Applying for a loan goes faster—and usually ends better—when you gather the right documents up front. This guide walks you through the 12 essentials most lenders ask for, why they matter, and how to prepare each one correctly. It’s written for anyone applying for a mortgage, auto loan, personal loan, or small-business credit. In one sentence: a loan application checklist is a practical list of documents and data points lenders use to verify identity, income, assets, debts, collateral, and risk before they decide. As of now, requirements vary by lender and country; examples here reflect common U.S. practice. This article is educational, not legal or financial advice.

Quick prep steps (skim-friendly):

- Confirm valid ID and address.

- Pull your credit reports and fix errors.

- Gather income proof (pay stubs/W-2s/1099s/tax returns).

- Download the last two months of bank and investment statements.

- List all monthly debts to estimate your DTI.

- If the loan is secured, assemble collateral details, valuation, and proof of insurance.

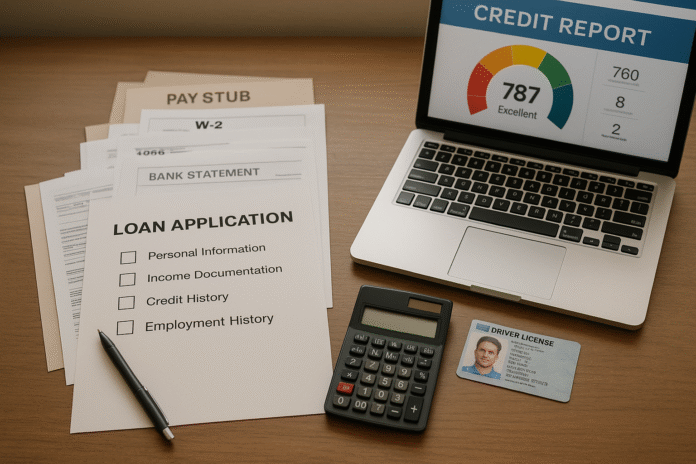

1. Valid Government ID and Personal Details

Most lenders start by verifying your identity and core personal information; you’ll typically need a current government ID (driver’s license or passport), your full legal name, date of birth, a physical address, and a taxpayer ID (SSN or ITIN in the U.S.). Banks and many finance companies must maintain a Customer Identification Program (CIP) and collect specific data before opening an account or extending credit. Practically, that means they’ll ask for an unexpired photo ID and an address that can be verified. If you’ve moved recently or changed your name, expect to provide supporting documents (e.g., utility bill, marriage certificate). Identity verification protects both sides from fraud and is required by banking regulations, so be ready to supply whatever the lender’s policy lists and understand that they may verify details using third-party databases.

1.1 Why it matters

CIP rules require banks to form a “reasonable belief” that they know the true identity of each customer. Missing, expired, or inconsistent ID can stall your application or trigger extra checks. Providing accurate, consistent personal data across all forms reduces follow-ups.

1.2 Mini-checklist

- Unexpired driver’s license or passport (front and back if requested)

- Current residential address (utility bill/lease if asked)

- SSN/ITIN and prior addresses (if recently moved)

- Name change documentation, if applicable (marriage certificate, court order)

Wrap-up: treat identity documents as your application’s foundation—clean, current, and consistent information saves days later.

2. SSN/ITIN and Consent to a Credit Check

You’ll generally provide your Social Security Number (or ITIN) and authorize the lender to obtain your credit report. Under the U.S. Fair Credit Reporting Act (FCRA), lenders must have a permissible purpose to pull a consumer report; loan underwriting qualifies, but the lender still needs to ensure the information pertains to you specifically. You can expect consent language in your application and separate authorization forms online or on paper. If you’re concerned about privacy or fraud, ask who will access your report and how mismatched data is handled—federal guidance emphasizes consumer-specific matching, not name-only lookups. Legal Information Institute

2.1 Numbers & guardrails

- It’s legal to check your own credit; doing so does not affect scores. Use AnnualCreditReport.com (the official site) to review and correct errors before you apply.

- Employers need written consent for employment-related credit checks; lenders rely on the credit transaction permissible-purpose provisions.

2.2 Mini-checklist

- Credit-pull authorization (e-signature or paper form)

- Full legal name(s) and any recent changes

- SSN/ITIN and prior addresses (last two years)

- Freeze/lift PINs if you’ve frozen your credit

Bottom line: precise identifiers + explicit consent = a clean, compliant credit pull and fewer delays. Consumer Financial Protection Bureau

3. Current Income (Employees): Pay Stubs, W-2s, and Related Proof

If you’re a W-2 employee, lenders typically verify current income with recent pay stubs and historical earnings with W-2s (usually two years), sometimes supplemented by tax transcripts or verification via authorized data services. The aim is to confirm stable wages, consistent hours, and types of pay (base, bonus, overtime). For mortgages, consumer guidance commonly suggests bringing the most recent 30 days of pay stubs, two years of W-2s, and two months of bank statements to show cash flow and reserves; similar proof supports auto and personal loans even if fewer items are required. Ensure pay documents show your name, employer, pay period, and year-to-date totals.

3.1 How to do it

- Download PDFs from your employer portal; avoid photos of screens.

- Check that YTD totals match W-2 sums for the same year.

- If paid variable income (tips, overtime), gather 12–24 months of evidence.

- For recent job changes, keep your offer letter handy.

3.2 Mini case

If your gross base pay is $5,000/month and you receive average overtime of $600 with a stable 18-month history, a mortgage lender might count some or all variable income depending on continuity and documentation; if overtime varies widely, they may average a longer period or exclude it. Always ask what they’ll accept.

Synthesis: complete, legible, and consistent income proof accelerates underwriting—and reduces post-submission “conditions.”

4. Self-Employed, Freelance, or Gig Income: Tax Returns and Business Docs

Self-employed borrowers (sole proprietors, partners, S-corp owners) generally document income with personal and business tax returns, schedules (C, E, F, K-1), and sometimes year-to-date profit & loss and balance sheets. For agency-eligible mortgages in particular, a two-year history of self-employment and earnings is commonly reviewed to determine stability and likelihood of continuance; in certain automated-underwriting cases, only one year may be sufficient, but two years remains the baseline many lenders expect. Keep clean records, separate business and personal accounts, and be prepared to explain add-backs and non-cash expenses that affect qualifying income.

4.1 Tools & examples

- IRS IVES (Form 4506-C) lets lenders, with your consent, request tax transcripts directly from the IRS for verification.

- If you reported $96,000 net on Schedule C last year and $78,000 the year before, a lender may average (and adjust for add-backs) unless your current YTD P&L shows a significant decline that must be explained.

4.2 Mini-checklist

- Personal 1040s (2 years) with all schedules

- Business returns (1120S/1065) and K-1s, if applicable

- YTD P&L and balance sheet

- 12 months of business bank statements (if requested)

- Signed Form 4506-C authorization for transcripts

Takeaway: accurate tax documentation plus clear narratives about trends gives underwriters confidence in variable income.

5. Employment Verification (VOE): Proving You Still Work There

Beyond paper, many lenders independently confirm that you’re currently employed—often via a Verbal Verification of Employment (VOE) near closing for mortgages, or by contacting HR/using third-party databases for other loans. For agency-eligible mortgages, guidance specifies timing (e.g., within roughly 10 business days of the note date for W-2 income) to confirm nothing changed right before funding. If you’ve switched jobs, gone on leave, or changed compensation structure, disclose it early to avoid last-minute re-underwriting.

5.1 How it works

- Lender calls your employer’s independently sourced phone line (not a number you provide).

- They may verify job title, status (active), start date, and base pay.

- Alternative validations via asset reports or payroll data may satisfy VOE under certain automated-underwriting messages and time windows. Selling Guide

5.2 Tips

- Alert HR you’re authorizing verification so they expect the call.

- If you’re on probation/trial period, provide your offer letter and first pay stubs.

Final word: VOE is a last-mile guardrail for lenders; be proactive if your employment status is changing.

6. Bank Statements, Assets, and Down Payment Sources

Lenders look at liquidity and cash flow to confirm you can handle upfront costs (down payment, taxes, fees) and maintain a buffer. For mortgages, two most recent months of bank statements and proof of where your down payment comes from are standard consumer-facing recommendations; if funds include gifts, expect a signed gift letter and evidence of the transfer. Statements should be complete (all pages), show your name and account number, and avoid unexplained large deposits—those trigger “source of funds” questions. Investment and retirement account statements can also count toward reserves, subject to rules.

6.1 How to do it

- Download official PDFs (not screenshots).

- Circle/flag your down payment path (e.g., savings → checking → escrow).

- Document gifts with a letter and transfer proof if applicable.

- Don’t move money around mid-underwriting unless advised.

6.2 Mini-checklist

- Last two months of bank statements (all pages)

- Latest brokerage/retirement statements

- Proof of earnest money or deposits

- Gift letter and transfer receipts, if any

Bottom line: clear, seasoned asset documentation reduces conditions and helps the lender validate capacity.

7. Your Monthly Debts and DTI (Debt-to-Income) Ratio

Every lender assesses whether your income can comfortably support your debts plus the new loan. The DTI ratio equals total monthly debt payments divided by gross monthly income. There isn’t a universal cap across all loan types, but mortgages commonly evaluate DTI in the mid-30s to mid-40s, and the historical 43% mark has long been a mortgage benchmark even as Qualified Mortgage (QM) rules moved toward price-based thresholds. As of now, plan to calculate your DTI and be ready to discuss it; lower DTI generally improves approvals and pricing.

7.1 Numbers & guardrails

- DTI = (credit cards + student loans + auto + housing + other installs) ÷ gross monthly income.

- For General QM mortgages, the CFPB replaced the hard 43% DTI cap with price-based criteria, but DTI remains a key risk metric in underwriting.

- Reducing revolving balances before applying may boost both DTI and credit score.

7.2 Mini example

If your monthly debts total $1,850 and your gross monthly income is $5,800, your DTI is 31.9%. Adding a $600 new payment would push DTI to 42.3%, which could narrow product options or raise pricing.

Key idea: know your DTI before you apply; it shapes eligibility and interest rates.

8. Housing History and Proof of Address

Lenders often ask for housing history—current lease, mortgage statement, or documentation showing your address and payment track record. Besides underwriting prudence, banks are obligated to collect address details under CIP rules. If you’ve moved recently, prepare a short timeline and supporting docs. Renters might be asked for landlord contact or canceled rent checks; homeowners will provide mortgage statements and insurance information. Consistency across your application, ID, and statements reduces identity and fraud concerns.

8.1 What to prepare

- Current lease or mortgage statement

- Utility bill (recent) to corroborate address

- Landlord contact, if requested

- Homeowner’s insurance dec page (for mortgages)

8.2 Region notes

Some countries rely on national ID databases for address verification; in the U.S., documentary proof (lease/utility) is common when address mismatches appear. Keep copies handy.

Summary: housing history answers “where do you live and how do you pay,” which supports both risk assessment and compliance. eCFR

9. Collateral Details for Secured Loans (Home, Auto, Equipment)

If your loan is secured, the lender will document and perfect a lien on the asset. For autos, expect the VIN, purchase agreement, title/registration info, and proof of insurance; for mortgages, you’ll provide the property address, purchase contract, and later title work. Lenders confirm ownership, liens, and whether the asset’s characteristics fit their lending policy. For refinances, title updates and payoff statements are routine. Understand that titles and lien recordings differ by state; your lender or closing agent will guide filing requirements.

9.1 Mini-checklist (auto)

- VIN, purchase order/bill of sale

- Existing title and lien payoff (for refinance)

- Insurance card or binder naming lender as lienholder

- State-specific title application steps (ELT where applicable)

9.2 Mini-checklist (mortgage)

- Executed purchase contract

- Seller disclosures and addenda

- Title/escrow contact info

- Earnest-money receipt

Bottom line: clean collateral files help the lender secure its interest—and keep your closing on schedule. Navy Federal Credit Union

10. Valuation and Appraisal: Proving What the Collateral Is Worth

Most secured loans require a valuation to confirm the collateral’s market value. For mortgages, an appraisal is an independent written opinion of value; lenders rely on it to size the loan, meet investor rules, and manage risk. Regulations also give you rights to receive copies of appraisals and other written valuations developed for first-lien mortgages on a dwelling. If a valuation seems off, ask about reconsideration processes. Auto lenders may rely on guidebooks, inspections, or dealer valuations rather than formal appraisals.

10.1 Numbers & timelines

- Appraisal fees vary by market and property complexity (commonly several hundred dollars).

- You’re entitled to a copy of the appraisal promptly upon completion (or at least three business days before closing for first-lien dwelling loans).

10.2 Tips

- Review comps and property condition notes; correct factual errors quickly.

- Understand “valuation independence” rules restrict undue influence on appraisers. Consumer Financial Protection Bureau

Takeaway: valuation validates the lender’s risk assumptions and your deal math; read it carefully and speak up if something’s wrong.

11. Insurance Evidence (Home and Auto)

Lenders generally require proof of insurance to protect collateral. For mortgages, you’ll shop for homeowner’s insurance and often provide a binder before closing; for autos, you must maintain coverage listing the lender as lienholder. If insurance lapses on a mortgage, servicers can impose force-placed insurance, which is costly and offers limited protection—keep your own coverage current. For homes in flood zones, separate flood insurance may be mandatory. Budget premiums in your monthly costs; mortgage impounds (escrow) commonly include taxes and insurance.

11.1 Mini-checklist

- Homeowner’s insurance quote and binder (mortgage)

- Auto insurance ID and declarations page (auto)

- Flood insurance if required by location

- Lender/lienholder listed correctly

11.2 Numbers & notes

- It’s common to prepay 6–12 months of homeowner’s insurance at or before closing.

- If you don’t maintain coverage, servicers can buy force-placed insurance and charge you for it.

Bottom line: insurance protects you and satisfies loan conditions—don’t leave it to the last minute.

12. Required Forms, Disclosures, and Your Rights

Expect to sign several authorizations and receive key disclosures. Mortgages often include IRS Form 4506-C consent so lenders can verify your tax transcripts through the IRS IVES program; you’ll also get appraisal copies (for first-lien dwellings) and, if your application is denied or counteroffered, an adverse action notice within 30 days stating reasons or your right to reasons. For home loans, you’ll get standardized Loan Estimates and Closing Disclosures—you aren’t obligated to hand over all documents for an initial Loan Estimate, but providing them improves accuracy. Keep track of what you sign and what you receive; these documents protect your rights and spell out costs.

12.1 Mini-checklist

- Form 4506-C (tax transcript authorization)

- Credit-pull consent

- E-consent and document delivery preferences

- Copies of Loan Estimate / Closing Disclosure (mortgages)

- Adverse action notice retention (if applicable)

12.2 Guardrails

- ECOA/Reg B requires lenders to notify you of action on a completed application within 30 days—file or save any notices you receive.

- Ask your lender to summarize any conditions remaining after initial review so you can resolve them quickly.

Big picture: the “paperwork” isn’t busywork; it’s a framework that ensures fair decisions, transparent pricing, and efficient funding.

FAQs

1) What documents do I always need for any loan?

At minimum: valid photo ID, address, SSN/ITIN, consent to pull credit, proof of income, and recent bank statements. Secured loans also need collateral and insurance details. Mortgage applicants should expect pay stubs, W-2s, tax returns/tax transcripts (with consent), asset statements, and closing disclosures. Having these ready shortens underwriting and reduces back-and-forth.

2) How do I check my credit before applying—and does it hurt my score?

Use AnnualCreditReport.com, the only official portal for free reports, and review each bureau’s file for errors. Checking your own reports is a soft pull and does not impact credit scores. Correct inaccuracies before applying; they can affect approval and pricing. Consumer Financial Protection Bureau

3) What DTI should I aim for?

There’s no one-size rule, but many lenders consider mid-30s favorable and upper-30s to low-40s workable depending on loan type and compensating factors. For mortgages, QM rules now rely on price-based criteria rather than a hard 43% cap, yet DTI remains a central affordability measure. Calculate DTI early and adjust debts or loan amount accordingly.

4) I’m self-employed—what’s different?

Expect to document two years of income with personal and, if applicable, business returns, plus a year-to-date P&L. Some automated findings allow one year, but two years is common. Keep business and personal finances separate and be ready to explain fluctuations and add-backs (e.g., depreciation). You’ll likely sign Form 4506-C so the lender can verify returns.

5) Do I need an appraisal?

For most mortgage transactions, yes—an independent appraisal supports the value used to size your loan; you’re entitled to a copy. For autos, lenders use valuation guides or inspections. If the report has errors, ask about a reconsideration of value process.

6) Why do lenders care about my bank statements?

They confirm funds for down payments and closing costs, reveal large deposits that must be sourced, and show ongoing liquidity. For mortgages, consumer guidance commonly suggests having the two most recent bank statements available; gift funds require a letter and transfer proof.

7) Is homeowner’s or auto insurance required before funding?

Yes for secured loans. Mortgage lenders typically require a homeowner’s insurance binder before closing, and auto lenders require active auto insurance listing them as lienholder. If coverage lapses, servicers may impose force-placed insurance, which is expensive and limited. Consumer Financial Protection Bureau

8) What if the lender denies my application?

Under ECOA/Reg B, the creditor must notify you of action taken—approval, counteroffer, or denial—generally within 30 days of receiving a completed application. An adverse action notice must state reasons (or your right to request them). Use that feedback to improve and reapply.

9) Do I have to provide documents to get a Loan Estimate?

No. For mortgages, a lender can issue a Loan Estimate with basic information (name, income, SSN to check credit, property address/value, and loan amount). However, the more documentation you share early, the more accurate the estimate. Consumer Financial Protection Bureau

10) What is Form 4506-C and why am I signing it?

Form 4506-C authorizes a lender (through the IRS IVES system) to request your tax transcript, which helps verify income and detect fraud. It’s common for mortgage underwriting; you can review the form and revoke consent if you change your mind before processing.

Conclusion

Successful loan applications aren’t just about a good credit score; they’re about completeness, consistency, and clarity. When you show a valid ID and address, authorize a properly scoped credit pull, document stable income (or clearly explain variable income), reveal accurate debts to understand your DTI, and present clean bank statements that source all funds, you reduce underwriter questions and gain leverage on pricing and timelines. For secured loans, assembling collateral details, valuations, and proof of insurance shows you’re ready to close, and signing the right authorizations (like 4506-C) lets your lender verify quickly. Regulations—from CIP identity checks to ECOA adverse-action timelines and appraisal-copy rights—exist to protect both you and the market; use them to your advantage by keeping organized records and asking informed questions.

If you’re applying soon, block 60–90 minutes to build a single PDF packet with the 12 essentials and a short cover note that maps each condition to a page. You’ll save days of email ping-pong and boost your approval odds. Ready to start? Gather the documents above, calculate your DTI, and request your free credit reports—today.

References

- Create a loan application packet, Consumer Financial Protection Bureau (Dec 12, 2024). https://www.consumerfinance.gov/owning-a-home/prepare/create-a-loan-application-packet/

- §1020.220 — Customer Identification Program requirements for banks, eCFR/FinCEN (accessed Sep 2025). https://www.ecfr.gov/current/title-31/subtitle-B/chapter-X/part-1020/subpart-B/section-1020.220

- What is a debt-to-income ratio?, Consumer Financial Protection Bureau (Aug 30, 2023). https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-en-1791/

- General QM Loan Definition under Regulation Z, Consumer Financial Protection Bureau (Dec 10, 2020; overview page updated). https://www.consumerfinance.gov/about-us/newsroom/consumer-financial-protection-bureau-issues-two-final-rules-promote-access-responsible-affordable-mortgage-credit/

- What are appraisals and why do I need to look at them?, Consumer Financial Protection Bureau (Mar 12, 2025). https://www.consumerfinance.gov/ask-cfpb/what-are-appraisals-and-why-do-i-need-to-look-at-them-en-167/

- 12 CFR §1002.9 — Notifications (ECOA/Reg B), eCFR (accessed Sep 2025). https://www.ecfr.gov/current/title-12/chapter-X/part-1002/subpart-A/section-1002.9

- Homeowner’s insurance: Why it’s required, Consumer Financial Protection Bureau (last reviewed Aug 8, 2024). https://www.consumerfinance.gov/ask-cfpb/what-is-homeowners-insurance-why-is-homeowners-insurance-required-en-162/

- Auto loans: key terms (insurance requirement), Consumer Financial Protection Bureau (Dec 28, 2022). https://www.consumerfinance.gov/consumer-tools/auto-loans/answers/key-terms/

- Income Verification Express Service (IVES) for taxpayers, Internal Revenue Service (Nov 27, 2024). https://www.irs.gov/individuals/income-verification-express-service

- Form 4506-C, IVES Request for Transcript of Tax Return, Internal Revenue Service (PDF; current form). https://www.irs.gov/pub/irs-pdf/f4506c.pdf

- B3-3.2-01: Underwriting Factors and Documentation for a Self-Employed Borrower, Fannie Mae Selling Guide (accessed Sep 2025). https://selling-guide.fanniemae.com/sel/b3-3.2-01/underwriting-factors-and-documentation-self-employed-borrower

- B3-3.1-07: Verbal Verification of Employment, Fannie Mae Selling Guide (Mar 6, 2024). https://selling-guide.fanniemae.com/sel/b3-3.1-07/verbal-verification-employment

- AnnualCreditReport.com — Official site, Central Source, LLC (accessed Sep 2025). https://www.annualcreditreport.com/index.action

- §1002.14 — Rules on providing appraisals and other valuations, Consumer Financial Protection Bureau (accessed Sep 2025). https://www.consumerfinance.gov/rules-policy/regulations/1002/14

- Loan Estimate explainer (insurance prepay note), Consumer Financial Protection Bureau (accessed Sep 2025). https://www.consumerfinance.gov/owning-a-home/loan-estimate/