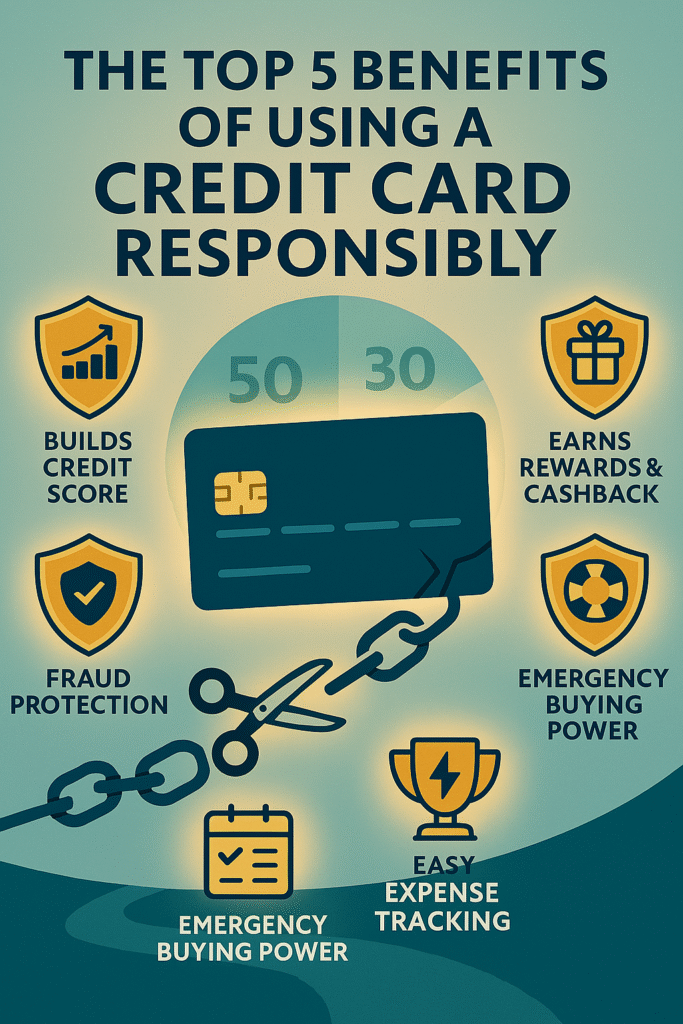

People have always had mixed feelings about using credit cards. Some people think of them as a way to get into debt, while others think of them as a useful tool. Credit cards can be very useful tools that help your finances instead of hurting them if you use them wisely. We’ll talk about how using a credit card responsibly can help you in many ways in this article. For example, it can help you get rewards, improve your credit score, make your account safer, give you access to money in an emergency, and help you learn how to budget better. This full guide will give you honest advice, real-life examples, and steps you can take to make sure you get the most out of using a credit card responsibly, whether you’re new to credit or want to use it more responsibly.

These days, credit cards are more than just plastic debt. They are well-designed financial tools that can help you get a better credit score and give you benefits that cash or debit cards can’t. You can build a good financial reputation if you use credit cards wisely, which means paying off your balances in full, keeping track of your spending, and not taking on debt that you don’t need. Not only do you get better loan rates and mortgage approvals with this good reputation, but you also get a lot of perks that make spending money more fun.

This article will give you the top five reasons to use your credit card wisely. We’ll talk about what responsible use really means, show you how to get the most rewards, and give you practical advice that goes beyond theory. If you’re new to credit or have been worried about the risks it poses, learning about these benefits can help you change how you feel about it. If you use them correctly, credit cards can help you handle financial emergencies and learn how to manage your money better and be more disciplined with your finances.

When you finish reading this article, you’ll know exactly how to use credit cards to your advantage. You’ll be able to turn them from possible problems into powerful tools that can help you get your finances in better shape. Let’s start this look at the benefits of using a credit card responsibly and see how the right mindset and strategies can make your credit card one of your most important financial tools.

What does it mean to “use a credit card wisely”?

Before we talk about the many benefits of using a credit card responsibly, we need to first explain what responsible use means. To use a credit card wisely, you need to keep your debt low and make payments that help your credit score instead of hurting it. This means that you should always pay off your balance in full each month. If you can’t do that one month, you should at least make the minimum payment on time. You should also pay attention to how much money you’re spending in general.

Things to Keep in Mind When Using a Credit Card:

- Pay on time: Paying off your balance on time every month (or at least the minimum amount) helps keep your credit score high and keeps you from having to pay late fees.

- Full Payment: Paying off your full statement balance as soon as you can will help you avoid interest charges and get benefits without having to pay more.

- Watching what you spend: Using online banking or budgeting apps to keep a close eye on your transactions can help you stick to a reasonable spending plan.

- Staying within credit limits: Responsible users don’t usually use all of their credit cards and try to keep their credit utilization ratio (the amount of credit they have available that they are using) below 30%.

- Not buying things on a whim: It’s very important to plan ahead and be disciplined. People who are responsible don’t buy things on credit without thinking about it first. They only buy things they can pay for.

People who misuse credit cards, on the other hand, often only make the minimum payments, spend too much, ignore their monthly statements, and use the card as cash without a clear plan for paying it back. This kind of behavior can cause you to get too much debt and pay too much interest.

The two most important ideas behind using credit cards responsibly are self-control and planning for the future. Don’t think of credit as “free money.” Instead, think of it as a promise to pay back. This will help make sure that every swipe is part of a bigger plan that is good for you. This strict way of doing things not only keeps you from going into debt, but it also gives you access to a lot of financial benefits.

We will talk about the specific benefits of acting this way in the next parts. Responsible use of a credit card can help you improve your credit score and earn travel miles, but only if you are careful with how you spend your money.

The first benefit is that you can raise and improve your credit score.

One of the best things about using credit cards wisely is that it can help your credit score. Your credit score is more than just a number. It’s a financial passport that opens doors to good loans, low interest rates, and other money-making chances in the future.

How credit cards can improve your credit score

There are a lot of things that credit scoring models like FICO and VantageScore look at, but your credit card use is the most important. Take a closer look:

- Your payment history (35% of your score): Paying your bills on time is one of the most important things about your credit profile. Every time you pay on time or early, you build a good history that shows lenders they can trust you. On the other hand, late payments can stay on your credit report for a long time and take years to go away.

- Credit Utilization (30% of your score): To get this number, divide your current balance by the amount of credit you have. Responsible credit card users keep their usage rate low, ideally below 30%. If your ratio is low, it means you’re not using your credit too much, which means you can handle it well.

- Length of Credit History (15% of your score): Your credit report will look better the longer you keep it in good shape. Keeping your accounts open and in good standing for a long time makes the average age of your credit accounts higher.

- Credit Mix (10% of your score): If you have a good mix of different types of credit, like credit cards and loans, it shows that you can handle more than one account. A big part of diversifying your credit mix is using credit cards.

- New Credit (10% of your score): Your score might go down a little bit every time you apply for new credit. But over time, using credit responsibly can lessen these small effects.

Things You Can Do to Improve Your Credit Score

- Always paying on time: Imagine Sarah, who only uses her credit card to buy things she needs every day. She avoids paying interest and builds a good payment history by paying off her balance in full every month. Sarah’s credit score is going up over time, which shows that she is disciplined. This makes her a good candidate for loans with lower interest rates in the future.

- Keeping your balance low compared to your credit limit: For example, John has a credit card with a $5,000 limit, but he usually doesn’t spend more than $1,000 on it. Lenders can see that he knows how to handle credit by how he uses it. John sometimes spends more, but his habit of paying off the balance quickly helps keep his utilization ratio low.

- Buying small things with credit that you can handle: A lot of people who are good with money use their credit cards for small, everyday expenses instead of big, long-term ones. This method makes it easy to make monthly payments and makes sure that you get the full benefit of paying on time.

How Having a Good Credit Score Affects More Than Just You

A good credit score is more than just your credit card. It affects almost every part of your money life:

- Approvals for loans and mortgages: If you want to get a loan or a mortgage, having a good credit score gives you more power to negotiate. Lenders are more likely to give you lower interest rates, which will make your long-term financial burden easier to bear.

- Insurance costs: A lot of insurance companies use credit scores to figure out how much to charge for premiums. Your home, car, or other types of insurance may cost less each month if you have a higher score.

- Applications for Rent: Landlords often check the credit histories of people who want to rent from them to see how risky they are. If you have a good credit score, you may be more likely to be able to rent a place.

- Job openings: In some fields, employers look at credit before hiring someone. Even though not everyone does it, having a good credit history can help you get a job in fields where there are a lot of applicants.

How to Keep an Eye on Your Credit Score and Raise It

- Look at your credit report often: Use free online tools to check your credit report at least once a year for errors or changes. Many experts say that if you are actively managing your credit, you should check it more often.

- Set Up Alerts for Payments: Most banks and credit card companies have systems that send you reminders about due dates. These reminders can help you make sure you always pay on time.

- Set up payments to happen automatically: You might want to set up automatic payments for either the full balance or the minimum amount due. Automation makes it less likely that you’ll make mistakes and helps you keep track of your payments.

- Keep old accounts open: It’s important to know how long people will live. Don’t close credit card accounts just because you don’t use them. Instead, use them from time to time to keep the account open. This will help keep your credit score high.

You can make your credit card a key part of your financial security by learning and using these tips. You can improve and build your credit score by using your credit card responsibly. A high score opens up a lot of doors in your financial life, giving you the confidence and peace of mind to deal with future money problems.

Benefit #2: You can get cash back and rewards.

Using your credit card responsibly is a good idea because you can earn rewards. These days, a lot of credit cards give you rewards, cash back, or points that you can use to buy things, travel, or even pay off your balance. The point of these programs is to reward you for spending your money wisely and paying off your balance on time.

A Look at Some Popular Rewards Programs

- Money back: If you have a credit card with a cashback program, you can get money back on a certain percentage of your purchases. You would get $20 back if you spent $1,000 in a month with a card that gives you 2% back on purchases.

- Points: Some cards give you points for every purchase. You can use these points to buy things like travel, gift cards, or other items. Sometimes, rewards that are based on points come with special offers or ways to get more points.

- Miles for travel: You can use travel rewards cards to earn miles that you can use to book hotels, flights, or car rentals. Most of the time, these cards come with extra travel perks like access to lounges, travel insurance, and no fees for transactions made in other countries.

Picking the Right Card Based on How You Use It

Choosing the right rewards program is a key part of making the most of credit card perks:

- Check out how you spend your money: Find out where you spend the most time. If you eat out a lot, a card that gives you extra points or cash back on restaurant purchases would be useful. People who travel a lot should get cards that give them a lot of travel miles and other perks.

- Check out the rewards and annual fees: Some rewards cards cost money every year. You can see if the benefits are worth the costs by comparing the possible rewards to the fee. If you get the most out of the rewards, the fee is usually worth it.

- Search for sign-up bonuses: If you spend a certain amount in the first few months, a lot of cards will give you nice bonuses for signing up. You can get more benefits faster with these bonuses because they help you build up your rewards balance faster.

Getting the most rewards without going too far

You shouldn’t let the chance to earn points or cash back make you spend too much, even though it’s easy to get carried away with rewards. You can do these things:

- Spending Based on Your Budget: Instead of buying things on the spur of the moment, use your credit card to buy things you have planned and budgeted for. Even if it gives you rewards, you shouldn’t put anything on your card that you can’t afford.

- Pay Off Your Balance in Full: The best thing about rewards is that they help you not have to pay interest. If you have a balance, you might lose any rewards you earn because of interest fees. You should always try to pay off the whole amount on your bill.

- Watch out for when rewards run out: Keep track of your rewards points or miles so you can use them before they run out. Many reward programs have strict deadlines for when you can use your points.

Rewards that work in the real world

- Improvements for your trip: Amy uses her rewards card to buy things she needs every day. She gets travel miles every month when she pays off her balance. She can use these miles to make her next vacation even better. She saved money on flights and got other perks, like access to lounges during long layovers, by smartly using a travel rewards card.

- Credits for statements: John is good with money because he puts his regular grocery, gas, and dining expenses on a credit card that gives him cash back. He earned enough cashback over the course of the year to use it as a statement credit to pay for other things, like utility bills.

- Gifts and Special Occasions: Laura’s credit card rewards have helped her buy nice gifts for her friends and family without having to dip into her savings. She can make her life better without spending more money by using her rewards wisely.

Be careful about going after rewards without thinking.

People will do things for rewards, but you have to be careful not to spend too much just to get points or cash back. To use a credit card wisely, you need to find a balance between wanting rewards and needing to be responsible with your money. The best way to use rewards is to combine them with a budgeting system that puts long-term financial stability ahead of short-term benefits.

You can get the most out of your rewards cards and get real benefits from your everyday purchases by picking the ones that fit your spending habits and lifestyle. With discipline and careful planning, rewards programs can be more than just a nice extra; they can also be a powerful way to improve your financial health.

Benefit #3: Purchases are safer and more secure.

It’s more important than ever to keep your money safe and secure in the digital age we live in now. One of the best things about credit cards is that they protect your purchases better than cash and debit cards.

The main security benefits of credit cards

- Protection from fraud: Most credit cards have good fraud protection policies that limit how much you have to pay if someone else uses your card without your permission. You usually don’t have to pay for any fake charges if someone steals your card information, but you do have to pay a small, often symbolic amount.

- Settling Arguments: When you have problems with a purchase, like when a product is broken or services aren’t delivered, credit cards make it easy to settle disputes. This means you can argue about transactions that seem wrong and maybe get your money back if the argument goes your way.

- Protections for purchases and longer warranties: Many credit cards automatically add to the manufacturer’s warranty on things you buy. Some stores also have return protection policies that let you get your money back even if the store’s policy on returns isn’t good enough.

- Travel and emergency insurance: Some high-end credit cards come with full travel insurance that covers things like lost luggage, canceled trips, and damage to rental cars. When things go wrong on your trips, this extra level of safety can be very helpful.

There are a lot of reasons why credit cards are safer than cash or debit cards.

- Transactions that happen online and don’t involve talking to someone: Credit cards are safer for online purchases because they have more advanced security features, such as encryption and tokenization. Digital credit card transactions leave a trail that can be tracked and disputed if necessary. This is not true for cash.

- Policies that don’t hold you responsible: If you commit fraud, most credit card companies have a “zero liability” policy. This means that your losses are small and the company works hard to fix the problem.

- Protection against identity theft: A lot of credit cards have programs that protect against identity theft and look for possible fraud. You can find strange transactions early on with early detection strategies so you can act quickly before any real harm is done.

How to Keep Your Credit Cards Safe

- Look at your account often: Use mobile apps and online banking to check your credit card statements often. Tell your card issuer right away if you see any charges on your card that look strange or weren’t approved.

- Make sure your passwords are strong and different: Your online security will be better if you use strong, unique passwords for your money accounts. Don’t use personal information that people can easily figure out.

- Activate Two-Factor Authentication (2FA): You should turn on two-factor authentication for your online accounts whenever you can. It adds an extra layer of security.

- Don’t let anyone know what your card information is: Be careful about when and where you give out your credit card information, whether it’s online or in person. Keep the security software on your devices up to date.

Fraud Protection Stories in Action

Imagine that Mark’s credit card information is stolen while he is shopping on a website he doesn’t know. Mark didn’t have to deal with a lot of problems because his card didn’t protect him from any losses. The fake charges were quickly reversed after he told his bank about them. In another case, Susan’s card’s extended warranty feature helped her because it paid for a broken appliance to be replaced for free long after the manufacturer’s warranty had run out.

These examples show that when you use credit cards wisely, they can be a safety net that keeps your money safe and gives you peace of mind. You don’t have to worry about using digital and contactless payments because you know your money is safe.

In short, the extra security and protection that come with a responsible credit card are much better than the benefits of using cash or other less secure payment methods. This protection isn’t just to stop fraud. It’s also to help you feel safe shopping, traveling, and handling your money in today’s fast-paced digital world.

Benefit #4: In an emergency, it’s easy to get money.

As the world becomes more digital and connected, cashless payments are no longer just a nice thing to have; they are now a must. When you use your credit card responsibly, you can get money quickly, whether you need it for everyday purchases or emergencies that come up out of the blue. This flexibility could save your life.

How easy it is to pay without cash around the world

- Accepted All Over the World: People all over the world take credit cards. You can use your credit card to pay for things anywhere in the world, whether you’re eating out at a restaurant in your hometown or booking a hotel room in another country.

- Transactions go faster: You don’t have to carry around a lot of cash when you use a credit card, which lowers the risk of losing it and the need to go to the ATM all the time. Keeping track of your purchases makes it easier to see how much you’ve spent.

- Payments made over the phone and without contact: Your smartphone now has your credit card built in thanks to the rise of mobile payment technologies. You can pay safely and without touching anything with just a tap or scan. This integration speeds up the checkout process and cuts down on physical contact, which is a great feature in today’s health-conscious world.

Easily Handling Emergencies

Using a credit card responsibly means more than just making regular purchases. It also means being ready for anything that might happen. Having quick access to cash can keep you from losing everything in an emergency.

- Costs that come up without warning: If you need money quickly for a car repair, a medical bill, or a surprise home repair, using your credit card can help you get it until you can find a better way to get it.

- Avoiding loans with high interest rates: Sometimes, it’s better to use a credit card to pay for an emergency expense than to get a payday loan or an overdraft with a high interest rate.

- Things that can help you keep track of your balance: Modern banking apps have tools for budgeting, alerts, and automatic payments. These can help you keep track of your emergency spending, manage it, and pay it back in full.

Using Credit in an Emergency Wisely

It’s great to have access to emergency funds, but you need to be smart about how you use them. Here are some rules to follow:

- Make a fund for emergencies: You need to have an emergency fund on top of your regular budget. If you have to use your credit card, do it only when you have to. Also, make sure you have a plan to pay off any debt you get into quickly.

- Create alerts for spending: Set up spending alerts that will let you know when you’re getting close to your monthly or emergency spending limit. Knowing this can help you keep your spending in check.

- Pick options with lower interest rates: If you need money quickly, look into credit cards with lower interest rates or promotional periods that can help you save money on borrowing.

Real-world use for convenience and emergencies

- Emergencies that happen while traveling: Imagine that someone is on vacation in another country and needs money right away because they missed their flight or their hotel charged them too much. They can relax because their credit card not only gives them a quick fix, but it also protects them from fraud. This quick access could mean the difference between a ruined trip and a minor issue.

- Simple to use every day: Mary uses her credit card to pay for everything she buys every day, including groceries, gas, and even subscription services. She works a lot. She doesn’t have any trouble with her money because she can easily see how much she’s spending online and set up automatic payments. Mary’s habits make sure that her credit card is always there for her in case of an emergency. It makes things easier for her and gives her peace of mind.

In short, using a credit card wisely gives you the financial security and ease you need to get through everyday life and unexpected emergencies without any trouble. This benefit proves that you won’t stay in debt if you use credit cards wisely. They are flexible tools that can help you deal with life’s problems without making you more stressed.

Fifth benefit: learning how to manage your money and keep track of your spending

Paying off your credit card debt is just one way to be responsible with your money. It can also help you learn how to be more responsible with your money and how to spend it. Every time you swipe, you can learn about your spending habits, keep track of your expenses, and get better at budgeting.

How to use credit card statements to figure out how much you spend

- Detailed records of all transactions: Credit card statements keep track of all of your purchases. When you buy something, the date and place are recorded, so you’ll always know how you spent your money.

- Looking for patterns in how you spend: You can see where your money is going by looking at data from month to month. Are you spending too much on going out to eat, going to the movies, or subscriptions? This detailed view will help you make smart changes to your budget.

- Budgeting apps and tools: Many money management apps now let you connect to your credit card accounts. They automatically put your purchases into groups and let you see how your spending habits are changing. These tools can help you find places where you’re wasting money that you didn’t know about and make the most of your monthly budget.

Using your spending data to help you be more financially responsible

- Putting a cap on spending: Use your statement to help you figure out how much you can spend without going overboard. Knowing where you tend to spend too much money can help you make a better budget that lasts longer.

- Keeping track of your spending over time: Keeping an eye on your spending on a regular basis can help you get ready for money problems and make changes when you need to. Keeping a close eye on your money can help you be more disciplined in other areas of your life as well.

- Holding people accountable: Checking your statements often helps you stay on track. Whether you use a simple spreadsheet or a complicated app, keeping track of your spending will help you be responsible.

Useful advice and examples from real life

- The Envelope Method Goes Online: Alex only uses his credit card for things that change, like going out to eat and have fun. He looks at his monthly statements and sees that he spends a lot more on going out on the weekends than he thought he would. He makes a “fun budget” that he checks on every month after realizing this. This self-control helps him save money by keeping him from spending too much money on things he doesn’t need.

- Spending wisely: A lot of people say that when they look at their credit card statements, they ask themselves, “Do I really need to buy this?” This kind of mindfulness helps you form habits that can help you save money right away and build wealth over time.

- How to Use Data to Make Plans for Your Life: Your detailed spending data can help you plan for big financial goals over the long term, not just for month-to-month budgeting. These goals could be vacations, home improvements, or saving for retirement. You learn from what you’ve done in the past, and every month you make better, smarter decisions.

When you use your credit card wisely, you not only have a way to keep track of your daily spending, but you also learn more about how you spend your money. This knowledge and self-control can change how you handle money in general, giving you a frugal and purposeful mindset that will affect all parts of your financial life.

Extra tips on how to use your credit card wisely

There are a number of best practices that can help you get the most out of your credit card while keeping risks to a minimum, in addition to the main benefits we’ve talked about. Here are some quick tips to help you keep your credit card a helpful financial tool and not a source of stress:

- Every month, pay off your balances in full: You won’t have to pay interest if you pay off your balance every month.

- Use Less Than 30%: To keep your credit utilization ratio healthy, only use a small amount of your available credit.

- Don’t get cash advances: Cash advances come with high fees and interest rates that start right away.

- Check your statements often: Check your monthly statements to make sure they’re correct and to see if there are any transactions that look suspicious.

- Limit the amount of money you can spend: Use digital tools or budgeting apps to set and keep an eye on limits for different types of spending.

- Set up reminders for payments or payments that happen automatically: Use technology to help you stay on top of your payments and avoid late fees.

Every time you use these habits, you’ll be one step closer to mastering your finances. These are simple steps that, when taken together, can lead to big benefits like lower costs, higher rewards, and a stronger financial base.

To sum up

We hope that this in-depth look at the benefits of using credit cards responsibly has changed the way you think about what credit cards can do when they are used wisely. By improving your credit score, getting great rewards, better purchase protections, easy access to cash in an emergency, and good money habits, you can turn your credit card from a potential liability into one of your most useful financial tools.

You don’t have to change your life a lot to get these benefits. You just have to promise to stick to a budget and make good choices. If you use your credit card responsibly, you’ll be safer with your money right now and in the future. When you pay your bills on time and think about your money, you’re putting money into a future where you can be financially free and safe.

Remember that the key is to find a balance: enjoy the benefits, use the credit wisely, and keep a close eye on how you’re doing. Now is a good time to think about how you use credit, follow these tips, and start using credit cards to help you with your finances. The first step to better credit, more rewards, and better overall financial health is to make good choices today.

Questions that are often asked

Q1: How do I stop my credit card from charging me interest?

A: The best and easiest way to avoid paying interest is to pay off your entire statement balance by the due date every month. Here are some specific things you can do to help:

- Set up reminders or automatic payments to pay: This makes sure that you always pay on time.

- Make a budget that you can keep track of: If you know how much you spend, you can stay within your budget and not go overboard.

- Plan for costs you didn’t see coming: Make an emergency fund so that you don’t have to carry a balance when something comes up that you didn’t expect.

Paying in full means that you won’t ever have to pay those high interest charges, which means that the benefits of using your credit card responsibly will always be greater than the costs.

Question 2: Do you need more than one credit card or just one?

A: There is no one answer that works for everyone. A lot of responsible credit card users have more than one card so they can get different rewards, introductory offers, and security features.

- A lot of cards: Can give you different benefits, such as one for everyday purchases, one for travel rewards, and another with special benefits.

- One Card: It can be helpful to keep things simple and easy to keep track of if you have a lot of accounts to keep track of.

In the end, you should choose something that works with your skills and how you like to handle your money. Using more than one card responsibly can be good for your credit score and your money.

Q3: How often should I check my credit report?

A: One important part of using your credit card responsibly is to check your credit report regularly:

- At least once a year: You should get your free credit report from the three main credit bureaus every year.

- More often if you are keeping an eye on your credit: You might want to check your credit every three to six months for free online if you want to improve it.

Checking your credit score often can help you find mistakes or strange activity early, which will keep your score a good sign of how well you’re doing financially.

Q4: Will using my credit card wisely help me get a loan?

A: Yes, for sure. When banks and mortgage lenders check your credit score, they can tell how trustworthy you are:

- A Good Credit Score: Shows that you can handle debt, which could help you get a lower interest rate on your mortgage.

- A steady and good history of payments: Lenders are more likely to approve bigger loans when borrowers make regular, on-time payments.

Taking care of your credit cards is an important step that can help you reach other important financial goals, like getting a mortgage.

Q5: What should I do if I can’t pay off my credit card bill in full this month?

A: The best thing to do is to pay off your balance in full every month, but there may be times when you don’t have enough money to do so:

- Pay at Least the Minimum: This keeps your account in good shape and helps your credit score.

- Plan how to pay off the rest: Adjust your budget so that you have extra cash next month to pay off the rest.

- Call the company that gave you your card: A lot of issuers have payment plans or programs for people who are having a hard time right now.

It’s important to pay off your balance as soon as possible to keep the benefits of using your credit card responsibly and avoid getting into debt that lasts a long time.

Final Thoughts

Using a credit card responsibly has a lot of advantages. Some of these are improving your credit score, getting great rewards, protecting your purchases, having quick access to emergency funds, and learning how to be more responsible with your money. If you take care of your credit card on a regular basis and know what you’re doing, it can be more than just a way to spend money; it can also be a way to open up new financial opportunities in the future.

You can always begin again. Use the tips we’ve talked about and add them to your monthly routine little by little. The first step on the road to financial freedom and stability is to make every small, responsible choice you can. Use your credit card to help you grow, stay safe, and have fun.

As you go on, be willing to learn and change. Your financial health is a journey that changes as you do. You need to use your credit cards wisely if you want to improve your credit score or get the most out of your travel rewards. Today, take control of your money and make sure your credit works for you in the best way possible.

You can change how you use credit cards by learning and following these rules. You can find a lot of information about budgeting, advanced credit monitoring tools, and how to get the most out of some rewards programs in a lot of places. Remember that every smart decision you make today will help you have a better and safer financial future.

Here’s to building a stronger financial life, one responsible swipe at a time! Have fun spending and saving!