If you’ve ever wondered exactly how much money (and time) a debt snowball plan can save you, this deep-dive is for you. We’ll turn the strategy into clear math—so you can calculate your payoff timeline, total interest saved, and month-by-month milestones with confidence. You’ll learn how interest is actually computed, how to set up a simple spreadsheet to model your debts, and how to compare snowball savings against “minimum payments only” and the debt avalanche approach. This guide is written for beginners and spreadsheet tinkerers alike and features practical, step-by-step instructions and a fully worked example.

Disclaimer: This article is educational and not individualized financial advice. For tailored guidance, consult a qualified financial professional.

Key takeaways

- Debt snowball = pay extra toward the smallest balance first while paying minimums on the rest.

- You can model snowball savings by estimating monthly interest, listing minimums, and rolling freed-up payments to the next debt.

- To quantify savings, compare snowball results to minimum-only and, optionally, debt avalanche (highest APR first).

- Small changes in extra payment (even +$50/month) significantly shift payoff time and total interest.

- Mind the details: how your issuer calculates interest, payment allocation rules, and fees affect your numbers.

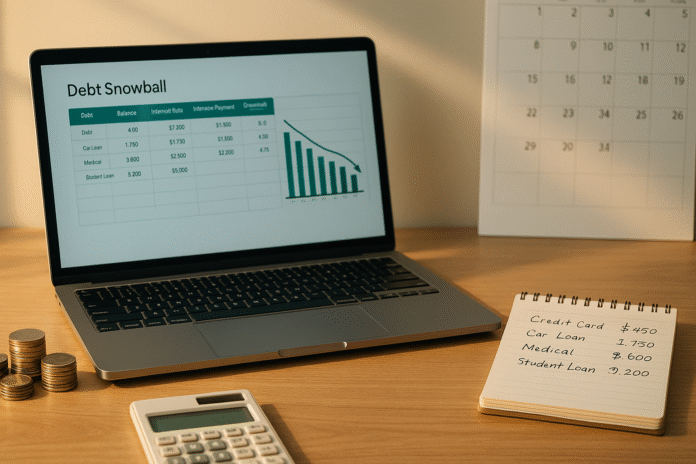

What the debt snowball is—and why people use it

What it is & core purpose

The debt snowball is a repayment plan that focuses on behavioral momentum. You list debts from smallest balance to largest, make the required minimum payments across all debts, and throw any extra cash at the smallest balance first. When that’s gone, you “roll” the freed-up payment into the next-smallest balance, and so on.

Benefits

- Early wins build motivation and reduce the number of open balances.

- Simplicity—you don’t need to compare APRs to get started.

- Predictability—once a debt is paid off, your monthly outflow stays the same (or drops), but more of it goes to principal on the next target.

Requirements & low-cost alternatives

- A list of debts with balances, APRs, minimums (from statements).

- A calculator or spreadsheet (Excel/Google Sheets work perfectly; the built-in PMT, IPMT, PPMT, and NPER functions help with amortizing loans).

- Optional: a budgeting app. Free spreadsheets are enough.

Step-by-step for beginners (high level)

- List all debts (balance, APR, minimum).

- Order them by balance (ascending).

- Decide on a fixed extra payment you can add each month.

- Pay minimums on all debts; send minimum + extra to the smallest balance.

- When a balance hits zero, roll that debt’s payment into the next debt.

Beginner modifications & progressions

- Micro-snowball: start with only +$25–$50 extra monthly to build the habit.

- Hybrid: if one account has a promotional 0% or a very high APR, temporarily reorder to avoid losing a promo or incurring outsized interest.

Recommended frequency & metrics

- Update your sheet monthly when statements arrive.

- Track KPIs: months to payoff, total interest, and “snowball width” (the amount rolling from paid-off debts into the next one).

Safety, caveats, mistakes to avoid

- Don’t ignore fees (e.g., balance transfer fees). Many are 3%–5% of the amount transferred.

- Keep paying minimums on all accounts to avoid penalties.

- Watch for prepayment penalties on certain loans (especially some mortgages or auto loans—check your contract).

Mini-plan example (2–3 steps)

- This month: List debts, sort by smallest balance, set +$150 extra.

- Next month: Pay minimums; send minimum +$150 to the smallest balance.

- When that’s gone: Roll that payment into the next debt automatically.

The math you need (no fluff, just mechanics)

How interest accrues on common debts

- Credit cards typically compute interest daily on your balance using a daily periodic rate (APR ÷ 365; some issuers use 360). That daily interest is then added to your balance (compounds), and your statement summarizes it for the cycle.

- Installment loans (car, personal, mortgage) use amortization: a fixed payment that splits into interest + principal; as the balance falls, each month’s interest portion declines and the principal portion grows.

Why the ordering matters

Ordering by smallest balance (snowball) speeds debt closures; ordering by highest APR (avalanche) generally minimizes total interest. You can estimate the interest gap by running both models side by side.

Payment allocation rules that affect your math

If you pay more than the minimum on a multi-APR credit card, card issuers generally apply the amount above the minimum to the balance with the highest APR first. This can quietly improve your interest savings even when snowballing. Check your statement details.

Minimum payment math: a workable approximation

For modeling card minimums, a common approach is the greater of a small percent of principal + interest (e.g., ~1% of principal + interest) or a flat $25–$35 floor. Your statement’s formula controls; adjust your sheet to match it.

Formulas you’ll actually use

- Monthly interest (installment):

interest_m = balance × APR/12. - Payment for an amortizing loan (installment): use

PMT(rate/12, term_months, balance)in Excel/Sheets. - Credit-card estimate (for modeling): either

- (More precise) simulate daily compounding using APR/365 and add new interest each day, or

- (Practical estimate) treat it like monthly compounding with APR/12 for planning purposes, noting actual results will vary slightly.

Gather your data (a quick audit checklist)

What to collect from each statement

- Current balance and APR.

- Minimum payment and how it’s calculated.

- Compounding method and whether you have a grace period.

- Any promotional APR end dates, balance transfer fees, or cash advance APRs.

Low-cost tools

- Spreadsheet (Excel/Google Sheets).

- Optional: a debt payoff calculator app. Free online calculators can help you check your math, but a sheet you control is more transparent.

Beginner mini-plan

- Tonight: Collect statements; add columns for balance/APR/minimum.

- Tomorrow: Enter data and verify one cycle of interest math using steps below.

Build your snowball calculator (step-by-step tutorial)

What it is & why it helps

A simple spreadsheet makes the plan visible and measurable. You’ll build a month-by-month model that shows interest per debt, payment allocation, crossover months, and rollover amounts.

Prerequisites

- Basic spreadsheet entry and formulas.

- Your debt list with APRs and minimums.

Step-by-step

- Set up your debt table

Columns: Debt name | Current Balance | APR | Type (Card/Loan) | Minimum. For loans, compute fixed payment using=PMT(APR/12, TermMonths, Balance). For cards, enter the statement minimum or your estimated formula. - Monthly interest column

For each debt,=Round(Balance × APR/12, 2)for a planning estimate (cards compound daily in reality; see caveat below). - Apply minimums

- For loans: fixed payment each month.

- For cards: minimum formula or your statement amount. (A common rule of thumb: interest + about 1% of principal, subject to a floor.)

- Add your extra payment

Decide on a constant extra amount (e.g., +$150 or +$300). Put it in a cell namedExtra. - Direct the extra to the current target

- Sort debts by balance (ascending), identify the current target debt (smallest open balance).

- Payment to target = minimum +

Extra. Everyone else gets their minimum.

- Recalculate balances

- Add monthly interest.

- Subtract payments.

- If a balance hits zero, roll that debt’s entire payment (its minimum + the extra you were sending) to the next smallest balance.

- Repeat per month

- Drag formulas down a monthly schedule (Rows 1–60+).

- Insert markers for “payoff month” of each debt.

- Add totals

- Sum interest across months and debts for Total Interest.

- Count months until all balances reach zero.

Beginner modifications & progressions

- Basic model: monthly compounding for all accounts (fast to build).

- Advanced model: for a credit card, compute daily interest =

PrevDayBalance × APR/365and sum each day in the cycle. Use it if you want tighter estimates.

Metrics to track

- Months to debt-free.

- Total interest.

- Interest saved vs. minimum-only and vs. avalanche.

- Crossover points (the month each debt is eliminated).

Caveats and common mistakes

- Underestimating minimum payments on cards (they change as balance changes).

- Ignoring promos/fees like 0% periods or 3–5% transfer fees.

- Forgetting payment allocation rules (over-minimum to highest APR on credit cards), which may actually help you more than your simple model shows.

Mini-plan

- Build a 36-row monthly grid.

- Enter one debt fully; copy logic to others.

- Add a summary box showing payoff date and interest saved.

Worked example: month-by-month savings with a real-world mix

To make the math concrete, here’s a fully modeled scenario (balances and rates are hypothetical; dollar results will differ for you). We’ll compare minimums only, debt snowball (+$300 extra), and debt avalanche (+$300 extra). For planning clarity, we’ll estimate using monthly compounding and realistic card minimums (interest + ~1% of principal, with a $25–$30 floor).

Starting debts

- Card A (low APR): $1,200 at 12.99%; minimum ≈ max($25, interest + 1% principal)

- Card C (high APR): $2,200 at 26.99%; minimum ≈ max($25, interest + 1% principal)

- Card B: $3,400 at 19.99%; minimum ≈ max($30, interest + 1% principal)

- Auto loan: $8,500 at 6.00% (48 months fixed payment ≈ $199.62 using PMT)

Month 1 cash outlay

- Combined minimums ≈ $386.74 (before any extra).

- Snowball/avalanche add +$300 extra to the target debt, so total ≈ $686.74 in month 1.

Results summary (modeled)

- Minimums only: debt-free in 170 months; total interest ≈ $9,801.

- Snowball (+$300): debt-free in 32 months; total interest ≈ $2,134.

- Interest saved vs. minimums: ≈ $7,667 and ~11.5 years faster.

- Avalanche (+$300): debt-free in 32 months; total interest ≈ $1,957.

- Interest saved vs. minimums: ≈ $7,844.

- Difference vs. snowball: ≈ $177 less interest (same timeline in this mix).

What pays off when (milestones)

- Snowball order (smallest first)

- Card A paid off in month 4

- Card C paid off in month 11

- Card B paid off in month 21

- Auto loan finished in month 32

- Avalanche order (highest APR first)

- Card C paid off in month 7

- Card B paid off in month 17

- Card A paid off in month 21

- Auto loan finished in month 32

Sensitivity checks

- Extra +$150 (snowball) → 44 months, ≈ $3,272 interest.

- Extra +$500 (snowball) → 24 months, ≈ $1,617 interest.

How to replicate this

- Enter your own balances/APRs/minimums.

- Fix a monthly extra you can sustain.

- Sort by balance (snowball) or APR (avalanche).

- Roll retired payments forward and tally months/interest.

Important context about rates

As of mid-2025, average credit card APRs on accounts assessed interest are in the low-twenties. If your APRs are higher than assumed above, you’ll save even more interest by accelerating payoff.

How to compute interest savings—formulas and shortcuts

Goal: quantify “Interest Saved” = (Total interest with strategy A) − (Total interest with strategy B).

Approach A: Spreadsheet tally

- Sum the “interest” column across all months and accounts for each scenario.

- Compute differences to report savings.

Approach B: Functions that speed you up (for loans)

- PMT: monthly payment.

- IPMT/PPMT: isolate the interest or principal part of each month’s payment.

- NPER: months needed to hit a target balance.

Use PMT/IPMT/PPMT to build an amortization schedule and total the interest quickly.

Approach C: Back-of-the-envelope estimate (cards)

- Approximate monthly interest =

balance × APR/12. - Estimate savings from extra payment: compare the time to zero with and without the extra using your sheet’s results; the reduction in months times your typical monthly interest gives a quick sense of interest avoided.

- Remember: credit cards accrue interest daily, so your exact statement interest will differ slightly from monthly approximations.

Mini-plan

- Model minimums only.

- Add your extra (+$X) and re-run.

- Subtract total interest to get “Interest Saved.”

Handling real-world wrinkles (and the math behind them)

0% promos & balance transfers

- A 0% promotional APR can be a powerful accelerator if you can pay the balance before the promo ends.

- Balance transfer fees often run 3%–5% of the transfer amount—include this cost in your sheet.

- Missed or late payments can void the promo; model the fallback APR as a contingency.

Payment allocation on multi-APR cards

If your card carries balances at multiple rates, amounts above the minimum generally go to the highest-APR portion first—good news for interest savings. Factor this into your expectations.

Prepayment penalties (non-card loans)

Some mortgages and a minority of auto loans can have prepayment penalties. Read your agreement; if present, add the fee to your model to ensure snowball still nets out.

APR volatility & variable rates

For variable-rate loans/cards, build a “Rate Up” sheet that adds +1% to APR and re-calculates months/interest to see your sensitivity.

Caveats

- If paying off a promotional balance early would forfeit other benefits, compare scenarios before changing your order.

- If your card uses average daily balance with compounding, the daily approach will be slightly more expensive than a simple monthly approximation; your snowball savings remain valid, just adjust expectations.

Mini-plan

- Add a “Fees & Penalties” line in your totals.

- Create “Base / Promo / Rate-Up” tabs and compare months/interest.

Quick-start checklist

- List all debts with balance/APR/minimum from statements.

- Choose an extra amount (+$50 to +$300 to start).

- Sort by smallest balance (snowball).

- Build a simple 36–60 month table; compute monthly interest and payments.

- Roll payments as debts close; log payoff months.

- Compare to minimums only and avalanche.

- Decide: keep snowball for motivation or switch to avalanche later to shave interest.

Troubleshooting & common pitfalls

“My card interest is higher than I estimated.”

Your issuer likely uses daily compounding on the average daily balance. Tighten the model (daily interest) or accept a conservative buffer.

“My minimums keep changing.”

That’s normal for revolving accounts; minimums are tied to balance and interest. Update monthly.

“I’m losing my 0% promo.”

Promos require on-time payments and may expire after a set period; check dates and rules.

“Do extra payments even help on my card?”

Yes—because amounts over the minimum generally hit the highest-APR bucket first.

“Should I consolidate first?”

Only if total fees + new APR shorten your payoff time and lower total interest. Include transfer fees (3%–5%).

How to measure progress

Monthly scorecard

- Debts closed this month (#).

- Cumulative interest paid vs. plan.

- Snowball width (the rolled amount heading into the next debt).

- Projected months remaining (recalculate after each payoff).

Quarterly review

- Increase your extra payment by a fixed step (e.g., +$25/quarter).

- Consider shifting to avalanche for the final stretch to trim extra interest if motivation is no longer a constraint.

A simple 4-week starter plan

Week 1: Inventory & plan

- Pull statements; list balance/APR/minimum and identify any promos/fees/penalties.

- Pick a realistic extra (+$50–$300).

Week 2: Build your model

- Set up the monthly grid, enter formulas, and run minimums only as a baseline.

- Add your snowball and view months to payoff and total interest.

Week 3: Automate & optimize

- Schedule automatic payments for minimums + extra.

- If a 0% transfer clearly saves net interest after fees, execute it now.

Week 4: Launch & track

- Make your first snowball payment.

- Record a quick scorecard (interest paid, balances, months to zero).

- Celebrate small wins—momentum matters.

FAQs

1) What’s the one number that most affects my total interest?

Your APR—especially on revolving debt. As of May 2025, average APRs on accounts assessed interest were in the low-twenties, which makes acceleration extremely valuable.

2) How do card issuers actually calculate interest?

Most use a daily periodic rate and compute interest on your average daily balance. Paying earlier in the cycle reduces that day-by-day interest.

3) Is avalanche always cheaper than snowball?

For the same extra payment, avalanche typically results in less total interest because it attacks higher APRs first—but the difference can be small. Choose the method you’ll stick with.

4) Can I switch from snowball to avalanche later?

Yes. Many people start with snowball for motivation and later switch to avalanche to shave a bit more interest.

5) Are minimum payments enough?

They’ll eventually pay down many debts, but often very slowly and at high interest cost. Run a “minimums only” model to see your own timeline and total interest.

6) Should I use a 0% balance transfer?

If the fee (often 3%–5%) is smaller than the interest you’d otherwise pay and you can finish before the promo ends, it can speed up payoff. Consumer Financial Protection Bureau

7) How do I handle a loan with a prepayment penalty?

Add the fee to your model and see if the snowball still wins. Some mortgages and a minority of auto loans have such clauses—read your contract.

8) What spreadsheet functions help most?

PMT for loan payments; IPMT/PPMT to split interest/principal; NPER to estimate payoff months.

9) How precise must my card interest model be?

Monthly approximations are fine for planning; just remember cards accrue daily, so statements will differ slightly.

10) Does paying mid-cycle help?

Yes—because cards accrue daily, reducing your balance earlier in the cycle lowers that month’s interest a bit.

11) What if my extra payment isn’t consistent?

Use your average extra for modeling; then apply windfalls immediately. Recalculate after big changes.

12) How do I prioritize when I have a 0% promo and a very high-APR card?

Usually keep minimums on the 0% and attack the high-APR card—unless the promo ends soon and you’ll carry a balance afterward. Then model both ways to see which costs less.

Conclusion

The debt snowball turns a messy pile of balances into a measurable plan. With a simple sheet and a steady extra payment, you can forecast your payoff date, quantify interest saved, and track momentum. Whether you choose snowball for motivation or avalanche for maximum interest savings, the discipline of modeling your numbers—and revisiting them monthly—puts you in control.

Copy-ready CTA: Start your snowball today: list your debts, pick an extra amount you can sustain, and make your first focused payment this month.

References

- How does my credit card company calculate the amount of interest I owe?, Consumer Financial Protection Bureau, last reviewed January 22, 2024, https://www.consumerfinance.gov/ask-cfpb/how-does-my-credit-card-company-calculate-the-amount-of-interest-i-owe-en-51/

- What is a “daily periodic rate” on a credit card?, Consumer Financial Protection Bureau, last reviewed September 23, 2024, https://www.consumerfinance.gov/ask-cfpb/what-is-a-daily-periodic-rate-on-a-credit-card-en-46/

- Commercial Bank Interest Rate on Credit Card Plans, Accounts Assessed Interest (TERMCBCCINTNS), Federal Reserve Bank of St. Louis (FRED), updated July 8, 2025, https://fred.stlouisfed.org/series/TERMCBCCINTNS

- Debt Avalanche vs. Debt Snowball: What’s the Difference?, Investopedia, updated May 16, 2024, https://www.investopedia.com/articles/personal-finance/080716/debt-avalanche-vs-debt-snowball-which-best-you.asp

- What Is an Amortization Schedule? How to Calculate With Examples, Investopedia, accessed August 2025, https://www.investopedia.com/terms/a/amortization.asp

- 4.3 Loan Amortization: Formula Approach, Mathematics of Business (Pressbooks / eCampusOntario), accessed August 2025, https://ecampusontario.pressbooks.pub/financemath/chapter/4-3-loan-amortization-formula-approach/

- How Is Credit Card Interest Calculated?, Bankrate, July 18, 2025, https://www.bankrate.com/credit-cards/advice/how-credit-card-interest-is-calculated/

- PMT function, Microsoft Support, accessed August 2025, https://support.microsoft.com/en-us/office/pmt-function-0214da64-9a63-4996-bc20-214433fa6441

- IPMT function, Microsoft Support, accessed August 2025, https://support.microsoft.com/en-us/office/ipmt-function-5cce0ad6-8402-4a41-8d29-61a0b054cb6f

- PPMT function, Microsoft Support, accessed August 2025, https://support.microsoft.com/en-us/office/ppmt-function-c370d9e3-7749-4ca4-beea-b06c6ac95e1b

- NPER function, Microsoft Support, accessed August 2025, https://support.microsoft.com/en-us/office/nper-function-240535b5-6653-4d2d-bfcf-b6a38151d815

- Credit card key terms (including balance transfers), Consumer Financial Protection Bureau, June 26, 2025, https://www.consumerfinance.gov/language/cfpb-in-english/credit-card-key-terms/

- How to understand special promotional financing offers on credit cards, Consumer Financial Protection Bureau, June 8, 2017, https://www.consumerfinance.gov/about-us/blog/how-understand-special-promotional-financing-offers-credit-cards/

- What is a prepayment penalty?, Consumer Financial Protection Bureau, September 13, 2024, https://www.consumerfinance.gov/ask-cfpb/what-is-a-prepayment-penalty-en-1957/

- Can I prepay my loan at any time without penalty?, Consumer Financial Protection Bureau, January 30, 2024, https://www.consumerfinance.gov/ask-cfpb/can-i-prepay-my-loan-at-any-time-without-penalty-en-843/

This is my first time visit at here and i am actually

happy to reead all at alone place.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.