If you’re applying for a personal loan—or thinking about refinancing one—you’ve probably noticed that interest rates can vary wildly. Two people borrowing the same amount for the same term can receive very different offers. This article explains the top 5 factors that affect your personal loan interest rates, shows you how to improve the terms you’re offered, and gives you a step-by-step roadmap to act on today. You’ll learn what lenders look at, what you can change quickly, and how to measure progress so your next quote is meaningfully better.

Disclaimer: This article is educational and not financial advice. For personalized guidance, consult a qualified financial professional.

Key takeaways

- Your credit profile (scores and history) is the single biggest driver of your APR, but it’s also the most improvable with smart, consistent habits.

- Capacity to repay—especially your debt-to-income (DTI) ratio and stable, documentable income—signals risk to lenders and influences pricing.

- Loan structure (amount, term, and fees that roll into APR) can make a good rate look expensive or a fair rate look great; always compare APR, not just the interest rate.

- Collateral, cosigners, and product type (secured vs. unsecured) meaningfully shift risk—and rates—if used wisely and safely.

- Market conditions and lender type (bank, credit union, online lender) plus relationship and autopay discounts can nudge the rate you’re offered up or down.

Factor 1: Credit Score & Credit History

What it is and why it matters

A credit score is a three-digit summary of risk derived from the data in your credit reports. Higher scores generally translate to lower perceived risk for lenders—and lower personal loan rates. Your history—on-time payments, credit utilization, length of credit history, new inquiries, and credit mix—feeds that score and shapes pricing.

Requirements & low-cost tools

- Requirements: A current snapshot of your credit report(s) and score(s).

- Low-cost options:

- Annual free reports from major bureaus.

- Free score updates from many banks and apps.

- Credit monitoring to catch errors early (free and paid options exist).

Step-by-step: Improve your rate via your credit profile

- Pull all reports and check for errors or outdated negatives. Dispute inaccuracies promptly.

- Automate on-time payments for every account to protect payment history.

- Lower revolving utilization (balances ÷ limits) below 30%—ideally <10%—by paying down cards ahead of the statement date or requesting higher limits (only if you won’t spend more).

- Avoid new hard inquiries unless you’re rate-shopping within a protected window (personal loans don’t have the same “single inquiry” rules as mortgages/auto, so be deliberate).

- Add positive data where available (e.g., rent/utility reporting services) if appropriate.

- Consider becoming an authorized user on a well-managed, older account to lengthen history and reduce utilization—only if the primary user has spotless habits.

Beginner modifications & progressions

- Beginner: Pay every bill on autopay for at least the minimum; make a second mid-cycle payment on high-utilization cards.

- Progression: Target specific score thresholds (e.g., 670, 720, 760+), sequencing actions to cross the next tier before applying.

Metrics to track

- FICO/VantageScore trend (target: steady monthly increase).

- Utilization rate on each revolving account (target: <10% at statement close).

- Number of hard inquiries in last 12 months (target: as few as possible).

Safety, caveats, and common mistakes

- Don’t close your oldest cards before applying; this can shorten credit history and raise utilization.

- Beware quick-fix schemes. Legitimate improvement is about accuracy, consistency, and time.

- If cash is tight, set autopay to at least the minimum to protect payment history.

Mini-plan example (2–3 steps)

- Week 1: Pull reports, dispute one clear error, enable autopay minimums.

- Week 2: Make an extra payment to drop your highest-utilization card below 30%.

Factor 2: Debt-to-Income (DTI) Ratio & Income Stability

What it is and why it matters

Your DTI is total monthly debt payments divided by gross monthly income. Lenders use it to gauge repayment capacity. Lower DTI usually yields better approval odds and pricing. Stable, verifiable income (W-2, salary, or well-documented self-employment) strengthens your profile.

Requirements & low-cost tools

- Requirements: Accurate list of monthly debt payments; recent pay stubs or tax returns.

- Low-cost options:

- Budgeting apps/spreadsheets to track obligations.

- A simple DTI calculator (many free versions exist).

Step-by-step: Optimize your DTI and income presentation

- Compute your DTI: add mortgage/rent, auto, student loans, credit card minimums, and other loans; divide by gross monthly income.

- Target reductions:

- Pay down revolving balances enough to reduce minimums.

- Refinance high-APR debts if it cuts total payments without extending risk.

- Eliminate small installment loans that inflate DTI.

- Increase documentable income:

- Add a steady side income stream you can verify (e.g., contracted work with invoices and deposits), even modest amounts.

- Ensure deposits are consistent for several months before applying.

- Time your application:

- Apply after a raise has shown up on pay stubs or after tax filing reflects higher income.

- Avoid applying right after taking on a new installment debt that spikes DTI.

Beginner modifications & progressions

- Beginner: Pay off one small installment loan or card to lower monthly obligations.

- Progression: Consolidate high-interest card debt if it reduces monthly payments and total interest without long lock-ins; build 2–3 months of consistent side-income deposits.

Metrics to track

- DTI percentage (target: as low as possible; many lenders prefer lower-to-mid-30s or below).

- Months of continuous income at current employer or role (stability).

- Total monthly minimums before and after adjustments.

Safety, caveats, and common mistakes

- Don’t boost “income” with unpredictable or non-documentable cash; lenders may disregard it.

- Avoid consolidation loans that merely extend the term, increase total interest, or add hefty fees—compare APR and total cost.

- Don’t open a new auto loan or large buy-now-pay-later plan right before applying.

Mini-plan example

- This month: Pay off a small installment loan ($40/mo) and reduce one card’s minimum by $20/mo. Combined $60/mo drop can shift your DTI tier.

Factor 3: Loan Amount, Term & Fees (APR vs. Interest Rate)

What it is and why it matters

You’ll see two price tags: interest rate and APR. The interest rate is the base cost of borrowing. APR wraps the rate and certain fees into a single yearly percentage, allowing apples-to-apples comparisons across lenders and terms. Your chosen amount and repayment term also affect pricing and the total you pay.

Requirements & low-cost tools

- Requirements: A realistic budget, desired amount, and preferred term.

- Low-cost options: Free loan calculators to compare monthly payment, total interest, and APR effects of fees.

Step-by-step: Structure your loan for a lower real cost

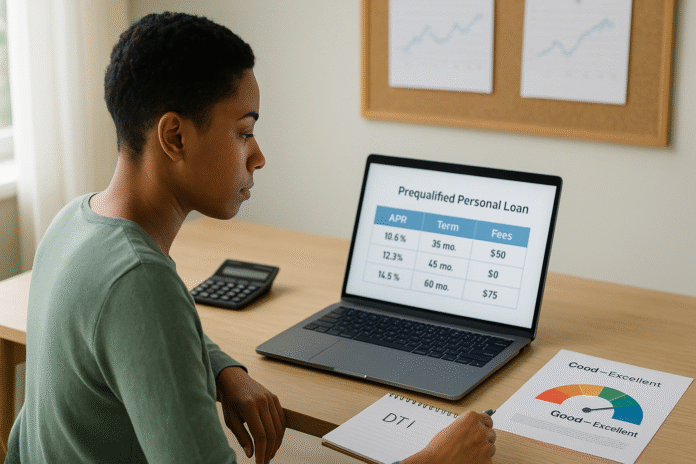

- Compare by APR, not just rate. A slightly higher rate with no origination fee can beat a “lower-rate” loan with a 6% fee.

- Right-size the amount. Borrow only what you need; smaller principal cuts total interest and sometimes fees.

- Choose the shortest affordable term. Shorter terms often carry lower rates and always reduce total interest; verify the payment fits your budget with room to spare.

- Watch for fees. Some lenders charge origination (commonly 1–10% of the loan), late fees, and sometimes check handling fees. Model them in your comparison.

- Ask about discounts. Many lenders offer small interest reductions for autopay or direct deposit and relationship banking.

Beginner modifications & progressions

- Beginner: Get 3–5 prequalified offers and sort by APR and total cost over the term, not just monthly payment.

- Progression: Run a side-by-side “with fee vs. no fee” comparison and a “36 vs. 48 months” comparison to see break-even points.

Metrics to track

- APR across offers (target: lowest).

- Total interest paid over the loan (target: lowest).

- Origination fee % (target: lowest, ideally zero).

- Term length vs. budget cushion.

Safety, caveats, and common mistakes

- Don’t anchor on the smallest monthly payment; a longer term can dramatically raise total interest.

- Avoid loans that precompute interest or include obscure add-ons that inflate cost.

- Confirm there’s no prepayment penalty if you plan to pay off early.

Mini-plan example

- Today: Prequalify with four lenders, export offers to a spreadsheet, rank by APR and total cost, then test whether a 36-month term with a slightly higher payment saves more than a 48-month term.

Factor 4: Collateral, Cosigners & Loan Type (Secured vs. Unsecured)

What it is and why it matters

Personal loans can be unsecured (no collateral) or secured (backed by cash, a vehicle title, or other assets). Collateral reduces the lender’s risk and can lead to lower rates. Similarly, a cosigner or co-borrower with strong credit and income can unlock better terms by improving the application’s risk profile.

Requirements & low-cost tools

- Requirements: If securing, you’ll need eligible collateral and documentation of ownership/value; if cosigning, the cosigner’s consent and documentation.

- Low-cost options: Free title valuation tools (for vehicles), bank statements for savings-secured loans.

Step-by-step: Use risk-mitigating features safely

- Evaluate secured options (e.g., savings-secured or CD-secured loans) if your credit is borderline; these often carry lower rates.

- Consider a cosigner or co-borrower with excellent credit and low DTI for rate relief—only with clear, written agreements about who pays and what happens if something goes wrong.

- Compare unsecured vs. secured APRs side by side, factoring in risks (loss of collateral if you default).

- Confirm collateral terms: valuation method, loan-to-value limits, and insurance requirements if applicable.

- Plan your exit: If you use a cosigner or collateral to secure better terms now, set milestones to refinance into a solo, unsecured loan later when your profile improves.

Beginner modifications & progressions

- Beginner: Ask your bank or credit union about a small savings-secured loan if you need to build credit and rate-shop later.

- Progression: Use a highly qualified cosigner to secure a lower APR, then refinance after 12–18 months of perfect payments to remove them.

Metrics to track

- APR difference between unsecured and secured options.

- Cosigner’s incremental benefit (how many basis points lower).

- Collateral coverage (loan-to-value) and any added costs (insurance/fees).

Safety, caveats, and common mistakes

- Never pledge collateral you can’t afford to lose.

- Cosigners are 100% liable; a missed payment hurts both parties’ credit.

- Avoid secured loans that impose aggressive repossession terms or excessive fees.

Mini-plan example

- This week: Price three unsecured offers and one savings-secured offer; if the secured APR is 4–6 percentage points cheaper, consider it for 12 months of credit building and then refinance.

Factor 5: Market Conditions, Lender Type & Discounts

What it is and why it matters

Even with the same borrower profile, your rate is influenced by the broader interest-rate environment and the lender’s business model. When benchmark rates are high, personal loan offers tend to be higher; when they fall, offers often improve. Lender type also matters: online lenders price for speed and risk models, banks may bundle relationship discounts, and credit unions often provide member-friendly pricing. Small discounts (like autopay) can stack with other improvements to lower your APR.

Requirements & low-cost tools

- Requirements: None beyond comparing lenders across categories.

- Low-cost options: Use prequalification tools to get soft-pull estimates from multiple banks, credit unions, and online lenders.

Step-by-step: Work the environment—not against it

- Check the rate climate. If policy rates are trending down, waiting a few weeks may improve offers; if trending up, consider locking sooner (only if your application is otherwise ready).

- Price across lender types: at least one bank, one credit union, and two online lenders.

- Leverage relationship perks: some institutions offer small APR reductions for existing customers, direct deposit, or autopay (often around 0.25%).

- Use prequalification to compare without dinging your score; then submit a full application to the best candidate.

- Negotiate if you have competing offers—some lenders will match or beat a qualified quote.

Beginner modifications & progressions

- Beginner: Start with your primary bank/credit union and two reputable online lenders using prequalification.

- Progression: Add 1–2 niche lenders (e.g., payroll-linked or secured options) and ask for relationship/autopay discounts in writing.

Metrics to track

- Number of prequalified offers (target: 4–6).

- Average APR across offers and best APR.

- Discounts applied (autopay, relationship, direct deposit).

Safety, caveats, and common mistakes

- Don’t chase a tiny discount if it requires tying up your primary checking where fees or restrictions offset the savings.

- Watch for teaser rates that assume unrealistic conditions (e.g., highest credit tier + autopay + direct deposit + no fees).

- Avoid applying to dozens of lenders at once; be strategic to minimize hard inquiries.

Mini-plan example

- Next 48 hours: Pull 4–6 prequal offers across lender types, list any autopay/relationship discounts, and calculate whether the lowest APR is still lowest after fees.

Quick-Start Checklist (print-friendly)

- Pull all three credit reports; dispute any errors you find.

- Turn on autopay minimums for every account; schedule extra payments on high-utilization cards.

- Compute your DTI; eliminate one small payment to drop the ratio.

- Decide the smallest needed loan amount and the shortest term you can comfortably afford.

- Prequalify with at least 4 lenders (bank, credit union, 2 online) and compare APR and total cost.

- Ask about autopay/relationship discounts and confirm fee structures in writing.

- If needed, evaluate secured or cosigned options—with written agreements and exit plan.

- Choose the lowest-APR offer that fits your budget and has no hidden traps.

Troubleshooting & Common Pitfalls

- “My rate is higher than expected.” Check your utilization at statement close; paying down balances mid-cycle may not reflect until the statement reports. Lower utilization and re-prequal in 30–45 days.

- “The monthly payment looks great, but total cost seems high.” You’re likely comparing different terms. Re-sort offers by APR and total interest, not monthly payment.

- “I was quoted a low rate online, but the final approval was higher.” The prequalification assumed certain conditions; ask for a breakdown of which assumptions (score tier, DTI, discounts) changed and how to fix them.

- “Fees surprised me at signing.” Request a fee sheet up front; run an APR comparison. Decline add-on products you don’t need.

- “My cosigner is nervous.” Draft a simple agreement: who pays, how you’ll communicate, how to handle emergencies, and your refinance timeline. Set alerts so both parties see due dates and confirmations.

- “I’m not sure whether to wait for the market to improve.” If policy rates look likely to fall soon, waiting could help—but only if your other factors (credit, DTI) are improving in the meantime. Otherwise, optimize controllables now.

How to Measure Progress (simple KPIs)

- Score improvement: track 30-day deltas; celebrate each 20-point climb.

- DTI movement: total monthly debt payments ÷ gross monthly income; aim for steady declines.

- Offer quality: number of prequalified offers and the spread between best and worst APR—shrinking spreads often mean your profile is stabilizing.

- Fee load: origination fee % and any mandatory add-ons—lower is better.

- Total cost of credit: sum of all payments over the loan term—use this as your ultimate scoreboard.

A Simple 4-Week Starter Plan to Lower Your Personal Loan Rate

Week 1: Clean & Prepare

- Pull credit reports and dispute one clear error (if any).

- Turn on autopay minimums everywhere; make an extra mid-cycle card payment to drop utilization below 30% on your highest card.

- Calculate DTI; pick one small installment balance you can eliminate this month.

Week 2: Model & Right-Size

- Build a quick comparison sheet (loan amount, 36 vs. 48 months, fees).

- Decide your maximum comfortable monthly payment and the shortest term that fits.

- If needed, ask a trusted potential cosigner whether they’d consider it—only after sharing a written plan to refinance them off within 12–18 months.

Week 3: Shop Smart

- Prequalify with at least four lenders (bank, credit union, two online).

- Record: interest rate, APR, term, monthly payment, origination fee %, and discounts (autopay/relationship/direct deposit).

- Eliminate any offer with a higher APR and higher total cost than your best option.

Week 4: Lock & Execute

- Choose the best APR and term that match your budget.

- Confirm no prepayment penalty and turn on autopay to preserve any discount.

- Set reminders for a 6-month and 12-month check-in to re-shop rates if your score, DTI, or the market improves.

Frequently Asked Questions

1) What’s a “good” personal loan interest rate right now?

It depends on your credit, DTI, loan amount/term, and lender type. As of mid-August 2025, widely reported averages for qualified borrowers with solid credit cluster around the low-to-mid teens, but individual offers vary. Always compare APR—not just the sticker rate—and check fresh data when you shop.

2) Which matters more to lenders: credit score or DTI?

Both matter. Score signals the likelihood you’ll repay as agreed; DTI shows whether you can afford the payment. Improving either can lower your rate; improving both moves the needle fastest.

3) Do origination fees always make a loan worse?

Not necessarily. A loan with a small fee and low rate can beat a no-fee loan with a higher rate. That’s why comparing APR and total cost is critical.

4) Will prequalification hurt my credit?

Prequalification typically uses a soft inquiry that doesn’t affect your scores. The full application usually includes a hard inquiry, which may cause a small, temporary dip.

5) Are secured personal loans always cheaper than unsecured?

They often are, because collateral lowers the lender’s risk. But they put your asset at risk if you default. Compare the APR savings against the potential consequences carefully.

6) Can a cosigner really lower my rate?

If the cosigner has excellent credit and solid, documentable income, it can. Lenders evaluate the combined risk profile, which may improve pricing.

7) How much can autopay or relationship discounts save me?

Many lenders offer around a 0.25 percentage point reduction for autopay, and sometimes additional small discounts for direct deposit or existing relationships. Confirm the exact amount and requirements in writing.

8) Is a longer term ever a bad idea?

Longer terms reduce the monthly payment but increase the total interest paid. If you need the lower payment for budget stability, that’s valid—just run the math and plan to prepay when possible.

9) Should I borrow a bit extra “just in case”?

Borrowing more increases interest cost and may raise your rate tier. If you must, keep it minimal and ensure the APR and monthly payment remain manageable.

10) How often should I re-shop my rate?

If your credit improves, your DTI drops, or market rates fall, it’s worth checking new offers—especially at 6–12 month intervals. Make sure any new loan’s fees don’t erase the savings.

11) Do credit unions really offer lower rates?

Many do, owing to their member-focused model and interest-rate caps in some jurisdictions. It’s not universal, so include a credit union quote alongside banks and online lenders when you shop.

12) What single action gives the biggest payoff?

For most borrowers, dropping credit card utilization and cleaning up report errors before applying produces the fastest, most reliable rate improvement.

Conclusion

Your personal loan interest rate isn’t random. It’s the result of five levers—credit profile, repayment capacity, loan structure, risk-mitigation features, and the lending environment—that you can understand and influence. Tackle what you can control today, shop deliberately, and compare by APR and total cost. Do that, and your next quote won’t just look better—it will be better.

CTA: Ready to lower your rate? Use the checklist above, prequalify with four lenders, and pick the lowest-APR offer that fits your budget this week.

References

- How Do Personal Loan Interest Rates Work? Experian, September 29, 2021. https://www.experian.com/blogs/ask-experian/how-do-personal-loan-interest-rates-work/

- What is the difference between a loan interest rate and the APR? Consumer Financial Protection Bureau, January 30, 2024. https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-loan-interest-rate-and-the-apr-en-733/

- What is an annual percentage rate (APR) and why is it higher than the interest rate for my payday loan? Consumer Financial Protection Bureau, December 5, 2024. https://www.consumerfinance.gov/ask-cfpb/what-is-an-annual-percentage-rate-apr-and-why-is-it-higher-than-the-interest-rate-for-my-payday-loan-en-1625/

- 1026.22 Determination of annual percentage rate. Consumer Financial Protection Bureau (Regulation Z). https://www.consumerfinance.gov/rules-policy/regulations/1026/22

- What is a debt-to-income ratio? Consumer Financial Protection Bureau, August 30, 2023. https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-en-1791/

- Debt-to-income calculator tool (PDF). Consumer Financial Protection Bureau. https://files.consumerfinance.gov/f/documents/cfpb_your-money-your-goals_debt_income_calc_tool_2018-11_ADA.pdf

- The Fed – Economy at a Glance: Policy Rate. Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/economy-at-a-glance-policy-rate.htm

- How the Fed Implements Monetary Policy with Its Tools. Federal Reserve Bank of St. Louis. https://www.stlouisfed.org/in-plain-english/the-fed-implements-monetary-policy

- Understand the different kinds of loans available. Consumer Financial Protection Bureau, December 12, 2024. https://www.consumerfinance.gov/owning-a-home/explore/understand-the-different-kinds-of-loans-available/

- Differentiating between secured and unsecured loans (PDF). Consumer Financial Protection Bureau. https://files.consumerfinance.gov/f/documents/cfpb_building_block_activities_differentiating-secured-unsecured-loans_guide.pdf

- What Factors Do Lenders Consider When Determining My Interest Rate? Experian, October 3, 2022. https://www.experian.com/blogs/ask-experian/what-factors-do-lenders-consider-when-determining-my-interest-rate/

- What’s a Good Interest Rate on a Personal Loan? Experian, April 10, 2025. https://www.experian.com/blogs/ask-experian/whats-a-good-interest-rate-for-a-personal-loan/

- Average Personal Loan Interest Rates in August 2025. Bankrate, August 13, 2025. https://www.bankrate.com/loans/personal-loans/average-personal-loan-rates/

- Origination Fees: What They Are and How They Work. Experian, September 19, 2024. https://www.experian.com/blogs/ask-experian/what-is-an-origination-fee/

- 5 Personal Loan Fees to Watch Out For. Experian, October 28, 2024. https://www.experian.com/blogs/ask-experian/personal-loan-fees-you-should-watch-out-for/

- How to Prequalify for a Personal Loan. Experian, May 29, 2025. https://www.experian.com/blogs/ask-experian/how-to-prequalify-for-loan/

- Does Getting Preapproved Affect Your Credit? Experian, July 9, 2025. https://www.experian.com/blogs/ask-experian/does-preapproval-affect-your-credit/

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.