Beginning

Hook: Do you ever wonder, “Why do paychecks go away so quickly?” You’re not the only one. A recent FINRA survey found that more than 68% of Americans have trouble sticking to a budget. This is often because standard methods don’t work for everyone [1]. This lack of clarity causes stress and frustration, which can be avoided with a methodical, detail-oriented approach called Zero-Based Budgeting (ZBB).

In simple terms, ZBB is

Zero-Based Budgeting means that every dollar you make in a certain time period has to have a specific job. This could be paying for rent, groceries, savings, debt, or other things. At the end of the period, your total allocations must equal your total income, which means you have a “zero” balance. This makes people spend money on purpose, which brings to light hidden subscriptions, impulse habits, or priorities that don’t match up with their budgets.

Why ZBB Is Getting More Popular:

- Financial Clarity: ZBB’s strictness shows hidden costs and breaks down spending patterns in great detail.

- Aligning Your Goals: Every dollar you spend should support your goals, whether that’s saving for an emergency fund, retiring early, or paying off student loans.

- Adaptive Flexibility: ZBB resets every period, unlike static budgets, to account for changes in income and life events.

The main point of this paper is:

This article looks at the five biggest ways that Zero-Based Budgeting can change your personal finances. You’ll learn a lot, see real-life examples, and get a step-by-step plan to take control of your money, get rid of myths, and achieve lasting financial freedom.

Plan:

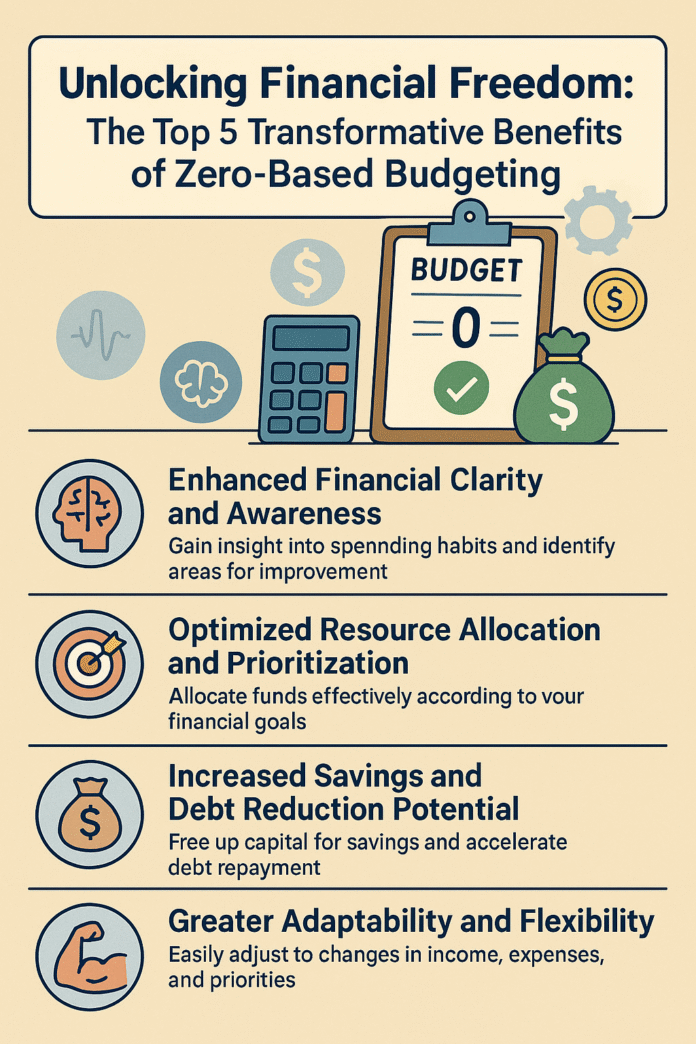

- Benefit 1: Better understanding and awareness of finances

- Section II: Benefit 2: Better use of resources and setting priorities

- Section III: Benefit 3—More chances to save money and pay off debt

- Part IV: Benefit 4: More adaptability and flexibility

- Section V: Benefit 5—More responsibility and better money management

- Section VI: A Guide to Putting It into Practice

- Part VII: How to Get Past Common Problems

- Section VIII: Detailed FAQs

- Part IX: Case Studies from the Real World

- Part X: The End and What Comes Next

- Appendix: Checklist for SEO and EEAT Optimization

Adding Keywords:

We use zero-based budgeting, personal finance, financial freedom, budgeting strategies, money management, debt reduction, and intentional spending throughout to make our content easier to find without making it harder to read.

I. Benefit 1: Better understanding and awareness of finances 🧠

1.1 The ZBB Clarity Mechanism

If you use traditional budgeting, you might set aside $300 a month for “Dining Out” based on the average from the previous month. But averages hide the extremes and don’t make you think about whether that spending really fits with your priorities. On the other hand, ZBB makes you:

- Write down every cost, from your mortgage to your coffee runs.

- Every period, you need to explain each line item again.

- Set exact dollar amounts for each category until your budget is even.

This process turns vague spending patterns into data points that can be measured. Jim Wang of Cash Money Life says, “When I first wrote down all of my expenses, I was shocked to find that $120 in subscriptions I rarely used were eating up my budget.” “Zero-based budgeting made me cancel them” [2].

1.2 Finding Hidden Costs

- Streaming and software subscriptions: It’s easy to forget about a $9-a-month app trial or a streaming service you signed up for on a busy night. ZBB forces you to deal with these charges that keep coming up.

- ATM fees and bank charges: Did you know that out-of-network ATM fees can add up to $60 a year? ZBB points out these hidden costs so they can be removed.

- Impulse Micro-Purchases: A $3 in-app purchase may not seem like much, but ZBB’s detailed tracking makes you see how those small habits add up—$90 a month on average, or $1,080 a year.

1.3 Examples of Personal Finance

“The Phantom Gym Membership” is the first example. Mark thought that paying $50 a month for a gym membership was a necessary expense. ZBB made him explain why that cost was worth it compared to other things he needed to do, so he switched to a $25/month community center membership and saved $300 a year.

Example 2: “Annual Fees That Were Missed” Lisa found out she hadn’t used the lounge access that came with her premium credit card. She got back $195 in annual fees by switching to a no-fee card, which she put into her emergency fund.

1.4 How Clarity Affects the Mind

- Less Financial Stress: Knowing where every dollar goes takes away the fear of finding unexplained deficits at the end of the month.

- Making decisions with confidence: Knowing where your money is going helps you make confident choices, like getting a lower cable bill or combining insurance policies.

- Progress Visibility: Keeping track of small wins, like saving $25 on subscriptions, keeps you going and strengthens your resolve to manage your money wisely.

II. Benefit 2: Better use of resources and setting priorities 🎯

2.1 Changing Spending from Habitual to Goal-Oriented

Traditional budgets often keep the same choices from the last period. Zero-Based Budgeting breaks that cycle by making each category a decision package that needs to be justified every month. You think to yourself:

“Is spending $200 on food the best way to use this money, or should some of it go toward paying off my debt faster?”

2.2 Making Decision Packages

- Identify Categories: Essentials (housing, utilities), Variable Necessities (groceries, transportation), Financial Goals (savings, debt), and Discretionary.

- Attach Purpose: Explain why each group is there. For instance, “Groceries: fuel for health and wellness” or “Emergency Fund: a buffer against income shocks.”

- Prioritize your spending: First, pay for things you can’t live without, then for things that are important to you (like a 401(k) match), and finally for things that are fun to do.

2.3 Personal Finance Situations

Scenario A: Getting out of debt faster

- Background: Jenna has $12,000 in credit card debt with a 19% APR.

- ZBB Action: She puts paying off her debts at the top of her list of priorities after her basic needs. She does this by cutting $200 from her dining out budget and $200 from her streaming services budget, giving her an extra $400 a month.

- Result: The extra payments cut her repayment time by 18 months and saved her more than $1,200 in interest.

Scenario B: Funding for Short-Term Goals

- Background: Luis wants to go skiing next winter and needs $3,000 for it.

- ZBB Action: He makes a “Vacation Fund” category and puts $250 a month into it for 12 months. He cuts $100 from his “fun money” bucket and $150 from his “miscellaneous spending” bucket.

- Result: Luis reaches his goal early and uses the extra $1,200 to buy discounted flights that he books early.

2.4 Effect on Growth and Efficiency

- Targeted Spending: Zero-Based Budgeting only sends money to categories that help you reach your financial goals.

- Faster Milestones: Intentional allocations speed up progress, whether that means paying off high-interest debt or building up investments.

- No more blind spots when it comes to getting rid of waste. Each category has to earn its keep or it gets cut.

III. Benefit 3: More chances to save money and pay off debt 💰

3.1 The Pipeline from Scrutiny to Savings

ZBB’s close look at every dollar often leads to a lot of money being moved around. You can free up cash that can help you save or pay off debt faster by cutting out unnecessary costs in a planned way.

3.2 Finding and Cutting Out Budget “Fat”

- Cable, internet, and phone—bundle or negotiate to save money and combine services.

- Energy Efficiency: Switching to LED lights, sealing drafts, and putting in programmable thermostats can save you up to 15% on your utility bills.

- Buying in bulk and swapping DIY items: Buying household staples in bulk or making your own cleaning products (like vinegar and baking soda) can save you a lot of money on groceries and cleaning.

3.3 A made-up case study: The Thompson family

- Profile: They make $85,000 a year together and have $25,000 in consumer debt (credit cards and personal loans) at an interest rate of about 16%.

- The ZBB results are:

- $480 a month for extra streaming and subscription services

- $150 in fees for ATMs and overdrafts

- $220 for eating out and taking out

- Reallocation every month: $480 + $150 + $220 = $850 for paying off debt.

- Result: They saved about $2,400 in interest by paying off their debt two years early at an extra $850 per month.

3.4 Examples of how to speed up savings

- Emergency Fund: Put $300 a month into a savings account to build up a $3,600 cushion in a year. This will cover most households’ expenses for one to two months.

- Retirement Boost: If you put an extra $200 a month into your 401(k), you’ll have more than $6,000 more saved for retirement in ten years (not counting the employer match).

- Down Payment Fund: Are you saving up for a 10% down payment on a $300,000 home? If you save $500 a month, you’ll reach your goal of $30,000 in just five years.

3.5 Effects on the mind and motivation

- Building momentum: Every time you reach a debt payment milestone or savings goal, it encourages you to keep doing good things.

- Visible Progress: Keeping track of your debt balances each month gives you motivation and helps you avoid getting tired of your budget.

- Compound Benefits: Paying off debt lowers your interest costs, which adds to your financial gains over time.

IV. Benefit 4: More adaptability and flexibility 🔄

4.1 The Changing Nature of ZBB

Some people think that detailed budgeting is always rigid, but ZBB’s period-by-period reset makes it more flexible than other methods. You start each cycle with a blank slate, which lets you change your priorities based on what’s going on right now.

4.2 How to Handle Changes in Income

- Freelancers, contractors, and people who make money on commission can average their income from the last 3 to 6 months to make predictions and then change their allocations as money comes in.

- Windfalls and bonuses: Instead of treating bonuses like extra money, ZBB puts windfalls into areas that will have the biggest effect, like investments, paying off debt, or building up buffers.

4.3 Dealing with Unplanned Costs

- Buffer Category: Every budget should have a “Buffer” (5–10% of income) to cover unexpected expenses like car repairs, medical bills, or trips that weren’t planned.

- Reallocating Discretionary Funds: If something comes up that needs your immediate attention, ZBB lets you move money from less important categories (like hobbies and entertainment) to more important ones without messing up your whole plan.

4.4 Life Changes and Financial Strength

- Changes in your career: If you lose your job or get a promotion, you can quickly change your budget for the next month by changing your priorities and how much you spend.

- Big events like weddings, having a baby, or buying a home all require changes to your budget. ZBB’s reset feature makes sure that your budget changes with as little trouble as possible.

- Geographical Moves: You can account for new cost-of-living situations, like higher rent and different tax rates, without having to deal with legacy allocations that are holding you back.

4.5 Benefits for the mind and body

- Less stress: Knowing that your budget can change gives you peace of mind when things are unclear.

- Proactive vs. Reactive: Instead of panicking when a big bill comes in, ZBB’s buffer and dynamic reallocations keep you in charge.

- Financial Resilience: Having a well-funded emergency fund and flexible spending plans makes it easier to deal with life’s ups and downs.

V. Benefit 5: More responsibility and better money management 💪

5.1 Developing a Stewardship Mindset

ZBB changes your role from a passive observer to an active steward of your money. You become more responsible and disciplined when you give each dollar a job to do.

5.2 From Impulse to Intention

- Friction for Impulse Buys: You have to think about whether a spontaneous purchase really deserves its share of discretionary funds because they have to compete with debt and savings categories.

- Pre-Allocated Discretionary: Setting aside “fun money” ahead of time helps you feel less guilty and keeps your impulse spending in check.

5.3 Making Good Financial Habits Last

- Weekly Check-Ins: Regular reviews in the middle of the cycle help keep track of progress and make sure spending stays in line with allocations.

- Accountability Partners: When you share your budget goals with a friend or partner, you’re more likely to stick to them. ZBB is a great way to do household budgeting together.

- Automate bill payments and savings transfers so that the budget runs itself. This will help you make fewer decisions.

5.4 Examples of Personal Finance

The Spender-Saver Duo is an example. Sarah enjoys shopping, but Tom is more careful. They each get $200 in “fun money” by using ZBB, which stops arguments over how to spend their money and encourages good communication about money.

Example 2: The Freelancer Who Works Alone Mike used to have months with both high and low incomes. ZBB’s discipline helped him set up a $1,500 “Income Smoothing Fund,” which made his cash flow more stable when it was previously very unpredictable.

5.5 Changes in behavior over the long term

- Habit Formation: Keeping track of and allocating money on a regular basis makes financial discipline a part of your daily life.

- Confidence Growth: Every month that goes well shows that you can handle your money well.

- Less Stress About Money: Being accountable means fewer surprises, so you have a lot fewer money problems.

VI. Guide to Putting Things into Practice

Step 1: Figure out your real net income

- Get your pay stubs, side gig statements, and investment distributions.

- To get a baseline for income that isn’t steady, average the last three to six months.

6.2 Step 2: Keep track of every last cost

- Export your bank and credit card statements.

- Use apps like YNAB or Mint, or write down your receipts by hand.

- Put into groups:

- Fixed costs: Rent or mortgage, insurance, and utilities are fixed costs.

- Things you need that change: groceries, transportation, and medical care

- Goals for your money: paying off debt, saving for emergencies, and retirement

- Optional: eating out, going out, and subscriptions

6.3 Step 3: Give each dollar a job

- Distribute your total net income across the different categories until your budget runs out.

- Put needs first, then financial goals, and finally wants.

- Set aside 5–10% of your income for unexpected costs in a “Buffer” category.

Step 4: Choose Your Tools

| Tool Type | Good things | Bad things |

| Spreadsheets | You can change everything about them, and there are no fees. | You have to update them by hand. |

| YNAB | True ZBB philosophy, strong reporting. | $14.99 a month or $99 a year. |

| EveryDollar | Easy to use, backed by Ramsey, and has a premium subscription for bank sync. | |

| Mint | Free, automatic syncing; more focused on keeping track of expenses |

Step 5: Keep track, look over, and make changes

- Check-Ins Every Week: A 10-minute review in the middle of the month to make sure spending is in line.

- Monthly Rebuild: At the end of each month, start over from scratch based on how well you did.

Step 6: Automate and Give Away

- Set up automatic transfers to pay off debt and save money.

- Set up autopay for bills that are always due.

- Give calendar alerts or budgeting apps the job of reminding you.

VII. Getting past common problems

7.1 Time spent

- Challenge: Setting up the first budget can take 1–2 hours.

- Solution: Set aside a weekend or do the tasks—exporting expenses, sorting them, and assigning them—in separate sessions.

7.2 Discipline and Consistency

- Challenge: Keeping up with weekly check-ins.

- Solution: Schedule your budget like a workout and set up app reminders.

7.3 Family Buy-In

- Challenge: The partner doesn’t want to do detailed budgeting.

- Solution: Focus on common goals, like saving for a down payment or going on vacation, and show quick wins to get people excited.

7.4 Income that isn’t steady

- Problem: monthly earnings that change.

- Solution: Create a “Income Smoothing” buffer that is equal to your average monthly expenses, and then plan your budget carefully.

7.5 Tired of budgeting

- Problem: Losing interest after a few months.

- Solution: Change the frequency of evaluations. Try one-minute check-ins every week, deep dives every three months, and reviews every year.

VIII. Detailed Questions and Answers

Is Zero-Based Budgeting only for people who don’t make a lot of money? Answer: No way. Its strength comes from how it intentionally allocates resources, no matter how much money it has. High earners benefit equally by making sure their money is in line with their values instead of letting their lifestyle inflation run wild.

What makes ZBB different from the Envelope System? Answer: Both set limits on how much you can spend, but ZBB tells you where to put every dollar, including digital, savings, and debt payments. Envelopes usually only cover cash categories.

Can I use the Debt Snowball or Debt Avalanche with ZBB? Answer: Yes, the answer is yes. Put your prioritized debt (the one with the smallest balance or the highest interest) in a high-priority category in ZBB and give it more money as needed.

Is ZBB flexible enough to handle unexpected costs? Answer: Yes, that’s right. The built-in Buffer category (5–10%) and monthly reset feature make sure your budget can change when unexpected things happen.

What if I give too much or too little to a category? Answer: ZBB’s openness makes it easy to see when things go wrong. You can either give more money to the future or take it away from somewhere else. Regular reviews stop chronic overruns.

What should I do about expenses that come up once a year or once every three months? Answer: Set up sinking fund categories, like “Car Repair Fund,” and make monthly payments to build up the amount you need by the due date.

IX. Case Studies from the Real World

Case Study A: The Engineer Who Retired Early

- Profile: Alicia, 38, is a software engineer who makes $120,000 a year and wants to retire by the time she is 50.

- Challenge: Even though she made a lot of money, her lifestyle creep was putting her savings at risk.

- Putting ZBB into action:

- Set aside half of your income for retirement accounts like a 401(k) or Roth IRA.

- Set up a “Lifestyle Fund” with $1,500 a month for spending money.

- Transfers that happen automatically on payday.

- Result: Reached a savings rate of 65%, which should be enough for a 4% safe-withdrawal retirement portfolio in 12 years.

The Young Family is the subject of Case Study B.

- Profile: The Khans are a couple with two toddlers and two jobs. Their combined income is $95,000.

- Challenge: Managing daycare, the mortgage, and credit cards was getting harder.

- How to Use ZBB:

- A full audit of expenses found $350 a month in services that weren’t being used.

- Set up “Childcare Buffer” and “Home Maintenance” sinking funds.

- Adopted mini-budgets every two weeks to make course corrections more often.

- Result: Cut credit card debt by 40% in 8 months and saved $5,000 for emergencies.

Case Study C: The Hustler in the Gig Economy

- Profile: Rashid is a freelance photographer who makes between $2,500 and $6,000 a month.

- Challenge: Income spikes and droughts made it hard to plan ahead.

- How to Use ZBB:

- Used an average of six months’ worth of income ($4,000) as the base net.

- Made a “Income Smoothing Fund” that was equal to one month’s worth of average expenses.

- Set aside a safe $3,500 as monthly income; any extra went to Buffer.

- Result: learned to stick to a budget, got rid of financial stress, and built up a $10,000 emergency fund.

X. Conclusion and What to Do Next

To sum up:

Zero-Based Budgeting is more than just a way to make a budget. It’s a powerful way to make sure that every dollar you spend is in line with your goals and helps you become more clear, disciplined, and resilient. By:

- Getting a crystal-clear picture of where your money is going.

- Putting your resources toward your most important goals.

- Strategic reallocations can help you save money and pay off debt faster.

- Being able to quickly adapt to changes in income and emergencies.

- Building responsibility and long-term financial discipline.

You put yourself on a path to real financial freedom.

Call to Action:

- Get started today by collecting the transactions from last month and making your first ZBB spreadsheet or app setup.

- Iterate: Expect to have to learn—refine your categories, allocations, and processes every month.

- Share & Learn: Get involved in budgeting groups like Reddit’s r/YNAB and the Bogleheads forums to get advice and stay motivated.

Last Thought:

Zero-Based Budgeting is a process that takes time, not just one time. But every month, you’ll get closer to living with purpose, free from money worries, and able to make your dreams come true, whether they are early retirement, living debt-free, or building wealth for your children and grandchildren.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.