Every minute and every dollar counts in today’s fast-paced world. You have a lot going on with work, family, and personal interests, and the thought of managing your money by hand can be too much. Picture a world where your money works for you automatically. In this world, smart automation makes saving, paying bills, and even investing easier. Financial automation is no longer just for tech-savvy millennials; it’s a smart way for anyone to improve their financial health.

Setting up systems that do your regular money tasks for you is what financial automation is all about. These tools and strategies can help you avoid doing the same things over and over again. For example, they can automatically move a set amount of money into your savings account right after your paycheck is deposited or pay your bills on time without you having to do anything. This method not only saves you time, but it also lowers the number of mistakes people make that can cause missed payments, extra fees, and the mental stress of having to keep track of due dates all the time.

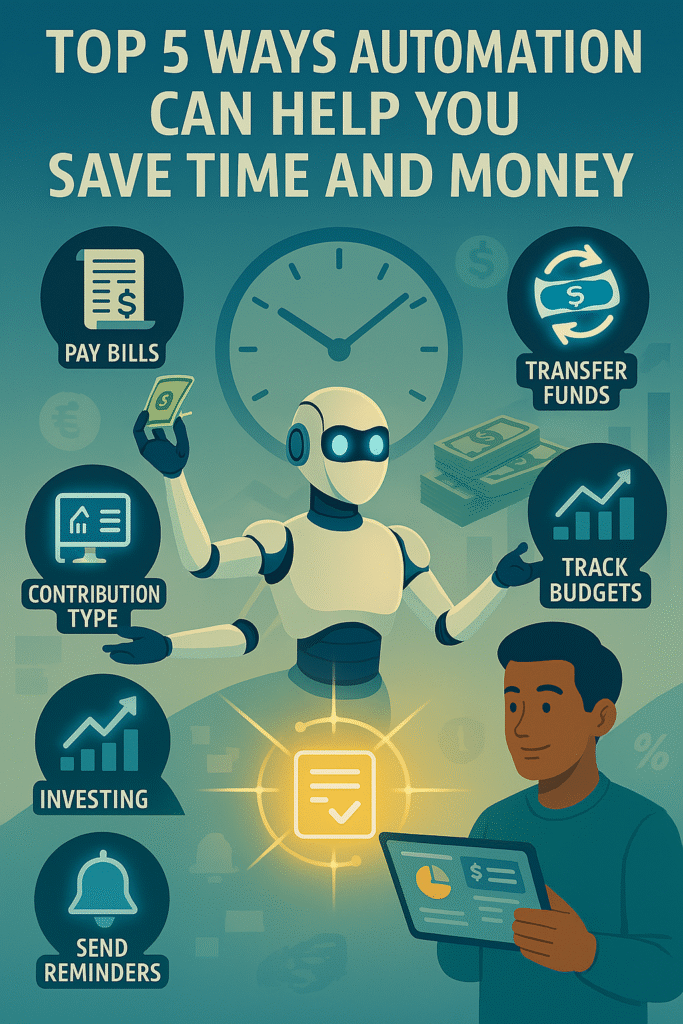

As you read on, you’ll learn how automation can help you stick to your personal finance habits, which will lower your stress and help you stay financially healthy in the long run. In this blog, we talk about five automation strategies that can help you save money and free up time in your busy schedule. We’ll talk about everything from automatic transfers to savings accounts, paying bills and subscriptions automatically, automating credit card payments, round-up saving apps, and even investing on autopilot through robo-advisors or 401(k) contributions.

Each part will go over the “how-tos,” give real-life examples, and suggest the best apps and tools for making your money life easier. These tips are meant to give you the power to take control of your money, whether you’re feeling overwhelmed by budgeting or just want to find better ways to do it. You’ll see by the end that even small automated tasks can have big effects over time. If you’re ready to change how you handle your money and have more free time without putting your financial security at risk, let’s look at how automation can help you the most.

What is financial automation, and why is it important?

Using technology to do the same personal finance tasks over and over again without problems and on time is what financial automation means. In a way, it lets your money work like a “self-driving system,” where not having to do anything doesn’t mean you’re not paying attention; it’s just that it’s meant to work in the background for your benefit.

Picture a system that automatically moves some of your pay into a special savings account, pays your bills on time, and even invests for your future. By automating these tasks, you get rid of a lot of the problems that come with managing money by hand, like forgetting a due date, miscalculating a deposit, or just losing track of your spending. Automation helps get rid of mistakes made by people, which is especially helpful when you have to do a lot of financial tasks at once.

When you compare manual and automated methods, the manual method usually has a lot of steps that take up your mental bandwidth. You need to keep track of your budget, remember when to pay your bills, and go to banking websites. These tasks may seem small on their own, but when you put them all together, they can cause a lot of stress and the chance of making a mistake. Automation, on the other hand, makes these tasks part of a normal routine. When you automate your finances, you build consistency into your habits. This lets you set up a system that works for you all the time, which helps you be more disciplined and makes sure you never miss a payment or delay a savings deposit.

Also, automating your finances has real-world benefits that go beyond just making things easier. By making it easier to manage your money, you free up your mind to focus on more important things, like finding new ways to make more money or just having more free time. Automation makes habits that last. Setting up a recurring transfer, for example, becomes a part of your financial routine, like a “payday ritual” that encourages good saving habits without you having to be reminded all the time.

You could compare financial automation to the autopilot feature in cars today. When you’re on a long, boring drive, autopilot keeps you on track without you having to steer all the time. Automating your finances works the same way: it keeps your money on track while you go about your daily life. If you’re new to automating your personal finances or want to make your current system work better, these tips can help you save time, lower your stress, and improve your financial health in the long run.

The first step in an automation strategy is to set up automatic transfers to savings accounts.

Setting up automatic transfers to your savings accounts is one of the easiest and most effective ways to take charge of your money. With this method, you set up your bank or financial app to automatically move a set amount of money from your checking account to your savings account as soon as your paycheck is deposited. This “set it and forget it” plan turns saving money from something you do every now and then into something you do all the time.

How It Works

Think about this: every time you get paid, a set amount, like $50, is automatically put into your savings account. If you do this twice a month, you’ll easily save $1,200 a year. The idea is to pay yourself first so that you can save money before you have a chance to spend it on other things. This method fits perfectly with the idea of “automate savings,” and it’s a great way to save money without having to think about it.

Advantages of Automatic Transfers

- Consistency: You won’t have to worry about putting money aside each month because the transfer is scheduled. This not only helps you save money regularly, but it also makes sure that your savings grow over time.

- Stopping yourself from spending too much: If you think of savings as a fixed cost, like your rent or utilities, you’re less likely to use them for everyday costs. Your financial priorities have changed, which can make it less tempting to spend too much.

- Less Stress: Automating your savings takes away the stress of having to remember to move money every month. This is especially helpful for people who are busy and might have trouble sticking to their budgeting routines.

Example from real life

Sarah was a busy professional who always thought she couldn’t save money because her monthly bills were too high. She set up a $75 transfer from her paycheck to her emergency fund every time she got paid so that she wouldn’t have to think about it. Sarah had saved almost $900 in a year without doing anything. This small, organized approach gave her the confidence to look into other parts of financial planning.

Apps and tools for automatic transfers

- Your Bank’s Online Banking: Most banks have features that let you set up automatic transfers. Check out the features of banks like Chase, Bank of America, or your local credit union.

- Chime: Chime is easy to use and lets you set up automatic transfers with ease. People really like its “Save When You Get Paid” feature.

- Ally Bank and Capital One 360: Both banks have good automatic savings options that let you make multiple savings buckets, like emergency funds, vacation accounts, or special purchase funds, to help you reach your financial goals.

Tips for Getting the Most Out of Your Savings

- Multiple Savings Buckets: Instead of putting all your money in one account, think about making separate buckets for different financial goals. This way, you can automatically set aside money for things that are important to you, like emergencies, travel, or even investments in the future.

- Start Small: If you’re not used to the idea of automating savings, start with a small amount. You can change the amount over time as you get used to the process.

- Review often: Even though automation is meant to be a “set and forget” solution, it’s a good idea to check your automatic transfers every few months. This makes sure that your savings goals stay in line with any changes in your finances.

You can build a strong financial discipline with little effort by using automatic transfers. This plan not only helps you save money automatically, but it also makes your overall personal financial management more consistent. You might soon stop worrying about whether you’re saving enough and start thinking about how to set new, high financial goals.

Strategy #2 for automation: Set up automatic payments for bills and subscriptions.

The long list of bills and subscriptions that need to be paid every month is a common cause of financial stress. If you forget a due date, you could have to pay late fees, interest, and even hurt your credit score. That’s where auto-pay for bills and subscriptions comes in. It’s a simple but powerful way to automate your payments so you don’t have to keep an eye on them all the time.

Make it easier to pay.

When you sign up for auto-pay, you tell your bank or service provider to automatically take the payment out of your account on the due date. This means you don’t have to spend valuable time every month logging into websites, finding your way around payment portals, and worrying about missing deadlines. You can be sure that all of your regular payments, like your internet, utility, or streaming subscription, will be taken care of automatically.

Benefits for Money and Yourself

- No More Late Fees: One of the best things about auto-pay is that it cuts down on late payment fees. There isn’t much of a chance of spending more money than you need to when you use automated payments.

- Saves Time: All of your bills are paid automatically, so you don’t have to search through your inbox for reminders and payment links. This gives you time to think about other things in your life or work.

- Better Credit Score: Paying your bills on time and regularly can help keep your credit score high and even raise it. Lenders see you as a reliable borrower when you always pay your bills on time.

- Custom Alerts and Overdraft Prevention: Most auto-pay systems come with alerts and notifications that let you know when payments have gone through. Some banks even let you set aside extra cash so you don’t have to pay overdraft fees.

Example from real life

Think about Mike, a freelance graphic designer whose income isn’t always steady. Before he started using automation, Mike had a hard time making ends meet and sometimes forgot when bills were due while working on busy projects. He got rid of late fees and made managing his money less stressful by setting up auto-pay for all of his fixed expenses. Mike can now relax because he knows that all of his regular payments are taken care of automatically. This lets him focus more on his creative work.

Tools and platforms that make it easier to pay your bills

- Online Banking Platforms: Most banks let you set up automatic payments. All you have to do is log in to your account, go to the bill payment section, and set up the automatic payment.

- Third-Party Apps: Apps like Mint or Monarch let you see all of your financial information in one place and set up automatic payments for different bills.

- Budgeting Platforms: Apps like Simplifi by Quicken not only keep track of your spending, but they also let you manage and schedule your regular payments. This way, you can keep track of your financial obligations without any stress.

Important Things to Think About and Be Careful Of

- Keep a Cash Buffer: When you use auto-pay, it’s very important to make sure that your checking account always has enough money to cover the payments that are due. Overdraft fees can quickly eat up the money you save by not paying late.

- Periodic Review: Auto-pay is a great way to save time, but you should check your bills and subscriptions on a regular basis. Are you paying for services you don’t use anymore or for bills that have gone up for no reason? A quick audit every month or three months can help you keep your spending in check.

- Notification Settings: Use your banking app to set up alerts so you know when automatic payments are due. This second check makes sure that you know how much money is in your accounts and can make changes if necessary.

You greatly lower the chance of making a mistake by automating your bill payments. This also saves you time and makes managing your money easier and less stressful. There are a lot of highly rated, easy-to-use tools that can help you automate your finances. There’s really no reason not to make your life easier and worry less about money.

Automating Credit Card Payments is the third strategy for automation.

Credit cards are very useful for keeping track of daily expenses and building credit. But if you miss a payment or only make the minimum payment, you could face serious consequences, such as high interest rates and a lower credit score. Automating your credit card payments is a smart way to make sure you never miss a payment and always know how your credit is doing.

Why should you set up automatic payments for your credit cards?

Setting up auto-pay for your credit cards can mean the difference between a calm financial life and a lot of late fees and high interest rates. Setting up automatic payments every month lowers the chance of making a mistake, like forgetting to make a payment when you’re busy, and makes sure your credit score stays good. The most important choice you need to make is whether to pay the full amount or just the minimum. Paying the minimum may keep you out of trouble right away, but paying the full amount each month is the best way to avoid interest charges and keep your debt levels under control.

How It Helps You

- No Late Fees: If you always make your payments on time, you won’t have to worry about getting $30–$40 late fees or worse.

- Keeping a Good Credit Score: Your credit score depends on you making full payments on time. Automation gives you the best of both worlds: ease of use and financial discipline.

- Time savings: Your settings take care of this process, so you don’t have to worry about multiple due dates and manual reminders. This lets you focus on other parts of your life.

Example from real life

Think about Lisa, a single mother who used to worry every month that she would forget to pay her credit card bill because she was so busy. Lisa saved herself from a lot of late fees by switching to an auto-pay system that paid off her full balance each month. She also saw her credit score slowly go up. Lisa can now focus on raising her kids and taking care of her home instead of worrying about money.

Things to Know and Use to Set Up Auto-Pay

- Built-In Features: Most credit card companies let you set up automatic payments directly from their websites. Find the option and choose between full payment and minimum payment. If you can, choose full payment.

- Email Alerts: Add monthly email alerts to your auto-pay settings. If you ever need to check your payment, these reminders can help you do so.

- Calendar Reminders: Even if you set up auto-pay, checking your calendar once a month can make sure you have enough money in your account to make the payment. This step helps you stay on top of your overall budget.

When you automate your credit card payments, you take control of your money and make sure your future is more stable. You also learn to be more disciplined with your spending. This easy change can save you time and money, and it will also help your credit health in the long run.

Strategy #4 for Automation: Round-Up Saving Apps

You don’t have to sit down and put money into savings all the time to use round-up saving apps. These apps are a great idea because they save the extra change every time you make a purchase. Over time, these small amounts add up to a savings account that you might use for an emergency, a vacation, or even to invest.

How Round-Up Savings Work

If you buy a coffee for $2.65, your app will round the price up to $3.00. Your savings account or investment portfolio gets the extra $0.35. It may seem like $0.35 isn’t much, but if you keep saving this way, it can add up to a lot of money—often more than $500 a year—without you even noticing it. This is a great example of how to set up your budget so that you don’t have to make decisions all the time.

More Benefits Than Just Saving

- Passive Savings: You save without having to actively set aside money every month. This is great for people who have trouble saving regularly.

- Investment Options: Some apps let you invest the money you round up. Even small amounts can help you reach your financial goals in the future because of compound growth.

- Easy to Use: These apps help you build a savings reserve passively with very little effort on your part. This is especially helpful for people who are new to financial automation.

Example from real life

Think about John, a busy consultant who was too busy with work to keep a close eye on his money. John started saving automatically with every purchase when he linked his debit card to a round-up saving app. At first, the savings didn’t seem like much, but after a year he was surprised to find that these small amounts had turned into a decent emergency fund that made him feel more financially secure.

Apps and tools we suggest

- Acorns: This is one of the most popular apps because it has a round-up feature. It also lets you invest your money, so you can use it to save money and grow your wealth.

- Qapital: This app not only rounds up your purchases, but it also lets you set your own goals. Qapital lets you see how far you’ve come, whether you’re saving for a vacation, a new gadget, or a rainy-day fund.

- Chime: Users love Chime for its automatic savings features. It easily rounds up your daily spending and sends the extra money to your savings account.

Round-up saving apps make it very easy to save money without changing how you spend it. You don’t have to give up any of your daily comforts. Just let these apps do the hard work for you while you relax knowing that your spare change is helping you reach your goals.

Investing on Autopilot (Robo-Advisors or 401(k) Contributions) is the fifth step in your automation strategy.

Investing can be scary, especially if you’re new to managing your own money. The idea behind investing on autopilot, though, is to make it easier to make decisions by using technology to build wealth over time. This strategy of automating your investments, whether through robo-advisors or automatic contributions to your 401(k), lets you invest consistently without having to keep an eye on market trends all the time.

How It Works

You don’t try to time the market or make decisions on the spur of the moment. Instead, you set up a system that automatically sends a certain percentage of your paycheck to your investment accounts. Robo-advisors like Betterment or Wealthfront look at your risk tolerance and financial goals, then build and manage a portfolio of investments that includes a variety of assets. Many companies offer auto-enrollment and automatic contribution increases to make investing even easier if you have a 401(k) plan through your job.

The Strength of Consistency

Staying consistent is one of the hardest things about investing. You can take advantage of dollar-cost averaging by automating your investments. This means that your fixed contributions buy more shares when prices are low and fewer shares when prices are high. This strategy lowers the risk of making mistakes when timing the market and lowers the effect of short-term market fluctuations over time. For instance, putting $100 into an investment account every month may not seem like much at first, but after ten years of compounded returns, that habit could turn into a large nest egg.

Advantages of Autopilot Investing

- Less emotional stress: When you automate your investments, you don’t have to worry about making snap decisions when the market changes. The system does the work for you, following a long-term plan and making it easier to make decisions without getting too emotional.

- Wealth Building Without Constant Attention: Your financial future starts to grow without you having to keep an eye on it all the time. This is especially helpful for people who are busy and want to “set it and forget it” while they work on other things.

- Financial Discipline: Automated contributions help you stick to your investing habits by making sure you always save money for the future instead of giving in to short-term spending urges.

A Real-Life Situation

Picture this: Emily, a mid-level manager, chose to set up automatic contributions to her 401(k) plan. She chose to have her contributions automatically go up every year, which meant that she didn’t have to worry about deciding how much to raise them each time. Over time, her portfolio grew because she kept putting money in it, and dollar-cost averaging helped protect her from the ups and downs of the market. Emily’s retirement fund is now in better shape, and she can relax knowing that her future is safe.

Investing on autopilot: tools and platforms

- Robo-Advisors: Betterment and Wealthfront are two examples of platforms that make it easy to invest your money automatically based on your financial goals and how much risk you’re willing to take.

- Employer 401(k) Plans: Many businesses now have ways for employees to automatically sign up and increase their contributions, making it easier than ever to save for the future.

- Investment Apps: Some apps let you save and invest money automatically. These make a smooth system where your money is not only saved but also smartly invested to help it grow.

When you automate your investments, you take away a lot of the guesswork and stress that can come with making decisions about the market. This plan lets you slowly and steadily build wealth, so your money keeps growing even when you’re sleeping. It’s the best way to save time with automation while also saving money and making the future safer.

Bonus Tips: How to Get the Most Out of Automation Strategies

Each automation strategy has its own big benefits, but using them all together can take your money management to a whole new level. Picture a system where automatic savings transfers, automatic bill payments, and automatic investing all work together without any problems. This all-encompassing method strengthens your financial health, leaving little room for mistakes or oversights.

Putting Layers on Your Financial Processes

Think about having a monthly financial check-in where you go over all of your automated processes. Tools like YNAB, Simplifi, or Monarch can help you see your income, expenses, and savings all at once. This review every so often helps you change your plans based on any changes in your life or goals. For instance, if you get a raise, you could maximize your savings by raising the amount of money that is automatically transferred to your savings account.

Advantages of a Unified System

- Holistic Control: By using a combination of different automation strategies, you can keep track of all your money without getting lost in the details. It makes a system that can run on its own, with each part supporting the others.

- Overall Financial Health: Automating your bills, savings, investments, and even your spending makes it easier to deal with money problems, stay within your budget, and reach your long-term goals.

- More Efficient Use of Time: An integrated approach cuts down on the time you spend on manual transactions, giving you more time to work on your own growth, your career, or just have fun.

Quick Wins for Fast Progress

- Start Small and Work Your Way Up: If you’re new to automating your finances, choose one area, like paying your bills automatically, and then add more areas as you get used to it.

- Personalize Your Dashboard: Automation dashboards let you keep an eye on your progress and let you know if something seems off. This proactive step makes sure you stay in the loop and in charge.

- Set Regular Reviews: Pick a short time each quarter to go over your automation settings. This makes sure that your system is always working at its best as your money situation changes.

By putting these strategies into a single, automated financial system, you’re not only saving money but also time and stress. This extra tip is about making a system that works on its own and helps you reach your long-term goals while letting you enjoy life.

Common Mistakes and How to Avoid Them

Automation makes managing money a lot easier, but you need to be careful with it so you don’t run into problems. If you rely too much on automated systems without checking them every now and then, you might miss mistakes or costs.

Things to Keep an Eye Out For

- Too much automation: If you rely only on automation, you might become complacent. It’s important to check your accounts often to make sure that all of your payments are going through correctly and that there are no mistakes.

- Subscriptions you don’t use: Auto-pay makes it easy to forget about services you don’t use anymore. Checking your subscriptions on a regular basis helps you get rid of things you don’t need and only pay for things that are useful.

- Risks of Overdraft: If your bank account balance gets too low, automatic payments could cause overdraft fees. Always make sure that your main checking account has enough money in it to cover any planned withdrawals.

- Not being flexible: Money situations can change quickly. If your income or expenses change, a rigid automated system might not be able to keep up, which could cause short-term financial stress.

Best Ways to Keep Control

- Review Every 90 Days: Even though automation is supposed to make things easier, you should still set aside time every three months to go over your system. Look over your bank statements to make sure payments went through and change the amounts that happen every month if you need to.

- Set Up Alerts and Reminders: Leverage your banking app’s notification features or set calendar reminders for review days. This extra level of watchfulness helps find mistakes before they turn into big problems.

- Have an emergency fund: No matter how well your automation is set up, you should always have a separate emergency fund to help you deal with any unexpected financial problems.

- Keep Up with Changes: Make sure to check for updates from banks, service providers, or financial apps on a regular basis. Staying up to date on new fees or features will help you quickly change your settings.

You can enjoy all the benefits of automation without any hidden problems if you know about these common mistakes and take simple steps to avoid them. Financial automation is meant to make your life easier, not harder, so a little extra care goes a long way.

In conclusion

Financial automation doesn’t mean giving up control; it means giving you more power to handle your money with less stress. The tips we talked about, like automatic transfers to savings, auto-pay for bills and subscriptions, automating credit card payments, using new round-up saving apps, and investing on autopilot, all give you a different way to make your money easier to manage while also making your future more secure.

By automating your finances, you make your daily life easier, lower the chance of making mistakes, and create habits that will help you stay on track in the long run. Even small automated actions, like moving $50 after each paycheck or rounding up your purchases, can add up to big savings and investment growth over time. Imagine how good it would feel to know that your money is working for you in a way that frees up time for you to focus on your family, hobbies, and health.

As you move forward, think about starting with one automation strategy that you can handle, like auto-paying your bills. Then, add more automated processes over time until your financial system is fully integrated. You can set up a part of a system in less than 10 minutes that will help you save money automatically, lower your stress, and lay the groundwork for long-term financial health.

Do it today. Look into what your bank has to offer, download some of the best apps, and let your finances run themselves. With some simple automated routines and time on your side, you’ll be amazed at how much time and money you can save. You’ll be changing your financial future one smart, automated step at a time.

More things you might want to look into

You might also want to learn about the following if you’re interested in how automation can change your finances:

- The Basics of Dollar-Cost Averaging: Learning how this strategy works in an automated setting can help you understand autopilot investing better.

- Budgeting Techniques: Good budgeting apps can help you manage your money even better when you combine them with automation.

- Advanced Personal Finance Tools: YNAB, Simplifi, and Monarch are just a few examples of platforms that not only help you automate your finances but also give you information and predictions that let you change your plans for the best results.

You can set yourself up for long-term financial success by always learning about ways to automate your finances and taking an active role in managing your money. Do something today to embrace the ease and power that automation can bring. Your future self will thank you.

Begin your path to a more organized and less stressful financial life right away. Setting up automatic transfers, scheduling bill payments, or maybe trying out a round-up saving app are all automated processes you could start with. Explore the world of financial automation in depth to find even more ways to save time and money.

Enjoy automating! Sources