When used wisely, credit cards can be great financial tools. They make it easy to pay bills, give you rewards, and let you choose how you want to pay. But if you use credit cards too much, they can quickly turn into a double-edged sword. If you rely too much on credit, you could end up with a lot of debt, high interest rates, lower credit scores, and always being stressed about money. To get your finances back on track, you need to be able to spot the early warning signs of credit card overuse. This guide is written with care and understanding to help you spot signs of overspending and give you useful tips on how to keep your finances healthy.

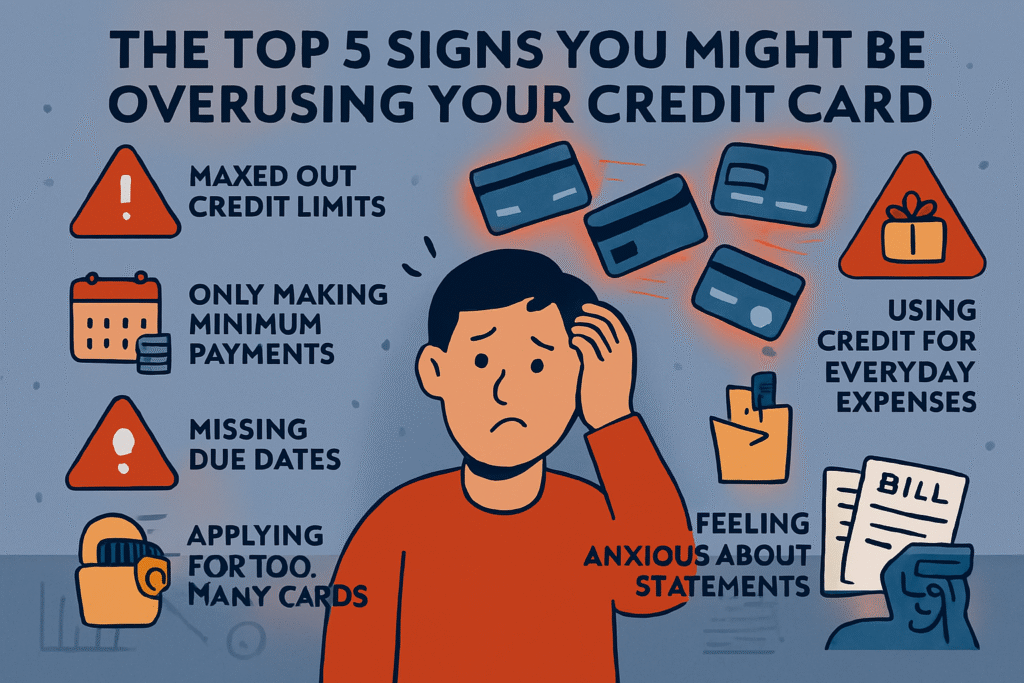

This article will talk about the top five signs that you might be using your credit card too much and give you useful tips on how to deal with and eventually break these habits. We’ll talk about how having higher balances, making minimum payments often, using credit cards for everyday expenses, maxing out your limits, and not keeping important financial documents can all be signs that you might be overusing them. Along the way, you’ll learn how to spot common signs of credit card debt and how to stop using credit cards too much before things get out of hand.

Self-awareness is the first step on the road to financial control. This article will give you a complete plan for how to deal with credit card spending problems, whether you’re already having them or just looking for ways to change your habits. We’ll go over each sign in detail, talk about how they relate to everyday situations, and give you expert advice on how to deal with these problems directly. By the end of this read, you’ll be better equipped to manage your credit card debt and build a more secure financial future. Let’s look at the top five signs:

- Raising your credit card balances every month

- Frequently Paying Only the Minimum Payment

- Using credit cards to buy things every day

- Regularly reaching or getting close to your credit limit

- Avoiding Looking at Your Credit Card Statements or Ignoring Bills

Let’s look at each of these signs in more detail so you can figure out how to cut back on your credit card use and make smart plans to do so.

Sign #1: Your credit card balances are going up every month.

One of the most obvious signs that you’re using your credit card too much is that your balances keep going up every month. Even though the increases may seem small at first, they can quickly add up to a scary amount that is harder and harder to handle. If your credit card balances keep going up, it could mean that you’re spending more than you’re making or that you’re using borrowing as a way to pay.

Getting to Know the Warning Sign

- What It Means: If you notice that your balance is going up all the time, it’s a clear sign that your spending or liquidity isn’t in line with your income. This isn’t just a one-time mistake; it’s a habit that builds up and can lead to a lot of debt.

- The Risk of Increasing Balances:

- Building up interest: The interest you have to pay on the amount you owe goes up as your balance goes up. Even with low interest rates, a high balance can lead to high interest fees over time.

- Getting into debt: An ever-growing balance can create an unsustainable debt cycle, where even making the minimum payment keeps you in debt for years.

- Effect on Credit Score: A higher credit utilization ratio means that you are using more of your credit, which hurts your credit score. This can make your financial problems worse because it makes it harder or more expensive to get loans in the future.

Example from the real world

Think about Jane, who at first only used her credit card for things she needed. But over time, small luxury purchases started to add up. Over the course of a few months, what started as a $150 increase turned into a balance of $1,200. The balance grew every month, not just because of the purchases, but also because of the interest that was added. At first, Jane thought she could handle the debt, but it started to get in the way of her saving and investing. Jane later had trouble paying off the big monthly increase that came from small daily overspends, like an extra coffee or an impulsive online order.

Ending the Cycle

If you see your balances going up, here are some ways to get them back under control:

- Review and change your budget:

- Keep an eye on your spending: To begin, look at how much you spend each month. Use budgeting apps like Mint or YNAB (You Need A Budget) or even a simple spreadsheet to keep track of all your purchases. Seeing a clear breakdown of your expenditures can be a wake-up call.

- Cut costs that aren’t necessary: Find out which costs are not necessary. It could be daily lattes, subscription services you don’t use, or shopping online on a whim. Once you know what they are, work on cutting back on these costs.

- Set Limits on Spending: Make a strict budget for things you don’t have to buy. For instance, set a monthly budget for eating out or having fun and stick to it no matter what.

- Checking your balance regularly: Make it a habit to check your credit card balance weekly or even daily. By being constantly aware of your debt, you can make more informed decisions about additional spending.

- Adopt a Cash-First Approach: When you have extra money to spend, think about using cash instead of your credit card. This can help limit your expenses, as it’s easier to track what you’re spending when you physically see the money leave your wallet.

- Get Professional Help: If your debt seems overwhelming, don’t hesitate to consult a financial advisor or credit counseling service. Sometimes you need to get help from a professional to make a debt management plan that works for you.

Useful Advice

- Create Visual Aids: Create charts to keep track of how your balance grows over time. Seeing things in pictures can help you stop spending money you don’t need to.

- Make Goals for Each Month: Set a specific goal for how much you want to lower your balance each month. Even a small cut can help you get started and lessen the effects of interest.

- Set up automatic alerts: A lot of banks will send you alerts when your balance goes over a certain amount. Use these alerts to help you stick to your budget.

The first step to turning things around is to notice that your balance is slowly going up. You can start coming up with ways to break the cycle before the debt gets out of hand if you can spot this sign early. A steady rise in your credit card balance is a warning sign that you should pay attention to right away, not ignore it. Taking action not only keeps your finances healthy, but it also gives you the power to change how you spend money.

Sign #2: Paying the minimum amount often

If you always pay only the minimum due on your credit cards, that’s another sign that you’re using them too much. This may seem like a good way to keep up with your monthly bills, but it often leads to a dangerous cycle of debt that gets worse over time because of the interest that builds up.

Why Minimum Payments Are a Warning Sign

- Little Effect on Principal: When you only pay the minimum, a lot of your monthly payment goes toward interest instead of lowering the principal. Because of this, the real debt stays high and the interest keeps adding up.

- Longer time to pay back: By paying just the minimum, you’re essentially elongating the repayment period, sometimes for years or even decades. What could have been a two-year journey to get out of debt can turn into a never-ending battle.

- Rising Interest Rates: Your card’s balance doesn’t go down because the principal doesn’t go down by much. In the end, this could mean that even if you make the minimum payments every month, your balance doesn’t go down much.

- Trap for the mind: Paying only the minimum every month can make you feel safer than you really are. You may think you’re in control of your debt, but you’re really just putting off the inevitable buildup of a lot of interest and debt.

The Minimum Payment Trap in the Real World

Think about Michael, who has a credit card balance of $4,000 and an average interest rate of 18%. If he only pays the minimum amount each month, which could be around 2% to 3% of the balance, he might end up paying almost all of that payment in interest. The debt doesn’t go away, and Michael finds that a large part of the original amount is still there after years of making payments. Not only does this situation give him more debt overall, but it also lowers his credit score because he is using a lot of credit.

How to Start Paying More Than the Minimum

The first step in changing your strategy is to realize that paying only the minimum is not a long-term solution. Here are some useful tips:

- Look over your budget again:

- Track All Expenses: Use apps like Mint or YNAB to keep a close eye on your spending. This will help you find places where you can save money and use that money to pay off your credit card debt.

- Set aside extra payments: Promise to pay a set amount each month that is more than the minimum. Even an extra $50 to $100 can make a significant difference over time.

- Set up automatic payments: Set up automatic payments for more than the minimum amount. This reduces the risk of forgetting or being tempted to pay the bare minimum.

- Payment Plans That Are Right for You: You might want to try the “debt avalanche” or “debt snowball” methods. The debt avalanche method focuses on paying off debts with the highest interest rates first, which saves you money in the long run. The debt snowball method, on the other hand, builds psychological momentum by quickly getting rid of smaller balances.

- Be smart with windfalls: Any time you get extra money, like a tax refund, a bonus, or an unexpected income, put it straight toward your credit card balance. This speeds up the process of paying off a lot.

Getting past the mental block

It’s normal to feel stressed or guilty when you have a lot of credit card debt. Paying only the minimum might seem like a quick fix, but it’s important to deal with the real problem: the habit of spending too much or not budgeting well. If you deal with these underlying issues, you will eventually gain the confidence and self-control to make bigger payments on time.

Helpful tips for making the switch to higher payments

- Make your goals clear: Define your financial goals clearly. Having a clear goal, like getting out of debt by a certain date or raising your credit score, can make you want to pay more than the minimum.

- Keep an eye on your progress: Keep a record of how much your debt has gone down. Charts, graphs, and regular check-ins can reinforce your progress and help you stay motivated.

- Help with money: If you can’t seem to get out of the cycle of making only the minimum payments, you might want to talk to a financial counselor. Professional advice can help you come up with a plan to restructure your debt and give you ideas on how to do it.

The main point is that minimum payments might help you avoid late fees, but they are a clear sign that you are using too much. It’s important to see this sign and take steps to increase your payments. This will help you pay off your debt more quickly and use your credit card as a financial tool to its fullest. It’s time to take charge of how much you spend on your credit cards.

Sign #3: Using credit cards to pay for things every day

If you find yourself relying on your credit card more and more for everyday expenses, this could be a sign that you’re using it too much. Credit cards are convenient and safe, but if you use them for every purchase, you might develop bad spending habits and not be able to manage your money well.

The Problem with Paying for Things with Credit Cards

- Dependency that has grown over time: It’s easy to forget how much you’ve spent when you use your credit card for everything, from groceries and gas to little things you buy on a whim. This habit can hide overspending because credit card statements don’t always show how quickly money is leaving your account.

- Problems with budgeting: If you use credit to pay for things every day, you might not have the self-control to stick to a monthly budget. Seeing a high credit card balance regularly can be discouraging, and it might even lead to a cycle where you feel you have no choice but to credit all expenses—even non-essential ones.

- Missed chances to save: If you only use credit cards for everyday purchases, you might miss out on budgeting tools like the envelope method or carrying cash, which help you spend less by limiting your options.

- Interest Risk: You are more likely to get compounding interest if you can’t pay off your balance in full because you use it every day. Even if you are careful with your money, using credit to pay for basic needs can put your monthly balance in a risky place.

Recognizing the Signs of Overdependence

- Spending money regularly without being watched: Do you often see a small charge on your statement that you didn’t expect? Using credit every day could cause hidden costs to add up without you knowing.

- Hard to Stick to a Budget: If you try to stick to a budget but keep going over your estimates because of all the little things you buy, you might be too reliant on your credit card.

- Stress and worry about money: If you feel anxious every time you look at your credit card statement or are always afraid of spending too much, it could mean that your daily purchases have become a crutch instead of a convenience.

How to Make a Budget That Works for You

- Use a mix of methods: Use cash or a debit card for everyday purchases, and save your credit card for planned purchases or emergencies. This separation in space can help you keep better track of your spending.

- Set Limits Every Day or Week: Define specific spending limits for non-essential items. Apps that keep track of your spending can let you know when you get close to these limits.

- Review and Adjust Your Budget: Look over your transactions often to find patterns. Learn to tell the difference between needs and wants and find places where you can cut back.

- Spend Mindfully: Before you swipe your card to buy something, stop and think about whether you really need it. These mindful spending habits can help you use your credit card less over time.

Example from real life

Consider Lisa, who used her credit card for nearly every purchase—morning coffee, lunch, groceries, and even small treats. Although she enjoyed the convenience, Lisa often found herself stressed each month by an unexpectedly high statement balance. When she transitioned to using cash for daily expenses and reserved her card for larger purchases, she not only reduced her overall balance but also regained a clearer sense of her financial priorities. Counting out cash by hand made her more aware of how she spent her money, which helped her use less credit and make better budgets overall.

Useful Suggestions

- Keep a daily spending journal: Keep track of everything you buy and see if it helps you reach your financial goals. Over time, this can help you figure out where you’re spending too much.

- Use apps to help you budget: PocketGuard and Goodbudget are two examples of tools that can help you keep track of your spending in real time and let you know when you’re getting close to your set limits.

- Learn about how to handle cash: Find out about envelope budgeting or other ways to manage your money. Try out these methods to find a balance that keeps credit easy to use without letting it dictate how you spend your money.

If you rely too much on your credit card for everyday purchases, it’s a clear sign that you might be overusing it. Recognizing this early can help you pivot to more balanced spending habits, reducing the risk of ballooning debt and ensuring financial stability. The most important thing is to know the difference between convenience and dependency and to develop habits that encourage conscious, mindful spending.

Sign #4: Maxing Out or Near-Maxing Your Credit Limit Regularly

If you keep getting close to your credit limit—or worse, maxing it out—it’s a sign that you might be using your credit card too much. This behavior not only shows that you rely too much on credit, but it also hurts your credit utilization ratio, which is an important part of your credit score.

The Risks of Using Too Much Credit

- What Does Credit Utilization Mean? Your credit utilization ratio is the percentage of your available credit that you’re currently using. Financial experts recommend keeping this ratio below 30%. When you often reach your credit limit or come close to it, your utilization rate goes up, which tells lenders that you might be spending too much money.

- What it does to your credit score: High utilization is a major red flag for creditors and can significantly lower your credit score. Even if you pay your bills on time, having a high balance compared to your credit limit means that you rely too much on credit, which could make it harder for you to get good loan terms in the future.

- Stress about money: If you always spend close to your credit limit, you’ll be in a cycle of financial stress. If you are always close to maxing out your credit card, even small, unexpected costs can push you over the edge, which will cost you more in fees and interest.

How to Spot the Warning Signs in Your Statements

- Regular Alerts: A lot of banks and credit card companies will now send you alerts when you’re close to your credit limit. Ignoring or repeatedly hitting those alerts should be a clear sign that your spending habits need to be re-evaluated.

- Keeping an eye on your balance: If you often find yourself shocked by a balance that’s dangerously close to your credit limit, it’s time to take a hard look at how you spend your money. Look for patterns where your discretionary spending is making you reach your limit.

Ways to Lower Usage

- Set limits on how much you can spend: Even if your credit limit is high, consider setting a personal cap—for example, not exceeding 50% of your available credit. This limit you set for yourself will help keep your credit utilization ratio healthy.

- Pay Often: You might want to make payments throughout the month instead of waiting for your monthly statement. This keeps lowering your outstanding balance, which keeps your utilization rate low.

- Avoid Impulsive Spending: If you see yourself nearing your credit limit regularly, use this as an opportunity to analyze which expenses are non-essential and learn to curb impulsive purchases.

- Think about raising your credit limit: In some cases, if you consistently meet your credit obligations and maintain a good credit score, it might be worth requesting a credit limit increase. A higher limit can lower your utilization ratio, but be careful—this is only good if it doesn’t make you spend more.

- Use Alternative Funding: Instead of just using your credit card, think about using a savings account or a personal loan with a lower interest rate for big, planned purchases.

Example from real life

Think of Tom, who always had a credit card balance that was close to its limit. Even though he made the minimum payments on time, his high credit utilization hurt his credit score and limited his financial options. Tom came up with a plan to keep a closer eye on his spending after noticing this pattern. He paid every two weeks and set up alerts to let him know when his balance reached 50% of his limit. Tom was able to lower his utilization ratio in just a few months. This led to a better credit score and a big drop in monthly interest charges.

Helpful Advice

- Use digital tools: Use online banking apps to keep an eye on your current balance in real time. You can set alerts and see how your spending is changing with many apps.

- Check Your Spending: Look over your transactions on a regular basis to find areas where you can cut back on non-essential spending that is causing your utilization to rise.

- Keep a buffer: Try to keep some extra credit available so that you can pay for unexpected costs without going over your credit limit.

By keeping an eye on how much credit you use, you show that you are using credit responsibly and protect yourself from unexpected money problems. One of the best ways to avoid using too much credit, which can lead to long-term debt and damage to your credit score, is to keep your spending within your credit limit.

Sign #5: Not looking at your credit card statements or bills

When someone avoids using their credit card too much, that’s often the best sign that they are overusing it. A lot of people will put off looking at their monthly statements or even paying their bills when they have high balances or are stressed out about spending too much. This behavior, while it may feel like a temporary escape, can lead to missed fees, late payments, and even unnoticed fraudulent activities.

The emotional and behavioral parts

- Emotional Avoidance: When people see a big credit card bill, it can be scary, and some people choose to ignore it instead of facing the truth about how much they spend. This emotional avoidance often comes from a place of shame or anxiety and can signal deeper issues with money management.

- Denial and Escalation: Ignoring what you say doesn’t solve the problem; it makes it worse. If you don’t check in on things regularly, you might miss mistakes, and even small fees can add up to big debts.

- Delayed Reactions: If you don’t check your statements, you might not be able to take important steps, like disputing a charge or finding a billing mistake, which could end up costing you more money.

What could happen if you don’t pay attention to your financial statements

- Missed Fees and Charges: Fees that you don’t know about, like late payment fees, over-limit fees, or even fake charges, can add up quickly and make your financial situation worse.

- Lack of Accountability: If you don’t look at your spending habits regularly, you forget what they are. This lack of accountability makes it easier to justify continued overspending.

- Effect on Credit Score: If you don’t pay your bills on time, your credit score will go down, making it harder to get good terms in the future.

How to Get Past Denial and Make Better Choices

- Set up regular reviews of your statements: Take some time each month to carefully go over your credit card statements. Think of this as an appointment you can’t miss for your financial health.

- Use technology wisely: A lot of banking apps will send you a message when a new statement is ready or when they see something strange happening. Use these alerts to prompt regular reviews.

- Hold Yourself Accountable to Break the Habit: Talk to a friend or family member you trust about your money goals. Talking to someone about how you’re doing with your money can help you stay interested in it.

- Seek Professional Support: If the idea of dealing with your bills makes you very anxious, you might want to talk to a financial counselor. They can give you tips on how to make the process less stressful and easier to handle.

Helpful Tips for Managing Statements

- Set reminders in your calendar: Mark the arrival of your statements on your calendar and dedicate at least 30 minutes to review each month.

- Make a list: Make a list of the most important things to check, like your total balance, interest charges, fees, and any transactions you don’t know about. Check this list to make sure you don’t miss anything.

- Make a schedule: Add reviewing your statements to your monthly budgeting routine so you can keep track of your progress and change your spending as needed.

It’s important to understand that ignoring your statements could mean you’re using them too much. By facing the truth about your finances, you can learn to spend more wisely and avoid the problems that come with rising debt and bad credit. Overcoming this avoidance is not just about financial discipline—it’s about reclaiming control over your financial narrative.

Bonus Section: What to Do if You See These Signs

If you’ve noticed one or more of these warning signs in your credit card usage, it’s important to take immediate action to get back on track. Here are some things you can do to get back in charge:

- Make a Plan to Pay Back: Make a list of all your debts and come up with a plan that you can actually follow to pay them off. This could mean moving money around in your budget or paying off debts with higher interest rates first.

- Seek Professional Credit Counseling: Consider speaking with a certified credit counselor who can help you understand your options and possibly enroll you in a debt management program.

- Use tools for budgeting: Use personal finance apps, notifications, and alerts to track your spending. Set strict limits on how much you can spend and check your transactions often to make sure you don’t go over them.

- Talk about or combine your debt: If you can’t handle your debt, talk to your lender about getting better terms or think about combining all of your debts into one loan with a lower interest rate.

- Change the way you spend money: Separate your needs from your wants to get a better idea of how much you spend. Make a habit of being careful with your money so you don’t spend too much in the future.

- Set up an emergency fund: Build a buffer that allows you to cover unexpected expenses without resorting to credit cards. This can help you borrow less money.

Keep in mind that the first step toward positive change is to notice these signs. It’s never too late to take control of your finances and build healthier credit habits.

In conclusion

Credit cards are great financial tools, but if you use them too much, their benefits can quickly fade. You shouldn’t ignore the signs that you’re using your credit card too much, like higher balances and minimum payments, relying on credit for everyday expenses, maxing out your card, and not looking at your statements. If you see these warning signs early, you can do something about them before they turn into too much debt and damage to your credit.

You can take back control of your money habits by recognizing and dealing with these warning signs. Making a budget, keeping track of your expenses on a regular basis, making payments that are higher than the minimum, and getting professional advice when you need it are all important steps toward a better financial future. Keep in mind that getting out of credit card debt is a slow process. Every small, thoughtful change can make a big difference in your financial health.

Take a few minutes today to think about how you spend your money, how you use your credit cards, and if you see any of these signs in your daily life. You can stop overusing your money, get your confidence back, and build a strong base for long-term financial success by being aware and taking action. You can change your credit card from a potential liability to a valuable asset that works for you instead of against you.

Section with Frequently Asked Questions

Question 1: How can I tell if I’m using my credit card too much? A: Look for signs like balances that keep going up, only paying the minimum payment, using your credit card for everyday expenses, getting close to or reaching your credit limit often, and not opening your monthly statements. These are common signs that you are using your credit card too much, and they can cause long-term money problems.

Q2: What should I do if I can’t pay my credit card bills? A: If you can’t make your monthly payments, you might want to change your budget, cut back on unnecessary expenses, and put paying off your debt first. You might also want to get professional financial advice, which can help you talk to your creditors or make a plan for paying off your debts.

Q3: Can using a credit card too much hurt my credit score? A: Yes, for sure. Having a lot of credit card debt, relying on minimum payments a lot, and going over your credit limit can all hurt your credit utilization ratio and credit score. This can make it harder to get good terms on loans or more credit in the future.

Q4: How can I stop using my credit card too much? A: To begin, keep track of your spending with budgeting apps or spreadsheets and set clear limits on how much you can spend. To be more aware of your spending, ask yourself if each purchase is really necessary. You might also want to use cash or a debit card for everyday expenses. Setting financial goals and giving yourself a reward when you reach them can also help you stop spending too much.

Q5: When Should You Get Professional Help? A: If you find that your credit card debt is unmanageable, or if overuse is causing you severe financial stress, it might be time to consult a financial advisor or credit counselor. Professional help can give you personalized plans, options for consolidating your debt, and information that can help you take charge of your money again.

Last Thoughts

The first and most important step toward financial stability is to learn how to spot the signs of too much credit card use. You can take charge of your spending habits by recognizing the warning signs, such as rising balances, always paying the minimum, using your credit for everyday purchases, reaching your credit limit, or ignoring your statements. Remember, every positive change, no matter how small, is a step toward a healthier financial future. Start your journey today by looking at your current habits, finding the warning signs, and putting into action the steps and strategies we’ve talked about here.

Know that you are not alone in this fight; many people have faced these problems and successfully changed their financial situations. You can manage your credit card use well, keep your credit healthy, and build a secure financial future if you are dedicated, disciplined, and do some planning ahead of time. Do something right now, and let what you’ve learned lead you to a life of financial freedom and confidence.

Have fun with your budget and make the most of your money!