Habits don’t fail because you’re weak; they fail because the default environment rewards the short-term. Behavioral commitment devices change those defaults. They’re agreements, settings, or structures you set in advance that make the desired action easier—or cheating costly—when your future self is tempted. In plain English: a commitment device is anything you arrange now to keep yourself from backing out later. Used well, they make good habits “the path of least resistance.”

Quick start: pick a habit, choose a device that raises the cost of skipping, set a concrete rule (time, place, amount), decide what happens if you slip, and track visible progress. This guide covers nine field-tested commitment devices—from public pledges and accountability partners to deposit contracts, savings locks, and device-level app blocks—plus exact steps, guardrails, and examples you can copy today. Short note: this article is educational, not medical, legal, or financial advice; vet any money or health decision for your situation.

1. Public Commitments (Pledges You Make Visible)

Public commitments work by putting your reputation on the line. The mechanism is simple: when your promise is visible to others, breaking it creates social cost, and the discomfort of letting people down nudges you to follow through. This isn’t just intuition. Classic community field experiments found that residents who publicly pledged to a specific behavior (like conserving energy or recycling) followed through more than controls, and newer work shows pledges can amplify real-world campaigns (e.g., municipal waste sorting). The upshot: if your goal benefits from steady, observable actions, making it public can be a strong first lever—especially when you set clear rules for what you’ll do and how you’ll report it.

1.1 Why it matters

Public commitments convert a private intention into a social contract. You’re adding accountability and structure without needing money or apps. A citywide study on recycling showed households that signed public commitment statements recycled more than controls during the follow-up period; more recent longitudinal data finds that adding a pledge boosts the effectiveness of a broader pro-environment campaign. That transfer principle applies to personal habits: if others will see your updates, you’re more likely to prepare, show up, and avoid slippery exceptions.

1.2 How to do it

- Choose an audience: a team Slack channel, a small WhatsApp group, or your running club newsletter.

- Define the behavior: “Run 3x/week, ≥30 min, Mon/Wed/Fri, before 8am.”

- Pick an update cadence: post a screenshot or simple checkmark after each session.

- Make the pledge concrete: pin a message, sign a simple statement, or use a pledge form.

- Set a “miss” rule: if you skip, you owe a makeup session within 72 hours.

Mini-case: In a neighborhood pledge drive, participants who signed and displayed a public conservation pledge reduced energy use by double digits versus baseline; effects persisted with ongoing feedback. Your version can be smaller—say, a pinned monthly pledge thread with weekly proof posts. Tools of Change

Bottom line: If you want early momentum at low cost, make your promise visible and your progress countable. Public doesn’t need to mean “viral”—a dozen eyes is plenty.

2. Accountability Partners & Group Check-Ins

Accountability partners add a live human backstop to your plan. You agree in advance to report progress (and misses) at set times; they ask clarifying questions, celebrate wins, and apply pressure when you wobble. The social mechanism overlaps with public commitment but adds specificity and timely feedback—two ingredients tied to better adherence in behavior-change research. Reviews in medicine and behavioral science highlight that leveraging existing social networks can be a low-cost way to sustain healthy behaviors, and structured check-ins are a common pattern in successful programs. PubMed

2.1 How to do it

- Pick the right person: dependable, neutral, and willing to follow your script.

- Write a micro-contract: list your goal, metrics, check-in days/times, and what counts as “done.”

- Automate reminders: calendar invites with video links; shared note to log outcomes.

- Decide consequences: a $20 donation, an extra interval run, or doing their least favorite chore.

- Rotate roles: if you’re both pursuing goals, swap who leads and who audits.

2.2 Numbers & guardrails

- Cadence: weekly works for most habits; daily for short, critical sprints.

- Lag policy: late updates count as misses unless sent within 12 hours.

- Proof: photo, file, or app screenshot (keeps conversations factual).

Mini-case: Two colleagues agree to a 10-week writing sprint: 5 pages/week submitted by Friday 5pm; Monday 9am 15-minute audit call; $25 to an “anti-charity” for each miss. The mixture of social proof and stakes (see Section 3) creates enough friction to prevent slide-by excuses.

Bottom line: Partners transform “I’ll try” into “I promised you.” The right cadence and pre-agreed rules make it fair—and effective.

3. Deposit Contracts & Anti-Charities (Money on the Line)

Deposit contracts turn your future temptation into today’s escrow. You put money at risk that you only keep if you hit the target; otherwise it goes to a recipient you’ve preselected. Randomized trials show financial commitment can boost short-term adherence. In one JAMA trial, about 47–53% of participants in deposit or lottery incentive groups hit a 16-lb weight-loss target, versus 10.5% in control—evidence that stakes change behavior. Commitment platforms operationalize this idea: stickK routes failed stakes to a friend, charity, or “anti-charity” you oppose; Beeminder charges you when you cross a “bright red line,” with pledge amounts that escalate if you derail again. As of September 2025, both services document how charging and anti-charity options work.

3.1 Tools/Examples

- stickK: free to set up; you choose recipient (friend/charity/anti-charity) and add a referee to verify. stickK

- Beeminder: pledge increases on derailments (e.g., $5 → $10 → $30), with optional “No-Excuses Mode.” Updated help pages explain timelines for charges.

3.2 How to do it

- Pick a clear, measurable target (e.g., “log 12 workouts in 4 weeks”).

- Set a stake you’d truly hate to lose (start modestly, escalate if needed).

- Add a verifier (friend, device, or connected app).

- Define legit exceptions (e.g., injury with doctor note).

- Review weekly and reset targets as you improve.

Numeric example: You cap a Beeminder goal at $30. If you derail once, you pay $5; next time $10; then $30 for subsequent misses until you raise the cap. That rising pain helps you find your “motivation point”—high enough to stay on track, not so high you quit.

Bottom line: Money focuses attention. Use amounts that sting but don’t harm, and combine cash stakes with social proof for compounding effect.

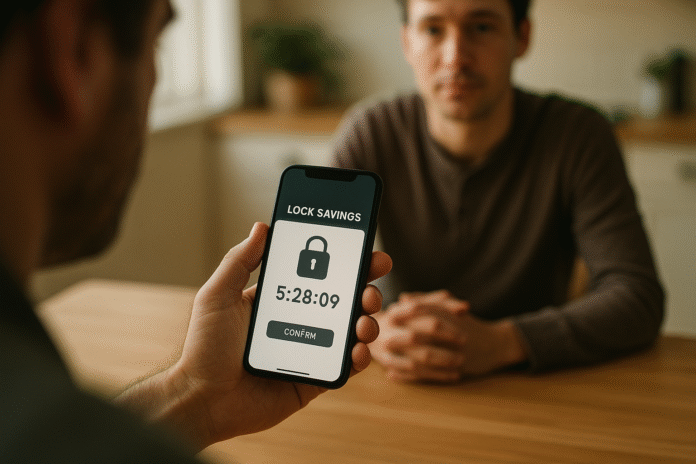

4. Commitment Savings & Locked Pots (Make Spending Harder Than Saving)

If you’re great at saving in theory but leak cash in practice, a commitment savings product can help. In a landmark randomized study in the Philippines, clients offered a restricted-access “SEED” account—locked until a date or goal—raised savings by 81 percentage points relative to control after 12 months; about 28% took up the offer. The key design: you can deposit freely, but you can’t withdraw until your pre-set rule is met. Modern consumer banking echoes this: some apps and digital banks offer “locked pots” or dated vaults you can’t dip into casually. Monzo, for example, allows users to lock a savings “Pot” for a period; you can add funds but not withdraw until the lock expires (unlocking requires extra steps and effectively closes the Pot).

4.1 How to design your “vault”

- Pick the lock rule: until date (e.g., tuition month) or until amount (e.g., $2,000 emergency fund).

- Automate deposits: payroll split or standing order on payday.

- Name the goal visibly: “Visa payoff,” “6-month cushion.”

- Add friction to withdrawals: separate bank, 1–2 day transfer delay, or app lock.

- Escalate later: raise the auto-transfer by 1–2% quarterly.

4.2 Region notes & examples (as of Sep 2025)

- Monzo (UK): “Locking Pots” prevent withdrawals until the chosen time; you can still add money.

- Revolut: rebranded “Vaults” into Pockets; Savings Vaults earn interest and live in a separate flow (locking rules vary by region/product). Revolut

Mini-case: You plan a $1,200 dental bill in March. In September, you lock a pot until March 1, auto-moving $200/month. The lock neutralizes “I’ll just borrow from it” moments; on March 1, the money’s ready without a willpower tax.

Bottom line: If spending is automatic, make saving automatic—and spending inconvenient.

5. App & Site Blockers (Device-Level Self-Binding)

When your phone is the temptation, block the trigger itself. Device-level controls let you pre-commit to app limits, focus modes, and downtime windows where selected apps and sites won’t open. On iPhone and iPad, Apple’s Screen Time lets you set app limits and scheduled downtime, with a passcode that prevents impulsive changes. On Android, Digital Wellbeing adds Focus mode (pause chosen apps), app timers, and schedules; many OEMs include similar features. These are built-in, free, and (as of September 2025) actively maintained.

5.1 How to do it (10-minute setup)

- List your top 3 distractors (e.g., TikTok, Instagram, Reddit).

- iOS/iPadOS: Settings → Screen Time → App Limits (set 15–30 min/day) and Downtime (e.g., 9pm–7am). Lock with a Screen Time passcode. Apple Support

- Android: Settings → Digital Wellbeing → Focus mode (choose apps to pause) and app timers; set an automatic schedule.

- Add a buddy lock: have a friend hold the passcode for the first 30 days.

5.2 Common pitfalls (and fixes)

- “I just override it.” Use “Block at Downtime” (iOS) and schedule Focus mode; keep the passcode with a partner. Apple Support Community

- “I need exceptions.” White-list essentials (Maps, Banking, Messages).

- “I work at night.” Create multiple schedules tied to calendar blocks.

Mini-case: A student blocks social apps entirely from 10pm–7am and sets 20-minute app timers during the day. Nighttime doomscrolling drops to zero; study blocks improve because the fastest escape routes are closed.

Bottom line: Don’t battle notifications with willpower. Pre-commit your devices to be boring when it matters.

6. Implementation Intentions (If-Then Plans That Bind Your Future Self)

Implementation intentions are “if X, then I will do Y” plans that pre-decide the cue, context, and action. They sound simple, but a landmark 2006 meta-analysis found they substantially improved goal attainment across domains by automating the response once the trigger appears. Think of them as mental contracts that reduce dithering at the moment of choice: “If it’s 7:00am on weekdays, I lace up and walk for 20 minutes.” The large literature shows effects on initiating action and shielding ongoing pursuit from distractions. Combining if-then plans with external proof (calendar holds, partner texts) turns them into robust commitment devices.

6.1 How to write a strong if-then

- One cue, one action: “If my lunch break starts, I walk 10 minutes.”

- Specify context: time, place, duration, minimum action.

- Pre-load tools: shoes by the door; water bottle filled.

- Add a back-up plan: “If it’s raining, I do 10 squats x 3 at home.”

- Bind it socially: text your partner a ✅ photo after each session.

6.2 Numbers & guardrails

- Use weekday cues for routines; event cues for sporadic tasks.

- Keep the action binary (did/didn’t), not “try harder.”

- Review weekly; refine cue/action pairs that fail twice.

Mini-case: “If I finish dinner, I floss immediately before any screen time.” The cue is reliable; the action is short; the reward (screen time) is gated by the plan. After 21 days, the behavior runs on autopilot.

Bottom line: If-then plans are tiny contracts your future self keeps without debate.

7. Temptation Bundling (Pair “Shoulds” With “Wants”)

Temptation bundling solves two problems at once: you pair an instantly gratifying activity you want (e.g., a favorite audiobook) with a task you should do (e.g., workouts), and restrict the “want” to the moments you’re doing the “should.” In a field experiment, pairing audiobooks with gym visits increased gym attendance during the intervention; the researchers also documented a willingness to pay for bundles—evidence that people value the commitment itself. This works outside the gym, too: reserve a premium coffee podcast for your commute only if you cycle; watch your favorite show only while meal-prepping.

7.1 How to do it

- List 3 “shoulds” (exercise, studying, inbox zero).

- List 3 “wants” (audiobook series, favorite show, special latte).

- Create exclusive pairs (want unlocked only during the should).

- Set rules and proof (photo at the gym, timer during prep).

- Remove other access to the “want” (logouts, app limits).

7.2 Tools/Examples

- Audio apps: reserve a series for workouts only.

- Streaming: one show allowed for chores; use watchlists to gate it.

- Cafés: premium drink ≠ allowed unless you biked there.

Mini-case: You allow yourself one episode of a favorite series only while cooking a week’s lunches every Sunday afternoon. The time flies; you batch-cook consistently because the fun is attached.

Bottom line: Make the right action the only way to get your treat.

8. Physical Self-Binding (Time-Lock Boxes & Environment Design)

Sometimes the most reliable block is physical: remove or delay access to temptations. A time-locking container like kSafe lets you set a countdown (up to days) during which the box can’t be opened—no overrides—until the timer expires. People use it for phones during deep work, snacks, credit cards, or game controllers on weeknights. The design principle is clean: you pre-commit during a calm moment so that later, when cravings spike, the decision is already made—and physically enforced.

8.1 What to lock (and for how long)

- Phones during focus: 60–120 minutes.

- Credit card at home: weekday work hours.

- Snacks or vapes: evenings; re-stock weekly only.

- Game controllers: school nights until Friday 6pm.

8.2 Guardrails

- Keep a true emergency workaround (not for minor discomfort).

- Place the box out of sight; pair with device/app limits for redundancy.

- Combine with a partner who “supervises” the timer when stakes are high.

Mini-case: A freelancer locks their phone 9–11am on weekdays. Revenue climbs after two months as deep-work hours stop getting cannibalized by micro-scrolls. The time-lock becomes a daily ritual that removes the debate entirely.

Bottom line: When in doubt, lock it away. Physical friction beats willpower in the heat of the moment.

9. Self-Exclusion From High-Risk Environments (Casinos, Betting, Apps)

Self-exclusion is a formal commitment to ban your future self from environments that trigger overspending or addiction (e.g., online casinos, betting apps, sometimes even physical venues). Research on voluntary self-exclusion suggests it can reduce gambling frequency and financial losses, though breaches happen and program design matters; prevalence is low globally, awareness is limited, and strong enforcement improves outcomes. If gambling or specific apps are your kryptonite, self-exclusion triggers are among the strongest hard-commitment levers available—best paired with counseling and ongoing supports. ScienceDirectPMCPMC

9.1 How to do it (safely)

- Start with a counselor or helpline to choose the right duration/scope.

- Use official mechanisms: national or operator lists; add device-level blocks.

- Close loopholes: verify identity on all platforms; request marketing opt-outs.

- Add social support: share the exclusion with a partner; weekly check-ins.

- Stack with blockers: DNS/site blockers, Screen Time/Digital Wellbeing schedules.

9.2 Numbers & notes

- A 2023 review found that breaching during exclusion is common (e.g., ~49% in one national system), so layered controls and venue cooperation are key. Short exclusions can reduce cravings but may be too brief to change long-term behavior.

Mini-case: After a rash of late-night sportsbook losses, you enroll in a 1-year nationwide self-exclusion and block gambling domains on every device. You also schedule weekly counseling. The combination removes easy access while you build alternative coping routines.

Bottom line: For high-risk triggers, formal bans plus support beat willpower. Treat self-exclusion as a serious safety rail, not a standalone cure.

FAQs

1) What exactly are behavioral commitment devices?

They’re pre-arranged constraints, incentives, or structures you set now so that later—when tempted—you either can’t deviate, or deviating is costly or embarrassing. Examples include public pledges, accountability partners, deposit contracts that send money to charity if you miss, locked savings pots, app blocks, and self-exclusion lists. They shift the environment instead of relying on moment-to-moment willpower.

2) How do I choose the right device for my goal?

Match the failure mode to the device. If you skip because you forget or hesitate, try implementation intentions plus a partner. If you doomscroll, use device-level blocks. If you splurge, try locked pots and deposit contracts. If a context is dangerous (e.g., gambling), choose self-exclusion and counseling. Start with the smallest device that consistently stops the miss, then escalate.

3) Do money-at-stake contracts really work long-term?

They can create strong short-term adherence and are useful to jump-start habits. Evidence from randomized trials shows meaningful improvements during the incentive period for goals like weight loss, though maintaining results after incentives end requires transitioning to routines and identity. Use escalating stakes for 8–12 weeks, then taper into maintenance structures.

4) What if public commitments backfire or stress me out?

Public doesn’t have to mean “the whole internet.” Use a small, trusted group and clear, fair rules. Field studies show pledges can amplify behavior change, but you should minimize shame and maximize specificity. If anxiety spikes, switch to a private accountability partner with structured check-ins. PNAS

5) Are locked savings accounts safe if I might need cash in an emergency?

Good products allow emergency unlocks under strict criteria, or you can keep a separate unlocked emergency fund while locking goal-based pots. In research, commitment savings products restricted withdrawals until a date or amount and still improved balances; consumer apps often let you add money while blocking withdrawals until the lock expires. Design your own “break glass” rule for true emergencies.

6) Can Screen Time/Digital Wellbeing be bypassed?

Any control can be bypassed with enough effort, which is why the combination—device limits + social oversight + time-locking tools—works best. Use passcodes held by a partner, enable “Block at Downtime,” and pair with physical or financial stakes during critical hours.

7) Is temptation bundling just “rewarding myself”?

It’s more structured. You restrict the “want” (audiobook, show, premium treat) only to the moments you’re doing the “should.” Field experiments show bundling can raise adherence during the intervention window. That makes it a true commitment—not just a bribe—because access is contingent on the target behavior.

8) What’s the difference between “hard” and “soft” commitments?

Hard commitments impose real costs for deviating (money loss, access blocked, public record). Soft commitments add structure and expectation without strict penalties (implementation intentions, partner check-ins). Reviews in economics distinguish both types; many people benefit from layering them: plan → social proof → stakes.

9) Can commitment devices backfire?

Yes—if they’re mis-sized or mis-matched. Choosing the wrong contract can reduce welfare (e.g., overly harsh penalties for a goal you don’t truly value). Start soft, calibrate stakes, and prefer reversible designs until you’re confident. Evidence suggests selection into ill-suited commitments can harm; choose thoughtfully.

10) How long should I use a commitment device?

Use it as “training wheels” until the behavior is ingrained. Many people need 6–12 weeks of strong scaffolding, then taper. Keep light versions—like a weekly check-in or small pledge—during maintenance. If you relapse, re-activate stronger constraints for another cycle.

Conclusion

Commitment devices aren’t about willpower—they’re about architecture. You arrange your environment, money, and social world so that following through is cheaper than failing. Across the nine devices in this guide, the pattern repeats: define the behavior precisely, pre-commit (socially, financially, or physically), make the rule observable, and close the obvious loopholes. Start with a simple public pledge and if-then plan; add an accountability partner and device blocks if you stall; use deposit contracts or locked pots when money leaks; and keep self-exclusion available for high-risk contexts. You’ll notice a secondary benefit: as your systems take over, you think less about the habit and simply live it. That’s the goal.

Copy-ready next step: Pick one habit and one device from Sections 1–3, set it up for the next 21 days, and tell one person today.

References

- Tying Odysseus to the Mast: Evidence from a Commitment Savings Product in the Philippines, Quarterly Journal of Economics (Ashraf, Karlan, Yin), 2006. Professor Nava Ashraf

- Financial Incentive–Based Approaches for Weight Loss, JAMA (Volpp et al.), 2008. JAMA Network

- Implementation Intentions and Goal Achievement: A Meta-Analysis of Effects and Processes, Advances in Experimental Social Psychology (Gollwitzer & Sheeran), 2006. ScienceDirect

- Holding the Hunger Games Hostage at the Gym: An Evaluation of Temptation Bundling, Management Science (Milkman, Minson, Volpp), 2014; open-access version via PMC. PMC

- Commitment Devices, Annual Review of Economics (Bryan, Karlan, Nelson), 2010. Annual Reviews

- Use Screen Time on your iPhone and iPad, Apple Support, updated 2025. Apple Support

- Manage time on Android with Digital Wellbeing (Focus mode & timers), Google Support. Google Help

- Locking Pots, Monzo Help, accessed Sep 2025. Monzo

- About/FAQ, Beeminder Help Pages (pledge escalation; derailment), updated 2025. and https://help.beeminder.com/article/17-what-happens-when-i-derail and https://help.beeminder.com/article/20-how-much-do-i-pledge-on-my-goals Beeminderhelp.beeminder.com

- How it Works / Anti-Charity, stickK Help Center, accessed Sep 2025. and https://stickk.zendesk.com/hc/en-us/articles/206833337-What-s-an-Anti-Charity stickk.zendesk.com

- kSafe by Kitchen Safe (Time-Lock Container), official site, accessed Sep 2025. kSafe by Kitchen Safe

- Self-exclusion and Breaching of Self-Exclusion from Gambling, Addictive Behaviors Reports (Håkansson et al.), 2023. PMC

- Effectiveness of a Voluntary Casino Self-Exclusion—Online, Addictive Behaviors Reports (Yakovenko et al.), 2021. ScienceDirect

- Save More Tomorrow™: Using Behavioral Economics to Increase Employee Saving, Journal of Political Economy (Thaler & Benartzi), 2004. https://www.journals.uchicago.edu/doi/10.1086/380085 Chicago Journals

- Increasing Community Recycling with Public Commitment, Journal of Applied Social Psychology (Burn & Oskamp), 1986; abstract and PDF links. and https://digitalcommons.calpoly.edu/cgi/viewcontent.cgi Wiley Online Library

- When Commitment Fails—Evidence from a Field Experiment, 2018 working paper. Yale Department of Economics