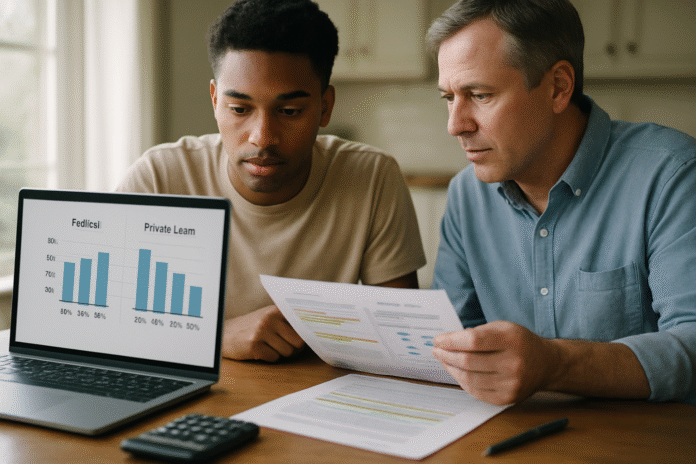

Picking the right loan can save you thousands and reduce risk. In short: federal loans offer fixed, annually set rates, broad borrower protections, and flexible repayment plans; private loans are credit-based with fixed or variable rates and fewer built-in safety nets. As of September 2025, new federal loan rates for 2025–26 are 6.39% (undergrad), 7.94% (grad), and 8.94% (PLUS), while private rates vary widely by lender and credit. Always exhaust federal options before turning to private loans. This article is educational, not individualized financial advice.

Quick chooser (30 seconds):

1) File the FAFSA and take all federal subsidized/unsubsidized aid first. 2) If there’s still a gap, compare private offers (APR, variable vs fixed, term, co-signer release). 3) Don’t refinance federal loans into private unless you’re sure you won’t need federal protections (PSLF, IDR, deferment).

1. How Interest Rates Are Set—and What You’ll Likely Pay

Federal loan rates are fixed for the life of each loan and reset once a year based on a formula tied to the 10-year U.S. Treasury note plus a statutory add-on; loans first disbursed from July 1, 2025–June 30, 2026, are 6.39% (undergrad), 7.94% (grad), and 8.94% (PLUS). Private loan rates are set by lenders, often off benchmarks like SOFR, and hinge on your credit, income, and co-signer; advertised ranges currently span roughly the mid-2% to high-teens APRs, with autopay discounts commonly shaving 0.25 percentage points. Because federal rates are fixed and credit-agnostic (except PLUS), they’re predictable; private loans can be cheaper for top-tier credit but carry variability and underwriting risk. Start by assuming federal is safer and compare private only to fill gaps.

1.1 Numbers & guardrails

- 2025–26 federal rates: 6.39% undergrad; 7.94% grad; 8.94% PLUS. Fixed for the life of each loan.

- Private ranges (recent): ~2.85%–17.99% APR; exact offer depends on credit profile and term; many lenders price off SOFR. Credible

- Caps (by law): Federal maximums are 8.25% (undergrad), 9.50% (grad), 10.50% (PLUS).

1.2 Mini example

Borrow $15,000 for undergrad. At 6.39% over 10 years, the payment is about $170/month and total interest about $5,400. A private 10% fixed loan for the same term costs about $198/month and $8,800 in interest—a ~$3,400 difference. The gap can be larger with variable rates if benchmarks rise.

Bottom line: Federal rates are stable and standardized; private rates may beat federal for excellent credit but can cost far more for average profiles or if rates climb.

2. Borrower Protections & Forgiveness: What Safety Nets You Get

Federal loans include statutory protections and potential forgiveness that private loans typically don’t match. Core federal benefits include Public Service Loan Forgiveness (PSLF), targeted discharges (e.g., school closure, total and permanent disability, borrower defense), and access to income-driven repayment (IDR). Some servicers/lenders may offer hardship forbearance or compassionate discharge on private loans, but these are discretionary and vary by contract. Importantly, parts of the SAVE IDR plan have faced court actions; as of Aug. 1, 2025, interest resumes for borrowers who were in SAVE forbearance. Regardless, PSLF and established discharge programs remain specific to federal loans.

2.1 Why it matters

- PSLF: Forgives remaining federal Direct loan balance after 120 qualifying payments while working full-time for government or qualifying nonprofits. Private loans are ineligible.

- Discharges: Federal law recognizes events (closed school, disability, death, certain certifications) that can cancel debt. Private discharge terms, if any, vary. Federal Student Aid

- SAVE/IDR context (2025): Some SAVE provisions have been paused by courts; borrowers emerging from SAVE forbearance should verify current options on StudentAid.gov.

2.2 Mini checklist

- Confirm PSLF eligibility with the PSLF Help Tool.

- If your school closed or misled you, review discharge options.

- For private loans, read the promissory note for any hardship or death/disability discharge.

Bottom line: Federal loans embed legal protections and pathways to forgiveness; private loans do not guarantee comparable relief.

3. Repayment Flexibility: IDR vs. Fixed Terms

Federal loans offer multiple repayment paths—Standard (10-year), Graduated, Extended, and several IDR plans that scale your payment to income and family size. That flexibility helps you throttle payments when income dips, and it can maintain eligibility for PSLF or eventual IDR forgiveness. Private loans generally offer a handful of fixed terms (e.g., 5–20 years), sometimes interest-only during school, and limited hardship options; payments are rarely tied to income and forgiveness isn’t standard. As of 2025, federal IDR application processes have been affected by litigation, so check the latest processing status and forbearance rules before choosing.

3.1 How to use it

- If cash-flow is tight: Federal IDR can drop payments—sometimes to $0 depending on income and family size. Private loans can’t.

- If pursuing PSLF: You must be on a qualifying plan (usually an IDR).

- If income rises: You can switch federal plans; for private loans, refinance for a new rate/term (but you can’t add PSLF/IDR later).

3.2 Mini example

A new teacher earning $42,000 might pay $120–$160/month on IDR (depending on plan parameters) instead of ~$300 on the Standard plan for the same federal debt—keeping PSLF eligibility intact. Private loans at the same balance would likely require the full amortizing payment regardless of income.

Bottom line: Federal loans are built for income volatility and public-service paths; private loans usually aren’t.

4. Eligibility, Underwriting & Co-Signers

Except for PLUS loans, federal student loans don’t require a traditional credit check, making them accessible to most students who file the FAFSA and meet general eligibility. PLUS loans for parents/grad students do require a check for adverse credit (not the same as a minimum credit score) and allow an endorser if adverse items exist. Private loans almost always underwrite based on credit, income, and debt-to-income; most undergrads will need a co-signer to qualify for good rates and limits. This makes private pricing highly individualized—excellent credit can unlock low APRs, but limited credit can push rates to the teens.

4.1 Common pitfalls

- Assuming approval: Private prequalification is not guaranteed funding; documentation and enrollment verification still apply.

- Overlooking adverse credit rules on PLUS: Certain recent delinquencies or bankruptcy count; review before applying. Federal Student Aid

- Skipping FAFSA: You can miss subsidized eligibility and lower fixed rates. Federal Student Aid

4.2 Mini checklist

- File the FAFSA early each year.

- If considering PLUS, read the adverse credit definition and endorser path.

- If going private, compare multiple lenders and check for co-signer release timelines.

Bottom line: Federal access is broad and predictable; private approval and pricing depend on your (or a co-signer’s) credit.

5. Interest Subsidies, Accrual & Capitalization

Federal Direct Subsidized Loans don’t accrue interest while you’re in school at least half time, during grace, and during qualifying deferments; the government pays it. Federal rules also govern when unpaid interest capitalizes (gets added to principal), which can increase total costs; capitalization events have been narrowed in recent years, but still occur in specific situations. Under the IDR landscape, SAVE was designed to eliminate 100% of remaining monthly interest after you make your scheduled payment, preventing balance growth—though parts of SAVE have been affected by court actions, and borrowers who were in SAVE forbearance began accruing interest again on Aug. 1, 2025. Private loans accrue interest continuously (simple interest) and generally lack interest subsidies; capitalization is defined by the promissory note.

5.1 Numbers & guardrails

- Subsidized coverage: No interest accrues in-school, grace, or eligible deferments. Unsubsidized and PLUS do accrue.

- Capitalization basics: Unpaid interest may be added to principal in certain scenarios (e.g., after some deferments/plan changes).

- SAVE intent vs. status: Designed to prevent interest growth after payment; verify current status due to litigation.

5.2 Mini example

If $40 in interest accrues this month and your SAVE payment is $25, the remaining $15 was intended to be subsidized so your balance wouldn’t grow. Without that protection (or on a private loan), the unpaid portion either accrues or may later capitalize, increasing long-term cost.

Bottom line: Federal loans can blunt or pause interest growth; private loans typically can’t.

6. Fees, Discounts & the Real APR

Federal Direct Loans charge origination fees that are deducted from disbursements: 1.057% for Subsidized/Unsubsidized and 4.228% for PLUS (unchanged through Sept. 30, 2026, per current sequester adjustments). Private loans often advertise no origination fee, but you must check the APR (which bakes in any fees) and watch for late-payment or returned-payment fees. Both federal and private lenders commonly offer a 0.25% autopay interest rate reduction, but only private loans may add other loyalty or co-signer-release perks. Evaluate total cost—rate, fees, and term—not just the headline APR.

6.1 Mini example

- Borrow $10,000 in a Direct Unsubsidized Loan: a 1.057% fee means $105.70 is withheld; you net $9,894.30. You still owe $10,000 plus interest.

- A private loan with 0% fees at 9.0% APR may still cost more over time than a 7.94% federal grad loan with a small fee—especially if you qualify for federal IDR or PSLF.

6.2 Quick checklist

- Compare APR, not just rate.

- Confirm autopay discount and whether it stacks with other discounts.

- On federal loans, budget for fees so refunds and payment plans aren’t short.

Bottom line: Federal loans include modest mandatory fees; private loans often skip fees but can carry higher APRs—run the math.

7. Refinancing & Consolidation: When Switching Makes Sense (and When It Doesn’t)

Federal Direct Consolidation simplifies multiple federal loans into one payment and can unlock certain repayment or forgiveness paths without lowering your interest rate. Private refinancing replaces existing loans (federal or private) with a new private loan at a new rate/term. If you refinance federal loans into private, you permanently lose federal protections (PSLF, IDR access, federal deferments). Refinancing might make sense only if you have strong credit, stable income, and no foreseeable need for federal safety nets. Conversely, consolidating federal loans can be smart for administrative simplicity or to qualify certain loans for PSLF counting—always verify current PSLF/IDR rules before moving.

7.1 Tools/Examples

- PSLF path: Use the PSLF Help Tool to evaluate whether consolidation helps or hurts your qualifying-payment count. Federal Student Aid

- Rate test: If your weighted average federal rate is 6.5%, refinancing at 5% might save money—but only if you’re certain you won’t need IDR/PSLF or federal forbearance.

7.2 Common mistakes

- Consolidating private loans via federal consolidation (not possible).

- Refinancing federal loans for a tiny rate cut and forfeiting federal benefits.

- Ignoring variable-rate risk on private refis pegged to SOFR.

Bottom line: Consolidate to manage federal loans; refinance only when the savings clearly outweigh losing federal protections.

8. Deferment, Forbearance & Hardship Relief

Federal loans offer structured deferments (e.g., in-school, unemployment, economic hardship, military) and forbearances for temporary relief. During deferment, subsidized loans don’t accrue interest; unsubsidized/PLUS do. Forbearance pauses payments but interest accrues on all federal loans. Private lenders may offer short-term forbearance or payment flexibility, but policies are lender-specific and rarely match federal breadth. If you anticipate career changes, graduate school, or income volatility, the reliability and clarity of federal relief can be decisive.

8.1 Types & timing

- Deferments: In-school, economic hardship, graduate fellowship, military service; terms and maximums vary.

- Forbearance: General or mandatory categories; interest accrues throughout. Federal Student Aid

- Grace periods: Federal Direct Loans usually have a 6-month grace after leaving school; private grace terms vary by lender. Federal Student Aid

8.2 Mini checklist

- If pausing payments, try deferment first if eligible (protects subsidized interest).

- If using forbearance, consider paying accruing interest to avoid future capitalization.

- Document everything; keep copies of approvals and end dates. Federal Student Aid

Bottom line: Federal relief is clearer and often cheaper during pauses; private relief is limited and contract-dependent.

9. Taxes, Bankruptcy & Legal Considerations

At the federal tax level, most student-loan forgiveness is tax-free through 2025 under the American Rescue Plan; PSLF has been and remains federally non-taxable, though state tax rules can differ. Employer student-loan repayment assistance of up to $5,250/year is also tax-free through 2025 under current IRS guidance. After 2025, absent new law, some forms of forgiveness (e.g., long-term IDR) may again be taxable federally. Discharging student loans in bankruptcy is difficult but possible under the “undue hardship” standard; updated DOJ/ED guidance has clarified processes for courts and attorneys. Private loans typically follow the same tax/bankruptcy frameworks (with fewer forgiveness paths to begin with). Always verify current rules before making irreversible moves.

9.1 Guardrails & examples

- Tax today (2025): Federal IDR/other qualifying forgiveness isn’t taxed federally; states vary. PSLF is federally tax-free.

- Tax tomorrow (2026+): Many observers expect federal taxation of long-term IDR forgiveness to return if Congress doesn’t extend ARPA’s relief. Plan accordingly. Bankrate

- Bankruptcy: You must prove undue hardship in an adversary proceeding; DOJ/ED guidance (Nov. 2022, updated materials 2025) informs case handling and borrower attestations. Department of Justice

Bottom line: Through 2025, federal tax treatment is borrower-friendly; beyond that, rules may change. Bankruptcy relief exists but remains stringent.

FAQs

1) Should I ever choose a private loan over a federal loan?

Yes—but only after you’ve accepted all federal grants, scholarships, and federal subsidized/unsubsidized loans. Private loans can bridge remaining costs, and top-tier borrowers may secure lower APRs than federal rates. Remember that you’ll give up federal protections like PSLF and IDR flexibility, and private hardship options are lender-specific. Compare true APRs, variable-rate risk, and co-signer obligations carefully.

2) Are federal student loan rates “good” in 2025?

Federal rates are mid-single digits for undergrads and higher for grad/PLUS. They’re fixed for the life of the loan and set annually by statute off the 10-year Treasury. Whether they’re “good” depends on your alternatives; private offers may beat them for excellent credit but can be worse for average credit or if you choose a variable rate that later rises.

3) What’s the practical difference between deferment and forbearance?

Deferment is typically better if you qualify, because subsidized federal loans don’t accrue interest during deferment. Forbearance pauses payments but interest accrues on all federal loans, increasing total cost unless you pay interest as you go. Private lenders may offer only forbearance. Federal Student Aid

4) How does SAVE change my interest?

SAVE was designed so that after you make your scheduled payment, 100% of remaining monthly interest would be covered so your balance wouldn’t grow—an improvement over prior plans. Due to court actions, some borrowers were placed in SAVE forbearance and, as of Aug. 1, 2025, interest began accruing again; check StudentAid.gov for the latest status and your options. edfinancial.studentaid.gov

5) Do PLUS loans look at my credit score?

PLUS loans use an adverse credit check, which is not the same as a minimum credit score threshold. Certain delinquencies or recent derogatory events can cause denial, but you may still qualify with an endorser or by documenting extenuating circumstances, plus required counseling. Federal Student Aid

6) Are private loan rates fixed or variable—and which should I choose?

Both exist. Variable rates track benchmarks like SOFR and can start lower but rise over time. Fixed rates offer predictability. If you need long-term certainty, fixed can be safer; if you’ll repay quickly and can handle rate risk, variable may save money. Always model worst-case increases.

7) What fees should I expect?

Federal Direct Loans have origination fees—1.057% for Subsidized/Unsubsidized and 4.228% for PLUS—deducted from each disbursement. Private loans often have no origination fee, but APRs still reflect total cost. Both federal and private commonly give 0.25% autopay discounts.

8) Can I refinance federal loans later if rates drop?

You can refinance into a private loan anytime if approved, but you’ll permanently lose federal benefits (PSLF, IDR access, federal deferment/forbearance structures). There’s no way to refinance back into federal. Consider Direct Consolidation for administrative simplicity without giving up protections. Federal Student Aid

9) Will forgiveness be taxable?

At the federal level, most student-loan forgiveness is tax-free through 2025 (PSLF is federally tax-free regardless). Some states may tax forgiven amounts. After 2025, unless Congress extends the rule, long-term IDR forgiveness may again be taxable federally.

10) How do I decide quickly between federal and private?

Use a simple filter: (1) Max out federal subsidized/unsubsidized first. (2) If you need more, collect at least three private quotes (fixed vs. variable, term, co-signer release, hardship policies). (3) If you might work in public service or need income-based payments, avoid converting federal debt to private.

Conclusion

Federal and private loans serve different needs. Federal loans are standardized, predictable, and come with legal protections—PSLF, structured deferments, IDR, and clearer discharge rules. Private loans are individualized credit products that can be cheaper for some borrowers but carry underwriting risk, fewer protections, and potential rate volatility. Your smartest path is to exhaust federal funding first, then use private loans surgically to fill remaining gaps where the math—and your career outlook—justify it. Keep an eye on evolving IDR/SAVE developments and verify PSLF and consolidation rules before making changes. If rates move, revisit your plan, but be cautious about giving up federal benefits for a small interest savings.

Copy-ready CTA: Compare your federal options on StudentAid.gov, then pull 3 private quotes side-by-side and choose the lowest-risk, lowest-cost mix.

References

- (DL-25-03) Interest Rates for Direct Loans First Disbursed Between July 1, 2025 and June 30, 2026, Federal Student Aid Knowledge Center, May 30, 2025 — FSA Partner Connect

- Interest Rates and Fees for Federal Student Loans, U.S. Department of Education (StudentAid.gov), accessed Sept. 2025 — https://studentaid.gov/understand-aid/types/loans/interest-rates Federal Student Aid

- Income-Driven Repayment Plans, U.S. Department of Education (StudentAid.gov), accessed Sept. 2025 — Federal Student Aid

- IDR Plan Court Actions: Impact on Borrowers, U.S. Department of Education (StudentAid.gov), updated 2025 — Federal Student Aid

- Public Service Loan Forgiveness (PSLF), U.S. Department of Education (StudentAid.gov), accessed Sept. 2025 — Federal Student Aid

- Get Temporary Relief: Deferment and Forbearance, U.S. Department of Education (StudentAid.gov), accessed Sept. 2025 — Federal Student Aid

- FY 2026 Sequester-Required Changes to Title IV Student Aid Programs (Loan Fees), Federal Student Aid Knowledge Center, May 5, 2025 — FSA Partner Connect

- Average Student Loan Interest Rate (2025), EducationData.org, Aug. 13, 2025 — Education Data Initiative

- Current Student Loan Interest Rates (Explainer on Federal vs. Private & SOFR), Bankrate, updated Sept. 2025 — Bankrate

- Publication 970: Tax Benefits for Education (2024), Internal Revenue Service — IRS

- IRS Newsroom: Educational Assistance Programs Can Help Pay Employee Student Loans Through 2025, IRS, Aug. 6, 2025 — IRS

- Loans: Federal Versus Private Loans, U.S. Department of Education (StudentAid.gov), accessed Sept. 2025 — Federal Student Aid