If you’ve ever looked at your 401(k) statement and wondered where the money goes, you’re not alone. This guide breaks down 401(k) fees, shows exactly where they hide, and gives you practical steps to cut them—without derailing your investment strategy. It’s written for employees who want more of their savings compounding for retirement, not leaking to costs. Brief note: this is educational, not individualized financial advice.

Quick answer: 401(k) fees fall into three buckets—investment fees (e.g., expense ratios), plan administration fees (recordkeeping, custody), and advice/managed account fees. To minimize them, choose low-cost index options, avoid funds with revenue sharing or 12b-1 charges when cheaper share classes exist, decline unnecessary add-ons, and periodically compare your plan’s costs against low-cost benchmarks (as of now).

Fast steps: Review your annual 404a-5 participant fee notice, sort funds by expense ratio, favor broad-market index funds or CITs when available, check for add-on managed account fees, and ask HR to benchmark providers at least every two years.

1. Know the Three Fee Buckets—and Where to Find Them

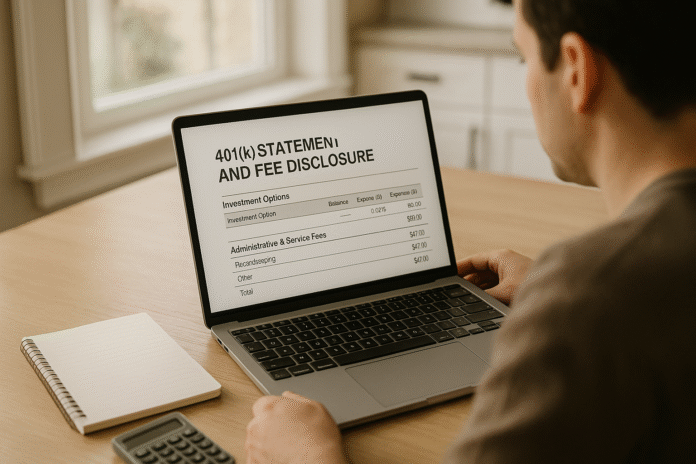

The fastest way to cut costs is to identify them accurately. In a 401(k), fees typically show up as (1) investment fees embedded in the fund’s expense ratio, (2) plan administration fees for recordkeeping, custody, and compliance, and (3) advice or managed account fees for optional guidance or automation. Your plan must disclose these, but the details are spread across documents: the annual participant-level disclosure (commonly called the 404a-5 notice), fund prospectuses or fact sheets, and any managed account enrollment materials. Start by downloading your plan’s latest 404a-5 notice and the fund sheets for every option you hold. Then, list each fee you can find next to your current balance and contribution rate so you can see real dollars, not just percentages.

1.1 Why it matters

Small percentages compound into large dollar differences. Asset-weighted expense ratios across U.S. funds have fallen for years, but many workers still pay materially more than necessary. Even a 0.50% gap on a six-figure balance can translate into thousands lost over a decade. With 401(k) investing, time is your ally—and fee drag is your enemy—so identifying each fee category is the foundation for everything else you’ll do.

1.2 How to do it

- Pull your 404a-5 participant disclosure and scan the “plan-level” and “individual service” fee sections.

- For each fund you own, record its expense ratio and any note about 12b-1 or “shareholder servicing” charges.

- If enrolled in a managed account, note the annualized percentage fee and the service description.

- Look for loan, processing, or trading fees tied to optional actions (loans, hardship withdrawals, brokerage windows).

- Convert percentages to dollars: fee% × balance × years held.

Mini case: On a $120,000 balance, trimming 0.40% in all-in costs saves ~$480 the first year. Over 20 years at a 5% gross return, avoiding that 0.40% can add tens of thousands to your final balance.

Checklist: Get the latest 404a-5, list expense ratios, list plan-level admin fees, list any add-on advice fees, total them, and rank by impact. Close the loop by prioritizing the biggest, easiest cuts first.

2. Prefer Ultra-Low-Cost Index Funds (or CITs) for Core Holdings

The single most reliable way to reduce ongoing costs is to allocate most of your 401(k) to broad, low-cost index options. These typically include U.S. total market or S&P 500, international developed/emerging markets, and core bond index funds. Many large plans now offer collective investment trusts (CITs) that track the same indexes as mutual funds but often at even lower fees because they’re built for retirement plans and avoid certain retail distribution costs. If your plan lineup includes both an index mutual fund and a CIT for the same benchmark, compare expense ratios and choose the cheaper one—assuming similar tracking and liquidity inside the plan.

2.1 Numbers & guardrails

- Asset-weighted fees across U.S. mutual funds and ETFs are around the low 0.30% range; index equity mutual funds and CITs can be 0.05%–0.10% or lower.

- Target-date mutual fund expense ratios have fallen materially over the last decade, but many still cost 0.20%–0.60%; the underlying building blocks may be even cheaper.

2.2 How to put it to work

- Build a three- or four-fund core: U.S. equities, international equities, core bonds, and optionally small-cap or REITs.

- Compare expense ratios for each asset sleeve; choose the cheapest fund/CIT for each index.

- If two options track the same index, prefer the lower expense ratio unless there’s a compelling reason (e.g., plan-specific restrictions).

Example: Swapping a 0.62% active large-cap fund for a 0.04% S&P 500 index fund on a $80,000 sleeve cuts annual costs by 0.58%, or $464 in year one—compounding every year thereafter.

Synthesis: Index where you can, save fees automatically, and let the market do the heavy lifting.

3. Pick the Cheapest Share Class—Avoid 12b-1 and Revenue-Sharing Layers

Two funds can look identical by name and strategy yet carry different share classes with very different fees. In 401(k) menus, “R” or “K” share classes (or institutional classes) often exist alongside more expensive retail classes. Some include 12b-1 fees or other revenue-sharing payments that compensate intermediaries but raise your total cost. Your objective is simple: hold the lowest-cost share class available that tracks the same strategy.

3.1 How to compare share classes

- Check the expense ratio and the 12b-1 line on each fund’s prospectus or summary sheet.

- If your menu lists multiple share classes of the same strategy, select the lowest expense ratio with no sales loads.

- When the only available class includes revenue sharing, ask HR if there’s a “clean” share class with explicit, transparent admin fees instead.

3.2 Mini case & math

Assume two share classes of the same bond index: Class A at 0.40% (includes 0.25% 12b-1) and Class I at 0.06%. On a $90,000 position, the difference is 0.34% = $306 in year one. Over 15 years at a 4% gross return, that extra 0.34% could cost you several thousand dollars in forgone compounding.

Checklist: For every fund you own, confirm (1) share class, (2) total expense ratio, (3) 12b-1 presence, (4) availability of an institutional or “clean” class, and (5) switch path inside your plan.

Synthesis: Same strategy + cheaper share class = immediate, risk-free savings.

4. Pressure-Test Target-Date Funds (TDFs): Fees, Underlying Holdings, and Glide Path

Most participants use target-date funds because they’re convenient and diversified. But not all TDFs are priced—or built—the same. Some bundle low-cost index building blocks; others use pricier active funds. Fees vary widely, and TDFs are “funds of funds,” so you’re paying for both the wrapper and the underlying holdings. Before relying on a TDF as your primary investment, pressure-test three things: expense ratio, underlying mix, and glide path (how the asset allocation changes over time).

4.1 How to evaluate your TDF

- Expense ratio: Compare TDFs in your plan with similar target dates; prefer those using index components when possible.

- Underlying holdings: Look for a breakdown of the sub-funds—are they low-cost index or higher-fee active strategies?

- Glide path: Check equity exposure near retirement; two “2050” funds can differ by 10–20 percentage points in stocks at the target date.

4.2 Example decision

If your plan offers a TDF at 0.58% built from active funds and another at 0.10% built from index funds with a comparable glide path, the index-built TDF is usually the cost-smart pick—assuming it fits your risk tolerance.

Mini-checklist: Confirm TDF expense, building blocks, glide path, any additional advice fee, and whether a “CIT” version of the same TDF is available at a lower cost.

Synthesis: TDFs can be a low-stress way to invest—but verify the price tag under the hood.

5. Audit Plan-Level Admin Fees—And How They’re Allocated

Beyond investment fees, your plan can charge administrative fees for recordkeeping, custody, statements, compliance testing, and customer service. These may be paid by the employer, taken from plan assets proportionally, billed as a flat per-participant fee (e.g., $3–$7/month), or funded indirectly via revenue sharing. The way admin fees are allocated matters: percentage-of-assets methods tend to penalize higher-balance participants, while flat-dollar fees are more equitable.

5.1 What to look for in your 404a-5

- The type and frequency of admin charges (monthly/quarterly/yearly).

- Whether fees are flat or asset-based.

- Any “wrap” or platform fees layered on top of fund expense ratios.

- If revenue sharing exists, whether excess credits are returned to participants.

5.2 Actions you can take

- If admin fees are asset-based, encourage HR to negotiate flat per-head pricing or employer-paid admin costs.

- Ask whether your plan can switch to clean-share funds and bill admin separately for transparency.

- If your balance is large and admin fees are asset-based, consider reallocating into the lowest-cost core options to minimize fee drag until the plan updates its structure.

Example: A 0.20% recordkeeping platform fee on a $200,000 balance costs $400/year. If the plan can shift to a $60/year flat fee, your annual cost drops by 85%.

Synthesis: How admin fees are billed can be as important as how much is billed—push for flat, transparent structures.

6. Evaluate Managed Accounts and Advice Add-Ons—Only Pay When Value Exceeds Cost

Many plans offer managed accounts that automatically choose funds and rebalance for you—at an additional fee, commonly 0.25%–0.75% of assets annually. For some investors (complex finances, outside assets, very low risk tolerance), this can be worthwhile. For others, a low-cost target-date fund or a DIY index mix may deliver similar results without the extra layer of fees.

6.1 How to decide

- Cost vs. benefit: Translate the managed-account fee to dollars and compare with a TDF or simple index portfolio.

- Customization: Do they incorporate outside assets or taxes in a meaningful way? If not, the value may be limited.

- Accountability: Check whether the service provides clear reports, rebalancing rules, and conflict-free fund selection.

6.2 Mini case

On a $150,000 balance, a 0.45% managed-account fee = $675/year. If your alternative is a 0.10% index-based TDF at $150/year, you’re paying $525 extra annually. Unless customization demonstrably improves outcomes, that extra cost likely isn’t justified.

Checklist: Confirm the fee, the method, how outside assets are handled, whether cheaper TDF or index paths exist, and how to opt out.

Synthesis: You don’t need to pay a premium for automation if a lower-cost fund can do the job.

7. Minimize Transaction-Based Fees: Loans, Hardship Withdrawals, and Brokerage Windows

Some 401(k) costs only appear when you take actions: initiating a loan, processing a hardship withdrawal, trading inside a brokerage window, or requesting paper checks and expedited services. While small individually, these fees add up—especially if they trigger taxes or early withdrawal penalties.

7.1 Guardrails

- Loans: Typical origination fees ($50–$100+) plus ongoing interest (paid back to your account) and potential $25–$75 maintenance charges. The bigger risk is leaving your job and failing to repay—taxes and penalties can dwarf fees.

- Hardship withdrawals: Processing fees ($50–$150) plus taxes/penalties; you’re also removing assets from the market.

- Brokerage window trading: Commissions, fund minimums, and access to higher-fee products you wouldn’t otherwise buy.

7.2 Practical moves

- Treat loans and hardship withdrawals as last resorts.

- If you use a brokerage window, restrict it to unique exposures you can’t get in the core menu—not higher-cost overlaps.

- Opt in to e-delivery when it reduces processing fees.

Mini case: Two loans over five years could easily cost $250–$400 in fees alone, plus the opportunity cost of cash leaving your investments briefly during processing.

Synthesis: Avoid optional transactions that incur fees unless they clearly serve a critical need.

8. Compare Rollovers vs. Staying In-Plan When You Change Jobs

When you leave an employer, you’ll choose to leave assets in the old 401(k), roll into a new employer’s plan, or roll into an IRA. Costs drive this decision more than anything else. Big-company plans often have institutional pricing and CITs you can’t access in an IRA. On the other hand, some small plans are costly, and a well-chosen IRA can be cheaper.

8.1 Comparison framework

- All-in cost: Compare expense ratios + admin + advice in each destination.

- Menu quality: Are there low-cost index options or only expensive active funds?

- Unique access: Does the 401(k) offer ultra-cheap CITs or stable value? Does the IRA unlock certain ETFs at very low cost?

- Execution fees: Any outgoing check, termination, or account closure fees?

8.2 Example decision

If your former plan’s index CITs cost 0.03%–0.06% and charge $0 admin, that can be cheaper than an IRA of low-cost ETFs with $0 commissions but average costs of 0.05%–0.10% plus any advisory wrap. Conversely, exiting a small plan that layers 0.70% in admin/platform fees could make an IRA materially cheaper.

Synthesis: Don’t default to “rollover.” Price your options carefully—lowest all-in cost plus adequate fund choice wins.

9. Ask HR for a Lower-Cost Lineup: What to Request and How to Make the Case

As a participant, you can influence plan costs. Employers (as ERISA fiduciaries) must ensure fees are reasonable for services provided. If your plan is expensive or confusing, raise it with HR or the benefits committee. Be specific, constructive, and data-driven.

9.1 What to ask for

- Benchmarking recordkeeping and advice fees every 1–2 years.

- Moving to clean-share funds or CITs to remove revenue sharing.

- Index-based defaults (e.g., low-fee target-date series).

- Flat per-participant fees instead of asset-based admin charges.

- Clear, plain-language fee disclosures to help participants compare options.

9.2 How to present it

- Bring a one-page comparison showing your plan’s expenses vs. a widely used low-cost benchmark lineup.

- Focus on risk-free savings from lower fees, not market returns you can’t control.

- Emphasize that lower costs can improve outcomes for everyone while reducing fiduciary risk.

Synthesis: A polite, evidence-based ask can nudge your plan toward lower costs—benefiting you and your coworkers for years.

FAQs

1) What are the typical fees in a 401(k)?

You’ll usually encounter investment fees (expense ratios), plan administration fees (recordkeeping, custody, statements), and advice/managed account fees. Investment fees are deducted within the fund; admin fees may be flat per participant or asset-based; advice fees are often an annual percentage of assets. Check your 404a-5 disclosure and fund sheets for exact amounts and whether any revenue sharing is embedded.

2) What’s a “good” expense ratio inside a 401(k)?

For broad index funds or CITs, costs are commonly 0.02%–0.10%; for index bond funds, ~0.05%–0.10% is typical in large plans. Target-date funds vary but under 0.20%–0.30% for index-based series is competitive. Actively managed funds often cost more; decide case-by-case, but make sure higher fees are justified by clear, persistent value.

3) Where do I find my plan’s fees and who discloses them?

Participants receive annual 404a-5 fee disclosures detailing plan-level and investment-level costs; employers (fiduciaries) receive 408(b)(2) service-provider fee disclosures. Fund prospectuses or fact sheets list expense ratios and 12b-1 charges. Your plan website often consolidates this in a “Plan Documents” or “Fees” section. Ask HR if you can’t find the files.

4) Are managed accounts worth paying for?

Sometimes, especially if they meaningfully integrate outside assets, taxes, and retirement income planning. But many services simply repackage a target-date-like mix for 0.25%–0.75% per year. Compare the added cost to a low-fee TDF or a DIY index portfolio. If there’s no clear, personalized value, opt out and save the fee.

5) What is revenue sharing (including 12b-1 fees)?

It’s money that some funds pay to plan providers for distribution or servicing—often embedded in the fund’s expense ratio. While not inherently illegal, it raises your all-in cost and can obscure what you’re paying. Prefer clean-share or institutional classes that strip out revenue sharing and bill admin fees separately and transparently.

6) Are target-date funds expensive?

Not necessarily. Many large plans offer index-based TDFs around 0.10%–0.20%; others use active components and cost more. Always check the expense ratio and the underlying funds. If two TDFs have similar glide paths but very different fees, the cheaper one usually leaves more money compounding for you.

7) Can I use ETFs inside my 401(k)?

Some plans offer ETFs in brokerage windows, but the core menu typically uses mutual funds or CITs. ETFs can be very cheap, but trading and commissions (if any) add friction—and their tax efficiency is less relevant inside a tax-deferred account. Unless you need a unique ETF exposure, the core low-cost menu may be simpler and cheaper.

8) How much do plan admin fees usually cost?

Large plans often negotiate flat per-participant fees (e.g., $3–$7 per month), while small plans may use asset-based pricing (e.g., 0.10%–0.40%). Flat pricing is generally more equitable. If your admin fees are asset-based and your balance is high, you’re likely subsidizing others—an argument for HR to rebid or restructure fees.

9) When is a rollover IRA cheaper than staying in a 401(k)?

If your former employer’s plan has high admin/platform fees or limited low-cost funds, a low-fee IRA could win. But if your old plan offers institutional share classes or CITs at rock-bottom costs and no admin fees, staying put may be cheaper. Compare all-in fees and fund quality before you move money.

10) What should I ask HR to lower our plan’s costs?

Request regular fee benchmarking, index-based defaults, clean-share classes/CITs, and flat per-participant admin fees. Ask for clearer, plain-English fee disclosures and a low-cost core lineup across U.S. stocks, international stocks, and bonds. The goal is transparent, reasonable fees for the services provided.

Conclusion

Fees are one of the few things you fully control in a 401(k), and the payoff from cutting them is permanent and compounding. Start by mapping the big three fee buckets: investment, admin, and advice. Move your core holdings into low-cost index funds or CITs, choose the cheapest share class, and audit plan-level charges—pushing for flat, transparent pricing where possible. Be skeptical of add-on services unless the value clearly exceeds the cost, and avoid optional transactions (loans, frequent trading) that trigger extra fees. When you change jobs, compare all-in costs before rolling over—large plans often offer pricing you can’t replicate elsewhere. Finally, remember you can influence your plan: a respectful, evidence-based ask to HR can help everyone save.

Next step: Download your latest 404a-5 disclosure, list every fee tied to your current holdings, and make one change this week that lowers your ongoing cost.

References

- A Look at 401(k) Plan Fees — U.S. Department of Labor, Employee Benefits Security Administration. https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/401k-plan-fees.pdf

- Understanding Your Retirement Plan Fees — U.S. Department of Labor, EBSA. https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/publications/understanding-your-retirement-plan-fees

- Final Rule to Improve Transparency of Fees and Expenses to Workers in 401(k)-Type Retirement Plans (404a-5) — U.S. Department of Labor, EBSA Fact Sheet. https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/fact-sheets/dol-transparent-401k-fees-fact-sheet.pdf

- Final Regulation Relating to Service Provider Disclosures (408(b)(2)) — U.S. Department of Labor, EBSA Fact Sheet (2012; current electronic delivery guidance referenced 2020). https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/fact-sheets/fact-sheet-service-provider-disclosure-regulation.pdf

- How Fees and Expenses Affect Your Investment Portfolio — Investor Bulletin — U.S. Securities and Exchange Commission, Office of Investor Education. https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/updated

- Mutual Fund and ETF Fees and Expenses — Investor Bulletin — U.S. Securities and Exchange Commission. https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/mutual-fund-and-etf-fees-and-expenses-investor-bulletin

- Mutual Fund Expense Ratios Remain at Historic Lows for Retirement Savers — Investment Company Institute News Release. https://www.ici.org/news-release/25-low-expense-ratios-benefit-retirement-savers

- Trends in the Expenses and Fees of Funds, 2024 — ICI Research Perspective, Vol. 31, No. 1. https://www.ici.org/system/files/2025-03/per31-01.pdf

- How Fund Fees Are Evolving in the U.S. — Morningstar Research Blog. https://www.morningstar.com/business/insights/blog/funds/us-fund-fee-study

- 401(k) Plans: Reported Impacts of Fee Disclosure Regulations — U.S. Government Accountability Office (GAO-24-107125). https://www.gao.gov/products/gao-24-107125

- Target Date Funds – Investor Bulletin — U.S. Securities and Exchange Commission. https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/target-date-funds-investor-bulletin

- Collective Investment Trusts in Retirement Plans — Wellington Management Insight. https://www.wellington.com/en/insights/collective-investment-trusts-dc-retirement-plans