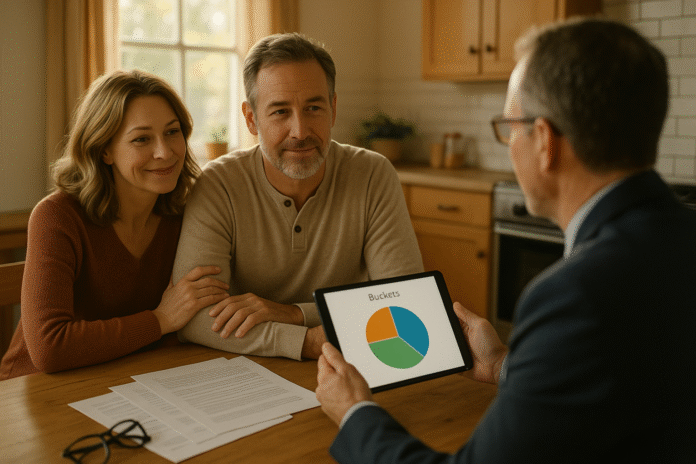

Want more control over your retirement tax bill, not just a bigger balance? That’s the promise of building tax diversification with Roth IRA accounts—creating a tax-free “bucket” you can tap in future high-tax years. Below you’ll find seven research-driven strategies to grow and use Roth dollars intentionally, whether you’re just starting out, hitting peak earnings, or already retired. This guide is educational and not individualized tax or investment advice.

Quick definition: Tax diversification means spreading savings across taxable, tax-deferred, and tax-free accounts so you can decide which dollars to spend in any given year to manage taxes. Roth IRAs are the cornerstone of the tax-free bucket because qualified withdrawals (including earnings) are tax-free and the accounts have no lifetime RMDs for the original owner.

1. Max out direct Roth IRA contributions (and time them smartly)

Direct Roth IRA contributions are the simplest way to grow your tax-free bucket, and for many households they’re the most reliable. In current year, you can contribute up to $7,000 (or $8,000 if you’re 50+), subject to income limits. For a full Roth contribution in 2026, the MAGI threshold is under $150,000 for single filers and under $236,000 for married filing jointly; phase-outs run to $165,000 and $246,000, respectively. If you’re eligible, consider funding early in the year to maximize time in the market—or automate monthly contributions if cash flow is tight. Remember: contributions (but not earnings) are withdrawable anytime, which can make Roth IRAs a flexible safety valve for long-term savers who still want some access.

1.1 Why it matters

- Roth dollars diversify tax risk—useful if your future tax rate could be higher due to income, policy changes, or RMDs from other accounts.

- Roth IRAs avoid lifetime RMDs, letting compounding work longer.

- Having a tax-free bucket gives you sequence-of-returns and tax flexibility in retirement.

1.2 How to do it

- Check eligibility: Compare your expected MAGI to the year’s IRS thresholds.

- Automate contributions: Dollar-cost average if lump sums aren’t feasible.

- Front-load if possible: More time invested can mean more growth.

- Coordinate with spouse: If your spouse has earned income, a spousal Roth IRA may double your household’s Roth funding even if one spouse has lower income.

- Track deadlines: Prior-year contributions are allowed until the tax filing deadline (typically mid-April).

Mini-example: A 45-year-old contributing $7,000 annually for 20 years at a 6% annualized return could accumulate roughly $257,000 in Roth dollars—tax-free for qualified withdrawals—versus a similar balance in a taxable account that may generate annual taxes on income/gains.

Bottom line: If you qualify, fund the Roth IRA first—it’s the cleanest path to tax-free retirement income and the foundation for everything else.

2. Use the backdoor Roth efficiently (and avoid the pro-rata trap)

If your income is above the Roth limits, the backdoor Roth—making a nondeductible Traditional IRA contribution and quickly converting it to Roth—can keep Roth funding on track. The key hazard is the IRS pro-rata rule: for tax purposes, all your non-Roth IRAs are aggregated on December 31 of the conversion year. That means you can’t just “cherry-pick” after-tax dollars; the taxable portion of the conversion mirrors the ratio of pre-tax to after-tax across all Traditional, SEP, and SIMPLE IRAs. You must also report nondeductible basis and conversions on Form 8606.

2.1 Numbers & guardrails

- Pro-rata in action: If you hold $93,000 pre-tax IRA money and add a $7,000 nondeductible contribution (total $100,000), then convert $7,000, ~93% of that conversion is taxable because your after-tax basis is 7% of all IRA dollars.

- Paperwork: Use Form 8606 each year you make nondeductible contributions or Roth conversions; keep copies to track basis over time.

2.2 Common mistakes

- Holding large pre-tax IRA balances when converting (creates high taxable percentage).

- Forgetting to file Form 8606, which can lead to double-taxation of basis.

- Waiting months between contribution and conversion (market gains can increase taxes).

2.3 Workarounds & tools

- Roll pre-tax IRA assets into a 401(k) (if the plan accepts roll-ins) to clear the IRA balances and neutralize the pro-rata rule before converting.

- Use your custodian’s basis tracking tools; confirm year-end balances before any conversion.

Bottom line: Backdoor Roth works best when you’ve moved pre-tax IRA dollars out of the way and you’re meticulously tracking basis on Form 8606.

3. Unlock the mega backdoor Roth via your 401(k)

If your workplace plan allows after-tax 401(k) contributions and either in-plan Roth conversions or in-service rollovers to a Roth IRA, you can funnel far more into Roth each year—often called the mega backdoor Roth. For now, employee elective deferrals cap at $23,500 (plus $7,500 catch-up if 50+), but the combined limit for all contributions (employee + employer + after-tax) rises to $70,000 (or $77,500 with catch-up). IRS guidance (Notice 2014-54) permits splitting a single distribution so after-tax dollars go directly to Roth, while pre-tax funds go to a traditional account—minimizing taxes. Plan rules vary, so check your SPD and HR portal.

3.1 How to do it

- Confirm eligibility: Your plan must allow after-tax contributions and either in-plan Roth conversion or in-service rollover.

- Calculate headroom: Subtract your deferrals and employer match from the $70,000 annual additions limit to see how much after-tax you can add.

- Automate conversions: Many plans let you trigger per-pay-period in-plan conversions to minimize taxable growth on after-tax dollars.

- Mind ACP testing: High earners at small firms should ask HR about discrimination testing constraints that can cap after-tax contributions mid-year.

3.2 Mini-example

You defer $23,500; your employer matches $10,000. That’s $33,500 total—leaving $36,500 of headroom to after-tax contributions to reach $70,000. If your plan auto-converts after-tax to Roth each payroll, most growth occurs in Roth.

Bottom line: When available, the mega backdoor Roth is the fastest legal way to super-size tax-free assets—just be sure your plan supports it and you stick within the annual additions cap.

4. Place the right assets in Roth for long-term tax-free growth (asset location)

Roth space is scarce—treat it like premium real estate. Because qualified Roth growth is never taxed, it often makes sense to place high-expected-return and tax-inefficient assets in Roth (e.g., small-cap growth, emerging markets, active strategies with high turnover), and keep income-heavy or ordinary-income-taxed assets in tax-deferred accounts. Meanwhile, highly tax-efficient broad-market index funds can live in taxable accounts with minimal drag. Research and industry guidance support this broad framework, though exact placement depends on risk tolerance, rebalancing needs, and withdrawal plans.

4.1 Why it matters

- Compounding leverage: Every extra percentage point of return captured tax-free matters over decades.

- Withdrawal sequencing: Roth assets you expect to tap later in retirement can be the growth engine while you spend taxable/deferred assets first.

- Total-portfolio tax rate: Smart asset location reduces lifetime taxes without changing your overall asset allocation.

4.2 Practical placement checklist

- Roth IRA: Highest expected return / least tax-efficient holdings you intend to own for many years.

- Traditional IRA / 401(k): Tax-inefficient income producers (e.g., taxable bonds, REIT funds) you may rebalance actively.

- Taxable account: Broad, low-turnover index funds; municipal bonds if appropriate.

- Rebalance with flows: Use contributions and distributions to avoid taxable sales when moving toward targets.

4.3 Evidence & caveats

- Morningstar’s tax-location analyses show long-term savings when pairing assets with account types intentionally; Vanguard simulations also examine placement trade-offs under many market paths. Not all households benefit equally—priorities change if you’ll spend Roth dollars earlier or if volatility changes rebalancing costs.

Bottom line: Treat Roth as your growth vault. Put the hardest-working assets there, and manage the rest of the portfolio for tax efficiency across all account types.

5. Plan surgical Roth conversions in low-tax years

Roth conversions move money from tax-deferred (Traditional IRA/401(k)) to Roth, creating taxable income today in exchange for tax-free growth tomorrow. They’re especially powerful in low-income years—career breaks, early retirement “gap years,” or before Social Security and RMDs start. Conversions also reduce future RMDs—and since Roth IRAs have no lifetime RMDs, you gain flexibility later. Be mindful that conversions increase MAGI, which can affect Medicare IRMAA surcharges two years later and certain credits or deductions. IRSCMS

5.1 How to do it

- Bracket management: Model “fill-up” conversions to the top of a target tax bracket each year.

- Withhold smartly: Prefer paying conversion taxes from taxable cash rather than the IRA, to keep more in Roth.

- Quarterly cadence: Spreading conversions through the year reduces timing risk.

- Watch cliff effects: IRMAA and certain tax credits have thresholds; crossing by $1 can trigger big costs. Kiplinger

5.2 Mini-case

A 60-year-old early retiree expects high RMDs starting in her 70s. In gap years (no wages, delaying Social Security), she converts $40,000–$60,000 annually—enough to “fill” a moderate bracket without jumping into the next one. Later, smaller RMDs plus a larger Roth bucket mean more control over taxes and Medicare premiums.

Bottom line: Conversions are a scalpel, not a sledgehammer. Use them to shape your future tax profile, keeping an eye on IRMAA and other thresholds.

6. Manage the Roth five-year clocks and withdrawal sequencing

Roth IRAs have two five-year rules: one for earnings to be tax-free (the account must be open five tax years and you must meet a qualifying condition like age 59½), and one for each conversion to avoid the 10% early distribution penalty if you withdraw converted amounts before age 59½. Your first Roth IRA starts the global five-year clock for earnings; each conversion starts its own five-year penalty clock. Keep meticulous records so you can tap contributions, conversions, and earnings in the right order.

6.1 Ordering rules & examples

- Ordering: Distributions come out as (1) contributions, (2) conversions (oldest first), (3) earnings.

- Qualified distribution example: If you first funded a Roth for 2020, you satisfy the five-year rule on Jan 1, 2026. If you’re 59½+ at that time, earnings are tax- and penalty-free.

- Conversion example: Convert $20,000 in 2026 at age 50. You can withdraw that $20,000 penalty-free on Jan 1, 2030 (five tax years later), but earnings still require a qualified distribution.

6.2 Mini-checklist

- Open any Roth IRA as early as possible to start the global five-year clock.

- Track each conversion year; consider separate small Roths if your custodian makes tracking easier.

- Avoid tapping converted amounts within five years if you’re under 59½.

- Keep copies of Form 5498/1099-R and statements as documentation.

Bottom line: Know your clocks. Getting the five-year rules wrong can turn a tax-free plan into an unexpected tax bill.

7. Coordinate Roths with RMD and charitable strategies (QCDs)

A major reason to build Roth dollars is to reduce future RMDs from tax-deferred accounts. Roth IRAs have no lifetime RMDs for the original owner; beginning 2024, even Roth 401(k) accounts are not subject to RMDs while the owner is alive. If you are charitably inclined, keep some traditional IRA dollars to make Qualified Charitable Distributions (QCDs)—direct transfers to charity that can satisfy RMDs without raising taxable income. The QCD limit is $108,000 per person (indexed), and rules require the transfer go directly from the IRA to the charity.

7.1 How to do it

- Segment buckets: Prioritize spending taxable assets first, then tax-deferred (with QCDs if applicable), letting Roth compound.

- Confirm eligibility: QCDs are available from IRAs for those 70½+; they don’t apply from 401(k)s and typically aren’t useful from Roth IRAs.

- Paper trail: Your custodian issues Form 1099-R; custodians include Code Y to flag QCDs.

7.2 Numeric example

At age 73, your traditional IRA RMD is $24,000. You plan to give $15,000 to charities this year. A $15,000 QCD directly from the IRA covers part of the RMD without increasing AGI. You then withdraw the remaining $9,000 as your taxable RMD. Meanwhile, you preserve your Roth IRA to grow tax-free for future needs. Schwab Brokerage

Bottom line: Use Roths to shrink future forced income and leverage IRAs for QCDs when giving is part of your plan.

FAQs

1) What’s the difference between a Roth IRA and a Roth 401(k) for tax diversification?

Both offer tax-free qualified withdrawals, but Roth IRAs have no lifetime RMDs; Roth 401(k) accounts had RMDs historically, but those were eliminated starting in 2024 while the owner is alive. You may roll a Roth 401(k) to a Roth IRA at retirement for broader investment choices and to consolidate five-year clocks.

2) How much can I contribute to a Roth IRA, and who qualifies?

The limit is $7,000 (or $8,000 if 50+). Full contributions require MAGI under $150,000 (single) or under $236,000 (married filing jointly), with partial contributions allowed up to $165,000 and $246,000, respectively. If you’re over the limit, consider the backdoor Roth path.

3) Do Roth contributions really come out tax- and penalty-free at any time?

Yes—contributions (your original dollars) can be withdrawn anytime without tax or penalty. Earnings require both the five-year clock to be satisfied and a qualifying event (e.g., reaching 59½) to be tax- and penalty-free. Keep records and understand ordering rules.

4) How does the pro-rata rule complicate backdoor Roth conversions?

For tax purposes the IRS treats all non-Roth IRAs as one. If any pre-tax dollars exist at year-end, a proportional slice of any conversion is taxable—even if you “only” convert the nondeductible contribution. Many high earners roll pre-tax IRA assets into a 401(k) before doing backdoor conversions.

5) Is the mega backdoor Roth available at every employer?

No. Your plan must explicitly allow after-tax contributions and an in-plan Roth conversion or in-service rollover to a Roth IRA. The overall annual additions limit is $70,000 (or $77,500 with catch-up), but your actual room depends on plan features and ACP testing.

6) What are the two Roth five-year rules in plain English?

Rule #1 (earnings): For earnings to be tax-free, your Roth must be open five tax years and you must have a qualifying event (usually age 59½). Rule #2 (conversions): Each conversion has its own five-year clock to avoid the 10% penalty if you’re under 59½. Contributions always come out first.

7) How do Roth conversions affect Medicare premiums (IRMAA)?

Conversions raise MAGI and can trigger IRMAA surcharges on Parts B and D two years later. Plan conversions with those thresholds in mind, especially around retirement and Social Security start dates.

8) Can I use QCDs with Roth IRAs?

QCDs must come from IRAs, but they’re most valuable from traditional IRAs because they avoid taxable income while satisfying RMDs. Roth IRAs have no lifetime RMDs, so QCDs from Roth don’t usually add tax benefit. The QCD limit is $108,000 per person.

9) When should I prefer taxable investing over more Roth?

If you’ve exhausted Roth options (including mega backdoor) and still have cash flow, a taxable account with tax-efficient ETFs adds flexibility: no contribution limits, immediate liquidity, and potential step-up in basis at death (subject to law changes). Pairing taxable with Roth and tax-deferred improves tax-management options over a full retirement. Morningstar

10) Are there RMDs for beneficiaries of Roth accounts?

Yes. While owners avoid lifetime RMDs on Roth IRAs and (since 2024) Roth 401(k)s, beneficiaries still face distribution rules—often the 10-year rule—though qualified withdrawals can remain tax-free if the decedent’s five-year holding period was met. IRS

11) How do I document backdoor or conversion activity for taxes?

Expect a 1099-R for distributions and 5498 for contributions. You (or your preparer) must file Form 8606 for nondeductible contributions and Roth conversions to track basis and prevent double taxation. Keep statements and forms organized.

12) What if my employer plan doesn’t allow after-tax contributions—am I stuck?

You can still build Roth via direct contributions (if eligible), backdoor Roth, and standard Roth conversions in strategic years. Consider lobbying your benefits team—many plans have added after-tax plus in-plan conversion features in recent years.

Conclusion

Roth IRAs are more than a tax perk—they’re a strategic lever for tax diversification and lifetime flexibility. By maxing direct contributions when eligible, executing backdoor moves carefully, tapping the mega backdoor where plans permit, and placing the right assets in Roth, you give your future self options that a single account type can’t provide. Layer in surgical conversions during low-tax years to shrink future RMDs, and mind the five-year clocks so you don’t accidentally turn tax-free growth into taxable missteps. Finally, coordinate the Roth bucket with QCDs and RMD planning if you’re charitably inclined. None of these tactics exists in isolation; the power shows up when you align them with your cash flow, benefits, and retirement timeline.

Pick one strategy to implement this week—set up automatic contributions, open your first Roth to start the five-year clock, or run a conversion “fill-up” model—and build from there. Ready to put a plan in motion? Draft your personalized Roth roadmap and review it annually, so your tax-free bucket grows on purpose.

References

- Retirement Topics — IRA Contribution Limits, IRS, IRS

- 401(k) Limit Increases to $23,500 ; IRA Limit Remains $7,000, IRS Newsroom, Nov 1, 2024, IRS

- Publication 590-A: Contributions to Individual Retirement Arrangements (IRAs), IRS, PDF, IRS

- Publication 590-B: Distributions from Individual Retirement Arrangements (IRAs), IRS, PDF (Roth five-year rules & ordering), IRS

- Roth IRAs (overview page), IRS, IRS

- Amount of Roth IRA Contributions You Can Make (income phase-outs), Fidelity, Fidelity

- Vanguard: Roth IRA Income Limits (full/partial MAGI thresholds), Vanguard, Vanguard

- Rollovers of After-Tax Contributions in Retirement Plans (Notice 2014-54), IRS, IRS

- Notice 2024-80: Retirement Plan Dollar Limits (402(g) elective deferral), IRS, Nov 2024, IRS

- Cost-of-Living Adjustments for Benefit Plan Limits (415(c) annual additions at $70,000), IRS, IRS

- About Form 8606: Nondeductible IRAs, IRS, IRS

- Backdoor Roth IRA: How It Works (pro-rata explanation), Vanguard, Vanguard

- IRS Urges Many Retirees to Make Year-End RMDs; Designated Roth Accounts Not Subject to RMDs in 2024, IRS Newsroom, Dec 10, 2024, IRS

- Give More, Tax-Free: QCD Limit Rises to $108,000, IRS Newsroom, Nov 14, 2024, IRS

- How Asset Location Can Help Save on Taxes, Charles Schwab, Oct 11, 2024, Schwab Brokerage

- Uncover Long-Term Tax Savings with Location Optimization (White Paper), Morningstar TRX, 2016, trx.morningstar.com

- Medicare Parts A & B Premiums and Deductibles (IRMAA context & premiums), CMS Fact Sheet, Nov 8, 2024, CMS

- Medicare Costs (IRMAA overview; two-year lookback), Medicare.gov, Medicare