Your digital life—photos, messages, documents, cryptocurrency, domains, memberships, and countless online accounts—belongs in your estate plan just as much as your home or bank accounts. In plain terms, including digital assets in your estate plan means documenting what you have, deciding who should access it, and giving them the legal and technical ability to do so without breaking platform rules or privacy laws. Many platforms now provide built-in tools to direct what happens to an account; where those exist, they typically take priority over directions in a will.

Quick path overview: (1) inventory assets, (2) classify ownership and access, (3) pick a digital executor, (4) centralize credentials, (5) capture crypto specifics, (6) turn on platform legacy tools, (7) write instructions without exposing secrets, (8) update legal docs for access, (9) plan transfers and backups, (10) handle IP and business accounts, (11) budget time and costs, (12) run a rehearsal and maintain.

Important: This guide is educational, not legal or tax advice. Digital-asset rules differ by jurisdiction and platform. Work with qualified professionals for decisions about your will, power of attorney, taxes, and cross-border issues.

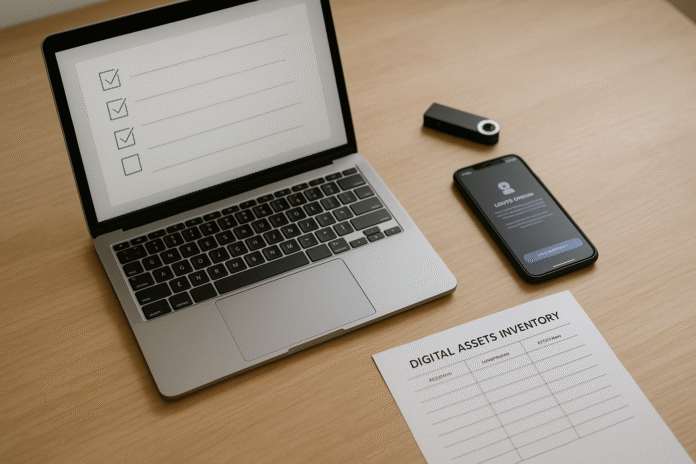

1. Build a complete inventory of your digital assets

Start by mapping everything with a login or digital value. This inventory is the backbone of your plan and the quickest way for loved ones to see “what exists” without guesswork. Include sentimental items (family photos, voice notes, cloud albums), financial accounts (brokerage logins, payment apps), productivity hubs (email, cloud drives, password managers), web properties (domains, hosting, DNS), creative/business platforms (YouTube, Etsy, Patreon, app stores), subscriptions (news, streaming, software), and any assets that can be bought, sold, or redeemed (miles, gift cards, in-game items). A complete list should also note two-factor methods (authenticator app, SMS number, hardware keys), recovery codes, and account-specific settings—especially for platforms with “legacy” controls that can override your will.

Example inventory table (keep details in your private document):

| Category | Platform | What to do | Who gets it |

|---|---|---|---|

| Photos & videos | iCloud Photos / Google Photos | Archive & share originals | Partner / children |

| Gmail / Outlook | Grant read-only access; close after exports | Executor | |

| Crypto wallets | Hardware + mobile wallets | Transfer to beneficiaries via trustee | Spouse / trust |

| Domains & hosting | Registrar + host | Transfer ownership; keep site live 90 days | Business partner |

| Social media | Facebook / Instagram | Memorialize or delete per your choice | Digital executor |

Mini-checklist

- List accounts, devices, and storage locations.

- Note 2FA methods and recovery codes (where stored).

- Group accounts by “keep,” “archive,” or “close.”

- Record any platform “legacy” settings you’ve enabled.

- Flag anything with business or tax implications.

Close this step by storing the inventory where your executor can actually find it (see Sections 4 and 7). The goal isn’t perfection; it’s giving your future helpers a clear map on day one.

2. Classify access levels and ownership (and separate personal vs. business)

Two questions simplify complex decisions: Who owns it? and Who needs what level of access to do their job? Ownership might be personal (your private email, photos), shared (family photo vault), or business (domains registered to an LLC, ad accounts). Access levels range from read-only (to gather records) to full control (to transfer or close accounts). Write these down per asset, so your executor isn’t forced to guess and risk violating terms of service or privacy laws.

How to do it

- Tag assets by role: personal, shared family, or business.

- Define access tiers: audit/export only; manage/settings; full control/transfer.

- Name the person: digital executor for personal, business manager for company assets, trustee for assets in trust.

- Add outcomes: memorialize, delete, transfer, or archive.

Common mistakes

- Mixing business domains or social handles in a personal account.

- Forgetting who controls 2FA for shared services.

- Assuming your general executor is comfortable triaging tech platforms.

Finish by updating your inventory with these tags. When your legal documents name fiduciaries (executor, trustee, agent under power of attorney), this classification helps them act with clarity while staying aligned with platform rules (see Section 8).

3. Appoint a capable “digital executor”

A digital executor is the person who will carry out instructions for your online life—closing accounts, securing copies of photos, managing memorialization requests, transferring domains or crypto, and working with providers. The role is often non-statutory but can be recognized in your will or a letter of instruction; the key is to choose someone organized, trustworthy, and reasonably tech-savvy. Many lawyers encourage naming a separate digital executor even if your primary executor handles everything else.

What to look for

- Comfort with password managers, 2FA, and recovery workflows.

- Willingness to follow your written instructions literally.

- Ability to coordinate with your lawyer and accountant.

- Emotional distance to make practical choices when others are grieving.

Mini-checklist

- Name your digital executor in your will or codicil and in your instructions letter.

- Provide contact info and a back-up person.

- Point them to your inventory, not your passwords (see Section 7).

- Confirm they understand platform legacy tools (Section 6).

Wrap this step by telling the person you’ve chosen and giving them a high-level overview of your plan. Clear expectations now mean fewer roadblocks later.

4. Centralize credentials with a password manager (and set up emergency access)

The safest way to give your fiduciaries practical access is through a modern password manager with emergency access or account recovery features. Password managers reduce lockouts, eliminate sticky-note sprawl, and let you share a subset of logins without emailing passwords. Security frameworks recommend long passphrases over forced complexity and favor breach-checking and rate-limits over arbitrary reset cycles. In short: one strong master passphrase, multi-factor authentication, and a plan for emergency hand-off.

Numbers & guardrails

- Passphrase length: allow at least 8 characters and ideally support up to 64+ in line with identity standards.

- No periodic forced changes: rotate only if there’s evidence of compromise.

- Emergency access: enable it for one or two trusted contacts.

- 2FA: prefer authenticator apps or hardware keys over SMS.

How to do it

- Pick a reputable password manager and turn on emergency access/recovery.

- Store recovery codes for critical accounts in a secure note inside the manager.

- Share only what’s needed with your executor via shared vaults—not your master password.

- Document where the master passphrase is stored (see Section 7).

Close by testing a recovery flow with a trusted contact so you know exactly what they will see and what approvals are required.

5. Capture cryptocurrency specifics: wallets, keys, and transfer paths

Crypto is uniquely unforgiving: if your executor can’t locate wallets, seed phrases, or hardware devices—and if they lack authorization to hold or transfer—value can be lost forever. For tax and probate, crypto is treated like property in major jurisdictions, which means it’s part of your estate and may be subject to estate/inheritance tax rules. Plan explicitly for discovery, valuation, custody, and distribution.

Numbers & guardrails

- Seed storage: keep a primary and a sealed backup stored separately.

- Hardware devices: inventory device model and firmware notes, but never write the PIN in clear text with the seed.

- Valuation snapshot: instruct your executor how to capture a price snapshot across exchanges and on-chain at the time required by local law.

- Custody hand-off: specify whether beneficiaries receive assets directly on-chain, via a trustee distribution, or through liquidation.

Mini case

You hold 0.8 BTC on a hardware wallet, 3 ETH in a mobile wallet, and some NFTs. Your letter states: “Executor to locate Trezor Model T in home safe; seed phrase split 12/24 and 12/24 in two envelopes at bank box. On settlement, transfer 0.4 BTC to each child’s self-custody address; liquidate ETH to cash for taxes; archive NFT art to a family vault address.” This prevents improvisation and reduces the risk of mistakes.

Finish by adding clear “do/do not” rules (e.g., do not type the seed phrase into any website) and naming a professional who can assist if your executor isn’t crypto-native.

6. Turn on platform legacy tools (Apple, Google, Facebook and others)

Several platforms now let you decide in-app what happens if your account becomes inactive or you pass away. These online tools often take legal precedence over conflicting directions in a will because you set them with the custodian directly. Enable them for any account that matters. For example: Apple Legacy Contact lets trusted people access data like photos and iCloud files; Google Inactive Account Manager can share selected data or alert contacts if your account stays inactive; Facebook Legacy Contact supports memorialization and limited management of your profile.

How to do it

- Apple: Add a Legacy Contact in Apple ID settings; store the Access Key with your documents.

- Google: Set inactivity period, choose contacts, and select data to share.

- Facebook: Designate a legacy contact and choose memorialize vs. delete.

Numbers & guardrails

- Define an inactivity window that balances false alarms with timely action.

- Choose at least one backup contact if the platform allows it.

- Document what each contact should do (download photos, post memorial notice, close account later).

This step removes ambiguity, speeds access to memories, and keeps loved ones from wrestling with support tickets at a hard time. Financial Planning Association

7. Write practical instructions without exposing secrets

Your letter of instruction or digital assets memo should explain what to do and where to find things—not spill passwords. Use it to point to your inventory, to the location of devices and backup drives, to the safe containing recovery codes, and to your wishes for each platform. Keep it with your estate papers and update it whenever something material changes. Many practitioners recommend notarizing or at least signing and dating it, while keeping sensitive credentials inside your password manager. trustandwill.com

Mini-checklist

- Write a one-page overview for your executor: “Start here.”

- List device passcodes only if you’re comfortable, and separate them from seeds/passwords.

- Point to the master passphrase location (sealed envelope, attorney escrow, or safe deposit box).

- State preferences for memorialization vs. deletion and for photo/drive downloads.

End this step by testing readability: hand the letter (with secrets redacted) to a trusted friend and ask if they could follow it. If not, simplify.

8. Update your legal documents to authorize access and disclosure

A will, trust, and power of attorney should expressly authorize fiduciaries to “access, manage, and receive disclosure of digital assets and electronic communications” and should reference your jurisdiction’s framework (such as the Revised Uniform Fiduciary Access to Digital Assets Act in most U.S. states). This language helps providers lawfully disclose content and reduces the chance your executor hits a wall with a terms-of-service agreement. Many laws also recognize the primacy of an online tool you set with the provider (Section 6) over contrary instructions in your documents. Work with counsel to tailor language to your region.

How to do it

- Ask your lawyer to add digital-asset authority to your will/trust/POA.

- Reference any online-tool directives you’ve set (Apple/Google/Facebook, etc.).

- Keep a printed list of platforms where you’ve made those selections.

Region notes

- U.S.: RUFADAA frames how custodians disclose content vs. catalog records and distinguishes types of fiduciaries (executor, agent, trustee, conservator).

- Elsewhere: Similar access often depends on contract terms and national privacy laws; you’ll still benefit from explicit consent language.

Legal alignment prevents conflicts and helps providers cooperate more quickly with properly appointed fiduciaries. Alaska Bar Association

9. Plan transfers, exports, and backups for photos and cloud libraries

For many families, photos and videos are the most precious digital assets. Decide which libraries should be exported, which shared albums should be preserved, and how originals will be backed up. Your plan should state who downloads what, how files are organized, and where long-term archives live. Consider cold storage for irreplaceable archives and shared “family vaults” for day-to-day access. Use provider export tools (e.g., Takeout for Google, downloaders in photo platforms) and avoid once-off, device-only copies that can be lost.

Mini-checklist

- Export full-resolution originals with metadata; keep a checksum or manifest file.

- Maintain a 3-2-1 backup strategy (3 copies, 2 media types, 1 off-site).

- Convert proprietary formats to open ones where possible.

- Add a readme file describing folder structure and people/tags.

Common mistakes

- Relying on a spouse’s device to hold the only master library.

- Forgetting to hand off ownership of shared cloud folders.

- Skipping video exports because they’re large; plan for storage.

Finish this step when a non-tech family member can locate the archive and open it without your help.

10. Handle intellectual property, domains, and monetized accounts

Creative works, newsletters, domain names, websites, and monetized accounts (ads, affiliate payouts, creator platforms) can have real value and recurring cash flow. Domains in particular require attention: registrars have processes for granting access to an account after death, and the ICANN transfer policy imposes specific authorization and lock periods that can affect timing. Your instructions should name who receives rights, who manages takedowns or license grants, and whether any sites remain live temporarily.

How to do it

- Identify registrars/hosts and list domain expirations; enable auto-renew.

- Put DNS, hosting, and web admin logins in a shared vault for your executor.

- State whether to transfer domains to a beneficiary or a business entity.

- Document how to wind down monetization or transfer account ownership where allowed.

Numbers & guardrails

- Expect possible lock periods when contact data changes or transfers occur, affecting how fast you can move domains.

- Keep sites live for a short window to post notices and export data; then transfer or park to reduce risk.

Synthesize this step by pairing ownership instructions (in your will/trust) with the practical “how to” your executor needs to avoid downtime or loss of rights. ICANN

11. Budget time, fees, and taxes for digital administration

Closing or transferring digital assets isn’t just “click and done.” There are support tickets, identity checks, notarizations, and, at times, tax filings. In the U.S., tax authorities treat crypto as property; in the U.K., crypto is considered property for inheritance purposes. Include a small fund to cover fees (storage, domain renewals, notarization, certified mail) and specify whether the estate pays for cloud storage during transition. If your estate includes monetized channels or gaming assets, list who values and liquidates them.

Numbers & guardrails

- Executor time: expect tens of hours to gather, export, and close accounts in a typical digital-heavy estate.

- Short-term budget: set aside cash for 6–12 months of domain renewals and storage.

- Crypto: instruct how to document cost basis and valuation at required dates in your jurisdiction; name the tax pro who will help.

Mini-checklist

- List fee-bearing renewals (domains, premium email, cloud tiers).

- Appoint who handles valuations and sales.

- Store prior year account statements and 1099-/equivalents in one folder.

End this step by making sure your executor has authority to spend these funds and knows which accounts to draw from first.

12. Run a “digital fire drill,” then review on a schedule

A great plan proves itself in testing. Do a brief fire drill with your digital executor: can they find your instructions, access shared vaults, and see where recovery codes live? Can they use a platform’s legacy tool to request data? Are any responsibilities ambiguous between fiduciaries? A rehearsal exposes broken links and out-of-date notes before your family has to discover them the hard way. Update your documents, inventory, and legacy tool settings whenever you add a new major account or device.

Mini-checklist

- Have your executor walk through at least three critical tasks end-to-end.

- Verify that emergency access invitations are active and accepted.

- Confirm contact details for your lawyer, accountant, and any platform-specific help pages.

- Re-export your photo/library manifest and verify backups.

You’ll finish with confidence that your plan works in practice, not just on paper. That peace of mind is the real outcome you’re aiming for.

FAQs

What counts as a “digital asset” for estate planning?

Anything of value or significance that lives behind a login or on a device: email, cloud folders, photos, social accounts, financial logins, subscriptions, domains, crypto wallets/NFTs, loyalty points, and more. Laws and platform policies treat some items differently (e.g., disclosure of message content vs. account metadata), so your instructions should be specific and your legal docs should authorize access to digital assets and electronic communications.

If I enable a platform’s legacy feature, do I still need to mention it in my will?

Yes. Online tools (e.g., Apple Legacy Contact, Google Inactive Account Manager, Facebook Legacy Contact) can override contrary will language, but aligning your documents prevents confusion and speeds cooperation from providers. Include both: enable the tool and reference it in your will/trust or instructions letter.

Should I give my executor my master password?

Generally, no. Share access through a password manager’s sharing or emergency-access features so you can limit scope and maintain logs. Keep the master passphrase location documented and sealed; never email passwords or store them in a plain file. Security standards prefer long passphrases and emphasize breach checks over forced rotations.

How do I handle two-factor authentication (2FA) in my plan?

Record which 2FA method each important account uses and where recovery codes live. Prefer authenticator apps or hardware keys over SMS. Put recovery codes and backup keys in your password manager as secure notes and point to their location in your instructions letter. Then test a recovery flow with your executor.

Can my executor access my emails and messages?

Often yes, but disclosure of message content vs. account records can differ by law and provider policy. Clear legal authorization, plus any online tools you set with the provider, makes cooperation more likely. Expect the provider to require proof of authority and identity before releasing content.

What happens to my photos if my family can’t unlock my phone?

Without platform-approved access, encrypted devices can be inaccessible. Enabling Apple’s Legacy Contact and maintaining cloud exports/backups ensures loved ones can retrieve photos even if the device stays locked.

How do taxes work for inherited cryptocurrency?

Crypto is generally treated as property for tax purposes. That means it’s part of the estate and may be subject to estate/inheritance rules, and later sales can trigger capital gains. Your plan should explain how to capture valuations and who files returns. Consult a tax professional in your jurisdiction for specifics.

Do domain names and websites need special treatment?

Yes. Registrars have processes for granting access after death, and domain transfers follow ICANN rules that can include lock periods. Plan for renewals during the transition, document registrar/host logins, and give your executor clear transfer instructions.

Is a “digital executor” legally recognized?

The title may not be defined in every jurisdiction, but you can name someone in your will and empower them via digital-asset clauses. Combine that with practical instructions so they know what to do on each platform. Rocket Lawyer

Where should I store my seed phrase for crypto?

Never in plain text or a photo in your camera roll. Use sealed, offline storage (e.g., two envelopes in separate secure locations), avoid typing seeds into unknown devices, and document exactly how the executor should perform transfers. Consider professional custody for complex estates.

Conclusion

Bringing your digital world into your estate plan is less about tech and more about clarity. You identify what exists, decide outcomes, authorize the right people, and give them the tools to do the job. The 12 steps here walk you from a blank page to a robust, testable plan: inventory, assign roles, secure credentials, lock in platform directives, and capture the tricky bits like crypto, domains, and monetized accounts. The payoff is enormous—fewer roadblocks for loved ones, preserved memories, and less risk of permanent loss. If you do nothing else today, enable legacy tools on your major platforms and start your inventory; your future executor will thank you. Ready to protect your digital legacy? Start your inventory and enable legacy settings now.

References

- Fiduciary Access to Digital Assets Act, Revised (RUFADAA) — Uniform Law Commission. (n.d.). uniformlaws.org

- Estate Planning for Digital Assets: Understanding the RUFADAA — The Tax Adviser (AICPA). (2019). https://www.thetaxadviser.com/issues/2019/aug/estate-planning-digital-assets.html The Tax Adviser

- About Inactive Account Manager — Google Help. (n.d.). https://support.google.com/accounts/answer/3036546 Google Help

- How to add a Legacy Contact for your Apple Account — Apple Support. (2024). Apple Support

- Legacy Contacts | Facebook Help Center — Meta. (n.d.). Facebook

- Frequently asked questions on virtual currency transactions — Internal Revenue Service. (n.d.). IRS

- CRYPTO25000 — Cryptoassets for individuals: Inheritance Tax — HMRC Manuals, GOV.UK. (2021). GOV.UK

- NIST SP 800-63B: Digital Identity Guidelines — Authentication & Lifecycle Management — National Institute of Standards and Technology. (current publication). NIST Publications

- How to gain access to domains or accounts after account holder’s death — GoDaddy Help. (n.d.). GoDaddy

- FAQs for Registrants: Transferring Your Domain Name — ICANN. (n.d.). ICANN

- Password managers guidance — National Cyber Security Centre (UK). (n.d.). NCSC

- How to Protect Digital Assets in Your Estate Plan — American Bar Association (Real Property, Trust & Estate Section). (2025). americanbar.org