If you’re serious about squeezing more growth out of your cash without adding risk or hassle, opening multiple high-interest accounts can be a smart, practical move. In a world where the national average savings yield still hovers near a fraction of a percent, placing all your money in a single, ho-hum account is like running a marathon in sand. This guide explains how multiple accounts help you earn more interest, stay fully insured, and organize your goals—then compares five standout high-yield options you can mix and match to build a resilient, high-earning cash system.

Disclaimer: This article provides general educational information and is not financial advice. Cash yields, terms, and fees change frequently. Always confirm current details and consult a qualified professional for personalized guidance.

Key takeaways

- Multiple accounts = more flexibility. Spread cash across several high-interest accounts to earn strong APY, automate specific goals, and keep emergency funds liquid.

- Insurance can scale with you. Distributing balances across different insured institutions helps keep more of your money protected while you grow.

- Not all “high-yield” is equal. Compare APY, fees, minimums, transfer speeds, and automation features—not just headline rates.

- Choose accounts that fit roles. For example: one “core” emergency fund, one “buckets” account for sinking funds, one “top-rate” challenger for excess cash, and one “promo” account to harvest limited-time boosts.

- Systems beat willpower. Use automated transfers, goal-based vaults/buckets, and monthly tune-ups to keep cash flowing to the right places without thinking.

Quick-start checklist (5 minutes)

- Pick one core high-yield account for your emergency fund (fast transfers, no fees, simple app).

- Add one or two satellites with higher APYs or better organizing tools (vaults/buckets).

- Turn on automatic transfers for payday.

- Label accounts clearly: “Emergency,” “3-month expenses,” “Home fund,” “Travel,” etc.

- Set monthly 10-minute check-ins to rebalance and confirm you’re fully insured.

Why multiple high-interest accounts beat one “catch-all”

1) Higher blended yield. No single bank always leads on APY. Splitting cash lets you park “excess” balances where the rate is richest—without moving your emergency fund away from a fast, reliable hub.

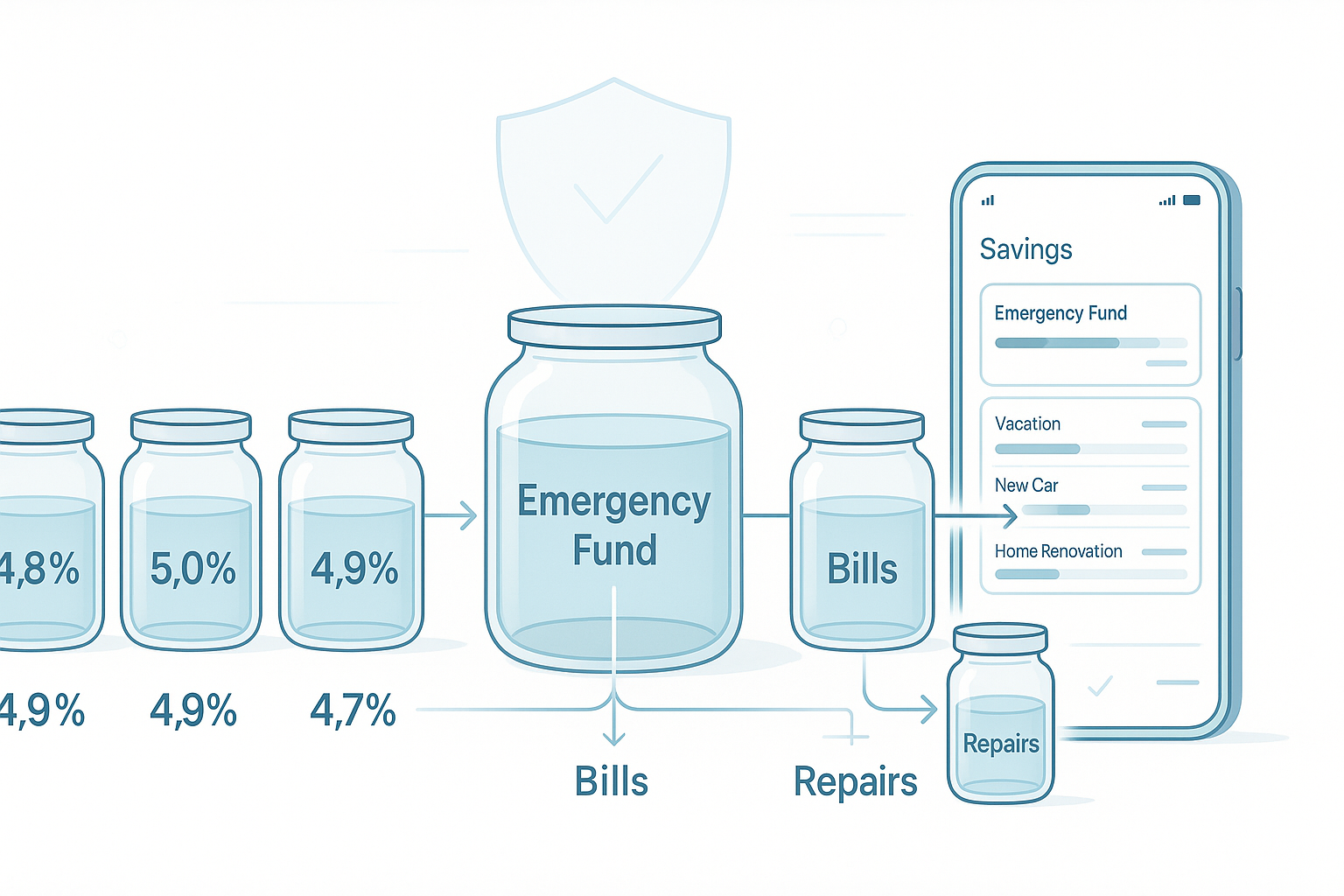

2) Better organization. Sub-accounts, “vaults,” or multiple named savings accounts make it easy to silo cash for specific goals—car repairs, insurance premiums, holidays—so you don’t overspend the emergency fund.

3) Insurance optimization. Insurance limits apply per depositor and per institution, by ownership category. Using multiple banks helps keep larger balances fully protected while you earn.

4) Speed and redundancy. If one bank’s transfers slow down or its app goes down, you still have access to cash in another institution. Two debit rails (or two ACH links) beat one during crunch time.

5) Promo harvesting. Periodic promos temporarily raise yields. A secondary account you already use can capture these boosts without re-KYCing from scratch.

Common objections—and why they fall short

- “Tracking multiple accounts sounds messy.” Not if each account has a clear job and you automate contributions.

- “Won’t this hurt my credit?” Opening deposit accounts doesn’t affect credit scores.

- “Transfers are slow.” Standard ACH often lands within 1–3 business days; many banks now process same-day within stated cutoffs. Keep a portion of cash at your fastest-transfer bank to bridge any gaps.

How to design your multi-account cash system

Assign roles:

- Core Emergency Fund (CEF): Fast transfer speeds, simple app, no fees.

- Sinking Funds (SF): Buckets/vaults for bills and short-term goals.

- Top-Rate Satellite (TRS): Highest APY for surplus cash you won’t need immediately.

- Promo/Booster (PB): A bank that occasionally offers temporary APY boosts.

- CD Sleeve (optional): For cash you truly won’t need for a fixed period.

Insurance layout (example for an individual):

- Maximize insurance by spreading balances across different institutions. Keep ownership titles accurate (individual, joint, trust) and review annually.

KPI dashboard for cash:

- Blended APY across accounts.

- Days-of-expenses covered in CEF (target: 90–180 days).

- Average transfer time from each bank to your checking.

- % of cash fully insured (target: 100%).

The Top 5 High-Interest Accounts (and how to use each)

Below are five strong, nationally available options as of mid-August 2025. Rates are variable and can change; use them as building blocks to assemble your personal mix.

1) EverBank Performance® Savings — TRS powerhouse

What it is & core benefits

A high-yield online savings account with a competitively high APY on all balances, no monthly maintenance fees, and $0 to open. Suitable as a Top-Rate Satellite (TRS) to maximize interest on dollars you won’t need immediately.

Requirements & costs

- $0 minimum to open; no monthly fees.

- Mobile/online access; interest typically compounded daily.

- Standard ACH linking required for transfers.

Step-by-step for beginners

- Open online; link your checking during setup.

- Fund with a modest test transfer.

- Once verified, schedule a monthly sweep of surplus cash from your core hub to EverBank.

- Review rate monthly; rebalance if yields change.

Beginner modifications & progressions

- Start simple: Move only the portion above your emergency threshold (e.g., above four months of expenses).

- Level up: Create a cadence—sweep excess on the 1st each month and pull back only when your emergency hub drops below target.

Recommended frequency/metrics

- Monthly sweep to maintain the highest blended APY.

- Track TRS balance and blended yield quarterly.

Safety, caveats & mistakes to avoid

- Don’t overfund your TRS; keep at least 1–2 months of expenses in your faster “core” hub.

- Confirm you remain fully insured as balances grow.

- Expect rate changes; they’re variable.

Mini-plan (example)

- Step 1: Keep three months’ expenses in your core hub; everything above moves to EverBank on the 1st.

- Step 2: If your checking dips below 1 month of expenses, auto-pull from EverBank back to the hub.

2) UFB Direct Portfolio Savings — high yield with bundle booster

What it is & core benefits

A high-interest online savings account offering a strong APY with no maintenance fees or minimum balance to open—plus the option to boost the APY by pairing with the bank’s checking bundle. Ideal for rate chasers or as a TRS with an optional checking fallback.

Requirements & costs

- $0 to open; no monthly maintenance fee.

- Optional checking bundle can add a small APY boost.

- Complimentary ATM card (for the savings account).

Step-by-step for beginners

- Open savings first; confirm the current APY and any requirements.

- If you’ll regularly keep a large balance, consider the checking bundle for the APY bump.

- Set a biweekly sweep from your core hub to UFB for surplus funds.

Beginner modifications & progressions

- Simple start: Use UFB as a secondary satellite—park only funds you don’t need quickly.

- Progression: Add the checking bundle if you want a bit more liquidity and the APY boost.

Recommended frequency/metrics

- Check posted APY monthly and confirm you still meet any bundle conditions.

- Track days of runway in your core hub so you don’t over-optimize for yield.

Safety, caveats & mistakes to avoid

- Promotional language can change; always confirm the current rate and any tiers.

- Keep your core emergency buffer elsewhere for faster transfers if needed.

- Don’t let an ATM card tempt you to raid savings for discretionary spending.

Mini-plan (example)

- Step 1: Park two months of non-urgent savings at UFB; leave three to four months in your core emergency hub.

- Step 2: If the bundle boost is worth it for your balance size, add checking and enable instant internal transfers.

3) Marcus Online Savings — fast transfers + strong, simple setup for your core

What it is & core benefits

An online savings account known for clean experience, no fees, and generous same-day transfer processing windows up to stated limits. Excellent as a Core Emergency Fund (CEF) because of its balance of yield, simplicity, and speed.

Requirements & costs

- No monthly fees; no minimum to open.

- Same-day ACH processing up to a high dollar limit if initiated by specified cutoff times.

- 24/7 support.

Step-by-step for beginners

- Open and link your main checking.

- Set up automatic deposits every payday into Marcus for the emergency fund.

- Use your CEF as the feeder: sweep any surplus above target to your TRS (e.g., EverBank/UFB).

Beginner modifications & progressions

- Start small: Automate a modest weekly transfer (even $25–$50) and increase quarterly.

- Advance: Add a same-day transfer habit—when unexpected bills hit, initiate by the cutoff.

Recommended frequency/metrics

- Weekly auto-transfer until you reach your target (3–6 months’ expenses).

- Track days-to-cash (how quickly funds land in checking) and CEF coverage each month.

Safety, caveats & mistakes to avoid

- Same-day processing still depends on the receiving bank’s availability of funds.

- Don’t stash every dollar here—once you hit your target, sweep surplus to higher-yield satellites.

Mini-plan (example)

- Step 1: Auto-transfer $200 each Friday into Marcus until you hit 4 months’ expenses.

- Step 2: Each month, sweep amounts above that target to your TRS account.

4) SoFi Checking & Savings (Savings) — automation and goal “Vaults,” with a promo boost potential

What it is & core benefits

A combined checking and savings setup with modern app features, goal-based “Vaults” for organizing funds, and periodic limited-time APY boosts for eligible members. Ideal as a Sinking Funds (SF) account for bills and short-term goals—and occasionally a Promo/Booster (PB) when a temporary APY increase is available.

Requirements & costs

- No monthly account fees; $0 to open.

- Savings APY depends on meeting eligibility criteria (e.g., direct deposit or qualifying deposits).

- Optional membership tiers may influence benefits and promos.

Step-by-step for beginners

- Open the combined account; set up direct deposit if you want the higher rate.

- Create Vaults: Emergency Buffer, Insurance, Travel, Car Repairs, Annual Taxes.

- Set rules (e.g., round-ups or scheduled transfers) so each Vault fills automatically on payday.

Beginner modifications & progressions

- Start with 3 Vaults: Emergency Buffer, Car Repairs, and Insurance.

- Add more as your budget stabilizes (e.g., Gifts, Home Maintenance).

Recommended frequency/metrics

- Weekly deposits aligned with your paycheck; measure % of upcoming bills pre-funded and time-to-goal in each Vault.

Safety, caveats & mistakes to avoid

- Promo boosts expire; plan for the rate to revert.

- Check any requirements (direct deposit, minimum activity) so you don’t accidentally drop to a lower APY.

Mini-plan (example)

- Step 1: Direct deposit 10% of each paycheck; split automatically—5% to “Emergency Buffer,” 3% to “Insurance,” 2% to “Travel.”

- Step 2: When a promo boost is active, temporarily raise transfers to Savings to harvest the higher yield, then adjust after the promo ends.

5) Capital One 360 Performance Savings — rock-solid app and effortless automation

What it is & core benefits

A user-friendly online savings account with a competitive APY, no fees or minimums, and friction-free automation tools. A great Sinking Funds or Core option if you value usability and easy goal management.

Requirements & costs

- No monthly fees; no minimum to open.

- Variable APY (rate effective dates posted on site).

- Integrates smoothly with checking via ACH; widely used app.

Step-by-step for beginners

- Open and link your checking account.

- Use automation to create named savings accounts (or use built-in tools) for separate goals—think of them as digital envelopes.

- Schedule AutoSave so each goal gets a slice of every paycheck.

Beginner modifications & progressions

- Simple start: One “Emergency Fund” + one “Bills Buffer.”

- Advance: Spin up multiple named accounts (medical, home, annual subscriptions) and automate each with different transfer amounts.

Recommended frequency/metrics

- Biweekly contributions; monitor goal completion %, days of expenses in the emergency bucket, and blended APY if you use satellites alongside.

Safety, caveats & mistakes to avoid

- Variable APY means rates change; review quarterly and adjust if competitors lead for long.

- Don’t let too many micro-accounts complicate tracking—prune old buckets twice a year.

Mini-plan (example)

- Step 1: Auto-transfer $150 per paycheck into “Emergency Fund” and $100 into “Car + Home.”

- Step 2: When those buckets hit target levels, redirect extra to your higher-yield satellite.

Head-to-head comparison snapshot (what really matters)

- APY: Your blended APY—not the single highest rate—is what determines earnings. Pair a fast core (e.g., Marcus or Capital One) with a top-rate satellite (e.g., EverBank or UFB) for the best of both.

- Fees & minimums: All five options avoid monthly maintenance fees and let you open with $0.

- Transfer speed: Look for clear same-day processing windows at your core hub. For satellites, standard ACH timing is usually fine.

- Automation & organization: If you struggle to keep goals straight, choose an account with built-in Vaults/buckets or easy multi-account nicknaming.

- Promotions: Promos can be worth it, but design your system so it still works when the bonus ends.

How to implement your multi-account plan (step-by-step)

- Pick your core hub (Marcus or Capital One). This is where your emergency fund grows and where you’ll pull money from in a pinch.

- Add one top-rate satellite (EverBank or UFB). Set a rule to sweep excess above your emergency threshold here once a month.

- Layer in organization (SoFi). Create Vaults for predictable expenses and short-term goals.

- Automate.

- Payday ➜ Core emergency hub.

- Month-end ➜ Sweep surplus to top-rate satellite.

- Weekly ➜ Sinking funds/Vaults.

- Insure and label. Keep balances within insurance limits per bank. Ensure account titles match your intent (individual, joint, trust).

- Maintain. Calendar a 10-minute monthly tune-up to check rates, balances, and goals.

Troubleshooting & common pitfalls

“My transfers feel slow.”

- Initiate earlier in the business day; many banks have a same-day cutoff.

- Use the core hub for urgent needs; keep at least 1–2 months of expenses there to bridge ACH delays.

“I keep overspending my emergency fund.”

- Split out a Bills Buffer bucket so predictable expenses don’t raid your emergency stash.

- Create a small “Oops” bucket for minor surprises.

“I lost track of accounts.”

- Consolidate to 2–3 institutions. Label clearly: CORE-EF, TRS-Yield, SF-Bills.

- Use your budgeting app’s net worth and cash sections to see totals at a glance.

“My rate dropped.”

- Don’t panic. Rates are variable. Check your blended APY and move only if a competitor leads by a meaningful margin (e.g., ≥0.50%) for several weeks.

“Am I still fully insured?”

- As balances grow, redistribute across institutions and ownership categories to keep 100% coverage. Review quarterly.

How to measure progress (and know it’s working)

- Blended APY: Calculate weighted average across accounts. Aim to beat national average by a wide margin.

- Runway: Track days of expenses covered in your core fund (target: 90–180 days).

- Automation adherence: How many of your scheduled transfers executed last month? Strive for 100%.

- Goal attainment: For each bucket/Vault, track % funded and days to target.

- Insurance coverage: Keep % of insured cash at 100%.

A simple 4-week starter plan

Week 1: Design + Core

- Open your core high-yield account.

- Link checking and set an automatic payday transfer (even $50–$200).

- Label this account “Emergency Fund (CORE)” and set a target (e.g., 4 months’ expenses).

Week 2: Satellites + Buckets

- Open a top-rate satellite account.

- Open a buckets/Vaults account for sinking funds.

- Create at least three buckets (Insurance, Car Repairs, Travel) and set small weekly transfers.

Week 3: Automate + Insure

- Schedule a month-end surplus sweep from CORE ➜ TRS.

- Confirm insurance coverage across institutions and titles.

Week 4: Tune-up + Test

- Do a dry run transfer from CORE to checking to confirm timing.

- Review rates; confirm your blended APY beats national average by a comfortable margin.

- Save this plan as a recurring monthly checklist.

FAQs (quick, practical answers)

1) How many high-interest accounts is “too many”?

Enough to cover distinct roles (core, satellite, buckets, promo) without confusion—typically 2–4 for most people.

2) Will opening multiple savings accounts hurt my credit score?

No. Deposit accounts aren’t reported to the credit bureaus.

3) How fast can I get my money?

Standard ACH typically takes 1–3 business days, and many banks offer same-day processing up to posted cutoffs. Keep 1–2 months of expenses in your fastest core hub.

4) What happens when a promotional APY ends?

Your rate reverts to the standard variable APY. Your system should still work—promo boosts are a bonus, not the backbone.

5) How do I keep everything insured as my balances grow?

Distribute funds across different institutions and keep track of ownership categories. Review quarterly.

6) Should I chase the single highest APY every week?

Not usually. Consider the blended APY, transfer speed, app quality, and your time. Move only for a sustained, meaningful rate advantage.

7) Do I need a separate account for every goal?

No. Use buckets/Vaults or a handful of named accounts. Keep it simple and automated.

8) Is a money market account better than a savings account?

Both can offer high yields; money market deposit accounts may include limited check-writing or debit access. Compare APY, access, and fees.

9) Are these accounts safe if a bank fails?

Insured deposits are protected up to the applicable limits per depositor and per institution. Keep balances within those limits and ensure you’re at insured institutions.

10) What if transfers don’t arrive when I need funds?

Initiate by the bank’s same-day cutoff where possible. Maintain a checking buffer and at least one to two months of expenses in your core hub.

11) Can I use joint accounts to increase coverage?

Yes—ownership categories have separate limits. Structure titles correctly to maximize protection.

12) How often should I rebalance between accounts?

A monthly rhythm works for most. Add a quick quarterly review to reassess rates, insurance, and goals.

Conclusion

A single “good enough” savings account leaves money on the table and adds fragility to your finances. A small network of multiple high-interest accounts—a fast, reliable core, a top-rate satellite, and a goal-organizing buckets account—can deliver higher earnings, better organization, and sturdier access when you need cash most. Build your system, automate it, and give yourself permission to stop constantly rate-shopping. Your money will finally start working like a team.

Call to action: Open your core, add one satellite and one buckets account today, and set your first auto-transfer—future you will thank you.

References

- High-Yield Online Savings Account – EverBank Performance Savings (APY, features, and fees). EverBank. Updated August 8–14, 2025. https://www.everbank.com/banking/performance-savings and https://www.everbank.com/rates and https://www.everbank.com/

- UFB Direct Portfolio Savings (APY, bundle boost, features). UFB Direct. Accessed August 14, 2025. https://www.ufbdirect.com/savings/high-yield-savings-account and https://www.ufbdirect.com/ and https://www.ufbdirect.com/checking-bundle

- Marcus Online Savings (APY snapshot, same-day transfer processing window, no-fee details). Marcus by Goldman Sachs. Updated August 14, 2025. https://www.marcus.com/us/en and https://www.marcus.com/us/en/faqs and https://www.marcus.com/us/en/savings/high-yield-savings

- SoFi Checking & Savings — Rates, Vaults, and promotional APY boost overview. SoFi. Updated August 5, 2025 (promo terms) and April 11, 2025 (APY eligibility). https://www.sofi.com/banking/ and https://www.sofi.com/banking/savings-account/vaults/ and https://www.sofi.com/learn/content/using-multiple-savings-accounts-for-different-goals/

- Capital One 360 Performance Savings — APY, features, AutoSave tools. Capital One. Effective August 13–14, 2025. https://www.capitalone.com/bank/savings-accounts/online-performance-savings-account/ and https://www.capitalone.com/bank/savings-accounts/online-performance-savings-account/features/ and https://www.capitalone.com/bank/open-an-account/

- National Rate: Savings (SNDR) — national average savings rate (0.38% in July 2025). Federal Reserve Bank of St. Louis (FRED). Updated July 21, 2025. https://fred.stlouisfed.org/series/SNDR

- National Rates and Rate Caps – methodology and updates. FDIC. Revised July 21, 2025. https://www.fdic.gov/national-rates-and-rate-caps and https://www.fdic.gov/national-rates-and-rate-caps/national-rates-and-rate-caps-previous-rates

- Deposit Insurance overview and coverage amounts per depositor, per institution, by ownership category. FDIC. Updated 2024. https://www.fdic.gov/resources/deposit-insurance/brochures/deposits-at-a-glance and https://www.fdic.gov/resources/deposit-insurance/brochures/insured-deposits and https://www.fdic.gov/resources/deposit-insurance

- Share Insurance coverage levels and FAQs. National Credit Union Administration (NCUA). Updated May 20, 2025 and May 28, 2024. https://ncua.gov/consumers/share-insurance-coverage and https://ncua.gov/consumers/share-insurance-coverage/frequently-asked-questions-about-share-insurance

- Regulation D – suspension of the six-transfer limit from savings accounts (policy background). Board of Governors of the Federal Reserve System. April 24, 2020; March 29, 2021; Federal Register April 28, 2020. https://www.federalreserve.gov/newsevents/pressreleases/bcreg20200424a.htm and https://www.federalregister.gov/documents/2020/04/28/2020-09044/regulation-d-reserve-requirements-of-depository-institutions and https://www.federalreserve.gov/supervisionreg/caletters/caltr2106.htm

- ACH transfers — typical processing times (1–3 business days), and settlement context. Plaid Resource Center, December 14, 2022; Stripe Guide, August 2, 2024; NACHA blog, August 28, 2023. https://plaid.com/resources/ach/how-does-an-ach-transfer-work/ and https://stripe.com/resources/more/how-long-do-ach-payments-take-to-process-here-is-what-you-need-to-know and https://www.nacha.org/news/significant-majority-ach-payments-settle-one-business-day-or-less

- High-yield landscape roundups (context on competitive rates as of July–August 2025). Bankrate and Fortune. July 21 & August 13–14, 2025. https://www.bankrate.com/banking/savings/high-yield-savings-rates-today-july-21-2025/ and https://fortune.com/article/best-savings-account-rates-8-13-2025/ and https://fortune.com/article/best-savings-account-rates-8-14-2025/