Changing your last name after marriage or reverting to a prior name after divorce can feel like a paperwork maze—especially when you’re worried about your credit. Here’s the short answer: a legal name change updates the personal information section of your credit reports, but it does not, by itself, create a new credit file or change your credit scores. The effects you’ll feel (good or bad) come from how lenders report under your new name and how you manage accounts during the transition. This guide unpacks nine research-backed facts and gives you practical steps to keep your credit accurate and protected while life changes unfold. It’s written for anyone in the U.S. changing their name due to marriage, divorce, or court order, and it includes clear checklists, timelines, and tools you can use right away. Brief disclaimer: this article is educational, not legal or financial advice; consult your attorney or advisor for your specific situation.

1. A Name Change Updates Your Credit Report’s Identity Section—It Doesn’t Reset Your File or Scores

A legal name change modifies how your identity appears on your credit reports, but it won’t erase prior history or directly affect credit scores. The bureaus (Equifax, Experian, and TransUnion) store multiple “name” fields—current name plus former names and aliases—linked to the same Social Security number and date of birth. Scoring models like FICO® and VantageScore® don’t use your name as an input; they focus on payment history, utilization, age of accounts, credit mix, and inquiries. In plain English: your credit follows your SSN and accounts, not the letters in your last name. You might see your maiden name, married name, or both on your report for years, depending on how your lenders reported over time. That’s normal. Real issues arise only if a reporting error creates duplicate files or merges your data with someone with a similar name.

Why it matters

- Worrying that a name change “wipes” your credit is a myth. Your history—good or bad—stays.

- Expect to see prior names listed under “Personal Information” or “Also Known As.” That helps lenders match older tradelines.

- Score swings after a wedding or divorce usually come from changed account handling (e.g., closing a long-aged card), not from the name change.

Numbers & guardrails

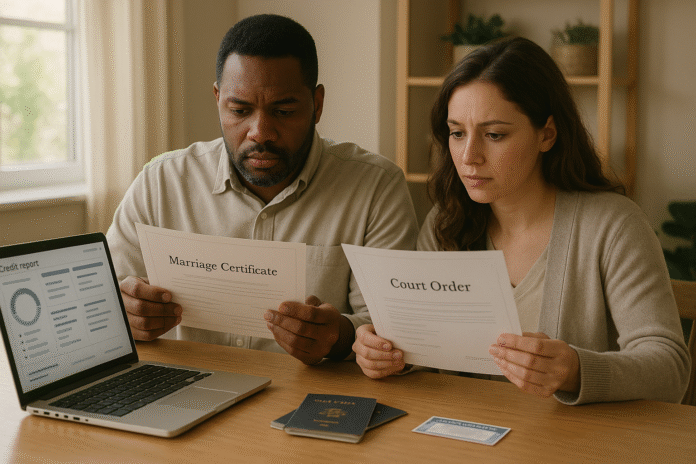

- Disputes about personal info typically require copies of legal documents (marriage certificate, court order, updated ID).

- Under federal rules, disputes are usually investigated within 30 days (up to 45 days in certain circumstances), and results must be sent to you promptly.

Common mistakes

- Assuming a name change will remove negative items; it won’t.

- Closing older accounts solely to “start fresh” can shorten credit age and dent scores.

Bottom line: treat the name change as an identity update, not a credit reset, and manage accounts to preserve your positive history.

2. Update in the Right Order: SSA → DMV/ID → Passport/IRS → Banks/Creditors (Then the Bureaus)

The smoothest path is to anchor your new name in government systems first, then cascade updates to financial institutions and, finally, the credit bureaus. Start with the Social Security Administration (SSA), since your SSN underpins tax records and many bank KYC checks. Next, update your state ID/driver’s license at the DMV and your passport if needed, followed by the IRS (often updated automatically after SSA, but verify). With government IDs in place, contact your banks, credit card issuers, mortgage servicer, student loan servicer, and insurance providers; they’ll issue replacement cards and update how they report to the bureaus. Once lenders start reporting your new name, the bureaus will reflect it. If they don’t, you can submit documentation directly.

How to do it

- SSA: Request a replacement Social Security card reflecting your new legal name. Bring your marriage certificate or court order, proof of identity, and immigration/citizenship documents if applicable.

- DMV/State ID: Update your license; requirements vary by state but typically include your updated SSA record and legal name-change proof.

- Passport/IRS: Update your passport (forms vary by timing) and confirm the IRS shows your new name so tax refunds and 1099s match.

- Financial institutions: Use secure messaging or branch visits to update your profile and request reissued cards/checks.

Mini-checklist

- Gather: certified marriage certificate or court order, current ID, updated SSA card/receipt.

- Sequence: SSA → DMV → Passport/IRS → Primary bank and top lenders → Remaining accounts.

- Confirm: after 1–2 billing cycles, pull all three credit reports to verify the new name appears.

Common mistakes

- Booking travel under your old name after updating your passport (or vice versa).

- Updating banks before SSA, causing mismatched records that delay changes.

Synthesis: lock the new name at SSA first, then ripple changes outward so your credit ecosystem updates cleanly.

3. Getting Your New Name to Show Up: Lender Reporting First, Then Bureau Updates (and When to Dispute)

Credit bureaus primarily rely on furnishers—your lenders and servicers—to supply updated personal information. When your bank changes your profile, it typically includes the new name in its next monthly file to the bureaus. Most people see the updated name on their reports within 30–60 days. If the change stalls, submit a direct update to each bureau with copies of your legal documents. For Equifax, the easiest path is through the myEquifax Dispute Center. Experian accepts online/dispute submissions. TransUnion may allow online updates for some items but often requests mailed documentation for sensitive identity fields.

Tools/Examples

- Equifax: Use the Dispute Center inside myEquifax to update name information; attach your legal documents.

- Experian: Submit a dispute/update to correct personal information and attach your proof of name change.

- TransUnion: For name, SSN, or DOB, be prepared to mail copies of your court order/marriage certificate plus a letter with your SSN, DOB, and current address.

Numbers & guardrails

- Timing: Expect 30–60 days after you update lenders for changes to propagate; disputes should be investigated within roughly 30 days (up to 45 under certain conditions).

- Proof: Provide legible copies—front/back—of IDs and legal orders; include your full SSN (not just last four) if the bureau requests it to locate your file.

Common mistakes

- Uploading unreadable photos of documents or omitting your address/SSN in mailed requests, slowing verification.

- Sending a dispute before lenders update, leading to mismatches the next month.

Tie-off: start with your lenders; if your credit reports don’t reflect the change after a couple of cycles, escalate with well-documented bureau updates.

4. Marriage Doesn’t Merge Credit Files—But Joint Accounts and Authorized-User Setups Can Affect Your Scores

Getting married doesn’t combine your credit histories or scores. You and your spouse keep separate files tied to your SSNs. However, joint financial decisions can influence each partner’s credit: opening a joint credit card or co-signing an auto loan makes both borrowers responsible, and any late payment can hurt both. Adding a spouse as an authorized user can help them benefit from your positive history—assuming the issuer reports authorized user data—but it also exposes them to utilization swings if balances spike.

Why it matters

- No automatic merge: Marriage changes your legal name, not your credit identity.

- Shared liability: Joint accounts mean equal responsibility. Even if one spouse “uses” the card more, both are on the hook.

- Authorized user: Usually no legal obligation to pay, but reported history can still influence the AU’s scores with many models.

How to do it (smart)

- If building credit together, consider one joint card with a low rate and strict autopay, keep balances under 30% utilization (ideally under 10%).

- If one spouse has thin credit, authorized-user status on an old, low-balance card can help—provided the card has no late-payment history.

- Before applying jointly for a mortgage, pull all three reports each (free weekly, as of now) and fix errors early.

Numeric example

- Suppose your spouse adds you as an AU on a card with a $10,000 limit and a $2,000 balance; your reported utilization rises by 20% if the issuer reports AUs. If your personal utilization was 5%, your composite may rise—plan payments accordingly.

Closing thought: keep accounts intentional; marriage is a legal union, but credit remains individual unless you choose to intertwine specific obligations.

5. Divorce Doesn’t Erase Joint Debts—Plan Closures, Refinances, and Account Access Carefully

A divorce decree reallocates responsibility between spouses, but it doesn’t change what lenders can enforce. If your name is on a joint debt, the creditor can still pursue you for missed payments—even if the decree says your ex is supposed to pay. The safest route is to remove joint exposure: refinance mortgages or auto loans into a single name, close or convert joint credit cards, and remove authorized users. During separation, consider freezes or at least fraud alerts if you fear misuse. Keep records of who was notified and when.

Common mistakes

- Assuming the decree protects your credit: a single 30-day late can sit on both reports for up to seven years.

- Leaving dormant joint cards open “just in case,” which invites surprise charges or utilization spikes.

How to do it

- Mortgage/auto: Ask the servicer about assumptions or refinances to remove a borrower; expect income/credit re-qualification.

- Credit cards: Request account closure or conversion to an individual account; confirm in writing and get a zero balance before closure to avoid utilization surprises.

- Authorized user cleanup: Remove each other as AUs on all cards; obtains letters confirming removal.

Mini-checklist

- Inventory every joint tradeline (credit, loans, retail cards, HELOC).

- Decide: pay off and close, or refinance into one name.

- Set autopay during the transition so a missed payment never lands on either report.

Wrap-up: courts allocate, creditors enforce—so convert, refinance, or close joint obligations to protect both parties’ credit long-term.

6. Protect Against Identity Mix-Ups and Fraud After a Name Change (Alerts, Freezes, and Monitoring)

Name changes can increase the risk of “mixed files” (your data combined with someone with a similar name) and identity scams that exploit newly issued IDs. If you suspect confusion or you’re in a contentious split, layer defenses. An initial fraud alert is free and lasts one year; it tells lenders to take extra steps to verify you. A credit freeze is stronger: it blocks new creditors from pulling your file until you lift the freeze—also free under federal law. You can now get free weekly credit reports from each bureau, permanently, so it’s easy to keep watch.

Numbers & guardrails

- Fraud alert: good for one year (renewable), extended alerts last seven years with an identity theft report.

- Credit freeze: free to place and lift at all three bureaus; PIN/credentials required to thaw temporarily for applications.

- Monitoring cadence: during the first 60–90 days post-change, check reports weekly; afterward, monthly is usually fine.

Tools

- Place an alert or freeze directly with Equifax, Experian, and TransUnion via their portals or by mail; one alert request should propagate to the other two bureaus.

- Use AnnualCreditReport.com to pull free weekly reports from each bureau (as of now).

Common mistakes

- Relying on alerts alone while actively applying for credit; if you’ll shop for a mortgage or auto loan, consider a freeze you thaw temporarily for the lender window.

- Ignoring small address/name typos that can snowball into mis-matches.

Takeaway: combine weekly report checks with a fraud alert or freeze during the transition; it’s low effort and high protection.

7. Fixing Reporting Errors: Hyphenations, Maiden Names, Duplicates, and Address Mismatches

Hyphenated surnames, apostrophes, or spacing differences (e.g., “De La Cruz” vs. “Delacruz”) can produce multiple variants across your lenders’ data feeds. Separately, some consumers see an old married name persist as the “primary” name or discover a duplicate file that splits accounts. These issues are fixable, but the fastest route is structured: correct your identity with the lender first, then the bureaus; escalate via disputes only when necessary. For address mismatches, standardize to USPS formatting and confirm your lenders’ profiles match your official ID.

How to do it

- Standardize: Decide on your exact spelling/format (with or without hyphen) and use it consistently across SSA, DMV, and lenders.

- Correct at the source: Ask each lender to resubmit data with the standardized name; this helps updates stick every month.

- Dispute when needed: If the bureaus still display the wrong “primary” name or duplicate files, send a dispute with your ID, legal order, and lender confirmation.

Mini-checklist

- Gather: marriage certificate/court order, updated SSA card, driver’s license/passport, recent utility bill or bank statement.

- Document: screenshots/letters from lenders showing your standardized name.

- Track: dispute submission dates; expect a written response in about 30–45 days.

Common mistakes

- Submitting disputes without fixing lender records, which causes the wrong version to reappear on the next cycle.

- Omitting a proof of address along with ID, leading to verification delays.

Finish: clean the source data, then synchronize the bureaus; this resolves most sticky name and address variations.

8. Mortgages, Auto Loans, and Student Loans: Avoid Underwriting Hiccups When Your Name Changes

Large lenders care about exact identity matching. If your mortgage or student loan servicer reports under your old name while your ID shows the new one, automated underwriting or manual reviews may flag inconsistencies. The solution is timing and documentation. For mortgages, coordinate with your loan officer: if you’re mid-process, it may be better to close under your current legal name and update the loan afterward. Auto lenders are typically more flexible, but titles and insurance must match your registration. Student loan servicers will update your name after you submit their forms with proof; expect a cycle or two for downstream reporting to follow.

How to do it

- If house-hunting: Ask your lender which documents must match; keep your ID and paystubs consistent until closing, then update everything post-close.

- If refinancing post-divorce: Lock in the refi to remove your ex from liability; ensure the deed and mortgage align with the same legal name.

- Student loans: Use your servicer’s name-change form; include your court order/marriage certificate and updated ID.

Numbers & guardrails

- Processing often aligns with monthly reporting; plan for 30–60 days for full propagation across all three bureaus.

- If your loan is in forbearance/deferment during the change, keep address/phone accurate so you don’t miss notices.

Common mistakes

- Mixing names across insurance, title, and registration, which can delay claims or DMV transactions.

- Updating mid-underwriting without alerting your loan officer, triggering additional verification steps.

Synthesis: plan the sequence with your lender and keep documents consistent through closing; update names on large loans after the dust settles.

9. Your 60-Day Action Plan and Checklist (Marriage or Divorce)

You can complete most credit-relevant updates in about two months if you follow a clean sequence. The goal is to keep payment history perfect, utilization steady, and identity consistent while the systems update. Use this checklist to stay organized and prevent score dips caused by avoidable mistakes.

0–7 days: legal and identity anchors

- Obtain certified copies of your marriage certificate or court order (3–5 copies recommended).

- Update your name with SSA; keep the receipt/confirmation.

- Notify your employer’s HR/payroll (W-4, benefits) so tax reporting matches.

7–21 days: government IDs and banking

- Update your driver’s license/state ID; then passport if you need international travel soon.

- Update primary bank and credit card issuers; request reissued cards and checks.

- Set autopay on all loans and cards; confirm due dates won’t be missed during transitions.

21–45 days: lenders, servicers, and insurance

- Update mortgage, auto, and student loan servicers; insurance policies; utilities; and major subscriptions.

- If divorcing, begin refinances/assumptions or close joint accounts; remove each other as authorized users everywhere.

30–60 days: verify and secure

- Pull all three credit reports weekly via AnnualCreditReport.com; confirm the new name appears and old names are listed as former/also-known-as.

- If anything looks off, file targeted disputes with the affected bureau(s) and lender(s) with clear documentation.

- Consider a fraud alert (1 year) or credit freeze if you’re at risk of misuse.

Mini case

- After marriage, Jamie standardizes to “Jamie Rivera-Lee,” updates SSA and DMV in the first week, then banks and cards by day 14. By day 45, Experian shows “Jamie Rivera-Lee” as primary and “Jamie Rivera” as former; Equifax catches up by day 55. No score change occurs because all payments stayed on autopay and utilization stayed below 10%.

Final note: the plan is the same for marriage or divorce; the divorce-specific additions are joint-debt exits, authorized-user removals, and extra vigilance for misuse.

FAQs

1) Does changing my name lower or raise my credit score?

No. Your name isn’t a scoring factor; models use payment history, utilization, account age, mix, and inquiries. Score changes you notice around a wedding or divorce almost always come from actions like closing a long-aged card, adding a new loan, or missing a payment during the transition. Keep autopay on and utilization below 30% (ideally under 10%) to keep scores steady.

2) Will marriage merge my credit with my spouse’s?

No. You and your spouse have separate credit files tied to your SSNs. Joint applications or co-signed loans will appear on both reports and affect both scores. Authorized-user status may help a spouse build credit if the primary account is well-managed, but it also exposes them to utilization spikes if balances rise.

3) After divorce, my decree says my ex must pay a joint card. If they don’t, can it still hurt me?

Yes. A divorce decree allocates responsibility between ex-spouses, but it doesn’t change the creditor’s contract. If your name is on the account and it goes late, the late pay can hit your report. Protect yourself by closing or converting joint cards and refinancing loans into one name, then monitoring all three reports.

4) How long until the bureaus show my new name?

If you update your lenders promptly, expect 30–60 days for propagation across all three bureaus. If it stalls, submit updates or disputes directly with copies of your legal documents. Bureau investigations typically wrap in about 30 days (up to 45 in specific circumstances), and they must notify you of the results.

5) Do I need to tell the IRS separately after updating Social Security?

Often, the IRS receives updates from SSA, but mismatches can still happen. Check that your next W-2/1099 and your IRS records reflect the new name to avoid refund delays. Ask your employer’s payroll team to ensure your name matches SSA exactly, including hyphens and spacing.

6) What should I do about hyphenated or accented surnames?

Choose a standardized format (with or without hyphen/accents) and use it consistently across SSA, DMV, passport, banks, and lenders. Ask lenders to resubmit data in that format. If a bureau shows a different “primary” name, dispute with documentation. Consistency is the best defense against mixed files and verification issues.

7) Is a fraud alert or a credit freeze better after a name change?

A fraud alert is a light safeguard that asks lenders to verify you; it’s free and lasts one year (renewable). A credit freeze is stronger: new creditors can’t access your report unless you lift the freeze. Freezes are also free to place and lift. If you’re actively applying for credit soon, consider an alert; if not, a freeze offers stronger protection.

8) How do I handle a pending mortgage while my name is changing?

Coordinate with your loan officer. It may be simplest to close under your current legal name and update the loan afterward. If you’ve already updated IDs, ensure all application documents match and be ready for extra verification. After closing, send your servicer your legal documentation to update statements and reporting.

9) Will my old name disappear from my reports?

Not necessarily. Prior names often remain listed as “former” or “also known as” to preserve continuity of your credit history. That’s normal and not harmful. If an obsolete name causes confusion or a mixed file, dispute it with proof of your legal name and ask for the outdated variant to be relegated appropriately.

10) Do I have to update every single account?

Prioritize accounts that report to credit bureaus (credit cards, loans) and those tied to identity verification (banking, insurance). Subscriptions and loyalty programs matter less for credit but are worth updating for billing and fraud prevention. Use a checklist to work through the big items first, then the rest as time allows.

11) Can I change my name with the bureaus even if a lender refuses to update?

Yes, you can. Submit your court order or marriage certificate directly to each bureau with ID and proof of address. Still, fix the lender data too; otherwise, the old name may reappear the next cycle. Working both angles (lender plus bureau) yields the most durable fix.

12) I changed my name outside the U.S.—does this apply?

This guide is U.S.-focused. Other countries use different credit reference agencies and processes. If you’ve recently immigrated or lived abroad, gather certified translations of your legal name-change documents and coordinate with your U.S. banks; be prepared for manual verification during account openings and underwriting.

Conclusion

Life events like marriage and divorce change names, not credit fundamentals. Your credit report reflects your legal identity, but scores move based on how accounts are managed—on-time payments, low utilization, age of accounts, and prudent applications. By anchoring your new name at SSA and rolling updates through IDs, banks, and lenders in a thoughtful sequence, you allow the three bureaus to synch automatically. Add safeguards—a fraud alert or freeze—and monitor reports weekly (free) during the transition to catch errors early. If something goes wrong, fix data at the source (your lenders) and escalate with precise, well-documented bureau updates. For divorce, take extra steps to exit joint obligations so a former partner’s missed payment can’t touch your file. Follow the 60-day plan, keep autopay on, and treat the process like a relay rather than a scramble.

Ready to protect your credit during a name change? Start today by updating SSA and turning on autopay for every active account.

References

- How to Report a Name Change to a Credit Bureau, Experian, updated article (accessed Sep 20, 2025). https://www.experian.com/blogs/ask-experian/how-to-report-name-change-to-credit-bureau/

- How to Update Your Credit Report’s Personal Information, Experian, Jul 27, 2020. https://www.experian.com/blogs/ask-experian/how-to-update-your-credit-reports-personal-information/

- What Happens to Your Credit When You Get Married?, Experian (section: “Will Changing Your Name Impact Your Credit?”), (accessed Sep 20, 2025). https://www.experian.com/blogs/ask-experian/credit-education/life-events/marriage-and-credit/

- Change Name with Social Security, Social Security Administration, current guidance (accessed Sep 20, 2025). https://www.ssa.gov/personal-record/change-name

- How do I change or correct my name on my Social Security card?, Social Security Administration FAQ, Nov 14, 2024. https://www.ssa.gov/faqs/en/questions/KA-01981.html

- A Summary of Your Rights Under the Fair Credit Reporting Act, Consumer Financial Protection Bureau (PDF), (accessed Sep 20, 2025). https://files.consumerfinance.gov/f/documents/bcfp_consumer-rights-summary_2018-09.pdf

- How do I dispute an error on my credit report?, Consumer Financial Protection Bureau, Dec 18, 2024. https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/

- If a credit reporting error is corrected, how long will it take…?, Consumer Financial Protection Bureau, Jun 6, 2023. https://www.consumerfinance.gov/ask-cfpb/if-a-credit-reporting-error-is-corrected-how-long-will-it-take-before-i-find-out-the-results-en-1339/

- Credit Freeze or Fraud Alert: What’s Right for Your Credit Report?, Federal Trade Commission, (accessed Sep 20, 2025). https://consumer.ftc.gov/articles/credit-freeze-or-fraud-alert-whats-right-your-credit-report

- Free Credit Reports, Federal Trade Commission, updated Oct 13, 2023 / Jan 4, 2024. https://consumer.ftc.gov/free-credit-reports

- AnnualCreditReport.com—Home, AnnualCreditReport, (accessed Sep 20, 2025). https://www.annualcreditreport.com/index.action

- Changing Your Legal Name on Your Equifax Credit Report, Equifax Newsroom, Nov 11, 2024. https://www.equifax.com/newsroom/all-news/-/story/equifax-shares-the-latest-steps-to-change-your-name-on-your-credit-report/

- Editing Your Personal Information, TransUnion Consumer Support, (accessed Sep 20, 2025). https://www.transunion.com/customer-support/editing-personal-information

- Place a Fraud Alert or Active Duty Alert, Equifax, (accessed Sep 20, 2025). https://www.equifax.com/personal/credit-report-services/credit-fraud-alerts/

- Can a debt collector contact me about a debt after a divorce?, Consumer Financial Protection Bureau, Apr 14, 2023. https://www.consumerfinance.gov/ask-cfpb/can-a-debt-collector-contact-me-about-a-debt-after-a-divorce-en-1413/