Tracking your net worth effectively is one of the simplest, highest-leverage habits in personal finance. Your net worth—what you own minus what you owe—shows you whether your money choices are moving you forward or backward. In the first 100 words of this guide, you’ll learn how to define net worth, set up a consistent tracking system, avoid the most common mistakes, and turn a monthly snapshot into a decision-making dashboard. This article is for beginners and seasoned planners alike who want a practical, repeatable approach that doesn’t require pricey software or complicated math.

Disclaimer: The information below is educational and general in nature. It is not financial, tax, accounting, or legal advice. For guidance tailored to your situation, consult a qualified professional.

Key takeaways

- Net worth = assets − liabilities; tracking it regularly turns scattered money facts into a clear story of progress.

- Consistency beats complexity: standardize categories, valuation rules, and a monthly “close” date.

- Document your assumptions so you can explain every number and spot errors fast.

- Focus on trends and ratios, not just the total; graphs make patterns obvious.

- Protect your data and audit your numbers with a light but disciplined checklist.

Tip 1: Build a complete, no-nonsense inventory of what you own and what you owe

What it is and why it matters

Your inventory is the foundation of an accurate net worth. It’s a list of assets (cash, investments, property, business interests, valuables) and liabilities (mortgage, student loans, credit cards, taxes owed, other debts). When this list is complete and current, the net worth calculation becomes trivial—and trustworthy.

Core benefits

- Gives you a single source of truth for your finances.

- Reveals hidden fees, inactive accounts, or debts you forgot about.

- Makes progress measurable month to month.

Requirements and low-cost alternatives

- Requirements: 60–90 minutes of quiet time, recent account statements, a calculator or spreadsheet, and internet access for price checks.

- Low-cost alternatives: A simple paper ledger or a free spreadsheet template. If aggregators are unavailable or expensive, manual updates work fine once a month.

Step-by-step instructions

- List your assets. Start with cash and cash-equivalents, investment accounts, retirement accounts, real estate, business equity, and any high-value items that could reasonably be sold (e.g., a car).

- List your liabilities. Include every loan and revolving balance: mortgages, personal loans, student loans, credit cards, installment plans, unpaid taxes, and any money you’ve borrowed from individuals.

- Assign a value to each item.

- Cash and deposits: face value on statement date.

- Public investments: closing value on your chosen “close” date.

- Real estate and vehicles: reasonable market estimates (see Tip 3 for valuation rules).

- Business interests: start conservatively; if in doubt, begin with book value or zero and revise later.

- Check for completeness. Compare against prior statements and personal memory: did you include that wallet app, the dormant savings account, or the old store card?

- Calculate your net worth: sum of assets minus sum of liabilities.

Beginner modifications and progressions

- Beginner: Track only the big items (bank accounts, investments, mortgage, major loans).

- Progression: Add secondary assets (HSA, brokerage sub-accounts, employer stock), then valuables, then private business interests. Keep a note next to each line for how you valued it.

Recommended frequency and metrics

- Frequency: Inventory quarterly; update balances monthly.

- KPI to watch: the completeness ratio—how many accounts are still “unknown” this month? Aim for zero.

Safety, caveats, and common mistakes

- Don’t double-count. If your checking account shows a pending credit card payment, don’t reduce the cash and the liability for the same transaction twice.

- Don’t inflate values. Use current market values, not purchase prices.

- Don’t forget contingent liabilities. If you co-signed a loan, it belongs on your list with a clear note.

Mini-plan example (2–3 steps)

- Download the latest statements for every bank, investment, and loan account.

- Enter balances into a two-column sheet (Assets/Liabilities) and compute the total.

- Flag any “unknown value” items to resolve in the next 7 days.

Tip 2: Standardize your system—categories, templates, and a repeatable monthly workflow

What it is and why it matters

A standardized system is a template plus a routine. Without standardization, your “net worth” becomes an apples-and-oranges comparison, and trends become meaningless. With it, you can close the month quickly and make consistent, comparable decisions.

Core benefits

- Cuts your monthly update time from hours to minutes.

- Reduces errors because every month follows the same checklist.

- Enables meaningful charts and ratios.

Requirements and low-cost alternatives

- Requirements: A spreadsheet (or simple accounting software), a recurring calendar reminder, and a short checklist.

- Low-cost alternatives: Use a free cloud spreadsheet for portability and automatic backups.

Step-by-step instructions

- Create your categories. Group assets into Cash, Investments, Retirement, Real Estate, Business, and Other; group liabilities into Mortgage/Real Estate Debt, Education, Consumer/Installment, Revolving/Credit Cards, and Other.

- Pick a monthly “close” date. End-of-month is common; mid-month works too if your pay cycle fits. Consistency is more important than the exact day.

- Lock your structure. Freeze headers, lock formula cells, and protect your template so you edit only the yellow input cells.

- Add a “Notes & Assumptions” tab. Record how you valued each non-liquid item (e.g., “Home value based on three local comparable listings; re-review each quarter”).

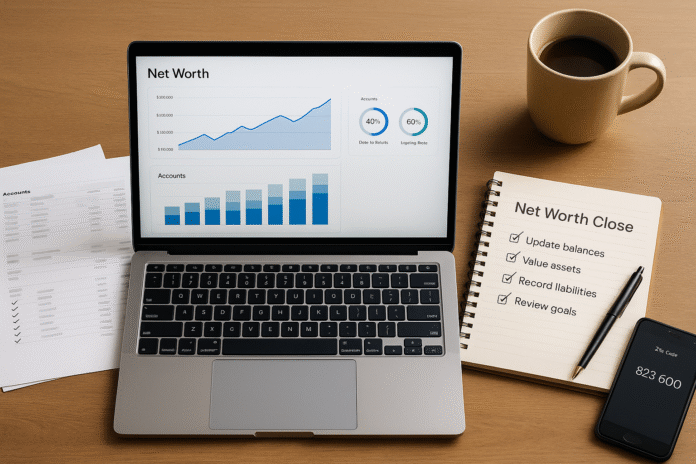

- Create a one-page dashboard. Include total net worth, monthly change (absolute and %), and a 12-month trend line.

- Schedule your routine. Put a 30–45 minute “Net Worth Close” on your calendar each month.

Beginner modifications and progressions

- Beginner: Download a simple template with just five asset lines and five liability lines; one chart for total net worth.

- Progression: Add sub-accounts, debt payoff timelines, separate tabs for property valuation and business interests, and a rolling 12-month change chart.

Recommended frequency and metrics

- Frequency: Do your “close” monthly; refresh valuation assumptions for illiquid assets quarterly.

- KPIs: monthly Δ Net Worth (change), % Change, and Debt-to-Assets Ratio.

Safety, caveats, and common mistakes

- Changing categories mid-year. If you rename or regroup, keep a mapping so historical charts still make sense.

- Over-automating too early. Manual first, then automate one step at a time to ensure you understand your own data.

Mini-plan example (2–3 steps)

- Set a monthly reminder titled “Net Worth Close” on the last business day of the month.

- Build a one-page template with asset/liability sections and a total that calculates automatically.

- Add a “Notes & Assumptions” section and commit to updating it every time you change a valuation method.

Tip 3: Use consistent valuation rules (and adjust for currency and inflation)

What it is and why it matters

Valuation rules ensure you value each asset the same way every month. That way, a change in your net worth reflects reality—not a different method. For example, valuing a home by last year’s purchase price in January and by a high app estimate in February creates noise, not insight.

Core benefits

- Keeps your trend line honest and decision-useful.

- Makes illiquid assets (property, private business) comparable over time.

- Lets you report both nominal (raw) and real (inflation-adjusted) net worth.

Requirements and low-cost alternatives

- Requirements: Your chosen “as-of” date, access to current price data for market assets, a simple way to estimate fair market value for property and vehicles, and a basic inflation index for your region if you want real-terms tracking.

- Low-cost alternatives: For property, start with a conservative median of three comparable listings or a broker’s letter; for vehicles, a median of local listing prices. For inflation, use the main consumer price index for your country.

Step-by-step instructions

- Define your “as-of” rules.

- Public investments: closing balance on your close date.

- Bank accounts: statement balance on the same date.

- Real estate: estimated market value using a consistent method (e.g., median of three comps); update quarterly unless a sale or appraisal occurs.

- Vehicles: estimated private-party sale value; update semi-annually.

- Business interests: a conservative estimate using book value, recent comparable transactions, or a simple revenue multiple with a haircut; update annually.

- Document each method in your Notes & Assumptions tab. Include the date, the source or approach, and why you chose it.

- Handle foreign currency. Fix a rule like “Use the central bank daily rate on the close date” and apply it every month.

- Optionally compute real net worth. Divide your net worth by the relevant consumer price index (scaled to a base year) to strip out inflation and reveal purchasing-power trends.

- Revisit rules once a year. If your market changed (for example, property prices became volatile), consider adjusting frequency or method—but document the change so charts remain interpretable.

Beginner modifications and progressions

- Beginner: Ignore inflation adjustment at first; use only end-of-month values from statements.

- Progression: Add a second line on your dashboard for real net worth. Track both so you can see growth beyond inflation.

Recommended frequency and metrics

- Frequency: Apply your valuation rules monthly; refresh non-market asset assumptions quarterly or when a major event occurs (renovation, appraisal, business sale).

- KPIs: Real Net Worth, Nominal vs. Real Δ, Illiquid Share of Assets (helps you see liquidity risk).

Safety, caveats, and common mistakes

- Cherry-picking. Don’t choose the highest comp or the day with the best exchange rate. Consistency over optimism.

- Over-precision on illiquid items. Round to the nearest realistic figure and keep your method documented.

- Taxes and selling costs. For large illiquid assets, optionally track a second column showing an after-cost value (estimated selling costs and potential taxes) to avoid illusions of liquidity.

Mini-plan example (2–3 steps)

- Write a one-sentence rule for each asset type (e.g., “Home value = median of 3 local comps each quarter”).

- Add an “Inflation index” cell and a formula to compute real net worth off your national CPI.

- Note your chosen FX source and apply it to any foreign-currency balances on close day.

Tip 4: Track the right metrics and visualize trends so you make better decisions

What it is and why it matters

A single number is encouraging, but trends and ratios tell the story. Visuals make it easy to spot plateaus, seasonality, or risk concentrations. The point isn’t to admire the chart; it’s to trigger smarter actions like debt pay-downs, rebalancing, or increasing savings.

Core benefits

- Turns a monthly routine into actionable insights.

- Helps you separate market noise from real progress.

- Surfaces hidden risks (too much leverage, too little liquidity).

Requirements and low-cost alternatives

- Requirements: Your standardized sheet from Tips 1–2 and a basic chart tool.

- Low-cost alternatives: Any spreadsheet can build line charts, bar charts, and simple ratios; no paid software is required.

Step-by-step instructions

- Build your core charts.

- A 12–36 month net worth line.

- A monthly change bar (positive/negative).

- A stacked assets area chart to visualize composition (cash vs. investments vs. property).

- Add three decision-useful ratios.

- Debt-to-Assets = Total Liabilities / Total Assets.

- Liquidity Ratio = (Cash + Cash-equivalents) / Total Expenses for the last month(s).

- Concentration Ratio = Largest Asset / Total Assets.

- Connect to goals. Set target bands (e.g., “Keep Debt-to-Assets under X,” “Maintain at least Y months of expenses in liquid assets,” “No single asset above Z%”).

- Create alerts. If your change dips below zero for three months or a ratio breaches a band, schedule a review.

Beginner modifications and progressions

- Beginner: Track only total net worth and monthly change.

- Progression: Add ratios and composition charts, then a goal tracker showing trajectory vs. target.

Recommended frequency and metrics

- Frequency: Review charts monthly; do a deeper quarterly review of goals, risk, and asset allocation.

- KPIs: 12-month trend slope, volatility of monthly change, and the three ratios above.

Safety, caveats, and common mistakes

- Comparing to others. Your plan, your progress; comparisons invite bad decisions.

- Chasing performance. A big market month isn’t a reason to shift strategy without a plan.

- Ignoring volatility. If your monthly change swings wildly, explore whether the driver is markets, income variability, or valuation method noise.

Mini-plan example (2–3 steps)

- Create a line chart of your last 12 months of net worth.

- Add a bar chart of monthly change beneath it.

- Set one alert: if three negative months happen in a row, you’ll review spending and debt strategy.

Tip 5: Protect your data and audit your numbers like a pro

What it is and why it matters

Your net worth file contains sensitive information. Protecting it—and auditing it—prevents both security issues and quiet calculation errors that compound over time. A simple, repeatable control process takes minutes and saves headaches.

Core benefits

- Reduces the risk of identity theft and unauthorized access.

- Keeps your figures accurate so decisions are based on reality.

- Makes it easier to collaborate with a partner or advisor without oversharing.

Requirements and low-cost alternatives

- Requirements: Strong, unique passwords, multi-factor authentication, offline or cloud backups, and a short audit checklist.

- Low-cost alternatives: Use a free password manager, enable built-in multi-factor on your accounts, and keep an encrypted copy of your spreadsheet in a second location.

Step-by-step instructions

- Harden access. Enable multi-factor authentication for email and any financial logins; store passwords in a manager; avoid reusing passwords.

- Create backups. Keep at least one off-device backup (e.g., cloud + encrypted USB). Name files with the date to avoid overwriting history.

- Run a monthly audit.

- Tick-mark each account against its statement.

- Reconcile cash movements (e.g., if you paid a loan, does both cash down and liability down appear?).

- Recompute totals with a fresh formula (or a separate sheet) to catch broken links or references.

- Review credit reports. This helps validate liabilities and spot identity issues or erroneous accounts.

- Keep a change log. If you change a valuation method or category, write down the “what” and “why.”

Beginner modifications and progressions

- Beginner: Start with multi-factor authentication and a single cloud backup.

- Progression: Add an encrypted offline copy, a monthly audit checklist, and a quarterly credit-report review.

Recommended frequency and metrics

- Frequency: Security once now and then annually; backups monthly; audit monthly; credit report review at least annually (or more frequently if available in your region).

- KPI: Audit exceptions resolved—aim to close any discrepancies within one week.

Safety, caveats, and common mistakes

- Emailing spreadsheets. Avoid sending your file unencrypted; if you must share, use a password-protected link with limited access.

- Keeping personally identifying information you don’t need. Remove full account numbers, security questions, or copies of IDs from your financial folder.

- Ignoring small discrepancies. Small reconciliation issues tend to reveal larger misunderstandings.

Mini-plan example (2–3 steps)

- Turn on multi-factor authentication for email and banking today.

- Make an encrypted backup of your net worth file and store it in a second location.

- Add a one-page audit checklist to your template.

Quick-start checklist (10 minutes to ready, 45 minutes to done)

- Download your latest account and loan statements.

- Open a clean net worth template with fixed categories.

- Pick a “close” date (e.g., last day of the month).

- Enter asset balances and liability balances.

- Apply your valuation rules for property/vehicles.

- Compute total net worth and monthly change.

- Add a short note for every assumption you made.

- Build a simple 12-month line chart.

- Enable multi-factor authentication and save an encrypted backup.

- Schedule next month’s “Net Worth Close.”

Troubleshooting & common pitfalls

“My numbers jump around a lot.”

Likely causes: inconsistent valuation dates, changing FX rates without a rule, or market volatility in a concentrated portfolio. Fix by standardizing your “as-of” date, defining a currency rule, and adding a composition chart to see concentration.

“I keep forgetting an account.”

Start a one-time “Account Hunt”: search your email for “statement,” “login,” and “password reset.” Add each discovery to your template and your password manager.

“Our household is mixed currency.”

Set a simple rule: use the official daily or month-end rate from one source on close day. Record it in a “Rates” tab and reference it in your balances.

“I’m not sure how to value my business.”

Be conservative. If there’s no reasonable market comp, start at book value or zero; track a separate “operating metrics” dashboard for the business and update your personal net worth only after material events (sale, funding, audit).

“I don’t want to include my car or furniture.”

You don’t have to include every item. Many people exclude low-value personal property because it’s not decision-relevant. Be consistent month to month.

“My partner and I track differently.”

Agree on a shared template and definitions. If your goals differ, keep a joint net worth plus individual tabs. Clarity beats compromise that muddles the numbers.

“I’m worried about privacy.”

Keep only what you need: balances and valuation notes. Don’t store full account numbers, addresses, or ID scans in the same folder as your net worth file.

How to measure progress or results (what “good” looks like)

- Trend direction: Is your 6–12 month trend line sloping up?

- Source of change: Split monthly change into savings/debt payoff vs. market movement/valuations. If markets are flat but net worth rises, your behaviors are working.

- Risk profile: Are your ratios within target bands (Debt-to-Assets, Liquidity, Concentration)?

- Data quality score: No missing accounts, zero audit exceptions, all assumptions dated and documented.

- Real vs. nominal: Is your real net worth growing, not just keeping pace with inflation?

A simple 4-week starter plan (first month)

Week 1 — Set your foundation

- Choose your template and categories.

- Gather all statements and list every asset and liability.

- Write your valuation and currency rules.

- Turn on multi-factor authentication and set up backups.

Week 2 — Do your first “close”

- Pick a close date and enter balances as of that day.

- Build a dashboard with a 12-month chart (start with 1 month and extend each month).

- Add a one-page “Notes & Assumptions” tab with dates.

Week 3 — Add clarity and controls

- Reconcile one discrepancy (if any).

- Create your three ratios and set target bands.

- Add an alert rule (e.g., three negative months triggers a review).

Week 4 — Review and make it a habit

- Do a mini-retrospective: what took the longest? Where did you guess?

- Simplify your template where possible; automate one step (e.g., a link to a CSV export).

- Schedule next month’s close and block 45 minutes for it.

FAQs

1) What exactly counts as an asset for net worth purposes?

Anything you own that has monetary value: cash, bank accounts, investments, retirement accounts, real estate, vehicles, and business interests. Many people exclude low-value personal items unless they’re easily saleable.

2) Should I include my home?

Yes, if you plan to value it consistently. Use a conservative market estimate and review quarterly. Pair it with the mortgage liability so you see equity accurately.

3) How do I treat retirement accounts that have taxes or penalties on withdrawal?

Record the full balance for net worth tracking, then optionally add a second “after-tax” view if that helps planning. Note your assumptions rather than guessing each month.

4) How often should I update my net worth?

Monthly is the sweet spot for most people: it’s frequent enough to see trends, not so frequent that you chase noise. Quarterly can work if your finances are simple.

5) What if my net worth is negative?

That’s common early in a career or during debt payoff. Focus on trend: reduce high-interest debt, build savings habits, and track steady improvement month over month.

6) How should I value a car?

Use a realistic private-party sale value from recent local listings and update semi-annually. Avoid using the original purchase price.

7) Do I need fancy software to track this?

No. A basic spreadsheet handles categories, charts, and ratios. Start simple; only add tools if they save time or reduce errors.

8) How do I handle assets or debts in another currency?

Pick a single official exchange rate source and apply the rate from your close date. Record the rate used each month so your history is consistent and auditable.

9) What if my partner and I have different money systems?

Agree on shared definitions for joint assets and liabilities. Track a joint net worth plus individual tabs. Meet monthly for a 20-minute review.

10) How do I know if I’m improving for real or just riding the market?

Split your monthly change into two drivers: net saving/debt payoff vs. market moves/valuation changes. The first shows your behavior; the second is noise you accept or manage.

11) Should I list loans to family or friends as assets?

If there’s a signed agreement and a realistic payback plan, include it—perhaps at a conservative value. If not, you may treat it as a gift for tracking purposes to avoid misleading your net worth.

12) Is there a right way to track valuables like art or jewelry?

Include only items with a demonstrable market and use a conservative fair market value method. Update infrequently and document how you arrived at the figure.

Conclusion

When you standardize your categories, lock in clear valuation rules, and close the books on a predictable schedule, net worth tracking becomes fast, accurate, and genuinely useful. You’ll see what’s working, catch errors before they snowball, and make confident choices about saving, investing, and debt payoff—not because you stared at a number, but because you built a system you trust.

Call to action: Open your calendar, book a 45-minute “Net Worth Close” this month, and start your trend line today.

References

- Net Worth: What It Is and How to Calculate It, Investopedia, updated May 10, 2025. https://www.investopedia.com/terms/n/networth.asp

- The One Financial Number You Shouldn’t Ignore: Your Net Worth, Investopedia, April 2025. https://www.investopedia.com/tracking-your-net-worth-11679626

- Consumer Price Index Frequently Asked Questions, U.S. Bureau of Labor Statistics, April 30, 2025. https://www.bls.gov/cpi/questions-and-answers.htm

- Consumer Price Indexes Overview, U.S. Bureau of Labor Statistics, September 9, 2024. https://www.bls.gov/cpi/overview.htm

- Publication 561: Determining the Value of Donated Property (PDF), Internal Revenue Service, December 2024. https://www.irs.gov/pub/irs-pdf/p561.pdf

- About Publication 561: Determining the Value of Donated Property, Internal Revenue Service, March 28, 2025. https://www.irs.gov/forms-pubs/about-publication-561

- Free Credit Reports | Consumer Advice, Federal consumer protection agency, 2023. https://consumer.ftc.gov/articles/free-credit-reports

- You now have permanent access to free weekly credit reports, Federal consumer protection agency (Consumer Alerts), October 2023. https://consumer.ftc.gov/consumer-alerts/2023/10/you-now-have-permanent-access-free-weekly-credit-reports

- AnnualCreditReport.com — Getting Your Reports, AnnualCreditReport.com, current page. https://www.annualcreditreport.com/gettingReports.action

- AnnualCreditReport.com — Home, AnnualCreditReport.com, current page. https://www.annualcreditreport.com/index.action