Credit card debt can feel like an endless storm, with new stress, high interest rates, and a sense of defeat every month. But the truth is that there is a way out. This complete guide will show you how to pay off your credit card debt faster, take back control of your money, and, in the end, get your peace of mind back. This article gives you a personalized plan for how to deal with your debt, whether you’re feeling overwhelmed by rising balances or just want a clearer, more effective way to do it.

Beginning

Credit card debt isn’t just a financial problem; it can affect every part of your life. The weight of missed payments and accrued interest can often lead to a cycle that can hurt your savings, hurt your credit score, and even hurt your relationships. Debt can have a big effect on your mental health. The constant worry about making ends meet, the stress that comes with getting a statement, and the guilt that comes from making financial mistakes can all drain your energy and limit your goals.

Getting rid of credit card debt quickly isn’t just about getting rid of a negative balance. Paying off your debt faster can lower the amount of interest you pay over time, raise your credit score, and give you more money to save for the future or invest in your future. You can get your financial freedom back by taking charge of your debt, one smart choice at a time.

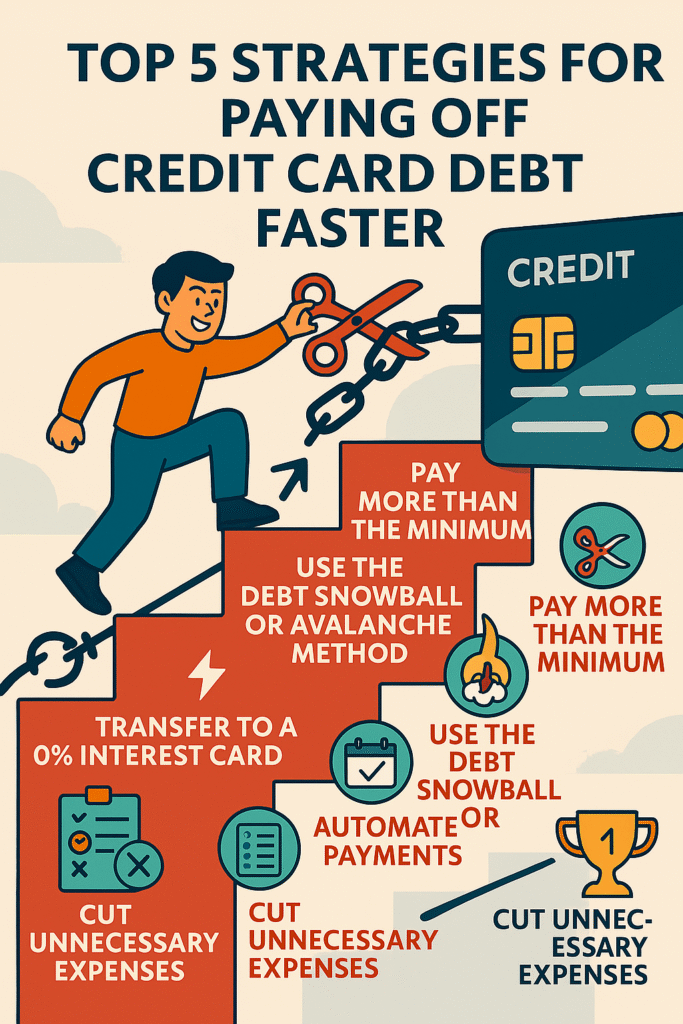

We’ll talk about five very effective ways that have helped many people pay off their debts faster in the next few sections. You can use a variety of tools to make your own debt reduction plan, from tried-and-true methods like the Debt Avalanche and Debt Snowball to more creative ones like balance transfers, making more money, and budgeting tightly. There will be step-by-step instructions, real-life examples, and useful tips that you can use right away for each strategy.

This guide is meant to give you the information and confidence you need to take action, no matter how scary your credit card debt may seem right now. You can not only pay off your debt faster, but you can also improve your overall financial health by learning how your debt works and using one or more of these strategies.

Take a deep breath, get a notebook, and get ready to start your journey to financial freedom. You can get out of credit card debt and have a better, safer future if you are dedicated, disciplined, and a little creative.

Why It Can Be Hard to Pay Off Credit Card Debt

It can feel like credit card debt is always there, taking away your financial stability even when you’re making payments. There are a number of reasons why it can be hard to deal with and get rid of this debt.

High Rates of Interest:

High interest rates on credit cards are one of the main reasons. Credit card interest is usually compounded monthly, which means that any unpaid interest is added to your balance. This is different from other types of debt. Over time, this can make your debt much bigger, which makes it harder to pay off the principal. If interest builds up faster than you can pay it off, even small balances can get out of hand.

The Minimum Payment Trap:

Credit card companies set up their payment plans in a way that can sometimes keep you stuck in a cycle of debt. It may seem like you can handle making only the minimum payment at first, but this strategy usually only covers the interest and doesn’t make much progress toward the actual balance. The longer you make minimum payments, the more time you give interest to build up, which makes it take longer to pay off your debt and costs you more in the end.

Emotional and mental factors:

Not only is debt about math, it’s also very emotional. A lot of people feel stressed, ashamed, or even hopeless when their credit card balances keep going up. These feelings can make you lose motivation and feel powerless, which can then lead to more bad financial habits. Stress and anxiety might even make you spend more money on things you don’t need as a way to escape, which would make the cycle worse.

The first step to getting over these problems is to understand them. When you know why credit card debt can be so hard to get rid of, you can better deal with it head-on with plans that deal with both the numbers and the feelings that come with being in debt. Knowing that this problem is both a financial and mental one will help you choose the right strategies and stay disciplined so you can reach your goals.

The first strategy is the Debt Avalanche Method.

The Debt Avalanche Method is one of the best ways to pay off credit card debt faster that is based on math. This method focuses on your debts based on their interest rates, making sure that every extra dollar you put toward paying off your debts is used in the best way possible.

What the Debt Avalanche Method Does

The Debt Avalanche Method means paying off your debts with the highest interest rates first while still making the minimum payments on all your other debts. You can pay off your high-interest debt first to lower the amount of interest you pay each month. This means that more of your payment goes toward paying off the principal balance on your other debts.

How to Use the Debt Avalanche Method

- Write down all of your debts: Start by making a list of all your credit card debts, including the balance, minimum payment, and interest rate. Put this list in order of interest rate, from highest to lowest.

- Set Aside Your Payments: To avoid penalties, keep making the minimum payments on each card. After that, put any extra money you have each month toward the debt with the highest interest rate. After that debt is paid off, use the extra money to pay off the debt with the next highest interest rate.

- Make changes as needed: Check your budget often. If you have extra money after paying off your debts, add it to your extra payment. Even a small increase in your aggressive payoff fund can make things even better by lowering interest costs even more.

- Keep an eye on your progress: Keep a picture of how much debt you have. Keeping track of your progress over time can be very motivating, whether you use a simple spreadsheet, a chart, or a special financial app.

Advantages of the Debt Avalanche Method

- Savings on interest: You can save a lot of money on interest payments over the life of your debt by paying off the debts with the highest interest rates first. This method lowers the cost of debt by lowering the effect of high-interest rates on the total amount owed.

- Payoff Faster: Because less money goes toward interest, more of your payments go toward the principal, which means you can pay it off faster overall.

- The best way to do math: The Debt Avalanche Method is the best way to go if you want to pay the least amount of money over time.

A Sample Situation

Let’s say you have three credit cards:

| Credit Card | Balance | Interest Rate | Minimum Monthly Payment |

|---|---|---|---|

| Card A | $5,000 | 22% | $150 |

| Card B | $3,000 | 18% | $100 |

| Card C | $2,000 | 15% | $70 |

Export to Sheets

If you use the Debt Avalanche Method, you would pay off Card A first because it has the highest interest rate. Even if Card A only has a little more money than the others, putting it first keeps the extra cost of high interest from going up. After you pay off Card A, you move the extra payment amount to Card B and then to Card C.

How to Stay Motivated

- Set goals: Set smaller, more manageable goals for yourself and celebrate each debt you pay off.

- Aids for the Eyes: Use charts or apps that keep track of your payments. Seeing the numbers go down can be very motivating.

- Give Yourself a Reward: Give yourself small, inexpensive rewards between milestones to help you stay on track without putting your progress at risk.

- Keep the End Goal in Mind: Remind yourself often of the benefits of not having debt: you have more money to spend, less financial stress, and the chance to save or invest.

Using the Debt Avalanche Method takes discipline and a focus on being financially efficient, but the rewards—both in terms of savings and peace of mind—can be huge. You are setting yourself up for long-term success and a clearer financial future by paying off the debt that costs you the most first.

The Debt Snowball Method is the second strategy.

The Debt Avalanche Method is the best way to do math, but the Debt Snowball Method has strong psychological benefits because it builds on early successes. This method says to pay off the smallest debts first, no matter what the interest rate is. This will give you momentum that can help you stay focused and motivated.

How the Debt Snowball Method Works

The first step in the Debt Snowball Method is to put your debts in order from smallest to largest. You pay the least amount on all of your debts except for the smallest one. You use any extra money you have for that one. After you pay off that debt, the money you were using to pay it off is added to the minimum payment of the next smallest debt. This makes a “snowball” effect, where each small win speeds up your progress toward being completely debt-free.

How to Use the Debt Snowball Method

- Make a list of all your debts: Write down all of your credit card debts, including the amount you still owe and the minimum payment. Put them in order from the lowest to the highest balance.

- Pay Attention to Your Payments: Keep up with the minimum payments on all of your cards, except the one with the lowest balance. Put every extra dollar you have toward paying off that debt first.

- Celebrate Small Successes: No matter what the interest rate is, getting rid of each debt gives you a boost. Every debt you pay off is one step closer to being free from debt. Celebrate the small wins.

- Payments that roll over: Once you’ve paid off the smallest debt, add the amount you paid to the minimum payment for the next smallest debt. This means that the amount you have to pay will go up as you pay off each debt.

Benefits for the mind

The Debt Snowball Method is appealing because it can help you get things done.

- Early Wins: Paying off a small debt can make you feel good right away. These wins boost your confidence and dedication to the big picture plan.

- A boost in motivation: Every time you pay off a debt, you can see your progress more clearly. This often means less stress and a greater willingness to keep your promise during hard months.

Example Situation

Let’s say you owe the following amounts:

| Credit Card | Balance | Interest Rate | Minimum Monthly Payment |

|---|---|---|---|

| Card X | $800 | 20% | $40 |

| Card Y | $2,500 | 18% | $90 |

| Card Z | $4,000 | 22% | $120 |

Export to Sheets

With the Debt Snowball Method, you start with Card X. After you pay off the $800 on Card X, you add the $40 you were paying on Card X to the payment on Card Y. This rollover payment speeds up the payoff of the next debt and sets off a chain reaction of “snowballing” extra money that builds up and gets closer to the bigger balances.

When to Use the Debt Snowball Method

- Being emotionally ready: If motivation is a big part of your financial journey, the Debt Snowball Method’s quick wins might be the best way for you to go.

- Reinforcement of behavior: Early, real successes can boost your mood and make you more likely to stick to a budget and pay off your debts.

How to Succeed

- Tracking by Sight: Use an app or a journal to keep track of your progress and see how each debt you pay off helps you pay off the next one.

- Be open to change: If you have to pay for something you didn’t expect, keep in mind that progress isn’t always straight. Change your plan, but get back to the method as soon as you can.

- Make a support network: Tell someone about your goals who can help you stay motivated, or join online groups where people talk about their own experiences to help you stay motivated.

The Debt Snowball Method may not lower interest rates as well as the avalanche method, but it does have the advantage of changing your mindset by giving you early and frequent wins. By paying off smaller debts first, you build the mental strength you need to pay off even the biggest debts. This shows that every payment, no matter how small, brings you one step closer to being debt-free.

Strategy #3: Move your balances to accounts with lower interest rates.

Using balance transfer offers is another great way to pay off credit card debt more quickly. You can move high-interest credit card debt to a card with a much lower interest rate with balance transfers. These cards often come with promotional periods that last 12 to 18 months. When used correctly, this strategy can change the game and help you pay off your debt faster by lowering the interest part of your payments.

Learning about balance transfers

Moving your credit card debt from one account to another is called a balance transfer. This is often done with a lower or even 0% introductory interest rate for a short time. This means that during the promotional period, you can almost completely focus on paying down the principal without having to worry about high interest rates.

How to Use Balance Transfers in a Smart Way

- Look at your debt: Find out if most of your debt is on a card with a high interest rate. Find out how much you owe and how quickly you can pay it off during a time when the interest rate is lower.

- Offers for Research: Look for balance transfer cards from trusted companies that have low or no interest rates. Keep an eye on important details like:

- Length of the promotional period: How long will the low interest rate last?

- Transfer Fees: Most cards charge a fee, which is usually a percentage of the amount being transferred.

- Requirements for a Credit Score: Make sure you meet them before you apply.

- Think about the timing: When you have a clear plan for how to pay off your debts, balance transfers work best. Take into account the promotional period and make sure you have a realistic plan in place to pay off as much of the debt as possible before the higher rate kicks in.

- Keep your finances in check: A balance transfer is not a cure-all; it’s just a tool. After you move your debt, it’s important not to add any new charges to the original card. Stick to your plan to pay back the loan, and use the extra money you have to pay down the principal.

The good things about balance transfers

- Lower interest rates: A lower or 0% interest rate means that more of your payments go toward paying off the principal. This means that debt will go down more quickly.

- Temporary Help: The promotional period gives you a chance to make a lot of progress on your debt without having to worry about high interest rates.

- Possible savings on costs: Even if there is a fee to transfer the balance, the overall savings can be big if the difference in interest rates is big.

Things to Watch Out For

- Fees and Costs That Aren’t Clear: Always check the small print. If you don’t keep track of it, a balance transfer fee (usually 3–5% of the amount transferred) can add to your debt.

- Effect on Credit Score: Getting a new credit card can temporarily lower your credit score. Also, using up all of your new card’s credit could be bad for you.

- End of the promotional period: Make sure your repayment plan is realistic and takes into account the time after the interest rate goes back to normal. If you don’t pay off most of your transferred debt before the end of the promotional period, your interest rates could go up suddenly.

Step-by-Step Example

Think about having a credit card with a $4,000 balance and a 24% interest rate. You find a balance transfer card that charges 3% and has 0% interest for 15 months after doing some research. Here’s one way you could handle the situation:

- Figure out the fee: If you charge 3% on $4,000, you get $120. You now have $4,120 in your account after adding this fee.

- Make a Payment Plan: To find out how much you owe, divide your balance by the number of months in the promotional period. For example, it would take about $275 a month to pay off $4,120 in 15 months. That payment mostly lowers the principal without adding more interest.

- Keep an eye on your progress: To make sure you stay on track to pay off your balance before the promotional period ends, use financial apps or a simple spreadsheet to keep track of your monthly payments.

How to Make Balance Transfers Work

- Make a plan: Before you start a balance transfer, make sure your budget can handle the new payment plan. Make sure you can make the monthly payment on a regular basis.

- Don’t take on new debt: Don’t use the old card or the new card to buy more things, as this could slow down your progress.

- Look at your goals again and again: Check in on your progress with your payments from time to time to stay interested. This can help you make changes if you need to and strengthen your resolve to stay debt-free.

When used correctly, balance transfers can be a very powerful tool. They give you a chance to lower the cost of your debt a lot and change your payments to focus on paying off the principal faster. But the key to success is to do a lot of research, stick to a budget, and make a clear plan for how to pay off the loan that makes the most of the promotional rate.

Strategy #4: Getting more money to make payments easier

A tight budget can make even the best repayment plan fail. Many people find that increasing their income to pay off debt is just as life-changing as cutting costs. You can pay off your credit card debt faster by adding to your regular income through side jobs, freelancing, or selling things you don’t need.

Why it’s important to make more money

If you make more money, you can make bigger monthly payments right away. If you have more money, you can pay off your debt faster, save money on interest, and feel less stressed about money. Also, having extra money can give you the freedom to deal with unexpected costs without going into credit card debt.

Ways to Make More Money

- Side Jobs: Think about things like ride-sharing, food delivery, or tutoring online. These jobs usually have flexible hours and can be done with your regular job.

- Working for yourself: Make extra money by using your skills, whether they are writing, graphic design, or programming. It’s easy to find freelance work on websites like Upwork and Fiverr.

- Getting rid of things you don’t use: Get rid of things you don’t need and sell them on eBay or in local buy-and-sell groups. You’ll not only make extra money, but you’ll also make your home less cluttered.

- Work Part-Time: If you have the time, look into part-time jobs that can give you a steady stream of extra money without getting in the way of your full-time job.

Adding Extra Money to Your Debt Payoff Plan

- Put your extra money first: Set up an automatic transfer so that a certain amount of any extra money you make goes straight to your debt repayment account. You can’t change this, just like you can’t change your regular payments.

- Plan for more money in your budget: When you start making more money, change your budget to show this new income. This new plan should use all extra money to pay off your debt, which will speed up the process by a lot.

- Keep an eye on your progress: Keep track of how your extra money is helping you pay off your debt by using a spreadsheet or a budgeting app. Seeing the numbers go down can make you more determined to keep working extra hours.

A Success Story from the Real World

Sara’s story is a good example of someone who had too much credit card debt because of unexpected medical bills. Sara decided to start a small side business making and selling crafts to make extra money. After a few months, the extra money let her make bigger payments than the minimum. Sara was able to pay off a lot of her debt, rely less on credit, and even start a small savings account in just over a year. This was all because she was determined to make more money.

Advice on how to balance time and effort

- Make goals that are possible: Make sure your side jobs or freelance work don’t take over your life. To avoid getting burned out, make sure you get enough rest.

- Use technology: Use apps and online tools to keep track of your extra money and spending. Automation can help make sure that every extra dollar goes toward paying off your debt.

- Make more money and cut costs at the same time: Keep in mind that cutting back on unnecessary costs doesn’t mean you can’t also make more money. When you do both things at the same time, they can work together to help you reach financial freedom faster.

Getting more money is a way to give yourself power. It may take more work and time management, but the benefits are threefold: you’ll pay off your debt faster, pay less interest, and have a stronger financial cushion for your future plans. You can turn your side jobs into a powerful engine that will help you get out of debt by seeing extra money as a tool instead of a burden.

Strategy #5: Make a budget and stick to it

No matter how you decide to pay off your credit card debt faster, it’s important to make and stick to a tight budget. A well-structured budget makes things clear, shows you what expenses you don’t need, and tells you how to use the extra money to pay off your debt faster.

Why Making a Budget is Important

Budgeting isn’t about not having things; it’s about making choices on purpose. You can see where your money is going by listing all of your sources of income and keeping track of all of your expenses. Being financially aware helps you spend less on things you don’t need, put more money toward paying off debt, and ultimately speed up your path to financial freedom.

Budgeting Tools and Frameworks

- The 50/30/20 Rule: A common way to divide your money is to spend half of it on necessities, 30% on things you want, and 20% on savings and paying off debt. This method gives you a good place to start changing how you spend your money.

- Budgeting from scratch: By the end of the month, every dollar will have a specific purpose with this method. This method works especially well when you need to make sure that there is no extra money lying around that could be used for something else.

- Tools and Apps for Budgeting: Budgeting can be easier with technology. You can keep track of your spending and see how close you are to reaching your financial goals with apps like Mint, You Need a Budget (YNAB), or even simple spreadsheets.

How to Make a Lean Budget in Steps

- Keep track of your spending: The first step is to write down everything you spend for a month. Know where the money goes, from bills that have to be paid to fun things you want to buy.

- Find Ways to Save Money: Point out extra costs that can be cut. Some things you might want to look into are eating out a lot, paying for extra subscription services, or buying things on a whim.

- Make Limits That Are Possible: Set limits on how much you can spend in each category after you know where your money is going. Put your most important needs first, and use any extra money to pay off your debts.

- Move savings around to pay off debt: Use the money you save by cutting back on things you don’t need to pay off more of your debt each month. Every dollar you save can make a big difference when you use it to pay off credit card debt with high interest rates.

- Look over and change things often: Your budget shouldn’t stay the same. Look at it again every month, especially when your income, debt, or spending habits change. Change your allocations so that they always match your goal of paying off your debt as quickly as possible.

Sample Budget

Let’s say you make $3,000 a month. You could divide your money up like this using the 50/30/20 rule:

- Needs (50% – $1,500): Rent, bills, food, and getting around.

- Optional (30% – $900): Eating out, having fun, and doing hobbies. Think about cutting this by 25% to 50% to free up more cash.

- Paying off debt and saving (20% – $600): Use all of this money to pay off your credit card debt.

You now have $1,050 to pay off your debt, which will speed up the process by a lot, if you cut your discretionary spending in half (saving $450).

Useful Advice for Sticking to Your Budget

- Use envelopes with cash: Withdrawing cash and sticking to a physical envelope budget can help you not spend too much on things like eating out or having fun.

- Get into the habit of planning meals: Cutting down on food waste and eating out can save you a lot of money each month.

- Regularly thinking about yourself: Check your progress from time to time and change your budget. Celebrate your progress and keep in mind your bigger goal: a safe, debt-free future.

Making a lean budget doesn’t mean giving up your quality of life; it means putting the things that are most important to you first. By cutting back on your spending and putting all of your energy into paying off your debt, you create a strong framework that speeds up your path to financial freedom.

Extra Tips: Keeping Up the Good Work and Staying Out of Debt

To be financially successful in the long run, you need to keep going and avoid the problems that come with new debt, even if you have a good plan in place.

Keeping Your Drive

- Keep track of your wins: A chart or an app that shows your progress visually can help you celebrate each step along the way. Every time your debt goes down by a percentage, it’s a win.

- Make Small Goals: Split your main goal into smaller, more doable ones. Celebrate every step you take, like paying off a credit card or lowering your balance by a certain amount.

- Partners in Responsibility: Get family and friends involved, or join online groups where you can talk about your progress and problems. During tough months, supporting each other can help you stay committed.

Staying out of the Debt Trap

- Stop buying things on a whim: Think carefully about what you buy. Think about putting a waiting period on decisions about spending that aren’t necessary.

- Stop using credit cards you don’t need: If you tend to add new charges, you might want to temporarily close or freeze access to your credit cards until you’ve made a lot of progress.

- Set up an emergency fund: An emergency fund is very important if you want to stop using credit cards in the future. Even small, regular payments can help you stay out of debt by giving you a financial cushion.

By using these extra tips along with the main ones, you can pay off your debt faster and develop habits that will help you stay on track for long-term financial freedom.

The end

It’s not impossible to pay off credit card debt faster; you can reach this goal by using smart strategies, sticking to a budget, and having a mindset that focuses on financial freedom. We looked at five important strategies in this article:

- The Debt Avalanche Method: To keep your overall interest costs as low as possible, pay off the debts with the highest interest rates first.

- The Debt Snowball Method: Paying off your smallest debts first will give you psychological momentum and motivation.

- Transfers of balances to lower interest rates: Use low or 0% introductory offers to pay off your debt faster and lower the amount of interest you owe.

- Raising your income to make payments easier: Use side jobs, freelancing, and other ways to make money to pay off your debts faster and make extra payments.

- Making a lean budget and sticking to it: Take a look at your spending again, cut out things you don’t need, and put the money you save toward your debt, all while keeping your life in balance.

Keep in mind that getting to financial freedom is a long process, not a quick one. Your best friends will be consistency, discipline, and the ability to change your plans to fit your needs. You are making a promise to yourself and your financial future by taking action today, whether that means changing your budget, starting a balance transfer, or starting a new side business. This is the time to take back control and confidently move toward a life without debt.

Part of the FAQ

Q1: Is it possible to use more than one strategy at the same time?

A: Yes, using more than one strategy can be very helpful. For example, you could lower your interest rates with a balance transfer while also making a lean budget and making more money with side jobs. The most important thing is to stay organized and make sure that the changes work together instead of making things harder. A hybrid approach could use the Debt Snowball Method to boost your mood and balance transfers to lower your interest payments, giving you two benefits.

Q2: What if I don’t make a lot of money and can’t pay a lot each month?

A: Every dollar counts if you don’t have a lot of money. Start by making a detailed budget that shows where you can cut back on spending that isn’t necessary so you can pay off your debts. Look into how you can slowly raise your income by doing freelance work or working part-time. Even if you can only make small extra payments, the balance will eventually go down if you keep doing it. Find community resources or financial counseling services that can help you more and give you advice that fits your needs.

Q3: Will paying off debt faster hurt my credit score?

A: Paying off debt on time and in a responsible way usually helps your credit score over time. A lower credit utilization ratio and a steady history of making payments show lenders that you are a responsible borrower. But be careful if you use strategies like balance transfers or open new lines of credit too quickly, as these can temporarily lower your score. If you stay disciplined and make steady progress, your credit profile should improve over time.

Q4: How do I keep going when the payoff journey is long?

A: Staying motivated is often the hardest part of a plan to pay off debt over time. Set clear, doable goals and keep track of your progress in a way that is easy to see. Give yourself a treat that doesn’t cost money, like a nice walk in nature, a movie night at home, or time with friends and family, to celebrate each small victory. Getting involved in support groups or online communities can also help you and others. Keep in mind that setbacks are normal, but you need to be consistent. If you mess up, go back to your plan, make changes, and keep going.

Q5: If I have bad credit, are balance transfers worth it?

A: To get the best promotional rates on balance transfers, you usually need to have a good credit score. If your credit score is low, it might be hard to get the best deals. There are, however, cards made just for rebuilding credit that may let you transfer your balance. Even if the limits and terms aren’t as good, a small drop in your interest rate can still be helpful. It’s important to do a lot of research, look at your options, and think about talking to a credit repair expert.

Last Thoughts

There is no one-size-fits-all way to get rid of credit card debt, but by carefully looking at your situation and using one or more of these strategies, you can make a strong, personalized plan to pay off your credit card debt faster. You can use the Debt Avalanche Method, which is more mathematically sound, or the Debt Snowball Method, which gives you a boost of motivation. You could also use a mix of these methods, such as balance transfers, higher income, and a tight budget. Whatever you choose, remember that consistency, discipline, and smart financial planning are the keys to success.

You can achieve financial freedom by taking small steps. Use these tips, make changes to fit your own situation, and stay focused on your long-term goals. There may be bumps in the road ahead, but if you stay determined and keep going, you will eventually be debt-free and empowered.

It’s time to take that first step: look over your debts, make a budget, and stick to a plan. Today is the first day of your journey to a debt-free future. Every good thing you do brings you closer to a life of peace of mind and financial security.

You’re not just paying off debt when you add these tips and strategies to your financial plan. You’re also building a stronger base for a brighter, safer financial future. Which strategy do you like the best? You might use more than one method, or you might already have a plan that just needs a few tweaks. No matter what you choose, remember that every payment, every change to your budget, and every extra dollar you make brings you closer to being financially free.

You can always come back to these tips if you feel like you’re not making progress. Your promise today is the first step toward a future without credit card debt. Good luck with your planning, and here’s to your freedom from debt!

There are a lot of other ways to learn about budgeting tools, side hustle ideas, or advanced ways to deal with creditors. There are many layers to the journey to financial health, and each strategy opens up new ways to grow and stay stable. Keep being curious, keep feeling powerful, and keep going.