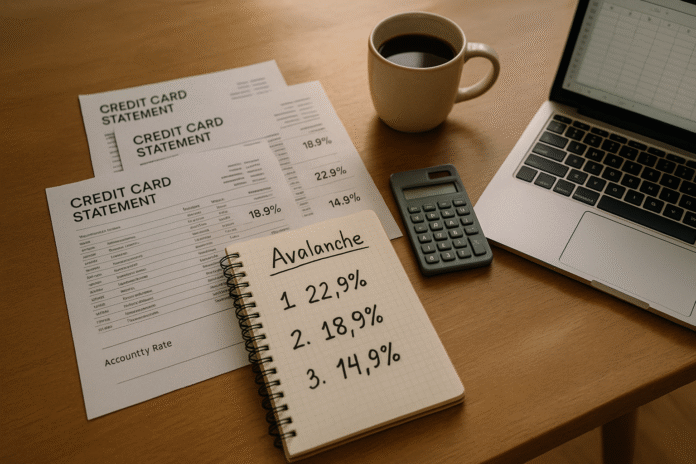

If you’re trying to get out of debt faster and cheaper, order matters. This article compares multiple paydown orders using the debt avalanche approach and shows, with real numbers, how the sequence you choose changes your monthly payments, payoff time, and total interest. It’s written for anyone juggling several balances (credit cards, personal loans, student loans) and wondering which to hit first. Briefly, the avalanche method means you pay the minimum on all debts, then send every extra dollar to the highest interest rate balance; once that’s gone, you “roll” the freed-up payment to the next-highest APR, and so on. By construction, this minimizes interest cost if you’re consistent.

Fast definition: The debt avalanche prioritizes debts by APR from highest to lowest, directing all extra cash to the top APR while maintaining minimums on the rest. It typically yields the lowest total interest versus other orders.

Why this matters right now: Credit card APRs remain elevated (average advertised APR ~23.99% in August 2025; across all accounts assessed interest, ~21.16% in May 2025), so inefficient payoff order can cost hundreds or thousands. Numbers below use realistic card APRs and common minimum-payment rules to illustrate trade-offs. Use them as templates to plug in your own balances.

Friendly reminder: This guide is educational, not individualized financial advice. Confirm your exact APRs, fees, minimum payment formulas, and promo terms before making changes.

1. Classic Three-Card Stack: Avalanche vs. Snowball (Same Budget, Different Order)

The quickest way to cut interest when you carry several credit cards is usually to rank them by APR and attack the highest first. In this classic three-card scenario, avalanche beats snowball (smallest balance first) on both total interest and speed. Here’s the setup we’ll analyze: Card A $4,200 at 24.99% APR, Card B $3,100 at 18.99%, Card C $2,700 at 9.99%; you can pay $600/month total, and all cards require at least 2% or $25 minimums. With the avalanche order (A → B → C), payoff takes 20 months and costs about $1,463 in interest. With the snowball order (C → B → A), payoff takes 21 months and costs about $2,027 in interest. That’s $565 saved and one month faster just by changing the order—no extra cash required.

- Numbers & guardrails (what we assumed)

- Starting balances: A $4,200 @ 24.99%; B $3,100 @ 18.99%; C $2,700 @ 9.99%.

- Budget: $600/month; minimums: greater of 2% or $25 (typical on many cards).

- Fixed payments until a card is cleared; then roll the freed payment to the next target.

1.1 What the numbers show

- Avalanche: ~20 months, $1,462.97 interest (modeled monthly).

- Snowball: ~21 months, $2,027.49 interest.

- Interest saved by avalanche: ~$564.52; time saved: ~1 month.

1.2 Why avalanche wins here

- Every month you allow a 24.99% balance to linger, you’re compounding more expensive interest than on the 9.99% card.

- The higher the APR spread among your debts, the more avalanche tends to outperform.

Bottom line: If your balances look like this—one clearly high APR, one medium, one low—avalanche’s order alone can shave hundreds in interest and a month or more off your timeline, without changing your budget.

2. The 0% Promo Trap: Don’t Pay the Free Money First

When a 0% balance transfer (with a fee) sits beside high-APR cards, it’s tempting to crush the “big number” first. But if that big balance is at 0% introductory APR, it often shouldn’t be first in line—until the promo is near expiry. Consider this mix: Card A $3,800 @ 24.99%; Card B $2,500 @ 18.99%; Balance Transfer (BT) $5,000 at 0% for 12 months, then 21.99% (with a 3% transfer fee added, so $5,150 starting). With $800/month to pay:

- Avalanche (prioritize A → B → BT during its 0% window): ~16 months total, ~$726.43 interest.

- Wrong order (BT first → A → B): ~17 months, ~$1,443.98 interest.

That’s ~$718 more interest and an extra month—purely from a poor order choice.

- Mini-checklist for 0% promos

- Confirm promo length, go-to APR, and transfer fee in the card’s Schumer Box.

- Prioritize high-APR, interest-accruing balances before a 0% promo unless the promo is close to expiring or credit utilization/score goals dictate otherwise.

- Set a reminder 60–90 days before promo end; be ready to switch targets.

2.1 Why it matters

Zero percent balances feel psychologically urgent due to their size, but they’re not costing interest during the promo. Paying them first diverts cash away from APRs that are compounding. As of 2025, average card APRs exceed 21% across accounts—so aim your extra dollars where the interest meter is actually running.

Bottom line: During a 0% window, leave the promo for later and hammer the balances that are actively costing you interest—then pivot before the promo expires.

3. Mixing Installment Loans and Cards: Why Avalanche Protects Your Wallet

What if you carry a high-APR card alongside an auto loan and a student loan with fixed payments? Suppose: Credit Card $5,200 @ 23.99%; Auto Loan $12,000 @ 6.9% (about $286.80 fixed for 48 months); Student Loan $9,000 @ 5.5% (fixed $200). Your total budget is $1,200/month. If you avalanche (credit card first, then auto, then student), you’re debt-free in ~24 months with ~$2,060 interest. If you pay installment loans first (auto → student → card), you spend ~25 months and ~$3,531 interest—~$1,471 more. Snowball (smallest balance first) lands close to avalanche on time (~24 months) but still costs ~$2,125—more than avalanche.

- Numbers & guardrails

- Installment loans keep their fixed payment unless you add extra.

- Extra dollars above minimums go to the avalanche target.

- Credit card APRs are high compared with many installment loans (auto/student), so lingering card balances are expensive.

3.1 Practical steps

- Keep making required fixed payments on loans.

- Direct all extra to the highest APR—usually the credit card—until it’s gone.

- Consider refinancing installment loans separately after high-APR cards are cleared, if rate drops or term changes produce real savings.

Bottom line: When revolving and installment debts mix, avalanche typically steers the most dollars away from high-rate compounding and is less costly overall than paying “the neat, fixed loans” first.

4. Budget Sensitivity: How Extra Cash Amplifies (or Shrinks) Avalanche Savings

The avalanche advantage isn’t static—it scales with your monthly budget and your APR spread. Using the same three cards as Section 1, look at two budgets:

- $400/month budget

- Avalanche: ~32 months, ~$2,467.60 interest.

- Snowball: ~34 months, ~$3,435.79 interest.

- Savings: ~$968 and 2 months faster.

- $800/month budget

- Avalanche: ~14 months, ~$1,056.08 interest.

- Snowball: ~15 months, ~$1,454.60 interest.

- Savings: ~$398.52 and 1 month faster.

- Why your budget changes the gap

- With lower budgets, expensive balances persist longer, so avoiding unnecessary interest (via avalanche) matters more.

- With higher budgets, even suboptimal orders end sooner, compressing the interest difference—but avalanche still wins.

4.1 Mini checklist to maximize budget impact

- Automate minimums and a fixed extra transfer on payday.

- Use windfalls (tax refund, bonus) to make targeted lump sums on the highest APR.

- Avoid adding new balances; a “no new debt” rule protects your progress.

Bottom line: The tighter the budget and the bigger the APR differences, the more avalanche shines. When you can pay more each month, avalanche still saves—but the gap narrows.

5. The “Motivated Avalanche”: One Quick Win, Then Pure Math

Behavior matters. Many people stick with payoff plans longer when they get an early win—even if the math isn’t perfect. Research shows “debt account aversion”: a tendency to eliminate small balances first for motivation, even when it isn’t interest-optimal. A practical compromise is the motivated avalanche: clear one small balance for momentum, then switch to strict highest-APR targeting. In our Section 1 three-card setup with a $600 budget, this hybrid (C → A → B) pays off in ~20 months with ~$1,895.25 interest. That’s ~$432 more than pure avalanche but ~$132 less than full snowball—and it keeps the psychological boost.

- How to do it (safely)

- Pick one low-balance “quick win” (usually the smallest debt).

- After it’s gone, lock into avalanche order without exceptions.

- Track total interest paid monthly to keep the math visible and motivation high.

5.1 Guardrails

- Don’t extend the “quick win” beyond one balance; otherwise you drift into full snowball costs.

- If your highest APR is very high (e.g., penalty APRs), skip the quick win and start with pure avalanche immediately.

Bottom line: If motivation is your bottleneck, a one-time quick win can make the plan stick—while keeping most of avalanche’s savings.

6. When APR Spread Decides Everything: Narrow vs. Wide Gaps

Avalanche’s edge grows as the spread between your rates widens. Consider two otherwise identical stacks (balances $4,200 / $3,100 / $2,700; budget $600):

- Narrow spread (14%–18% APRs)

- Avalanche: ~19 months, ~$1,346.27 interest.

- Snowball: ~20 months, ~$1,490.99 interest.

- Savings: ~$145 and 1 month faster.

- Wide spread (9%–29% APRs)

- Avalanche: ~20 months, ~$1,525.24 interest.

- Snowball: ~21 months, ~$2,332.17 interest.

- Savings: ~$807 and 1 month faster.

6.1 Why this happens

- In wide-spread scenarios, every dollar not aimed at the top APR burns more in avoidable interest.

- When APRs are similar, the penalty for a “less-than-perfect” order is smaller; motivation or simplicity may weigh more heavily in your choice.

Bottom line: The wider your APR spread, the more crucial it is to rank by APR and attack in strict avalanche order.

FAQs

1) What is the debt avalanche method, in one sentence?

It’s a repayment strategy where you make minimum payments on all debts and send every extra dollar to the highest APR first; after that balance is paid, you roll the freed cash to the next-highest APR. This ordering usually minimizes total interest paid if you keep payments consistent.

2) How does avalanche compare to the debt snowball?

Snowball targets the smallest balance first, then moves up—great for motivation but typically more expensive in interest. Avalanche targets the highest APR first, which is mathematically cheaper. Choosing between them depends on your need for motivation versus cost minimization; a “motivated avalanche” can blend both.

3) Do I need a special calculator to run my own numbers?

No, but it helps. You can model month-by-month interest compounding and minimums in a spreadsheet or with reputable online calculators. Make sure the tool lets you set APR, minimum payment formula, and extra payment and supports ordering by APR so you can mimic avalanche accurately. (Bank and personal finance sites offer free calculators; confirm assumptions.)

4) How are credit card minimum payments calculated?

Many issuers set minimums around 1%–3% of balance or a flat floor (e.g., $25), plus any interest/fees—terms vary. Your statement discloses the formula. Paying only the minimum dramatically increases total interest and payoff time, which is why avalanche adds extra above the minimum every month.

5) When should I pay off a 0% balance transfer?

Usually near the end of the promo, not at the beginning—so long as you’re on track to clear it before the rate resets. During the promo, prioritize balances that are actually accruing interest. Calendar a reminder 60–90 days before expiry to pivot your target if needed, and watch the go-to APR and any fees. (Promo terms are in your card’s disclosures.)

6) Can I tell my issuer how to allocate payments across balances?

If you have different balances on a single account (e.g., purchase vs. cash advance), U.S. rules under Regulation Z address how payments above the minimum are allocated and generally allow issuers to follow consumer requests in some circumstances. Check your issuer’s policy and the regulation for specifics.

7) Should I ever prioritize an installment loan over my credit card in avalanche?

Only if the installment loan’s APR is actually higher than your cards, or if there’s a near-term rate reset/penalty that would make it higher. Most of the time, revolving credit cards carry the top APRs, so hitting them first saves more—even while you keep making required fixed payments on loans.

8) How do changing interest rates affect payoff order?

If variable rates drop (or rise), the “highest APR” target may change. Re-check APRs after central bank moves or issuer notices. In elevated-rate environments, the cost of leaving a high APR unpaid remains steep, so periodic re-ranking by current APR is smart practice. (Prime/fed funds changes flow through to many card APRs.) Reuters

9) I need motivation—will one early small win ruin avalanche’s benefits?

Not if you limit it to one quick win, then switch to strict avalanche. Our modeled hybrid cost a few hundred dollars more than pure avalanche but still beat full snowball and helped maintain momentum. Behavioral research supports the motivational pull of eliminating a balance early.

10) What data should I gather before running my own avalanche plan?

List each debt’s balance, APR, minimum payment (formula or fixed amount), fees, promo expiry, and whether the rate is variable. Then set a monthly budget you can sustain. Sort by APR, automate the payments, and schedule check-ins whenever an APR or promo changes. The clarity up front prevents costly order mistakes and keeps you consistent.

Conclusion

Order, not just effort, determines how fast and how cheaply you get out of debt. The six scenarios above show how avalanche sequencing—aiming extra dollars at the highest APR first—cuts hundreds to thousands of dollars in interest without increasing your monthly budget. When a 0% promo sits beside high APRs, wait on the promo and hammer the interest-bearing balances; when installment loans share the stage with cards, keep their fixed payments going while you wipe out the revolving balances. As your budget grows, avalanche still wins, though the savings gap narrows; and if motivation is a sticking point, one early quick win can help you stick to a plan that still preserves most of the math advantage.

From here, gather your exact APRs and minimums, set a sustainable monthly budget, and rank your debts by current APR. Automate minimums plus extra to the top APR, revisit the order when promos end or rates change, and track both months remaining and interest-to-date so your progress stays visible. You’ll reduce cost, build momentum, and reclaim cash flow for your future.

Call to action: Rank your balances by APR tonight, automate next month’s payments, and start your avalanche tomorrow.

References

- How to reduce your debt, Consumer Financial Protection Bureau (CFPB), July 16, 2019. Consumer Financial Protection Bureau

- Debt Avalanche: Meaning, Pros and Cons, and Example, Investopedia, accessed August 2025. Investopedia

- Average Credit Card Interest Rate for August 2025: 23.99% APR, Investopedia, August 2025. Investopedia

- Commercial Bank Interest Rate on Credit Card Plans, All Accounts (TERMCBCCALLNS), Board of Governors of the Federal Reserve System via FRED, observation May 2025; updated July 8, 2025. FRED

- Debt Avalanche vs. Debt Snowball: What’s the Difference?, Investopedia, accessed 2025. Investopedia

- Debt snowball method vs. debt avalanche method, Fidelity Learning Center, accessed 2025. Fidelity

- Understanding minimum payments, CFPB (Educator Tools), updated July 14, 2022. Consumer Financial Protection Bureau

- 12 CFR §1026.53 – Allocation of payments, CFPB (Regulation Z), current as of 2025. Consumer Financial Protection Bureau

- Winning the Battle but Losing the War: The Psychology of Debt Management, Journal of Marketing Research, 2011. SAGE Journals

- Consumer Credit – G.19 (Current Release), Federal Reserve Board, September 8, 2025. federalreserve.gov