Turning 18 unlocks your first real shot at a strong credit profile—and the habits you build now can save you thousands in interest later. This guide shows you exactly how to start building credit at 18 with practical, low-risk moves that work in the real world. You’ll learn how to open your first tradeline, keep utilization low, report rent and utilities, avoid avoidable dings, and protect your identity while you grow. Short answer: to start building credit at 18, open one reporting account (a starter/secured card or a credit-builder loan), pay on time every month, keep balances very low, and monitor your reports for accuracy. We’ll walk through the “how,” “how much,” and “what to avoid.”

Quick-start steps (skim-friendly):

- Pull your free credit reports and baseline score.

- Open one primary account (secured/student card or a credit-builder loan).

- Use autopay and keep utilization under 10% (never over 30%).

- Consider an authorized-user boost on a well-managed, older card.

- Report rent and eligible utilities.

- Space new applications, monitor, and dispute errors fast.

Friendly disclaimer: This article offers general, educational information—not individualized financial, legal, or tax advice.

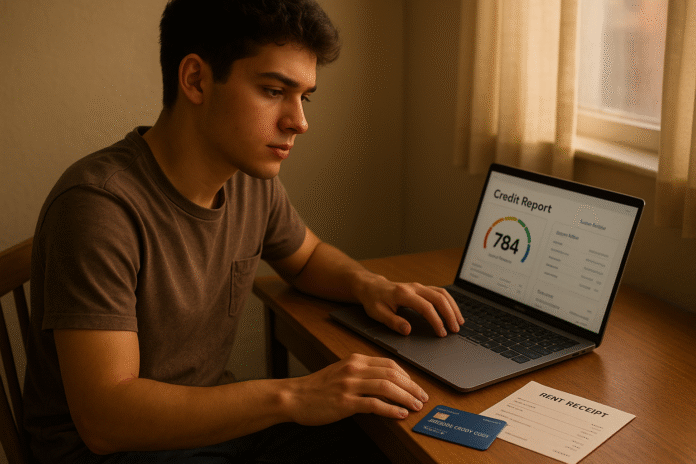

1. Check Your File First: Get Your Free Reports and Baseline Score

Start by confirming what’s already in your credit file and that it’s accurate. At 18, many people have no file at all; others may already have a thin file from being added to a parent’s account, a student loan, or a phone plan. Pulling your reports shows whether you’re starting from zero, need to fix errors, or can build on an existing history. In the U.S., the official portal to access your free credit reports is AnnualCreditReport.com—the only site authorized by federal law. Once you’ve seen what’s there, take note of any personal information mistakes, unknown accounts, or late-payment notations. If something’s wrong, dispute it right away with both the credit bureau and the company that reported the item. Catching errors early prevents avoidable score damage and helps you start clean. It’s also smart to check at least one credit score (from your bank, card issuer, or a reputable service) to establish a baseline; just remember that different models (FICO vs. VantageScore) weigh data differently and may appear at different times in your journey.

- Mini-checklist:

- Get all three reports via AnnualCreditReport.com.

- Save PDFs; highlight any errors.

- If needed, dispute errors with the bureau(s) and the furnisher; keep records.

1.1 Numbers & guardrails

- Expect score visibility to vary: FICO generally needs at least 6 months of reported activity; VantageScore can often produce a score sooner.

Synthesis: Start by knowing your starting point—clean reports and a baseline score make every next decision easier and safer.

2. Pick Your First Primary Account: Secured/Student Card or Credit-Builder Loan

Your first “tradeline” is the engine of your credit journey. If you have income, a student or starter credit card is often the simplest path; secured cards work well if approval is tough—your refundable deposit (often $200–$500) usually equals your credit limit. If a card isn’t viable yet, a credit-builder loan (CBL) from a credit union or fintech can report on-time payments and return your savings at the end. Under U.S. rules, people under 21 typically must show independent ability to pay or apply with a qualified co-signer for a card. Read the fine print, pick the lowest-fee option you can manage, and set up autopay from day one. For a secured card, choose the lowest deposit that still keeps utilization comfortable (see Section 3). For a CBL, confirm the lender reports to at least one major bureau and that the term fits your budget.

- How the products work (at a glance):

- Secured card: You pay a refundable deposit; issuer reports your usage/payments. Experian

- Credit-builder loan: Lender locks funds; you pay monthly; payments are reported; savings unlock at term end.

- Under-21 rule: Issuers generally require independent income or a 21+ co-signer.

2.1 Tools/Examples

- Check your bank’s student card, local credit union secured card, or a CBL from a community lender.

- Make sure the lender/issuer reports to at least one bureau (ideally all three).

Synthesis: Choose one primary account you can manage flawlessly; approval path differs by income and product, but reporting and on-time payments are what build your score.

3. Use Ultra-Low Utilization and Pay in Full—Every Month

Credit scores reward two habits above all: on-time payments and low utilization. Payment history is the single largest FICO factor, and even one 30-day late payment can sting for years. Keep your utilization (reported balance ÷ credit limit) ideally under 10%—never above 30%—and pay in full to avoid interest. Statement balances are what most issuers report, so you can pay before the statement closing date to show a tiny balance or zero. Set autopay for at least the statement balance; use calendar reminders to prepay mid-cycle if needed.

- Numeric example: $300 limit × 10% = $30 target balance; $300 × 30% = $90 red-line cap.

- Why it matters: Payment history is ~35% of a classic FICO; amounts owed/utilization is ~30%.

3.1 Common mistakes

- Maxing out for rewards, then paying after the statement closes (high utilization gets reported).

- Relying on minimum payments—interest can snowball and mistakes become costly.

Synthesis: Keep reported balances tiny and never miss a due date; this single habit does most of the scoring work for you.

4. Add a Credit-Builder Loan (Optional) to Diversify Your Mix

If your first account is a credit card, consider adding a credit-builder loan after 1–3 months to diversify your “credit mix” (installment + revolving). A typical CBL holds the loan proceeds in a locked savings account while you make fixed payments; those payments get reported, and you receive the savings at term end. Choose a small dollar amount and a short term (e.g., 12 months) that you can comfortably afford, and confirm the lender reports to at least one bureau. If you already opened a CBL in Step 2, you’re covered—just pay on time and finish the term.

- Mini-checklist:

- Verify reporting to one or more bureaus.

- Select a payment that fits your budget—automation is your friend.

- Avoid overlapping too many new accounts at once; see Section 9.

4.1 Evidence snapshot

- CFPB research (randomized evaluation) found CBLs can help consumers without scores establish files and improve scores for those without current debt. Consumer Financial Protection Bureau

Synthesis: A small, well-managed installment loan can round out your file and reinforce positive payment history while you save.

5. Consider Becoming an Authorized User on a Well-Managed, Older Card

Being added as an authorized user (AU) on a trusted adult’s long-standing, low-utilization card can help your profile—if the issuer reports AU data and the account is handled well. Not all issuers report for all ages, and negative behavior on that card (late payments, high utilization) can hurt you, so choose carefully. This is not a substitute for having your own primary tradeline, but it can add age and history while you’re getting started.

- What to verify with the primary cardholder:

- No late payments ever; utilization consistently low.

- Issuer reports authorized users to bureaus.

- Agreement on spending rules (or no physical card issued to you).

- Plan to remove AU status if account practices change. Consumer Financial Protection Bureau

5.1 Region notes

Policies on reporting AUs vary by issuer and country. In the U.S., most major issuers report, but it’s not guaranteed—ask before proceeding.

Synthesis: An AU slot on a pristine, older account can be a helpful boost; treat it as a supplement, not your foundation.

6. Report Your Rent (If You Pay It)

Rent is often your biggest monthly bill—make it count. Rent reporting adds a positive tradeline when your landlord or a service furnishes on-time payments to credit bureaus. Not every landlord participates, but adoption is growing, and some jurisdictions encourage or require offering the option. Before you sign up, compare fees and which bureaus receive data. Positive rent data may appear on your standard credit report (Experian includes some) and can help you become scoreable faster under certain models. Unpaid rent sent to collections can hurt, so consistency is key.

- How to activate:

- Ask your landlord if they report; many use platforms integrated with TransUnion or Experian RentBureau.

- If not, explore reputable tenant-facing services and confirm which bureaus they report to (and costs).

- Understand that reporting coverage and impact vary by model and lender.

6.1 Evidence snapshot

- CFPB lists Experian RentBureau and notes some positive rent data is included in standard reports; research shows positive-only rent reporting increases the chance of having a credit score. Consumer Financial Protection Bureau

Synthesis: If you already pay rent on time, reporting it can convert everyday housing payments into visible credit history.

7. Get Utilities and Phone Bills Counted (Where Possible)

By default, utilities and cell bills usually don’t build your score unless they’re reported—and they often aren’t. However, tools like Experian Boost can add eligible utility, phone, streaming, and some rent payments to your Experian file by scanning your bank transactions. The effect varies by person and scoring model; it’s not a magic fix, but it can help thin files become scoreable and nudge certain scores up. Late or unpaid utility bills can still hurt if they go to collections, so pay on time regardless.

- Action steps:

- See if Boost or similar opt-in services are a fit for you; know that impact is typically Experian-only.

- Keep expectations realistic; the biggest gains still come from on-time payments and low utilization.

7.1 Numbers & guardrails

- Utilities generally don’t report positive payment history by default; collections do show up—which is avoidable with autopay and buffers.

Synthesis: Use opt-in reporting to turn everyday bills into data points—helpful, but supplemental to the core habits in Section 3.

8. Automate Payments and Build a “Never-Late” System

The simplest way to protect a young credit file is to automate good behavior. Enable autopay (at least for the statement balance), schedule calendar nudges a few days before due dates and statement close, and stash a small cushion in checking so an unexpected expense doesn’t trigger an NSF or missed payment. For shared expenses (roommates, family plans), centralize payments to one person and settle up via peer-to-peer transfers so the reported account stays pristine. If you travel or change banks, double-check that autopay followed you.

- Mini-checklist:

- Autopay: ON for statement balance or full balance.

- Due-date & statement-close reminders: ON.

- Mid-cycle “utilization check”: quick balance pay-down if needed.

- For variable income: set a weekly micro-review ritual.

8.1 Tools/Examples

- Your bank’s bill-pay vs. merchant auto-debits work differently—know which you’ve enabled and keep records. Consumer Financial Protection Bureau

Synthesis: Systems beat willpower; with automation, “on-time, low-balance” happens by default.

9. Apply Sparingly, Space Hard Inquiries, and Use Pre-Qualification

Every new application can trigger a hard inquiry, which may cost a few points temporarily and stays on your reports for up to two years (usually affecting FICO for about one). Space applications by several months, and use pre-qualification tools (soft-pull) to gauge your odds before applying. If you’ve placed a credit freeze for security, remember to lift it at the bureau(s) your lender uses before you apply, then refreeze afterward. Rate shopping rules apply to certain loans (like auto/mortgage) but not usually to credit cards—so batching card apps isn’t a free pass.

- Quick facts:

- Hard inquiries can cause a small, temporary dip; avoid multiple back-to-back card apps.

- Freezing/unfreezing is free and often instantaneous online or by phone.

9.1 Mini-checklist

- If frozen, thaw the relevant bureau(s) 24–48 hours before applying; set a re-freeze date after.

- Prefer pre-qualification; if denied, wait and improve metrics before retrying.

Synthesis: Fewer, smarter applications protect your score while you build history the right way.

10. Monitor, Dispute Errors, and Protect Your Identity

Young files are vulnerable to data-entry mistakes and identity theft. Get in the habit of reviewing reports and scores regularly. If you see an error, dispute it in writing with both the bureau and the furnisher; include documents, keep copies, and track responses. For stronger protection, consider a credit freeze at all three bureaus; you can thaw it when applying for credit. If a company won’t fix a clear mistake, you can escalate to the CFPB complaint portal after you’ve tried with the company directly.

- How to dispute (high level):

- Identify each error clearly; state what you want corrected; provide proof; keep records.

- Freeze or lift freezes for free at Equifax, Experian, and TransUnion.

10.1 Tools/Examples

- USA.gov and the FTC maintain clear freeze/dispute how-tos and timelines. USAGov

Synthesis: Vigilant monitoring and quick, well-documented disputes keep your file accurate—accuracy drives your score as much as good habits do.

11. Let Your Age Work for You: Keep Your First Card Open and Grow Gradually

Length of credit history matters. Keep your first, no-annual-fee card open long-term to anchor your “oldest account” age and average age of accounts. After 6–12 months of perfect use, consider a credit limit increase (CLI) from your issuer (many do soft-pull CLIs), which helps utilization. Don’t rush to collect cards: two well-managed primary accounts (e.g., one card + one CBL) are more than enough to build strong early results. Let time, not volume, do the heavy lifting.

- Numbers & guardrails:

- In classic FICO models, length of history and new credit categories together account for ~25%; fewer, older, well-managed accounts generally win.

- Remember: some scoring models won’t appear until enough history accrues (FICO ≈ 6 months).

11.1 Common mistakes

- Closing your first card “to simplify.” Instead, stash it with a small recurring charge + autopay to keep it active.

Synthesis: Time is your silent ally; keep early accounts healthy and let age accumulate.

12. Practice Credit-Safe Spending: Budget Buffers, BNPL Caution, and “No Co-Sign” Boundaries

Finally, protect your progress with a few safety rules. Budget a buffer so a surprise expense doesn’t trigger a missed payment. Be cautious with Buy Now, Pay Later (BNPL)—as of now, some lenders are starting to furnish BNPL tradelines to TransUnion, but much of this data does not yet feed common scores, and missed payments can still show up negatively. Don’t co-sign loans at 18; if the borrower misses, you’re fully on the hook and your score pays the price. Keep your eyes on the prize: on-time payments, low utilization, and measured growth.

- BNPL snapshot (as of now):

- TransUnion indicates some BNPL tradelines began furnishing in late 2024 but many don’t impact scores yet; visibility varies.

- CFPB has been active on BNPL disclosures and protections; policies continue to evolve. Consumer Financial Protection Bureau

12.1 Mini-checklist

- Keep a one-month expense buffer.

- Avoid co-signing and impulse BNPL.

- Rely on Sections 2–3 habits—they carry most scoring weight.

Synthesis: Defensive moves keep small mistakes from becoming credit-history scars—your score is easier to protect than to repair.

FAQs

1) How long does it take to get a credit score from zero?

With FICO, you generally need about six months of activity on at least one account to generate a score. VantageScore can often produce a score sooner because of different minimum-data rules, but lenders use a mix of models, so build for both.

2) What’s the easiest first account at 18: card or loan?

If you have income, a student or secured card is usually simplest. If you can’t qualify yet, a credit-builder loan is a solid alternative that reports on-time payments and returns your savings at term end.

3) Do debit cards or prepaid cards build credit?

Generally no—debit and prepaid activity isn’t reported as credit. Use them for budgeting if you like, but open at least one reporting credit account to build a score. Consumer Financial Protection Bureau

4) What utilization ratio should I target?

Aim for under 10% whenever possible; staying below 30% is the common red-line. Paying before your statement closes can reduce the reported balance and help utilization. Consumer Financial Protection Bureau

5) Does becoming an authorized user always help?

It can, but only if the issuer reports AU data and the account is managed well. High balances or late payments on the primary account can hurt you. Verify reporting first.

6) Can rent and utilities build credit?

Rent: Often yes, if your landlord or a service reports payments. Utilities/phone: usually not by default, but Experian Boost can add eligible payments to your Experian file.

7) How many accounts should I have in year one?

One or two well-managed tradelines (e.g., one card + one small CBL) are plenty. Focus on perfect payment history and low utilization before adding more.

8) Do hard inquiries ruin your score?

No—each hard inquiry usually causes only a small, temporary dip. Avoid stacking multiple card applications in a short window. Investopedia

9) I’m under 21—can I get my own credit card?

Yes, but you’ll typically need to show independent income or apply with a qualified co-signer, per U.S. rules implementing the CARD Act. myFICO

10) What if my dispute isn’t fixed?

Escalate: re-dispute with better documentation and consider filing a CFPB complaint after engaging the company.

11) Does BNPL help build credit?

Not reliably. Some BNPL tradelines are being furnished, but many don’t affect common scores yet; missed payments can still harm you.

12) What’s the single best move at 18?

Open one reporting account you can manage perfectly, set autopay, keep balances tiny, and let time compound your results.

Conclusion

Starting to build credit at 18 is less about hacking the system and more about mastering a few controllable behaviors. Open one reporting account you can comfortably manage, use autopay to never miss, keep utilization under 10%, and add strategic boosters like rent reporting or a credit-builder loan when they fit your budget. Space applications, monitor your file, and fix errors quickly. Over the next 6–12 months, these habits create the on-time history and low balances that most scoring models reward—and they’ll keep rewarding you for years. Begin small, be consistent, and let your earliest accounts grow old with you.

CTA: Set up your first tradeline and autopay today—then calendar a 90-day check-in to measure progress.

References

- How do I get a free copy of my credit reports? Consumer Financial Protection Bureau, Sept 8, 2025. Consumer Financial Protection Bureau

- AnnualCreditReport.com – Home Page. AnnualCreditReport.com, accessed Sept 2025. https://www.annualcreditreport.com/ annualcreditreport.com

- What are the minimum requirements for a FICO® Score? myFICO, accessed Sept 2025. myFICO

- What is Payment History? myFICO, accessed Sept 2025. myFICO

- Can a card issuer consider my age when deciding whether to issue a credit card? CFPB, Sept 6, 2024. Consumer Financial Protection Bureau

- 12 CFR §1026.51 – Ability to Pay. CFPB Official Interpretations, accessed Sept 2025. Consumer Financial Protection Bureau

- Targeting Credit Builder Loans (Report + Summary). CFPB, July 13, 2020. and https://files.consumerfinance.gov/f/documents/cfpb_targeting-credit-builder-loans_report_2020-07.pdf Consumer Financial Protection Bureau

- What Is Experian Boost? Experian, July 31, 2025. Experian

- How does being an authorized user affect your credit? myFICO FAQ (Authorized User). Accessed Sept 2025. myFICO

- Experian RentBureau – Rental payment database. Experian, accessed Sept 2025. Experian

- How Renting Can Impact Your Credit. TransUnion, Oct 14, 2024. TransUnion

- Free credit freezes are here. FTC Consumer Advice, June 23, 2022. Consumer Advice

- How to report your rent payments to credit bureaus. Bankrate, May 17, 2024. Bankrate

- Utilities & credit reports—do they help? CFPB Ask CFPB, Sept 11, 2025. Consumer Financial Protection Bureau

- VantageScore vs. FICO—minimum history differences. Chase, Nov 2024. Chase

- Dispute errors on your credit report. CFPB Ask CFPB, Dec 18, 2024. Consumer Financial Protection Bureau

- Buy Now, Pay Later loans and your credit. TransUnion, Nov 12, 2024; plus BNPL furnishing update, Aug 28, 2025. and https://www.transunion.com/blog/bnpl-and-point-of-sale-lending TransUnion

- What Is a Security Deposit on a Credit Card? Capital One, June 10, 2025. Capital One