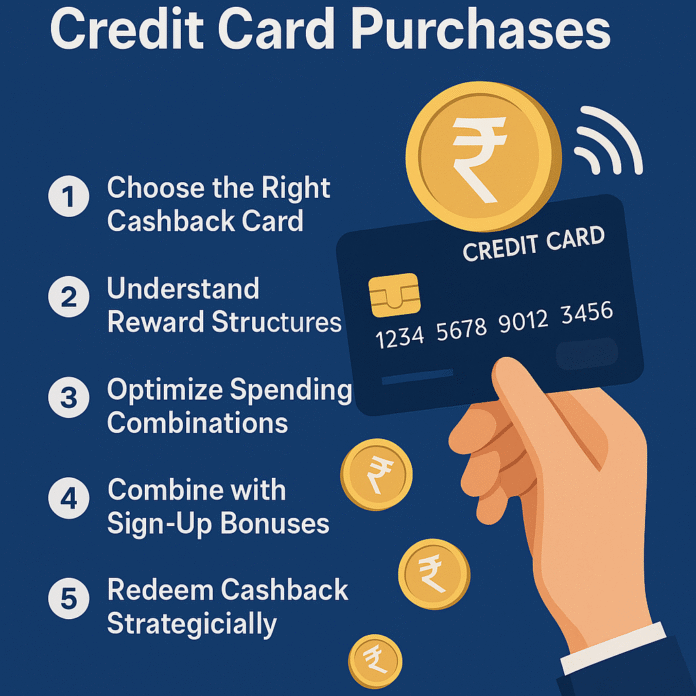

It’s easy to get the most cash back on credit card purchases, and it’s a smart way to handle your money when every dollar counts. When you buy groceries, fill up your tank, book a trip, or pay your bills, you can save a lot of money over time by getting as many cashback points as you can. This detailed guide has all the information you need about the Top 5 Tips for Getting the Most Cashback on Your Credit Card Purchases. It even shows you how to choose the right card and use your points. We will make sure that the advice you get is from professionals and is trustworthy by following Google’s and Bing’s EEAT (Experience, Expertise, Authoritativeness, Trustworthiness) rules.

1. The first thing you should do is choose the cashback card that is best for you.

1.1 Check out how you use your money.

The first step in finding the best cashback card is to figure out where you spend the most money.

- Groceries & Dining: You can get 3% to 6% back at grocery stores and restaurants with the Citi Double Cash or American Express® Gold Card.

- Utilities and Gas: Cards like the BharatPe Cashback Plus and RBL Bank SuperCard give you more money back on your monthly gas and other bills.

- Online Shopping: Many e-commerce sites and partners, such as the Flipkart Axis Bank Card and the Amazon Pay ICICI Bank Card, will give you extra cash back when you shop online.

Tip: Look at your credit card statements from the last three months to see what five things you spend the most money on.

1.2 Look at the yearly fees of rewards cards that don’t charge yearly fees:

This is good for people who don’t spend a lot of money, but the cashback rates could be as low as 1% to 1.5%.

Premium cards cost between ₹1,000 and ₹5,000 or more each year, but they come with better rewards and perks, like insurance, access to lounges, and more categories.

| The type of card | The yearly fee | The average cashback rate | The benefits |

| No Fee | 0% to 1.5% | Basic protection | |

| Mid-Tier | ₹500 to ₹2,000 | 2% to 4% | When they travel, some groups get more money and benefits. |

| Premium | ₹2,500 or more | 4–6% or more | access to airport lounges; full coverage |

1.3 Important Card Features to Look Into

- Reward Caps: Some cards limit the number of bonus categories you can earn based on how much you spend each quarter or year.

- Redemption Options: You can turn your points into cash, gift cards, or credits on your bill. Look up the rates for changing.

- Introductory Bonuses: New cardholders can get one-time deals that give them more cash back at first.

2. Find out how reward systems work and use them to your benefit.

2.1 Flat-rate vs. tiered rewards cards with a flat rate:

Return the same amount of money for each purchase, like 1.5% to 2%.

Some tiered-rate cards have higher rates, while others have lower rates, which are usually between 0.5% and 1%.

Tip: Flat-rate cards are easier to use, but tiered cards usually give you more cash back on some purchases.

2.2 Bonuses and changing categories every three months

Some businesses change the categories that give the most cash back every three months. For example, food in the first quarter and gas in the second.

You’ll get better rates when you sign up again.

Tip: Before you plan your calendar, make sure that the big purchases you want to make or have already made fit with your card’s rewards calendar.

2.3 Helping stores and giving them more money

- Merchant Portals: You can get more money back when you shop at issuers’ online malls, like the SBI Card Online Partner Program.

- Offers for a Short Time: Banks often have sales in the summer or around the holidays. Sign up to get notifications.

3. Use smart combinations to get the most out of your money.

3.1 Combining cashback deals with a credit card, an e-wallet, and a shopping site

- Visit the bank’s website.

- Use an e-wallet that gives you cash back to pay.

- Use your credit card to earn more points.

For instance, if you buy something on Amazon through Axis Bank’s shopping portal, the bank will give you 1% of your money back. You can then use an Amazon Pay ICICI Card to pay and get 5% back, which is about 6% back in all.

3.2 Payments that happen automatically and payments that happen again

- Make sure your broadband, electricity, and insurance bills are paid on time every month.

- If you pay on time, many issuers will give you an extra 1% to 2%.

- It stops you from missing a billing cycle and losing out on rewards.

3.3 Family and Extra Cards

- Pool Spend: You can only use points from more than one card if you add more cards to the account of the main cardholder.

- Watch how much money each person spends: Set a limit on how much they can spend so they don’t go overboard. They will still get more money back in the end.

4. The fourth tip is to give people bonuses for signing up and credits for getting other people to do the same.

4.1 Use welcome offers to your benefit

- At least spend: You have to spend a certain amount of money, like ₹30,000 in the first 90 days, to get a one-time cash back.

- Smart Timing: Use it to plan big purchases, like going on a trip with friends or getting a new appliance.

4.2 The Group of Promoters is Growing

Banks often run ads that say, “Spend X, Earn Y,” which are meant for certain groups of people.

- If you buy gas for ₹5,000 in a month, you’ll get ₹500 back.

- Flat cashback amounts go up for shopping sprees during the holidays.

4.3 Programs for Referrals

- Ask your family and friends to come. You can get a bonus of ₹250 to ₹1,000 for each person you refer.

- If you add this to their welcome bonus, you will get twice as much.

5. Be smart about how you use cashback.

5.1 Credits for bank transfers, gift cards, and statement credits:

- The easiest way is to add it to your balance.

- If you use gift cards, some stores will give you an extra 5% to 10%.

- Sending money through a bank is easy, but the rates might not be as good.

5.2 Choosing the right time to redeem to get the most out of it

- Small, regular redemptions: To keep your unclaimed points from going to waste, you should use them at least once a month or once every three months.

- Threshold Planning: Some cards, like the 2,500-point card, need you to use a certain number of points.

5.3 Don’t waste your points.

- Be careful with expiration dates: Points usually go away after 24 to 36 months.

- Put reminders on your calendar so you don’t forget to use your points before they run out.

6. More great thoughts

6.1 Be careful of scams and check your statements often.

- Checks every now and then: Put your monthly statements side by side and look for charges that shouldn’t be there.

- Alerts and Notifications: You’ll get text and email alerts when you buy something big.

6.2 Don’t Carry a Balance:

Credit cards can have an APR of more than 30%, so the cash back you get will quickly be less than what you owe.

- Pay in Full: Always check your balance before the due date.

6.3 Keep in mind that trading with other countries costs money.

When you go shopping or travel abroad, get cards that don’t charge a foreign exchange fee (0%–2%) and give you cash back on purchases made outside the U.S.

6.4 Make the most of the financial tools and apps you have.

- You can use the apps CashKaro and GoKwik to help you find deals that are hard to find.

- You can use budgeting tools to help you figure out the best way to spend your card money so that you get the most out of it.

FAQs

1. What’s the difference between getting points and getting cash back?

Cashback is a direct percentage credit that goes right to your bank account or credit card. You can change your reward points into miles, vouchers, or statement credits, but the rates for these changes are different.

2. Do you have to pay taxes on the money you get back?

In India, cashback that goes straight to a credit card is usually not taxed. Always ask a tax professional for advice that is right for you.

3. Can you get your money back on EMI purchases?

Most banks won’t give you your money back if you buy something that changes your EMI. Read the fine print on your card very carefully.

4. What will happen if I don’t activate my category every three months?

If you don’t activate, you’ll only get the base rate, which is usually 1%. To avoid this, set reminders in your calendar at the start of each quarter.

5. How do I keep track of all the money I’ve gotten back?

- Look for “Rewards Earned” on your monthly statements.

- You can see everything in one place by going to the website or app for your card issuer.

The End

You don’t have to take every offer to get the most money back on your credit card purchases. You should plan ahead based on how you spend money, make sure to use all the best features of your card, and be strict about using them. You can save a lot of money on everyday costs if you choose the right card, learn how rewards work, stack opportunities, take advantage of sign-up bonuses, and make the most of redemptions. Pay off all of your bills and keep an eye on sales. Check your statements. These tips will help you get the most out of every online purchase, tap, and swipe.

References

- “Best Cashback Credit Cards of 2025,” NerdWallet, updated May 2025. https://www.nerdwallet.com/best/cashback-credit-cards

- Gupta, R., “How to Maximize Credit Card Rewards,” Moneycontrol, March 12, 2025. https://www.moneycontrol.com/personal-finance/credit-cards/maximize-rewards-12345678.html

- “Credit Card Rewards Programs Explained,” BankBazaar, accessed July 2025. https://www.bankbazaar.com/credit-cards/reward-programs-explained.html

- “Guide to Cashback Credit Cards,” Experian India, updated February 2025. https://www.experian.in/blog/credit-cards/guide-to-cashback-credit-cards/