Monthly sales vs budget is the backbone of performance control and planning. In practice, the teams who do it best don’t just report a gap; they explain it with evidence and then update the forecast so leaders can act. This guide gives operators, FP&A, and RevOps a practical, repeatable 12-step workflow—from clean baselines and price-volume-mix to seasonality, driver-based forecasting, and how to present findings so decisions happen. In one sentence: monthly sales vs budget compares actual sales to the planned figure, quantifies the difference (variance), explains the drivers, and uses those insights to improve next month’s forecast.

At a glance, the 12 steps:

1) Lock a clean, apples-to-apples baseline. 2) Align recognition and timing. 3) Calculate and prioritize variances. 4) Do price-volume-mix (PVM). 5) Bridge to margin. 6) Adjust for seasonality and calendar. 7) Add leading indicators and drivers. 8) Pick a forecasting method and horizon. 9) Measure forecast accuracy and backtest. 10) Run scenarios and sensitivities. 11) Visualize cause-and-effect clearly. 12) Set cadence, governance, and automation.

Educational note: This article provides general finance guidance, not legal, tax, or investment advice. Adapt thresholds and controls to your context.

1. Lock a clean, apples-to-apples baseline (data hygiene comes first)

Start by ensuring your “actuals” and “budget” are defined the same way, at the same granularity, and over the same dates. A variance is simply the difference between an actual measured result and a budgeted basis—so any mismatch in definitions creates fake variances that waste everyone’s time. Use one source-of-truth table for monthly sales actuals (bookings or revenue, depending on your object), and a matching table for budget. Standardize currency, tax treatment (gross vs net), and channel/product hierarchies. Decide whether your baseline is a static budget or a flexible budget (re-phased for known timing shifts). Finally, document the exact formulas for absolute variance (Actual − Budget) and percent variance ((Actual − Budget)/Budget), as well as the sign convention you use in your org. A clear baseline prevents “variance about variances” and enables trusted storytelling. AccountingTools

1.1 How to do it

- Create a canonical calendar table (month start/end, workdays, fiscal flags).

- Normalize dimensions (SKU, region, channel) and map all aliases to a master list.

- Convert currencies with a fixed monthly rate table and store the rate used.

- Define “sales” consistently: bookings, billings, or revenue (IFRS/GAAP).

- Lock your static budget version; if using a flexible budget, save both copies.

- Add a “materiality” threshold (e.g., investigate only variances > ±3% and > $X).

Mini-checklist: one owner for data definitions; one page of formulas; one shared dataset feeding your dashboards. Synthesis: a locked baseline ensures every subsequent variance you compute represents reality—not data noise.

2. Align recognition and timing (cut-offs, taxes, and credits)

Many monthly sales vs budget debates are timing problems disguised as strategy problems. If budget assumed shipment on the 30th but the goods posted on the 2nd, the “miss” is timing. Align revenue recognition rules (shipment vs delivery vs activation), returns, credit notes, and tax/VAT so that budgeted and actuals reflect comparable events. For international teams, note the effect of regional tax treatments (VAT/GST-inclusive retail vs net pricing in B2B), and document whether sales are captured by invoice date, delivery date, or service start. Get month-end cut-offs in writing with Ops and Accounting to reduce “moved the goalposts” arguments.

2.1 Numbers & guardrails

- Treat timing deltas as timing variance and reverse in next period to avoid double counting.

- For retail with tax-inclusive tags, normalize to net revenue before variance calculations.

- Define materiality: e.g., don’t chase timing items < 0.5% of monthly sales.

Synthesis: with recognition rules aligned, you strip out pseudo-variance and focus analysis on price, mix, and demand—where action lives.

3. Calculate and prioritize variances (focus on what moves the needle)

Now quantify the core gaps. Start with total absolute and percent variance, then split by product, region, channel, and customer segment. Use both horizontal analysis (trend across months/YoY) and vertical analysis (mix share). Label favorable vs unfavorable using your org’s signs. Then apply materiality to select the few variances worth investigating deeply. Create a short list of “Top 10 unfavorable” and “Top 10 favorable” drivers to review with Sales and Supply. The point is not to catalog everything but to concentrate on explainable, repeatable effects.

3.1 How to do it (quick math)

- Absolute variance = Actual − Budget

- Percent variance = (Actual − Budget) / Budget

- Contribution variance (optional) = (Actual − Budget) × Budgeted GM%

Mini-checklist: one variance table; flags for “investigate” by size & percent; owner per variance. Synthesis: prioritization turns variance analysis from a report into a decision queue.

4. Decompose revenue with Price-Volume-Mix (PVM)

PVM analysis answers the executive’s first question: “Was it price, volume, or mix?” Break the revenue delta between Budget and Actual into Price effect, Volume effect, and Mix effect, holding the other factors constant in turn. At a simple level, Sales price variance isolates the impact of selling above/below the standard price; Sales volume variance isolates units change at budget price; Sales mix variance captures mix shifts toward higher/lower margin items. Use item-level granularity, then roll up to product families. PVM makes variance actionable: price policies, discount control, assortment, and inventory placement.

4.1 Numbers & guardrails

- Price effect (revenue): (Actual ASP − Budget ASP) × Actual Units

- Volume effect (revenue): (Actual Units − Budget Units) × Budget ASP

- Mix effect (revenue): Residual to reconcile total after price & volume, or use mix-weighted methods for precision.

Mini case: Budget: 10,000 units @ $20 = $200,000. Actual: 9,200 units @ $22 = $202,400. Volume = (9,200−10,000)×$20 = −$16,000; Price = ($22−$20)×9,200 = +$18,400; Mix = balance to tie to +$2,400. Synthesis: PVM converts a vague miss into targeted levers—discount discipline vs demand gen vs assortment.

5. Bridge from sales variance to margin (explain profitability, not just revenue)

Sales wins can still disappoint at the P&L if margin mix deteriorates or costs rise. Extend PVM to a gross margin bridge, separating price realization, cost realization/inflation, volume, and mix impacts. Visualize as a waterfall from Budget GM$ to Actual GM$, so leaders see exactly how far price gains were offset by cost inflation or product mix. This is essential when explaining why “sales beat, profit missed.”

5.1 Tools/Examples

- Excel/Sheets: build a GM waterfall; set totals for start/end bars.

- Power BI: Zebra BI visuals or native chart; pair with a decomposition tree for root-cause drill. Zebra BI

Synthesis: tying variance to the margin bridge elevates the conversation from “top-line noise” to “unit economics”, enabling sharper pricing and mix decisions.

6. Adjust for seasonality and calendar effects

Monthly sales often have monthly/weekly seasonality, holidays, and trading-days effects. If your budget didn’t perfectly model these, actuals will appear “off” for reasons unrelated to performance. Use established seasonal adjustment methods to isolate true underlying movement. Two common approaches: X-13ARIMA-SEATS (used by US statistical agencies) and ETS exponential smoothing (as implemented in Excel’s FORECAST.ETS). Pick one method, document it, and use it consistently in your reviews and forecast updates. As of now, Excel supports FORECAST.ETS() (AAA ETS) for seasonality; Power BI’s built-in forecast also uses ETS-style smoothing under the hood.

6.1 How to do it

- Short series or simple patterns: ETS (additive/multiplicative, auto seasonality).

- Official/stat use-case: X-13 for monthly/quarterly, with diagnostics. SAS Help Center

- Note: Clearly mark seasonally adjusted vs unadjusted charts to avoid confusion.

Synthesis: removing calendar noise lets you explain variance with business drivers instead of the calendar.

7. Add leading indicators and driver-based forecasting

Variance analysis is retrospective unless you connect it to drivers you can monitor and influence: funnel inflow, conversion rates, average order value, price indices, shipment capacity, or promo cadence. Model revenue as #Customers × Orders/Customer × AOV × Price Realization, and update each driver monthly. In B2B, include pipeline coverage, stage-to-stage conversion, and velocity; pressure-test any sales commit against these drivers. Driver-based models also make your forecast resilient to sudden market shifts because you can update the few variables that truly move revenue. Corporate Finance InstituteAFP

7.1 Practical driver set (examples)

- Traffic/leads → MQL → SQL → Opportunity → Win rate (%), sales cycle (days). PeakEquity Partners

- Orders/customer, AOV, discount %, stockouts %, new vs repeat mix.

- External indices: promo calendar, holidays, industry demand proxies.

Synthesis: driver-based thinking turns “variance” into “levers”—so you can forecast forward, not just explain backward.

8. Pick a forecasting method and horizon (then keep it rolling)

Use methods proportionate to your data and decisions. For most monthly sales, start with an ETS model (good with trend/seasonality), compare with an ARIMA baseline, and consider Prophet if you need explicit holiday and changepoint handling. Always validate with rolling cross-validation and combine models if that improves accuracy. Maintain a rolling 12–18-month forecast updated monthly, not just a static annual budget—this aligns planning with the cadence of reality. OTexts

8.1 Methods at a glance

- ETS (Exponential Smoothing): fast, robust for seasonal patterns; Excel/Power BI friendly. OTexts

- ARIMA: strong for short-term autocorrelation without strong seasonality. OTexts

- Prophet: holiday modeling, changepoints, uncertainty intervals; R/Python.

Synthesis: right-sized methods + rolling cadence = forecasts that stay relevant as the business moves.

9. Measure forecast accuracy and backtest (trust comes from evidence)

If you update the forecast monthly, measure how good it was. Use MAE, RMSE, and cautious use of MAPE (MAPE is popular but has pitfalls—division by near-zero and biased penalties). Consider MASE as a scale-free alternative and avoid sMAPE for decision-making, per forecasting literature. Backtest with rolling origins (e.g., refit using data up to each month and predict the next), and publish a small accuracy table with variance reports so stakeholders see which method works best for your series.

9.1 Mini example

- Last 12 months: MAE = 28k; RMSE = 34k; MAPE = 3.1% (but 0% months distort); MASE = 0.62 (better than naïve).

- Decision: keep ETS as primary, Prophet as challenger; revisit after holiday cycle.

Synthesis: accuracy metrics and backtests make the forecast a measurable product, not an opinion.

10. Run scenarios and sensitivities (quantify upside/downside)

Variance analysis tells you what happened; scenarios tell you what could happen next. Build a simple sensitivity matrix around key drivers (price, conversion, AOV, units) and show the revenue effect of ±5–10% changes. Then assemble three scenarios—base, downside, upside—linked to concrete assumptions (promo intensity, pipeline quality, supply constraints). Publish the assumed driver values with each scenario so stakeholders can debate assumptions, not the math.

10.1 Mini-checklist

- Tie scenarios to drivers (Step 7), not just a % fudge factor.

- Include capacity and inventory constraints (so upside is feasible).

- Update scenario probabilities monthly.

Synthesis: scenarios convert driver uncertainty into quantified risk bands around your forecast.

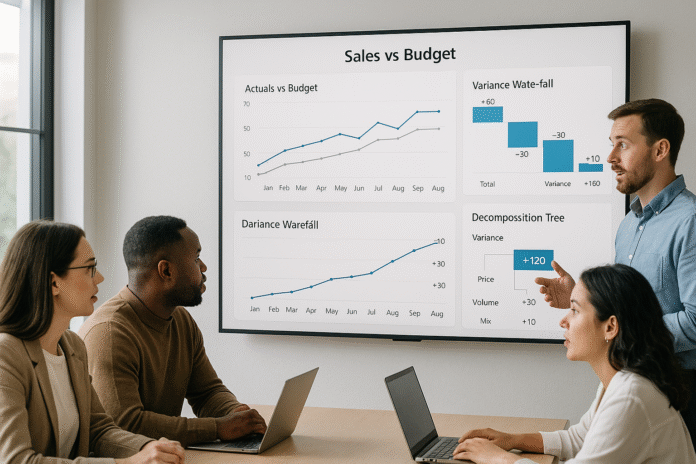

11. Visualize cause-and-effect (so decisions happen faster)

Executives decide faster when they can see what drove the variance. Use three visuals:

(a) Line chart of Actual vs Budget with shaded forecast interval;

(b) Waterfall bridging Budget → Actual (or GM$) with labeled contributions;

**(c) Decomposition tree to explore drivers by region/product/channel using AI-guided splits. Power BI’s decomposition tree is designed for ad-hoc root-cause analysis, and Excel can create native waterfall charts in two clicks. In Tableau, you can build variance and waterfall views with table calcs. Keep labels crisp and totals clearly marked.

11.1 Do’s

- Label bars as Price, Volume, Mix, Costs (not cryptic codes).

- Mark Totals/Subtotals explicitly in waterfalls.

- Use the decomposition tree’s “AI split” to surface the biggest driver first.

Synthesis: better visuals shorten meetings and align leaders on what to fix.

12. Set cadence, governance, and automation (make it sustainable)

Great variance decks fail when the process is hero-work. Establish a monthly cadence: Day 1–2 close, Day 3 variance & PVM, Day 4 forecast refresh, Day 5 exec review. Assign owners for data, analysis, and forecast. Automate ingestion and transformations; track changes to budgets and models. Adopt a rolling forecast across 12–24 months so new actuals roll the horizon forward without waiting for budget season. Document your definitions and thresholds so future you can reproduce every number.

12.1 Automation tool stack (examples)

- Data: Power Query, dbt, or scripts to build the monthly dataset.

- Modeling: Excel

FORECAST.ETS, R/Python (ETS/ARIMA/Prophet). - BI: Power BI (decomposition tree, variance pages), Tableau dashboards.

Synthesis: a predictable cadence + light automation turns monthly sales vs budget into a quiet machine that continuously explains and improves performance.

FAQs

1) What’s the simplest definition of monthly sales vs budget—what am I actually calculating?

It’s the difference between actual monthly sales and the budgeted amount for the same period. Most teams report absolute variance (Actual − Budget) and percent variance ((Actual − Budget)/Budget), then explain why via price, volume, and mix. Keep the definitions (bookings vs revenue), currency, and timing aligned so the number reflects performance, not data quirks.

2) Should I use a static budget or a flexible (re-phased) budget for variance?

Use the static budget for accountability (“Did we hit the plan we set?”). Use a flexible budget for operational insight when clear timing shifts occur (e.g., big orders moved into next month). Many organizations show both: static variance for governance; flexible for operational “what changed” analysis.

3) How do I calculate price, volume, and mix quickly?

At product level, compute volume at budget price (volume effect), then price effect at actual units, and take the mix residual—or apply a full mix-weighted formula if your catalog is large. Roll up to families and brands. This isolates discounting vs demand vs assortment, which map to different actions.

4) What metrics are best for forecast accuracy—MAPE, MAE, RMSE, or MASE?

Use MAE/RMSE for scale measures and MASE to compare across series. Be cautious with MAPE: it can blow up when actuals are near zero and can bias towards under-forecasting; many experts advise against relying on sMAPE, too. Report more than one metric and validate with rolling backtests.

5) How do I handle seasonality and holidays in monthly sales?

Use ETS for quick, reliable seasonal modeling or X-13 for statistical-grade adjustment. Mark which charts are seasonally adjusted and keep the method consistent month to month. In retail, add holiday calendars (e.g., Ramadan, Diwali, Black Friday) to reflect demand spikes.

6) Is Power BI good enough for forecasting?

Power BI is superb for visualizing and exploring variance drivers (decomposition tree, drill-downs). Its built-in forecast uses ETS and is fine for light extrapolations, but for robust forecasting you’ll often fit models in Excel, R/Python, or specialized tools and visualize the outputs in BI.

7) What’s “pipeline coverage” and why does it matter to the forecast?

Pipeline coverage is pipeline value divided by target for a period (e.g., 3× target). It only helps if quality is high—look at stage conversion and deal aging. High coverage with low quality creates false confidence; use coverage together with conversion and velocity to pressure-test Sales commits. forecastio.ai

8) How far out should my rolling forecast go?

Common practice is 12–18 months forward, updated monthly. That’s long enough for capacity and hiring decisions but short enough to keep accuracy practical. Keep the near term (next 1–3 months) under tighter review and accept wider intervals farther out.

9) How do I visualize variance for executives who have five minutes?

Use one page: a line of Actual vs Budget (with next-month forecast band), a PVM or GM waterfall, and a decomposition tree to drill. Label contributions in dollars and percent. Executives will ask “What changed?”—the decomposition tree surfaces the biggest driver fast.

10) What’s a reasonable threshold for investigating a variance?

Set dual thresholds to avoid noise (e.g., investigate entries where |variance| ≥ 3% and ≥ $25k). Adjust by scale and risk—smaller thresholds for strategic products or key regions. Publish the policy so teams know when to raise a flag.

Conclusion

Monthly sales vs budget is less about a month-end report and more about a learning loop. When you standardize definitions, align timing, quantify price-volume-mix, and link everything to drivers, you move from after-the-fact commentary to forward-looking control. Add simple, trustworthy forecasting (ETS/ARIMA/Prophet), measure accuracy transparently, and keep a rolling 12–18-month view so the finance posture stays proactive. Finally, present the story visually—a variance waterfall and decomposition tree let leaders see cause-and-effect and commit to actions. If you adopt the 12-step cadence here, you’ll spend fewer cycles debating the number and more cycles changing it. Next step: build your PVM and GM waterfalls on last month’s data, refresh the rolling forecast, and schedule a 30-minute driver review with Sales and Supply.

References

- Sales variance definition, AccountingTools, Jul 30, 2025 — AccountingTools

- What is variance analysis?, AccountingTools, May 19, 2025 — AccountingTools

- Sales Price Variance: Definition, Formula, Example, Investopedia, Jan 4, 2011 — Investopedia

- Sales Mix Variance, Investopedia, 2011 — Investopedia

- A Quantifiable Approach to Price Volume Mix Analysis, FTI Consulting, May 3, 2024 — fticonsulting.com

- Insights from a bottom-up sales and price variance analysis, FM Magazine (AICPA & CIMA), Feb 28, 2021 — FM Magazine

- FORECAST.ETS function, Microsoft Support, accessed Sep 2025 — Microsoft Support

- X-13ARIMA-SEATS Seasonal Adjustment Program, U.S. Census Bureau, Jul 10, 2025 — Census.gov

- Reference Manual for X-13ARIMA-SEATS, U.S. Census Bureau (PDF), 2025 — Census

- Create and view decomposition tree visuals in Power BI, Microsoft Learn, Jun 29, 2022 — Microsoft Learn

- Evaluating point forecast accuracy, Forecasting: Principles and Practice (FPP3), OTexts, 2021-2023 — OTexts

- 8.5/8.7 ETS models, Forecasting: Principles and Practice (FPP3), OTexts — ; https://otexts.com/fpp3/ets-forecasting.html OTexts

- Forecasting at scale (Prophet docs), Meta Open Source, updated Sep 2025 — ; Uncertainty intervals — https://facebook.github.io/prophet/docs/uncertainty_intervals.html facebook.github.io

- Best Practices in Implementing Rolling Forecast, FP&A Trends, Dec 7, 2021 — fpa-trends.com

- Create a waterfall chart, Microsoft Support, accessed Sep 2025 — Microsoft Support