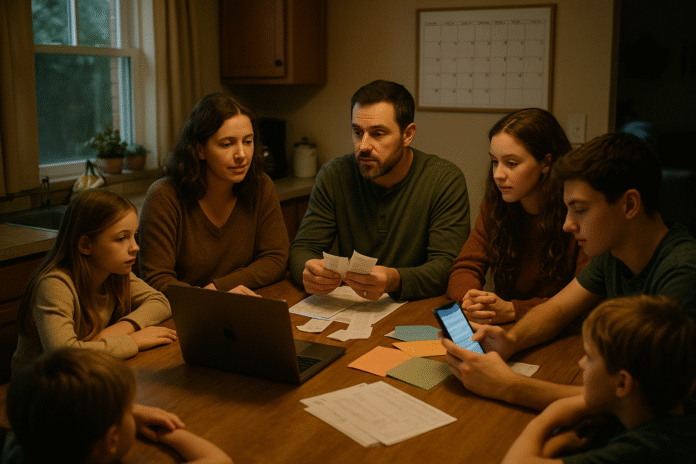

If your household has many moving parts—multiple kids, school terms, activities, medical appointments, and two (or more) incomes—zero-based budgeting gives you a way to make sure every currency unit you earn is assigned to a clear job. In simple terms, zero-based budgeting means your income minus planned spending (including savings and debt payments) equals zero for the period; nothing is left idle. For large families, the method works best when you add structure: category architecture, per-person benchmarks, sinking funds, and role-based routines. This guide is educational, not financial advice; adapt the ideas to your circumstances and local laws. Here’s a fast path: (1) map family-scale categories, (2) size a realistic buffer and emergency fund, (3) control groceries with per-person targets, (4) build sinking funds for school, health, and transport, (5) schedule weekly check-ins, (6) automate what you can, and (7) review annually with data. You’ll find concrete numbers, examples, and tool suggestions throughout (current as of now; see References).

1. Build a Family-Scale Category Map (Core, Shared, Per-Child)

Start by answering the big question: “What exactly are we funding each month?” For large families, an unstructured list of 60–100 categories becomes chaos fast. The direct answer is to group your zero-based budget into three layers: Core (housing, utilities, insurance, groceries), Shared (transport, internet/phones, household supplies), and Per-Child (school fees, uniforms, activities, pocket money, health co-pays). State this structure at the top of your budget and tag every line accordingly. This clarifies trade-offs—when you move money from a Per-Child item to a Core item, you’re making a visible, explicit choice. The result is fewer surprises, simpler discussions, and faster adjustments mid-month. A clear map also enables delegation: older kids can “own” certain shared categories (e.g., pets) with a mini-checklist and a spending cap.

1.1 Why it matters

- It reduces cognitive load during busy seasons (start of term, holidays).

- It highlights structural overspend in Core before it starves Per-Child items.

- It enables apples-to-apples comparisons across kids and months.

1.2 How to do it

- Core: Rent/mortgage; property tax/HOA; electricity/gas/water; groceries; premiums; debt minimums.

- Shared: Fuel and transit; phones/internet; household/pet supplies; family entertainment.

- Per-Child: Tuition/fees; clubs/sports; lessons; exam fees; uniforms/equipment; pocket money/allowances.

- Add a “Hold” category for irregular income and a “True Expenses” group for annual/seasonal costs.

- Document category rules in one sentence each (owner, cadence, and cap).

Mini-checklist: (a) three-layer map drafted, (b) every category labeled Core/Shared/Per-Child, (c) owners assigned, (d) caps written.

Synthesis: A layered category map turns a sprawling family budget into a navigable plan, making re-allocation quick and drama-free when life happens.

2. Size Your Buffer and Emergency Fund for Household Risk

Large families carry higher exposure to shocks: job changes, medical events, travel to support relatives, or two vehicles breaking the same month. A direct, practical answer is to build two cushions: a one-month buffer inside your zero-based budget (so you budget this month with last month’s income) and a separate emergency fund sized to household risk. The common rule of thumb—3–6 months of essential expenses—often needs to skew higher when dependents are many or income is variable; 6–9 months is reasonable if one earner supports most costs. Track those targets as categories you fund every month, even when times are good. When money is tight, defend the buffer first; it stabilizes the whole plan and prevents credit-card “bridges.”

2.1 Numbers & guardrails

- Buffer: 100% of next month’s Core + Shared essentials (exclude Per-Child wants).

- Emergency fund: 3–6 months minimum; consider 6–9 months with >3 dependents or one volatile income.

- Keep emergency money in a high-yield, principal-safe account; don’t invest it for growth.

2.2 Steps to build it

- Redirect windfalls (tax refunds, bonuses, gifts) to the buffer until full.

- Set a fixed monthly line for the emergency fund (e.g., 5–10% of take-home).

- Refill the fund before restoring discretionary categories after a withdrawal.

Mini case: If essentials run ₹350,000/month (≈US$1,250 at an illustrative rate), a 6-month emergency fund is ₹2.1M; if one earner is a contractor, aim for 8–9 months.

Synthesis: Right-sized cushions absorb the shocks that are inevitable in big households and keep your zero-based plan intact when real life hits.

3. Control Groceries with Per-Person Benchmarks and Menu Planning

Food is the largest controllable line in most big families, and it inflates quickly with teens. The direct answer is to set per-person targets using a public benchmark, then manage to menus not moods. In the U.S., the USDA Thrifty Food Plan publishes age- and sex-based monthly food costs; use it as a reference, then adjust for your region and dietary needs. Build a 4–6-week rotating menu with bulk staples, and shop from that plan. Track spend per person per week; share it at family check-ins so everyone sees the same numbers. Finally, maintain a pantry/freezer inventory to prevent duplicates and waste—each duplicate silently taxes your budget.

3.1 Numbers & guardrails

- As of January 2025, the USDA’s monthly Thrifty estimates ranged roughly US$167–315 per person by age/sex; adolescents (especially boys 14–19) sit at the high end.

- Use per-person × household count to form a target; adjust ±10–20% for local prices/diet.

3.2 How to do it

- Build a 30-meal “family hits” list (costed); schedule breakfasts/lunches as repeating blocks.

- Shop weekly from a shared list; buy proteins and staples in bulk when unit costs drop 15%+.

- Keep a running inventory; set a “use first” bin for soon-to-expire items.

- Track cost/serving for 10 frequent meals (e.g., dal + rice ≈ ₹65/serving at home vs. takeout).

Region notes: Benchmarks differ—use local price guides or your own 90-day average where USDA isn’t relevant.

Synthesis: Benchmarks plus menu discipline tame grocery volatility and make trade-offs visible without food-fight debates.

4. Create Sinking Funds for School, Activities, and Learning

School and activity costs are lumpy: term fees, uniforms, exam registrations, instruments, tournaments, field trips. The zero-based approach is to convert lumpy to monthly via sinking funds—small, steady payments into labeled categories that mature right before due dates. Map each child’s school year on a calendar, list all expected costs, and divide by the months remaining. Add a 10–15% cushion for surprise fees. This removes drama in August/September and during tournament season, and it teaches kids that money for wants follows needs that were planned for months ago.

4.1 Steps

- One child per category (e.g., “Aisha—School 2025–26”), plus global “Family Learning” (books, museum passes).

- Enter all dates/amounts (fees, exams, uniforms, sports) with reminders.

- Auto-transfer the monthly amount on payday.

4.2 Numbers & guardrails

- Add 10–15% contingency to each sinking fund.

- Cap yearly “activities” per child (e.g., ₹60,000) and re-evaluate after each term.

Mini-checklist: calendar done, totals divided into monthly lines, auto-funding turned on, 10% buffer added.

Synthesis: Sinking funds transform school season from a budget cliff into a smooth ramp you already paved.

5. Budget Health Costs: Premiums, OOP, and HSA/FSA Where Available

Health expenses blow up plans when they aren’t separated into premiums and out-of-pocket (OOP). The direct answer is to create distinct categories for premiums, routine OOP (co-pays, prescriptions), and rare OOP (procedures). If you’re in the U.S. with a High-Deductible Health Plan, fund an HSA up to the family limit; treat it as both a tax shelter and a medical reserve. For predictable costs—braces, therapy—use sinking funds with due dates. Keep a shared folder for EOBs and receipts to audit bills and trigger reimbursements on time.

5.1 Numbers & guardrails (U.S., as of 2025)

- HSA family contribution limit: US$8,550; HDHP family minimum deductible US$3,300.

- Budget routine OOP at last-12-months average + 10% until you have a 6-month trend.

5.2 Steps

- Separate “Routine OOP” from “Rare OOP.”

- Pre-fund orthodontics/therapies with monthly sinking funds.

- Audit medical bills; request itemized statements before payment.

Region notes: Countries with national health systems still face OOP for dental, optical, and prescriptions; build categories for those lines.

Synthesis: Splitting premiums from OOP and using HSA/FSA or local equivalents brings clarity and cushions medical surprises.

6. Manage the Transportation Stack (Fuel, Maintenance, Insurance)

With multiple drivers and school runs, transport often rivals groceries. The zero-based fix is to budget per vehicle and by cost type: fuel, maintenance, insurance, registration, parking/tolls. Track mileage and create maintenance sinking funds (e.g., ₹5–7 per km or US$0.04–0.06/mi set aside). Stagger big services and renewals across months where possible. If teens drive, assign them a sub-category cap and a shared rules list; driving comes with responsibilities and a line-item they can help fund via part-time work.

6.1 How to do it

- One category per vehicle; one “Household Fuel” line if cars share fill-ups.

- Add annual lines (registration/insurance) as 12-month sinking funds.

- Log odometer monthly; schedule oil/filters/tires by mileage, not surprises.

6.2 Numbers & guardrails

- Set aside 1–1.5% of vehicle replacement cost monthly for depreciation/repair reserve.

- Price teen-driver insurance increases before they start; adjust caps accordingly.

Mini-checklist: vehicles listed, maintenance reserve on auto-fund, renewals spread over the year, teen rules written.

Synthesis: Treat each vehicle like its own mini-budget and you’ll turn transport from an emergency generator into a predictable machine.

7. Smooth Housing & Utilities with Seasonality and Efficiency

Rent or mortgage dominates Core, but utilities swing seasonally. The direct approach is to average your last 12 months of electricity/gas/water and fund that average every month, keeping surpluses for peak months. Explore efficiency that yields 10–20% reductions: sealing leaks, LED lighting, thermostat scheduling, and off-peak usage where tariffs apply. For large families, laundry and hot water are major drivers; batch-run, cold-wash when possible, and maintain appliances on schedule. If you pay property taxes or HOA dues annually, treat them as sinking funds with clear due dates.

7.1 How to do it

- Compute 12-month average; budget that amount monthly; keep a “Utilities Buffer.”

- List peak months; set reminders for air-filters/AC service before summer.

- When rates change, update targets and note “as of <Month Year>” in the category memo.

7.2 Numbers & guardrails

- Aim to shave 10–15% off annual kWh/therms via basic efficiency upgrades.

- Treat property tax/HOA like subscriptions: 12 equal payments into a sinking fund.

Region notes: Time-of-use tariffs, subsidies, or tiered pricing vary widely; check local rules before shifting usage.

Synthesis: Averaging plus small efficiency wins turns bill spikes into steady flows your budget anticipates.

8. Plan Clothing & Gear with a Lifecycle (Capsule + Hand-Me-Downs)

Without a plan, clothing costs balloon in large families—especially with sports gear and fast growth spurts. The direct answer is to lifecycle clothing: set per-child seasonal caps, build capsule wardrobes, and maintain a labeled storage bin system for hand-me-downs. Track sizes and upcoming needs on a shared note. Fund uniforms and specialty gear via sinking funds. Schedule two family swap days per year to re-allocate stored items. Donate or sell outgrown items and recycle the proceeds into the clothing category.

8.1 Steps

- Per-child seasonal cap (e.g., ₹12,000/season or US$120); list must-have items first.

- Use a 4-bin system: “Now,” “Next size,” “Donate/Sell,” “Repair.”

- Photograph gear sets for quick inventory before sales season.

8.2 Numbers & guardrails

- Allocate 70–80% of the cap to must-haves; leave 20–30% for mid-season surprises.

- For sports: budget the full season cost (fees + travel + gear) before committing.

Mini-checklist: caps set, bins labeled, sizes tracked, swap days on calendar.

Synthesis: Treat clothing as an inventory you manage, not a monthly emergency, and your spend predictably fits the plan.

9. Use Allowances and Teen Income to Teach Shared Rules

Money habits form at home. The direct answer is to create age-appropriate allowances with clear jobs (e.g., personal treats, small gifts) and, for teens, link increased privileges to real responsibilities and part-time work or side gigs. Teach the 50/40/10 split for teen income (50% spend, 40% save for a medium-term goal, 10% give), or your own variation. Use prepaid cards or supervised debit cards so older kids learn digital money safely. Their categories live under Per-Child and are funded on payday like any other priority.

9.1 How to do it

- Decide allowance amounts and what they cover; write rules (“We don’t re-fund overspends”).

- For teens, set category caps for fuel/data/clothes and review weekly.

- Encourage goal-based saving (e.g., US$300 for a used bike; ₹15,000 for a course).

9.2 Numbers & guardrails

- Start with modest amounts (e.g., ₹300–₹800/week or US$5–$10 for younger kids; scale with age).

- Require receipts/photos for larger purchases as an accountability habit.

Mini case: A teen earning ₹10,000/month splits ₹5,000 spend, ₹4,000 save, ₹1,000 give; the “save” category funds a laptop target in five months.

Synthesis: Allowances with clear jobs turn your budget into a training ground, not a police station.

10. Calendar-Driven Cash Flow for Irregular or Multiple Incomes

Multiple pay cycles and side gigs make cash flow lumpy. The direct fix is to budget only money you have and park surplus in a “Hold for Next Month” category until you have a full month’s buffer. Treat large, less-frequent incomes (bonuses, freelance payouts) as quarterly events that fill true-expense and sinking funds first. Pin payday reminders on a shared calendar and hold a 15-minute huddle that day: reconcile, fund, and re-prioritize based on the next 2–3 weeks’ obligations.

10.1 Steps

- Use a wall or shared digital calendar with paydays, tuition dates, renewals.

- Fund True Expenses (annual/seasonal) immediately after essential bills.

- Move leftover to “Hold for Next Month” until you can budget one month ahead.

10.2 Numbers & guardrails

- Aim for one full month ahead within 6–12 months; faster if windfalls arrive.

- For variable income, set a conservative monthly floor (e.g., 70% of 12-month average).

Mini-checklist: calendar live, floors set, “Hold” category funded, payday huddles booked.

Synthesis: When every rupee/dollar has a date as well as a job, irregular income stops derailing your month.

11. Bulk Buying and Household Inventory for Real Savings

Bulk buying saves only if it matches your consumption rate and storage. The practical answer is to bulk-buy known winners (detergent, rice, beans, toilet paper, frozen veg, long-life dairy) and track days-to-empty so you don’t stockpile beyond 60–90 days. Use unit-price comparisons and a simple inventory sheet. Create a “buy list” rule: bulk only when (a) unit cost is ≥15% cheaper and (b) you have storage without risking spoilage. Fund bulk purchases from a dedicated “Bulk Stock” sinking fund that refills monthly.

11.1 How to do it

- Keep a 2-column list: item, unit price (₹/kg or $/lb) across 2–3 stores.

- Mark par levels and days-to-empty for top 20 items.

- Rotate stock FIFO; date every package.

11.2 Numbers & guardrails

- Target 15–25% savings on bulk staples; avoid perishable bulk unless freeze-friendly.

- Keep bulk inventory ≤90 days of usage to protect cash flow and storage.

Mini case: Switching to 10-kg rice sacks at ₹70/kg from ₹95/kg saves ₹1,250 per sack; at two sacks/month, that’s ₹30,000/year.

Synthesis: Inventory discipline makes bulk buying a cash-flow ally instead of a pantry-stuffing hobby.

12. Budget Childcare and Caregiving with Transparent Trade-offs

Care costs (daycare, after-school, babysitting, elder care) are high and often unavoidable. The zero-based move is to cost all options—paid care, schedule shifts, or family help—and then budget the least-stress, sustainable mix. Record hourly/daily rates, commute effects, and the value of regained work hours. Use sinking funds for predictable spikes (school breaks, summer). Put the decision in writing: which days rely on paid care; who’s on pickup; what’s the backup plan.

12.1 Steps

- List options with total monthly hours and rates; include transport time.

- Run a “net work” calculation (after-tax pay minus care and commute costs).

- Build a “Back-up Care” sinking fund for sick days and emergencies.

12.2 Region notes & resources

- U.S.: Check SNAP, WIC, or state programs if applicable; eligibility rules update annually (FY2025: standards effective Oct 1, 2024–Sept 30, 2025).

- UK: Child Benefit rates are published annually; factor them into your net plan.

- Canada: Canada Child Benefit (CCB) provides monthly tax-free payments; use the CRA calculator for amounts.

Synthesis: Transparent costing and a written plan keep care decisions aligned with your budget and your sanity.

13. Choose Tools and Shared Workflows That Fit a Big Household

Software can make or break consistency. The direct answer: pick a shared-friendly tool and a simple workflow. YNAB supports true zero-based budgeting (“give every dollar a job”) with rule-driven category moves. Monarch Money offers shared household views built for couples/households. Tiller links bank feeds to Google Sheets for customizable, multi-person collaboration. Decide roles: one person reconciles daily; both attend weekly reviews; older kids view specific categories on read-only. Keep notifications on so small errors don’t become month-enders.

13.1 Numbers & guardrails (as of 2025; features evolve)

- YNAB: zero-based method with category moving; strong for envelope-style planning.

- Monarch: shared household features and joint views.

- Tiller: bank feeds into Sheets; flexible templates for family budgets.

13.2 Mini-checklist

- Pick one tool; define roles (Reconcile, Report, Review).

- Lock your weekly check-in time; keep it under 30 minutes.

- Turn on bank alerts and tool notifications.

Synthesis: Tools don’t run the budget—you do—but the right ones reduce friction so your plan survives busy weeks.

14. Hold Family Budget Check-ins and Write the Rules

Conversation beats confusion. The direct answer is to host a weekly 20–30 minute check-in with a simple agenda: (1) wins/overages, (2) category moves, (3) upcoming seven-day calendar, (4) per-child updates. Keep a written Budget Rules page (e.g., “No purchases >₹5,000 without a message to the group,” “If a category is empty, we move money before spending”). Rotate a small reward—movie night pick, dessert choice—to keep buy-in high. If conflict arises, move to data: last 90 days by category. The goal isn’t perfection; it’s a process everyone understands and can live with.

14.1 How to do it

- Fixed weekly slot; phones down; shared screen of the budget.

- Start with gratitude and one small fix; end with the calendar.

- Document rule changes immediately in the budget notes.

14.2 Mini-checklist

- Agenda printed/saved, data ready, timeboxed to 30 minutes.

- Notes saved where everyone can see.

- One morale-boosting ritual to close.

Synthesis: Short, predictable check-ins prevent small leaks from becoming big arguments and keep the plan relevant every week.

15. Review Annually with Equivalence Weights and KPIs

Big families change fast—new baby, a teen’s appetite, a graduate leaving home. The direct answer is an annual audit using equivalence scales (e.g., OECD modified scale) to compare spending per adult-equivalent across years; this normalizes changes in family size. Track KPIs: grocery spend per person per week, transport per km, healthcare OOP per member, school costs per child, and percent of income to “True Expenses.” Update caps and targets and decide if the emergency fund needs resizing. Archive snapshots so you can see trend lines, not just feelings.

15.1 Numbers & guardrails

- OECD modified equivalence scale: first adult = 1.0; other adults = 0.5; each child <14 = 0.3; use as a normalization tool for comparisons.

- KPI targets: set from your own 12-month averages, then aim to lower by 5–10% where realistic.

15.2 How to do it

- Export last-year data; compute per-person and per-equivalent metrics.

- Reset caps (groceries, clothing, activities) based on reality, not hope.

- Adjust buffer/emergency fund for the new household risk profile.

Synthesis: A simple, data-driven annual review keeps your zero-based plan matched to the family you have now—not the one you had last year.

FAQs

1) What is zero-based budgeting in one sentence?

It’s a method where you assign every unit of income a specific job—spending, saving, or debt—so income minus outflows equals zero, and you adjust categories as real life happens. This structure is especially helpful in large families because it makes trade-offs explicit and visible.

2) How much should a large family budget for groceries?

Use a per-person benchmark and adjust to your region and diet. In the U.S., the USDA Thrifty Food Plan lists monthly costs by age and sex (teens often cost most), which you can sum for your household and then tune ±10–20% for local prices and preferences. Track your 90-day average to set a realistic target.

3) How big should our emergency fund be with several dependents?

Start with 3–6 months of essential expenses; if one earner supports most costs or income is variable, consider 6–9 months. Fund it monthly and refill it after any use before restoring discretionary lines. Keep it liquid in a secure, interest-bearing account so it’s available when life happens.

4) Which budgeting app works best for big households?

Choose the one you’ll actually use. YNAB enforces true zero-based budgeting with flexible category moves; Monarch Money offers shared household views; Tiller integrates bank feeds into collaborative spreadsheets. Set roles (reconcile, review) and keep weekly check-ins to 30 minutes.

5) How do we budget for school costs across multiple kids?

Create a sinking fund per child with all term-year costs (fees, uniforms, exams, trips), divide by months until due, and auto-fund monthly with a 10–15% buffer. Keep a shared calendar for due dates and review each term before enrolling in new activities.

6) What benefits or credits should we factor into our plan?

This varies by country. In the U.S., check eligibility for SNAP and other programs; standards update annually. In the UK, factor in Child Benefit. In Canada, estimate your Canada Child Benefit using CRA guidance. Always confirm current rates and rules in your region.

7) How do we manage irregular income (bonuses, freelance) with a large family?

Budget only money you actually have. Set a conservative monthly floor (e.g., 70% of your 12-month average), fund true expenses first, and send the rest to “Hold for Next Month” until you’re one month ahead. Use payday huddles to reconcile, fund, and re-prioritize in 15 minutes.

8) What’s a fair teen allowance—and what should it cover?

Start small and link it to responsibilities. Give clear scope (personal treats, small gifts), set category caps for larger items (data plans, fuel), and teach a simple split like 50/40/10 (spend/save/give). Review weekly with receipts or photos for larger purchases to build accountability.

9) Should we bulk-buy to save money?

Yes—selectively. Bulk items should be at least 15% cheaper per unit, match your 60–90-day consumption, and have safe storage. Track unit prices and days-to-empty for your top staples, rotate stock FIFO, and fund bulk purchases from a dedicated “Bulk Stock” line so you don’t starve other categories.

10) How do we normalize our budget when family size changes?

Use equivalence scales (like OECD’s modified scale) to convert your household to adult-equivalents and compare costs year over year. This helps you see whether groceries, transport, and health spend per equivalent are trending up due to prices or because your household composition changed.

Conclusion

Large families don’t need more willpower—they need more structure. Zero-based budgeting works at scale when you (1) map categories into Core, Shared, and Per-Child; (2) stabilize cash flow with a buffer and fully funded true expenses; (3) manage grocery and transport with per-person, per-vehicle targets; (4) turn lumpy bills into monthly sinking funds; (5) schedule short, consistent check-ins; (6) use shared-friendly tools with clear roles; and (7) run an annual, data-driven audit. Do this and money conversations become calmer, teens learn real-world habits, and big, joyful family moments aren’t overshadowed by last-minute scrambles. Your next step: choose one strategy from sections 1–3 to implement this week, book a 30-minute check-in, and give every rupee/dollar a clear job—before it finds one on its own. Start today with a 4-week menu plan and a “Hold for Next Month” category.

References

- Zero-Based Budgeting: What It Is and How It Works, NerdWallet, Jan 27, 2025. NerdWallet

- USDA Food Plans: Monthly Cost of Food Reports, U.S. Department of Agriculture (FNS). Accessed 2025. fns.usda.gov

- US Average, January 2025—Thrifty Food Plan (PDF), USDA FNS, Jan 2025. USDA Food and Nutrition Service

- Consumer Expenditures in 2023—BLS Report, U.S. Bureau of Labor Statistics, Dec 3, 2024. Bureau of Labor Statistics

- Consumer Expenditures—2023 (News Release PDF), U.S. Bureau of Labor Statistics, Sept 25, 2024. Bureau of Labor Statistics

- OECD Framework for Statistics on the Distribution of Household Income, Consumption and Wealth (PDF)—Equivalence scales overview, OECD, 2013 (accessed 2025). OECD

- Sensitivity Analysis Using Different Equivalence Scales (PDF), LIS Cross-National Data Center, 2011 (accessed 2025). lisdatacenter.org

- Child Benefit: Rates (2025–26), GOV.UK, Apr 6, 2025. GOV.UK

- Child Benefit—What you’ll get, GOV.UK, accessed 2025. GOV.UK

- Canada Child Benefit—How much can you get, Canada Revenue Agency, Jun 6, 2025. Government of Canada

- Canada Child Benefit (T4114), Canada Revenue Agency, 2025. Government of Canada

- SNAP Eligibility, USDA FNS (FY2025 standards: Oct 1, 2024–Sept 30, 2025). fns.usda.gov

- FY2025 Income Eligibility Standards (PDF), USDA FNS, effective Oct 1, 2024–Sept 30, 2025. USDA Food and Nutrition Service

- Rev. Proc. 2024-25 (HSA limits for 2025) (PDF), Internal Revenue Service, 2024. IRS

- What Is a Zero-Based Budget?, YNAB, July 25, 2022. YNAB

- The YNAB Method, YNAB Help/Guides, accessed 2025. and https://support.ynab.com/ YNAB

- Monarch for Couples—Help, Monarch Money, July 18, 2025. help.monarchmoney.com

- For Couples, Monarch Money, accessed 2025. Monarch Money

- Tiller Money Feeds—Google Workspace Marketplace, accessed 2025. Google Workspace

- Free Google Sheets Budget Templates (2025), Tiller, Jan 31, 2025. Tiller