If you’ve ever felt that retirement planning and pension accounts are a maze, you’re not alone. The good news: with a clear plan, setting up the right mix of accounts is straightforward—and you can do it in days, not months. This guide walks you through, step by step, how to set up the top five pension-style accounts most savers use to build durable retirement income. You’ll learn what each account does, how to open and fund it, the common mistakes to avoid, how to track your progress, and a simple 4-week roadmap to go from “I should start” to “I’ve started.”

Disclaimer: This article is for education only and is not financial, tax, or legal advice. Rules vary by country and change over time. Consult a qualified professional for guidance tailored to your situation.

Key takeaways

- Start simple: Capture any available employer match first, then automate contributions to individual accounts.

- Use the right mix: Combine an employer plan, a traditional account, a Roth-style account, a self-employed plan (if applicable), and—optionally—an income annuity as a guaranteed-income layer.

- Automate everything: Automatic contributions, target-date or diversified index funds, and annual “set-and-check” reviews cut decision fatigue.

- Mind fees and mistakes: Small fee differences compound. Avoid early withdrawals, excess contributions, and scattered accounts.

- Measure what matters: Track savings rate, contribution progress vs. limits, investment costs, allocation drift, and readiness milestones.

1) Employer-Sponsored Defined Contribution Plan (e.g., 401(k), 403(b), 457, TSP)

What it is & why it matters

An employer-sponsored plan lets you divert part of your paycheck into a tax-advantaged retirement account. Many employers also offer a matching contribution—arguably the highest-return dollars you’ll ever earn because the match is immediate and risk-free. Plans typically include a Roth option (after-tax) and a pre-tax option; both are powerful tools for tax diversification across your lifetime.

Core benefits

- Payroll automation: money goes in before you see it.

- Potential employer match (free money you shouldn’t leave on the table).

- Institutional pricing and access to a simple default fund lineup (often including a target-date fund).

Requirements & low-cost alternatives

- You need: employment with a sponsoring organization and plan eligibility (often immediate or after a short waiting period).

- Low-cost alternative if no plan: open an individual retirement account and a taxable brokerage account to keep saving consistently.

Step-by-step setup (first-timer)

- Find the plan portal: Look for onboarding emails or HR benefits page. Create your login.

- Elect contributions: Pick a starting savings rate you can stick to (for beginners, 10% is a sturdy target; adjust based on your budget).

- Capture the match: Contribute at least enough to maximize any employer match.

- Choose your investment default: If you want hands-off simplicity, select a target-date fund aligned with your planned retirement year.

- Turn on auto-increase: Schedule a 1%–2% annual bump until you reach your ideal savings rate.

- Add beneficiaries: Name primary and contingent beneficiaries in the portal—don’t skip this.

- Save your confirmations: Download your enrollment confirmations and investment choices for your records.

Beginner modifications & progressions

- Simplify (beginner): Use a single low-cost target-date fund.

- Progress (intermediate): Build a three-fund portfolio (total stock, total international, total bond) to fine-tune costs and allocations.

- Advanced: Add a Roth vs. pre-tax split to engineer tax flexibility in retirement.

Frequency, duration & metrics

- Frequency: Contributions each paycheck; investment review annually.

- Metrics to watch: savings rate %, match captured %, net expense ratio of chosen funds, and allocation drift (how far you’ve moved from your target mix).

Safety, caveats & common mistakes

- Watch fees: Expense ratios and plan admin fees quietly erode returns over time.

- Avoid early withdrawals: Hardship withdrawals and loans can jeopardize compounding.

- Mind job changes: Don’t leave old accounts scattered; consolidate thoughtfully.

Mini-plan example

- Enroll today; set contribution to the match threshold.

- Choose a target-date fund; enable 1% auto-increase each year.

- Add/update beneficiaries and save the confirmation PDF.

2) Traditional IRA (Individual Retirement Account)

What it is & why it matters

A Traditional IRA is a personal retirement account with tax-deferred growth. Depending on your income and participation in a workplace plan, contributions may be deductible. Even when not deductible, tax deferral on growth still aids compounding.

Core benefits

- Full control over where you open, what you invest in, and what you pay.

- Tax-deferred growth—gains aren’t taxed each year while invested.

- Broad investment menu: index funds, bonds, CDs, and more.

Requirements & low-cost alternatives

- You need: earned income and a provider (brokerage, bank, or robo-advisor).

- Low-cost alternative: if you cannot deduct contributions, consider a Roth IRA (if eligible) or use taxable brokerage with tax-efficient index funds.

Step-by-step setup (first-timer)

- Pick a provider: Compare account fees, index fund expense ratios, and user experience.

- Open the account: Complete the application online; provide ID and Social Security/tax ID.

- Fund it: Link your bank and set a monthly auto-contribution that fits your budget.

- Choose investments: Start with a single target-date or balanced index fund.

- Track contributions: Keep a simple spreadsheet or use your provider’s dashboard to avoid over-contributing.

- File and store: Save statements and year-end tax forms in a secure folder.

Beginner modifications & progressions

- Simplify (beginner): One target-date fund.

- Progress (intermediate): Build a two- or three-fund index portfolio to dial in costs and asset mix.

- Advanced: Coordinate with your employer plan so your overall stock/bond split fits your risk plan.

Frequency, duration & metrics

- Frequency: Monthly auto-payments.

- Metrics: total contributed YTD, % of annual target funded, expense ratio of holdings, and diversification score (how many asset classes you actually own).

Safety, caveats & common mistakes

- Excess contributions: Going over your annual limit can trigger penalties—track carefully.

- Ineligible deductions: Deductibility may be limited if you or your spouse have a workplace plan and your income exceeds certain thresholds.

- Short-term speculation: Avoid chasing hot funds; stay the plan.

Mini-plan example

- Open a Traditional IRA at a low-cost brokerage.

- Set a monthly auto-contribution you can maintain.

- Invest in a target-date fund and review once a year.

3) Roth IRA (after-tax contributions, tax-free qualified withdrawals)

What it is & why it matters

A Roth IRA accepts after-tax contributions; qualified withdrawals in retirement are tax-free. That makes Roth dollars a potent hedge against future tax uncertainty and a flexible source of retirement cash flow.

Core benefits

- Tax-free qualified withdrawals in retirement.

- No lifetime mandatory withdrawals for the original owner.

- Contributions (not earnings) are generally accessible without taxes or penalties, offering emergency flexibility.

Requirements & low-cost alternatives

- You need: earned income within eligibility limits and a provider.

- Low-cost alternative: If your income is too high for direct Roth contributions, consider whether strategies like back-door contributions are available and appropriate in your jurisdiction—speak with a professional first.

Step-by-step setup (first-timer)

- Compare providers: Look for $0 account fees and low-cost index funds.

- Open & fund: Create the account; schedule a monthly transfer.

- Pick an investment: Target-date fund for simplicity or a diversified index mix.

- Set reminders: Calendar a spring check-up to confirm you’re on track to meet your annual target.

- Document: Save confirmations and note your total contributions each year.

Beginner modifications & progressions

- Simplify (beginner): Single target-date fund.

- Progress (intermediate): Split between domestic and international stock index funds plus a bond index.

- Advanced: Coordinate Roth vs. pre-tax across your accounts to diversify your future tax brackets.

Frequency, duration & metrics

- Frequency: Monthly contributions; review annually.

- Metrics: annual Roth funding progress, % equity vs. bonds, and total expense ratio.

Safety, caveats & common mistakes

- Income eligibility: Confirm that your income allows direct contributions.

- Over-contribution fixes: If you accidentally overfund, contact your provider promptly to correct it.

- Trading temptations: Don’t time markets; automate and stay diversified.

Mini-plan example

- Open a Roth IRA; set auto-contributions.

- Invest in a target-date fund aligned to your expected retirement year.

- Each January, increase the monthly amount by a small step to keep pace with your income.

4) Self-Employed Plan (Solo 401(k) or SEP IRA)

What it is & why it matters

If you freelance, consult, or run a small business, a self-employed plan lets you contribute more than a personal IRA typically allows, accelerating your retirement savings. Two popular choices are Solo 401(k) (for owner-only businesses) and SEP IRA (easy to set up, allows employer contributions).

Core benefits

- Higher potential contribution room than a personal IRA.

- Tax deferral and broad investment options.

- Flexibility to choose Roth or pre-tax (Solo 401(k) options vary by provider).

Requirements & low-cost alternatives

- You need: self-employment income. Solo 401(k) is typically for businesses with no employees (other than a spouse), while SEP IRAs can be used by businesses of any size (but require contributions for eligible employees if you have them).

- Low-cost alternative: If your self-employment income is small or irregular, keep funding your IRA and employer plan first while your business grows.

Step-by-step setup (first-timer)

- Pick the plan type: If you’re truly solo and want employee+employer contribution structure or a Roth option, explore a Solo 401(k). If you want dead-simple setup and only employer contributions, consider a SEP IRA.

- Choose a provider: Compare plan fees, paperwork, contribution mechanics, and Roth availability (for Solo 401(k)).

- Open the plan: Complete the application (some Solo 401(k)s require adoption documents); keep copies for your records.

- Fund it: Transfer from your business bank account based on your net earnings.

- Invest: Use a low-cost, diversified mix or a target-date fund.

- Calendar deadlines: Contributions have specific timing rules relative to your tax filing—note them and coordinate with your accountant.

Beginner modifications & progressions

- Simplify (beginner): Start with a SEP IRA for easy setup.

- Progress (intermediate): Move to a Solo 401(k) if you need Roth contributions or higher deferral flexibility.

- Advanced: Coordinate contributions across your day-job plan and your side-business plan within annual limits and tax rules.

Frequency, duration & metrics

- Frequency: Contribute when you pay yourself or finalize your books; review quarterly.

- Metrics: % of net business income saved, expense ratios, and investment allocation fit.

Safety, caveats & common mistakes

- Eligibility and employees: Adding employees can change your plan obligations—know the rules.

- Paperwork and deadlines: Missed forms or late contributions can create penalties—coordinate with your tax pro.

- Over-contribution risk: Understand how contributions across multiple plans interact.

Mini-plan example

- Open a SEP IRA using your business info.

- Set aside a fixed percentage of net income each quarter.

- Invest in a single target-date fund to stay hands-off.

5) Lifetime Income Layer (Immediate or Deferred Income Annuity)

What it is & why it matters

A retirement income annuity is an insurance contract that converts a portion of your savings into a guaranteed stream of income for a period or for life. Used in moderation, it can turn a slice of your nest egg into pension-like income, reducing the risk you’ll outlive your assets.

Core benefits

- Predictable, stable income you cannot outlive (depending on contract).

- Behavioral relief: fewer decisions about which assets to sell in a downturn.

- Customization: options for joint life, inflation adjustments, or guaranteed periods.

Requirements & low-cost alternatives

- You need: a reputable insurer, clear understanding of fees and features, and a realistic sense of how much guaranteed income you want.

- Low-cost alternative: build a “bond ladder” or use low-fee retirement-income funds if you prefer to avoid insurance products.

Step-by-step setup (first-timer)

- Clarify the goal: How much baseline income do you want alongside social benefits and withdrawals?

- Collect quotes: Compare multiple insurers; review guaranteed income, fees, optional riders, and inflation adjustments.

- Verify strength and costs: Check insurer financial strength ratings and understand surrender charges and liquidity.

- Fund prudently: Consider annuitizing only a portion of your assets so you keep flexibility elsewhere.

- Coordinate taxes: Understand how annuity income is taxed relative to your other accounts.

Beginner modifications & progressions

- Simplify (beginner): Consider a plain-vanilla immediate annuity for lifetime income starting soon.

- Progress (intermediate): Explore deferred income annuities that start later to hedge longevity risk.

- Advanced: Layer multiple smaller annuities over time or add inflation riders if appropriate.

Frequency, duration & metrics

- Frequency: One-time purchase or staged purchases; review annually.

- Metrics: share of baseline expenses covered by guaranteed income, payout rate, and insurer rating.

Safety, caveats & common mistakes

- Complexity and fees: Understand the contract; avoid high-cost riders you don’t need.

- Liquidity trade-off: Money used to buy an annuity is generally illiquid—balance with other savings.

- Shop around: Quotes vary; compare widely and read the fine print.

Mini-plan example

- Get three competing quotes for an immediate annuity covering 20%–30% of core expenses.

- Pick the simplest contract that meets your needs (e.g., joint life with a modest inflation adjustment).

- Fund and connect the income stream to your retirement budget.

Quick-Start Checklist (print this)

- Enroll in your employer plan and contribute at least enough to capture the full match.

- Open a Traditional IRA and/or Roth IRA at a low-cost provider; set monthly auto-contributions.

- If self-employed, open a SEP IRA or Solo 401(k) and note contribution deadlines.

- Consider a small income annuity to cover a portion of fixed expenses.

- Choose simple, low-fee investments (target-date or broad index funds).

- Turn on auto-increase for contributions each year.

- Add beneficiaries to every account and store confirmations securely.

- Schedule a 30-minute annual review on your calendar.

Troubleshooting & Common Pitfalls

“I changed jobs and now have multiple old accounts.”

Consolidate purposefully. Consider direct rollovers to reduce paperwork and tax friction. Keep a record of what moved where.

“I accidentally over-contributed.”

Contact your provider promptly. Many allow you to remove or reclassify excess contributions before tax filing deadlines to avoid penalties.

“My investments feel too complicated.”

If your portfolio has more than five overlapping funds, simplify to a target-date fund or a three-fund index mix.

“I’m worried about a market crash.”

Write an Investment Policy Statement (IPS) with your target stock/bond mix and rebalancing rules. Revisit annually, not daily.

“Fees seem tiny—do they even matter?”

They do. Compare expense ratios; favor low-cost index funds where appropriate. Small differences compound over decades.

“I contributed to the wrong IRA type.”

Speak with your provider about your options and with a tax professional to confirm the cleanest fix in your jurisdiction.

“I’m self-employed and confused about contribution calculations.”

Coordinate early with your accountant. Mark plan deadlines and contribution formulas on a one-page calendar.

“I need guaranteed income but don’t want to lock up everything.”

Annuitize only a slice of your assets. Keep the rest liquid and invested for growth.

How to Measure Progress (your dashboard)

Track these five signals quarterly or semi-annually:

- Savings rate: % of gross income saved toward retirement (target a level that fits your plan and budget).

- Match captured: Are you getting the full employer match every paycheck?

- Contribution progress: Year-to-date contributions vs. your annual target for each account.

- Cost check: Weighted average expense ratio across your holdings.

- Allocation drift: Deviation (in percentage points) from your target stock/bond mix—rebalance if it strays beyond your ±5% band.

Bonus signals: number of accounts (fewer, well-organized accounts are easier to manage), and guaranteed-income coverage (share of baseline expenses covered by pensions, social benefits, and annuity income).

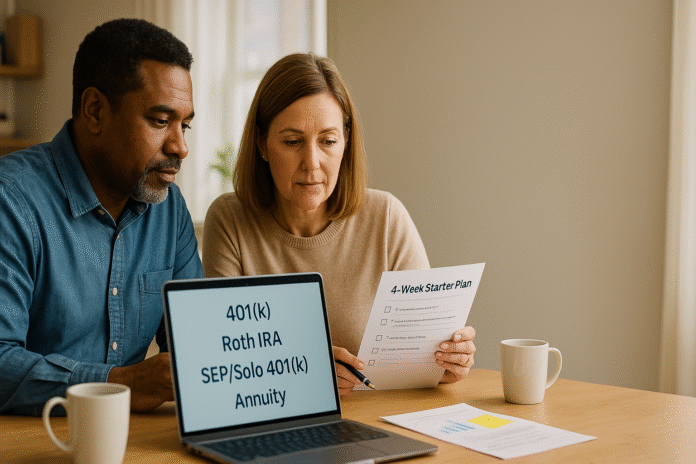

A Simple 4-Week Starter Plan

Week 1: Inventory & Intent

- List current accounts, balances, and fees.

- Confirm employer match details and plan login credentials.

- Decide your “core mix”: employer plan + Traditional or Roth IRA + (if self-employed) SEP/Solo + optional income annuity later.

Week 2: Open & Enroll

- Enroll in the employer plan and set contributions (at least to the match).

- Open your Traditional IRA or Roth IRA.

- Choose a simple investment default (target-date or broad index fund).

- Add beneficiaries across accounts.

Week 3: Automate & Simplify

- Turn on monthly auto-contributions for your IRAs.

- Enable a 1%–2% auto-increase in your employer plan.

- If self-employed, open a SEP IRA or Solo 401(k) and note deadlines.

- Consolidate any small legacy accounts via direct rollovers.

Week 4: Calibrate & Confirm

- Check your expense ratios and replace any high-fee funds with lower-cost alternatives.

- Write a one-page IPS with your target allocation and rebalancing rule.

- Put a 30-minute annual review on your calendar.

- Relax—you’re set up. Keep contributing and let time do the heavy lifting.

FAQs

1) Which account should I fund first?

Start by contributing enough to your employer plan to capture the full match. Then fund your IRA (Traditional or Roth, depending on your situation). If you still have room, increase contributions to the employer plan and, if self-employed, to your SEP or Solo 401(k).

2) Can I have both a Traditional and a Roth IRA?

Yes. You can hold both, but your combined annual contributions across IRAs are subject to a single limit. Choose the mix that best fits your tax planning.

3) I don’t have an employer plan. What now?

Open a Traditional or Roth IRA at a low-cost provider and set up automatic monthly contributions. Consider a taxable brokerage account for additional savings.

4) How do I choose investments if I’m new to this?

A target-date fund is a one-decision solution that automatically rebalances. If you want more control, a three-fund index portfolio is a simple, low-cost alternative.

5) I’m worried about picking the “wrong” year for a target-date fund.

The year is just a guidepost. Choose based on your risk comfort. If you prefer more caution, pick a fund dated earlier; for more growth, choose one dated later.

6) What happens to my accounts when I change jobs?

Consider a direct rollover to your new employer plan or to an IRA to keep things organized. Avoid cashing out—this can create taxes and penalties and disrupt compounding.

7) Are annuities right for me?

They can be useful for covering essential expenses with guaranteed income. Keep the contract simple, compare quotes, and consider annuitizing only a portion of assets.

8) How much should I save for retirement?

There’s no single number. Many savers aim for a double-digit savings rate and adjust based on age, existing assets, and desired retirement lifestyle. A professional can help you refine the target.

9) Should I use pre-tax or Roth contributions in my employer plan?

Diversifying across both can hedge future tax uncertainty. If your current tax rate is high, pre-tax can help now; if you expect higher taxes later, Roth may be attractive.

10) What if I accidentally over-contribute or contribute to the wrong IRA type?

Contact your provider quickly. There are established processes to correct excess contributions or to reclassify in some cases—act before tax deadlines and consult a professional.

Conclusion

You don’t need to master every rule to build a resilient retirement plan. You need a repeatable system: capture your match, automate contributions to the right personal accounts, invest simply at low cost, and review once a year. Add a measured layer of guaranteed income later if it helps you sleep at night. Do the simple things well, and time becomes your ally.

Start today: enroll in your plan, open your IRA, and set your first automatic contribution.

References

- 401(k) plans overview, Internal Revenue Service, updated May 27, 2025 — https://www.irs.gov/retirement-plans/401k-plans

- 401(k) plan overview for plan sponsors, Internal Revenue Service — https://www.irs.gov/retirement-plans/plan-sponsor/401k-plan-overview

- Operating a 401(k) plan (automatic enrollment basics), Internal Revenue Service — https://www.irs.gov/retirement-plans/operating-a-401k-plan

- Traditional and Roth IRAs, Internal Revenue Service (updated July 29, 2024) — https://www.irs.gov/retirement-plans/traditional-and-roth-iras

- Roth IRAs (general rules and features), Internal Revenue Service — https://www.irs.gov/retirement-plans/roth-iras

- Retirement topics: IRA contribution limits, Internal Revenue Service — https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

- Rollovers of retirement plan and IRA distributions, Internal Revenue Service (May 30, 2025) — https://www.irs.gov/retirement-plans/plan-participant-employee/rollovers-of-retirement-plan-and-ira-distributions

- Rollover chart (eligible plan-to-plan and IRA rollovers), Internal Revenue Service (PDF) — https://www.irs.gov/pub/irs-tege/rollover_chart.pdf

- One-participant (Solo) 401(k) plans, Internal Revenue Service (updated May 27, 2025) — https://www.irs.gov/retirement-plans/one-participant-401k-plans

- Simplified Employee Pension (SEP) plan, Internal Revenue Service — https://www.irs.gov/retirement-plans/plan-sponsor/simplified-employee-pension-plan-sep

- Retirement plans FAQs regarding SEPs, Internal Revenue Service — https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-seps

- Target Date Funds – Investor Bulletin, U.S. Securities and Exchange Commission (Mar 25, 2025) — https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/target-date-funds-investor-bulletin

- Target date retirement funds: Tips for ERISA plan fiduciaries, U.S. Department of Labor — https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/fact-sheets/target-date-retirement-funds-tips-for-erisa-plan-fiduciaries

- A Look at 401(k) Plan Fees (PDF), U.S. Department of Labor — https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/401k-plan-fees.pdf

- Annuities (investor education), FINRA — https://www.finra.org/investors/investing/investment-products/annuities

- Pension lump-sum payouts and your retirement security (PDF), Consumer Financial Protection Bureau — https://files.consumerfinance.gov/f/201601_cfpb_pension-lump-sum-payouts-and-your-retirement-security.pdf

- Helping people plan for retirement (blog), Consumer Financial Protection Bureau — https://www.consumerfinance.gov/about-us/blog/helping-people-plan-retirement/