If you’re drawn to the momentum and motivation of the debt snowball method, you’re not alone. Lining up your debts from smallest balance to largest and knocking them out one by one can build quick wins that keep you engaged. But the same simplicity that makes the debt snowball powerful can also create blind spots. This guide breaks down the five most common mistakes people make when using the debt snowball method—and exactly how to avoid them—so you can stay motivated and make steady, measurable progress toward becoming debt-free.

Educational disclaimer: The information below is for general educational purposes and is not individualized financial, legal, or tax advice. Your situation may call for a different approach; consider consulting a qualified financial professional for personalized guidance.

Key takeaways

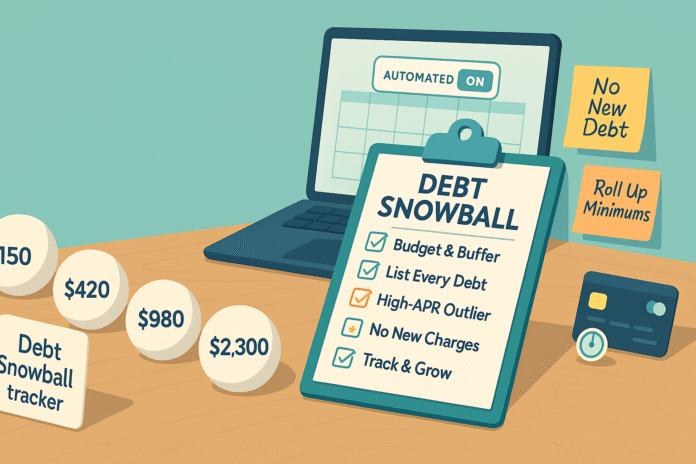

- Momentum matters—but structure matters more. Pair the snowball with a written budget, a small emergency buffer, and clear rules for spending.

- List every debt, accurately. Hidden debts, deferred interest offers, and past-due accounts can derail your plan if you ignore them.

- Don’t treat the snowball as dogma. Consider hybrid tweaks if a single high-APR balance is draining cash.

- Protect your credit—and your cash flow. Automate minimums, avoid new debt, and stay on time; payment history matters.

- Track, review, and grow your snowball. Increase your extra payment as balances fall, capture windfalls, and measure progress weekly.

Mistake #1: Starting Without a Budget or Emergency Buffer

What it is and why it matters

The debt snowball is an execution plan for debt payoff, not a complete money system. If you jump in without a basic budget and even a small emergency buffer, the first unexpected expense (a busted tire, a medical copay, a school fee) will typically land on a card—and your snowball melts. A simple cash cushion plus a written plan for monthly money flow keeps you from backsliding.

Core benefits of fixing this

- Prevents “two steps forward, one step back” relapses.

- Reduces reliance on credit for small emergencies.

- Helps you identify a realistic, sustainable extra-payment amount for your snowball.

Requirements and low-cost alternatives

- Requirements: Somewhere to track income/expenses (spreadsheet or free app), a checking account for bills, a separate high-yield savings account for your emergency buffer.

- Low-cost alternatives: Use a printable worksheet and your current bank account if you can’t open a separate savings yet; automate transfers later.

Step-by-step (beginner friendly)

- Map your month. List net income, fixed bills, minimum debt payments, and variable categories (food, gas, household).

- Pick a simple rule. Start with a proportional rule of thumb (for example, a balanced needs-wants-savings structure) and adapt it to your reality.

- Fund a starter buffer. Aim for a modest, reachable target (even a small amount offers protection). Automate a weekly transfer.

- Set your snowball amount. After minimums and essentials, the remainder is your extra payment for the smallest balance.

- Lock it in. Schedule auto-pay for all minimums and the snowball transfer on payday.

Beginner modifications and progressions

- If cash is tight: Start with micro-transfers (e.g., small weekly amounts) into your buffer while still paying minimums and making a token extra snowball payment (even a few dollars).

- As your buffer grows: Increase the snowball extra each month (e.g., increase by a small fixed amount every payday) until your buffer reaches your target.

Recommended frequency, duration, and metrics

- Frequency: Review budget weekly for 10 minutes. Automate transfers each payday.

- Duration: Maintain the starter buffer throughout your payoff period; expand it later.

- Metrics: Track buffer balance, on-time payment streak, and monthly extra payment amount.

Safety, caveats, and common mistakes to avoid

- Avoid raiding your buffer for non-emergencies.

- Keep the buffer liquid—no lockups or penalties for withdrawing.

- Don’t overfund the buffer at the expense of missing minimum payments.

Mini-plan example (2–3 steps)

- Open a separate savings account labeled “Emergency Buffer.”

- Auto-transfer a small weekly amount every Friday; auto-pay all minimums the day after payday.

- Use the remainder as your snowball extra toward the smallest balance.

Mistake #2: Not Listing Every Debt (or Mis-Ordering Them)

What it is and why it matters

The snowball depends on the order of your list. If you forget a store card with deferred interest, a buy-now-pay-later installment, a small medical collection, a past-due utility, or a consolidation loan, your payoff plan is incomplete. Mis-ordering balances can trigger avoidable fees or interest surprises—especially when a promotional clock is ticking.

Core benefits of fixing this

- Prevents “surprise” balances from wrecking your timeline.

- Avoids missed-payment fees and penalty rates.

- Makes your progress numbers accurate.

Requirements and low-cost alternatives

- Requirements: Copies of all statements (paper or online), your credit reports, and a simple debt inventory sheet with fields for balance, minimum, APR, due date, and any promo end date.

- Low-cost alternatives: Use a free credit report portal to gather accounts; keep a notebook if you prefer analog.

Step-by-step (beginner friendly)

- Pull a full list. Use statements and recent credit reports to list all open and collection accounts.

- Add details. For each account, jot down balance, minimum, APR, due date, and whether there’s a promotional or deferred-interest period with an end date.

- Identify priority risks. Mark debts with serious consequences for nonpayment (e.g., secured loans, utilities at risk of shutoff, taxes).

- Build your snowball order. Typically order from smallest balance to largest while ensuring high-consequence debts are safely current.

- Set reminders. Put due dates and promo expirations on your calendar with alerts two weeks and three days before.

Beginner modifications and progressions

- If you’re overwhelmed: Start with three accounts: the smallest balance you’ll attack, the largest APR you’ll monitor, and any past-due bill you’ll bring current. Add the rest over the next week.

- As you gain control: Upgrade your inventory into a tracker that calculates days to payoff, cumulative interest, and total debt reduced year-to-date.

Recommended frequency, duration, and metrics

- Frequency: Update your inventory monthly; verify balances and due dates.

- Duration: Continue until all unsecured debts are paid off.

- Metrics: Debts listed versus total on credit report, number of accounts current, count of promo periods and days remaining.

Safety, caveats, and common mistakes to avoid

- Deferred-interest traps: Some “no interest if paid in full by X date” plans can charge retroactive interest if you miss the payoff date—even by a dollar.

- Intro APR clock: Promotional balance-transfer rates typically have time limits, and a single late payment can end the promo early.

- Minimum payment disclosure box: Your statement includes a box showing how long payoff takes with only minimums and what to pay to finish in three years—use it to sense-check your plan.

Mini-plan example (2–3 steps)

- Create a one-page debt roster and highlight any promo end dates.

- Bring any past-due bill current this month, even if it slows your snowball—fees and penalties cost more.

- Re-sequence your snowball if a small balance hides a big promotional risk.

Mistake #3: Treating the Snowball as Dogma and Ignoring Interest Drain

What it is and why it matters

The snowball prioritizes behavior change by focusing on the smallest balances first. But if you have one monster balance with a very high interest rate, paying it late in the sequence can cost you significantly. The solution isn’t to abandon the snowball—it’s to apply a hybrid approach when needed.

Core benefits of fixing this

- Keeps motivation from early wins while reducing expensive interest drag.

- Shortens total time in debt when a single high-APR account dominates.

- Uses your cash more efficiently without sacrificing simplicity.

Requirements and low-cost alternatives

- Requirements: Your debt inventory (from Mistake #2), a simple calculator, and willingness to tweak your order.

- Low-cost alternatives: Use a free online payoff calculator to compare “pure snowball” vs. “hybrid” sequences.

Step-by-step (beginner friendly)

- Identify outliers. Flag any account whose APR is dramatically higher than the rest or whose interest charges each month exceed your extra snowball payment.

- Run a quick comparison. Estimate total interest if you keep the outlier at the end versus moving it earlier—without reshuffling every other account.

- Choose a hybrid rule. For example: “Snowball all balances under $1,000 first, then switch to the highest APR until it’s gone, then resume snowballing.”

- Re-confirm minimums and automation. Keep every other account current while you adjust.

- Write your rule on paper. When decisions feel messy mid-month, your pre-committed rule reduces second-guessing.

Beginner modifications and progressions

- Micro-hybrid: Keep your snowball order but split your extra (e.g., 80% to smallest balance, 20% to the highest APR) until the interest outlier is less painful.

- Temporary switch: After your first two small wins, switch to the highest APR until it’s halfway paid, then return to snowballing.

Recommended frequency, duration, and metrics

- Frequency: Re-evaluate your sequence quarterly or whenever a promo ends.

- Duration: Only maintain the hybrid while the interest outlier is meaningfully costly.

- Metrics: Monthly interest paid, principal reduction rate, and time to next paid-off milestone.

Safety, caveats, and common mistakes to avoid

- Running too many scenarios can paralyze you. Choose a simple tweak and stick to it for 90 days.

- Don’t skip minimums on lower-priority debts—or you’ll rack up fees and potentially lose promotional terms.

- Consider balance-transfer math carefully: transfer fees and the risk of losing a promo for a late payment can erase savings if mishandled.

Mini-plan example (2–3 steps)

- Snowball your first two smallest balances for quick wins.

- For the next 90 days, direct all extra cash to the highest-APR account while paying minimums on the rest.

- Resume standard snowball ordering once the high-APR balance is below a set threshold.

Mistake #4: Continuing to Use Credit (or Missing Payments) During the Snowball

What it is and why it matters

New charges raise balances, expand interest costs, and extend your payoff timeline. Missing or late payments trigger fees, can end promotional rates, and can harm your credit; your payment history is the single most influential component of widely used credit-scoring models. The fix is simple, boring, and incredibly effective: don’t add new debt, and never miss a minimum.

Core benefits of fixing this

- Preserves promotional terms.

- Eliminates fees and penalty APRs.

- Protects your credit profile while you pay down balances.

Requirements and low-cost alternatives

- Requirements: Auto-pay for minimums, due-date calendar alerts, and a spending rule for categories that trigger swipes (groceries, gas, online shopping).

- Low-cost alternatives: If you can’t automate, set two alarms per bill (one a week early, one two days early) and pre-fund those amounts in a separate checking sub-account.

Step-by-step (beginner friendly)

- Freeze the plastic. Remove cards from digital wallets; physically store cards out of reach if that helps.

- Automate minimums. Schedule payments at least three business days before the due date.

- Set a “no new debt” rule. If it’s not budgeted cash, it waits.

- Create a cash alternative. Use a debit card or prepaid envelope for spending categories that caused most swipes.

- Review statements. Spot fees or rate changes quickly and respond before they snowball.

Beginner modifications and progressions

- If you must keep a card for travel or online orders: Use one low-limit card for planned, budgeted purchases and pay it in full weekly.

- As you stabilize: Consolidate recurring bills onto a single card you pay in full every payday (only if you’re consistently on track).

Recommended frequency, duration, and metrics

- Frequency: Weekly review; monthly audit of statements.

- Duration: Maintain “no new debt” until all targeted debts are gone.

- Metrics: On-time payment streak, number of new charges to debt accounts (target zero), fees avoided.

Safety, caveats, and common mistakes to avoid

- A single 60-day late payment can undo months of progress by ending promotional rates and adding back interest.

- If you’re struggling to stay current, contact creditors early; hardship options sometimes include reduced rates, waived fees, or temporary plans.

- Beware of companies that promise to reduce rates or erase debt for upfront fees.

Mini-plan example (2–3 steps)

- Set auto-pay for every minimum today.

- Move recurring online purchases to a checking-linked payment method for now.

- Post a sticky note on your laptop: “No New Debt During Snowball—Use Cash.”

Mistake #5: Failing to Track, Review, and Grow Your Snowball

What it is and why it matters

The snowball accelerates when you keep adding to it. As each debt disappears, you roll its minimum into the next, plus any savings you discover in your budget. If you never update your extra payment, your plan stalls. Likewise, if you don’t measure progress and celebrate milestones, motivation fades.

Core benefits of fixing this

- Shortens payoff timelines as minimums roll up.

- Keeps morale high by turning progress into visible, weekly wins.

- Ensures windfalls (tax refunds, bonuses, side-gig income) actually hit principal.

Requirements and low-cost alternatives

- Requirements: A payoff tracker (spreadsheet or app), calendar reminders, and a simple “windfall rule” (e.g., 80% to debt, 20% to fun).

- Low-cost alternatives: Use a whiteboard thermometer chart and transfer the rolled-up minimum manually after each payoff.

Step-by-step (beginner friendly)

- Create a simple dashboard. Track total debt, monthly interest paid, principal paid, and time to next payoff date.

- Schedule a monthly review. Increase your extra payment by the amount of any debt you’ve just killed.

- Adopt a windfall rule. Pre-decide what percent of any extra money goes to debt.

- Reward micro-milestones. For every $500 of principal reduced, mark it publicly (chart, fridge, or app) and celebrate with a tiny budgeted treat.

Beginner modifications and progressions

- If you need more motivation: Break goals into 30-day challenges (“$200 extra to principal this month”).

- As you advance: Add charts for cumulative interest avoided and average monthly debt-free date movement.

Recommended frequency, duration, and metrics

- Frequency: Weekly check-ins; monthly strategy tune-up.

- Duration: Until all targeted debts are gone.

- Metrics: Principal paid YTD, average monthly extra payment, debt-free date trend.

Safety, caveats, and common mistakes to avoid

- Don’t cut essentials or skip insurance to throw more at debt; one emergency can reverse progress.

- If progress stalls for 60 days, revisit your budget and consider temporary income boosters or expense triage.

Mini-plan example (2–3 steps)

- Add a calendar event on the last day of each month: “Roll Up Minimums.”

- Apply 80% of any windfall to your current snowball target within 48 hours.

- Update your tracker and share your win with a friend for accountability.

Quick-Start Checklist

- List every debt with balance, APR, minimum, due date, and promo end date.

- Build a small emergency buffer; keep it liquid and separate.

- Create and automate a budget: minimums + essentials + snowball extra.

- Freeze new credit use; automate minimums before due dates.

- Pick your rule: pure snowball or a simple hybrid for any high-APR outlier.

- Track progress weekly; roll up paid-off minimums immediately.

- Calendar promo expirations and statement due dates with alerts.

- Pre-commit a windfall rule (e.g., 80/20).

Troubleshooting & Common Pitfalls

- “I keep having small setbacks.” Your buffer may be too small; redirect a slice of your snowball to shore it up for 30–60 days, then resume.

- “A promo rate ended early.” Check if a late or missed payment triggered the change. Get current, call the issuer, and ask for reinstatement; then set double reminders.

- “I can’t stop using the card I’m paying off.” Remove it from digital wallets, delete it from online stores, and carry a debit card with a strict weekly limit instead.

- “My minimums are overwhelming.” Prioritize staying current. Ask creditors about hardship or rate-reduction options; explore nonprofit credit counseling for a structured plan.

- “I’m losing motivation.” Shorten the feedback loop. Chase a 14-day win: sell two items, cut one subscription, and send the proceeds to your target debt.

How to Measure Progress and Results

- Debt-free date movement: Track how your projected payoff date shifts each month as you roll up minimums.

- Principal paid vs. interest paid: Aim for a growing principal-to-interest ratio month over month.

- On-time streak: Record consecutive months with 100% on-time payments.

- Snowball growth rate: Calculate the increase in your extra payment each quarter.

- Buffer health: Keep your emergency savings above your chosen floor at month-end.

A Simple 4-Week Starter Plan

Week 1: Inventory & Buffer Setup

- Pull statements and credit reports; list every debt with key details.

- Open a separate emergency savings account and automate a small weekly transfer.

- Choose your rule: pure snowball or hybrid if you have a single high-APR outlier.

Week 2: Budget & Automation

- Draft a simple monthly plan covering minimums, essentials, and your snowball extra.

- Automate minimums and your extra payment; set calendar alerts for due dates and promo end dates.

- Remove cards from digital wallets; set a “no new debt” rule.

Week 3: First Wins & Tracking

- Make your first snowball payment and mark the milestone on a tracker.

- Review statements for fees or changes; call issuers about hardship options if needed.

- Sell or cancel something and immediately send the proceeds to your smallest balance.

Week 4: Review & Grow

- Revisit your numbers: principal vs. interest, buffer balance, next payoff date.

- Pre-commit a windfall rule and schedule a monthly “Roll Up Minimums” session.

- Celebrate progress with a small, budgeted reward—then start Month 2.

FAQs

1) What if my smallest balance also has the lowest interest rate—is the snowball still worth it?

Yes, if motivation is your main challenge. Early wins build momentum. If a single high-APR balance is costing you a lot, consider a hybrid: secure a few quick wins, then attack the expensive balance.

2) Should I pause retirement contributions while using the snowball?

It depends. Staying current on debts and maintaining essential protections (like insurance) matters first. For short, intense payoff periods, some pause extra investing above employer matches; others continue minimum contributions for long-term goals. Consider personal advice for your situation.

3) Is a balance transfer card compatible with the snowball?

It can be, but do the math. Transfer fees and promo limits matter, and late payments can void promos. If you use one, include the fee in your balance and keep auto-pay on to protect terms.

4) How big should my emergency buffer be while I’m paying off debt?

Start with a small, reachable amount that prevents routine setbacks from going on a card. As your situation stabilizes, grow it toward a larger cushion that fits your needs.

5) What if I can’t stop using my card for essentials like gas?

Budget those purchases and pay that card in full weekly, or switch temporarily to a debit card with a weekly cap to avoid rolling balances.

6) I missed a payment. Should I reset my snowball?

No, but act fast. Bring the account current, call the issuer, and ask about waiving fees or restoring prior terms. Then tighten your reminders and automation.

7) How do I stay motivated over months (or years) of payoff?

Shorten the distance between effort and reward. Track wins weekly, set small 30-day challenges, and celebrate milestones with pre-budgeted treats.

8) Which debts should I exclude from the snowball?

Many people exclude mortgages or low-rate student loans from their initial snowball and focus on higher-rate unsecured debts. Always keep all accounts current; include any account that’s adding meaningful stress or interest.

9) Can nonprofit credit counseling work alongside a snowball plan?

Yes. Counseling can help with budgeting, creditor negotiations, and structured repayment. It’s a complementary support if you’re struggling to stay current or organize payments.

10) How do I know whether to switch from snowball to avalanche?

If monthly interest on one account routinely exceeds your extra payment, a temporary switch (or hybrid) to target that balance is often sensible. Reassess quarterly or when promo terms change.

Conclusion

The debt snowball works because it turns a complex, emotional challenge into a straightforward sequence of wins. Avoid these five mistakes—skipping the basics, hiding debts, ignoring interest outliers, adding new charges or missing payments, and failing to grow your snowball—and you’ll transform a good idea into a reliable, repeatable system.

One-line CTA: Start today: list every debt, automate your minimums, and send your first extra payment to the smallest balance before the day ends.

References

- Debt Snowball Method: How It Works to Pay Off Debt, Investopedia, updated July 2, 2024 — https://www.investopedia.com/terms/s/snowball.asp

- Debt Avalanche: Meaning, Pros and Cons, and Example, Investopedia, updated May 21, 2024 — https://www.investopedia.com/terms/d/debt-avalanche.asp

- Debt Avalanche vs. Debt Snowball: What’s the Difference?, Investopedia, accessed Aug 14, 2025 — https://www.investopedia.com/articles/personal-finance/080716/debt-avalanche-vs-debt-snowball-which-best-you.asp

- How to Reduce Your Debt, Consumer Financial Protection Bureau, July 16, 2019 — https://www.consumerfinance.gov/about-us/blog/how-reduce-your-debt/

- Reducing Debt Worksheet (Your Money, Your Goals Toolkit), Consumer Financial Protection Bureau, 2017 — https://files.consumerfinance.gov/f/documents/cfpb_ymyg-toolkit_reducing-debt-worksheet.pdf

- Lowering Your Debt (Strategies & Prioritization), Consumer Financial Protection Bureau, 2021 — https://files.consumerfinance.gov/f/documents/cfpb_lowering-your-debt_tool_2021-08.pdf

- An Essential Guide to Building an Emergency Fund, Consumer Financial Protection Bureau, Dec 12, 2024 — https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

- Saving for Financial Shocks and Emergencies (FinEd Digest), Consumer Financial Protection Bureau, 2015 — https://files.consumerfinance.gov/f/cfpb_fin-ed-digest_saving-for-emergencies.pdf

- Save for a Rainy Day, Investor.gov (U.S. Securities and Exchange Commission), accessed Aug 14, 2025 — https://www.investor.gov/introduction-investing/investing-basics/save-and-invest/save-rainy-day

- Ten Things to Consider Before You Make Investing Decisions, U.S. Securities and Exchange Commission, accessed Aug 14, 2025 — https://www.sec.gov/investor/pubs/tenthingstoconsider.htm

- Start an Emergency Fund, FINRA Foundation, accessed Aug 14, 2025 — https://www.finra.org/investors/personal-finance/start-emergency-fund

- Analyzing Budgets (50-30-20 activity), Consumer Financial Protection Bureau, April 4, 2023 — https://www.consumerfinance.gov/consumer-tools/educator-tools/youth-financial-education/teach/activities/analyzing-budgets/

- Learning About Budgets (Guide with 50-30-20 Rule), Consumer Financial Protection Bureau, 2022 — https://files.consumerfinance.gov/f/documents/cfpb_building_block_activities_learning-about-budgets_guide.pdf

- Credit Card Statement Minimum Payment Warnings: Appendix M1 to Part 1026, Consumer Financial Protection Bureau (Regulation Z), accessed Aug 14, 2025 — https://www.consumerfinance.gov/rules-policy/regulations/1026/M1

- G-18(C) Minimum Payment Warning Forms (Regulation Z Appendix G), Consumer Financial Protection Bureau, accessed Aug 14, 2025 — https://www.consumerfinance.gov/rules-policy/regulations/1026/G

- What Is a Balance Transfer Fee? (Ask CFPB), Consumer Financial Protection Bureau, Sept 25, 2024 — https://www.consumerfinance.gov/ask-cfpb/what-is-a-balance-transfer-fee-can-a-balance-transfer-fee-be-charged-on-a-zero-percent-interest-rate-offer-en-53/

- How Long Can I Keep a Low Introductory Rate? (Ask CFPB), Consumer Financial Protection Bureau, Sept 25, 2024 — https://www.consumerfinance.gov/ask-cfpb/how-long-can-i-keep-a-low-rate-on-a-balance-transfer-or-other-introductory-rate-en-15/