If you’re ready to save the most money on interest and get out of debt faster, the “avalanche” approach—paying extra to the highest APR first—often delivers the best math-driven results. This guide curates the 9 best spreadsheets, online calculators, and mobile apps to help you set up, compare, and track an avalanche plan from day one to debt-free day. It’s designed for anyone who wants clarity: which tool to start with, how to avoid mistakes, and how to keep momentum when real life gets messy. Quick definition: the debt avalanche method prioritizes paying off debts by highest interest rate while making minimums on the rest, typically reducing total interest and time to payoff compared with other methods.

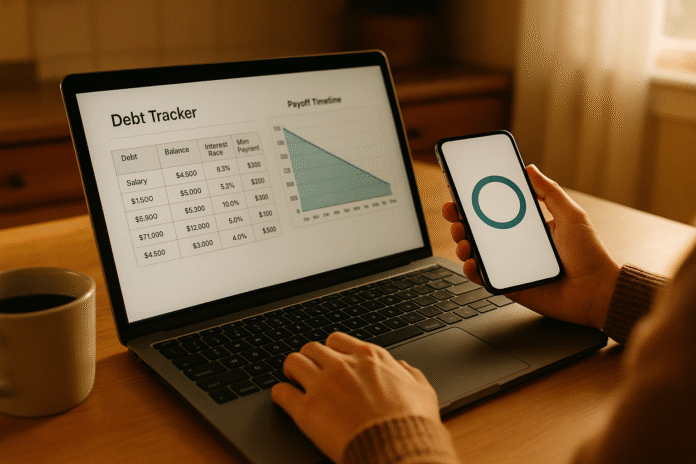

Mini step list to get started (as of now): 1) List every debt with balance, APR, and minimum payment. 2) Pick a tool below to model scenarios. 3) Lock in your monthly “extra” amount. 4) Automate payments where possible. 5) Review progress monthly; adjust when balances or rates change.

Friendly disclaimer: This article is educational, not individualized financial, legal, or tax advice. Consider your circumstances and, if needed, consult a qualified professional.

1. Vertex42 Debt Reduction Calculator (Spreadsheet, Excel/Google Sheets)

Start here if you want a flexible, offline-first spreadsheet that supports both avalanche and snowball while giving you granular control. Vertex42’s Debt Reduction Calculator is a mature, well-documented Excel template (also usable in Google Sheets) with dropdowns to choose avalanche or snowball and clear amortization-style outputs. For many users, it’s the perfect balance of transparency and detail: you see how ordering debts by APR versus balance changes total interest, payoff date, and monthly cash flow, and you can experiment with extra payments or one-off “lump sums.” If you like to keep your data local and prefer a traditional spreadsheet layout with formulas you can audit, this tool sets a high baseline for planning and recordkeeping.

1.1 Why it matters

Spreadsheets make assumptions explicit. You can check formulas, add notes (“APR promo ends in March”), and build a personalized dashboard without waiting on an app update. If your motivation spikes when you understand the “why,” a spreadsheet keeps the math and the plan in one place.

1.2 How to do it (quick setup)

- Enter each debt: name, balance, APR, minimum payment.

- Choose “Debt Avalanche” from the strategy dropdown.

- Add an “extra” monthly amount and test scenarios (e.g., +$50, +$100).

- Record irregular “snowflakes” (tax refund, bonus) as one-time extras.

- Print or PDF the payoff schedule to review monthly.

Mini example: Suppose you owe $6,000 at 26% APR (min $150), $3,500 at 18% ($70), and $2,000 at 9% ($40). With a $200 extra payment, switching the order from balance to APR can shave months off your timeline and hundreds in interest; the sheet shows the delta immediately so you can lock the avalanche plan with confidence. Close the loop by saving a “Scenario: +$100 extra” copy for future comparison.

Bottom line: Vertex42 is ideal if you want auditability, precise control, and an exportable plan you can share or print for accountability.

2. Tiller Money Debt Payoff Planner (Spreadsheet, Google Sheets)

Choose Tiller if you want bank feeds populating a Google Sheet so your balances update with minimal manual work. Tiller’s community Debt Payoff Planner supports avalanche, snowball, and custom ordering; it connects to your accounts, so the scheduled amounts and actual payments live in the same place. This makes monthly reviews easier: you can reconcile what you planned to pay with what actually cleared, adjust, and keep your avalanche ordering intact even if a payment posted late or a balance changed unexpectedly. If you’re already using Tiller for budgeting, adding the debt template gives you one integrated money hub.

2.1 Numbers & guardrails

- Works best when transactions are categorized consistently.

- Reconcile at least monthly; weekly is better during high-interest periods.

- Document promo APR end dates to avoid accidental reordering.

2.2 Mini-checklist to implement

- Install the Tiller Debt Payoff Planner template.

- Connect credit card, loan, and line-of-credit accounts.

- Set payoff priority to Avalanche; confirm highest APR is first.

- Add a recurring “extra” line; note variable months (e.g., holidays).

- Review variance: planned vs. posted payments; roll forward shortfalls.

Synthesis: Tiller combines spreadsheet flexibility with live data, removing a major avalanche failure point—stale balances—without forcing you into a closed app ecosystem.

3. Undebt.it (Online Calculator & Web App)

If you want a dedicated, purpose-built payoff planner with avalanche baked in, Undebt.it is a long-standing favorite. You can run a free plan without creating an account, get a month-by-month schedule, visualize timelines, and then save your plan if you decide to stick with it. Advanced touches like “debt snowflakes” (irregular extra payments) make it easier to map real life onto the model—bonus checks, tax refunds, or side-gig spikes. It’s browser-based and lightweight, so you can test avalanche versus snowball quickly and settle on the strategy that fits you.

3.1 Tools/Examples

- Avalanche calculator: order debts by highest APR and see your debt-free date and interest saved.

- Snowflakes page: schedule one-time extras and visualize effects on the payoff table.

- Timeline graph: snapshot of progress and remaining months.

3.2 Common mistakes to avoid

- Forgetting to adjust minimums when a card issuer raises them.

- Ignoring promo APR expirations—update APRs promptly.

- Spreading extras across accounts; avalanche works best when extras are focused.

Bottom line: Undebt.it is fast to try, strong on visual timelines, and great for modeling irregular extra payments alongside an avalanche plan.

4. PowerPay (Online Tool & App by Utah State University Extension)

Prefer a research-backed, university-hosted calculator? PowerPay has been around since the 1990s, is free, and focuses on building a personalized, self-directed payoff plan. It supports comparing strategies, shows how consistent payments accelerate debt elimination, and emphasizes interest savings. There’s also a mobile app developed with New Mexico State University’s Learning Games Lab, so you can carry your plan with you. If you want a nonprofit tool that’s been used by extension services, the military, and community educators, PowerPay’s credibility is compelling.

4.1 Why it matters

For avalanche planning, consistency is everything: extra money must stay pointed at the highest APR. PowerPay illustrates that discipline visually and historically, which can be motivating when a “quick win” (snowball) is tempting.

4.2 How to use it (quick start)

- Create an account; enter each debt with APR, balance, minimum.

- Run the standard plan, then switch to Avalanche to compare.

- Add a fixed monthly extra (e.g., $150) and a few known snowflakes.

- Save and revisit monthly; PowerPay recalculates remaining months and interest.

Synthesis: If you value longevity, neutrality, and education-first design, PowerPay gives you a sturdy avalanche planner with both web and app options.

5. Bankrate Debt Payoff Calculator (Online)

Bankrate’s calculator is useful when you want a quick, media-grade projection and side-by-side strategy explanation. Enter balances, APRs, and minimums, choose avalanche, and get a payoff horizon with contextual guidance about the method. While it’s not a full task manager, the interface is clean and perfect for initial “what-if” work: you can sanity-check your spreadsheet outputs, demonstrate savings to a partner, or validate that your extra payment is big enough to move the needle. The page also links to supporting articles on sticking with a payoff plan, which can help with consistency.

5.1 Mini-checklist

- Use Bankrate to create a baseline avalanche projection.

- Capture the payoff month and total interest saved.

- Cross-check your spreadsheet/app schedule for alignment within ±1 month.

- Re-run after balance or APR changes (e.g., a rate hike).

5.2 Numbers & guardrails

- Expect small rounding differences versus spreadsheets.

- If your minimums are percentage-based, confirm how the tool models them.

- Document assumptions in your notes; consistency beats perfection.

Takeaway: Bankrate is a trustworthy second opinion and a great “show-and-tell” tool for quick avalanche comparisons.

6. Calculator.net Debt Payoff & Credit Card Payoff Calculators (Online)

When you want simplicity plus avalanche-first logic, Calculator.net’s Debt Payoff and Credit Card Payoff calculators are workhorses. They explicitly default to the avalanche method for multi-debt plans and allow extras to see how small changes in “extra per month” affect total interest and months to zero. It’s particularly handy if you’re modeling credit-card-only debt, since there’s a dedicated calculator for that use case. The outputs are straightforward, printable, and ideal for people who want the math without the ecosystem.

6.1 How to do it (step-by-step)

- Choose the multi-debt or credit-card-specific calculator.

- Enter each balance, APR, and minimum payment.

- Select Avalanche; add a monthly extra.

- Print or save the schedule and pin it near your workspace.

6.2 Mini case

Adding $75 extra to a $10,000 card at 24% APR can cut several months and hundreds in interest. Use Calculator.net to quantify the exact savings and then automate the new payment so it sticks.

Bottom line: Clear, no-frills calculators that keep the avalanche math front and center—perfect for quick plans and printable schedules.

7. Debt Payoff Planner & Tracker (Mobile App: iOS/Android)

If you want a mobile-first experience optimized for building and following a payoff plan, Debt Payoff Planner is a strong pick. It supports avalanche and snowball, shows your debt-free date, and lets you track real payments against the plan. The app’s focus is momentum: quick data entry, clear charts, and the ability to modify balances, APRs, and extra payments as life changes. It’s great if your phone is your primary financial command center and you want a dedicated, distraction-free debt tool.

7.1 Common mistakes

- Forgetting to update APRs after a promo ends.

- Scheduling extras but not enabling autopay or calendar reminders.

- Changing strategies midstream—stick to avalanche unless your motivation truly depends on a quick win.

7.2 Quick setup checklist

- Enter debts; pick Avalanche as your payoff strategy.

- Add a recurring extra amount and a few one-off snowflakes.

- Turn on notifications for due dates and milestone alerts.

- Review the progress graph every payday.

Takeaway: Purpose-built, on-the-go avalanche tracking that keeps the focus on dates, interest saved, and habit formation. Debt Payoff Planner

8. YNAB (You Need A Budget) Loan Payoff Simulator & Targets (Mobile/Web App)

Choose YNAB if you want budgeting and avalanche planning in one ecosystem. YNAB’s Loan Payoff Simulator and loan/credit-card targets let you model “what if I add $100 more?” and immediately see months shaved and interest saved. Because YNAB budgets every dollar, you can move money deliberately toward your avalanche target without jeopardizing rent or groceries. Recent updates (as of May–August 2025) refined its loan tools and documentation, making it easier to visualize progress and create payoff targets tied to a specific date. If you want an all-in-one cash-flow system with a capable payoff planner, YNAB is hard to beat.

8.1 How to use YNAB for avalanche

- Create a Loan Account (or track a credit card balance you’re paying down).

- Set a Debt Payment or Pay-Down target aligned to your avalanche “extra.”

- Use the Loan Payoff Simulator to test adding $50–$200/month.

- Fund the target first on payday; YNAB will guide you on the monthly amount.

8.2 Why it works

YNAB prevents accidental overspend from stealing your avalanche extra. With categories and targets, your extra payment is a first-class budget item, not an afterthought.

Synthesis: A robust budgeting app with credible payoff tooling—ideal if you want one place to manage spending, savings, and an avalanche plan.

9. EveryDollar: Debt Tracking Inside a Budget (Mobile/Web App)

If you want straightforward budgeting with built-in debt tracking you can set and forget, EveryDollar is a practical option. While its ecosystem is philosophically aligned with the snowball approach, the software still lets you track debts, record payments, and visualize progress—which you can implement in an avalanche order by focusing your extra dollars on the highest APR account in your plan. It’s best for households already using EveryDollar for the monthly budget who want to layer in a payoff strategy without learning a new app.

9.1 How to do avalanche in EveryDollar

- Add each debt and minimum payment; label the highest APR “Focus Debt.”

- Budget your extra into that Focus Debt category first each month.

- When the focus debt is paid, redirect that entire amount to the next-highest APR.

9.2 Tips & pitfalls

- Because the app emphasizes snowball, you’ll manage avalanche order yourself—add APR notes in the debt name for clarity.

- Revisit categories after rate changes to keep the order correct.

- Use calendar reminders for due dates to avoid late fees eating your interest savings.

Bottom line: A simple way to track an avalanche inside a familiar budgeting app—especially if you’re already committed to EveryDollar’s workflow.

FAQs

1) What is the debt avalanche method, in one sentence?

It’s a payoff strategy where you make minimums on all debts and send every extra dollar to the highest-APR balance first, then repeat down the list—usually minimizing total interest and time to payoff compared with alternatives.

2) Avalanche vs. snowball—which saves more money?

All else equal, avalanche typically saves the most interest because you attack the costliest debt first; snowball can feel more motivating because you see a balance hit zero sooner. Many people model both and choose the one they’ll actually follow for 12–24 months.

3) How much “extra” should I add to my avalanche each month?

Even $25–$50 can move your debt-free date forward. Use a calculator or spreadsheet to quantify the gain from +$50, +$100, and +$200 and pick the largest sustainable number you can automate—then protect it in your budget so it actually hits the highest APR account first.

4) Do I need a spreadsheet and an app?

No. Many people start with a spreadsheet (Vertex42 or Tiller) to design the plan, then use a web or mobile app (Undebt.it, YNAB, Debt Payoff Planner) for day-to-day tracking. The best setup is the one you’ll open weekly without dread.

5) How often should I update balances and APRs?

Monthly is the minimum; weekly is better for credit cards. APRs can change after promotional periods or variable-rate hikes. A stale APR can throw off your avalanche order and cost extra interest. Set calendar reminders to review.

6) Can I mix avalanche with balance transfers or consolidation loans?

Yes. If you get a lower effective APR via a balance transfer or consolidation loan, your avalanche will reprioritize automatically with the new rates. Model the fees, promo durations, and revert APRs before committing. Bankrate

7) What if I need quick wins to stay motivated?

You can run a hybrid: start with one small-balance “warm-up” payoff for momentum, then switch to avalanche for the big interest savings. If motivation is fragile, pick the version you’ll consistently follow; savings depend on staying the course. Ramsey Solutions

8) Which tool is best for couples planning together?

Tools with clear visuals and sharable plans (Undebt.it, Bankrate’s calculator, a Vertex42 PDF) are great for joint reviews. If you co-budget, YNAB or Tiller centralizes spending and debt in one place so both partners see the same numbers.

9) Are there credible nonprofit or university-backed options?

Yes—PowerPay by Utah State University Extension has been used for decades in education and military settings and is free. It’s a solid choice if you want a non-commercial tool with strong fundamentals.

10) What’s the most common reason avalanche plans fail?

Inconsistency. Missing a payment, letting APRs change unnoticed, or raiding your “extra” for other spending erodes the advantage. Automate payments, protect your extra in the budget, and review monthly to keep your plan on track.

Conclusion

An avalanche plan turns discipline into dollars. By focusing extra money on the highest APR, you reduce interest costs and usually reach debt-free status sooner than with alternatives. The right tool makes that discipline easier: spreadsheets like Vertex42 give you auditability; Tiller brings live data; Undebt.it and PowerPay add proven calculators; Bankrate and Calculator.net offer quick what-ifs; mobile apps like Debt Payoff Planner put your schedule in your pocket; and budgeting suites like YNAB or EveryDollar protect your extra in the flow of everyday spending. Pick one tool today, model your numbers, and commit to a monthly review rhythm. With a consistent “extra,” automated payments, and occasional one-off snowflakes from refunds or bonuses, your avalanche becomes measurable progress you can see in charts—and in shrinking interest charges.

Your next step: choose one tool from the list, plug in your debts, and schedule your first extra payment today.

References

- Debt Reduction Calculator (Spreadsheet), Vertex42, updated Jan 11, 2023, Vertex42.com

- Debt Payoff Planner – Overview & Method Guides, DebtPayoffPlanner.com, various pages updated 2024–2025, and https://www.debtpayoffplanner.com/debt-avalanche-method/ and App Store listing https://apps.apple.com/us/app/debt-payoff-planner-tracker/id1009323715 Debt Payoff Planner

- Debt Avalanche vs. Snowball (Explainers), NerdWallet, updated 2025, and related debt strategy articles https://www.nerdwallet.com/article/finance/pay-off-debt NerdWallet

- How to Reduce Your Debt (Highest-Interest vs. Snowball), Consumer Financial Protection Bureau (CFPB), July 16, 2019, Consumer Financial Protection Bureau

- Debt Paydown Calculator & How to Stick to a Plan, Bankrate, calculator page current 2025 and article Nov 6, 2024, and https://www.bankrate.com/personal-finance/debt/how-to-stick-to-debt-payoff-plan/ Bankrate

- Debt Payoff Calculator (Avalanche by Default), Calculator.net, current 2025, and https://www.calculator.net/credit-card-payoff-calculator.html Calculator.net

- Undebt.it (Free Online Avalanche/Snowball Calculator), Undebt.it, current 2025, and calculator pages https://undebt.it/debt-avalanche-calculator.php and https://undebt.it/debt-snowball-calculator.php and “How it works” page https://undebt.it/how-undebt.it-works.php Undebt.itUndebt.itUndebt.it

- PowerPay (Debt Reduction Tool), Utah State University Extension (web tool & app), accessed 2025, and https://extension.usu.edu/powerpay/how-to and app page https://apps.nmsu.edu/powerpay.html Utah State University Extension

- YNAB Loan Payoff Simulator & Loan Accounts Guide, YNAB, updated May 19, 2025 and Aug 21, 2025, and https://support.ynab.com/en_us/loan-accounts-a-guide-HkNSkPHJi and features page https://www.ynab.com/features/debt-management YNABsupport.ynab.com

- EveryDollar Help: How to Track Debts, Ramsey Solutions, June 10, 2025, EveryDollar

- Debt Avalanche: Meaning, Pros and Cons, Investopedia, updated 2024–2025, and comparison article https://www.investopedia.com/articles/personal-finance/080716/debt-avalanche-vs-debt-snowball-which-best-you.asp Investopedia

- Tiller Community Template: Debt Payoff Planner, Tiller Money, current 2025, and roundup of spreadsheets (Jan 5, 2025) https://tiller.com/debt-snowball-spreadsheet/ Tiller