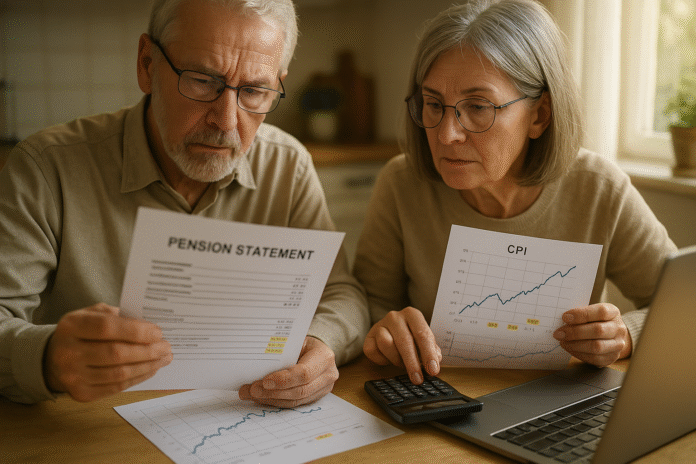

Cost-of-living adjustments (COLAs) are periodic increases to pension benefits designed to preserve purchasing power as prices rise. In plain terms, a COLA helps your monthly pension check keep pace with inflation so today’s groceries, utilities, and healthcare don’t crowd out tomorrow’s budget. Most COLAs are tied to published inflation indexes (often versions of the Consumer Price Index) and applied annually, though specifics vary by plan and jurisdiction. At their best, COLAs are a practical hedge against inflation risk built into lifetime income. At their worst, they’re misunderstood, sporadic, or capped so tightly that purchasing power still erodes. This guide unpacks the 10 essentials—from index selection to funding impact to red flags in plan documents—so you can read your plan with confidence and make better retirement decisions. Quick definition: a COLA is an automatic or discretionary increase in pension payments intended to offset inflation, commonly calculated once per year.

Educational note: This article is general information, not legal, tax, or investment advice. Confirm any decisions with your plan administrator and qualified professionals.

1. What a COLA Is—and How It’s Applied

A COLA is an adjustment to pension benefits meant to offset inflation; it either compounds on top of last year’s benefit or resets from a defined base, depending on plan design. In most plans, COLAs are calculated annually using a specified formula and index, then applied beginning on a particular effective date (for example, payments due each January or each April). Some plans promise automatic COLAs; others provide them at the plan sponsor’s discretion, often subject to funding tests or board approval. The details matter because two retirees with identical starting benefits can end up with very different real incomes after a decade, depending on compounding, caps, floors, and timing. As of now, many public pensions and Social Security-style programs still peg increases to CPI variants, but private plans may use fixed-rate COLAs, ad hoc increases, or none at all. Understanding your plan’s definition, timing, and compounding rules is the foundation for realistic retirement income planning.

- Checklist to read your plan summary (SPD) or member handbook:

- Is the COLA automatic or discretionary?

- Which index is used (CPI-U, CPI-W, a local CPI, etc.)?

- Is the COLA compounding or applied to an original base?

- Are there caps (e.g., max 2%) or floors (e.g., minimum 1%)?

- What’s the effective date and pro-ration for first-year retirees?

1.1 Mini example

Assume an initial monthly pension of $2,000. With a 2.5% compounding COLA, year 2 is $2,050, year 3 is $2,101.25, and by year 10 it’s about $2,561. With a 2.5% non-compounding COLA applied to the original base, you’d receive $2,050 every year going forward—not keeping up as well over time.

Bottom line: The “what” and “how” of your COLA—automatic vs. discretionary and compounding vs. non-compounding—determine how effectively your benefit fights inflation.

2. Choosing the Inflation Index: CPI-W, CPI-U, R-CPI-E, and Chained CPI

COLAs are only as good as the inflation yardstick behind them. Many U.S. public plans and Social Security use CPI-W (Urban Wage Earners and Clerical Workers), while broader programs may prefer CPI-U (All Urban Consumers). Some analysts advocate R-CPI-E (a research index for Americans 62+), which tends to place more weight on medical costs; however, it remains a research series rather than an official index in most statutes. A chained CPI (C-CPI-U) accounts for consumer substitution and generally runs lower than traditional CPI measures, which would slow benefit growth if used. Outside the U.S., plans often use national CPI measures (e.g., UK CPI, Canada CPI All-items). The index choice affects your long-term real income, especially over multi-decade retirements.

- Comparing common indexes (at a glance):

- CPI-W: Based on wage earner/clerical households; widely used for Social Security COLAs in the U.S.

- CPI-U: Covers ~all urban consumers; sometimes used for tax parameters and policy work.

- R-CPI-E: Research index for ages 62+; not officially adopted for most benefit indexation.

- C-CPI-U: Chained index incorporating substitution; typically grows more slowly over time.

2.1 Why the index matters

If your plan uses CPI-W with a 2% cap, a 5% inflation year yields only a 2% COLA—locking in a 3% real loss for that year. Over time, repeated gaps compound. Conversely, plans that mirror CPI-U without caps better preserve purchasing power but can face higher funding volatility.

2.2 Region notes

Some plans—particularly in federations or countries with large regional cost differences—reference national CPI rather than regional CPI. That’s simpler administratively but may under- or over-compensate members in high-cost regions.

Bottom line: Learn the exact index your plan uses and whether it has caps/floors—these features set the trajectory for your real income.

3. COLA Formulas: Fixed Rates, CPI-Linked, Caps/Floors, and Compounding

Beyond the index, the formula architecture dictates how inflation translates into your paycheck. The spectrum runs from fixed-rate COLAs (e.g., “2% every year regardless of CPI”) to CPI-linked formulas with caps (e.g., “CPI up to 2%, compounded”) and floors (e.g., “minimum 1%”). Some plans add a sharing mechanism (e.g., CPI up to 3% if funding is above a threshold). In ad hoc designs, the plan sponsor grants increases non-contractually when finances allow—less predictable but sometimes generous in low-inflation regimes. Compounding is crucial: a compounding 2% is not the same as a flat 2% applied to an original base.

- Common designs (with implications):

- Fixed % (non-index): Predictable cost; may lag in high inflation and over-pay in deflation.

- CPI with cap/floor: Aligns with inflation within bounds; caps can erode purchasing power in spikes.

- CPI “banking”: Unused inflation can carry forward (less common, but helpful in cap years).

- Ad hoc/discretionary: Budget-friendly for sponsors; uncertainty for retirees.

3.1 Numbers & guardrails

- Compounding advantage: Over 20 years, a 2% compounding COLA increases a $2,000 benefit to about $2,971; a 2% non-compounding COLA stuck to the original base stays at $2,040.

- Cap risk: Two back-to-back years of 6% CPI with a 2% cap imply roughly 8% real loss before any later catch-up.

3.2 Mini case

Plan A: CPI-U with 2% cap, compounding.

Plan B: Fixed 2%, non-compounding.

In a decade averaging 3% CPI with two 6% spikes, Plan A preserves more value in normal years, but spikes still bite; Plan B steadily lags.

Bottom line: Read the math. Caps, floors, compounding, and ad hoc language decide whether your COLA truly behaves like inflation insurance.

4. Funding Impact and Actuarial Considerations

COLAs increase liabilities because benefits are expected to rise for as long as members live. Actuaries bake COLA assumptions into the projected benefit obligation and cost measures, and accounting frameworks (e.g., GASB for U.S. public plans, IAS 19 internationally) require transparent reporting of assumptions. Higher assumed COLAs raise liabilities; conversely, tightening COLA rules can reduce liabilities—sometimes materially. Investment return assumptions, discount rates, and longevity also interact with COLA features to drive the plan’s funded ratio and contribution needs. For sponsors, a generous CPI-linked, uncapped, compounding COLA creates funding volatility; for members, it provides the strongest purchasing-power defense.

- What sponsors weigh when setting COLAs:

- Long-term inflation outlook and index behavior.

- Funded status and contribution capacity.

- Accounting visibility (e.g., GASB 67/68 disclosures).

- Stakeholder expectations (members, unions, taxpayers/shareholders).

4.1 Tools & disclosures to watch

- Valuation reports (funded ratio trends, sensitivity to COLA assumptions).

- Notes/Risk disclosures in financial statements (e.g., discount rate sensitivity).

- ASOP No. 4 guidance for actuaries (assumption setting and measurements).

4.2 Practical takeaway for members

If your plan ties COLAs to explicit funding triggers (e.g., only when funded ratio > X%), expect variability. Build a budget buffer for low-COLA years.

Bottom line: COLAs are not “free”—they’re a policy choice with funding, accounting, and risk consequences that show up in liabilities and contributions.

5. Plan Types: Public vs. Private, DB vs. DC, and Social Security Context

Most defined benefit (DB) pensions specify a COLA policy in plan documents or statute. Public sector DB plans commonly adopt CPI-based indexation (with caps/floors), though some shifted after financial stress to reduce or suspend COLAs for certain cohorts. Private sector DB plans in some jurisdictions offer fixed or discretionary increases—or none—because no universal law compels indexation of private pensions in many countries. Defined contribution (DC) plans don’t have a COLA by design; any inflation protection must be purchased (e.g., via an annuity with indexation) or managed through investments and withdrawal strategy. Understanding where your plan sits on this spectrum clarifies how much inflation risk remains on you.

- Snapshot:

- Public DB: Often CPI-linked; subject to legal/political rules; funding affects discretion.

- Private DB: Varies widely; some fixed, some discretionary, many none.

- DC (401(k), PRPP, etc.): No built-in COLA—consider index-linked annuities or laddering TIPS.

5.1 Social Security–style programs

In the U.S., Social Security benefits receive an annual COLA based on CPI-W; timing and exact percentages are defined in law and published each year. In Canada, CPP benefits are indexed to CPI (All-items) and adjusted yearly each January. In the UK, the State Pension applies the “triple lock” (highest of earnings growth, CPI inflation, or 2.5%)—a policy choice, not a guarantee for private pensions.

5.2 Member mindset

If your main retirement income is DC or a private DB without indexation, treat inflation risk as a core planning priority—consider partial annuitization with CPI-linking, equity exposure for long-run growth, and a COLA-aware withdrawal rate.

Bottom line: Your plan type dictates how much inflation protection you automatically get—and how much you must build yourself.

6. Eligibility, Timing, and How Retirement Age Affects Your COLA

Not everyone gets the COLA the same way in the same year. Many plans pro-rate the first increase if you retired mid-year; some delay eligibility until benefits have been in payment for 12 months; others exclude early retirement supplements from COLA entirely. If your benefit includes multiple components (e.g., base pension plus a temporary bridge), only certain components may be indexed. Retirement timing can slightly change your first COLA and the resulting lifetime path of payments, which matters if you’re choosing between late-year vs. early-year retirement dates.

- Timing details to confirm:

- Is the first COLA pro-rated based on months in payment?

- Does the COLA apply to all benefit components?

- Are deferred vested members treated differently from in-service retirees?

- Are survivor benefits indexed at the same rate as member benefits?

6.1 Numeric illustration

Retire on February 1 with $2,000/month, annual COLA effective April 7 (UK-style) or January 1 (North America). If pro-rated by months in payment, your first-year COLA could be 2/12 or 10/12 of the full rate depending on the jurisdiction and plan rules. That seemingly small difference compounds over decades.

6.2 Guardrails

- Check whether early retirement reductions apply before indexation—this affects the base subject to COLA.

- If moving between plans/employers, ask how deferred benefits are revalued pre-retirement vs. indexed in payment.

Bottom line: The first COLA, pro-ration rules, and component coverage can nudge your long-run income path—know them before setting your retirement date.

7. Governance: Automatic vs. Discretionary COLAs, Legal Limits, and Communications

Governance shapes how faithfully a plan delivers on COLA promises. Automatic COLAs (hard-coded indexation) reduce uncertainty for members but increase funding and political pressure in bad markets. Discretionary COLAs give sponsors flexibility but shift uncertainty to retirees. Legal frameworks matter: in U.S. ERISA-governed private plans, anti-cutback rules protect accrued benefits and certain optional forms, but whether a COLA is a protected benefit depends on how it’s embedded in the accrued formula. Public plans operate under state or national laws that vary in how strongly they protect COLAs; some have amended COLA formulas for future service or even for current retirees in past crises. Transparent communication—clear member booklets, timely notices, and funding dashboards—builds trust and helps retirees plan.

- Good governance signals:

- Clear, plain-language SPD/handbook descriptions of index, caps, compounding, and eligibility.

- Published policy for discretionary COLAs (e.g., funding triggers).

- Regular funding reports and sensitivity analyses.

- Prompt, accessible member communications before COLA effective dates.

7.1 Practical step

Keep official plan notices and link to the page that specifies the COLA policy. If your plan is discretionary, model low-COLA scenarios in your personal budget to avoid surprises.

Bottom line: Policy clarity and communications reduce uncertainty; where discretion exists, plan your household cash flow as if the COLA might be lower in tough years.

8. International Variations: Canada, the UK, and Beyond

COLA practices diverge globally. Canada’s CPP indexes benefits annually to CPI All-items, effective January 1, with increases legislated to “keep up with the cost of living.” Canadian federal public service pensions also publish an annual indexing rate applied at the start of each year. In the UK, public service pensions in payment are typically increased in line with CPI each April, with pro-ration for new retirees; the State Pension uses the triple lock (highest of earnings, CPI, or 2.5%). Across OECD countries, indexation for public pensions ranges from full CPI linking to partial or ad hoc increases; some systems use wage indexation or hybrid formulas. The trend in recent decades has been toward price indexation rather than wages to manage costs—though policy is periodically revisited when inflation spikes.

- Region specifics to watch:

- Effective dates (January vs. April).

- Which CPI (national CPI vs. sector-specific).

- Pro-ration rules for first-year retirees.

- Statutory minima for private DB indexation (varies by country).

8.1 Planning tip

If you’re an expatriate or have service in multiple countries, map each plan’s indexation basis and timing. Currency movements plus different index standards can create unexpected gaps.

Bottom line: Country rules differ in index choice, timing, and strength of promise. If you have multi-jurisdiction benefits, build a side-by-side comparison.

9. Personal Planning with COLAs: Budgeting, Healthcare, and Sequence Risk

A COLA is not a silver bullet. Even with solid CPI-linking, healthcare costs and housing can outpace headline inflation for periods; caps may bite in spikes; and sequence risk (inflation + market downturns) can strain DC savings. Treat the COLA as a base layer of inflation defense, then add strategies: maintain an emergency fund, diversify investments, and consider annuity options for non-indexed income. Adjust spending in high-inflation years—especially discretionary categories—to protect long-term sustainability. If Medicare-style or national health premiums rise, recognize that net income may increase less than the headline COLA.

- Practical tactics:

- Build a COLA-aware budget with scenarios (e.g., CPI 2%, 4%, 6%).

- For DC assets, consider TIPS ladders or funds to complement non-indexed income.

- Revisit withdrawal rates after low-COLA or high-inflation years.

- Track healthcare and housing specifically; they’re big drivers for retirees.

9.1 Mini example

If your $2,500/month pension gets a 2.5% COLA but your health premium rises 6%, your net purchasing power shrinks despite the headline increase. Model net-of-premiums income annually.

Bottom line: A COLA is necessary but not sufficient—layer additional inflation defenses and budget flexibility.

10. Red Flags and Fine Print: Caps, Non-Compounding, Ad Hoc Language, and Delays

Reading the fine print can save your future self. Caps (e.g., 2% maximum) are common; non-compounding language reduces long-term protection; ad hoc wording signals uncertainty; delayed eligibility (e.g., must be in payment 12 months) can shrink the first year’s increase; and component exclusions (e.g., supplemental bridges) can reduce indexation where you expect it. Also watch for index substitutions (e.g., reserve the right to change the index) and funding triggers that suspend COLAs below certain funded ratios. If your plan is private, check whether any COLA feature is part of the accrued benefit (and thus protected) or an ancillary benefit that could be amended more easily.

- Red-flag list (3–7 quick checks):

- “Up to X%” without clarity on catch-ups or banking.

- “Non-compounding” or “calculated on original base.”

- “Ad hoc” with no objective policy or funding trigger.

- “Index may be changed at sponsor’s discretion.”

- “Pro-ration” rules that sharply reduce the first year’s increase.

10.1 What to do if you find a red flag

Ask the administrator for written clarification. Then stress-test your plan: model a decade of low or zero COLAs and examine whether your cash flow remains viable. Adjust saving, work, or annuitization decisions accordingly.

Bottom line: The devil is in the details—identify caps, compounding, and discretion clauses now, while you still have levers to pull.

FAQs

1) What exactly is a pension COLA, in one sentence?

It’s an annual (or periodic) increase to your pension intended to keep pace with inflation, usually tied to a published index such as a CPI measure, and applied by formula on a set effective date; whether it compounds and whether caps/floors apply depends on your plan’s rules.

2) How is a U.S. Social Security–style COLA determined?

By statute, it’s based on the CPI-W reading comparing the third quarter of one year to the third quarter of the next; the increase (if any) is announced and then applied to benefits beginning in January of the following year, providing a transparent, index-based adjustment.

3) Why do some pensions cap COLAs?

Caps limit funding volatility and help sponsors budget; however, in years when inflation exceeds the cap, retirees suffer a real loss that compounds over time. Some plans “bank” excess CPI for future years, but many do not—so caps are a key risk factor to understand.

4) What’s the difference between CPI-W, CPI-U, R-CPI-E, and chained CPI?

CPI-W focuses on wage earner/clerical households and is used in some statutes; CPI-U covers nearly all urban consumers; R-CPI-E is a research index for Americans 62+ and is not widely adopted in benefit law; chained CPI (C-CPI-U) accounts for substitution and typically reports slightly lower inflation over time.

5) Do private sector pensions have to offer a COLA?

Often no—requirements vary by country and plan design. Many private DB plans provide fixed or discretionary increases, and some provide none. Your plan’s SPD/handbook is the definitive source; if absent, assume you must manage inflation risk yourself.

6) Does a COLA always compound?

No. Some plans apply COLAs to the current benefit (compounding), while others apply increases to the original base only (non-compounding). Over long retirements, compounding provides materially stronger protection.

7) How do international systems differ on indexation?

Canada indexes CPP to CPI All-items annually each January; the UK increases public service pensions roughly with CPI each April and applies a triple lock to State Pension. Many OECD countries use CPI for public pensions, but details and strength of promise vary.

8) Can a plan change or suspend its COLA?

It depends on the legal framework. In some public systems, legislatures have modified COLAs for future accruals or certain cohorts. In private plans, whether a COLA is a protected accrued benefit depends on how it’s embedded in plan terms; seek written guidance before assuming permanence.

9) How should I plan if my pension has an ad hoc COLA?

Model conservative scenarios—e.g., 0–1% increases for several years—and see if your budget holds. Consider supplementing with indexed annuities, TIPS, or higher equity exposure (appropriately risk-managed) to defend against inflation variability.

10) Will rising healthcare costs outpace my COLA?

Sometimes. Headline CPI may underweight your personal basket if medical or housing costs dominate. Track net-of-premium income and adjust spending or savings drawdowns accordingly, especially after high-inflation years.

Conclusion

A COLA can be the quiet hero of retirement security—or a disappointing afterthought—depending on its index, formula, caps/floors, compounding, and governance. If your plan is automatic and CPI-linked without tight caps, you’re in a stronger position to preserve purchasing power through multi-decade retirements. If your plan is fixed-rate, ad hoc, non-compounding, or heavily capped, recognize the residual inflation risk and plan accordingly. The practical steps are straightforward: find and read your plan’s COLA section; confirm the index and any cap/floor/compounding features; understand eligibility timing and component coverage; and stress-test your household budget against lower-than-expected increases. Finally, monitor official plan communications each year—especially around the effective date—so you can update cash-flow projections and make timely adjustments to savings, investments, and insurance choices.

Next step: Pull your plan document/SPD today, highlight every line about indexation, and run a 10-year budget with “cap-year” and “no-COLA” scenarios.

References

- “Cost-of-Living Adjustment (COLA) Information,” Social Security Administration. https://www.ssa.gov/cola/

- “Latest COLA and How It Is Calculated,” Social Security Administration. https://www.ssa.gov/oact/cola/latestCOLA.html

- “CPI-W Definition,” U.S. Bureau of Labor Statistics (BLS), Help Page. https://www.bls.gov/help/one_screen/cw.htm

- “R-CPI-E Homepage,” U.S. Bureau of Labor Statistics. https://www.bls.gov/cpi/research-series/r-cpi-e-home.htm

- “Chained Consumer Price Index for All Urban Consumers (C-CPI-U),” U.S. Bureau of Labor Statistics (Q&A). https://www.bls.gov/cpi/additional-resources/chained-cpi-questions-and-answers.htm

- “Canada Pension Plan amounts and the Consumer Price Index,” Government of Canada. https://www.canada.ca/en/services/benefits/publicpensions/cpp/after-apply/consumer-price-index.html

- “Public Service Pensions Increase: UK Government. https://www.gov.uk/government/publications/public-service-pensions-increase-2025

- “The New State Pension: What You’ll Get—Annual Increases,” UK Government. https://www.gov.uk/new-state-pension/what-youll-get

- Pensions at a Glance 2023, OECD, 2023. https://www.oecd.org/en/publications/2023/12/pensions-at-a-glance-2023_4757bf20.html

- “Guidance on the Anti-Cutback Rules of Section 411(d)(6),” Internal Revenue Service. https://www.irs.gov/retirement-plans/guidance-on-the-anti-cutback-rules-of-section-411d6

- “ASOP No. 4—Measuring Pension Obligations and Determining Pension Plan Costs or Contributions,” Actuarial Standards Board. https://www.actuarialstandardsboard.org/asops/asop-no-4-measuring-pension-obligations-and-determining-pension-plan-costs-or-contributions/

- “Occupational Pension Increases,” House of Commons Library (UK). https://commonslibrary.parliament.uk/research-briefings/sn05656/