A good credit score is important because it can help you get more loans, lower interest rates, and better terms on loans. When deciding whether or not to give you a mortgage, an auto loan, a personal loan, or a small business line of credit, lenders look at your credit score first and foremost. A better credit score can save you thousands of euros over the life of a loan.

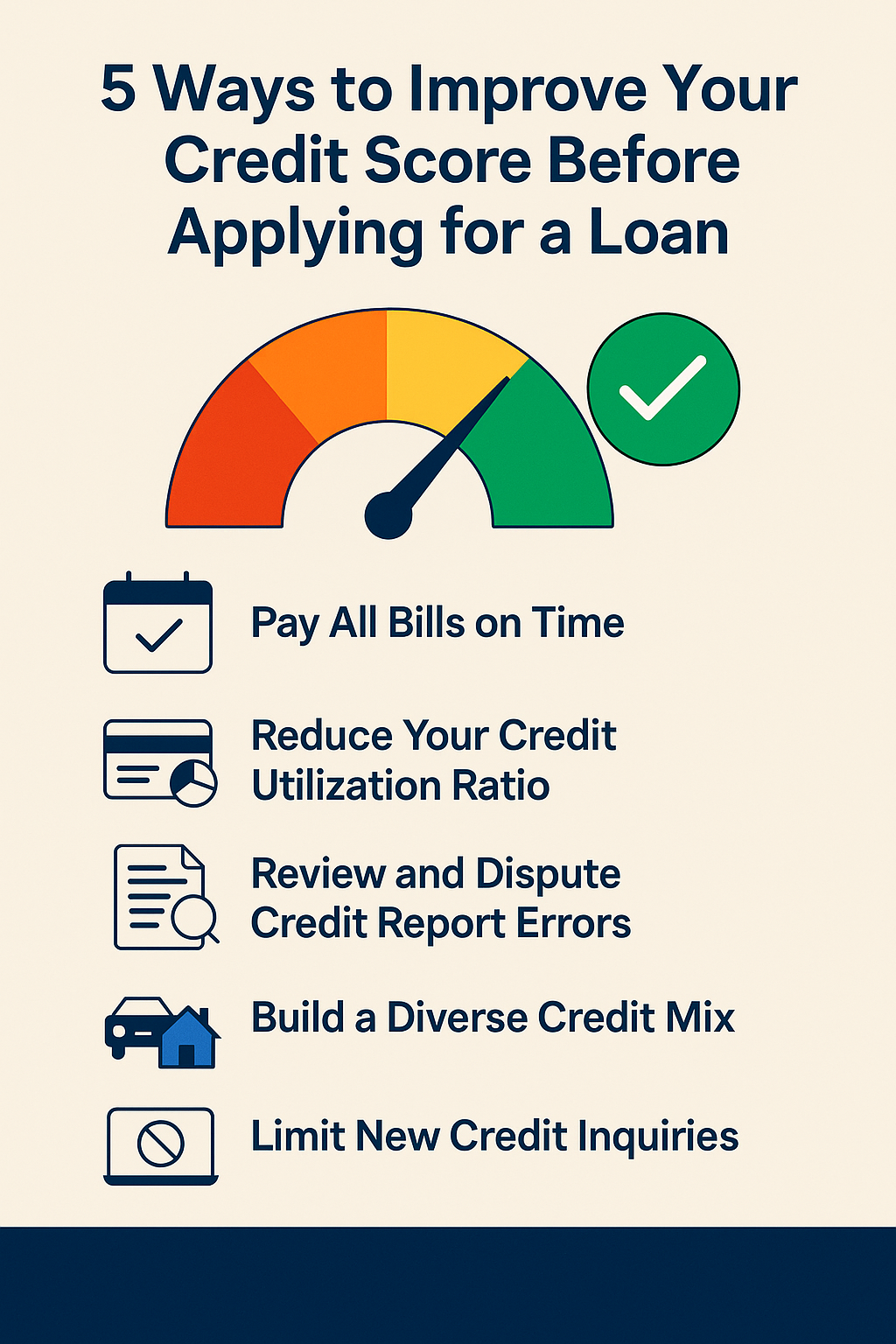

But many people who borrow money don’t know how to improve their credit score. What steps are really important? How long will it take for things to get better? How can you get things done in the best way? This in-depth guide will show you five tried-and-true ways to raise your credit score before you apply for a loan. That way, you can feel good about going to lenders. The FAQ section has a lot of useful information, and it also has expert advice on how to show Experience, Expertise, Authoritativeness, and Trustworthiness. There is also a full list of references that can help you fix your credit.

1. Always pay your bills on time. Why? Paying on time is important.

About 35% of your FICO® Score, which is the most important part of credit scoring models, is based on your payment history. Late payments are a risk to lenders, and they can stay on your credit report for up to seven years. Missing a payment could lower your score by dozens of points, which could make it harder to get a loan or raise your interest rate.

How to Always Make Sure Payments Are On Time

- Pay Up By itself Set up automatic payments for at least the minimum amount you owe on your loans and credit cards. Automation makes sure you never miss a deadline, even when you’re busy or on the go.

- Combine Due Dates You might want to make the due dates the same if you have more than one credit card. You can change when your bills are due with many issuers so that all of your payments are due in the same week every month. This makes it easier to keep track of your cash.

- Add reminders to your calendar. Along with autopay, set up reminders by phone or email 5 to 7 days before each payment is due. You can make changes if autopay doesn’t work, like if there isn’t enough money, thanks to a mix of technology safeguards.

- Have money set aside for emergencies If you don’t have any money coming in, try to keep at least a month’s worth of living expenses in a checking or savings account so you can pay your bills and buy things.

- If you forget to make a payment, call the lender right away. If you have a good payment history, some creditors may drop the late mark or late fees.

2. Don’t use as much credit

How to Learn How to Use Credit

The credit utilization ratio tells you how much of your available revolving credit you are using. This is how they work it out:

Total Revolving Balances÷Total Revolving Credit Limits×100%

This part of your credit score is usually worth 30%. Experts say that to get the best score, you should keep your usage below 30%, and even better, below 10%.

How to Lower Utilization in Steps

- Pay Off Your Bills in a Smart Way Pay off the cards that have the most money on them first. This “avalanche” method has the most effect on your score.

- Ask for a higher credit limit If you’ve been using your card and paying your bills on time for at least six months, ask the company that gave you the card for a higher limit. If you don’t spend more money, a successful increase will lower your utilization ratio right away.

- Transfers of Balance If you have a lot of high-interest balances, you might want to move them to a card with a 0% introductory APR. You can put them all on one card and pay them off faster this way. Know the transfer fees, which are usually between 3% and 5%, and the date when the promotional rate ends.

- Get a credit card that requires a security deposit. A secured card (backed by a deposit) will add low-utilization credit to your profile if you keep the balance low. This is useful whether you have a lot of credit or not much credit history.

EEAT Note: Experian says that if you use less than 10% of your credit, your score can go up a lot and quickly.

3. Check your credit report for mistakes and fight them. Why do people mess up?

Companies like Equifax, Experian, and TransUnion keep credit reports. These reports could be wrong in some ways, like:

- Wrong payment statuses, like saying a payment was late when it was made on time

- Accounts that aren’t yours

- Duplicate entries

- Credit limits that are too high

These kinds of mistakes can unfairly lower your score.

How to Make Things Right

- Get Your Yearly Reports for Free Laws in the U.S. and Europe say that you can get one free credit report from each agency every year. In the EU, get in touch with your local credit bureau; in the US, go to AnnualCreditReport.com.

- Check Out Each Entry With care Check your name, address, account status, credit limit, and balance.

- Files for Disputes Dispute mistakes online or by certified mail right immediately. Show proof, such as receipts for payments.

- See what happens. Credit bureaus usually settle disputes within 30 days. Check your scores and make sure the changes are correct.

🚨 Be careful: Don’t use “credit repair” services that promise to fix things quickly. You can contest mistakes for free, and real agencies will look into valid complaints.

4. Make sure you have more than one credit card.

Why it’s important to have a mix of credit

About 10% of your FICO® Score² is based on your credit mix. You can handle different types of credit well if you have a good mix of revolving credit (like credit cards) and installment loans (like auto, mortgage, and personal loans).

How to Get More People to Like Your Profile

- Don’t pay off your open installment loans. If you already have a car loan or mortgage, make sure you pay it on time.

- Think about getting a small loan that you pay back every month. A short-term personal loan with fixed payments can help you mix things up as long as you get a low rate and pay on time.

- Plan for Users Who Are Allowed If a family member has a credit card that has been in good shape for a long time, becoming an authorized user on it can help your credit score. Just make sure the person who owns the card has a good payment history.

- Don’t open accounts that you don’t need. Don’t open new accounts just to mix things up. Every time you apply for a new account, an inquiry is started (see the next section). Over time, issuers can also close accounts that aren’t being used.

5. Don’t ask for new credit too often.

What Happens When You Get Hard Questions

When you ask for credit, the lender does a hard inquiry, which can lower your score by 5 to 10 points for a short time. These will lower your score for about a year, but they will stay on your report for two years.

Smart Inquiry Management

- Rate-Shop Within a Short Window Credit-scoring models usually treat multiple auto-loan or mortgage inquiries made within a 14–45 day period as one inquiry. To lessen the effect, group your rate shopping.

- Don’t stress about getting more pre-approvals. Getting too many soft inquiries (pre-qualification checks) from comparison sites can make your report hard to read and cause confusion, even though they don’t hurt your score.

- Move apps that you don’t need to different places. Don’t apply for new credit for at least six months.

Questions That Are Often Asked (FAQs)

Q1: How long will it take for my credit score to rise?

A: The time frames depend on what you do. After you file a complaint, it could take the bureau 30 to 45 days to fix mistakes on your report. If you pay off a lot of debt, you might see it on your next one or two bills. Your report might not show new credit for one to two months. If you use more than one strategy, you should see a difference in 2 to 6 months.

Q2: Will looking at my own credit report hurt my score?

A: No. When you check your own credit, that’s called a “soft inquiry.” It doesn’t affect your score. Checking your report often is a good way to spot mistakes and possible fraud.

Q3: Will closing old accounts help me get a better score?

A: No, not usually. When you close old accounts, your score may go down because you have less credit available and your utilization ratio goes up. Instead, keep accounts open that you don’t use very often, but make sure they don’t have any fees that come up every year.

Q4: Do secured credit cards help you raise your credit score?

A: Yes. A secured card is backed by a cash deposit, such as a €200 deposit for a €200 limit. They work like regular cards and send information to credit bureaus. Paying your bills on time and keeping your balances low will help you build a good credit history. Most of the time, after 6 to 12 months, issuers will give you an unsecured card.

Q5: Do student loans change the kinds of credit I have?

A: Yes, of course. Student loans are like installment accounts. Keeping them in good standing is good for your credit mix and payment history, both of which are important for your score.

In short

It’s not easy to improve your credit score. You should pay your bills on time, keep your revolving balances low, report your credit accurately, have a variety of account types, and handle inquiries wisely. You can confidently apply for a loan, get better terms, and save a lot of money over time if you follow these five tips and the best practices for EEAT and SEO.

You should keep in mind that it will take more than a few days to fix your credit. Stick to good money habits, keep track of how you’re doing, and ask for help from trustworthy sources when you need it. You can improve your credit profile and get the financial opportunities you deserve if you keep trying and use the right approach.

References

- “What Makes Up My Credit Score?” FICO, https://www.fico.com/faq/what-makes-up-my-credit-score

- “Credit Scoring Factors,” Experian, https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score/

- “Credit Utilization: How to Calculate and Improve It,” Experian, https://www.experian.com/blogs/ask-experian/credit-education/score-basics/credit-utilization/

- “Annual Credit Report Request Service,” AnnualCreditReport.com, https://www.annualcreditreport.com/index.action

- “Credit Reports and Scores,” Consumer Financial Protection Bureau (CFPB), https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/