If high-interest credit card balances are eating your paycheck, the debt avalanche gives you a clear, math-first path out. This guide is for anyone ready to stop bleeding interest, track balances precisely, and pay in a smart order. We’ll show you how to list every APR, line up cards by cost, automate minimums, and channel all extra money to the most expensive balance first. You’ll also learn how statement timing, utilization, and payment allocation rules affect your plan. Quick note: This is educational information, not individualized financial advice.

Fast definition: The debt avalanche for credit cards means you pay minimums on all cards, then put every extra dollar toward the highest APR balance; once it’s paid, you “avalanche” those dollars to the next-highest APR, and so on until you’re debt-free. This method minimizes total interest paid over time.

Skimmable steps: List cards + APRs → order by APR → set a fixed extra payment → automate minimums → target the highest APR with all extra → repeat monthly → monitor utilization and dates → adjust for promos/balance transfers → stay motivated with visible progress.

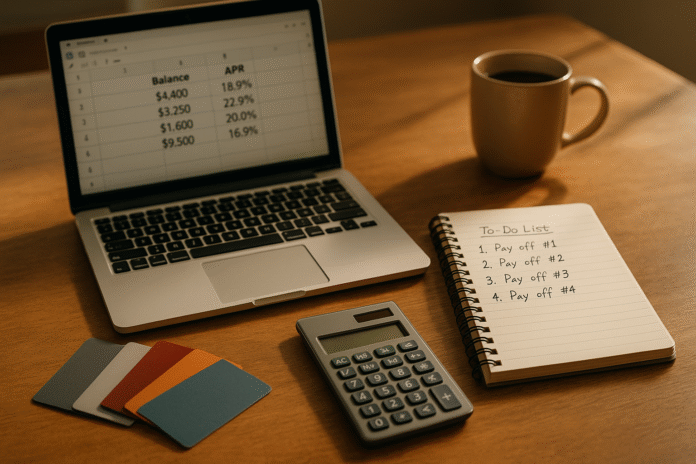

1. Inventory Every Card, APR, and Balance (Get the Numbers Right First)

Start by collecting every credit card’s current balance, APR(s) by category (purchases, cash advances, balance transfers), credit limit, minimum payment, statement closing date, and due date. Accurate inputs drive a reliable avalanche plan. Pull the latest statements or log in to each account; issuers often use the average daily balance method and daily periodic rate to compute interest, so your balances can shift daily. Record promo terms (0% intro APRs, deferred-interest offers) and the month they end; those details matter for both costs and how your payments are applied. While it’s tempting to rush into paying, resist—misreporting even one APR can distort your payoff order and cost you real money. As of September 2025, typical credit card APRs remain elevated, so precision here pays off later.

1.1 What to capture (minimum data set)

- Issuer, last 4 digits

- Current balance and credit limit

- APRs for each balance type (purchases, cash advances, transfers)

- Minimum payment and due date

- Statement closing date (when most issuers report to bureaus)

- Any promo or deferred-interest terms and their end dates

1.2 Mini-checklist to avoid blind spots

- Check if cash advance APR is higher than purchases (it often is).

- Verify if a balance transfer fee was added to the balance.

- Confirm whether new purchases are accruing immediate interest because you carried a balance.

- Note if your issuer has multiple APR buckets on the same card.

Numeric example: Card A $2,900 @ 27.99% purchases; Card B $3,400 @ 21.49% purchases + $600 transfer @ 4.99%; Card C $1,250 @ 17.99%. With these inputs assembled, your avalanche priority becomes obvious—and measurable.

Synthesis: A clean, complete inventory is the single best predictor that your avalanche plan will reflect reality and save the most interest.

2. Sort by APR and Lock Your Target Order (How the Avalanche Actually Works)

The avalanche answer is simple: Pay minimums on all cards; send every extra dollar to the card with the highest APR. When that balance hits zero, roll the freed-up payment to the next-highest APR. This ordering reduces total interest because dollars stop the most expensive daily accrual first. Payment allocation rules also help: in the U.S., issuers must direct any amount above the minimum to the highest APR balance first (with some nuances), aligning the avalanche with how payments are applied internally. Establish your card order now and stick to it unless promo terms or APRs change.

2.1 How to do it

- List cards by effective APR (start with the highest purchase APR; include cash-advance APRs if present).

- If two APRs tie, target the smaller balance first for a quick win.

- Keep $0 new purchases on avalanche-targeted cards to prevent interest creep.

- Re-check APRs quarterly; variable APRs can move with prime rate changes.

2.2 Numbers & guardrails

- Daily periodic rate ≈ APR/365. A 24% APR → ~0.0658% per day.

- Paying $300 extra to a 27.99% card saves more interest than the same $300 elsewhere, especially early in the plan.

- If a deferred-interest promo exists, consider prioritizing it so you don’t trigger retroactive charges at promo end.

Synthesis: Sorting by APR then locking your order is the core of the avalanche—small admin work that produces outsized savings over time.

3. Build a Monthly Payoff Budget and Timeline (Dates, Dollars, and Deadlines)

A plan without dates is a wish. First, decide on a fixed “extra” payment you can sustain each month beyond all minimums. Then map your statement closing dates and due dates so you can schedule payments that both avoid late fees and reduce average daily balance quickly. Use a payoff calculator to estimate your debt-free date and total interest across scenarios (flat extra payment vs. ramping up as balances drop). As of May–September 2025, with average card APRs hovering around the 21% ballpark and prime recently eased, even modest extra payments can shave months off your schedule—if you stay consistent.

3.1 Tools/Examples

- Calculators: Capital One payoff calculator, Bankrate’s payoff tool, and Undebt.it’s avalanche calculator can model month-by-month timelines.

- Example: $7,550 across three cards at 27.99%, 21.49%, and 17.99%; minimums total $185. With an extra $400/month aimed at the 27.99% card, timeline falls by many months vs. paying only minimums (exact results depend on dates and compounding).

3.2 Mini-checklist

- Fix an extra payment you can sustain through variable months.

- Schedule around statement close to manage reported utilization.

- Re-run your calculator after every major change (rate moves, promo endings).

- Keep a one-month buffer in checking to avoid missing due dates.

Synthesis: Dollars + dates + a fixed monthly surplus convert the avalanche from a theory into a predictable finish line.

4. Create a Tracking System You’ll Actually Use (Sheet, App, or Both)

You need a single source of truth for balances, APRs, dates, and progress. Whether you prefer a spreadsheet or an app, build lightweight tracking that survives busy weeks. Capture beginning-of-month balances, payments made (with timestamps), interest charged, and new charges (ideally zero). Include a running total of interest avoided vs. a minimum-only scenario to keep motivation high. A good tracker helps you spot drifts—like a creeping utilization or a promo ending next cycle—before they cost you. Don’t overcomplicate it; aim for a dashboard you can update in five minutes. Undebt.it

4.1 Suggested columns (spreadsheet)

- Card nickname | APR(s) | Balance start-of-month | Statement close date | Due date

- Payment date + amount | Interest charged | Notes (promo end, fee posted)

- Utilization (per card and total) | Target order rank

4.2 Apps/Tools to consider

- Undebt.it (free avalanche/snowball plan & timeline)

- Budgeting apps (e.g., YNAB or simple envelope systems) to ringfence your extra payment

- Bank/issuer alerts for statement close and due dates

Mini-case: Tracking reveals Card B’s statement closes on the 20th. By pushing an extra payment on the 15th, your average daily balance drops for several days before close, lowering interest and often reducing the balance reported to bureaus.

Synthesis: A five-minute tracker keeps the avalanche aligned with real-world dates, balances, and behavior.

5. Automate Minimums and Attack Interest Mid-Cycle (Timing Beats Guesswork)

Automation protects your plan from human error. Set autopay for the minimum on every card to avoid late fees and score damage. Then schedule your extra avalanche payment separately—ideally mid-cycle (about 10–15 days before statement close) on the highest-APR card. Because many issuers use average daily balance with interest accruing daily, paying earlier in the cycle lowers the balance for more days, which can reduce monthly interest and the figure reported after the statement closes. You’re not just paying; you’re strategically altering the math in your favor.

5.1 Steps to implement

- Autopay minimum due on all cards (due-date timing).

- Create a recurring mid-cycle payment on the target card.

- Turn on alerts: statement close, due date, and large transactions.

- Avoid new purchases on avalanche-targeted cards during payoff.

5.2 Numbers & guardrails

- Daily periodic rate example: 24% APR ÷ 365 ≈ 0.0658% per day; lowering the balance 10 days earlier cuts ~0.658% worth of daily accrual on that slice of principal.

- If cash advances exist, remember they accrue at a higher APR and often without a grace period—another reason to prioritize them. U.S. Bank

Synthesis: Autopay shields your credit; mid-cycle extra payments chip away at interest more efficiently than end-of-month lump sums.

6. Treat Promos, Balance Transfers, and Deferred Interest with Caution

Promos can accelerate your avalanche—or blow it up if mishandled. Balance transfers may carry 3–5% fees and can eliminate the grace period on new purchases, meaning every new swipe may accrue interest immediately until you fully pay the transfer and purchases. Deferred-interest plans are particularly risky: fail to pay the promo balance in time (or miss a payment), and you could owe retroactive interest back to the purchase date. If you use promos, wall them off: no new purchases on that card, diarize the end date, and pay them off before the clock runs out.

6.1 How to integrate promos into the avalanche

- If a deferred-interest balance exists, elevate it in your order to avoid retroactive charges.

- For 0% transfers, factor the fee into your breakeven math; don’t transfer unless savings exceed the fee.

- Keep the promo card on ice—no purchases—to preserve (or regain) grace periods on other cards.

6.2 Region & rule notes (U.S.)

- Under Regulation Z §1026.53, issuers must allocate payments above the minimum to the highest APR balance, but special rules apply to deferred-interest programs—read your terms.

Synthesis: Promos can help, but only with airtight execution: isolate them, track end dates, and never mix in purchases that change how interest is assessed.

7. Lower APRs and Boost Cash Flow (Negotiation, Hardship Plans, and When to Consolidate)

The avalanche works faster if you reduce APR or free up cash. Call your card issuers to request a lower rate or temporary hardship program if you’re struggling—be ready to explain why, how much you can pay, and for how long. Many issuers can offer short-term concessions or payment plans; reputable credit counseling can help if you need structure. Consider balance transfers only if the math beats your current APRs after fees and you can avoid new purchases. Installment consolidation loans can simplify payments, but watch for origination fees and longer terms that can increase total interest.

7.1 Call script (adapt)

- “I’ve been a customer since __. My current APR is %. Based on my payment history and credit profile, can you lower my APR or place me on a temporary hardship plan? I can commit $ monthly and aim to resume normal payments by __.”

7.2 Numbers & timing

- Rate environments shift. In September 2025, large U.S. banks cut prime to 7.25% after the Fed’s move; some variable APRs may follow (with lags/margins). Revisit negotiations as conditions change.

Synthesis: A five-minute phone call or a reputable counselor can shave points off your APR or stabilize cash flow, shrinking both timelines and total interest.

8. Protect Your Credit Score While You Avalanche (Utilization, Reporting Dates, and Limits)

Staying credit-healthy makes the journey cheaper. On-time payments are non-negotiable. Next, manage credit utilization—the ratio of balances to limits—because it’s a significant factor in most scoring models. Aim to keep overall and per-card utilization as low as reasonably possible (often under ~30%, and lower is usually better). Since most issuers report around statement close, pushing a payment before the close can reduce the balance that gets reported, improving utilization optics. Avoid closing old cards during payoff (unless fees force it), and consider asking for credit limit increases if you can do so without a hard inquiry or extra spending temptation.

8.1 Practical moves

- Autopay minimums to avoid any late mark.

- Make a pre-close payment on high-utilization cards.

- Keep old no-fee cards open to preserve average age and limit.

- If a limit increase is available without a hard pull, consider it for utilization.

8.2 Guardrails

- Utilization influences a meaningful share of many FICO® Scores; generally, lower is better.

- Don’t sacrifice avalanche momentum to micro-optimize utilization; prioritize interest savings, then fine-tune timing.

Synthesis: Protecting payment history and utilization while you avalanche keeps borrowing costs down and opportunities open as you near the finish.

9. Stay Motivated and Relapse-Proof (Behavior, Milestones, and “Post-Avalanche” Planning)

Debt payoff is a behavior game as much as a math game. Build visible progress into your week: a chart in your tracker, a countdown to the next payoff date, and a monthly “interest saved” tally. Celebrate interim wins (first card closed, utilization under 30%, half the total interest avoided) with non-spend rewards. Build a starter emergency fund (even $500–$1,000) to keep surprises from derailing payments. Finally, plan your post-avalanche habits now—automate transfers to savings and avoid reopening the spending loop that created balances. This “next chapter” mindset turns debt freedom into durable financial health.

9.1 Mini-checklist

- Visual progress: monthly payoff chart and debt-free date on the fridge/phone.

- Sinking funds for predictable expenses (car, travel, holidays).

- Emergency fund auto-transfer on payday, even a small amount.

- “Freeze” cards you’re paying off—physically or via digital wallet removal.

9.2 Example milestone ladder

- Month 1: All autopays set; first mid-cycle extra completed.

- Month 2–3: First card paid off; roll the payment to the next target.

- Month 6: Total interest this quarter < last quarter; utilization trending down.

Synthesis: Motivation systems and safety nets prevent backsliding—ensuring the avalanche keeps rolling until the last card is gone.

FAQs

1) What’s better: debt avalanche or debt snowball?

Avalanche (highest APR first) generally saves the most interest because it targets the most expensive debt immediately. Snowball (smallest balance first) can provide faster psychological wins. If you stick with either method consistently, you’ll get results; avalanche usually minimizes total interest paid, while snowball can feel more motivating early on. Many payoff calculators let you compare timelines and costs side by side before you commit.

2) How do statement closing dates affect my plan?

Most issuers report after statement close, so a payment just before that date can reduce the balance that gets reported to bureaus and may lower utilization. It also lowers your average daily balance for more days in the cycle, which can reduce interest accrued. Learn your close dates, then aim your extra avalanche payment roughly 10–15 days prior for a reliable effect on both interest and reporting.

3) Do I really save money by paying mid-cycle instead of on the due date?

Often yes. When interest accrues daily using the average daily balance method, paying earlier reduces the balance for more days, cutting finance charges. The exact savings depend on your APR, balance, and timing, but the mechanism is straightforward: lower principal × more days = less interest. If you have a grace period and pay in full, interest may not accrue on purchases, but most people carrying balances don’t have that grace.

4) Will a balance transfer help my avalanche?

It can—if the fee and terms still beat your current APRs and you can avoid new charges. Balance transfers often come with 3–5% fees and can remove the grace period on new purchases, causing those to accrue interest immediately. If you transfer, isolate the card, diarize the promo end date, and pay it off before the rate resets. Investopedia

5) What’s the difference between 0% intro APR and deferred interest?

A 0% intro APR typically charges no interest during the promo, then applies a normal APR to any remaining balance at the end. Deferred interest can charge retroactive interest back to the purchase date if you don’t pay in full by the deadline or if you’re more than 60 days late. Deferred-interest plans require tight tracking to avoid costly surprises. Consumer Financial Protection Bureau

6) How important is credit utilization during payoff?

It matters. Utilization is a meaningful component of many credit scoring models, and lower is better in most cases. Managing balances so that reported utilization stays controlled—especially on individual cards—can protect your scores while you’re eliminating debt. Still, don’t let utilization micromanagement derail the core avalanche goal of minimizing interest. myFICO

7) Can I negotiate a lower APR?

Yes. Call your issuer and ask; provide context (why you’re requesting a reduction, how much you can pay, when you can resume normal terms). Some issuers offer temporary hardship or long-term rate reductions. If you need structure, nonprofit credit counseling can help you build a sustainable plan and may secure concessions.

8) Why does APR seem so high lately?

Card APRs are usually variable and often track the prime rate plus a margin. In September 2025, major U.S. banks cut prime to 7.25% after a Fed move, but changes flow through with lags and vary by issuer and your credit profile. That’s why checking your actual APRs regularly—and repricing them when possible—is essential.

9) Should I close paid-off cards?

Usually not, unless there’s an annual fee you no longer want to pay. Keeping no-fee cards open can help utilization (more available credit) and sometimes your average account age. If you do close a card, consider waiting until your utilization has improved elsewhere so you don’t spike ratios. Experian

10) How big should my extra avalanche payment be?

Pick a number you can sustain through good months and bad. Even $100–$300 extra monthly can make a noticeable difference at today’s APRs. Use a calculator to preview your timeline and total interest; then automate that extra so it actually happens each month.

11) Does the avalanche still work if I have multiple APRs on one card?

Yes. Payments above the minimum must go to the highest APR balance first in the U.S., such as cash advances or promotional tiers—though special deferred-interest rules apply. Your tracker should list APRs by balance type so you know which portion you’re truly attacking.

12) What if I can’t even make the minimums?

Act quickly. Call issuers to request a hardship plan, and consider reaching out to reputable nonprofit credit counseling for help. Avoid companies that demand upfront fees for debt relief. Stabilizing payments prevents collections and preserves options while you get back on track. Consumer Financial Protection Bureau

Conclusion

The debt avalanche for credit cards wins because it focuses relentlessly on the most expensive interest first. By getting your numbers right, sorting by APR, and fixing a sustainable extra payment, you convert a vague goal into a precise schedule. From there, small tactics magnify results: timing a mid-cycle payment, isolating promos and transfers, protecting utilization, and negotiating rate relief when possible. The plan isn’t complicated; it’s a series of consistent actions that compound in your favor, month after month. Keep the tracker simple, automate the boring parts, celebrate milestones, and build a safety buffer so surprises don’t derail your momentum. If you do those things, your debt-free date stops being hypothetical and becomes a calendar event—one you can aim at with confidence and clarity.

Your next step: List your cards and APRs, pick your fixed extra payment, and schedule your first mid-cycle avalanche payment today.

References

- Consumer Credit – G.19 (Current Release), Board of Governors of the Federal Reserve System, Release date: September 8, 2025. Federal Reserve

- Commercial Bank Interest Rate on Credit Card Plans (TERMCBCCALLNS), Federal Reserve Bank of St. Louis (FRED), Updated July 8, 2025. FRED

- 1026.53 Allocation of Payments (Regulation Z), Consumer Financial Protection Bureau, current regulation page. Consumer Financial Protection Bureau

- How does my credit card company calculate the amount of interest I owe?, CFPB “Ask CFPB,” January 22, 2024. Consumer Financial Protection Bureau

- What Should My Credit Utilization Ratio Be?, myFICO Blog, February 9, 2022. myFICO

- How Often Is a Credit Report Updated?, Experian, August 2025 (page updated “last month”). Experian

- When Do Credit Card Payments Get Reported?, Experian, 2021 (approx.; reporting after statement close). Experian

- Credit card payoff calculator and tips for tackling debt, Capital One, May 8, 2025. Capital One

- Credit Card Payoff Calculator, Bankrate, accessed September 2025. Bankrate

- Undebt.it: Free Online Debt Snowball/Avalanche Calculator, Undebt.it, accessed September 2025. and https://undebt.it/debt-avalanche-calculator.php Undebt.it

- Big U.S. banks lower prime lending rates after Fed rate cut, Reuters, September 17, 2025. Reuters

- Do I pay interest on new purchases after I get a zero or low rate balance transfer?, CFPB “Ask CFPB,” February 2, 2024. Consumer Financial Protection Bureau

- What is a balance transfer fee?, CFPB “Ask CFPB,” September 25, 2024. Consumer Financial Protection Bureau