelope method mention), Consumer Financial Protection Bureau, July 7, 2025. Consumer Financial Protection Bureau

- “2025 Findings from the Diary of Consumer Payment Choice,” Federal Reserve Financial Services (FedCash®), 2025. frbservices.org

- “2023 Survey and Diary of Consumer Payment Choice,” Federal Reserve Bank of Atlanta, 2024. atlantafed.org

- Drazen Prelec & Duncan Simester, “Always Leave Home Without It: A Further Investigation of the Credit-Card Effect on Willingness to Pay,” MIT, 2001. Massachusetts Institute of Technology

- “Evidence-Based Strategies to Build Emergency Savings,” CFPB, July 2020. Consumer Financial Protection Bureau

- “PS24/8: Access to Cash,” UK Financial Conduct Authority, July 12, 2024. FCA

- “2024 Diary of Consumer Payment Choice,” Federal Reserve Financial Services, 2024 (overview page). frbservices.org