One of the most important financial decisions you can make is to make a will that is legally valid. This is the main goal of estate planning. A will is more than just a piece of paper; it’s your voice after you’re gone. It makes sure that your wishes, values, and assets are honored exactly how you want them to be. No matter how old you are, how much money you have, or how little money you have, it’s important to have a will to protect your legacy and the future of your loved ones.

A lot of people believe that only wealthy people or those with complicated estates need a will. Anyone who dies without clear legal instructions could be hurt by this misunderstanding. If you don’t have a will, the law will decide how to divide up your property, even if you don’t want it to. This can lead to long legal battles, family fights, and even the loss of property because of delays in probate or high taxes.

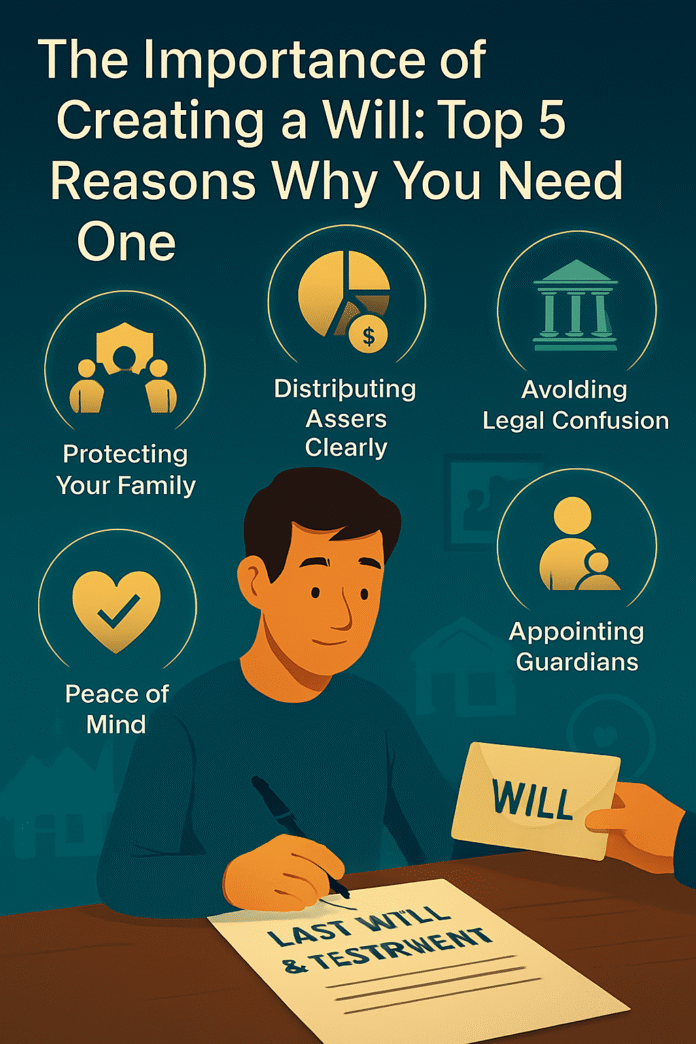

In this complete guide, we’ll talk about the five most important reasons why everyone should have a will and why it’s important to make one. You’ll learn what a will is, how it works in estate planning, and why it’s so important for keeping your property safe and making sure your family’s future is safe. We’ll talk about everything, from making sure your assets are divided up the way you want them to speeding up the probate process and even making the most of tax planning opportunities. We naturally use keywords like “importance of creating a will,” “why you need a will,” “benefits of having a will,” “what happens if you die without a will,” “how to make a will,” and “estate planning wills” throughout this guide to make sure you get the most relevant and useful information possible.

When you finish reading this article, you will know exactly why writing a will is an important part of planning your estate. This guide has useful advice and real-life examples to help you take charge of your future, whether you want to avoid family fights, keep your kids safe, or make sure that your assets move through the probate process quickly and easily.

What is a Will and How Does It Work?

A will is a legal paper that tells people what to do with your money and property after you die and how to care for any minor children. It’s a short guide for your estate that tells you who should get your things, how to divide them up, and who should be in charge of running your business.

How a Will Splits Up Your Stuff

In your will, you name people who will get your things when you die. These assets might be:

- Homes, land, and other properties are all part of real estate.

- Accounts for money, like savings, checking, or investment accounts.

- Personal property includes things like jewelry, cars, sentimental items, and collectibles.

- Business Interests: owning a part of or shares in a private company.

If you don’t have a will, the default rules for intestate succession will usually decide how to divide up your property. These laws are different in each state and may not be what you want. This could make you make choices that cause problems in your family or don’t manage your money the way you want.

The Steps of Probate

Probate is the legal process that checks your will and makes sure your assets are divided up according to it. A clear and legally binding will can make this process, which is often hard and takes a long time, easier by:

- Giving Clear Directions: Making things clear can help the probate process go faster.

- Lowering Legal Costs: A will that is clear and easy to read makes it less likely that heirs will fight over things and have to go to court.

- Keeping the Peace in Your Family: Clear instructions can help your heirs avoid fighting over what your last wishes really mean.

Who Can Write a Will?

Anyone who is legally able to do so (usually adults over a certain age and in good health) can make a will. The basic legal requirements are usually:

- A written note about what you want to do.

- Your signature and, in many cases, the signatures of witnesses.

- A clear list of who will get your money and someone to manage your estate.

It’s a good idea to talk to an estate planning lawyer to make sure your will is legal, since the rules can be different in different states or countries.

A good will is a key part of making good plans for your estate. One of the most important parts of your financial legacy is that you get to choose who gets what. In the next few sections, we’ll talk about the five most important reasons to make a will. We’ll show you how important it is to have a legally valid will by using clear examples and real-life situations.

Reason #1: Ensures That Your Property Goes to the People You Want It To Go To.

One of the best reasons to write a will is that it lets you choose exactly how you want your assets to be divided. If you don’t leave clear instructions, your estate could be subject to intestate succession laws, which divide up your assets based on legal formulas instead of what you want.

The Power of Clear Beneficiary Designations

A will lets you do the following:

- Name Beneficiaries: Write down the names of the people or groups who will get certain assets.

- Control Asset Distribution: Decide if you want to keep some things together (like a family heirloom) or give them to several people.

- Promote Fairness: Don’t let beneficiaries think they are getting something different from what the law says they should get. This could cause people to favor one side or the other.

What Happens to Your Things When You Die Without a Will

The court follows the laws of intestate succession if someone dies without a will. This could lead to outcomes that don’t match your values or the people you cared about. For example:

- Family Problems: Imagine what would happen if an older parent died without a will and left behind a lot of money. State law might divide the estate equally among all the children, even if one child was closer to the parent or had been in charge of their care. This could cause fights and even long court battles.

- Unintended Beneficiaries: Your assets could go to relatives or distant family members you never thought of, leaving your closest friends or chosen charities without the help you wanted.

A Situation in Real Life

For example, look at Mr. Thompson. He owned a small business that did well, and he thought he didn’t need a will because his family was close. After he died suddenly, his estate went through intestate succession. It took years for the legal process to finish, and in the end, his kids fought over the business and personal property. His family, which had always been close, fell apart because he didn’t say what he wanted.

How to Make Sure Your Will Says What You Want It to Say

- Check it often: If you get married, divorced, or have a new family member, you should update your will.

- Talk to Professionals: An estate planning lawyer can help you stay away from mistakes that could cause problems in the future.

- Be Clear: Instead of giving vague instructions about who should get what, be clear about who should get what.

- Talk to the people who will get your money about what you want. There is less of a chance of fights after you die if you make your wishes clear.

If you write a will that clearly says how you want your assets to be divided, you can be sure that your legacy will be handled the way you want it to be. This clarity not only keeps your loved ones out of trouble with the law, but it also shows that you respect your values and the work you’ve done in your life.

Reason #2: It Protects Kids and Gives Them Guardians.

Parents with young kids really need to have a will. If you die suddenly, you can name guardians in your will who will take care of your kids. This way, they will still get the help, love, and advice they need.

The Important Task of Picking Guardians

If you don’t have a will that says who you want to take care of your minor children, the courts will decide. Why you should name a guardian in your will:

- Control Over Care: You can choose someone who shares your beliefs and understands what you want for your kids.

- Legal Security: A legally appointed guardian makes things clear legally, so the state can’t make that choice based on laws that may not be what your family wants.

- Peace of Mind: Knowing that a trusted person will look after your kids can help you and your family relax a lot.

What Happens If You Don’t Choose a Guardian?

If you don’t pick a guardian:

- State Intervention: A court can choose a guardian who doesn’t agree with how you raise your children.

- Family Fights: Family members may not agree on who should be in charge, which can cause fights.

- Delayed Care: The court process for deciding who will be the guardian can take a long time, leaving your kids in limbo at a very important time.

In Real Life

Imagine a couple with two young children who never named a guardian. When something bad happened, family members went to court to fight over who could give the best care. The long court process not only made it take longer to reach a final decision, but it also put a lot of stress on the kids who were stuck in the middle of family problems.

Benefits of Having a Will for Kids

You should write a will that includes the following to protect your minor children:

- Choosing a Guardian: Choose someone who is responsible and will make sure your child has a loving, stable home.

- Meeting Their Financial Needs: Make it clear how your money should be used to pay for their schooling, medical care, and other needs in the future.

- Planning for the Unexpected: You might want to name a backup guardian in case your first choice can’t or won’t serve.

Advice for Parents That Will Help

- Talk to Possible Guardians: Make sure that the people you are thinking about are willing and able to take on the job.

- Get in touch with lawyers: An estate planning lawyer can help you write a will that makes your wishes clear and explains the legal requirements for guardianship.

- Check Often: Life is always changing, so if your family situation or the situation of a possible guardian changes, make sure your will is still valid.

You can protect your children’s future by making sure they are cared for by someone you trust completely. You can relax knowing that your will says who will take care of your children if something happens to you. This also keeps the courts from having to make hard choices in tough situations.

Reason #3: It Keeps the Family from Fighting and Having Legal Problems.

Having a clear, legally binding will is one of the best things you can do to avoid family fights and legal problems. A will tells your heirs exactly how you want your property to be divided and other important things. This helps them not get confused and fight.

How a Will Can Help Keep Fights from Happening

When you write down what you want:

- Things Are Clear Again: Beneficiaries know exactly what to expect, which makes it less likely that there will be problems.

- Avoiding Conflict: A well-written will makes it less likely that people will fight over language that isn’t clear or what they think is favoritism.

- Simple Change: The executor has a clear plan to follow, which makes the process of settling the estate go more smoothly and with fewer arguments.

Why Families Argue

Some problems could happen if you don’t have a will:

- Knowing the laws about intestate succession: Courts decide how to divide up assets, which may not be in line with your values or relationships.

- Miscommunication: If beneficiaries believe they deserve more than their fair share, it can be hard to agree on how to split up the assets.

- Perceived Inequality: Family members may feel bad if they see others getting more than their fair share without clear instructions.

A Real Life Example

Imagine a family with siblings where one thinks they will get the house and the other thinks they will get some of the business’s assets. The state laws decided how to split the estate when their parent died without a will. A clear will could have stopped years of lawsuits and family fights over what happened.

How to Avoid Fights

- Use language that is clear and specific: Make sure your will is easy to read.

- Tell Your Family What You Want: Let them know what you want while you’re still alive so they know what to expect.

- Think about Mediation Clauses: Some wills say that if there are disagreements between beneficiaries, they should try to work things out through mediation.

- Choose a Fair Executor: A trustworthy executor who can carry out your wishes fairly helps keep the peace and stop fights.

Benefits of a Clear Will

Not only is it important to make a will to divide up your property, but it’s also important to keep the peace in your family. You are able to:

- Avoid Confusion: Make it less likely that your heirs will not understand or agree with your decisions.

- Don’t go to court, which costs a lot of money and time.

- Honor Your Legacy: Plan carefully so that people remember you for your careful planning instead of family problems.

In short, a clear will is a powerful tool that helps keep things from going wrong and makes it easier to settle the estate fairly and quickly. You can protect your family’s emotional health and your property by taking care of these issues before they happen.

Reason #4: It Speeds Up the Process of Probate.

Probate is the legal process that makes a will valid and divides up a dead person’s property. This process can take a long time and be hard to understand, but if you have a will that is clear and legally binding, it can go a lot faster.

What is Probate?

The probate process has a number of steps:

- Validation of the Will: The court makes sure the will is valid.

- Asset Inventory: A list of all assets with their values.

- Debt and Tax Settlement: You pay off all of your debts and taxes that are still due.

- Distribution of Assets: The beneficiaries get the rest of the assets.

How a Will Speeds Up the Probate Process

There are many ways that a clear will makes the probate process easier:

- Reduces delays: If you give the court clear instructions, they can quickly take care of your estate without having to spend extra time figuring out what you mean.

- Fewer Legal Issues: If a will is legally sound, it’s less likely that beneficiaries will contest its terms. This lowers the chances of disputes that can make probate take longer.

- Helps the Transition Go Smoothly: The executor can start settling the estate right away because they have a clear plan for how to do it.

What Happens If You Don’t Write a Will

If someone dies and doesn’t leave a will:

- Longer Process: The court has to figure out how to divide the estate according to intestate laws, which can take a lot longer.

- More Expensive: The longer the probate process takes, the more money it costs in legal and administrative fees. This means that the estate is worth less to heirs.

- Family Issues: When an estate takes a long time to settle, it can be hard on the living family members, both emotionally and financially.

How to Choose an Executor to Help with the Process of Probate

- Choose someone who is organized. Choose someone who pays attention to details and can handle tight deadlines and paperwork that is hard to understand.

- Make sure they know about money: An executor who knows a lot about money will be better able to deal with tax and asset appraisal issues.

- Be Clear: The executor should keep in touch with the beneficiaries and tell them what is going on during the probate process.

A clear will not only makes sure that your assets are divided up the way you want them to be, but it also makes the probate process go more smoothly and quickly. This benefit can help your loved ones a lot during a hard time, both emotionally and in terms of paperwork.

Reason #5: It Gives You Time to Plan Your Taxes and Keep Your Money Safe.

A will is not just a way to split up your property; it can also help you figure out your taxes and keep your estate safe from extra costs. By carefully planning your estate, you can lower your taxes and make sure that more of your money goes to your heirs.

Advantages of Planning Your Taxes

- Lower Estate Taxes: If you plan how to set up your estate carefully, you can lower your estate taxes. A will can work with other estate planning tools, like trusts, to keep assets from being taxed too much.

- Help Charitable Causes: You can tell people in your will how to give money to charity. This could help you leave a legacy and save money on taxes.

- Plan for Future Costs: By considering how taxes will affect your estate, you can put money aside to pay off any debts or obligations that may arise in the future. This will make sure that your heirs get the most out of it.

Advantages of Asset Protection

- Keeping Your Assets Safe from Creditors: A well-written will, along with other estate planning tools, can help keep your assets safe from creditors or legal claims.

- Making Sure Your Finances Are Stable: By properly distributing your assets in your will, you can stop your estate from losing money during the probate process, which will keep wealth for future generations.

- Adding Trusts: If you include trusts in your will, they can help protect your assets even more by making sure they are handled the way you want them to be and given out at the right time.

Getting Help from a Pro

Tax planning and making a will to protect your assets can be very helpful, but you might need help from a professional to do them. Lawyers and financial advisors who specialize in estate planning can help you make sure that your will makes the most of these opportunities.

Putting your will in the context of a larger estate planning strategy not only tells how your assets will be divided, but it also makes tax planning easier and protects your assets better. This all-encompassing method helps make sure that your legacy lasts for a long time, which is good for both your heirs and the causes you care about.

The Basics of Making a Will

It may seem like a lot of work to make a will, but it can be easier if you break it down into simple steps that are easy to follow. You can either hire an estate planning lawyer or use reliable do-it-yourself tools to write your own will. In any case, these are the basic steps you need to follow to make a will that is legal:

Basic Legal Needs

- Find out if you qualify: In general, you need to be of legal age (usually 18 or older) and have a clear mind.

- Make a document: Writing a will is very important. Oral wills aren’t accepted in most places.

- Find the Beneficiaries: Write down a clear list of the people or groups who will get your property when you die.

- Pick an Executor: Choose someone you can trust to carry out your wishes.

- Sign the Will and Have Someone See It: Most states make you sign your will in front of witnesses who also sign it.

How to Write a Will

- Kits for making your own will: There are a lot of free and low-cost online tools and kits that can help people with simple estates write a will.

- Wills made with a lawyer’s help: You should hire a lawyer if your estate is complicated or if you have specific wishes that need special legal language.

How to Keep Your Will Current

- Reviews on a regular basis: After big life events like getting married, getting divorced, having kids, or making big changes to your finances, you might need to update your will.

- Keeping Safe: Put your will in a safe place where you can easily get to it, and let someone you trust, like the executor, know where it is.

Following these steps will help you write a will that is legal and clearly states what you want. Don’t forget that even though the process may seem scary at first, having a good estate planning document will make you feel better.

What People Think About Wills

Some people may not do anything because they don’t understand how wills work. Let’s get rid of some of the most common lies:

Myth #1: “Only rich people need wills.”

- Truth: Everyone should have a will, no matter how much money they have. Anyone, even those with little money, can make clear plans for how their things will be split up and who will take care of their kids. This means that the government can’t make choices for you.

Myth #2: “I don’t have enough money to make a will.”

- Truth: A will not only says who gets what, but it also says who will take care of your kids and what you want to happen after you die. It makes sure that your legacy is carried out the way you want it to be.

Myth #3: “My spouse will automatically get everything.”

- The truth is: Having a will lets you say exactly how you want your assets to be divided. This can help avoid fights and make sure that other beneficiaries know what you want.

Myth #4: “Making a Will Is Hard and Costs a Lot.”

- The truth is: A lot of people believe that writing a simple will is hard and expensive, but with today’s online tools and inexpensive legal services, it is often easier and less expensive than they think. It’s a way to keep the family together and feel safe.

When you look at these myths, it’s clear that everyone should have a will. No matter how simple or complicated your estate is, it’s important to have a will that is legally binding so that your wishes are followed.

Last Thoughts

One of the best things you can do for your family’s future and your legacy is to make a will. A will is an important part of planning your estate because it makes sure that your assets are divided up the way you want them to be and that your minor children are safe by naming guardians. It helps with tax planning and protecting assets, cuts down on family fights, and speeds up the probate process.

In this guide, we talked about the five most important reasons why you should make a will:

- Guarantees that your assets are divided up the way you want them to be: Following the strict rules of intestate succession leads to less conflict and a more personalized distribution of your estate.

- Protects Minor Children and Appoints Guardians: Make sure your kids are safe by making it clear who will look after them.

- Lessens Family Conflicts and Legal Disputes: A well-written will makes things fair and clear for everyone who will get something.

- Speeds Up the Probate Process: A valid will makes it easier to settle an estate, which means lower legal fees and fewer delays.

- Gives You Choices for Tax Planning and Protecting Your Assets: Keep your estate’s money safe from creditors and extra taxes while making the most of it.

A will is not only a legal requirement, but it is also a sign of love and duty. It lets you decide what happens after you die, so your values, priorities, and love for your family will continue to shape the future. If you haven’t already, now is the time to start writing a will. Check your estate planning papers, use online tools, or talk to an estate planning lawyer to make sure your will really says what you want it to.

Remember that planning your estate is a process that never ends. Your will should change as your life does. You’re not only keeping your things safe today, but you’re also giving peace of mind to the people you care about.

What to Do:

Today, talk to a trusted advisor or an estate planning lawyer about making or changing your will. Keep your loved ones safe, your legacy safe, and relax knowing that your future is in good hands.

Writing a will is a simple but effective way to make sure that your wishes are followed and that your estate is run in a way that is in line with your values. Whether you’re just getting started or need to update an old will, knowing why estate planning is important will help you make smart decisions. Accept the process, learn about the benefits, and take that important step toward planning your future.

You can protect your assets and make things easier for your loved ones during tough times by realizing how important estate planning is and doing things like making or updating your will. Remember that a will is more than just a piece of paper; it’s your last message and a legacy that will last forever. Write a clear, legally binding will now so you can take charge of your future.

We hope this guide has helped you understand better why having a will is important and what the benefits are. Don’t leave your future to chance; write a will that protects your legacy and shows what you want.