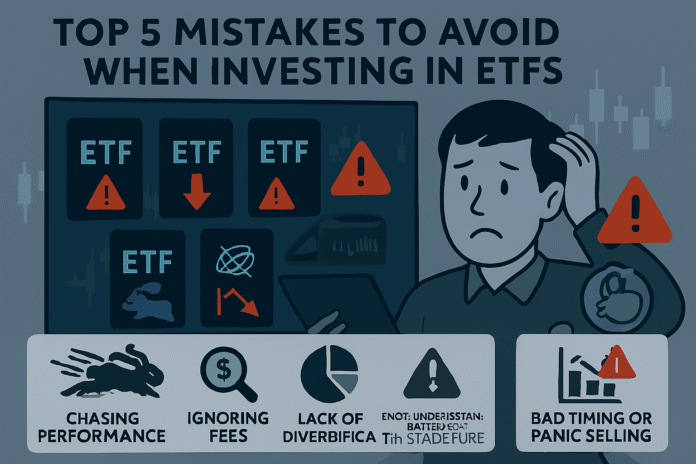

Exchange-Traded Funds (ETFs) have become very popular in the world of investing. More and more investors, both new and experienced, are learning that ETFs are a cheap, easy, and diverse way to invest in the market. This is making them more popular. But even though ETFs are easy to use, there are some common mistakes that can hurt your portfolio’s returns over time if you don’t pay attention to them. This article will show you the five most common mistakes that investors make when they buy ETFs and give you useful advice on how to avoid them.

At the end of this article, you’ll know exactly why careful planning is so important for making money with ETFs. We’ll talk about everything from hidden fees to making decisions based on feelings so that you can make better investment choices. Whether you are building your first portfolio or looking to fine-tune an existing one, recognizing these mistakes early can help you achieve better long-term success.

1. The Start

ETFs have changed the way people buy exposure to the stock market. Many people like ETFs because they are easy to trade like stocks and give you the benefits of having a basket of securities. They let investors get into big parts of the market, strategic sectors, or even specific commodities for less money than a lot of other types of investments. People like ETFs because they are flexible, easy to understand, and cheap.

There are a lot of good things about ETFs, but they can still make mistakes. A lot of investors make mistakes that they don’t even know about that can greatly lower their returns over time. Not paying attention to expense ratios, not spreading your investments out enough, or letting your emotions get the best of you when you invest are all common mistakes that can have a big effect on how well you do in the long run. Some people think of ETFs as investments that you can “set it and forget it,” but this isn’t good for building wealth over time.

This article talks about the five biggest mistakes you should avoid when you buy ETFs. We will go over each mistake in detail and give you clear, useful advice on how to avoid them. We want to help you make better choices that will lead to better results in the long run. If you want to protect and improve your investment returns, you need to know about these common mistakes, whether you’re new to investing or trying to improve an existing strategy.

Before we get into the problems, let’s talk about what ETFs are, what makes them special, and why it’s important to know how they work.

2. A Quick Look at ETFs

Before we talk about common mistakes, let’s first talk about what ETFs are and why they are so appealing to investors.

What are ETFs? An Exchange-Traded Fund (ETF) is a type of investment fund that holds a group of assets, such as stocks, bonds, or commodities, and follows a specific index or strategy. At the end of the day, people buy and sell mutual funds based on their net asset value (NAV). ETFs, on the other hand, trade on stock exchanges all day long. This means that you can buy and sell ETF shares at prices set by the market, just like with individual stocks.

Pros of ETFs

- Diversification: You can buy a group of securities when you buy an ETF. For example, an ETF tracking the S&P 500 provides an investor with indirect ownership of 500 large companies—all in one trade.

- Cost-Effectiveness: Most ETFs are passively managed, which means they don’t have to pay as much in fees as actively managed funds. Less fees mean that more of your money stays invested and grows over time.

- Trading is flexible: ETFs can be traded at any time during market hours, which is different from mutual funds. This lets investors react to market news and volatility in real time.

- Being open: Most ETFs tell people about their holdings a lot, sometimes even every day. Investors can see exactly what they have because of this openness.

- Tax Efficiency: ETFs are often better for taxes than many mutual funds because their unique ways of creating and redeeming shares result in lower capital gains distributions.

ETFs and Other Ways to Put Money to Work There are some similarities between ETFs and mutual funds (for example, both give you a wide range of investments), but there are also some important differences. You usually only have to trade once a day with mutual funds, but they may have higher management fees or sales loads. In contrast, ETFs offer real-time trading, lower fees, and greater flexibility. However, these benefits mean that investors must be more vigilant about factors like trading costs, market timing, and expense ratios.

It’s important to know these basic things about ETFs because even though they’re easy to use and understand, mistakes in how you choose, use, and manage them can take away their benefits. In the next few sections, we’ll talk about the five most common mistakes that can make ETFs less useful and how to avoid them.

3. Mistake #1: Not paying attention to hidden costs and fees

Getting to know the ratios of expenses An expense ratio is the yearly fee that an ETF charges its shareholders to pay for things like management and administration. This fee is based on the fund’s average assets under management. If an ETF has an expense ratio of 0.20%, you will pay $20 every year for every $10,000 you invest.

What You Need to Know About Expense Ratios Expense ratios may not seem like a big deal, but over time, even small changes in fees can have a big impact on your overall returns. Take a look at two ETFs: one has an expense ratio of 0.20% and the other has an expense ratio of 1.00%. The higher fee ETF can eat away at a lot of your compounded growth over time. When everything else is the same, studies by investment experts show that funds with lower fees do better than funds with higher fees. This is the power of every percent point adding up over time.

Costs You Should Know About Expense ratios are often just the beginning. Other costs that can lower your profits are:

- Bid-Ask Spreads: The bid-ask spread is the difference between the price you can buy an ETF for and the price you can sell it for. When you trade, you might have to pay more when the spreads are bigger, especially for ETFs that aren’t very liquid.

- Brokerage Fees and Commissions: A lot of brokers now let you trade ETFs without paying a commission, but some still charge for every trade. A lot of trading can add up and hurt your overall performance.

- Error in tracking: This tells you how well the ETF’s performance matches that of its benchmark. If there are more tracking errors, it could cost more because the replication isn’t perfect or the management isn’t doing a good job.

A real-life example Consider investing $10,000 in an ETF that charges 1.00% in fees. If you think this ETF will make 7% a year for 30 years, the difference in performance between it and a similar ETF with a 0.20% expense ratio can be very big. The lower-fee ETF would compound more effectively, leaving you with a significantly higher balance after three decades of investing.

How to Save Money

- Check out the expense ratios: Look around all the time. Many financial websites and comparison tools have information on expense ratios. You will see that passive ETFs tend to have lower fees than actively managed ETFs.

- Consider how liquid it is: Look for ETFs that have a lot of trading activity and small bid-ask spreads. This keeps extra costs to a minimum.

- Find out how much your broker charges: Even if the ETF is cheap, high brokerage fees can eat up the savings. Choose a broker that lets you trade ETFs for free or for a small fee.

- Go over the ETF paperwork: To find out about all the fees and costs, even the ones that aren’t clear right away from the headline expense ratio, read the prospectus and fund fact sheets carefully.

Advice that can be used Knowing that fees can slowly eat away at your returns should make you put cost-effectiveness at the top of your list when choosing an ETF. Put ETFs with low expense ratios and a history of good management at the top of your list. Not only does this hard work help you make more money in the long run, it also fits with the idea of letting compound interest work for you.

To invest wisely, keep an eye on your portfolio and be aware of any changes in fees or costs that aren’t obvious. These little savings can make a big difference in how well your portfolio does over time.

4. Mistake #2: Not having enough different types of ETFs in your portfolio

What does it mean to spread out? Diversification means putting your money into different types of assets, regions, and sectors to lower your risk. ETFs are naturally diverse because they hold a lot of different securities. However, many investors end up focusing too much on certain sectors or parts of the country, which cancels out the benefit of diversification.

Mistakes People Make When Diversifying

- Putting too much money into one area: Some investors believe that a “hot” or popular ETF can solve all their problems. They invest a lot of money in one field, like energy or technology, which makes them more open to the risks and changes that happen in that field.

- Concentration by location: Many ETFs only invest in one market, like U.S. stocks. The U.S. market is strong, but investing in a variety of countries can help you avoid risks that are unique to each one and take advantage of the growth of emerging markets.

- Bias in Asset Class: A good portfolio should have a mix of asset classes, like stocks, bonds, and maybe even commodities. An investor who only uses equity-based ETFs might lose money when the market goes down.

Why It’s Important to Diversify People often say that diversification is the only “free lunch” in investing because it lowers risks without always lowering returns. When the market goes down, different asset classes and sectors behave differently. For instance, high-growth tech stocks might drop sharply in some market conditions, but bonds or consumer staples might stay the same or even go up. You can lower the risk of your portfolio by investing in a variety of asset types. This will also make it more likely that your investments will grow steadily over time.

Examples from the real world If an investor puts all of their money into one technology ETF because they believe “tech is the future,” they could lose a lot of money if the tech sector goes down because of new rules, changes in what people want, or a slowdown in the economy. On the other hand, an investor who spreads their money across a number of ETFs that cover different sectors, regions, and asset classes is much less likely to face these kinds of risks.

Tips for making a diverse ETF portfolio that will help you

- Putting together themes and sectors: Add ETFs that track different parts of the market. You could, for instance, combine a broad-market index ETF with more specialized ETFs that give you access to technology, healthcare, consumer goods, and industrials.

- Different places: Find ETFs that give you exposure to other countries, like those that track emerging markets or developed economies outside the U.S. This helps keep your portfolio safe when one area does badly.

- Adding fixed income and other types of assets: Bonds, real estate ETFs, and commodity ETFs can all help keep your portfolio stable and lower its overall volatility.

- Reviewing and rebalancing your portfolio on a regular basis: Check to see if your asset allocation still fits with your investment goals and how much risk you are willing to take. As market fluctuations occur, your portfolio may drift from your intended mix, so regular rebalancing is essential.

Advice that is useful Don’t believe that buying one ETF will make you well-diversified. Always look at your asset allocation as a whole. When selecting ETFs, consider how each one fits into your overall strategy and whether it fills a diversification gap in your portfolio.

By diversifying and spreading your risk on purpose, you can better deal with the ups and downs of the market. Remember that the goal is not to get the most money back in one area, but to build a portfolio that grows steadily over time.

5. Mistake #3: Trying to time the market instead of keeping your money in it

The Risks of Timing the Market One of the worst things investors can do is try to time the market by buying and selling ETFs based on short-term changes in the market. It might be tempting to try to buy low and sell high, but the truth is that timing the market is very hard and often doesn’t work.

Why It’s So Hard to Get It Right

- Short-term volatility: Markets are always changing. It’s not always easy to guess what will happen next, even if it happens every day or every hour. If you pull out at the wrong time, you could miss out on gains because what looks like a short-term drop could quickly turn into a rise.

- The Cost of a Lot of Trading: Every time you trade, you might have to pay transaction fees and capital gains taxes, which will lower your returns over time.

- Mistakes in behavior: People who sell when the market goes down and buy when it goes up often make bad investment choices. People often do poorly when they go through these emotional investing cycles.

The Benefits of Staying Invested

- Finding the Average Cost of a Dollar: Instead of trying to guess when the market will go up or down, think about using dollar-cost averaging. This plan says that you should put a certain amount of money into the market at regular times, no matter what the market is doing. Dollar-cost averaging can help you deal with volatility and lower your average cost per share over time.

- Adding up over time: Your earnings will grow exponentially if you stay invested. It’s important to remember that even if the market goes down for a short time, you will still get a lot of benefits from compounding if you keep your investment for a long time.

- Study and Proof: A lot of research has shown that investors who stay broadly invested do better in the long run than those who try to time the market. Missing just a few of the best days in the market can cut your overall returns by a lot.

Real-life example Think about an investor who sells their ETFs every time the market goes down, but then misses the next time it goes up. Over the course of several decades, an investor who stays invested all the time will see much lower overall growth than one who misses a few of the market’s best days. This shows how important it is to stay with something for a long time and how dangerous it is to try to time the market.

How to Stay Out of the Timing Trap

- Stick to a plan for the long term: Make a clear plan for how to invest for the long term and stick to it. Recognize that short-term fluctuations are part of the market cycle.

- Make your investments automatic: You might want to set up automatic payments to your investment account. This plan not only helps you stick to your goals, but it also stops you from wanting to time the market.

- Remember Your Goals: Keep your money goals at the top of your mind. Instead of worrying about daily price changes, think about your long-term goals. This will help you avoid making decisions based on market noise.

Advice you can follow It’s not about being able to guess when the market will go up or down; it’s about being patient and disciplined. Even though market downturns can be scary, they are also chances to buy good investments at lower prices if you think about the long term.

Don’t let the daily changes in the market get to you too much. Instead, stick to your plan, put money into the market on a regular basis, and let compound interest work for you. This disciplined method usually makes more money than trying to catch the highs and lows of the market.

6. Mistake #4: Not thinking about taxes

How ETFs are taxed If you don’t pay attention to the tax implications of even low-cost ETFs, they could cut your net returns by a lot. While ETFs are known for their tax efficiency due to the in-kind creation and redemption process, many investors still overlook how capital gains taxes, dividend taxes, and other tax-related issues impact their portfolios.

Mistakes People Make When Paying Taxes on ETFs

- Distributions of Capital Gains: ETFs usually have fewer taxable events than mutual funds. However, there are still times when capital gains distributions happen, such as when the market moves a lot or when the portfolio is rebalanced. Even if you haven’t sold any ETF shares, these distributions could still cause you to owe taxes.

- Taxes on Dividends: You have to pay taxes on the money you make from ETFs. Your tax rate can change a lot based on whether or not the dividends are qualified. This lowers the amount of money you make.

- Knowing about taxes when you trade: If you trade or rebalance a lot without thinking about the tax consequences, you might end up with taxable events that you didn’t mean to. How you manage your portfolio in taxable accounts can have a big effect on your overall tax bill, even if the ETF itself is tax efficient.

Strategies for Tax-Efficient ETF Investing

- Open accounts that help you save on taxes: One of the easiest ways to lower the tax effects of ETFs is to keep them in tax-advantaged accounts like IRAs or 401(k)s. You don’t have to pay taxes on the money you make in these accounts.

- Use Tax-Loss Harvesting: If some of your investments don’t do well, you can sell ETFs at a loss to make up for the money you made from other investments. This plan will help you pay less in taxes.

- Know About Holding Periods: Long-term holdings, which are assets that you own for more than a year, are often taxed at a lower capital gains rate. So, having a long-term view can help your compound growth and lower your taxes at the same time.

- Rebalancing for a purpose: Instead of making a lot of trades that cause taxable events, plan your rebalancing ahead of time and think about how each move will affect your taxes. Some brokers have tools that can help you figure out the best way to rebalance your portfolio so you don’t have to pay as much in taxes.

An Example Situation Imagine two people who own the same ETFs. One investor makes a lot of trades and changes their portfolio without thinking about how it will affect their taxes. The other investor looks at things from a long-term perspective, uses accounts that help with taxes, and only rebalances every now and then with tax-loss harvesting in mind. Over a long period, the second investor’s returns will likely be significantly higher after accounting for taxes, even if both portfolios started with the same nominal gains.

Helpful tips Tax planning is not something you do after the fact; it’s an important part of your whole investment plan. Always think about how your ETF trades and asset allocation choices will affect your taxes. If you need help, talk to a tax advisor. You might want to use tax-efficient strategies to keep the money you make in your portfolio.

7. Mistake #5: Not checking out the ETF’s underlying assets and strategy

Why It’s Important to Do Your Homework A lot of investors buy ETF shares just because they are popular, have a good track record, or have a catchy name. But if you don’t take a closer look at what the ETF really owns and how it works, you might be taking risks that aren’t clear from the headline data.

Things You Should Look Into

- Holdings that are underneath: Look at the specific stocks or bonds that the ETF owns. Are they spread out across a lot of industries or just a few? If you know what’s in the ETF, you can better understand how well it fits with your investment plan.

- Management Strategy: Some ETFs are passively managed to follow an index, while others are actively managed using different methods. You should find out if the ETF’s strategy matches your risk tolerance and investment goals.

- The Fund Manager’s Past: You can use the fund manager’s experience and past performance to guess how an actively managed ETF will do in the future.

- How the index works: You should know how the index is made if the ETF follows one. What standards are used? This information can show possible biases or gaps in the ETF’s holdings that could affect how closely it tracks the overall market.

The Risks of Following Popular ETFs Without Thinking

- Not in line with the goals of the investment: A lot of people may like an ETF, but that doesn’t mean it’s right for your plan. For instance, an ETF that is heavily weighted in high-growth tech stocks might not be right for you if you also need defensive exposure.

- Not being clear: There are differences between ETFs. Some people may not be as open or clear about what they own as others, which makes it harder to figure out what the real risks are.

- Chasing performance: You might want to buy the “hot” ETF of the moment if you don’t know the basics. This can lead to chasing past performance instead of making smart, strategic choices.

Some useful tips for doing in-depth research

- Read the Prospectus: Take your time reading the ETF’s prospectus. It tells you what the fund wants to do, how it plans to do it, what it owns, and what risks it faces.

- Use Tools for Financial Research: Platforms and financial news sites give you detailed information about ETF holdings, strategies, and past performance. Tools from well-known banks can give you a lot of information.

- Check out ETFs that are like: You can compare ETFs that track the same sectors or indices. Look at their expense ratios, how many different types of investments they hold, how much they track errors, and how well they have done in the past.

- Stay Up to Date: The makeup of ETFs changes with the markets. Every once in a while, check your ETF’s holdings and strategy to make sure they still fit with your long-term investment goals.

The Bottom Line Doing your homework is a way to invest in yourself. You can lower your risk and get closer to your investment goals by doing a lot of research on an ETF’s underlying holdings and strategy.

8. Extra Tips: Don’t let your feelings affect your investments and stay up to date.

How Emotions Affect Investing One of the biggest mistakes investors make is acting on impulse instead of sticking to a long-term plan that they have thought through. It can be bad to invest based on your feelings, like selling in a panic when the market goes down or buying too much when it goes up. The best investors stay disciplined and make decisions based on logic, even when the market is volatile.

How to Stay Disciplined

- Make a plan for your investments in writing: Write down your goals, how much risk you’re willing to take, and what you plan to do. A written plan helps you stay on track and not make rash choices.

- Automatically make investments: Automation, such as setting up automatic contributions and using dollar-cost averaging, takes the emotional side out of the equation by making choices for you.

- Reviews on a regular basis, not reactions: Instead of always keeping an eye on market noise, set up regular reviews of your portfolio. This will help you stay up to date without reacting to every little change.

- Use Sources You Can Trust: To stay up to date, subscribe to reliable financial newsletters, use research platforms, and join investor communities. People who know a lot about investing are less likely to be influenced by how the market feels in the short term.

Advice you can use Stick to your plan and remember what you want to achieve in the long run. If you get into the habit of staying informed but not getting too emotionally involved in every market movement, your investments will do much better. Remember that discipline is very important to avoid making a lot of common mistakes. Knowledge and good habits are your best friends.

9. In short

ETFs are a simple, cheap, and flexible way for people to invest in the markets. But even a good investment tool can fail if you don’t know about and avoid common mistakes. We looked at the top five mistakes that a lot of ETF investors make in this article:

- Not paying attention to hidden fees and expense ratios: Over time, even small costs can add up and cut into your profits. Always check the expense ratios and know the bid-ask spreads and brokerage fees.

- Your ETF portfolio doesn’t have enough variety: Putting too much money into one area, sector, or asset class can put you at risk for no good reason. Use a strategy that spreads risk across a lot of different areas.

- Timing the Market Instead of Staying Invested: Trying to time market highs and lows by trading a lot often means missing out on chances and getting less compound growth. The key is to invest for a long time and keep doing it.

- Not considering the tax effects: Bad tax planning can greatly lower your net returns. Use tax-advantaged accounts and tax-loss harvesting to keep more of your profits.

- Not looking into the ETF’s underlying holdings and strategy: If you don’t know what the basics of an ETF are, you might end up with investments that don’t work together and risks that you didn’t expect.

On top of these common mistakes, don’t let your feelings make your choices. Being consistent, disciplined, and always learning are the best things you can do to reach your money goals. You can get all the benefits of ETFs without the problems that can get in the way of your investment goals if you follow these tips and stay up to date.

The first steps to better ETF investing are to be aware and disciplined. No matter what the market does, you should always know how much you’re paying in fees, spread out your investments, and keep your eyes on the long-term goal. With these best practices in place, you’re well on your way to achieving better long-term results.

10. Frequently Asked Questions

Here are some questions that people often ask to help clear up common worries about investing in ETFs and help you avoid making these mistakes.

Q1. What do I need to know about an ETF? Answer: You need to know what you want to do with your money, how much risk you can take, and how the ETF will fit into your portfolio in order to choose the right one. Look at things like the ETF’s expense ratios, liquidity (daily trading volume and bid-ask spreads), its investment strategy, and the assets it holds. Don’t just look at how the ETF has done in the past; also think about how it fits into your overall asset allocation. You can make a smart choice by reading the prospectus and looking at other ETFs that are similar.

Q2. Are ETFs safer than stocks by themselves? Answer: Because they hold a mix of assets, ETFs usually have more diversification than individual stocks. This diversification lowers risk, which is why ETFs are less volatile than stocks on their own. However, the level of safety depends on the ETF’s composition. ETFs that focus on a certain niche or sector may be more unstable than ETFs that cover the whole market. In the end, your investment goals, portfolio, and risk tolerance will determine how safe your money is.

Q3. How often should I look at my ETF investments? Answer: ETFs are meant for long-term strategic investing, but you should look at your portfolio at least once a year or every six months. Regular reviews make sure that your asset allocation stays in line with your financial goals and help you figure out when you need to rebalance or make changes, especially if the market changes or your own situation changes.

Q4. What costs should I be aware of when using ETFs? Answer: The expense ratio is one of the most important fees because it directly affects how much money you make. Also, be aware of hidden costs like bid-ask spreads and any broker fees that your trading platform may still charge. Even though a lot of brokers now let you trade ETFs without paying a commission, it’s still a good idea to check that you’re not paying any other fees. Always compare ETFs that are similar to each other because lower-cost ETFs usually give you more value over time.

Q5. Can I lose money if I buy ETFs? The answer is: Yes, like with any investment, there is always a chance of losing money. There are risks in the market for ETFs, and while diversification can help lower those risks, it can’t get rid of them completely. Things like market downturns, poor sector performance, or changes in the economy that you didn’t see coming can affect ETF returns. You should know how much risk you can take, how to spread your money out right, and how to invest for the long term.

Q6. What are the best ways to put money into ETFs? Answer: Here are some best practices:

- Knowing the Costs: Always look at the expense ratios and be aware of any extra fees.

- Diversification: Avoid over-concentration by building a balanced portfolio that includes multiple asset classes, sectors, and geographical regions.

- Long-Term Focus: Don’t try to time the market; instead, invest regularly using dollar-cost averaging and stay invested.

- Tax Efficiency: Utilize tax-advantaged accounts and employ tax-loss harvesting strategies where appropriate.

- Keep Learning: To stay up to date, read reliable financial research, keep an eye on market trends, and check your ETF’s holdings every so often.

Q7. What are some mistakes that people often make when they invest in ETFs? Answer: The first steps to not making common mistakes are to learn and be disciplined. Learn the basics of ETFs, such as how much they cost and how their fees work. After that, make a clear plan for your long-term investments. Don’t let your feelings decide what to do, and check your portfolio from time to time. Spread your investments across different asset classes and sectors. Using the tools and resources you have available and following these best practices can help you make your ETF portfolio more stable and profitable.

Last Thoughts

One of the best ways to build long-term wealth is to invest in ETFs, but even the simplest investment strategy can be hurt by common mistakes. By knowing about and avoiding these mistakes, like not thinking about taxes, not doing the important research on your underlying holdings, and trying to time the market, you can get better, more stable returns.

Don’t forget that making money in the stock market isn’t about following the latest trends or making quick decisions when the market changes. It’s about making smart choices, planning ahead, and learning new things all the time. By paying attention to costs, diversification, long-term stability, and tax efficiency, you can avoid these common mistakes and set your portfolio up for long-term growth.

Use these tips, keep learning, and stick to your investment plan. If you work hard and stay disciplined, you’ll be able to handle the market’s ups and downs and build a portfolio that will last. Have a good time with your money!