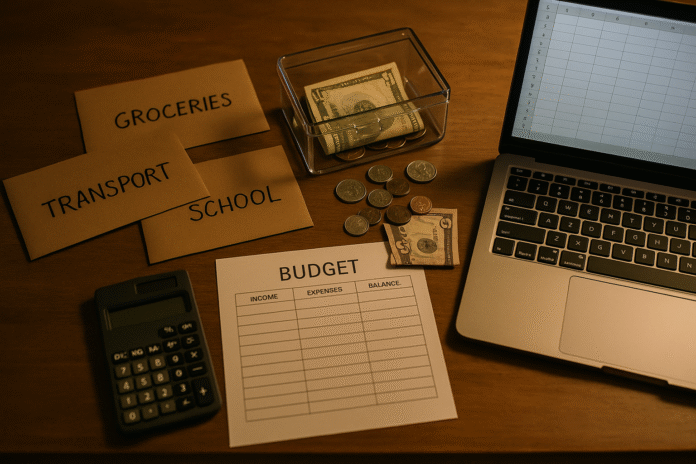

Cash seems to “vanish” in busy households: a school snack here, a ride-share tip there, a quick repair payment—none of it large, all of it adding up. Petty cash envelopes and budget templates give you a simple, tactile way to control those leaks without learning complex software. In short, you assign cash to labeled envelopes for frequent small purchases, track every outflow on a template, and reconcile weekly to keep your categories honest. This guide is for households that want clarity fast—whether you prefer paper, a spreadsheet, or a hybrid. Definition: Petty cash envelopes are labeled cash categories for small, frequent expenses; a household budget template records planned vs. actual spending and reconciles the envelopes regularly. Below are 10 practical, field-tested ways to set up, run, and maintain this system at home.

1. Define Cash-Friendly Categories and Set Envelope Limits

The fastest way to make cash envelopes work is to choose only the categories that benefit from paying in cash and seeing balances physically decline. Start with categories that tend to “leak” or require lots of small payments—groceries at local markets, produce stands, school canteen, parking, tips, household supplies, personal care, small repairs, and kids’ pocket money. Avoid forcing everything into envelopes; fixed bills (rent, utilities, insurance) are better left to bank transfers so you don’t carry excessive cash. Set limits for each envelope based on your monthly plan and split them by week so refills are predictable. When in doubt, pilot with three to five categories for one month before scaling to more.

1.1 How to do it

- Review the last 60–90 days of transactions and mark every cash-like purchase under $25 (or your local equivalent).

- Group similar outflows into 3–7 categories that you’ll actually carry.

- Assign monthly limits; then divide by 4 or 5 to create weekly envelope fills.

- Write category name, month, and weekly limit on each envelope’s front.

- Put a small index card inside each envelope to log date, purpose, and amount.

1.2 Numbers & guardrails

- Start with a cash pool equal to 10–25% of your total monthly variable spend.

- Keep no more than one week of petty cash on hand to manage risk.

- If an envelope empties early twice in a row, raise the limit 10–15% or add a separate category.

Synthesis: Limiting envelopes to leak-prone categories keeps the system light, safe, and effective, while weekly caps prevent mid-month surprises.

2. Build a Simple Budget Template That Mirrors Your Envelopes

Your budget template is the source of truth—envelopes are just the execution tool. The template should show planned vs. actual by category, weekly fills, and running balances. Whether you use paper or a spreadsheet, make columns intuitive: Date, Category, Description, In (fills/returns), Out (spend), Balance, and Notes. Maintain a separate section for “Budget vs. Actual” with variance (% and amount) and a monthly summary. If you like spreadsheets, set data validation to restrict categories to your envelope list; if you prefer paper, print a monthly ledger sheet per category and a dashboard page.

2.1 Tools/Examples

- Paper: ruled ledger pages + a monthly dashboard clipped to a clipboard.

- Spreadsheet: Google Sheets or Excel with SUMIF/S and DATA VALIDATION to prevent typos.

- Automation add-ons (optional): Tiller-style bank sync for non-cash categories; keep envelopes manual.

2.2 Mini checklist

- Mirror envelope names exactly in your template.

- Pre-fill weekly “In” entries (e.g., Week 1–4) with planned amounts.

- Add a “Reason” memo when you adjust limits mid-month.

- Protect formulas; enter transactions only in the log section.

Synthesis: When your template reflects your envelopes line-for-line, reconciliation is quick and you always know where cash stands relative to plan.

3. Establish a Weekly Refill & Reconciliation Ritual

Consistency—not perfection—wins. Pick a weekly time (e.g., Sunday evening) to count each envelope, record totals, and refill to the next week’s planned amount. During this ritual, you’ll log all new transactions, update balances, and handle exceptions like IOUs or misplaced receipts. Reconciliation also means matching non-cash categories in your template (groceries paid by card, utilities, subscriptions) so your monthly dashboard remains holistic.

3.1 Step-by-step

- Count: Confirm each envelope’s cash and match to the running balance.

- Log: Enter any missing spends from index cards or receipts.

- Refill: Add the planned weekly amount; record it in the “In” column.

- Variance: Note any category over/under; decide whether to move cash (see Section 6).

- Reset: Store envelopes securely and set next week’s reminder.

3.2 Numeric example

Suppose “Groceries” has a $320 monthly limit split into four weekly $80 fills. Week 1 you spend $68, leaving $12. On refill day, add $80, balance $92. Week 2 you spend $94, leaving −$2 (IOU). Refill $80; first clear the $2 IOU, then your usable Week-3 cash is $78. Variance shows you’re $14 over plan by mid-month—an early warning to trim.

Synthesis: A predictable weekly checkpoint catches small issues early and keeps the whole system truthful without daily micro-management.

4. Use Sinking Funds for Predictable but Non-Monthly Costs

Many “surprises” aren’t surprises—school uniforms, car servicing, birthdays, annual fees, and holiday travel recur on a schedule. Create sinking-fund envelopes (or sub-rows in your template) for these, and fund them monthly so the money is ready on time. Keep sinking funds separate from day-to-day envelopes to avoid accidental spending. For larger goals, consider keeping the cash in a labeled bank sub-account and transferring to an envelope only when you’re within a week of paying.

4.1 How to size them

- List the next 12 months of known non-monthly costs.

- Divide each cost by months remaining; round up to a whole currency amount.

- Fund on payday and track in your template’s “In” column as Sinking Fund.

4.2 Region-specific notes

- Where cash-handling is less common or carrying larger sums isn’t safe, store sinking funds digitally in a sub-account; withdraw to envelopes right before purchase.

- For currencies with large denominations, use smaller change envelopes (e.g., a separate coin pouch) to prevent overpaying.

Synthesis: Sinking funds smooth out big, irregular expenses so your weekly envelopes aren’t derailed by predictable “one-offs.”

5. Create a Petty Cash Log That Survives Real Life

Great systems fail for small reasons: lost receipts, smudged notes, or no place to write in a hurry. Design your petty cash log to be resilient. Use index cards inside each envelope for at-the-moment jotting and a master ledger in your template. Require three data points per spend: date, amount, purpose—that’s enough to reconcile even if the receipt disappears. Standardize abbreviations (e.g., “PKG tip,” “canteen,” “bus fare”) to keep entries readable later.

5.1 Common mistakes

- Writing after the fact: You’ll forget. Log immediately or before leaving the store.

- Rounding casually: Round only in the template; write exact amounts on the card.

- No payer initials: If multiple family members use envelopes, require initials.

5.2 Mini checklist

- Pencil for cards (doesn’t smear); pen for template entries.

- Keep a tiny binder clip inside each envelope to hold the card.

- Photograph high-value receipts and store digitally by category/month.

Synthesis: A lightweight, redundant logging method preserves accuracy without adding friction to every small spend.

6. Decide Your Transfer Rules Before You’re Tempted

At some point a category will run short. Pre-decide when you’re allowed to move cash between envelopes and when you must wait until the weekly refill. Many families adopt a 10% swap rule: you can borrow up to 10% of the donor envelope’s monthly limit and must record an IOU and reverse it during the next refill. For larger shortfalls, require a family huddle to adjust the plan, not just the cash. Codify these rules in your template so everyone plays fair.

6.1 Example transfer policy

- Swaps allowed for small emergencies (<$20) or price spikes.

- IOU must be logged in both envelopes and cleared within 7 days.

- Two or more IOUs in the same category triggers a limit review next month.

- No swaps from sinking funds unless the planned event is complete.

6.2 Numbers & guardrails

- Set a monthly cap for total swaps (e.g., no more than 5% of all cash limits).

- If a category is over by >15% two months running, re-baseline its limit by +10–20% and cut elsewhere.

Synthesis: Clear rules prevent heat-of-the-moment decisions from undermining the integrity of your plan.

7. Track Budget vs. Actual and Use Variance to Improve Next Month

Budgets aren’t a moral score—they’re a feedback loop. Each week, compute the difference between planned and actual for each category and flag anything over ±10%. At month-end, add a short retrospective: what changed, what you controlled, and what to do differently. Use this to fine-tune next month’s envelope limits and your template’s assumptions. Over time, your category amounts will converge toward reality, making the system feel easier, not stricter.

7.1 How to do it in a spreadsheet

- Add columns for Plan, Actual, Variance (Amt), Variance (%).

- Use conditional formatting to color >+10% red, <−10% blue.

- Create a pivot or summary that ranks the top three positive and negative variances.

7.2 Mini case

If “Transport” planned $160 but actuals hit $196 (23% over) because fuel prices rose and you added two ride-shares, you might raise the plan to $180 and reduce “Dining Out” from $200 to $180 next month. That keeps the total spend flat while acknowledging reality.

Synthesis: Variance turns feelings (“we’re overspending”) into a concrete, month-over-month tuning process.

8. Blend Envelopes with Digital Tools Without Losing Control

You don’t have to choose between paper and pixels. Keep envelopes for cash-centric categories and use your bank app, a spreadsheet, or a budgeting app for everything else. The key is a single source of truth—your template—so you never double-count. If you want card convenience for groceries, create a virtual envelope in your template with a weekly cap and log each grocery receipt like cash. For accountability, take a quick phone photo of the receipt and paste the total into your sheet the same day.

8.1 Tools/Examples

- Spreadsheet + bank: Manual entry for envelopes; CSV import for card transactions.

- Apps: Use an app that supports category caps and manual transactions; keep envelopes for cash-only merchants.

- Shared notes: A family chat or shared note for quick “spent $7.50 from Snacks” pings.

8.2 Pitfalls to avoid

- Syncing and envelopes out of step (update the template first, then refill envelopes).

- Treating the app balance as cash on hand; envelopes are the only “spendable” cash.

Synthesis: A hybrid setup keeps the tactile discipline of envelopes while harvesting digital convenience for bigger or online categories.

9. Make It Family-Proof: Roles, Rules, and Visual Cues

A household system fails if only one person understands it. Assign roles—one person manages the master template, another handles weekly counts, older kids can log their own pocket-money spends. Post category limits on the fridge or inside a cupboard door, and use color-coded envelopes to help everyone grab the right one. Consider a small lockbox for security and teach kids how to log amounts correctly (date, what, how much) before they take spending money out.

9.1 Mini checklist

- Color code: green for food, blue for transport, yellow for school.

- Label every envelope with the month; archive old ones in a folder.

- Weekly “money huddle” takes 15 minutes—count, log, refill, review one lesson.

9.2 Region-specific notes

- In areas with cashless transit, make “Transport” a virtual envelope with a card top-up limit instead.

- Where change is scarce, keep a jar of small denominations to avoid rounding up.

Synthesis: Shared ownership and visible cues turn the budget into a family habit, not one person’s chore.

10. Create a Quick-Start Kit and a 30-Day Pilot

The best system is the one you’ll actually start. Build a quick-start kit with 6–10 sturdy envelopes, a clip, index cards, a calculator, and a printed one-page template or spreadsheet link. Run a 30-day pilot with just three envelopes (e.g., Groceries, Transport, Household Supplies) and one sinking fund (e.g., School). Keep notes on what felt easy or annoying and adjust. At the end of the pilot, decide which categories deserve a permanent envelope and which can remain digital.

10.1 Step-by-step pilot plan

- Day 1: Set limits and stuff Week-1 cash.

- Weekly: Reconcile, refill, and capture lessons learned (1–2 lines).

- Day 30: Compare plan vs. actual, update limits, and add/remove categories.

10.2 Numbers & guardrails

- Limit total cash in the home to one week’s envelope sums for safety.

- Replace worn envelopes every 2–3 months; fading labels invite mistakes.

Synthesis: A low-risk, time-boxed trial builds confidence and gives you real data to tune the system before you lock it in for the long term.

FAQs

How do petty cash envelopes differ from the classic “envelope budgeting” method?

They’re closely related. Classic envelope budgeting replaces most variable categories with cash. Petty cash envelopes focus on small, frequent transactions that are easier to control with physical cash, while leaving fixed bills and larger purchases to bank transfers or cards. The hybrid approach reduces the amount of cash you carry while still giving you the visual feedback that makes envelopes effective.

Is it safe to keep cash at home for envelopes?

Yes—if you set safety limits and store it well. Keep only one week’s cash on hand, use a low-visibility lockbox, and avoid discussing amounts publicly. If you live in a cash-light region or worry about safety, keep sinking funds in a labeled bank sub-account and withdraw cash right before purchases. The goal is control and visibility, not hoarding cash.

What’s the best template format—paper or spreadsheet?

Choose the format you’ll actually maintain. Paper works great if you like to write; spreadsheets make variance and summaries effortless. Many families use a paper log at point of purchase and a spreadsheet for weekly reconciliation and month-end review. Whichever you pick, mirror envelope names exactly and use simple columns (Date, In, Out, Balance, Notes) to keep data clean.

How much should I start with in envelopes?

Begin with 10–25% of your total monthly variable spending allocated to envelopes. Pilot with 3–5 categories for 30 days and adjust. If an envelope empties early two weeks running, increase the limit by 10–15% next month or split the category (e.g., separate “Snacks” from “Groceries”) to gain clarity.

Can I run envelopes if I’m mostly cashless?

Absolutely. Use virtual envelopes in your template: set a weekly cap, log each purchase, and stop when the cap is hit—even if the payment was by card. You’ll still get accountability and variance tracking without withdrawing physical cash. Keep physical envelopes for places that only take cash (markets, tips, small vendors).

How do I handle change and coins without making a mess?

Use a coin pouch and round only in your template, not on the index card. Some households keep a small “Change” envelope to swap notes for coins during the weekly ritual. Photograph any receipt totals if coins get mixed up—your template’s running balance is the arbiter of truth.

What if my partner or teen forgets to log a spend?

Design for forgetfulness. Require three quick fields (date, amount, purpose) and allow a “late log” during weekly reconciliation. If missed logs happen often, assign roles—e.g., spender snaps a receipt photo; template owner enters it on Sunday. Positive feedback (“Thanks for logging!”) beats policing and keeps the system collaborative.

How are sinking funds different from savings?

Sinking funds are earmarked savings for known future expenses (annual fees, school supplies, birthdays). Regular savings are for building reserves and goals without a set date. In envelopes, treat sinking funds as protected—no transfers out unless the planned event has occurred. This keeps big expenses from crashing your weekly categories.

What’s the right number of envelopes?

Enough to capture leak-prone spending, but not so many that you avoid using them. Most households settle on 4–8 active envelopes plus 2–4 sinking funds. If you’re consistently under or over in a category, merge or split it. The right number is the one you can reconcile in 15 minutes weekly.

How do I evaluate whether envelopes are “working”?

After 30 and 90 days, check three signals: (1) total variable spending vs. plan (are you within ±5–10%?), (2) fewer mid-month “where did the cash go?” moments, and (3) envelope balances matching your template. If those improve and stress drops, it’s working. If not, reduce categories, adjust limits, or switch a category back to digital.

Conclusion

Petty cash envelopes and a clear budget template give you two powerful levers: behavioral visibility (seeing cash decline) and financial truth (a reconciled plan vs. actual). You don’t have to go all-cash or master a new app; you only need to pick a few leak-prone categories, set weekly limits, and show up for a 15-minute reconciliation ritual. Over the first month, expect to iterate—tweak category definitions, right-size limits, and implement transfer rules that keep you honest without being rigid. As you add sinking funds, you’ll stop calling predictable expenses “surprises,” and variance reviews will steadily narrow the gap between intention and reality. Most importantly, the system becomes a shared family habit—clear roles, visible cues, and a dashboard that tells you what’s true. Start with a 30-day pilot, keep only a week’s cash at home, and let your envelope + template combo evolve into a calm, repeatable budget rhythm. Your next step: set up three envelopes, print or open your template, and schedule this week’s 15-minute money huddle.

References

- “Create a budget that works for you,” Consumer Financial Protection Bureau (CFPB), n.d., https://www.consumerfinance.gov/consumer-tools/budgeting/

- “Petty Cash: What It Is, How It’s Used, and How to Manage It,” Investopedia, updated 2024, https://www.investopedia.com/terms/p/pettycash.asp

- “Consumer Expenditures—2023,” U.S. Bureau of Labor Statistics, Sept 2024, https://www.bls.gov/news.release/cesan.nr0.htm

- “Household budgeting basics,” consumer.gov (U.S. FTC), n.d., https://consumer.gov/managing-your-money/make-budget

- “Free budget templates in Google Sheets,” Google Workspace Learning Center, n.d., https://support.google.com/a/users/answer/9300022

- “Household budget templates,” Microsoft Create, n.d., https://create.microsoft.com/en-us/templates/household-budget

- “How sinking funds work,” The Balance, updated 2024, https://www.thebalancemoney.com/what-is-a-sinking-fund-1293682

- “Envelope Budgeting Method,” Ramsey Solutions, updated 2024, https://www.ramseysolutions.com/budgeting/envelope-system