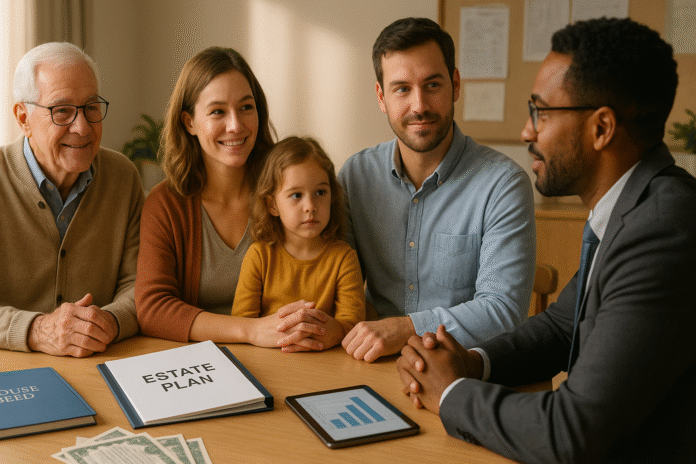

When families talk about “generational wealth,” they’re usually imagining a future where children and grandchildren are better off because prior generations built assets that last. Taxes—estate, inheritance, gift, capital gains, and even income taxes on estates and trusts—shape how much of that wealth actually reaches the next generation. Exploring the impact of taxes on passing down generational wealth helps you understand where the friction is, how to reduce it legally, and how to organize your estate so wealth transfers are smooth, documented, and intentional.

Disclaimer: This article is for educational purposes only and does not constitute tax, legal, or investment advice. Tax rules change, and they vary by country and state. Always consult licensed professionals (tax advisers, lawyers, and financial planners) for guidance specific to your situation.

Key takeaways

- Transfers can be taxed in multiple ways. Estate, inheritance, gift, and capital gains rules intersect; understanding each one is essential to preserving family wealth. Congress.gov

- Thresholds and exclusions are high in some places—but not everywhere. In the United States, the federal basic exclusion is $13.99 million per person for 2025; many states still impose their own transfer taxes. Other countries use different systems.

- “Step-up in basis” can dramatically cut capital gains for heirs. Correct valuation and records are crucial.

- Spousal and charitable rules are powerful—but require paperwork and timing. Portability, marital deduction, and QTIP elections hinge on meeting filing deadlines and election requirements.

- Planning beats reacting. Annual reviews, documented appraisals, beneficiary designations, and a playbook for liquidity (to pay final expenses and taxes) are the difference between wealth preserved and wealth lost.

The big picture: how taxes interact with generational wealth transfers

What it is & why it matters

Wealth transfers don’t trigger just one tax. They can implicate transfer taxes (estate, inheritance, gift, generation-skipping) and income taxes (capital gains, interest, dividends) at the estate, trust, and beneficiary level. Your aim isn’t to “avoid taxes at all costs,” but to sequence, title, value, and document assets so each transfer takes the least taxed, cleanest path the law allows.

Requirements & prerequisites

- A current net worth statement and list of titled assets.

- Copies of deeds, account statements, and prior gift/estate filings, if any.

- A will, powers of attorney, and (if used) one or more trusts.

- Contact details for your attorney, CPA, and financial adviser.

Step-by-step for beginners

- Inventory everything. Real property, business interests, retirement accounts, brokerage, cash, collectibles, life insurance, and digital assets. Note titling and beneficiaries.

- Map the tax exposure. Identify where estate, inheritance, gift, and potential capital gains might apply. If you live in the U.S., check whether your state has its own estate or inheritance tax.

- Decide who gets what—and how. Direct bequests, beneficiary designations, or trusts.

- Build liquidity. Estimate taxes and expenses at death; earmark cash, a line of credit, or life insurance to cover them without fire-sale asset disposals.

- Document valuations. Keep appraisals and broker statements to support basis and estate values.

- Calendar reviews. Revisit annually and after major life or law changes.

Beginner modifications & progressions

- Simplify: If your estate is well below applicable thresholds, focus on wills, beneficiaries, and keeping basis records.

- Progress: As complexity rises (businesses, multi-state property, large accounts), add trust structures, a gift plan, and state-specific counsel.

Recommended frequency & metrics

- Annual review of documents and beneficiaries.

- Quarterly spot-checks on titling for newly acquired assets.

- Metrics: percent of assets with current beneficiaries (target: 100%), updated will/trust (target: current within last 2 years), estimated liquidity coverage ratio (liquidity ÷ projected taxes/expenses; target ≥1.0).

Safety, caveats & mistakes to avoid

- Assuming one country’s rules apply everywhere. They don’t.

- Ignoring state-level taxes (U.S.) or provincial rules (Canada, Australia).

- Neglecting paperwork (e.g., missed elections or late returns) that forfeits valuable tax relief.

Mini-plan example (2–3 steps)

- List all accounts with beneficiaries; fix any that default to “estate.”

- Order appraisals for high-value real estate and closely held shares; file the reports with your estate binder.

Estate, inheritance, gift, and GST taxes—what they are and how they hit generational wealth

What each tax is & purpose

- Estate tax: A tax on the transfer of a decedent’s taxable estate before assets pass to heirs. In the U.S., the federal basic exclusion amount is $13.99 million per person for 2025 (double for many married couples with portability), and the top rate is 40%. Some U.S. states impose their own estate or inheritance taxes.

- Inheritance tax: Paid by beneficiaries (not the estate) in certain jurisdictions; rates and exemptions vary. Some U.S. states and many countries use this model.

- Gift tax: Applies to lifetime transfers above annual exclusions; in the U.S., $19,000 per recipient in 2025 without using lifetime exemption.

- Generation-skipping transfer (GST) tax: A federal tax (U.S.) on transfers skipping a generation (e.g., grandparent to grandchild), with its own exemption and filings for certain trust events.

Requirements & prerequisites

- Know your country and state/province rules.

- Maintain records of prior large gifts and any filed returns (e.g., U.S. Forms 709/706/706-GS).

Step-by-step to assess your exposure

- Check thresholds where you live. Example: U.S. federal exclusion $13.99M (2025). If you live in a U.S. state with estate/inheritance tax, note the lower state threshold.

- Add up taxable transfers. Tally lifetime taxable gifts that reduce your remaining exclusion.

- Identify GST exposure. If you plan to benefit grandchildren directly or via “skip” trusts, note GST rules and filings.

- Model scenarios. Estimate potential estate/inheritance tax given your values and beneficiary plan.

Beginner modifications & progressions

- Beginner: If far below thresholds, keep basic documents and consider simple annual gifts within exclusions.

- Advanced: Layer in dynasty or GST-exempt trusts for multigenerational planning if your estate is near/exceeds exemptions.

Recommended frequency & metrics

- Annual: Update your lifetime gift ledger and remaining exclusion.

- Metric: ratio of projected estate value to applicable exclusion (target <1.0 if minimizing estate tax).

Safety, caveats & mistakes to avoid

- Assuming federal rules are all that matter if you live in the U.S.; many states impose separate taxes at different thresholds.

- Forgetting that only a tiny fraction of U.S. estates pay federal estate tax—helpful perspective, but not an excuse to skip planning.

Mini-plan example

- Pull your state’s estate/inheritance tax rules; if applicable, set a reminder to revisit thresholds every January.

- Create a one-page snapshot of lifetime gifts and current exclusion remaining.

Step-up (or step-down) in basis—why timing and valuation save heirs real money

What it is & purpose

When an heir inherits assets, their tax basis may reset to fair market value at the decedent’s death (“step-up” or, if values fell, “step-down”). That means pre-death appreciation usually isn’t taxed to the heir upon sale—only post-inheritance gains are. This can be one of the most valuable tax features of passing assets at death.

Requirements & prerequisites

- Reliable date-of-death valuations and statements.

- A process to track adjusted basis going forward.

Step-by-step implementation

- Document values at death. Appraisals for real estate and private businesses; broker statements for securities.

- Record the new basis in your estate file and beneficiary packets.

- Coordinate with the tax preparer for the estate/trust and for heirs, so future sales use the correct basis.

Beginner modifications & progressions

- Beginner: Start with the largest two or three assets (home, main investment account).

- Progress: Extend to all taxable assets; add appraisal schedules for complex property.

Recommended frequency & metrics

- At each death in the family wealth plan: ensure every taxable asset has a substantiated basis record.

- Metric: percent of assets with documented basis (target 100%).

Safety, caveats & mistakes to avoid

- Confusing gift basis rules (carryover) with inheritance basis rules (often fair market value at death).

- Skipping formal appraisals—problematic years later if an heir sells and faces an audit.

Mini-plan example

- Order a USPAP-compliant appraisal for the family home within 60–90 days after death.

- Save statements showing the closing market value for brokerage accounts on the date of death.

Spousal, charitable, and portability rules—the highest-impact elections you can make

What they are & purpose

- Marital deduction: Many jurisdictions allow transfers to a surviving spouse tax-free at the first death (deferral, not elimination).

- Charitable bequests: Assets left to qualified charities can reduce the taxable estate.

- Portability (U.S.): The surviving spouse may use a deceased spouse’s unused exclusion—but only if a timely and properly prepared estate tax return is filed. Relief is available for certain late filings.

Requirements & prerequisites

- A will or trust that clearly directs assets and, if needed, creates a QTIP or bypass trust.

- Awareness of filing deadlines (e.g., U.S. Form 706 due 9 months after death; possible 6-month extension with Form 4768; simplified late-portability relief up to 5 years in specified cases).

Step-by-step to capture the benefits

- Elect portability when appropriate. File an estate tax return even if no federal estate tax is due at the first spouse’s death, to preserve unused exclusion.

- Decide on marital deduction structure. Outright bequests or a QTIP trust so the survivor benefits for life, taxable at the second death.

- Coordinate charitable intent. If philanthropy is part of your plan, design bequests or trusts that maximize deductions within your goals.

Beginner modifications & progressions

- Beginner: If married and below thresholds, still file for portability as a safeguard.

- Progress: Use QTIP for blended families or to control ultimate beneficiaries while deferring tax.

Recommended frequency & metrics

- Event-driven: File within deadlines after a spouse’s death; calendar relief windows if needed.

- Metric: Deceased Spouse’s Unused Exclusion (DSUE) documented and preserved (target: yes, if applicable).

Safety, caveats & mistakes to avoid

- Missing the portability filing because “no tax is due”—a common and costly error.

- Assuming charitable transfers automatically reduce income taxes of heirs; bequests primarily impact estate/transfer taxes. IRS

Mini-plan example

- If a spouse dies, engage a CPA immediately and file Form 706 (with extension if needed) to elect portability, even when the estate is under the exclusion.

- For a second-marriage couple, ask counsel about a QTIP with clear remainder beneficiaries.

Jurisdiction snapshots—how rules differ across countries (and why that matters)

United States (federal + state layer)

- Federal basic exclusion: $13.99 million per person for 2025; annual gift exclusion $19,000; separate state estate/inheritance taxes exist in many states.

- Only a tiny share of estates owe federal estate tax, but state rules can change the picture for moderate estates.

United Kingdom

- Inheritance Tax typically applies at 40% above a £325,000 nil-rate band (with an additional home-related band that can raise the effective threshold when a residence passes to direct descendants). Policies are under discussion, but the core thresholds and mechanics remain essential planning anchors.

Canada

- No federal estate or inheritance tax, but “deemed disposition” at death can trigger capital gains on appreciated assets in the final return.

Australia

- No federal estate/inheritance tax; capital gains tax applies when inherited assets are later sold. Cost-base rules differ depending on when the deceased acquired the asset; documentation matters.

Pakistan

- No inheritance, estate, or gift taxes at the national level; other transaction-based taxes (like property and capital value taxes) can still affect transfers.

Requirements & prerequisites

- Confirm your domicile and residency for tax purposes.

- If you hold assets in multiple countries, obtain local advice to avoid double taxation or missed reliefs.

Step-by-step

- List jurisdictions where you own assets or where beneficiaries live.

- Pull official guidance for each, starting with revenue authority websites.

- Prioritize the strictest or most expensive rules in planning scenarios.

Beginner modifications & progressions

- Beginner: Focus on your home country first; add cross-border advice if any asset or beneficiary is abroad.

- Progress: Use situs-specific wills or local trust arrangements for property in other countries.

Recommended frequency & metrics

- Every 12–24 months or after major law changes.

- Metric: Coverage map complete (all jurisdictions addressed) and updated.

Safety, caveats & mistakes to avoid

- Relying on news instead of primary guidance for threshold changes.

- Failing to align your plan with forced-heirship or family law considerations abroad (seek counsel).

Mini-plan example

- If you live in one country and own rental property in another, ask a cross-border tax adviser to model both countries’ rules before deciding who inherits that property.

Trusts and structures that help you transfer wealth with control (and fewer tax surprises)

What they are & purpose

Trusts are legal containers that hold assets and specify who benefits, when, and under what conditions. They can streamline probate, protect beneficiaries, coordinate taxes, and document basis and valuation. Common tools include revocable living trusts, bypass/credit-shelter trusts, QTIP trusts for spousal support with control over remainders, and charitable trusts for tax-efficient philanthropy.

Requirements & prerequisites

- Accurate titling: assets must be re-titled or beneficiary-designated to the trust.

- A trustee who can keep records, file returns, and follow the instrument.

- Clear drafting that anticipates contingencies (incapacity, remarriage, special needs, business succession).

Step-by-step for a basic revocable trust plan

- Draft a revocable trust and pour-over will.

- Fund the trust: re-title accounts and deed property as instructed by counsel.

- Add transfer-on-death (TOD) or payable-on-death (POD) designations where appropriate.

- Maintain a trust asset schedule and store appraisals with the trust.

Beginner modifications & progressions

- Beginner: Start with a will + beneficiaries + one revocable trust for probate simplification.

- Progress: Add QTIP/bypass structures for tax deferral and control; layer charitable tools as desired.

Recommended frequency & metrics

- Annual trust review and funding audit (what’s titled properly?).

- Metric: percent of intended assets actually titled to the trust (target: 100%).

Safety, caveats & mistakes to avoid

- Drafting the trust but not funding it.

- Naming a trustee who can’t administer (or won’t engage professionals).

Mini-plan example

- After signing your trust, block a half-day to re-title brokerage accounts and record a deed for the family home to the trust (if counsel recommends it).

A practical quick-start checklist (warm-up)

- Inventory and value every asset (include basis where known).

- Confirm beneficiary designations and TOD/POD instructions.

- Draft or update your will and (if appropriate) a revocable trust.

- Decide whether to elect portability at a spouse’s death; calendar deadlines.

- Build a liquidity plan to cover taxes/expenses without forced sales.

- Create a gift log tracking annual exclusion gifts and lifetime taxable gifts.

- Set an annual planning date to review law changes and documents.

Troubleshooting & common pitfalls

- “We’re under the federal exclusion, so we’re fine.” Maybe; but state death taxes or cross-border rules can still bite.

- “I didn’t file for portability because no tax was due.” You can permanently lose the deceased spouse’s unused exclusion. Late relief exists but is conditional—don’t rely on it.

- “We’ll figure basis later.” Missing valuation records at death leads to capital-gains problems for heirs.

- “I gifted the house; that avoids tax.” Gifts use carryover basis and can create bigger future taxes for the recipient than an inheritance with step-up.

How to measure progress (results & KPIs)

- Readiness score: percent of assets with accurate titling and beneficiaries (target 100%).

- Documentation score: percent of high-value assets with current appraisals/basis records (target 100%).

- Liquidity ratio: liquid funds ÷ projected taxes/settlement costs (target ≥1.0).

- Compliance score: on-time filings (estate, gift, GST) and elections (portability/QTIP) (target 100%).

A simple 4-week starter plan (roadmap)

Week 1: Inventory & intent

- Build a net worth statement; flag complex assets (businesses, rental property).

- Write a one-page “disposition memo” that says who should receive what and why.

Week 2: Documents & designations

- Draft/update will, powers of attorney, and (if appropriate) a revocable trust.

- Update all beneficiaries, TOD/POD instructions, and transfer forms.

Week 3: Valuation & basis

- Order appraisals for real estate/business interests; download date-of-death-style reports for securities (for your file).

- Start a basis folder with deeds, closing statements, and improvement receipts.

Week 4: Taxes & funding the plan

- Review estate/inheritance/gift rules for your jurisdiction(s); set annual gift cadence if desired.

- Build a liquidity plan (cash, credit line, or life insurance held and titled according to your plan).

Real-world examples and mini-plans

Example A: U.S. couple with $10M net worth (home + portfolio)

- File for portability at the first death even if no tax is due. Move the survivor’s estate below thresholds via lifetime gifts within exclusions and charitable bequests at the second death.

Example B: Parent in the U.K. with a paid-off home

- Check IHT thresholds and how the residence band applies for direct descendants. Consider gifting strategies within small annual allowances and ensure will provisions align with current rules.

Example C: Canadian resident with a large non-registered portfolio

- Model deemed disposition at death and the resulting capital gains on the final return; consider spousal rollover options or charitable strategies to offset gains.

Example D: Pakistan-domiciled family with property

- While no inheritance/estate/gift taxes apply nationally, evaluate property-related taxes and ensure clear titling plus succession planning compliant with local law.

Frequently asked questions

- What is the difference between estate tax and inheritance tax?

Estate tax is levied on the decedent’s estate before distribution; inheritance tax is levied on the recipient. Some places have one, the other, or both. - How many U.S. estates actually pay federal estate tax?

A very small share—well under 1%—pay federal estate tax each year. Planning still matters for state taxes, capital gains, liquidity, and family control. - What is the U.S. federal exclusion and annual gift exclusion right now?

For 2025, the basic exclusion is $13.99 million per person and the annual gift exclusion is $19,000 per recipient. - If my spouse dies and no tax is due, do I need to file anything?

If you may benefit from using their unused exclusion later, file an estate tax return to elect portability within deadlines (or seek limited late-relief options). - What is a step-up in basis, and why do heirs care?

It generally resets an inherited asset’s tax basis to its fair market value at death, limiting capital gains tax to appreciation after inheritance. Keep valuation records. - Do all U.S. states have the same rules?

No. Many have their own estate or inheritance taxes with different thresholds and rates, separate from federal rules. - How do the U.K., Canada, and Australia differ from the U.S.?

The U.K. uses inheritance tax with defined thresholds; Canada taxes capital gains via deemed disposition; Australia relies on capital gains rules for later sales of inherited property. - Is gifting always better than leaving assets at death?

Not necessarily. Gifts often carry carryover basis, which can increase a recipient’s future capital gains tax compared with receiving the same asset at death with a step-up. IRS - What is GST tax and when does it apply?

It applies when transfers skip a generation (e.g., to grandchildren) and has its own exemption and filing rules for certain trust events. - What deadlines matter most after a death?

In the U.S., estate tax returns are generally due in 9 months (with possible 6-month extension), and special late-portability relief may apply if conditions are met. - What documents should every family have, even if below tax thresholds?

A will, powers of attorney, beneficiary designations, and (often) a revocable trust to streamline administration. - How do I know if I need a QTIP or bypass trust?

These are useful when you need spousal support plus control over ultimate beneficiaries, or when tax deferral and blended-family dynamics are key concerns. Get bespoke legal advice. Legal Information Institute

Conclusion

Taxes don’t have to derail your legacy. The families that preserve generational wealth understand the rules, do the paperwork, document values, and keep their plan current. Whether your estate is modest or complex, a thoughtful mix of beneficiary designations, trusts, timely elections, and careful valuation can move more of your life’s work to the next generation—with fewer surprises along the way.

Copy-ready CTA: Start your plan today—document your assets, fix your beneficiaries, and book a meeting with your adviser to map your tax-smart legacy.

References

- IRS releases tax inflation adjustments for tax year 2025, Internal Revenue Service, May 29, 2025, https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025

- Gifts & Inheritances 1 (Annual Exclusion and Gift Tax Return), Internal Revenue Service, January 2, 2025, https://www.irs.gov/faqs/interest-dividends-other-types-of-income/gifts-inheritances/gifts-inheritances-1

- Gifts & inheritances (Basis of Inherited Property), Internal Revenue Service, October 10, 2024, https://www.irs.gov/faqs/interest-dividends-other-types-of-income/gifts-inheritances/gifts-inheritances

- Frequently asked questions on estate taxes (including marital deduction and filing deadlines), Internal Revenue Service, accessed August 14, 2025, https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-estate-taxes

- Revenue Procedure 2022-32 (Late portability relief), Internal Revenue Service, July 8, 2022, https://www.irs.gov/pub/irs-drop/rp-22-32.pdf

- How many people pay the estate tax?, Urban-Brookings Tax Policy Center, January 2024, https://taxpolicycenter.org/briefing-book/how-many-people-pay-estate-tax

- Estate and Inheritance Taxes by State, 2024, Tax Foundation, November 12, 2024, https://taxfoundation.org/data/all/state/estate-inheritance-taxes/

- How Inheritance Tax works: thresholds, rules and allowances, UK Government, accessed August 14, 2025, https://www.gov.uk/inheritance-tax

- Taxable capital gains on property, investments and other capital property (Deemed disposition at death), Government of Canada (CRA), accessed August 14, 2025, https://www.canada.ca/en/revenue-agency/services/tax/individuals/life-events/doing-taxes-someone-died/prepare-returns/report-income/capital-gains.html

- Cost base of inherited assets, Australian Taxation Office, June 22, 2025, https://www.ato.gov.au/individuals-and-families/investments-and-assets/capital-gains-tax/inherited-assets-and-capital-gains-tax/cost-base-of-inherited-assets

- How CGT applies to inherited assets, Australian Taxation Office, June 22, 2025, https://www.ato.gov.au/individuals-and-families/investments-and-assets/capital-gains-tax/inherited-assets-and-capital-gains-tax/how-cgt-applies-to-inherited-assets

- Pakistan – Individual – Other taxes (Inheritance, estate, and gift taxes), PwC Worldwide Tax Summaries, accessed August 14, 2025, https://taxsummaries.pwc.com/pakistan/individual/other-taxes

- Topic No. 703, Basis of assets, Internal Revenue Service, June 25, 2025, https://www.irs.gov/taxtopics/tc703

- About Form 706-GS(T) (Generation-Skipping Transfer Tax), Internal Revenue Service, January 28, 2025, https://www.irs.gov/forms-pubs/about-form-706-gs-t

- Instructions for Form 706 (Estate Tax; portability timing and elections), Internal Revenue Service, October 2024, https://www.irs.gov/instructions/i706

- What is a step-up in cost basis and how can it affect me?, Fidelity Learning Center, accessed August 14, 2025, https://www.fidelity.com/learning-center/personal-finance/what-is-step-up-in-basis

- 26 U.S. Code § 1014 – Basis of property acquired from a decedent, Legal Information Institute, accessed August 14, 2025, https://www.law.cornell.edu/uscode/text/26/1014