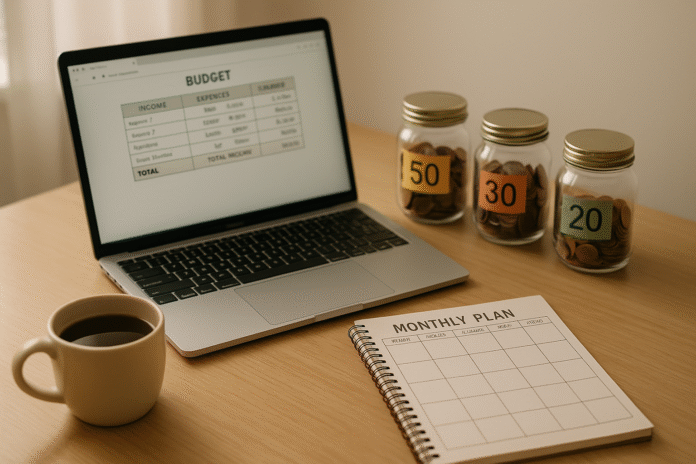

When you’re overwhelmed by choices—debt strategies, insurance types, account options, tax rules—the 50/30/20 rule offers a simple starting line. This article shows how to turn that starting line into a complete plan you can actually run with: cash flow, debt, protection, investing, taxes, and ongoing reviews. It’s written for anyone who wants a practical, numbers-driven approach without jargon overload. You’ll learn the nine pillars that transform “50% needs, 30% wants, 20% saving/debt” from a budget idea into a whole-life financial operating system.

Quick definition: The 50/30/20 rule allocates 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt. Used as a baseline, it keeps cash flow honest while you layer on long-term planning.

Fast-start steps (skim-friendly): Define after-tax income → categorize spend into needs/wants/saving-debt → set an emergency fund target → rank debts by rate → right-size insurance → set retirement rate and goals → pick an allocation and accounts → plan for taxes → track KPIs and automate.

Brief, good-faith disclaimer: This is general education, not personal advice. For decisions with legal or tax consequences, consult a qualified professional in your region.

1. Map Your After-Tax Cash Flow and Lock the Baseline

Your first pillar is a clear, after-tax cash-flow map; without it, percentages are just vibes. Start by confirming your monthly take-home pay (salary after taxes and payroll deductions, plus any variable income). Then inventory expenses and tag each line as need, want, or saving/debt. The 50/30/20 rule is a baseline, not handcuffs, so your immediate goal is awareness and a realistic target range: for example, a high-cost city might push needs to 55–60% early on while you still try to hold 20% for saving/debt. Lock these targets for the next 90 days and track variance weekly. By anchoring decisions to a simple frame, you prevent runaway lifestyle creep and keep more complex planning—like investments and taxes—grounded in reality.

How to do it (mini-checklist):

- Pull the last 90 days of transactions from your bank/credit cards; export to a CSV.

- Tag each line: need (housing, groceries, utilities, transport, minimum debt, basic insurance), want (dining out, travel, entertainment), saving/debt (emergency fund, investments, extra debt paydown).

- Convert to monthly averages; verify your totals equal your monthly after-tax income.

- Set your initial target split (e.g., 55/25/20 if costs are high); write it down.

- Monitor weekly; note drift and the reason (new bill, subscription, travel).

1.1 Numbers & guardrails

A practical starting guardrail is ±5 percentage points around each bucket (e.g., needs 45–55%). If needs are 60%+, document a path to compress (renegotiate rent on renewal, refinance or pay down high-interest debt, cut car costs, or house-share). If wants exceed 30%, isolate “joy-per-dollar” spend—the 2–3 wants that add the most happiness—and trim the rest.

Mini case: Take-home PKR 300,000 (or USD equivalent). Baseline 50/30/20 → Needs 150,000; Wants 90,000; Saving/Debt 60,000. If actual Needs land at 180,000, set a 6-month plan to move them back toward 150,000 while keeping Saving/Debt at least 45,000.

Synthesis: A clean, tagged cash-flow map translates percentages into decisions, giving you the dashboard you’ll reuse for every other pillar.

2. Build and Stage the Emergency Fund Inside the “20”

Your emergency fund is the shock absorber that keeps the rest of the plan intact. The 50/30/20 baseline makes room for it inside the 20% saving/debt bucket. Aim for 3–6 months of core needs (the “N” in your 50%) if you have a stable job and strong insurance; lean toward 9–12 months if your income is variable or you support dependents. Keep the fund liquid (high-yield savings or money market). If starting from zero, stage it: first one month, then three, then the full target, all while meeting minimum debt payments.

Practical steps:

- Calculate monthly needs only (exclude wants) to size the fund.

- Open a separate high-yield account; nickname it “Safety—Do Not Touch.”

- Automate transfers on payday from your checking to this account.

- Park windfalls (tax refunds, bonuses, side-income spikes) here until the fund is on target.

- Establish withdrawal rules: only for job loss, medical emergencies, urgent home/car repairs.

2.1 Tools/Examples

Use bank automation rules, round-ups, or envelope sub-accounts. Many households target PKR/USD/EUR equivalent of their needs for 3–6 months; for example, if your needs are PKR 150,000/month, a 6-month fund is PKR 900,000. If high-interest debt is present (see Pillar 3), you can run a split strategy: 50% of your “20” to emergency fund until 1–3 months are saved, 50% to extra debt payments; then finish the emergency fund.

Synthesis: A staged, rules-based emergency fund turns the “20” into real resilience—your plan can flex without breaking.

3. Prioritize Debt Strategically: Interest Rate, Risk, and Cash-Flow Impact

Debt strategy fits naturally in the “20” alongside saving. The core answer: prioritize high-interest, non-deductible debt (credit cards, payday loans) while maintaining minimums on all accounts; then tackle other debts by a mix of interest rate (avalanche), behavioral wins (snowball), and risk reduction (variable rates, balloon payments). The right sequence maximizes interest saved while freeing cash flow to redirect into investments and goals.

Execution steps (3–7 bullets):

- List all debts: balance, APR, minimum payment, rate type (fixed/variable), tax treatment.

- Pay minimums on all; route extra from the “20” to the highest APR first (avalanche).

- If motivation is the bottleneck, pay a small balance first to build momentum (snowball).

- Refinance or consolidate cautiously if it lowers effective APR and total cost.

- After each payoff, roll the freed payment into the next debt (debt snowball effect).

3.1 Numbers & guardrails

Use thresholds to guide choices: >15–18% APR usually demands top priority; variable-rate loans are riskier in rising-rate cycles; deductible student mortgage interest (where applicable) may move down the list if rates are moderate.

Mini case: If you free PKR 20,000/month by paying off a 28% card, redirect that 20k immediately to the next debt or to investment contributions, preserving your 20% saving/debt rhythm.

Synthesis: A rate- and risk-aware hierarchy turns the “20” into compounding progress—first by reducing interest drag, then by accelerating saving.

4. Right-Size Insurance So “Needs” Are Truly Needs

Insurance converts catastrophic risks into affordable premiums. The baseline rule keeps core insurance (health, life for dependents, disability/income protection, auto/home/renters) in Needs (50%), so your plan reflects the true cost of living securely. The key is to cover low-probability, high-severity losses while avoiding over-insuring small, manageable ones. Choose deductibles you can pay from your emergency fund; align coverage with your income, dependents, and regional norms.

Mini-checklist:

- Health: aim for an out-of-pocket max you can cover from cash + emergency fund.

- Life: if others rely on your income, target 10–12× annual income for term coverage (adjust for region, debts, and survivor benefits).

- Disability: look for own-occupation where available; target 60–70% income replacement.

- Property: set deductibles that lower premiums but won’t wreck cash flow.

- Liability: consider umbrella coverage if you have assets/high earnings or higher risk profile.

4.1 Why it matters

Under-insurance can erase years of saving; over-insurance starves long-term goals. By placing core premiums in Needs, you price reality into your 50% and avoid pretending uncovered risks don’t exist. Region-specific note: coverage names and rules vary—e.g., national health systems vs. private markets; always use local definitions, mandatory minimums, and tax treatments.

Synthesis: Protection placed correctly in the 50% ensures shocks don’t derail the 20%; it’s the quiet backbone of a robust plan.

5. Set a Retirement Saving Rate and a Realistic Glidepath

Within the “20,” decide how much goes to long-term investing. A common evidence-based guideline is to target ~15% of gross income for retirement saving (including employer matches) when you have a long runway; adjust for start age and goals. Use the baseline to fit this into your after-tax cash flow and balance with near-term priorities. Define a glidepath: for example, increase contributions by 1% of pay per year until you reach your target, and escalate after debt payoff.

How to do it (bullets):

- If your employer matches, contribute at least to the full match—it’s part of the 20%.

- Choose tax-advantaged accounts first (availability varies by country): workplace plan, personal pension/IRA, etc.

- Automate contributions on payday; align raises/bonuses to auto-increase savings.

- If starting late, plan a catch-up phase (higher rate temporarily) alongside controlled spending.

5.1 Numbers & examples

If you start at 25 and save 15% of gross consistently, many households can target maintaining their lifestyle in retirement; starting at 35 may require 18–20% or working longer. As you near retirement, model withdrawals using conservative “safe withdrawal” assumptions and consider sequence-of-returns risk. Region note: some systems have mandatory contributions; coordinate your voluntary savings so the total hits your target.

Synthesis: A pre-committed rate and glidepath convert aspirations into calendar-driven action, making the “20” your future income engine.

6. Fund Short- and Mid-Term Goals with Sinking Funds

Comprehensive planning means today’s life and tomorrow’s life. Use dedicated sinking funds inside the “20” for goals due in <5 years (travel, car replacement, tuition installments, home down payment). Match the vehicle to the time horizon: cash and short-term instruments for ≤2–3 years; conservative bond funds or term deposits for 3–5 years depending on risk tolerance. Keep each goal in a separate sub-account with a name and target date.

Step plan:

- Define goal, amount, deadline → compute monthly contribution (Goal ÷ Months).

- Open nicknamed sub-accounts (e.g., “Down Payment—Mar 2028”).

- Automate monthly deposits; review progress quarterly.

- For multi-currency households, plan FX buffers (e.g., +5–10% on targets).

6.1 Mini case & guardrails

Home down payment in 36 months for PKR 6,000,000 → monthly target PKR 166,667. If your 20% bucket is PKR 60,000 today, you’ll combine timeline adjustments, cost trade-offs, or income growth to bridge the gap (e.g., extend to 60 months → PKR 100,000/month). For any goal ≤36 months, favor capital preservation over returns; volatility risk often outweighs the yield.

Synthesis: Sinking funds prevent goals from cannibalizing emergency reserves or long-term investing; they put dates and dollars behind your “why.”

7. Write an Investment Policy Statement (IPS) and Choose an Allocation

An IPS is your investment “constitution.” It documents objectives, risk tolerance, time horizons, target asset allocation, rebalancing rules, and when you will not take action. With a baseline budget, you can choose an allocation you can fund and hold through market cycles. For many long-term savers, a globally diversified stock/bond mix with automatic rebalancing is sufficient; add real assets if appropriate. Keep costs low; understand how taxes, fees, and trading behavior compound.

Core components (H3 subsections):

7.1 Targets & rebalancing

Select a target (example): 80/20 stocks/bonds for 20- to 30-year horizons; 60/40 for 10- to 15-year horizons; 40/60 if withdrawals begin soon. Rebalance annually or when a band breaches ±5 percentage points. Automate in retirement accounts where possible.

7.2 Tools/Examples

Use broad index funds or ETFs, a target-date fund, or a robo-advisor that maintains allocation and harvests tax losses where allowed. Keep expense ratios low (basis points matter).

Mini case: Investor with PKR 60,000/month to invest chooses a 70/30 allocation across three funds and rebalances each January; they commit in the IPS to no allocation changes based on headlines—only life changes.

Synthesis: A one-page IPS plus a low-cost, rules-based allocation keeps your “20” compounding and your behavior disciplined.

8. Coordinate Accounts and Taxes: Location, Order, and Rules

Taxes and account rules shape your real returns. Use the baseline to decide which accounts to fund, in what order, and where to locate assets for tax efficiency (subject to local law). Typical funding order (adapt to region): capture employer match → fund tax-advantaged personal accounts to the limit → then taxable brokerage. Asset location rule of thumb: place tax-inefficient assets (e.g., ordinary-income-generating bonds) in tax-advantaged accounts; hold tax-efficient stock index funds in taxable accounts where applicable. Track contribution limits, deduction/credit phase-outs, and required withdrawals later in life.

Execution bullets:

- Make a one-page “account map” with contribution limits, deadlines, and tax features.

- Use payroll automation for workplace plans; calendar reminders for personal accounts.

- Keep tax records: cost basis, contributions, carryforwards, withholding estimates.

- For self-employed, evaluate pension options and quarterly estimated taxes; separate business and personal cash flows.

8.1 Numbers & guardrails

Mind annual contribution limits and catch-ups (age-based) in your jurisdiction. For withdrawals in retirement, start with a conservative initial rate and coordinate across taxable and tax-advantaged accounts to manage brackets. Consider charitable strategies (e.g., qualified charitable distributions where applicable) once RMDs begin.

Region note: Rules differ substantially; always reference your local tax authority’s current publications and deadlines.

Synthesis: Smart account sequencing and asset location turn the same “20” into more after-tax wealth, without extra risk.

9. Monitor KPIs, Automate, and Course-Correct with Scenario Planning

A plan that isn’t monitored drifts. Choose a monthly review and a quarterly deep dive. Track a small set of KPIs: savings rate (as % of income), emergency fund months, debt-to-income, net worth trend, investment contribution streak, and allocation drift. Automate everything you can—payday transfers, bill pay, contribution increases—so willpower is not a dependency. Each quarter, run scenarios: income shock (−20%), expense spike (+15%), market drawdown (−25%), and a positive scenario (bonus, raise). Update the 50/30/20 targets if life or prices change markedly; the baseline is meant to flex intelligently, not stay rigid forever.

Mini-checklist:

- Monthly: reconcile transactions, check the 50/30/20 split, confirm automations ran.

- Quarterly: update net worth; rebalance if bands breached; review insurance and goals.

- Annually: adjust targets for inflation and life changes; refresh IPS if milestones shift.

- Trigger events: job change, birth, death, marriage/divorce, relocation, major purchase.

9.1 Tools/Examples

Use a budgeting app or a spreadsheet with a control panel dashboard. Keep a one-page Plan on a Page summarizing your nine pillars, with live links to accounts and documents. If a scenario shows a sustained 60% needs ratio due to rent hikes, set a two-step fix: compress wants to 20–25% and temporarily allow 15% saving/debt while you negotiate housing or increase income; then restore the 20% within a target date.

Synthesis: With a short KPI set and calendar-driven reviews, your plan learns and adapts—turning the 50/30/20 baseline into a durable system.

FAQs

1) Is the 50/30/20 rule net or gross income?

Use after-tax (take-home) income so the percentages reflect cash you can actually allocate. Payroll deductions for retirement and insurance still “count” toward your overall plan—just make sure they’re captured either in your needs (premiums) or your 20% (savings).

2) What if my rent makes “Needs” exceed 50%?

Document why and for how long. In high-cost areas or during inflation spikes, 55–60% can be unavoidable. Compress wants temporarily and protect at least some of the 20% (even 10–15%). Schedule a housing decision point (renegotiate, move, add roommates) to bring needs back toward 50% over the next lease cycle.

3) Should debt payoff or investing come first?

Pay minimums on all debts; prioritize high-interest balances (often >15–18% APR) before aggressive investing. In parallel, fund a starter emergency buffer (1–3 months) so you don’t relapse into new debt. Once dangerous debt is gone, redirect those payments to long-term investing and goal funds.

4) How big should my emergency fund be?

A common range is 3–6 months of essential expenses if your job is stable and insurance is solid; 9–12 months if income is variable, you support dependents, or you’re in a job market with longer rehire times. Build it in stages while meeting minimum debt payments.

5) What retirement saving rate should I target?

If you have decades ahead, ~15% of gross income (including employer match) is a widely cited starting point. Starting later, or wanting to retire earlier, pushes the rate higher or the retirement age later. Use calculators and your plan’s real numbers to refine it.

6) How do I invest the “20” if I’m a beginner?

Pick a target-date fund or a simple stock/bond index mix matched to your time horizon; write an Investment Policy Statement that sets your allocation and rebalancing rules. Automate contributions on payday and avoid changing the plan based on headlines.

7) Where do insurance premiums fit?

Core protection—health, life (if dependents), disability, property/liability—belongs in Needs (50%). Price your life realistically by including these premiums before you decide how much is left for wants and savings.

8) How should I handle variable income?

Base your needs and wants on a conservative average (e.g., a 6–12-month trailing average), and use a sweep rule for months above average: a set percentage goes to the emergency fund, sinking funds, and extra debt or investment contributions. Maintain a larger cash buffer (closer to 6–9 months).

9) What’s a safe retirement withdrawal rate?

There’s no single number; a conservative initial rate around the mid-3% range is often cited in current research, with flexibility to adjust during market downturns. Your actual rate should reflect your asset mix, fees, taxes, and longevity expectations.

10) How often should I rebalance investments?

Once a year or when your allocation drifts beyond ±5 percentage points from target is a practical rule. Automate it in retirement accounts if possible to minimize taxes and friction.

11) How does the 50/30/20 rule compare to other models (e.g., 60/30/10)?

Alternatives exist and can be useful in high-cost or early-career contexts. Use 50/30/20 as your baseline; adapt the split deliberately and temporarily based on data (e.g., 60% needs during a lease cycle) and work back toward your long-run target as conditions allow.

12) What KPIs should I track to know if this is working?

Track savings rate, months of emergency fund, debt-to-income, net-worth trend, contribution streak, and allocation drift. Reviewing these monthly/quarterly keeps your plan honest and your adjustments precise.

Conclusion

Using the 50/30/20 rule as a baseline for comprehensive financial planning gives you a simple, repeatable way to manage complexity. It starts with a clear cash-flow map, then layers in resilience (emergency fund and insurance), momentum (debt strategy), and growth (retirement saving, investing, and tax coordination). Dedicated sinking funds protect mid-term goals, while a written IPS and a funding order translate your intentions into automatic behaviors. Finally, a small set of KPIs and scenario tests ensure your plan adapts as life and markets change. Whether you’re stabilizing after a rough year or optimizing for long-term wealth, these nine pillars keep you focused on what you can control—income, spending, saving rate, risk, and process. Start with one improvement this week (automate one transfer, cancel one unused subscription, write your IPS draft), then compound the wins.

CTA: Convert this article into your one-page action plan today—set your 50/30/20 targets, open your sinking fund, and schedule your first review.

References

- “Consumer Expenditures in 2023,” U.S. Bureau of Labor Statistics, Dec 3, 2024. https://www.bls.gov/opub/reports/consumer-expenditures/2023/

- “How America Saves 2024,” Vanguard, 2024 (report on 2023 plan data). https://corporate.vanguard.com/content/dam/corp/research/pdf/how_america_saves_report_2024.pdf

- “Publication 590-A (Contributions to Individual Retirement Arrangements),” Internal Revenue Service, 2024–2025 updates noted. https://www.irs.gov/publications/p590a

- “Benefit Calculators,” Social Security Administration, accessed 2025. https://www.ssa.gov/benefits/calculators/

- “Household Savings—Definition and Methodology,” OECD Data, accessed 2025. https://www.oecd.org/en/data/indicators/household-savings.html

- “How Much Money Should I Save Each Year for Retirement?” Fidelity Viewpoints, updated 2024/2025. https://www.fidelity.com/viewpoints/retirement/how-much-money-should-I-save

- “Morningstar’s Retirement Income Research: Reevaluating the 4% Rule,” Morningstar, Feb 27, 2025. https://www.morningstar.com/retirement/morningstars-retirement-income-research-reevaluating-4-withdrawal-rule

- “Learning About Budgets (includes 50-30-20 rule),” Consumer Financial Protection Bureau, June 16, 2022. https://www.consumerfinance.gov/consumer-tools/educator-tools/youth-financial-education/teach/activities/learning-about-budgets/

- “Consumer Expenditures—News Release (2023 results),” U.S. Bureau of Labor Statistics, Sept 25, 2024. https://www.bls.gov/news.release/cesan.nr0.htm

- “Why a 60/30/10 Budget Could Be the New 50/30/20,” TIME, 2024. https://time.com/6916834/how-to-budget-60-30-10/