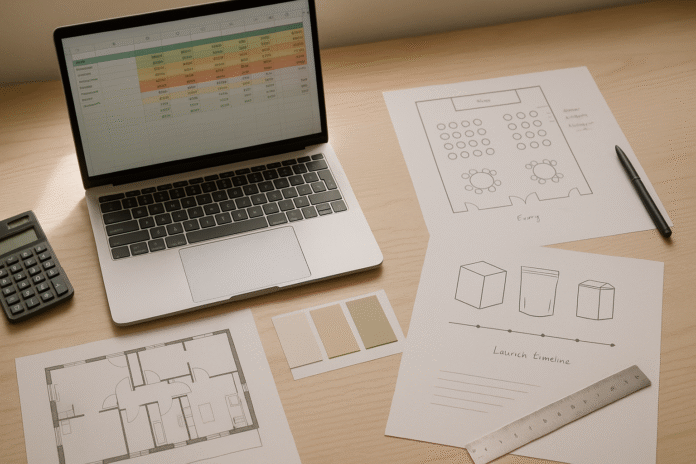

Whether you’re pricing a conference, refitting a kitchen, or bringing a new product to market, the fastest way to estimate with confidence is to start from project budget templates that already encode best-practice structure, formulas, and guardrails. Below, you’ll find 13 templates (with use cases) that map cleanly to how real projects spend money—so you don’t miss hidden costs or lose track of changes. A project budget template is a structured spreadsheet or form that breaks work into cost categories, quantities, and rates, then rolls them up into totals, contingencies, and approvals. It lets you estimate quickly, track actuals, and forecast the finish. To use this guide safely: treat it as practical education, not financial advice; final decisions should reflect your organization’s policies, contracts, and local regulations.

Quick start steps: define scope → choose the template → set cost codes → enter quantities and unit rates → add contingency and taxes → baseline and track changes.

1. WBS-Driven Cost Breakdown Template (Your Scope-to-Cost Backbone)

A WBS-driven cost breakdown template is the most reliable starting point because it turns the project scope into a hierarchical list of deliverables with matching cost codes and rollups. In practice, this means every event area (venue, AV, catering), every renovation subassembly (demolition, framing, finishes), and every launch stream (creative, media, enablement) gets its own subtree—so nothing hides in “miscellaneous.” Start by mapping deliverables to rows, attach units (hours, days, sqm/sqft, each), and capture rates next to them. The first 1–2 sentences answer the sub-intent directly: Use a WBS template to translate scope into costed line items, then let the hierarchy roll up totals by work package and phase. Expect to spend most time on structure first—if the tree is wrong, your numbers will be wrong, too. A good WBS template also includes a dictionary column (short definition for each line) and a responsible owner, so updates flow to the right person. Close by baselining a version once scope stabilizes, then track variances against that baseline as the project evolves.

1.1 Why it matters

- It enforces scope discipline and prevents orphan costs.

- It enables apples-to-apples comparisons across vendors.

- It makes contingency sizing and change control auditable.

1.2 How to do it

- Start with 3–4 levels (e.g., 1.0 Venue → 1.1 Room Rental → 1.1.1 Setup Hours).

- Assign cost codes (e.g., 2000-series for labor, 3000 for materials, 4000 for services).

- Add unit + quantity + rate columns; calculate extended costs and rollups.

- Include “owner” and “assumptions” columns to capture context.

- Lock a baseline tab once approved.

Mini example: If your launch has 12 demo kits at $180 each plus 24 staff hours at $20/hour for assembly, the line total is $2,160 + $480 = $2,640 under “1.2.3 Demo Kits,” which rolls into “1.2 Booth Build,” then “1.0 Event”.

Synthesis: Build the budget around the WBS first; it becomes your single source of truth for estimates, approvals, and change logs.

2. Estimating Methods Template (Analogous, Parametric, Three-Point, Bottom-Up)

Different projects and phases need different estimating methods, and the right template bakes those into columns you can actually use. Use an estimating methods template to choose—and combine—analogous (past project), parametric (rate × size), three-point (optimistic/most likely/pessimistic), and bottom-up estimates, then document the basis of estimate (BOE). Early in planning, a parametric tab (e.g., $/attendee, $/sqm, $/feature) speeds directional estimates; later, bottom-up detail takes over. The template should include confidence levels and a way to reconcile multiple methods (e.g., average or weighted by confidence). Three-point estimating (PERT) helps expose risk skew—large spreads signal volatility and the need for more investigation. By capturing the method per line, you keep audits clean and stakeholders aligned on why a number is what it is.

2.1 Numbers & guardrails

- Parametric rates: document source and date (e.g., last year’s conference $/attendee).

- Three-point PERT: Expected = (O + 4M + P) / 6; Stdev ≈ (P − O) / 6.

- Bottom-up: require unit, quantity, and rate; disallow “lump sums” without a note.

2.2 Mini-checklist

- Identify method per line.

- Capture BOE source and assumption.

- Record confidence (e.g., ±15%).

- Reconcile methods when they differ.

Numeric example: A venue AV package: O=$8,000, M=$10,000, P=$13,000 → Expected ≈ ($8k + 4×$10k + $13k)/6 = $10,166; Stdev ≈ ($13k−$8k)/6 ≈ $833. Use this to size contingency at the line or work-package level.

Synthesis: Explicit methods plus a BOE column turn hand-waving into traceable numbers and make reviews faster and fairer.

3. Direct, Indirect, and Overhead Template (So You Don’t Miss the Hidden 20–30%)

Many estimates fail not on materials or vendors, but on the indirects—permits, supervision, insurance, software, and internal time. Use a direct/indirect/overhead template to separate cost types, allocate shared costs, and normalize vendor bids. For events, indirects include planner hours, credit card fees, and contingency; for renovations, think general conditions, builder’s risk insurance, and site security; for launches, add PM hours, tools (DAM, MAP), and legal reviews. The template should auto-allocate shared overheads (e.g., 10% project management) proportionally to direct costs, with the percentage documented and adjustable. That way, you see the true “all-in” picture and can compare options on equal footing.

3.1 Common mistakes

- Burying internal time in “free labor.”

- Double-counting tax or fees across vendors.

- Ignoring payment processing costs for ticketed events.

- Forgetting warranty/maintenance for renovated assets.

3.2 Region-specific notes

- VAT/GST may apply to services and rentals; check whether quoted prices are before/after tax.

- Withholding taxes on cross-border services can alter vendor economics.

- Insurance requirements vary; certificates may cost vendors time/money—budget for it.

Mini-checklist: tag each line as direct, indirect, or overhead; set allocation rules; review “unallocated” before approval.

Synthesis: Making indirects visible typically adds 10–25% realism to early estimates and prevents late “surprise” requests.

4. Unit-Rate & Quantity Takeoff Template (Best for Renovations)

For physical work, units drive cost. Use a quantity takeoff template that lists assemblies (e.g., drywall, paint, flooring), their units (sqm/sqft, linear meters/feet), and unit rates, then multiplies by measured quantities to compute totals. Couple this with a assumptions tab that logs sources (plans, site measures) and productivity rates. For interior refits, you’ll track demolition quantities, rebuild quantities, finish types, and any specialty trades (MEP). Good templates include waste factors, productivity multipliers (weekend/night work), and escalation if the schedule spans seasons or a new fiscal year. By standardizing unit codes (CSI/Uniclass or your firm’s catalog), you also make supplier quotes easier to compare.

4.1 How to do it

- Build a room-by-room sheet with areas and linear runs.

- Apply unit rates from a reliable source or recent bids; date the source.

- Include separate lines for mobilization, disposal, and protection.

- Add a column for access constraints (elevator size, working hours).

4.2 Numeric example

- Paint 250 sqm at $7.50/sqm → $1,875 (incl. prep); add 8% waste → $2,025.

- Flooring 120 sqm at $28/sqm → $3,360; night work +12% → $3,763.

Synthesis: Quantity × unit-rate math is transparent, reviewable, and portable across bids; it’s the renovation estimator’s best friend.

5. Vendor Quote Comparison Template (RFP Normalization)

Three bids rarely come apples-to-apples. Use a vendor comparison template to line up scope, inclusions/exclusions, payment terms, and risk, then normalize the numbers before selection. Add columns for delivery dates, warranty, and service levels. Capture clarifications in a notes column tied to each line item; if Vendor B bundles two services, unbundle them in your sheet to compare properly. Include a risk row for each vendor (e.g., “overnight labor availability,” “equipment hold deposit”), scored and costed where feasible. For ticketed events or media buys, factor in currency and FX fees if quotes arrive in different currencies.

5.1 Mini-checklist

- Record quote validity date.

- Normalize tax, freight, and setup.

- Add “assumptions to verify” column.

- Score non-price factors (1–5) with weighting.

5.2 Numbers & guardrails

- Apply a like-for-like tax basis.

- Include payment schedule impact on cash flow (e.g., 50/40/10).

- Note refundable vs non-refundable deposits.

Synthesis: Normalization prevents “cheap because incomplete” selections and yields a defensible award decision.

6. Contingency & Risk Reserve Template (From P-Levels to Line-Item Buffers)

Uncertainty is not optional; contingency is how you price it. Use a contingency template to compute reserves at the right level—line, work package, or total—based on risk analysis. Early estimates may use a percentage by class, while later phases use three-point spreads or risk registers tied to dollar impacts. Distinguish contingency (known-unknowns) from management reserve (unknown-unknowns); keep reserves outside base costs so you can track usage transparently. The template should let you tag contingency against specific risks (e.g., “permit delay = +$4,000 labor float”) and record drawdowns when risks materialize.

6.1 How to do it

- Assign confidence per line (e.g., ±10%, ±25%).

- For high-volatility items, use three-point inputs.

- Roll up to P50 and P80 totals for decision-making.

- Track contingency draws with reason codes.

6.2 Mini example

Base cost $180,000; risk register suggests $12,000 P50 and $24,000 P80. Approve at P65 = ~$18,000; total budget $198,000. As actuals arrive under P50, release surplus by governance rule.

Synthesis: Contingency sized with method—not guesswork—keeps your estimate credible and your stakeholders calm.

7. Cash Flow & S-Curve Template (Time-Phased Budgeting)

Projects fail not because totals are wrong but because timing is. Use a cash flow template to spread costs by month (or week) and visualize an S-curve of planned vs actual spend. For events, deposits and milestone payments dominate; for renovations, labor ramps and materials spikes; for launches, media spend often peaks near go-live. Include payment terms and retainage to avoid month-end surprises. A good template also forecasts EAC (Estimate at Completion) using burn rates and remaining work, so finance sees deviations early.

7.1 Steps

- Map vendor payment schedules into months.

- Phase internal labor by resource plan.

- Add taxes when payable (invoice date vs payment date).

- Plot cumulative plan vs actual for the S-curve.

- Flag negative cash months for funding actions.

7.2 Numeric example

If your $120,000 budget lands 30%/50%/20% across Q2–Q3–Q4, plan $36k/$60k/$24k; if a vendor moves to 60% upfront, Q2 becomes $72k—does funding cover it?

Synthesis: Time-phasing turns a static budget into an operational instrument that protects delivery and working capital.

8. Taxes, Duties, Permits & Compliance Template (Jurisdiction-Ready)

Regulatory costs vary widely and can flip a decision. Use a compliance template to list taxes (VAT/GST/sales), duties, permits, inspections, licenses, and compliance documentation by jurisdiction—and to state whether vendor quotes are tax-inclusive. Events may need noise permits, fire marshal approvals, and insurance riders; renovations face building permits, inspections, and utility fees; launches can attract labeling, privacy, and import duties on samples. Add a “lead time” column and deadline alerts. Where cross-border vendors are involved, note withholding and treaty positions for net-of-tax comparisons.

8.1 Region-specific notes

- EU/UK: VAT handling for cross-border services differs from goods; reverse charge can apply.

- US/Canada: Sales tax exemptions vary by service and state/province.

- APAC: Some venues require local tax IDs for invoicing; build onboarding time into schedule.

8.2 Mini-checklist

- Confirm tax basis (inclusive/exclusive).

- List permit names, fees, and lead times.

- Capture insurance certificate requirements.

- Add compliance sign-off owner.

Synthesis: Pricing compliance explicitly avoids late blockers and makes bids comparable across borders.

9. Change Control & Budget Baseline Template (When Scope Moves)

Scope always moves—sometimes for good reasons. Use a change control template to log change requests, evaluate cost/schedule impact, route approvals, and update the budget baseline. Separate “estimate” from “approved” columns, and require a WBS reference. Add fields for funding source (contingency vs new funds) and revision numbers. For renovations, include a “field directive” path for urgent site changes; for events, capture sponsor upgrades; for launches, track scope creep on creative assets or channels.

9.1 Common mistakes

- Implementing changes before pricing/approval.

- Failing to adjust contingency after major scope cuts or adds.

- Not updating the baseline tab, leaving reports inconsistent.

9.2 Steps

- Record change description and WBS link.

- Estimate cost/schedule effect; state assumptions.

- Route for approval; record decision and funding.

- Update baseline, cash flow, and risk register.

Synthesis: A living baseline plus a disciplined log keeps truth aligned across PM, finance, and vendors.

10. Earned Value & Variance Analysis Template (Early Warning System)

If you want early warning, track earned value. Use an EVM template to calculate PV (planned value), EV (earned value), and AC (actual cost), then derive CPI, SPI, CV, and SV to see cost and schedule health. For events and launches, “earned” can be milestone-based (contracts signed, assets approved); for renovations, percent complete per work package works well. Add thresholds for management attention (e.g., CPI < 0.9 or SPI < 0.9). Include charts so leadership digests trends fast.

10.1 Numbers & guardrails

- CPI = EV / AC; SPI = EV / PV.

- EAC common formula: BAC / CPI (or more nuanced if schedule risk dominates).

- Use consistent progress rules (0/100, 50/50, or weighted milestones).

10.2 Mini example

Budget (BAC) $300k; month 3: PV $120k, EV $105k, AC $115k → CPI 0.91, SPI 0.88. Expect overrun and delay; trigger root-cause and corrective actions.

Synthesis: EVM metrics, even at a lightweight level, turn “feels off” into objective steering signals.

11. Funding Sources & Approvals Template (Capex/Opex, Stage Gates)

Money flows through rules. Use a funding template to tag each cost as CAPEX or OPEX, record funding sources (internal budget, sponsorship, grant), and map approvals by stage gate. Many organizations require pre-approval for deposits, POs, or contracts over a threshold. For product launches, marketing spend might need separate approvals than engineering or packaging. The template should clarify who can commit funds, what documents are required, and what evidence (quotes, BOE) must accompany submissions. Tie approvals to baseline versions to preserve audit trails.

11.1 Mini-checklist

- Capex/opex tag per line.

- Approval matrix by amount and category.

- Evidence links (quotes, SOWs, BOE).

- Stage gate dates and owners.

11.2 Region-specific notes

- Some grants reimburse only direct costs—not overhead—so tagging is critical.

- Sponsorships may be restricted; budget must reflect allowed uses.

Synthesis: Funding clarity prevents last-minute escalations and accelerates procurement without breaking policy.

12. Scenario Planning & Value Engineering Template (Options, Not Opinions)

Good decisions compare options on cost and impact—not gut feel. Use a scenario template to model best/base/worst cases and structured alternatives (e.g., venue A vs B, material grade X vs Y, channel mix 60/40 vs 80/20). Include toggles for scale (attendee count, sqm), service levels (standard/premium), and timing. For renovations, wire in alternates (e.g., laminate vs hardwood) with lifecycle cost notes; for launches, vary media weights and promo incentives. The template should summarize deltas in cost, risk, and schedule so sponsors can trade off openly.

12.1 Steps

- Define decision drivers (budget ceiling, ROI target, date).

- Build assumptions per scenario; label and date them.

- Show cost deltas and qualitative impacts side-by-side.

- Tie choices back to risks and contingency.

12.2 Numeric example

Event venue: A = $95k all-in, capacity 1,200; B = $72k + $18k AV = $90k, capacity 900. If attendance forecast is 950 ± 150, B risks over-capacity; model overflow cost or revenue loss.

Synthesis: Options framed in dollars, dates, and risks empower stakeholders to decide—fast and transparently.

13. Handover, Actuals & Lessons-Learned Template (Close the Loop)

The project ends, but your estimating gets better only if you close the loop. Use a closeout template to capture actuals vs estimate, reasons for variance, asset warranties, and lessons that update your rate library and templates. Include final WBS cost report, retained documents (permits, certificates), and a punch-list of post-event or post-launch tasks. Tag each variance with a root cause (scope change, productivity, price change, estimate error) and propose a preventive action for next time. Store this in a shared knowledge base so future teams can price faster and better.

13.1 Mini-checklist

- Final actuals by WBS vs baseline and latest EAC.

- Vendor performance scores and notes.

- Update parametric rates and BOE library.

- Archive compliance and warranty docs.

13.2 Why it matters

- It turns one-off learning into institutional advantage.

- It sharpens contingency practices with real distributions.

- It strengthens vendor negotiations with facts.

Synthesis: Treat closeout as part of budgeting; tomorrow’s accurate estimate is built from today’s finished project.

FAQs

1) What is the difference between a project budget template and a simple expense tracker?

A project budget template maps costs to scope, time, and approvals; an expense tracker merely logs spend after the fact. Templates include WBS structure, estimating methods, contingency, and cash-flow phasing—so you can forecast and control outcomes, not just record them. Use an expense tracker inside a larger template to monitor actuals, but keep planning logic (quantities, rates, risks) visible and auditable for decisions.

2) Which template should I start with if my project is still fuzzy?

Start with an estimating methods template that supports analogous and parametric inputs, paired with a lightweight WBS. That lets you produce a directional estimate quickly, capture assumptions, and size initial contingency. As scope firms up, migrate volatile items to bottom-up detail. The key is to baseline versions as you go, so stakeholders see how confidence improves and why numbers move.

3) How much contingency should I add to my project budget?

There’s no universal percentage. Calibrate contingency to scope clarity, volatility, and risk exposure. Early-stage ranges might be ±25–40%, while late-stage engineered estimates narrow to ±10–15%. For high-risk lines, use three-point estimates and compute P-levels across the rollup. Document the basis and track contingency draws with reasons, so you can release unused funds or request more with evidence.

4) What’s the best way to compare vendor quotes fairly?

Normalize everything onto one structure. Align inclusions/exclusions, taxes, freight, setup, and payment terms. Unbundle any bundled services so each line compares apples-to-apples. Add non-price scoring (quality, responsiveness, risk) with weights. Where currency differs, include FX and bank fees. Finally, check validity dates and lead times—an “expiring” cheap quote can be more expensive operationally if it forces a rushed decision.

5) How do I phase spend over time for cash flow?

Build a month-by-month view that reflects real payment terms and delivery milestones. Map deposits, progress payments, and retainage. For labor, use the resource plan to spread hours. Then chart the S-curve: planned vs actual cumulative spend. When variance appears early (e.g., SPI < 0.9), decide whether to resequence work, shift vendor payments, or draw on contingency to protect critical dates.

6) What makes renovation budgets different from event or launch budgets?

Renovations rely heavily on unit-rate × quantity math, site access constraints, and permitting/inspection sequences. Events concentrate costs into a short window with big deposits and service bundles; launches often blend internal labor with media and creative spend that can be scaled. All three benefit from WBS structure, but the estimating methods, risk profiles, and cash-flow patterns differ—your template should reflect those realities.

7) How do I handle internal labor—do I cost it if salaries are fixed?

Yes. Cost internal time for decision quality and true project economics. Use loaded rates (salary + benefits + overhead) if available, or a proxy agreed with finance. Even if cash doesn’t move, internal capacity is limited; costing it exposes trade-offs (e.g., hire a vendor vs delay another project). Keep internal time as a visible category so leaders can prioritize with facts.

8) What if stakeholders resist change control because they think it slows us down?

Show them the risk. Uncontrolled changes hide costs and create audit issues later. A simple, fast template—description, WBS link, estimated impact, assumptions, approver—can be completed in minutes and protects the team. Pair it with a weekly review cadence and thresholds for urgent “field directives.” Over time, you’ll see fewer disputes and better alignment because decisions and funding sources are recorded.

9) Are earned value metrics overkill for small projects?

Not if you keep it light. Even a milestone-based EV with CPI and SPI can surface early trouble. Define clear progress rules, update monthly, and react to thresholds. The return is real: you’ll know within weeks—not months—if the project is slipping or burning too hot, and you can correct course before costs compound.

10) What tools work best to build these templates?

Spreadsheets (Excel, Google Sheets) remain the most flexible. For collaboration and workflow, many teams pair sheets with Smartsheet, Airtable, or project suites (Asana, ClickUp, Notion) that handle approvals and file links. For renovation unit rates, use reputable cost books; for events, venue/AV calculators and BEOs help; for launches, marketing platforms provide channel-level pacing and cost data. Choose tools your team will actually maintain.

Conclusion

Budgeting is not about guessing a big round number—it’s about converting scope into cost, timing, and risk with enough structure that decisions become obvious. The 13 project budget templates above mirror how real work gets bought and delivered, from WBS structure and estimating methods to contingency, cash flow, compliance, change control, and closeout learning. If you start with the right template for your project’s phase—parametric early, bottom-up later—and make indirects, taxes, and reserves explicit, you’ll avoid the most common pitfalls and hold a stronger negotiating position with vendors and sponsors. Add light-touch variance tracking (CPI, SPI) and scenario planning, and you’ll steer proactively rather than reacting to late surprises. Your next step is simple: pick one template that fits your immediate decision, populate 10–20 key lines with assumptions, and baseline version 0.1. Then iterate weekly.

Call to action: Duplicate the template that fits your project today, populate assumptions, and baseline your first version by end of day.

References

- A Guide to the Project Management Body of Knowledge (PMBOK® Guide), Seventh Edition, Project Management Institute (PMI), 2021 — https://www.pmi.org/pmbok-guide-standards/foundational/pmbok

- Cost Estimating and Assessment Guide: Best Practices for Developing and Managing Program Costs, U.S. Government Accountability Office (GAO), March 2020 — https://www.gao.gov/products/gao-20-195g

- Recommended Practice No. 18R-97: Cost Estimate Classification System, AACE International, latest revision 2020 — https://web.aacei.org/resources/publications/recommended-practices

- The Green Book: Central Government Guidance on Appraisal and Evaluation, HM Treasury (UK), 2022 update — https://www.gov.uk/government/publications/the-green-book-appraisal-and-evaluation-in-central-government/the-green-book-2022

- DOE Cost Estimating Guide (G 430.1-1), U.S. Department of Energy, 2011 — https://www.directives.doe.gov/directives-documents/400-series/0430.1-EGuide-01

- ISO 21502:2021 — Project, programme and portfolio management — Guidance on project management, International Organization for Standardization (ISO), 2021 — https://www.iso.org/standard/74374.html

- RSMeans Data — Construction Cost Data, Gordian/RSMeans, accessed 2025 — https://www.rsmeans.com/

- Free Project Budget Templates, Smartsheet, updated 2024 — https://www.smartsheet.com/free-project-budget-templates

- How to Create and Manage an Event Budget, Bizzabo Blog, 2023 — https://www.bizzabo.com/blog/event-budget

- Marketing Budget: How to Create One (+ Templates), Shopify, updated 2024 — https://www.shopify.com/blog/marketing-budget