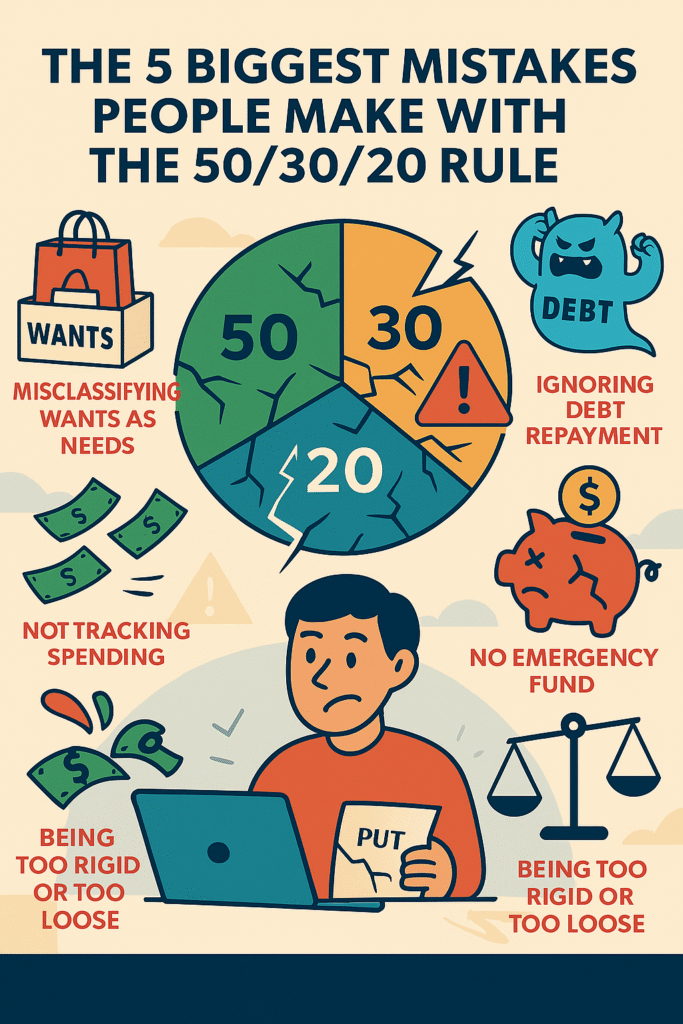

If you do it right, a simple idea can make a huge difference in how you handle your money when it comes to budgeting. The 50/30/20 budgeting method has become very popular because it is so simple and easy to understand:

- 50% for Needs (bills you can’t live without, like rent, groceries, insurance, and utilities)

- 30% for Wants (spending that isn’t necessary, like going out to eat, subscriptions, and entertainment)

- 20% for savings or paying off debt (for your future security, from emergency funds to paying off credit card debt)

At first glance, this rule seems like a simple way to keep track of your money. One of the best things about it is how simple it is, but a lot of people who use it, especially beginners and even intermediate users, end up misusing or misunderstanding the rule in ways that can slow down their financial progress.

We’re going to talk about the five biggest mistakes people make with the 50/30/20 rule in this article. We’ll talk about why these mistakes happen so often, give you real-life examples and expert advice, and give you tips you can use to avoid or fix these problems. This guide is meant to help you improve your use of the 50/30/20 rule, whether you’re just starting out or have been using it for a while. This method is very useful, and you can get the most out of it by following these steps.

By the end of this post, you’ll know exactly what a lot of people do wrong when they make a budget and, more importantly, how to do it right. You’ll learn how to correctly categorize your expenses, use your net income as a starting point, deal with those annoying irregular expenses, and change the framework to fit your own life—all while making sure you don’t give up your future financial security. Let’s look at these common mistakes one by one to make sure your budgeting journey goes as smoothly and successfully as possible.

A quick review of how the 50/30/20 rule works

Before we get into the problems, let’s go over the basics of the 50/30/20 budgeting method again. This review will not only explain what goes in each category, but it will also explain why the rule is so popular with people who want a simple and balanced way to handle their money.

The Three Groups

- Needs (50%): These are the costs you have to pay that you can’t avoid. You will put the following in this category:

- Housing: Payments for rent or a mortgage

- Utilities: things like electricity, water, the internet, and other important services

- Groceries: Basic food items you need to live every day

- Insurance: Health, car, home, or renters insurance

- Transportation: Bus and train fares, gas, or car payments

- Other needs: paying off at least some of your debts, getting basic health care, and sometimes taking care of your kids

- Wants (30%): This is your room for spending money on things that make you happy but aren’t necessary for survival. Here are some common costs:

- Eating Out: going to restaurants and coffee shops

- Fun things to do: movies, concerts, or streaming services like Netflix

- Subscriptions: Gym memberships (if they aren’t necessary for your health), magazines, or other leisure subscriptions

- Shopping: clothes, gadgets, or hobbies that aren’t necessary

- Savings and debt (20%): This piece helps you plan for the future and protects you from unexpected problems. It has:

- Emergency Fund: Money set aside for unexpected emergencies

- Retirement Savings: Putting money into IRAs, 401(k)s, or other retirement accounts

- Paying off debt: Making extra payments on credit cards, loans, or other debts that are more than the minimum.

A Monthly Example

Let’s say that after taxes, your net income is $3,000 a month. The 50/30/20 rule says that you should divide your income like this:

| Category | Percentage | Dollar Amount |

|---|---|---|

| Needs | 50% | $1,500 |

| Wants | 30% | $900 |

| Savings/Debt: | 20% | $600 |

This easy-to-follow plan makes sure you can pay for your basic needs, have some fun spending money, and save for your future. The best thing about the 50/30/20 rule is that it can be used by anyone, whether they have a steady job or make money on the side. All you have to do is add up your net monthly income and use these percentages.

These percentages are not set in stone, so keep that in mind. Life happens, and a lot of people change their ratios to better fit their situations (for instance, if your rent takes up 60% of your income, you might need to change your budget). But the mistakes that are made when the rule is used often do more damage than the changes that need to be made. Now, let’s look at the five most common mistakes people make when using the 50/30/20 rule and how to avoid them.

The 50/30/20 Rule: The Five Most Common Mistakes People Make

Mistake #1: Confusing wants with needs

Budgeters often make the mistake of putting discretionary expenses in the same category as necessary ones. This mistake can easily push your “needs” category well past the 50% limit, making it hard for you to find what you want and save money.

What Happens When You Get It Wrong?

When you label things that aren’t really needs as needs, your financial priorities get messed up. For example, think about costs like:

- Netflix or other streaming services: These are not necessities for life, but they are nice to have.

- Gym memberships: If you can work out at home or in a park, this cost should be considered a “want.”

- Takeout Meals: Eating out a lot may start out as a convenience, but if you don’t pay close attention, it could turn into a “need.”

You raise your basic costs by putting these things in the “needs” category. This mistake in classification can cause a number of problems:

- Budget Imbalance: Spending too much on things you think you need leaves less money for savings or fun things you want to do.

- False Sense of Security: You might think you’re doing a good job with your money because you’re meeting your “needs,” but the basic costs are actually higher than they are.

What Causes This?

- Emotional Justifications: People who budget often convince themselves that they need to spend more money on things that are good for them.

- Cultural Norms: When convenience is very important in a culture, it can be hard to tell the difference between needs and wants.

- Immediate Gratification: The desire for instant pleasure can sometimes get in the way of a more strategic, long-term view of your money.

Example from the real world

Think about Jamie, a 28-year-old professional who makes about $2,500 a month after taxes. Jamie called her monthly gym membership, premium cable package, and frequent takeout dinners “needs.” Because of this, her “needs” took up almost 70% of her income, leaving her with little money to save or have fun. She moved these costs to the “wants” category when she looked at her budget again with a better understanding. What happened? A more even distribution that helped her save more often and make better choices about how to spend her money.

What to Do Instead

- Set strict rules: Make it clear what a “need” is by asking yourself:

- Is this cost absolutely necessary for survival or to keep things running?

- Can I do without it or find a cheaper way to get it?

- Look over and reclassify: Check your spending on a regular basis. If you see an expense in the “needs” category and are unsure if you really need it, change it to a “want.”

- Use tools for budgeting: Use apps and tools that let you make your own categories. This visual separation helps make sure that costs are put in the right category.

Tip to remember: Make a list that clearly shows the difference between needs and wants. Needs include things like rent, utilities, and groceries. Wants include things like subscriptions and eating out. This easy exercise can help you avoid the common mistake of misclassifying things, which will help you make a better and more balanced budget.

Mistake #2: Not taking into account after-tax income when figuring out percentages

A lot of people make the mistake of using their gross income instead of their net income to figure out the 50/30/20 breakdown. The rule is meant to apply to the money you actually have to spend, so not including taxes and other deductions can make your budget very wrong.

What Happens When You Use Gross Income

Using your gross income (the amount you make before taxes and other deductions) makes you think you have more money to spend than you do. If you make $60,000 a year, your gross monthly income might look like it’s around $5,000. But after taxes, health insurance, and other deductions, your take-home pay might be closer to $3,500 or less. If you use the 50/30/20 rule on the inflated number, the goals for spending and saving are not realistic.

What Makes This Happen?

- Not Knowing: A lot of people who are new to budgeting think that the gross income number is the right one to use for calculations.

- Misunderstandings: A lot of people think that using a bigger number gives you more “wiggle room” for spending, but that’s not true; it hides the real financial picture.

- Not Enough Tools: Some people use mental math or too-simple spreadsheets that don’t automatically include deductions.

Example from the real world

Maria is a freelance writer who makes $4,800 a month before taxes. She made her budget as if she had the full amount available, not taking into account taxes and other irregular withholdings. In real life, her monthly take-home pay was closer to $3,200 after taxes and other deductions. Because of this, her “needs” budget was too tight. Maria could realistically set aside 50% of her net income for needs, 30% for wants, and 20% for savings or paying off debt once she adjusted her budget.

What to Do Instead

- Always figure out your net income first: Take out taxes, insurance premiums, retirement contributions, and any other required deductions from your gross income. This net income should be the starting point for your budget.

- Use tools that work automatically: Think about using budgeting apps or payroll calculators that automatically take these amounts out. This makes sure you don’t think you have more money to spend than you do.

- Check your budget again: Check your budget plan from time to time to make sure you’re always using your net income. This will help you stay on track with your money goals and avoid spending too much.

Tip to remember: Before you even start making a budget, make it a habit to figure out how much money you have left over after expenses. This simple step is very important for correctly using the 50/30/20 rule and avoiding money problems that come from having an inflated income base.

Mistake #3: Not remembering about irregular costs like subscriptions, repairs, and yearly bills

Not planning for unexpected costs is one of the biggest mistakes people make when making a budget. Your daily expenses may seem to fit perfectly into the 50/30/20 framework, but if you don’t plan for yearly or periodic costs like car maintenance, insurance premiums, holiday gifts, or subscription renewals, they can throw your budget off.

Why people often forget about irregular expenses

- They don’t happen every month: You don’t have to pay for things like annual subscriptions or bi-annual car repairs every month. This makes it easy to forget about them when you do your monthly budget.

- Unexpected Financial Blow: When these costs do happen, they can eat up a lot of money in a certain category (usually “needs” or “wants”), which makes it hard for you to keep your finances in order.

- No Buffer: If you don’t set aside money for these costs, you may have to use your savings or even go into debt to pay for them.

Example from the real world

Think about David, a 32-year-old graphic designer who makes $3,000 a month after taxes. David’s budget worked well for everyday expenses, but it didn’t work so well when he had to pay for his car’s registration and unexpected repairs. These unexpected costs messed up his monthly budget and put him in a tight spot financially because he hadn’t planned for them. David’s budgeting got a lot easier once he started using the idea of “sinking funds” for these one-time costs. Now, he sets aside a small amount of money each month from his “needs” or “wants” category to build up a small emergency fund for unexpected costs.

What to Do Instead

- Make plans for sinking funds: Sinking funds are savings accounts that you set up for known, unexpected costs.

- How to Set Up a Sinking Fund:

- Make a list of all of your irregular costs, like car repairs, insurance deductibles, and yearly subscriptions.

- Figure out how much each cost will be in total

- Take that cost and divide it by the number of months until the bill is due.

- Put that much money aside every month

- Annual Costs Pro-Rated: Instead of seeing these costs as one-time hits, spread them out over the year. For example, if you know you have to pay a $240 fee every year, set aside an extra $20 each month.

- Look over what you’ve spent in the past: Check your bank statements or receipts from last year. Add any costs that keep coming up that don’t fit into your monthly budget to your plan so you won’t be surprised.

Tip to Take Away: Set aside a separate line item or a sinking fund in your budget just for expenses that come up from time to time. This proactive approach makes sure that even those yearly or occasional costs are covered, which smooths out the bumps in your finances over the course of the year.

Mistake #4: Not Changing the Rule When Things Change

The 50/30/20 rule is a great place to start, but it’s not the only way to do things. A lot of people get stuck in the habit of sticking to the standard percentages even when their lives tell them to do something else. If your income is much lower or higher than average, or if your expenses are unusual because of things like medical bills, childcare, or student loans, following the rule too strictly can do more harm than good.

Why being flexible is so important

- Differences Between People: Every financial situation is different. Some people may not have many non-essential expenses, while others may have to temporarily change the 50/30/20 formula because their living costs are too high.

- Changes in life that are always happening: Life isn’t fixed. You may need to make changes because of job changes, family growth, or unexpected emergencies. If people don’t change the default percentages, they could end up with a budget that is either too tight on necessities or too loose on discretionary spending.

- Financial Goals Change: Your money priorities can change over time. If you get married or start a family, you might need to rethink what you thought was a fair distribution when you were single.

Example from the real world

For example, Angela is a 35-year-old single mother who makes $2,500 a month after taxes. More than half of her income goes to her basic needs, like childcare and healthcare. Following the 50/30/20 rule strictly meant she had very little money to save and always felt like she was under financial pressure. Angela was able to better cover her higher-than-average essential costs when she changed her ratios to 60/20/20 for a while. As time went on and her situation got better, she slowly got closer to the normal 50/30/20 split.

What to Do Instead

- Change your ratios: Keep in mind that the 50/30/20 rule is just a suggestion. If your “needs” go over 50% because of special circumstances, you might want to change your percentages for a short time. Depending on your situation, you could choose 60/20/20 or even 55/25/20.

- Check your budget often: Your budget should change as your life does. Set up quarterly or biannual reviews of your finances and change the percentages as needed to make sure they accurately show how much money you make and spend.

- Talk to a financial advisor: If your finances are complicated, don’t be afraid to ask a professional for help figuring out how to make the budgeting method work best for you.

Tip to remember: Keep in mind that the rule is there to help you, not to limit you. Make the percentages work for your life. To make the system work for you instead of against you, you need to review it regularly and be open to change.

Mistake #5: Thinking that the 20% Savings/Debt Category is Optional

One of the most dangerous things you can do is not realize how important the 20% set aside for savings or paying off debt is. A lot of people who make budgets see this part of the rule as an afterthought—a “nice to have” instead of a must-do. Skipping or cutting back on this category “just this month” can be a bad idea that will hurt your financial stability over time.

What Happens When You Ignore

- Savings Goals That Are Late: If you don’t make saving a priority, you might put off starting an emergency fund or putting money into your future.

- The Debt Spiral: If you don’t pay your debts and instead spend money on things you need right now, your interest will keep going up and your debt will keep growing.

- Missed chances: If you don’t keep up with it, setting aside even a small amount of your income can lead to wealth that can be recovered over time.

Why This Happens

- Focus on the Short Term: People naturally want to get what they want right away, and the benefits of saving are often seen as far away.

- How flexible it seems: A lot of people believe that if a month is hard, they can just “skip” savings without any problems right away. In fact, this habit makes it hard to stay consistent over time, which is important for financial stability.

- Not enough automation: It’s easy to tell yourself you’ll save “next month” instead of this month if you don’t automate your savings.

Example from the real world

Jason, who was in the middle of his career and made about $3,000 a month, used to think of his savings as a flexible expense. When times were tough, he would stop putting money into his savings to pay for things he needed or wanted right away. This skipping caused slow progress toward building an emergency fund over time. When Jason had to make unexpected repairs to his home, he had to scramble to find cash and ended up using high-interest credit to pay for them. Once he set up his 20% savings to be automatic and treated it as non-negotiable, his financial situation got a lot better and he started to build wealth steadily.

What to Do Instead

- Set up automatic savings: Set up automatic transfers to your savings account or a special fund for paying off debt right after you get paid. This “pay yourself first” method makes it less likely that you’ll skip saving.

- Treat savings like a regular bill: Add savings to your regular monthly bills, like rent or utilities. It’s important to be consistent. If you don’t save today, you could mess up your plans for the future.

- Keep track of and celebrate milestones: Keep an eye on your savings progress and celebrate small victories. This makes the habit stronger and gives you a reason to stick to your plan.

Tip to Remember: Make a promise to automate your savings. Make the 20% a part of your budget that you can’t change, and remember that every little bit helps build a safety net for the future.

Mistake: Making the rule too complicated or giving up on it too soon

One common mistake that isn’t talked about much is when people make the 50/30/20 rule too complicated or give up on it too soon. Some people expect things to be perfect right away and get upset when they run into problems at first. This makes them change their plans or stop budgeting altogether.

Getting to Know the Problem

- What you expect vs. what really happens: Budgeting isn’t a quick fix; like any habit, it takes time to see results. A lot of people give up on the 50/30/20 rule too soon when they don’t see results right away.

- Too Much Complexity: Some people who make budgets try to be too exact by adding too many subcategories or trying to keep track of every single expense. This goes against the rule’s goal of being simple.

- Looking at other people: Seeing other people or flashy ways to budget online can make you expect too much. Keep in mind that the goal is to make progress, not to be perfect.

The Dangers of Making Things Too Complicated

- Burnout: Tracking too many small details can lead to tracking fatigue, which makes it hard to keep up with the budget.

- Leaving: The more complicated the system seems, the more likely you are to give up completely, and starting over with a new budget can slow down your financial progress.

What to Do Instead

- Stay with the Basics: Enjoy how simple the 50/30/20 rule is. Don’t micromanage every expense; instead, keep your categories broad.

- Give It Some Time: For at least two to three months, try the budgeting method. During this time, you can collect enough data, spot patterns, and make changes without feeling like you have to be perfect.

- Light, regular reviews: Instead of checking your spending every day, set a weekly or biweekly review schedule to keep an eye on it and make small changes.

Tip to remember: Be patient and give the system a few months to work before making big changes or giving up on it. The key to long-term budgeting success is to be consistent instead of perfect.

How to Fix Things If You’ve Done These Things

It can be hard to accept that you’ve made some mistakes with your budget, but it’s important to remember that every mistake is a chance to learn. This is a step-by-step list to help you get back on track with the 50/30/20 rule:

- Look over your expenses from the last three months:

- Collect bank statements, receipts, and interest statements.

- Find out where your budget didn’t follow the 50/30/20 split you wanted.

- Reclassify Your Spending Accurately:

- Make a list of all your expenses and put each one in the right group.

- Use a spreadsheet or budgeting app to show the difference between needs, wants, and savings/debt.

- Change to a Net Income Budget:

- To find out how much money you have left over after taxes and other required deductions, subtract those amounts from your gross income.

- Use your actual take-home pay to figure out the 50/30/20 percentages again.

- Make a buffer for bills that come up at odd times:

- Make sinking funds for things like yearly subscriptions, maintenance, or special events.

- Set aside a small amount of money each month to build these buffers.

- Change your 50/30/20 plan:

- Change your allocations if you need to. If your life changes (like needing to pay for childcare or medical bills), you might want to make temporary changes to the standard percentages.

- Set up automatic savings:

- Set up automatic transfers for the 20% savings/debt category so that you never forget to make this important payment.

- Watch and think:

- Set up monthly check-ins and keep track of how your spending and saving habits change.

- Think about what worked and what didn’t, and make small changes to make things better.

Tip to Remember: Think of your budgeting process as a system that changes over time instead of a set rule. Check in on your progress often, make any changes that need to be made, and don’t be afraid to start over if things aren’t going well. The way to long-term financial control is to learn from your mistakes.

In conclusion

No budgeting system is perfect from the start, especially if you’re trying to change how you handle your money. The 50/30/20 rule is a simple, clear way to help people find a balance between necessary spending, fun spending, and saving for the future. But, as we’ve seen throughout this article, there are a number of common mistakes that can make it less effective if they aren’t fixed.

Each mistake, like misclassifying your expenses, using gross income by mistake, forgetting about those extra costs, not changing the rule to fit your changing life, or not saving enough money, can have a big effect on your overall financial health. The most important thing is to stay aware, make changes when necessary, and see each mistake as a chance to learn and grow.

It’s important to remember that the path to financial stability isn’t perfect. It’s about making progress, being consistent, and being willing to change. Start small, check your progress every week, go over your budget every three months, and use the tips above to improve your approach. In this way, you can turn common budgeting mistakes into building blocks for a safe financial future.

Final Thought: It’s normal for everyone to make mistakes when they are learning how to budget. You can get the most out of the 50/30/20 rule by being aware of it, making small changes, and sticking to them. Accept the process of learning, celebrate your successes, and keep going. Each step gets you closer to financial freedom.

Questions and Answers

Here are some questions that people often ask about the 50/30/20 budgeting method to help clear up any worries:

- Is it possible to use the 50/30/20 rule if I don’t make much money? Yes, the rule can be changed. The main idea is to help you be more disciplined by putting your money into categories, even if you don’t have a lot of money. If your low income means that more than 50% of your essential expenses are covered, you might want to temporarily change your percentages while still trying to set aside some money for savings. The most important thing is to be aware of and consistent with how you spend your money.

- What if my rent is more than half of what I make after taxes? When living costs are high, your “needs” can go over 50%. In these situations, you might have to change the rule for a short time. For example, you could try for a 60/20/20 split or look at your housing situation again. The 50/30/20 rule is a suggestion, not a strict rule, so you should change it to fit your life while still trying to save.

- Is it okay for me to use the 50/30/20 rule if I work for myself and my income changes? Of course. If you’re a freelancer or have an income that isn’t steady, it’s important to figure out your net income for each period and use the right percentages. Budgeting apps that take into account changing incomes can make this process easier. Even when your income changes, it is still helpful to keep track of where each dollar goes.

- Should I put my debt payments in the “needs” or “savings” category with the 50/30/20 rule? Usually, the 20% set aside for savings and debt is meant to help you save money and pay off debts beyond the minimum payments. Some people think that the minimum payments on their credit cards or loans are part of their “needs.” But if you’re paying off debt faster than the minimum, you should put those extra payments in the 20% bucket. Make sure you know your own priorities and financial goals.

- What tools can help me stick to the 50/30/20 rule? There are a lot of budgeting tools and apps out there, like Mint, YNAB (You Need A Budget), and personal spreadsheets that make it easy to divide your expenses into the 50/30/20 framework. These tools can automatically figure out and keep track of your net income, help you sort your expenses, and remind you to make changes when your income changes or you get an unexpected bill.

A short list of common questions:

- The rule can be changed to fit people with very low incomes or very high necessary costs.

- Always use net income to get the right percentages.

- You can handle income that isn’t steady or changes by using flexible planning and the right tracking tools.

- It’s important to group your expenses, especially your debt, in a way that reflects your financial goals.

- There are many apps and tools for budgeting that can make the process easier.

Last Thoughts

If you use the 50/30/20 budgeting method the right way, it could change your financial life. You can get better at budgeting by learning about and avoiding common mistakes like misclassifying expenses, using the wrong income base, forgetting about bills that come up only once in a while, not adjusting to changes in your life, and not valuing savings enough.

Keep in mind that everyone makes mistakes when they learn something new. The most important thing is that you’re learning and changing as you go. Start with small amounts, keep an eye on your spending, and check your budget every few months to make sure it changes as your life does. You not only take charge of your money this way, but you also set yourself up for long-term success, whether that means saving for a dream home, investing in your future, or just getting rid of the stress that comes with living paycheck to paycheck.

Enjoy the journey, keep improving your approach, and remember that every step you take brings you closer to financial security. You can avoid these common budgeting mistakes and really make the most of the 50/30/20 rule for a better financial future if you have the right attitude and the right tools.

Happy budgeting, and here’s to making better money choices, one step at a time!

You can improve your use of the 50/30/20 budgeting rule by avoiding these common mistakes, being flexible with your own situation, and knowing where you might have gone wrong. Follow the advice and tips in this article to change the way you budget. Remember that consistency, even in small steps, is the key to financial freedom.