If you’ve ever set a money goal only to watch it fade under day-to-day demands, you’re not alone. The good news? Reaching your saving targets has far less to do with willpower and far more to do with how you design your system. This guide breaks down a practical, step-by-step method to set goals that actually stick, automate momentum, choose the right accounts, engineer your cash flow, and measure progress with the same clarity you’d bring to a project at work. Whether you’re building an emergency cushion, planning a wedding, or saving for a down payment, you’ll find clear instructions, examples, and a simple 4-week plan to get moving today.

Disclaimer: The information below is educational and general in nature. It isn’t financial advice. For personalized guidance, consult a qualified professional who can consider your specific circumstances.

Key takeaways

- Systems beat willpower. Turn vague wishes into specific, time-bound saving targets and link them to concrete actions you control.

- Automate everything you can. Automatic transfers and split direct deposits make saving the default—not a monthly debate.

- Match money to the goal. Use liquid, insured accounts for near-term needs; use dedicated “sinking funds” for planned expenses; invest only for longer timelines.

- Track a few key metrics. Savings rate, months of expenses saved, goal funding % and streaks of successful transfers tell you what’s working.

- Review monthly. Short, recurring “money dates” prevent drift, reveal leaks, and keep your plan aligned with real life.

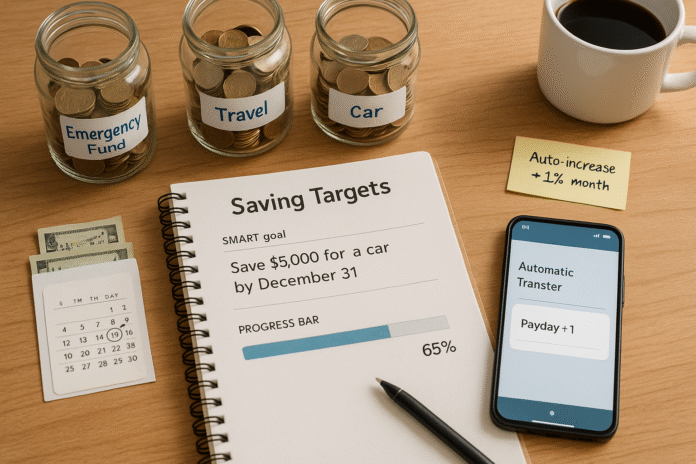

Tip 1: Turn Vague Goals into SMART, Prioritized Targets

What it is & why it works

Saving “more” is a hope. A saving target is a commitment: “Save 600,000 PKR for a six-month emergency fund within 12 months by transferring 50,000 PKR every payday.” SMART goals—specific, measurable, achievable, relevant, and time-bound—turn intention into a plan you can act on and track. Prioritizing targets (what gets funded first, second, third) helps your limited resources do the most good fast.

Core benefits

- Provides clarity: you’ll know exactly what “done” looks like.

- Reduces procrastination: if the next step is obvious, you won’t stall.

- Increases follow-through: visible progress keeps motivation high.

Requirements & low-cost alternatives

- Requirements: a notebook or notes app, access to recent bank statements, a calculator (phone is fine).

- Low-cost alternatives: printable goal worksheet or a free spreadsheet; no paid app required.

Step-by-step instructions

- List your top 5 money outcomes (e.g., emergency fund, travel, car replacement, rent deposit, down payment).

- Make each SMART. Example: “Save 200,000 PKR for a new laptop by May 1 next year by allocating 16,700 PKR monthly.”

- Rank by urgency and impact. Emergencies and high-cost essentials first; nice-to-haves later.

- Define success metrics for each (target amount, deadline, monthly/bi-weekly transfer amount).

- Pre-mortem the obstacles. Ask: “What could derail this?” (e.g., seasonal expenses, irregular income). Write one mitigation for each.

- Choose a single lead goal to fully fund first while minimum-funding others to keep momentum.

Beginner modifications & progressions

- Beginner: choose just one goal for 30 days. Keep the transfer tiny (even 1,000 PKR) to build the habit.

- Progression: add a second goal or increase the transfer by 5–10% after the first 4 weeks of success.

Recommended cadence & metrics

- Cadence: set/refresh goals quarterly; review monthly.

- Metrics: percent funded, on-track/off-track versus timeline, and success streak (number of consecutive automated transfers).

Safety, caveats & common mistakes

- Mistake: setting multiple aggressive targets with the same deadline.

- Fix: stagger timelines; fully fund one priority before the next.

- Mistake: ignoring irregular expenses (car registration, gifts, annual renewals).

- Fix: create “sinking funds” (see Tip 3) so these don’t blow up your plan.

Mini-plan example (2–3 steps)

- Convert “save more” into: “Save 300,000 PKR for emergencies within 9 months.”

- Set monthly transfer: 33,500 PKR; auto-transfer on payday +1 day.

- Track % funded weekly in a simple note or spreadsheet.

Tip 2: Make Saving Automatic—and Invisible

What it is & why it works

Automation removes monthly decision fatigue. When a transfer to savings or a split direct deposit happens before you can spend, saving becomes the default. It’s the closest thing to a “set-and-forget” advantage in personal finance.

Core benefits

- Ensures consistency, even during busy months.

- Protects you from impulse spending by moving money out of checking.

- Makes progress trackable without manual effort.

Requirements & low-cost alternatives

- Requirements: checking and savings accounts (online access), ability to schedule automatic transfers or split your paycheck between accounts.

- Low-cost alternatives: if your bank doesn’t support automation, set a recurring calendar reminder and use instant transfers on payday.

Step-by-step instructions

- Open/identify your goal accounts. Use one for emergency fund and one for each major sinking fund (or use labeled “buckets” if your bank provides them).

- Schedule automatic transfers. Start the day after payday to reduce overdraft risk.

- Use split direct deposit. Send a fixed percentage (e.g., 10–20%) to savings, the rest to checking.

- Add auto-escalation. Increase your transfer by 1–2% every month or quarter until you reach your target savings rate.

- Create a transfer “success log.” Count successful transfers; aim for a streak of 12–16 in a row.

Beginner modifications & progressions

- Beginner: start with a symbolic amount (even 500 PKR) to establish the automation.

- Progression: implement split deposit, then add quarterly auto-escalation.

Recommended cadence & metrics

- Cadence: transfers every payday; review automation rules monthly.

- Metrics: savings rate (% of income saved), transfer success streak, and number of active automations.

Safety, caveats & common mistakes

- Overdraft risk: avoid same-day transfers; schedule for payday +1.

- Cash-flow crunches: if income is irregular, set a floor transfer plus a % of surplus after essential bills are paid.

- “Out of sight, out of mind” in a bad way: set alerts for balances so you don’t miss bill payments.

Mini-plan example

- Set an automatic transfer of 8,000 PKR every Friday (weekly pay) to the emergency fund.

- Enable split deposit: 10% of paycheck to travel sinking fund.

- Add a rule: increase both transfers by 1% of pay every second payday.

Tip 3: Build the Right Accounts and “Buckets” for Your Timeline

What it is & why it works

Not all savings are the same. Match the time horizon and purpose of each goal to the right account. Doing this correctly keeps your money safe, liquid when you need it, and productive when you don’t.

Core benefits

- Avoids tapping long-term investments for short-term needs.

- Preserves liquidity for emergencies.

- Keeps progress visible with dedicated balances for each purpose.

Core buckets

- Emergency fund (near-term, liquid): Cash reserve for unexpected events like job loss or medical bills. A common range is three to six months of essential expenses, with many aiming toward the top of that range over time, especially if income is less stable.

- Sinking funds (0–24 months): Dedicated sub-accounts for planned, non-monthly expenses (rent deposit, annual insurance, car maintenance, gifts, school fees, travel).

- Longer-term goals: For horizons beyond a few years, consider investment accounts that allow your money to compound at rates cash accounts typically cannot match (knowing that market values can fluctuate).

Requirements & low-cost alternatives

- Requirements: at least one high-liquidity savings account; optional sub-accounts or naming features; basic spreadsheet for tracking categories.

- Low-cost alternatives: if your bank doesn’t offer sub-accounts, keep a single savings account and use a spreadsheet to tag each contribution by category.

Step-by-step instructions

- Calculate essential monthly expenses (rent, food, utilities, insurance, transport, minimum debt payments).

- Set your emergency fund target (e.g., 4 months × essential expenses).

- List 5–8 sinking fund categories you face each year and assign monthly amounts (e.g., 5,000 PKR for car upkeep, 3,000 PKR for gifts).

- Open or label accounts/buckets. Name them clearly (e.g., “Emergency—6 months,” “Car—Annual,” “Travel—Dec”).

- Automate contributions from Tip 2 into each bucket.

- Protect safety and access: keep emergency cash in a liquid, insured account. Understand APY (the standardized way banks show total interest you’ll earn in a year, including compounding).

Beginner modifications & progressions

- Beginner: start with just two buckets—Emergency and one sinking fund you need in the next 6–12 months.

- Progression: expand to 4–6 sinking funds and increase the emergency target to the full six-month mark as your capacity grows.

Recommended cadence & metrics

- Cadence: contribute each payday; audit buckets monthly.

- Metrics: months of expenses saved (emergency fund), funding % for each sinking fund, number of categories fully funded.

Safety, caveats & common mistakes

- Chasing yield with your emergency fund: liquidity and safety come first; if you can’t access the cash quickly without fees or penalties, it’s not an emergency fund.

- Forgetting deposit insurance limits: if balances grow large, diversify across institutions/ownership categories to stay within standard coverage limits.

- Mixing goals in one pot: use names or separate ledgers so you don’t spend travel money on a car repair by accident.

Mini-plan example

- Emergency fund target: 360,000 PKR (4 months × 90,000 PKR essential expenses).

- Sinking funds: Car (5,000 PKR/mo), Gifts (3,000 PKR/mo), Annual Fees (2,000 PKR/mo).

- Automation: 25,000 PKR/mo to Emergency; 10,000 PKR/mo split among sinking funds.

Tip 4: Engineer Your Cash Flow—Budget, Plug Leaks, and Raise Income

What it is & why it works

Your saving targets compete with recurring bills, variable spending, and surprise costs. A simple, flexible spending plan ensures cash first flows to your priorities and automation, not just to whatever bill screams loudest.

Core benefits

- Aligns daily spending with long-term goals.

- Converts “leftovers” into scheduled savings.

- Surfaces subscription creep and seasonal expenses before they hit.

Requirements & low-cost alternatives

- Requirements: 90 days of bank/credit statements; a spreadsheet or budgeting app; calendar for due dates.

- Low-cost alternatives: paper envelopes or a notes app to allocate weekly cash; a free bill-tracking sheet.

Step-by-step instructions

- Baseline your cash flow. Total monthly net income; then list fixed bills and average variable categories.

- Pay yourself first. Move your automated savings (Tips 1–3) to the top of the plan.

- Plug leaks. Identify 2–3 subscriptions to cancel or downgrade, and one bill to renegotiate (internet, phone, insurance).

- Smooth the spikes. Fund sinking buckets monthly to handle annual or quarterly costs.

- Adopt a weekly rhythm. Give yourself a weekly spending allowance for flexible categories (food, fun, transport) to avoid blowing the whole month’s budget in Week 1.

- Add income levers. Look for quick wins: a small freelance project, selling unused items, asking for a rate adjustment at work after new responsibilities, or seasonal overtime.

Beginner modifications & progressions

- Beginner: track only three categories (food, transport, “fun”) for two weeks and cap each with a weekly envelope or app category.

- Progression: after a month, add two more categories and increase your savings transfer by the average you underspent.

Recommended cadence & metrics

- Cadence: weekly check-in for variable spending; monthly budget rollover and reset.

- Metrics: savings rate, discretionary burn rate (average weekly spend), number of bills renegotiated, total subscriptions canceled.

Safety, caveats & common mistakes

- All-or-nothing thinking: extreme cuts don’t last; build small, permanent changes.

- Ignoring annual expenses: if it happens every year, it isn’t an emergency; it needs a sinking fund.

- Underfunding essentials: never let aggressive savings starve rent, utilities, insurance, or minimum debt payments.

Mini-plan example

- Weekly allowance: 15,000 PKR for variable spending.

- Cancel two unused apps and downgrade one plan (expected savings: 3,000–5,000 PKR/month).

- Redirect savings to increase emergency fund transfer by 4,000 PKR/month.

Tip 5: Review, Measure, and Adjust with a Monthly “Money Date”

What it is & why it works

A 30–45 minute money date each month turns your plan into a living system. You’ll catch drift early, celebrate wins, and course-correct before small issues become expensive.

Core benefits

- Keeps goals aligned with changing reality.

- Maintains motivation with visible milestones.

- Encourages proactive fixes (adjusting transfers, rebalancing buckets, pausing or resuming contributions).

Requirements & low-cost alternatives

- Requirements: calendar invite (recurring), access to bank and savings dashboards, your goal tracker.

- Low-cost alternatives: a printed checklist on the fridge; a simple journal entry template.

Step-by-step instructions

- Open your dashboards. Check balances, transfers, and upcoming bills.

- Update your goal tracker. Record current balances and percent funded.

- Run a brief post-mortem. What worked? What didn’t? One small improvement for next month.

- Adjust transfers. Increase by 1–2% if cash flow allows; pause or reduce temporarily if needed (resume date required).

- Set one micro-task for the week (e.g., cancel a subscription, open a new sinking fund bucket).

Beginner modifications & progressions

- Beginner: 15-minute session focusing only on balances and upcoming bills.

- Progression: add category-level spending review and quarterly goal resets.

Recommended cadence & metrics

- Cadence: monthly; quarterly “bigger picture” review.

- Metrics:

- Savings rate (money saved ÷ net income).

- Months of expenses saved (emergency fund ÷ essential monthly spend).

- Goal funding % (current balance ÷ target).

- Automation streak (consecutive successful transfers).

Safety, caveats & common mistakes

- Mistake: skipping the review after a bad month.

- Fix: treat it like brushing your teeth—miss one, never miss two.

- Mistake: changing too many variables at once.

- Fix: adjust one transfer, one category, or one bill at a time.

Mini-plan example

- First Saturday each month: log balances, update % funded, increase one transfer by 1%.

- Add a micro-task (“call provider about plan downgrade”) and schedule it.

Quick-Start Checklist

- Write one SMART saving target with an exact number and date.

- Open or label a dedicated savings account/bucket for that goal.

- Schedule an automatic transfer for payday +1 day.

- Create a weekly allowance for variable spending.

- Book a recurring 30-minute monthly money date.

- Start a streak counter for successful transfers.

Troubleshooting & Common Pitfalls

“I keep overdrafting after I automate.”

Schedule transfers the day after payday, keep a small buffer in checking, and set low-balance alerts. If income is irregular, automate a minimum transfer plus a percentage of any surplus.

“Annual costs keep derailing me.”

List every annual/quarterly bill from last year’s statements. Create a sinking fund for each and split the annual amount into monthly contributions.

“My goals feel unrealistic.”

Shorten the timeline to a 30-day sprint with a modest target. Build wins first, then scale.

“I forget what each balance is for.”

Name your accounts/buckets. If your bank doesn’t support nicknames, track categories in a simple spreadsheet.

“I’m tempted to dip into my emergency fund.”

Decide now what counts as an emergency. If it happens every year, it’s not an emergency—fund it as a sinking category.

“Motivation fades after a few weeks.”

Use visible trackers: progress bars, milestone amounts, or a streak calendar. Celebrate thresholds (25%, 50%, 75%) with free/not-spendy rewards.

How to Measure Results (Simple Metrics That Matter)

- Savings rate: target a steady increase over time (e.g., +1–2 percentage points each month or quarter) until you hit your desired level.

- Months of expenses saved: emergency fund ÷ essential monthly costs. Aim to grow this steadily toward your personal target.

- Goal funding %: shows momentum at a glance for each target.

- Automation streak: counts consecutive successful transfers; longer streaks predict success.

- Leakage reduction: total monthly amount saved from cancellations, downgrades, and renegotiations.

A Simple 4-Week Starter Plan (Roadmap)

Week 1: Build the base

- Write one SMART goal and rank your top three.

- Calculate essential monthly expenses and choose your emergency fund target (e.g., 4 months).

- Open/label a savings account/bucket for the emergency fund.

- Schedule a small automatic transfer for payday +1 day.

- Set up low-balance and transfer-success alerts.

Week 2: Engineer cash flow

- Review the last 90 days of statements.

- Cancel two subscriptions and downgrade one plan.

- Set a weekly spending allowance; withdraw or allocate digitally each week.

- Create two sinking funds (e.g., car maintenance, annual fees) and automate small monthly contributions.

Week 3: Strengthen automation

- Enable split direct deposit if available (e.g., 10% of pay to savings).

- Add auto-escalation: increase transfers by 1–2%.

- Start a transfer streak counter; aim for 12 in a row.

Week 4: Review & refine

- Hold your first money date.

- Update % funded and months of expenses saved.

- Choose one micro-task (renegotiate a bill, list an item for sale).

- If the month went smoothly, increase your main transfer by another 1%.

Repeat monthly; layer more sinking funds or raise targets as your capacity grows.

FAQs

1) How much should I keep in an emergency fund?

A common range is three to six months of essential expenses, with many aiming higher if income is variable or dependents are involved. Start small and build steadily—consistency beats intensity.

2) Should I save or pay off high-interest debt first?

Do both—just in the right order. Build a small starter emergency buffer to avoid relying on credit for every surprise, then direct extra cash to high-interest debt. After that, grow the emergency fund toward your target and fund other goals.

3) What’s the difference between APY and interest rate?

APY shows the total interest you’ll earn over a year including the effect of compounding. It lets you compare accounts on an apples-to-apples basis.

4) Is a high-yield savings account safe?

Look for accounts protected by standard deposit insurance and keep balances within the coverage limits. Prioritize liquidity and safety for emergency funds.

5) What are sinking funds, and why do they matter?

They’re dedicated pots for planned but irregular expenses (like annual insurance, car maintenance, or holidays). Funding them monthly prevents those costs from wrecking your budget.

6) I have irregular income. How can I automate without overdrafts?

Automate a small base transfer, then add a percentage-of-income top-up after invoices clear. Keep a checking buffer and schedule transfers a day after deposits.

7) How do I stay motivated for long timelines?

Track progress with visible milestones (25/50/75/100%), celebrate each threshold with a low-cost reward, and maintain a monthly money date to keep momentum.

8) What if I fall behind?

Do a quick audit: pause non-essential sinking funds, lower but don’t cancel your transfers, and set a catch-up timeline. The key is to keep the automation running—even at a reduced level.

9) Can I invest my emergency fund to earn more?

Emergency money’s job is stability and access, not returns. Keep it liquid and protected. For goals several years away, you can consider investment options separately.

10) How many savings accounts should I have?

As many as help you stay organized without creating complexity. Two is plenty for beginners (Emergency + One Goal). Expand as your plan matures or use labels/buckets within one account.

11) What’s a good savings rate to aim for?

There’s no one-size-fits-all. Start with any positive rate you can sustain, then nudge it up by 1–2% every month or quarter until you reach a level that supports your goals and timeline.

12) How do I avoid dipping into my savings for non-emergencies?

Write a simple “Emergency Fund Rules” list now (what qualifies/doesn’t). Use sinking funds for predictable costs and keep emergency money in a separate, clearly labeled account.

Conclusion

You don’t need perfect discipline to reach your saving targets—you need a system that puts progress on autopilot, keeps your money in the right place for each job, and nudges you forward with small but steady improvements. Start with a single SMART goal, automate a modest transfer, and meet yourself for a short money date next month. Reaching your targets is less about heroic effort and more about consistent design.

CTA: Pick one goal, automate one transfer, and start your streak today.

References

- An essential guide to building an emergency fund, Consumer Financial Protection Bureau, December 12, 2024. https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

- How does compound interest work?, Consumer Financial Protection Bureau (Ask CFPB), (publication date not listed; accessed August 14, 2025). https://www.consumerfinance.gov/ask-cfpb/how-does-compound-interest-work-en-1683/

- What is compound interest?, Investor.gov (U.S. Securities and Exchange Commission), (publication date not listed; accessed August 14, 2025). https://www.investor.gov/additional-resources/information/youth/teachers-classroom-resources/what-compound-interest

- Compound Interest Calculator, Investor.gov (U.S. Securities and Exchange Commission), (publication date not listed; accessed August 14, 2025). https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

- Appendix A to Part 1030 — Annual Percentage Yield (APY), Consumer Financial Protection Bureau, (regulatory text; accessed August 14, 2025). https://www.consumerfinance.gov/rules-policy/regulations/1030/A

- Deposit Insurance FAQs, Federal Deposit Insurance Corporation, April 1, 2024. https://www.fdic.gov/resources/deposit-insurance/faq

- Your Insured Deposits, Federal Deposit Insurance Corporation, May 14, 2024. https://www.fdic.gov/resources/deposit-insurance/brochures/insured-deposits

- Understanding Deposit Insurance, Federal Deposit Insurance Corporation, April 1, 2024. https://www.fdic.gov/resources/deposit-insurance/understanding-deposit-insurance

- Saving for the Unexpected and Your Future, Federal Deposit Insurance Corporation, January 3, 2025. https://www.fdic.gov/consumer-resource-center/2025-01/saving-unexpected-and-your-future

- Declare Your Financial Independence Using Direct Deposit and Split Deposit, Nacha (Electronic Payments Association), (publication date not listed; accessed August 14, 2025). https://www.nacha.org/news/declare-your-financial-independence-using-direct-deposit-and-split-deposit

- Looking for an easy way to save money? Make it automatic, Consumer Financial Protection Bureau (Blog), August 26, 2019. https://www.consumerfinance.gov/about-us/blog/looking-easy-way-save-money-make-it-automatic/

- Start saving today with our new savings booklet and email boot camp, Consumer Financial Protection Bureau (Blog), August 26, 2019. https://www.consumerfinance.gov/about-us/blog/start-saving-today-our-new-savings-booklet-and-email-boot-camp/

- Adults who have 3 months emergency savings (S.H.E.D. data visualization), Board of Governors of the Federal Reserve System, May 28, 2025. https://www.federalreserve.gov/consumerscommunities/sheddataviz/emergency-savings.html

- Prevention – Emergency Savings, MyCreditUnion.gov (National Credit Union Administration), (publication date not listed; accessed August 14, 2025). https://mycreditunion.gov/protect-your-money/prevention

- SMART Goals: A How-to Guide, U.S. (SAMHSA) fact sheet (PDF), April 2025. https://www.samhsa.gov/sites/default/files/nc-smart-goals-fact-sheet.pdf

- Using Behavioral Economics to Increase Employee Saving, Journal of Political Economy (Thaler & Benartzi, Save More Tomorrow™), 2004 (PDF hosted by UCLA Anderson; accessed August 14, 2025). https://www.anderson.ucla.edu/documents/areas/fac/accounting/smartjpe226.pdf

- Influencing Retirement Savings Decisions with Automatic Enrollment and Related Tools, NBER Reporter, October 22, 2024. https://www.nber.org/reporter/2024number3/influencing-retirement-savings-decisions-automatic-enrollment-and-related-tools