Building and keeping good credit is important for financial success, but there are a lot of false ideas and myths out there. These false ideas can confuse you, lead you astray, and even keep you from reaching your financial goals. In this post, we’ll debunk the five most common myths about building credit, tell you the truth behind each one, and give you the practical tips you need to get started on the right foot. If you’re new to credit, trying to raise your score, or getting over past financial mistakes, knowing these common credit myths will help you take charge and build a strong credit history.

Intro

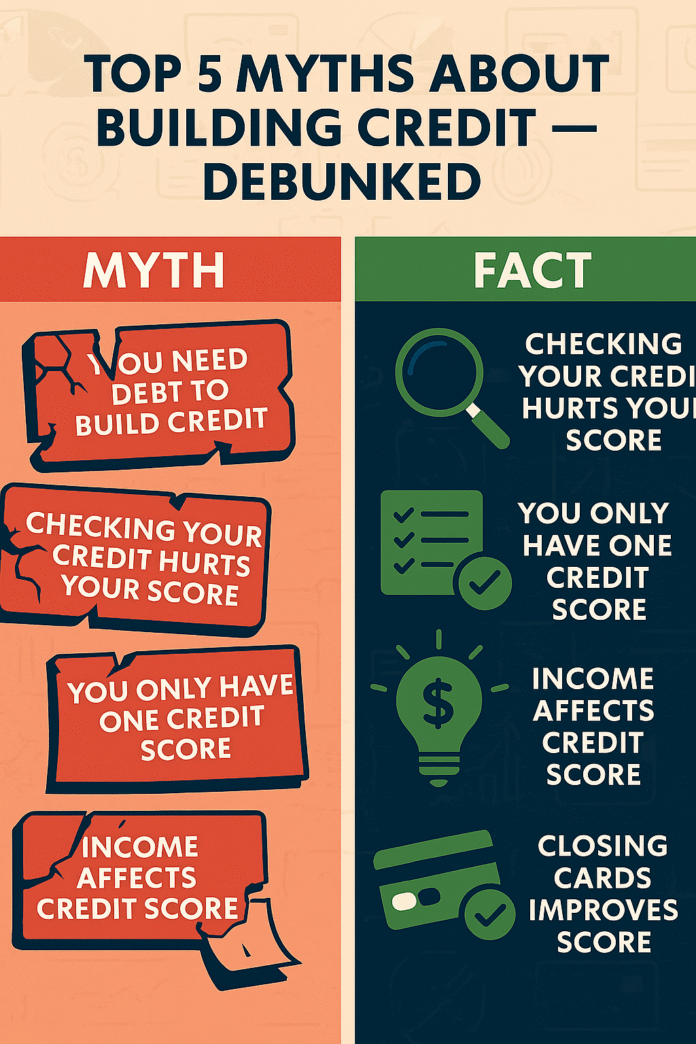

People often don’t understand credit. If you talk about money with someone, you might hear things like “you have to carry a balance to build credit” or “checking your credit score will lower it.” These are common myths that parents pass down, friends give bad advice, or online sources give wrong information. If you believe the wrong things about credit, you might not only make decisions that hurt your credit score in the long run, but you might also make decisions that slow down your progress.

A lot of false information is out there on the internet, and it can be hard for someone who is just starting to learn about money to know what to believe. A lot of people think that building credit is hard or mysterious, but the truth is that it’s not. You can make smart decisions that lead to financial freedom if you have the right information and plans.

We’ll talk about five common myths that are keeping people from getting and keeping good credit in this post. You will learn why these myths are out there, how they can hurt your financial progress, and most importantly, what you should do instead. By the end, you’ll feel empowered, knowledgeable, and ready to take charge of your own finances. Let’s get to the bottom of this!

Myth #1: You need to carry a balance to build credit

The Myth:

A lot of people think that to build credit, you have to keep a balance on your credit card every month. The idea is that using your card and not paying it off in full shows that you are creditworthy in some way.

What Makes People Believe This Myth:

This myth is often based on a misunderstanding of how credit scoring works and old advice. Some experts used to say that having a balance on your credit card was a way to show that you were using credit responsibly. People you know might say, “If you pay off your card every month, the credit bureaus won’t see any activity,” which could lead you to think that having a small balance is good.

The Truth:

Keeping a balance on your credit cards does not help your score. One of the best ways to build your credit is to pay your full balance every month. Your payment history, credit utilization ratio, length of credit history, and types of credit used are the main things that go into your credit score. This is what really matters:

- Payment History (35% of your FICO score): The most important thing is to pay on time. Paying off your full balance on time shows that you can be trusted and doesn’t add to your debt.

- Credit Use (30%): It tells you how much of your credit limit you are using. It’s best to keep your utilization below 30%, and having a balance might even push you over that limit.

- Charges for Interest: If you have a balance, you have to pay interest, which can add up quickly and put you in debt. That extra money you pay in interest doesn’t help you build credit history; it just makes your finances harder.

Effect on Real Life:

Picture a young man named Jason who works. He thought that “using” his card meant leaving a small balance each month instead of paying it off. Even though he always paid on time, his credit utilization stayed around 40% because he never paid off his balance completely. Because of this, his credit score stayed the same. Jason’s utilization went down when he started paying off his card in full each month, and over time his score started to go up.

What to Do Instead:

- Pay off your balance in full: Pay your full balance by the due date whenever you can. This keeps your use low and keeps you from having to pay interest.

- Limit Your Spending: Only spend money that you know you can pay back right away. Think of your credit card as a debit card that helps you build your credit history.

- Keep an eye on how much credit you use: Try to use no more than 30% of your available credit, and even less if you can. Apps for budgeting or services that watch your credit can help you stay on track.

You can avoid getting into debt by knowing the truth: you don’t need to have a balance to build credit. The credit myths that are debunked here remind us that the best way to keep your credit profile healthy is to act responsibly, like paying your bills on time and keeping your balances low.

Myth #2: Checking Your Credit Score Will Hurt It

The Myth:

A lot of people think that checking their own credit score will lower it, so they don’t keep an eye on their progress.

Why People Think This Is True:

This misunderstanding probably comes from the fact that lenders do a “hard inquiry” when you apply for credit, which could lower your score a little. But this has been mixed up with looking at your own score. People you know, like friends and family, and even some financial advisors might say, “Don’t check your credit too often, or you’ll hurt it.”

The Truth:

A “soft inquiry” is when you check your own credit score. It doesn’t change your credit at all. You should know this:

- Soft inquiries vs. hard inquiries:

- When you check your own score, when a lender pre-qualifies you, or when a business does a background check, that’s a soft inquiry. These things don’t change your score.

- When you apply for new credit, like a loan, mortgage, or credit card, you may get a hard inquiry. This can lower your score by a few points for a short time.

- Advantages of Keeping an Eye on: Checking your score often can help you find mistakes, catch fraud, and keep track of your progress. Power comes from knowledge. You can act quickly if something strange happens or if you need to contest a mistake by keeping an eye on your score.

What it means in real life:

Let’s look at Sara, who was careful because she thought that looking at her score might hurt it. She was too scared to look at her credit report very often, so she missed a billing mistake that hurt her score. After she found out that checking her credit was safe and even good for her, she started doing it every month. This proactive approach helped her find and fix a clerical mistake that, once fixed, made her score go up noticeably over the course of a few months.

What to Do Instead:

- Use free tools to keep an eye on your credit: You can check your score without any problems using services like Credit Karma, Experian’s free service, or other trusted apps.

- Set up regular check-ups: Think about looking at your credit report at least once a year, or use a monthly monitoring service to keep track of changes.

- Know the Difference: Learn the difference between soft and hard inquiries so you know exactly what actions affect your score.

You can take control of your financial journey by proving that checking your credit score doesn’t hurt it. It’s important to keep an eye on your progress and stay confident in how credit scores work by checking them often.

Myth #3: You don’t need credit if you pay for everything in cash.

The Story:

People who think you don’t need credit at all if you pay for everything in cash. People think that the only way to stay financially healthy is to never have any debt.

Why People Think This Is True:

Cash is real and right now. A lot of people are taught that debt is bad and that the best thing to do is to stay away from credit altogether. People who think this way are more likely to be in places where the “cash is king” mindset is strong. If you don’t borrow money, you won’t have to deal with the stress and responsibility that come with managing credit.

The Truth:

Paying in cash means you don’t have any debt, but it also means you don’t have a credit history. Not having a credit history can make it harder to get loans, rent apartments, or even get lower insurance rates in the future. Here’s why credit is important:

- Your credit history can help you get jobs: Credit checks are common for landlords, employers, and lenders. Having a good credit history can help you get better loan rates, make it easier to rent an apartment, and even get a job.

- Taking on debt shows that you are responsible: You show that you can handle debt by using credit wisely (not cash). This is very important for big purchases like a car or a house.

- Getting to emergency funds: If you have a good credit score, you can get lines of credit or loans in case of an emergency. Even if you usually pay with cash, there may be times when you need credit.

Effect on Real Life:

Think about Alex, who used to be proud of living a cash-only life. He didn’t have any debt, but he couldn’t rent an apartment because the landlord needed to check his credit. Even though he had a steady job and saved money wisely, landlords were worried about him because he didn’t have a credit history. When Alex started using a small, secured credit card responsibly and paying off his balance in full each month, he built a small credit history that helped him get the apartment of his dreams.

What to Do Instead:

- Begin with a small amount: Even if you like to use cash, you might want to think about getting a credit account with a secured credit card or a credit-builder loan.

- Use both cash and credit: Make small, regular purchases with a credit card and pay it off every month to build a good credit history.

- Keep an eye on your credit: Make sure your credit report shows that you spend money responsibly. This will help you in many areas of your financial life.

You can open up more financial opportunities by realizing that responsible credit use and cash-based habits can work together. The truth is that a good mix of managing your money well and having good credit habits will help you financially in the long run.

Myth #4: Closing credit cards will help your credit score.

The Myth:

Many people think that closing credit card accounts that they don’t use or that are “risky” will help their credit score by making it less likely that they will spend too much.

Why People Think This Myth Is True:

This myth often comes from the idea that it’s better to “prune” your accounts if you’re not using a card, like getting rid of dead weight. Some friends or even some advisors might tell you, “Let it go if you’re not using it.” This advice may seem reasonable, but it can actually make things worse.

The Truth:

Closing a credit card can actually hurt your credit score. This is why:

- The ratio of credit used to total credit: How much of your available credit you use, or your credit utilization, is a big part of your credit score. Closing a card lowers your total available credit, which can raise your utilization ratio if you have balances on other cards.

- Length of Credit History: Older accounts help your credit history in a good way. If you close an old account, your average account age may go down, which is bad for your score.

- Mix of credit: Having a mix of credit types, like credit cards and loans, shows that you can handle different kinds of credit responsibly. Closing accounts makes this diversity less.

What it means in real life:

For example, Jenna closed two of her older credit cards because she thought it would make her finances easier. She applied for a car loan not long after that. Even though she had a good payment history, her utilization ratio went up, and the shorter credit history meant she had to pay a higher interest rate on her loan. Jenna learned the hard way that it’s better to keep old accounts open, even if you don’t use them much, than to close them.

What You Should Do Instead:

- Keep old accounts open: Keep small balances on older cards, even if you don’t use them very often, and pay them off on time.

- Keep an eye on usage: If your old card has an annual fee, think about switching to a no-fee version instead of closing the account.

- Learn: Know that having a long credit history and not using it much are important for having a good credit score.

By showing that the idea that closing credit cards is good is false, you’ll see that sometimes doing nothing is the wrong thing to do. In this case, keeping accounts open is very important for keeping a good credit profile.

Myth #5: Your credit score is based on how much money you make.

The Myth:

Many people think that your credit score depends on how much money you make. A lot of people think that if you make more money, your credit score should go up, and if you make less money, your credit score should go down.

Why People Think This Is True:

Most financial decisions depend on income, and it’s only natural to think that a higher income means better creditworthiness. Sometimes ads, stories from friends and family, and even your own experiences make you think that you can’t build good credit if you make less money.

The Truth:

Your credit score is not directly affected by how much money you make. Your credit history is the only thing that goes into your credit score. This includes things like how often you pay your bills on time, how much credit you use, how long you’ve had credit, how many new credit inquiries you’ve made, and what kinds of credit you use. Your credit report doesn’t show your income, savings, or job history.

- Pay attention to behavior: No matter how much money you make, $25,000 or $250,000, it’s important to use credit wisely. Timely payments and low balances are the most important parts.

- Lenders vs. Credit Scores: When you apply for new credit, lenders look at your income to see if you can pay it back. However, credit scoring models like FICO do not take this information into account.

Impact on Real Life:

Think about Maya and Ethan. Maya, a college graduate with a low income, was responsible with her credit by always paying on time and keeping her utilization low. Ethan often maxed out his credit cards and missed payments, even though he made a lot of money. Maya’s score went up over time, but Ethan’s stayed the same. Their stories show that common misunderstandings about income and credit scores are not true.

Instead, do this:

- Pay attention to responsible borrowing: No matter how much money you make, you can build credit by paying your bills on time and keeping track of your balances.

- Keep your income and credit scores separate: Know that your credit score shows how you handle your money, even though income is important for getting a loan.

- Get Professional Help: If you don’t understand how credit works, talk to experts or look for reliable sources that explain the details of credit scoring.

By debunking this myth, you can focus on what really matters: making smart choices to build a good credit history, not how much money you make. This change in focus is very important for the truth about building credit.

Bonus Section: Two More Common Misunderstandings About Credit

Myth #1: You need a lot of money to get a credit card

What They Think:

Some people think that you can only get a credit card if you make a lot of money, and that having a lower income means you can’t get one.

Why People Think It Is:

People often think that having a steady income means they are financially stable. Sometimes, media and ads make credit cards look like luxury items for people who have extra money, which reinforces the idea that people who make less money don’t belong in the world of credit.

The Real Deal:

Not just your income, but also your credit history, how you use credit, and how you handle your money in general will determine whether you get a credit card. Many starter cards and secured credit cards are made just for people with low incomes or those who are just starting to build their credit.

Advice that you can use:

- Research Starter Cards: Look for cards that are made for people with little credit history or low incomes.

- Use it responsibly: Even if you get a basic card, you should use it responsibly to build a good credit history.

- Keep in mind that your current income level doesn’t stop you from developing good credit habits that will help you in the long run.

Mistake #2: Paying off collections right away takes them off your credit report.

The Idea:

Many people think that paying off a collection will make it go away from your credit report, which will immediately raise your credit score.

Why People Think

It makes sense: if you pay off the debt, it should be like it never happened, right? This expectation is based on misunderstandings about how to report and how to figure out a credit score.

The Truth:

You can still see the record of that debt on your credit report for up to seven years after you pay it off. Paying off a collection, on the other hand, could still help your score over time because it shows that you are taking responsibility for your past mistakes. A paid collection has less of an effect than an unpaid one, but it won’t go away right away.

Advice that you can use:

- Think about how you’ll act in the future: settling collections is a good thing to do, but don’t expect an instant score boost. Use it as a chance to learn.

- Check Your Report: Make sure the account is marked as “paid,” and if it isn’t, contact the credit bureau to make sure it is.

- Be patient: Know that fixing your credit takes time. As you build a good payment history, the bad effects will get less over time.

The End

If you believe in these false credit myths, it can slow down your progress and make it harder to make good decisions about building good credit. As we’ve seen, having a balance doesn’t help your score, checking your credit is actually good for it, paying for everything in cash means you don’t have a credit history, closing old cards can hurt your credit, and your income isn’t a direct factor. Also, wrong ideas like needing a high income to get a credit card and thinking that collections will go away right away only make things more confusing.

It’s time to take back control of your financial journey by learning the truth about how to build credit. Every time you pay off your balance, check your credit regularly, or keep that old card open, you build a strong credit history that opens doors for you in the future. Keep in mind that the goal is not to be perfect; it’s to keep going. Every good choice you make, no matter how small, helps you become more financially secure and free.

If these common credit myths have been holding you back, you should know that you can change. Use the real facts and expert-backed advice in this article to change the way you act in the past. Credit doesn’t have to be hard to understand. You are in charge if you have the right information. Start today and make your financial future brighter.

Questions that are often asked (FAQ)

1. How can I build credit from scratch the fastest?

The best way to build credit quickly is to get a secured credit card or credit-builder loan, use it wisely, keep your credit utilization low, and pay your bills on time every month. Your score may start to show signs of improvement within three to six months if you consistently use credit responsibly.

2. Is it different for students or immigrants to build credit?

Students and immigrants may have more trouble because they don’t have a long credit history, even though the basics are still the same. You can start building credit even if you don’t have a traditional credit history. Many cards and loans now use different types of data, like rent or utility payments. Look for items that are made just for these groups.

3. How often do I need to look at my credit report?

You should check your credit report at least once a year. But if you’re actively working to fix or build your credit, you might want to check it every three months or use free tools to keep track of any changes.

4. Can my credit score go down even if I do everything right?

Yes, outside factors like a lender’s hard inquiry or changes to a scoring model can make things change for a short time. Your overall credit health should get better over time, though, if you keep making payments on time and using your credit card sparingly.

5. Does not having any debt mean I have good credit?

Not always. You may not have a credit history if you don’t have any debt. A history of borrowing and paying back money responsibly builds good credit. You need to use credit responsibly, even if it’s just a little bit, to show lenders that you can handle debt well.

6. Do late payments automatically hurt my score for good?

Paying bills late can really hurt your credit score, especially if you do it a lot or if the bills are really big. But the bad effects get less bad over time, especially if you start making your payments on time again. If you dispute any mistakes and make your payments on time every month, your score will go up.

Now that you’ve broken these myths and accepted the truth about building credit, you’re better able to make smart choices and build the financial future you want. Keep in mind that every good financial decision you make helps your credit score. It’s time to stop believing things that aren’t true and take charge of your credit, one smart move at a time.

Take action today and learn something new. With the right information, you really are in charge.