Your 20s and 30s are two of the most exciting and scary times in your life as an adult. You have new duties, things change all the time, and there are always new chances. Building good money habits during these years is the key to long-term financial freedom and health. It’s important to feel good about your money, whether you’re starting your first full-time job, dealing with student loans, or dreaming of being free of debt. Having money isn’t the only thing that gives you financial confidence. It’s a state of mind that lets you make smart choices, face challenges, and take advantage of opportunities without being too scared.

Many young adults believe that only financial experts can do things like budgeting, saving, or investing. The truth is that little, regular, and proactive habits can have a big effect. As you get older, you realize that making smart choices over time, not overnight, is what keeps your finances stable. Every good choice you make is important because it affects not only your money but also how much power you have over your future.

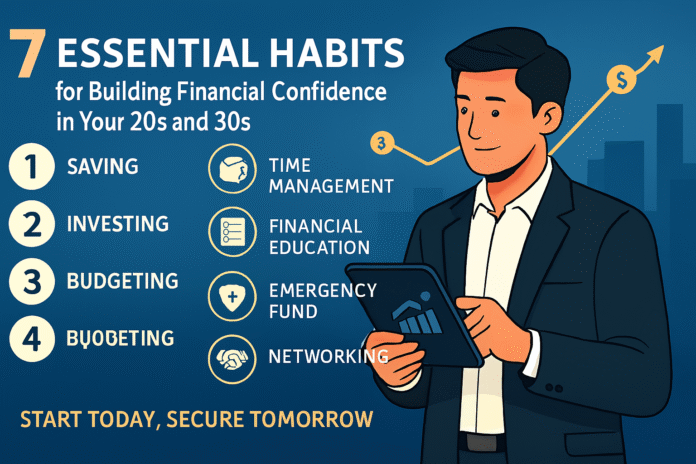

This article will talk about seven important habits that will help you build your financial confidence from the ground up. These tips will help you learn how to be financially successful, whether it’s making a realistic budget, setting up an emergency fund, or even learning how to spend money wisely. We’ll explain financial terms that are hard to understand, show you things you can do right away, and give you examples of how these habits work in real life. Get ready to reclaim control over your money, boost your decision-making power, and set a stable course toward long-term wealth-building. Pay attention to everything that is said to you. With each one, you’re getting closer to a time when your financial confidence will change not only your bank account but also every other part of your life.

Let’s start a journey where financial knowledge meets everyday usefulness. This will make sure that every step you take toward your financial goals is based on purpose and confidence.

What It Means to Have Financial Confidence

Being financially confident means more than just being able to handle money well. It also means having a way of thinking that shows you are sure of yourself, can make good decisions, and isn’t afraid of the unknowns in life. At its core, financial confidence allows you to wake up every day knowing that regardless of the short-term ups and downs of the economy or unforeseen expenses, you have the power to steer your financial destiny.

What does it mean to have financial confidence?

- Knowledge is Power: To feel good about your money, you need to know how to budget, save, invest, and spend wisely. It’s knowing that you’re getting closer to being financially free, even if you start small.

- Bridging the Gap Between Dreams and Reality: It’s an inner strength that makes you set realistic short- and long-term goals. If you believe in your money, you can keep going on your journey, whether you want to travel the world, buy a house, or retire comfortably.

- Reducing Financial Stress: You feel less stressed when you have faith. It’s easier to make choices when you have clear plans and habits, and you feel good about how clear your financial goals are.

Why It Matters More Than Cash

- Effects on Life Choices: When you are sure about your money choices, it affects more than just money; it gives you confidence in all areas of your life. You are more confident about asking for what you want, whether it’s a raise or a big change in your life.

- Taking Risks and Making Opportunities: If you know how to handle your money well, you’re more likely to take smart risks, like starting a new business or investing in new ideas, without worrying about losing everything.

- Affects Personal Growth: Building financial confidence takes learning and adapting; it’s a never-ending journey that builds discipline, resilience, and the ability to plan ahead.

How your habits and way of thinking affect each other

You don’t get financial confidence by chance or by getting a lot of money from your parents. You get it by making choices that are smart and planned. These habits not only help you keep track of how much money you spend each day, but they also teach you and give you power over time. They change your way of thinking from one that reacts to financial problems to one that takes action with a clear and purposeful goal in mind. Knowing that every choice you make, like getting a cup of coffee or putting money into a 401(k), affects your overall financial picture is freeing. This will help you do well in the long run.

In short, financial confidence is a complicated idea that includes both good habits and a strong sense of self-worth. Once you embrace this framework, your money stops being a source of stress and becomes a tool for attaining freedom, happiness, and the life you aspire to lead.

The First Thing You Should Do is Make a Budget That Works and Stick to It.

The best way to keep your money stable is to make a budget. Even if you aren’t an accountant or financial expert, writing, following, and improving a budget is one of the best things you can do in your 20s and 30s. Let’s talk about why budgeting is so important and how to fit it into your daily life.

The Strength of a Budget

- Laying the Groundwork for Your Financial Life: A budget allows you to visualize your income and expenses clearly. It tells you how much money you spend and how much more you make than you spend.

- Setting Priorities: A budget helps you figure out what’s most important by putting your expenses into groups, like rent, groceries, debt payments, and fun activities. This helps you spend money in a way that gets you closer to your long-term goals.

- Stopping Impulses: A realistic budget helps you stay on track. You won’t be as likely to buy things on impulse that could set you back on your financial goals if you plan your spending ahead of time.

- Keeping Track of Your Progress: A budget shows you how far you’ve come, which reminds you of the good things that come from being frugal and pushes you to keep getting better.

How to Make a Realistic Budget

- First, keep a diary of your money: Keep track of every penny you spend for a month. This exercise will help you think about how you spend your money and show you costs that you may not have thought of before.

- Get your spending in order: You should separate your spending into three groups: fixed costs (like rent and utilities), variable costs (like groceries and entertainment), and discretionary costs (like eating out and buying things you don’t need). This will help you figure out where to move extra money around.

- Set clear and reachable limits: Look at your monthly income and set spending limits for each category that you can’t change. Tools and apps like Mint or YNAB (You Need A Budget) can help by automatically keeping track of and sorting your expenses.

- Strong but open: A budget should change over time. Check on your plan often and change it when your income, goals, or costs change. But always stay focused on the big picture.

- Balance Fun with Responsibility: Set aside a small amount of your budget for fun or entertainment to keep things in balance. You can keep up good budgeting habits by celebrating small victories without feeling like you’re missing out.

Apps and tools that can help, for example

- Apps for mobile devices: PocketGuard and Goodbudget are two tools that help you keep track of your spending and saving in real time.

- Spreadsheets: If you like to do things yourself, making your own Excel or Google Sheets template can give you more freedom to keep track of and analyze your money.

Example from life

Think of Sarah, a 28-year-old marketing professional who had trouble not buying things on impulse. When Sarah started using a budget, she was surprised to see how much of her income went to daily coffee runs and eating out. She set a fair monthly limit on these extra costs and saved the extra money in a bank account. She even started putting money into a portfolio of ETFs that were spread out. As Sarah’s savings grew, her debt went down, and her financial goals, like planning a vacation, started to take shape, she felt more sure about her money.

Last Thoughts on Budgeting

In a world where things happen quickly and people want things right away, making and sticking to a budget is a way to show that you care about yourself and take charge of your life. It takes care of problems right away, so your money works for you instead of against you. This will teach you a lot of discipline that is worth its weight in gold. It’s not about deprivation; it’s about being intentional with every dollar you spend, which brings you closer to long-term financial security and peace of mind.

The Second Habit is to Set Up an Emergency Fund.

Life can throw off even the best-planned budgets. For example, if you lose your job or have to pay for an unexpected medical bill, your budget may not work out. You save money in an emergency fund to protect yourself from life’s storms. It’s your money safety net. This habit is very important for getting the peace of mind and stability you need to build wealth over the long term without worrying about the next crisis.

What is an emergency fund?

An emergency fund is a special savings account that holds money set aside just for unexpected and short-term money problems. You shouldn’t use it for everyday expenses. It’s for those times when you need money right away but don’t want to mess up your regular budget.

Why You Need an Emergency Fund

- Money security: If you have to pay for something you didn’t expect, having an emergency fund lowers the chance that you’ll go into debt. When you have a backup fund, emergencies are less stressful and you can deal with them more logically.

- Avoiding being dependent on expensive credit: Many young adults have to use high-interest credit cards or loans because they don’t have an emergency fund. This could hurt your credit score and your overall financial health in the long run.

- Peacefulness: You can make choices based on what’s best for you in the long run when you have some extra cash instead of having to do things right away.

How Much Should You Save?

Most financial experts say that you should start with an emergency fund that can cover at least three to six months of basic living costs. But this number can change depending on your situation and the risks you face. For example, if you work in an industry that changes a lot or live in an area where living costs are higher, it might be a good idea to lean toward the higher end of this range.

How to Save Money for Emergencies

- Write down everything you need: List your monthly fixed costs, which are things like rent, utilities, groceries, and loan payments. To set a savings goal, multiply this number by three to six months.

- Start with small steps: If saving three to six months’ worth of bills seems like too much at first, start by saving one month’s worth of bills. Celebrate small victories along the way.

- Make savings automatic: Set up automatic transfers from your checking account to a dedicated savings account each payday. You can be sure that you will stick with this habit and not be tempted to spend what you want to save if you make it a habit.

- Check back in every so often: Check your emergency fund goal again if your income, living situation, or financial obligations change to make sure it is still enough.

When an emergency fund can really help

- Medical Emergencies: An unexpected bill from the hospital can be a lot of money. When things get tough, you won’t have to take on high-interest debt if you have a well-funded emergency account.

- Losing your job: If you have an emergency fund, you can keep living the way you do for a while, which gives you time to look for a new job without having to cut back on important things.

- Fixing your car or house: Big repairs can happen out of nowhere, but if you have money set aside, you can take care of them right away without having to rush.

What the Psychology Says About a Financial Safety Net

Putting money aside for emergencies isn’t just a financial exercise; it’s a life-changing process that makes you stronger mentally. Putting money in the bank makes you feel like you have more control over your financial future. This constant act of taking care of yourself and being responsible slowly changes the way you think so that you feel safe, ready, and sure of yourself no matter what life throws your way.

In short, an emergency fund is more than just a pile of money; it’s a friend you can count on when things are uncertain. Putting this habit at the top of your list early on in your financial journey gives you a solid base from which to confidently go after other goals without worrying about losing everything.

Habit #3: Putting Debt Management and Responsible Credit Use First

Debt can be both good and bad. People often believe that certain types of debt, like a student loan or a mortgage, are good ways to invest in their future. But if you don’t handle your debt well, it can quickly become a huge burden. It’s important for young adults to learn how to handle debt and use credit wisely so they can keep and build their financial confidence.

How debt can hurt your financial confidence

- A Lot of Weight on Your Shoulders: You might always be worried if you have a lot of debt and not be able to take smart risks. The stress of having to deal with a lot of loans or high interest rates can make long-term financial goals seem less important.

- What Credit Scores Mean for the Future: Using credit wisely builds your credit history and raises your credit score. This could help you get a job, rent a new apartment, or even get a mortgage.

- A Sword with Two Edges: Some debt can be used wisely to build up assets, but borrowing too much or misusing credit cards can put you in a cycle that lowers your confidence and puts your financial future at risk.

How to pay off debt quickly and easily

- Look at and rate: Make a list of all your debts and the interest rates on each one. Pay off your debts with high interest rates first, but make sure to make at least the minimum monthly payments on all of your accounts.

- Use the Snowball or Avalanche Method:

- The Snowball Method: Pay off your smallest debts first and your biggest debts last. For the bigger debts, only make the minimum payments. Closing out debts makes you feel good, which gives you energy.

- The Avalanche Method: This is a different way to pay off debts. You pay off the ones with the highest interest rates first so that you don’t have to pay as much interest overall.

- Merging and Refinancing: Combining a few debts into one loan with a lower interest rate or refinancing a loan with a high interest rate can make things easier to deal with and lower the total amount of interest paid.

Using Credit Wisely

- Checking Your Credit: Look at your credit report and score often to make sure there are no mistakes or signs of fraud. This proactive step helps you keep track of how well your finances are doing.

- Knowing how to use your credit wisely: Your credit utilization is the percentage of available credit you use. Try to keep it below 30%. This practice not only improves your credit score but also gives you a buffer in emergencies.

- How to Stay Away from Common Errors:

- Too Many Credit Cards: Credit cards can be useful and give you rewards, but if you spend too much or only pay the minimum, you could end up with a lot of interest payments.

- Impulse Borrowing: Always plan your purchases, especially for things you don’t need, so you don’t get into debt that you don’t need.

An example from real life

Alex is a 32-year-old graphic designer who got a lot of credit card debt while he was in college. Alex slowly freed up his income by using the avalanche method consistently and combining some of his high-interest debts. Alex’s credit score is better than ever, and he feels more in control of his debt. This will help him with his investments and make his future safer.

Getting along with debt

The secret to being financially confident in your 20s and 30s is to change how you think about debt, turning it from something that makes you anxious into a manageable part of your overall financial plan. You can improve your financial future by using credit wisely and managing your debt proactively. Every little choice you make, like paying off a balance early or not giving in to the urge to buy something on a whim, adds to a bigger story of control and stability.

If you make managing your debt and using credit responsibly your top priorities, you can take smart risks, seize future opportunities, and build wealth instead of being stuck with high interest rates and penalties. This habit isn’t just about getting out of debt; it’s also about learning to plan ahead, control yourself, and be responsible. These are three important traits that will help you be financially successful in the long run.

Habit #4: Putting Money into Things Early and Often

People often say that investing is the skill of making your money work for you. People in their 20s and 30s don’t just want to get rich by investing; they also want to use the power of compound interest to make sure they can be financially free in the future. If you start investing regularly when you’re young, you’ll build a strong base that will help you reach your long-term goals with confidence and strength.

The Advantages of Investing Early

- The Strength of Compound Interest: Your account can grow a lot over time if you put money into it. The longer you have to do it, the more the effects build up.

- Learning and Adjusting: Investing early lets you see how the market goes up and down. These lessons will help you get better at your strategy over time, which will make you a smarter and more confident investor.

- Bringing down inflation: Investing can help protect your savings from the slow but steady effects of inflation. This means that your money will be worth more as time goes on, not less.

Simple Ways for Beginners to Invest

- ETFs, which are short for exchange-traded funds: You can invest in a lot of different things with ETFs by following an index or a group of assets. They are usually cheap and make it easy for new investors to get started.

- Accounts for retirement: You can save a lot of money with a 401(k) or an Individual Retirement Account (IRA) because they come with tax breaks and, in some cases, money from your employer.

- Robo-Advisors and Index Funds: Robo-advisors can automatically spread your money across a number of assets based on your goals and how much risk you’re willing to take if you don’t want to pick individual stocks.

How to Keep Investing

- Set up automatic investments: Set up automatic deposits to your investment accounts, just like you do with your savings. You have to be consistent, even if it’s just a little bit.

- Add more variety to your portfolio: Don’t put everything you have in one place. A portfolio with a variety of assets can protect you from market swings while still giving you the chance to grow.

- Educate Yourself: When you know the basics of investing, you can make smart decisions. Use online courses, books, or even podcasts that are made for people who are new to investing.

- Make Plans for the Future: Don’t let short-term changes in the market worry you. Instead, think about your long-term goals. Remember that putting money into something is a long-term thing, not a short-term one.

How making regular investments boosts your financial confidence

Mia is a 25-year-old software developer who started putting a small amount of money into a diversified ETF every month. Mia stuck to her plan of reinvesting dividends and watching her portfolio grow over time, even when the market went down. Her steady approach made her wealthy and gave her more faith in herself. She learned how market cycles work and how sticking to a plan can help you get through hard times.

Getting past common worries about investing

- Market that isn’t stable: Know that changes are a normal part of any investment plan. Taking a long-term view and spreading your investments out can help lower these risks.

- Fear of the Unkown: Put a little bit of money into your investments at first, and then add more as you learn more. Make learning about money a regular part of your life.

- Pressure to Compare: Don’t look at your portfolio and compare it to those of investors who have been doing it longer. Your financial path is unique to you. Focus on your goals, how much risk you can handle, and how compounding works.

The Amazing Power of Starting Early

You are not only growing your wealth by investing early, but you are also developing a mindset of planning ahead and taking action. Consistent investing helps you look past short-term pleasures and focus on building assets that will help you succeed in the long run. Even the smallest things you do today can add up to a lot of money over time.

People who are rich or know a lot about money don’t have to invest; anyone who is willing to keep learning and practicing can do it. Every dollar you invest strengthens the idea that you are in charge of your own financial future. This is a strong message that not only makes you rich but also gives you a lot of confidence.

Habit #5: Getting to Know Your Own Money

In the world of managing money, where things are always changing, it’s not just helpful to stay up to date; it’s necessary. Financial education gives you the skills you need to make smart decisions and stay in charge of your money. The more you know, the more power you have, and that power gives you more confidence.

Why it’s important to learn about money

- Knowledge is power: You can make smart financial choices if you know the basics of budgeting, managing debt, investing, and the ins and outs of credit. Knowing things makes you less afraid of the unknown and gives you clear steps to take instead of being unsure.

- Getting used to new places: The world of money is never the same. Because of new technologies, changes in the economy, and changes in the market, you need to change your plans. You are always ready to change if you are always learning.

- Making a network of people who can help: Learning about money gives you the chance to connect with financial communities, whether it’s through online forums, local workshops, or seminars. These groups can help, give you advice, and show you different ways of looking at things.

How to Learn More About Money in Real Life

- Blogs and Books: “Rich Dad Poor Dad” by Robert Kiyosaki and “The Total Money Makeover” by Dave Ramsey are two books you should always read. Blogs about becoming financially free can also give you advice right away.

- Podcasts and Webinars: You can learn in a fun and easy way by listening to shows like NPR’s Planet Money or The Dave Ramsey Show.

- Online Courses: You can learn the basics of investing and managing your money on websites like Coursera, Udemy, and Khan Academy. These classes can be very helpful in getting a full picture of how to plan your finances.

- Workshops and seminars in your area: Community centers and banks often hold free or low-cost workshops for young adults. These sessions are also a great way to meet experts in person and ask questions.

How to Use What You Know to Be Confident

Picture yourself as an explorer venturing into uncharted territory. Every new piece of financial information is like a map that shows you where to go to stay out of trouble and find hidden treasures. You are less likely to fall for scams, make bad decisions, or get bad financial advice the more you know. The more you know, the better you’ll be at setting realistic goals, making smart investments, and not making common mistakes. This knowledge builds on itself, and each lesson you learn not only adds to your financial toolkit but also makes you more confident in your ability to make good decisions.

Getting into the habit of always learning

- Make time to learn: Read financial articles or listen to a podcast that goes into detail about how to manage your money for a few hours each month. It’s important to stick to your plans.

- Join financial communities: Talking to people who think like you will help you understand things better and keep you going. No matter where you are, online or off, these communities are there for you.

- Keep a journal of your finances: Write down what you learn, any new ideas you have, and how you can use what you’ve learned. Writing in a journal helps you turn ideas that only last for a short time into habits that you can use over time.

You can turn money management from a mysterious area into a series of clear, actionable steps that boost your overall confidence by staying curious and committed to learning about money. Your journey of learning not only keeps you from making common financial mistakes, but it also motivates you to reach new heights.

Habit #6: Being Clear About Your Money Goals

Goal-setting in personal finance is analogous to mapping out a road trip—you need a clear destination to plot the most efficient route. Setting SMART (specific, measurable, attainable, relevant, and time-bound) financial goals will help you stay motivated and on track as you work toward being financially confident.

Why You Need Clear Financial Goals

- Goal and direction: Having clear goals makes your dreams into things you can measure. You don’t just have vague wants; you have clear goals that help you make decisions about how to spend and save money.

- Duty and Drive: Setting clear goals keeps you focused on what you want to do. This focus helps you stay on track, even when you want to do something fun right now that gets in the way of your goals.

- More options: You should think about how well each financial choice fits with your goals, no matter how big or small it is. This alignment stops people from making decisions too quickly and makes sure that every action has a purpose.

How to Set SMART Financial Goals

- Specific: Be clear about what you want to accomplish. “Save $10,000 for a down payment on a house” is a much better goal than “save money.”

- Can be measured: Find a way to keep track of how far you’ve come. This could mean setting monthly or quarterly goals to make sure you stay on track.

- Possible: Set goals that are hard but still possible. Unrealistic goals can make you angry and unmotivated, but realistic goals can make you feel like you’re making progress.

- Important: Your goals should match your long-term goal of having stable finances. This could involve buying a house, retiring early, or starting a business.

- Time-limited: Give each goal a due date. A timeline pushes you to keep working and check your plan every so often.

Examples of Short-Term and Long-Term Goals

- Short-Term Goals:

- Set up an emergency fund that can cover one month’s worth of bills.

- Pay off a specific credit card balance within 12 months.

- Make plans that will help you feel better and stick to good habits, like saving money for a new gadget or a weekend trip.

- Goals for the long term:

- Put money aside for a down payment on your dream home.

- Keep putting money into your retirement fund until you reach your goal.

- Save money for things you want to do in the future, like going back to school or starting your own business.

Making sure that the things you do every day help you reach your goals

Setting clear financial goals isn’t something you do on its own; it should be part of your daily life. For example, if your goal is to save a certain amount monthly, every purchase should be scrutinized against that aspiration. Over time, you’ll learn how to save and spend money at the same time. This will help you reach your future goals.

Last Thoughts on Setting Goals

Goal-setting is a powerful tool that transforms financial anxiety into focused action. Setting clear, SMART financial goals gives you both something to work toward and a way to keep your good money habits. As you reach your goals, your growing collection of wins boosts your confidence, which in turn encourages you to manage your money wisely and sets you up for long-term success.

Habit #7: Don’t Spend Too Much Money on Things That Aren’t Necessary.

When you want to have fun and be smart with your money, it can feel like you’re walking a tightrope. Lifestyle inflation is when you start to spend more as your income rises because of the appeal of modern consumer culture and rising living standards. Being mindful about how you spend your money means being careful about how you spend it. It’s about enjoying the small things in life without losing your financial freedom in the future.

What does it mean to spend with care?

When you spend mindfully, you keep track of how much money you spend and think about how each purchase fits with your goals. As part of this process of thinking about what you want, you should ask yourself, “Is this purchase in line with what really matters to me?” before you open your wallet.

The Risks of Lifestyle Inflation

- Hidden Cost Creeps: You might want to improve your life right away if your income goes up, like going out to eat more often or buying the newest gadgets. If you don’t keep an eye on these little extras, they can slowly eat away at your savings over time.

- Making Your Financial Goals Less Clear: It becomes harder to build wealth when you spend too much on things you don’t need, even if your income is higher. The need for instant pleasure can get in the way of the self-control needed for long-term savings and investments.

- Spending because of your feelings: A lot of the time, lifestyle inflation is more about how you feel than what you really need. If you know when you’re spending money to fill a hole, you can change your financial priorities.

How to Be Careful with Your Money

- Take a break and think about it: Before you buy something big, ask yourself if it will help you reach your goals. A short wait time, like a 24-hour rule, can help you avoid buying things on a whim.

- Know the difference between needs and wants: Create a simple checklist that categorizes planned expenses into “needs” and “wants.” Focus your finances on essential purchases and allocate only a limited portion for discretionary items.

- Keep track of how much you spend: You can keep track of your spending patterns with budgeting apps or a simple spreadsheet. People can change how they act when they see patterns.

- Limit the amount of money you can spend: Based on your financial goals, set limits on how much you can spend on things that aren’t necessary each month or week. This way of life makes it easier to save money without taking away all the fun.

- Give yourself a treat: Plan in occasional treats as rewards for reaching your financial goals. This way, you won’t be missing out on anything, but you also won’t be going too far.

How Being Careful with Your Money Can Make You Feel More Secure About Your Finances

Imagine Amir, a 30-year-old business owner who got a promotion and moved into a nicer apartment. He also went out to eat more often. He quickly realized that his savings were running out and that he was losing sight of his long-term goals. By recalibrating his habits—prioritizing essential expenses and curbing impulsive spending—Amir not only reclaimed his financial stability but also regained confidence in his ability to manage his money effectively. He could still enjoy the fruits of his work, but he could do so even more because he knew that every purchase was a deliberate, well-thought-out choice.

Finishing Up Mindful Spending

You have to put in some effort to keep your lifestyle from costing more. You need to find a way to enjoy the present while also making plans for the future. You can keep your quality of life high while also making sure that your money grows in a way that lasts by being mindful of how you spend it. This balance is a key part of having financial confidence. It lets you enjoy the present without worrying about the future, which is a dual wisdom that leads to a safe and happy life.

Conclusion

It takes a long time to build financial confidence, and you have to do it one careful, planned step at a time. The seven habits we’ve talked about in this article won’t work right away. When people use them regularly, they are proven to help them manage their money better. To build a stable, secure financial future, you need to make a realistic budget, invest early, and be careful with how you spend your money.

These useful, actionable tips will change the way you handle your money. The problems you have in your 20s and 30s, like dealing with debt or avoiding lifestyle inflation, can teach you important lessons that will make you stronger and more confident in the future. Remember that every smart choice, no matter how small, adds up over time. This will lead to a future where you don’t have to worry about money and have a lot of options.

These tips can help you if you’re just starting out in your career, want to be financially independent, or want to change the way you handle money. You don’t get financial confidence all at once. Instead, you build it up over time by making good habits that celebrate small wins, encourage you to keep learning, and eventually lead to long-term wealth and security.

May you step into each day with the assurance that every conscious decision takes you closer to the financial freedom you deserve.

FAQ Section

1. How do I make a budget if I’ve never done it before?

Starting a budget from scratch might seem scary, but it’s really not that hard. Just follow these steps:

- Keep track of your spending: Start by writing down everything you spend for a month. This is where you start.

- Sort your expenses: Sort your expenses into fixed costs (like rent and utilities) and variable costs (like groceries and entertainment).

- Use budgeting tools: Use budgeting tools like Mint, YNAB, or even a custom Excel or Google Sheets template to help you.

- Set Realistic Limits: For each category, set a spending limit that is based on how much money you make.

- Check in often: Make changes to your budget as needed, and as you get better at managing your money, celebrate small wins.

This step-by-step method helps you see your money more clearly and make decisions that are in line with your goals, which makes you feel more confident.

2. How much money should a person in their 20s have saved up for an emergency?

People often say that you should save enough money to cover your basic living costs for three to six months in case of an emergency. But if that seems like too much to handle at first:

- Start with one month’s worth of expenses. Save a little bit at a time until you have enough.

- Set up automatic transfers to your emergency savings account so that you always put money into it.

- Change Based on Your Situation: If you work in a field that isn’t as stable or you have higher living costs, aim for the higher end of the range.

When you make a safety net, you don’t have to worry as much about unexpected costs, which makes it easier to stick to your budget.

3. When is the best time to start investing in stocks?

The sooner you start investing, the more you can benefit from compound interest. Even small, regular deposits into an investment account, like an ETF, an index fund, or a retirement account, can add up to a lot over time. In your 20s or 30s:

- Use time wisely: Your money has more time to grow.

- Consistency Over Speed: Even modest, consistent investments outperform sporadic, large ones.

- Learn at Your Own Pace: If you’re not sure what to do, start with low-risk options and add more as you get more comfortable.

4. How can I stop spending more money when my income goes up?

When your income goes up, but your spending goes up too, that’s called lifestyle inflation. To stop this:

- Set Financial Goals: Ensure that a portion of any income boost goes toward your savings or investments before increasing discretionary spend.

- Spend mindfully: Before you buy something, think about whether or not it helps you reach your long-term goals.

- Stick to Your Budget: Even if you make more money, keep an eye on how much you spend.

- Reward Yourself Wisely: Enjoy your better financial situation, but do it in a controlled, disciplined way. Small treats can make you feel better without putting your future security at risk.

5. What is the best way for me to learn about money?

There are many ways to keep learning about money:

- Books and podcasts: Try reading “Rich Dad Poor Dad” or “The Total Money Makeover.” You can also listen to “Planet Money” or “The Dave Ramsey Show.”

- Online Courses: Sites like Coursera, Udemy, and Khan Academy have courses on everything from basic budgeting to advanced investing.

- Financial Blogs and Forums: Get involved in online groups where people talk about their own money problems and give each other advice.

- Workshops in your area: Ask your bank or community center about seminars on how to manage your money.

Learning more about money is one of the best things you can do for yourself. It not only teaches you more, but it also makes you feel more sure about every money decision you make.

Keep in mind that every little thing you do matters as you think about these habits. You have control over your financial future with every little thing you do, like keeping track of your daily expenses or learning about how to invest. Building up your financial confidence takes time and work. What you do today will help you in the future.

Use these tips, be proud of what you’ve done, and keep pushing the limits of what you think you can do with your money. There is a lot of information out there waiting to be found if you want to learn more about things like advanced investing strategies, how to negotiate your salary, or even how to plan for an early retirement. Have a great trip to financial freedom!