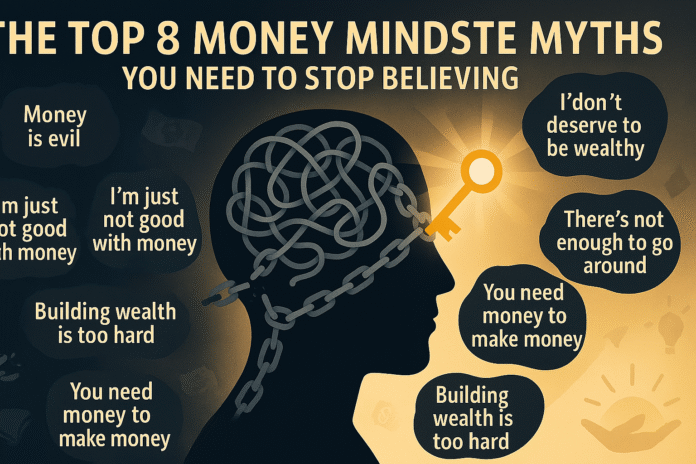

A positive, empowered way of thinking about money starts in the mind. The way we think about money affects what we do, how we act, and how well we do with money in the end. Sadly, many of us believe false ideas about money that keep us from reaching our full financial potential and keep us stuck in old habits. These wrong ideas about money not only lead you in the wrong direction, but they can also make it harder for you to grow, be creative, and make money.

We’ll talk about what money mindset really means and why these wrong ideas are both common and bad for you in this article. We’ll debunk eight common myths that have kept people from fully managing their money. By questioning these false stories, you can open up new ways of thinking and use practical strategies to improve your financial situation.

This is what you should expect:

- Myth 1: “You have to be wealthy to think like a wealthy person” We’ll talk about why having a wealth mindset means building beliefs and habits that give you power, no matter where you are right now.

- Myth 2: “Having a money mindset means that you always think positively.” Learn why you need more than just hope to be successful: you need plans that you can follow, good habits, and emotional work.

- Myth 3: “Talking about money is bad and wrong.” Learn more about money and how talking about it can help you grow.

- Myth 4: “If you have debt, you’re bad with money” Understand the difference between “good” debt and “bad” debt, and why your thoughts on borrowing matter.

- Myth 5: “You Can Get Rich Fast If You Have the Right Mindset” We’ll tell you why you can’t get rich overnight: you have to work hard and build good habits over time.

- Myth 6: “Money Can Make You Happy” Find out more about the complicated link between money and real happiness, and why happiness comes from within.

- Myth 7: “You Should Never Take Risks” Find out why it’s important to take risks in a smart way to grow your money.

- Myth 8: “People with financial degrees are the only ones who know how to handle money” You don’t need to go to school to learn how to handle your money; anyone can do it.

You will be able to question and get rid of these limiting beliefs by the end of this article. Let’s get rid of the lies, find out the truth, and begin the process of changing how we think about money.

Myth 1: “You Have to Be Rich to Have a Wealth Mindset”

One common myth about how to get a mindset that attracts wealth is that you have to be rich first. This myth says that only very wealthy people can have an abundant mindset. This makes a lot of people think that people who come from humble beginnings can’t become financially independent. But the truth is very different.

This Idea Is Wrong

How you think about, value, and handle money is what makes you rich, not how much money you have in the bank. It starts with building a set of beliefs that help you grow, learn, and get stronger. You don’t need a lot of money to get started on your path to financial freedom. You have to change yourself first. A lot of people who have made a lot of money did so by changing the way they think long before they saw the money in their bank accounts.

Things that are important to think about:

- First, how you think: Your thoughts, not how much money you have, affect how you spend money, make decisions, and form habits. People who start out with little money can and do become very rich later on if they promise to keep learning and stick to their plans.

- Giving people power through learning: You can learn how to handle, save, and invest your money no matter how much you have. People can think about what they can do and how much they can have with this kind of education.

- Real-life examples: Consider self-made business owners or regular workers who changed their financial situations by changing the way they think. There are many stories of people who started out with very little money but worked hard, made smart choices, and believed in their own potential to reach big financial goals.

How a Shift in Your Mindset Can Change Everything

You can learn, change, and do things when you stop thinking that only rich people can be wealthy. Having a growth mindset is important:

- Read stories that inspire you about people who became rich from nothing.

- Join groups that teach people about money so you can talk about your ideas and plans.

- To learn more, take online classes on personal finance, investing, and starting a business.

The most important thing is that you don’t have to be rich to have a wealth mindset. A lot of the world’s wealthiest people started out with nothing but a belief that they could grow and a promise to make habits that would help them. A wealth mindset can change your finances, no matter what your current situation is. Start with what you have, focus on growing, and know that.

Myth 2: “Being Positive Is All About Money Mindset”

It’s not only wrong to think that you can get rich by just sending out “positive vibes,” but it could also be dangerous. It’s important to have a positive attitude if you want to be strong and confident, but just thinking positively won’t get you to do anything. To have a strong money mindset, you need to change your mind, stick to good habits, be emotionally smart, and do things that make sense.

The Full Range of Mindset Work: More Than Just Thinking Positively

- A Base of Positive Thoughts:

- Trust and Hope: When things go wrong, thinking positively can help you stay hopeful and confident.

- Strength: You need to believe that you can get through hard times before anything else.

- Why discipline and good habits are important

- Plans that are all about taking action: Having a wealth mindset means having a set of structured, repeatable actions, like making a budget, saving money, and investing. Real plans need to back up these actions.

- How to Handle Your Feelings: Part of developing a wealth mindset is learning how to deal with fear, stress, and anxiety. It means changing emotional habits like being patient, sticking with things, and making decisions carefully.

- How to Use in the Real World:

- Consistency Is Important: Think about the business leaders and athletes who say that they are successful not just because they are positive, but also because they work hard, plan, and follow through.

- Together, Mindset and Action: Imagine someone who says to themselves every day, “I attract wealth,” but doesn’t keep track of their spending, invest, or learn new ways to handle their money. If you don’t do something about it, having a good attitude won’t help you in the real world.

How to Make Positive Thinking Work

- Write down what you need to do: Make sure your financial goals are clear and can be measured. For example, if you want to save money for emergencies, make a plan and set a goal for how much you want to save each month.

- Use Mindset Work in Your Daily Life: Every morning, do both affirmations and a review of your priorities for the day to make sure that your positive thoughts are put into action right away.

- Spend money on learning all the time: Read personal finance books and follow trustworthy financial blogs every day to learn about money. This mix of learning and doing things helps you stay positive in real life.

You can prove this myth wrong and start your financial journey with a balanced plan by realizing that having a money mindset means more than just wishing for things to happen. It also means taking disciplined, informed action. When a positive attitude leads to real steps to improve your money situation, it gets a lot stronger.

Myth 3: “Talking about money is bad and wrong.”

A lot of people still don’t want to talk about money because they feel ashamed or awkward. People who think it’s rude or wrong to talk about money can make it hard for others to learn about money and share ideas that will help them grow. For everyone to be able to make smart choices and get past their limiting beliefs, they need to be able to talk about money in a real and healthy way.

Why it’s bad to keep money talks secret

- Not knowing how to deal with money:

- Missed chances: People who are told not to talk about money miss out on the chance to learn from what others have been through. People in a home or community where money is a taboo subject might never talk about how to save, budget, or invest.

- Secrecy and Shame: If you keep your money problems to yourself, you might make bad decisions and feel more stressed. When people are quiet, misunderstandings and fears grow.

- The good things about talking about money are:

- Knowledge is Strength: When you talk about money openly, it becomes less of a mystery. You can learn more about your behavior, make new plans, and find services and resources that you might not have known about if you talk about money.

- Building a network of support: People can talk about their problems and successes in a community of learning and support that is open to everyone.

- Real-life examples:

- Talks about money in the family: Families that are open about money and budgets often create an environment of support and responsibility.

- Forums and groups of friends: Talking about money with other people can help you make better financial decisions, feel less alone, and be more motivated. For example, there are social media groups and local meetups that teach people about money.

Creating a culture that makes it okay to talk about money

- Start with a little bit: Talk to people you know well, like friends or family, to get started. Talk about how you plan your money or ask others how they do it.

- Talk in a way that is neutral and factual: Don’t use your feelings or opinions to guide your conversations; use facts and numbers instead.

- Share to Teach: Share books, podcasts, or financial blogs that have changed the way you think about money.

- Build Safe Places: Join or start online or in-person groups where it’s normal and encouraged to talk about money problems and successes.

People can learn more, feel more confident, and be more in control of their money if they aren’t afraid to talk about it. Not believing this myth will not only help you change the way you think about money, but it will also help everyone in your community who wants to be financially free.

Myth 4: “If you have debt, you don’t know how to handle money.”

A lot of people think that the word “debt” always means shame or being irresponsible. A lot of people think that if you have any debt, it means you’re bad with money. This makes it harder to understand how debt works and how it can help you grow. This myth says that all debt is bad, but it doesn’t take into account that some types of debt are bad in some situations.

How to Tell the Difference Between Good and Bad Debt

- How to Use Debt as a Money Tool:

- Good Debt: Not all debt is bad. For example, getting loans to pay for school, buy a house, or start a business can help you make money in the long run.

- Debt that hasn’t been paid: On the other hand, borrowing money to buy things you don’t need without a clear way to pay it back can be bad. You need to know the difference to have a good money mindset.

- How your view of debt affects how quickly you can get back on your feet financially:

- Stigma vs. Chance: A lot of people don’t ask for help or come up with ways to deal with or get rid of their debt because they think it’s wrong. Instead, thinking of debt as just one of many financial tools can help you find realistic ways to pay it off and grow.

- Strong recovery: Many successful people have used debt wisely. It’s not the debt itself that matters most; it’s how you handle it and learn from it.

How to Deal with Debt Without Being Embarrassed

- Find out: Learn about managing credit, interest rates, how to pay off debt, and how to combine debts. Fear goes away when you understand.

- Make a Plan: If you owe money, include paying it back in your overall financial plan.

- Change What You Say: Instead of saying, “I’m a failure because I’m in debt,” try saying, “I’m learning as I go along and taking care of my money.”

- Seek Professional Help: A financial advisor or debt counselor can give you good advice and help you look at your debt situation in a more positive light.

Changes in the Real World

For example, a small business owner who borrowed money to start her business. She didn’t see her debt as a sign that she had failed; instead, she saw it as an investment in her future. She not only paid off her debts, but she also built a successful business by being smart with her money and willing to learn. This story shows that being in debt doesn’t mean you’re a bad person. It’s just a normal step on the way to being financially stable.

You can handle your money better if you stop thinking that having debt means being irresponsible. Learning about and telling the difference between different kinds of debt can help you develop a mindset that is focused on solutions and strong. This way of thinking sees debt as something to work through instead of a sign of failure that will last forever.

Myth 5: “You can get rich quickly if you think the right way.”

In today’s fast-paced world, it’s easy to believe that a simple change in how you think can make you rich overnight, especially with all the success stories on social media. This “get rich quick” myth is especially bad because it makes people expect too much and pushes them to take shortcuts instead of doing the work.

The Truth About the Path to Getting Rich

- Long-Term Goals Are More Important Than Short-Term Gains:

- Money Takes Time: Most of the time, you have to work hard for decades to really build up your wealth. People don’t usually become successful overnight.

- Patience and willpower: To have a mindset that attracts wealth, you need to know that progress builds up over time. Over time, doing little things on a regular basis can lead to much bigger things.

- The Dangers of Wanting to Get Rich Fast:

- Choices that are dangerous: People may start high-risk businesses or scams that promise quick returns but often lose a lot of money because they want to get rich fast.

- Anger and Disappointment: People can get frustrated when quick fixes don’t work, which makes them keep thinking in the short term and not making long-term plans and sticking to them.

- No Order: When you only care about getting results right away, you forget about the disciplined, step-by-step ways that are the key to building lasting wealth.

A Fair Way to Make Your Money Grow

- Make a Strong Base: Over time, make sure to develop good money habits like saving, budgeting, and investing.

- Be Realistic About What You Want: Every small financial goal you reach is a victory. You don’t get rich all at once; you get rich by doing a lot of little things.

- Learn from What You Did Wrong: Instead of looking for the next “get rich quick” scheme, read success stories that talk about how hard work, learning, and making progress slowly over time led to success.

Exercises that will help you do well in the long run

- Plan what you want to do with your money in the long run: Set realistic goals that will take you a few years to reach as part of your plan. Break down big goals into smaller, manageable tasks.

- Check on how you’re doing: Look at your money situation often. To stay motivated, celebrate small wins and remember that making progress slowly and steadily is normal and good.

- Don’t give in to the need to get what you want right away: To be aware, keep in mind that it takes time to get rich. Instead of getting excited quickly, use affirmations that stress taking your time and doing things consistently.

By debunking the myth that you can get rich overnight, you can shift your focus to making steady, measured efforts that will lead to real financial success. If you want to build wealth that lasts, you need to be willing to work hard and keep going. This is a lot stronger than the promise of a quick fix.

Myth 6: “Money Can Make You Happy”

One of the most common myths about money is that it makes you happy. It’s true that having enough money can help you relax and give you more options, but saying that being rich will make you happy forever is too easy. After a certain point, having more money doesn’t usually make you happier in the same way that it does.

The hard-to-understand connection between money and happiness

- Money is a Tool, Not a Goal:

- Basic Needs vs. More: To meet basic needs and feel safe, you need money. But once those basic needs are met, having more money usually doesn’t make you any happier.

- Fulfillment from within vs. fulfillment from outside: Money can make you happy, but not for long if you don’t have other things that make you happy, like meaningful relationships, personal growth, and a sense of purpose.

- The Problems with Believing Money Equals Happiness:

- Satisfaction in the Short Term: Things you buy often make you happy for a little while. If you only think about how much money you have, the search for more money can make you unhappy all the time.

- Not paying attention to other parts of life: People who believe that money is the most important thing for happiness might not pay attention to things that will make them happy in the long run, like their health, their community, and their creativity.

Why Your Attitude Toward Fulfillment Matters More

- Use your money to buy experiences: Research shows that people tend to be happier for longer when they buy experiences instead of things.

- Increase your inner wealth: You don’t need money to make your life better. You can do this by working on your skills, making friends, and becoming a better person.

- Priorities that are in order: A healthy money mindset knows that money is a useful tool for making safety and chances, but real happiness often comes from things other than money.

Things to do to change how you see things

- Think about what makes you feel good: Think about the times in your life when you were the happiest and write about them. A lot of those times came from relationships, personal growth, or being creative, not just making money.

- Be kind: Put some of your money aside to help other people or do good things in your area. Being kind to others not only helps them, but it also reminds us that giving makes us happy.

- Find Values That Aren’t Material Again: You can improve your mental and emotional health by doing things like meditating, working out, or doing creative hobbies. These things often make people happier and more satisfied for longer than just making money.

You can change your mind about money by realizing that it is a tool and not the most important thing that makes you happy. You can have a balanced life with both good health and enough money if you stop believing the lie that money can make you happy.

Myth 7: “You Have to Stay Away from Risk at All Costs”

A lot of people who want to get rich are afraid of taking financial risks. A lot of people think that all risk is bad, which makes them too careful and stops them from growing in their lives and in their money. You should manage risk, but if you don’t take any risks at all, you might miss out on chances to make money.

Why it’s good to take risks in a balanced way

- Risk as a Way to Get New Ideas:

- Risks that have been considered: People who are good at investing and starting businesses know that in order to get big rewards, they have to take risks. It’s not being careless; it’s making plans.

- Changing and Learning: Taking risks and dealing with them is a good way to learn. Every risk you take, whether it pays off or not, helps you learn and grow as a person and as a business.

- The Risk of Being Too Careful:

- Missed Opportunities: You might miss out on good investments, promotions at work, or business opportunities that require you to leave your comfort zone if you want to avoid all risk.

- Slow Growth: You might not reach your full potential if you always think about the bad things that could happen. Fear can stop you from being creative and make you put off making decisions.

How to Take Risks Without Being Stupid

- Plan how to deal with risks: You need to gather information, think about the possible outcomes, and set limits on how much you can lose to figure out how risky something is. If you do your research and spread your money around, you can lower the risks.

- Small Steps, Big Gains: Start by taking small risks, like putting a little bit of your income into a new asset class, to boost your confidence. Over time, taking small risks can lead to bigger projects.

- Changes in how you think: Instead of saying “risk is bad,” say “risk is a chance to learn and grow.” Use phrases like “Every risk is a chance to learn more and improve my skills.”

Exercises that help you take risks in a healthy way

- Writing down your risks: Write down the risks you’ve taken, what happened, and what you learned from them. This exercise teaches you that taking risks can often lead to useful information, even if the results aren’t good right away.

- Getting ready for different situations: Think of possible risks and how you will deal with them. This exercise not only helps you get ready for surprises, but it also makes you feel more confident that you can handle them.

- Making connections and getting advice: Talk to people who are good at taking risks. If you think about it carefully, their advice can help you make plans and give you peace of mind that risk can be a good thing.

You can now be more flexible with how you grow your money because you don’t think you have to avoid all risk. A good strategy and smart decision-making, along with a healthy appetite for risk, can help you find opportunities that you would never see if you were just being careful.

Myth 8: “Only People with Degrees in Finance Know How to Handle Money”

A lot of people believe that only people who have studied finance in school can understand money issues. This myth can be very limiting because it makes a lot of people think they aren’t good enough to handle their money well. Anyone can learn about money, no matter what their level of education is.

Removing the barrier to education

- Money Is for Everyone:

- Learning that is simple to reach: There are a lot of ways to learn about money these days, like books, podcasts, online courses, seminars, and even YouTube channels.

- Experience in the real world: When you manage money in the real world, you have to try things, learn from your mistakes, and ask other people for help. These practical tips are often more helpful than just theories.

- The Myth of the “Expert”

- Different Ways of Looking at Things: Money is a big and complicated world. People from all walks of life can share useful ideas with each other. Many successful investors, business owners, and accountants learned most of what they know on their own.

- Taking Action to Give Power: Reading books about money and taking small, regular steps to learn can help you feel more sure of yourself and give you the tools you need to make smart money decisions.

How to Learn About Money Without Going to School

- Read a lot: Some classic books about money are “Rich Dad Poor Dad,” “The Richest Man in Babylon,” and “Your Money or Your Life.” They turn complicated ideas into clear, helpful advice that anyone can use.

- Agree to Learn Online: Some websites that have easy-to-understand courses on money management, investing, and economics are Coursera, Udemy, and Khan Academy.

- Join communities: Join online groups, local meetups, or discussion boards that are all about learning how to manage money. People can talk about what they know in these groups without worrying about being judged.

- Experiment and learn: Start with simulation tools or small investments. Managing your own money is one of the best ways to learn.

Things you can do to get better at managing your money

- Make a plan to learn: Set aside time each week to learn about a financial topic that interests you. Make short-term goals for yourself, like learning how to save money or the basics of investing.

- Keep a record of your journey: In a learning journal, write down the most important things you learn from books, articles, and classes. Think about how each lesson can help you reach your own money goals.

- Ask Questions: Don’t be afraid to get help from people who know more about money. When you’re learning, it’s important to ask questions, whether you’re with a mentor, a friend, or an online group.

If you stop thinking that only rich people know how to handle money, you can start a lifelong journey of learning and growing. You can learn how to understand and manage money by being curious, working hard, and using resources that are easy to find.

To sum up

The things we tell ourselves about money can have a big effect on our financial futures, and sometimes they can even limit them. By getting rid of these eight common myths, we can change our lives and build lasting wealth.

In short:

- Myth 1: You don’t need to be rich to have a wealth mindset; it all starts with how you think.

- Myth 2: To have a money mindset, you need to do more than just think positively. You also need to take action, be disciplined, and work on your emotions.

- Myth 3: Talking about money can help people learn and grow.

- Myth 4: Having debt doesn’t mean you’re irresponsible; knowing the details can help you handle your money better.

- Myth 5: You can’t get rich quickly; you have to work hard over time to build wealth.

- Myth 6: Money can help with stress, but a full life is what really makes you happy.

- Myth 7: Staying away from all risks limits your chances. Taking some risks is necessary for growth.

- Myth 8: Anyone can learn about money, no matter what their education level is.

If you let go of these limiting beliefs, you can make room for a new way of thinking about money that is informed, strong, action-oriented, and, most importantly, empowering. It’s time to question what you’ve been told, accept that you can always learn new things, and make plans to get out of debt. Think about what you’ve learned, question any old beliefs you have, and start making changes to your money life right now.

What to Do:

Think about which of these myths might be affecting the decisions you make. Ask them questions, replace them with beliefs that make you feel strong, and promise to keep learning. You need to change the way you think if you want to be successful with money in the future. Now do it.

Questions and Answers Area

1. How can I find out what false beliefs I have about money?

- Write it down and think about it: Spend some time writing about how you first learned about money. Find patterns or negative thoughts that keep coming up.

- Think About These Things: Do you believe that only rich people can manage money well? Or that it’s bad to talk about money? These questions that make you think can help you find myths that are hiding.

- Get Feedback: Get in touch with a financial coach, a friend, or a mentor who can help you see things in a new way.

2. Can changing how I think about money really change my finances?

- Yes, of course: Over time, your beliefs affect how you act and what you do. When you go from a place of lack and fear to one of abundance and strength, you are more likely to take advantage of opportunities, save money, and make smart investments.

- Attitude and Action: It’s not just about feeling better; when you think like someone who has smart money habits, you’ll naturally do things that make you richer.

3. What if my old beliefs keep me from moving forward?

- Accept and Move On: What happened in the past doesn’t mean that the future will be the same. The first thing you need to do is admit that you had limiting beliefs.

- Do Mindset Exercises: You can slowly change your old beliefs into ones that give you power by doing affirmations, meditating, and writing in a journal every day.

- Get Help from a Professional: You can get help moving forward by talking to a financial coach or therapist who works with people on their money mindset. They can give you advice and personalized exercises.

4. How do I start to change the way I think about money?

- Start with a small step: Pick one of the myths in this article and try to show that it is false. If you think that only wealthy people can become wealthy, make a list of people who made their own money and think about how their way of thinking helped them along the way.

- Be clear about your money goals: Be sure that what you do matches how you think now. A clear, doable plan makes your beliefs stronger.

- Find out: Read books, listen to podcasts, or take online courses to learn about your own money. When you know things, you feel more sure of yourself and can think positively about money.

5. Are there any exercises that can help you get rid of beliefs that hold you back?

- Keeping an affirmation journal: Every day, write down positive things that go against the negative things you think. Change “talking about money is bad” to “talking about money gives me power.”

- Changing the way you think: Don’t let any bad thoughts get the best of you. Write down proof that goes against the bad story.

- Mindfulness Tasks: Meditation and mindfulness can help you notice and change negative thoughts right away. This will help you make your new, good beliefs stronger.

- Images: Take a few minutes every day to picture yourself being able to handle your money well. Imagine how great it would be to be able to talk about money without worrying about what other people think and reach your financial goals.

You can slowly get rid of the limiting myths that have been holding you back and replace them with a proactive, empowered money mindset by doing these exercises and finding groups or mentors who can help you.

Today is the day to start changing the way you think about money. Get rid of old beliefs that hold you back, and learn the skills and information you need to truly succeed with money. You are the one who controls your financial future. Start rewriting your story right away to see how changing your thoughts can bring you wealth, confidence, and long-term success.