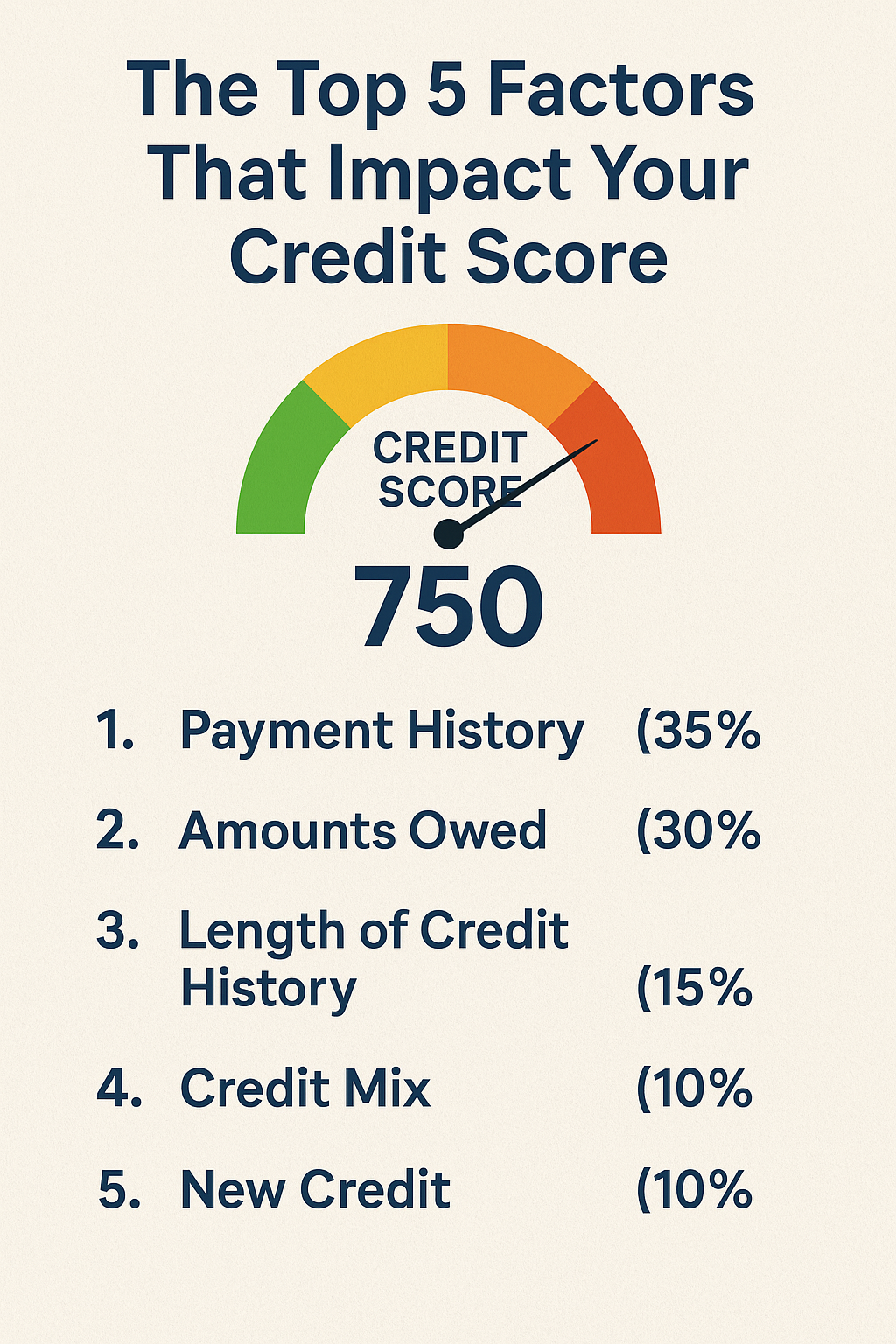

Your credit score is more than just a three-digit number; it’s like a financial passport that helps you get loans, low interest rates, and even rental agreements. In today’s mostly digital economy, your credit score is a big part of how risky something is for lenders, landlords, and service providers. You can save thousands of dollars over your lifetime and make smart choices if you know what affects your credit score. There are five main things that can lower your credit score that this article talks about a lot.

1. History of payments (35%)

What It’s important

Experian says that the way you pay your bills is the most important thing that can hurt your credit score. It accounts for 35% of the FICO® Score. Lenders need to know that you will always do what you say you will do. You are low risk if you pay on time, but if you miss a payment or are late, that is a red flag.

Key Parts

- Timeliness: If you don’t pay on time, your report could show a payment that is even 30 days late for seven years.

- Severity: Bankruptcies, foreclosures, repossessions, and charge-offs are all things that can really hurt your score.

- Payments over time: Always paying on time builds a good history, but being late on payments over and over again makes things worse.

How to get things done

- Setting up autopay or calendar reminders can help you remember to pay your bills on time.

- Put accounts with a lot of risk first: Don’t get bad grades by ignoring accounts that are about to go bad.

- Proactive Communication: If you think you might have trouble, call your lender to talk about how to deal with your problems or how to make your payments last longer.

2. Amounts owed (30%)

Why It Matters

According to MyFICO, 30% of your credit score is based on how much credit you use or how much you owe. This factor tells you how much of your credit you are using. People think there is more risk when there is a lot of use, which means overextension.

Important numbers

- The revolving utilization ratio is the total amount of credit card debt divided by the total amount of credit limits.

- Installment loan balances are the amounts that are still owed on mortgages, car loans, and student loans.

- Account Concentration: Having one account with a lot of money in it might be better than having a lot of accounts with high balances.

How to make the most of it

- Stay Below 30%: If you can pay off an account over time, don’t go over 30% of the limit. Use less than 10% to get the biggest score boost.

- Look at both the individual ratios and the overall ratios. You can still lower your score with one card that is maxed out, even if you don’t use it very often.

- Request Limit Increases: A higher limit without spending more lowers utilization, but don’t give in to the urge to build up balances.

3. How long you’ve had credit (15%)

What Your FICO® Score Means

The age of your credit accounts counts for 15% of myFICO. Lenders can see more about how you pay your bills when you have a longer credit history.

Main Parts

- Age of Oldest Account: A credit line that has been open for a long time is still good.

- Average Account Age: This score is based on the age of all the accounts.

- Recency of Use: If you haven’t used an account in a long time, the issuer may close it, which shortens your history.

How to get things done

- Keep Your Old Accounts Open: You should keep your oldest credit card open even if you don’t use it very often.

- You should use your cards to buy little things from time to time and pay them off right away to keep them active.

- Don’t close accounts that you don’t need to: Your average age and available credit go down when you close an account. This could hurt how long you’ve had credit and how much you use it.

4. A mix of credit (10%)

What It Means

MyFICO is your credit score. It depends on 10% of the types of credit you have, such as credit cards, retail accounts, installment loans, and mortgages. It shows that you can be responsible with different types of loans.

What Kinds of Credit Matter

- Revolving Credit: Credit cards and lines of credit are both kinds of credit that can be used again and again.

- Installment Loans: Car loans, student loans, mortgages, and personal loans are all types of installment loans.

- Retail Accounts: Store-branded cards and financing plans, like buy-now-pay-later services, are examples of retail accounts.

How to finish things

- Balanced Portfolio: If you only have credit cards, you might want to think about getting a small personal loan that you pay back in installments.

- Don’t take out loans you don’t need: Don’t borrow money if you want to mix. Think about the terms and costs.

- FICO will start adding information about “buy now, pay later” in the fall of 2025. If you use BNPL wisely, your mix score will go up.

5. New Credit (10%): Why It’s Important

Getting new credit and asking for it makes up the last 10% of your FICO® Score. Every hard inquiry could mean more debt for you, and if you get a lot of them in a short amount of time, your score could go down.

Things to think about

- When you ask for new credit, lenders look at your credit history and ask you hard questions. They will stay on your report for two years.

- Age of New Accounts: When you open a new account, the average age of your credit history goes down.

- Rate Shopping: If you ask about a car loan or mortgage in a short amount of time (usually 14 to 45 days), it only counts as one inquiry.

How to get things done

- Limit Applications: Only apply for credit when you really need it, and only after doing your research and getting prequalified.

- Strategic Rate Shopping: Fill out loan applications quickly to limit the effects of inquiries.

- Check your pre-qualifications: Before you apply, use soft inquiries to see if you meet the requirements. These won’t affect your grades.

Questions and Answers

1. How long do mistakes stay on my credit report? Most bad marks, like collections, can stay on your credit report for seven years after the first missed payment if you don’t pay your bills on time. Bankruptcies can last for up to ten years.

2. Will looking at my own credit score hurt it? No. Asking questions politely, like checking your own credit score through a credit monitoring service, won’t change your score. When you apply for credit, only hard inquiries from lenders will change your MyFICO score.

3. Will paying off a loan early help my credit score? Paying off installment loans on time is good for your payment history, but closing an account you’ve already paid off can hurt your credit mix and make your credit history shorter. Think about the good and bad things that could happen before you close any accounts.

4. How often should I check my credit report? You should check your credit reports from all three bureaus once a year at AnnualCreditReport.com. You might also want to sign up for a service that will watch your credit and tell you when something changes.

5. Are you able to talk to your creditors and get them to stop charging you for late payments? Some creditors might agree to a “good-will adjustment” if you’ve always paid on time. This means they will take away a late mark. Write down what you want and then check back.

6. What does it mean for my score if someone else uses my account? Both the main signer and the co-signer are responsible. Paying on time can help you, but not paying on time can hurt both of your scores.

The end

How you handle your money can make your credit score go up or down. You can steadily improve your creditworthiness by keeping an eye on the five most important things: your payment history, the amounts you owe, the length of your credit history, the mix of your credit, and your new credit. Follow the advice on this list, keep track of how you’re doing, and make use of the many resources that reliable groups offer. If you take care of your credit, your score will go up over time, and you’ll have more money options and peace of mind.

References

- Experian. “What Affects Your Credit Scores?” Ask Experian. Retrieved from Experian

- FICO. “What’s in Your FICO® Scores?” myFICO. Retrieved from myFICO

- MarketWatch. “A warning for all Americans…” MarketWatch. Retrieved from MarketWatch

- MarketWatch. “Demystifying credit scores and how to get a good one.” Retrieved from MarketWatch

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.