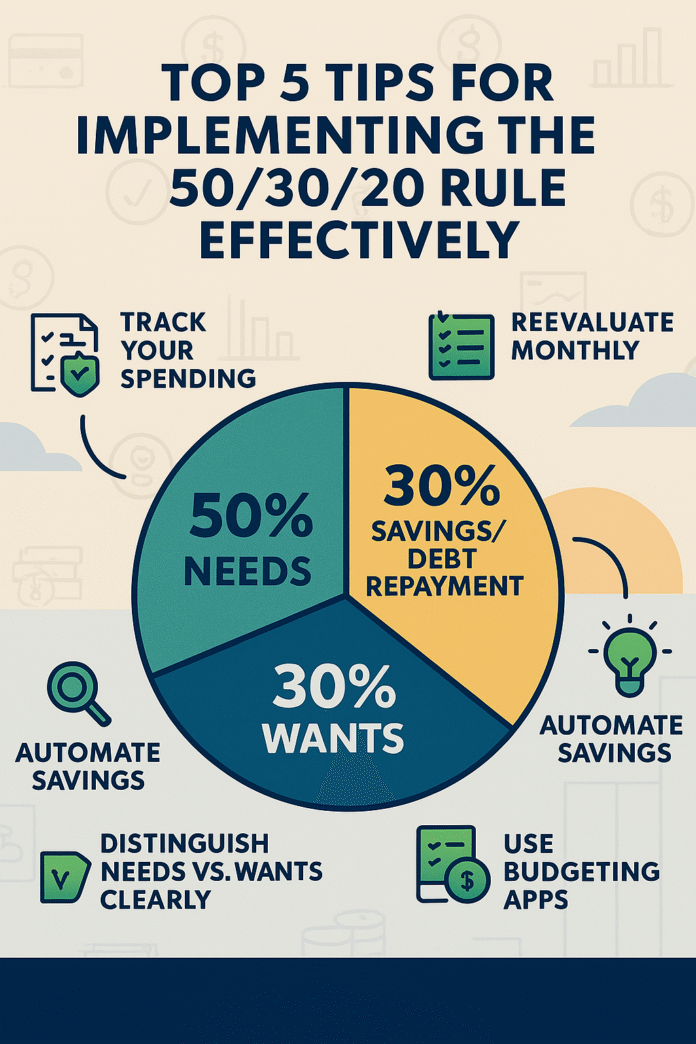

In today’s fast-paced world, where money problems seem to get worse every day, having a simple but strong way to budget can help you feel more at ease with your finances. The 50/30/20 rule is a budgeting method that has worked for a long time. This method splits your income after taxes into three simple groups: 50% for Needs, 30% for Wants, and 20% for Savings/Debt. This rule is easy to understand and can be used by anyone, whether you’re a young adult just starting to become financially independent, a student learning how to manage a small amount of money, or a family trying to get a handle on their spending. In this article, we’ll explain the basics of the 50/30/20 rule and give you five expert-backed tips on how to confidently use it in your daily financial planning.

The 50/30/20 rule is meant for people who might feel overwhelmed by complicated budgeting apps or detailed financial plans. You don’t have to deal with complicated spreadsheets or software with a lot of categories. Instead, you get a framework that is easy to understand and can be changed. You should think about your expenses in general terms: what you need to pay (needs), what you want (wants), and what you can save or owe (savings and debt). This method is very popular because it is both realistic and flexible. It is a guideline, not a strict rule, so you can change it as your situation changes.

The 50/30/20 rule also helps you keep your finances in balance. It makes sure that you are not only paying for your basic needs, but also having money left over for fun and planning for the future. The best thing about this system is that it works for everyone, no matter how much money they make. We will talk about five concrete ways to get the most out of the 50/30/20 rule in the next few pages. These easy budgeting tips will help you take charge of your future by giving you the financial planning tools you need to pay off debt, save for emergencies, or just get better at controlling your spending.

By the end of this post, you’ll not only know how to use the 50/30/20 rule well, but you’ll also have a clear, step-by-step action plan that works for both new and experienced budgeters. If you’re ready to move from financial chaos to clarity, keep reading to find out how this rule can be the foundation of your money management plan.

A Quick Look at How the 50/30/20 Rule Works

Before we get into our top five tips, let’s look at the 50/30/20 rule in its most basic form. This method divides your income after taxes into three big groups:

- 50% for Needs: You have to pay these bills with this part of your income. Think about things like rent or mortgage payments, groceries, utilities, necessary insurance premiums, transportation costs, and the least amount of money you have to pay back on your debts. These are the bills you have to pay that keep your daily life running smoothly.

- 30% for Wants: This group is for the fun things that make your life better but aren’t necessary for survival. This includes going out to eat, paying for streaming services, going on vacation, doing hobbies, and shopping for things you don’t need. These costs are important for a good quality of life, but they can be changed or cut back if needed.

- 20% for Savings/Debt: The last piece is about your financial future. This includes putting money away for emergencies, retirement accounts, investments, or paying off any debt you already have more than the minimum payments. You might need to move money around within these 20% in some cases to meet urgent financial needs.

An Example from Real Life

Think about how much money you make each month: $3,000. If you follow the 50/30/20 rule, your budget would look like this:

| Category | Percent | Dollar Amount |

|---|---|---|

| Needs | 50% | $1,500 |

| Wants | 30% | $900 |

| Savings/Debt | 20% | $600 |

This example shows clearly how to divide up a fixed income in a fair way. But keep in mind that the 50/30/20 rule is just a suggestion, not a strict rule. There may be times when you need to temporarily change your budget, like when your rent goes up or you have an unexpected bill. This rule is truly adaptable and useful for different lifestyles because it is flexible. It makes sure that you aren’t stuck with a budget that is too strict and stops you from being spontaneous or growing.

This method is very popular with people who are just starting to budget and want straightforward tips that get to the point. The next sections will give you five tips that you can use to apply the rule in a way that works for you, whether you have a low income, student debt, or the unpredictable nature of freelance work. These tips will help you manage your money better. Let’s look at these strategies that experts say work.

Five Best Ways to Make the Rule Work

Tip 1: Make sure you know the difference between your “needs” and your “wants.”

One of the most important things to do when using the 50/30/20 rule is to tell the difference between your “needs” and “wants.” This may sound easy, but it can be hard to do when your own wants make it hard to tell what’s necessary and what’s just for fun. For example, when you’re stressed or bored, a subscription to a streaming service might seem like a must-have, but when you look at your long-term goals, it’s clear that it’s a “want.”

How to Sort Your Expenses into Groups:

- Write down all of your costs: To begin, write down all of your monthly costs. Use a computer or a notebook. Put each item into a big group, like housing, transportation, food, entertainment, and personal care.

- Clearly define what “needs” are: Think about whether you really need to spend money on each item. Some common needs are:

- Housing: Rent or mortgage payments, property taxes, and necessary repairs.

- Utilities: Electricity, water, heating, and internet if you need them for work or school.

- Groceries: The basic foods you need to eat to stay healthy.

- Transportation: costs of getting to work, like car payments, gas, public transportation, or other costs.

- Insurance and Healthcare: Necessary medical costs and the costs of health, auto, or home insurance.

- For example: If you have to buy groceries instead of going out to eat, the groceries are a need and the restaurant is a want.

- Define “Wants” Without Feeling Bad: Wants are things you want that make your life better but aren’t necessary for you to live. These are:

- Fun things to do: going to the movies, concerts, eating out, and traveling.

- High-end goods: clothes, gadgets, and makeup from well-known brands.

- Subscription Services: Streaming services like Netflix or Spotify (if you don’t need them for work or school).

- Make Two Groups on Your Budget Spreadsheet: You can see where your money is going and where you might be able to save by color-coding or visually separating your “needs” from your “wants.”

- Take a look at it again every now and then: Things change in life, and something you thought you wanted a year ago might now be necessary. If you live in a remote area without public transportation, for instance, keeping a reliable car becomes a necessity. Check your categories often to see if you need to make any changes.

Things to Stay Away From:

- Expenses that overlap: Sometimes, it’s hard to tell if something is a want or a need. For example, cable TV might seem like a want, but if you need it to stay up to date on work news, it might be a need. If you’re not sure, think about your priorities and how this cost will help you reach your long-term goals.

- Spending for emotional reasons: Many people use small “needs” to make themselves feel better when they are stressed or overwhelmed. Know what these triggers are and give yourself some time to cool off before putting these costs back into your budget.

- Not doing regular reviews: If you don’t check your expenses often, you might keep putting some of them in the wrong category, which would mess up your whole budget.

Things to Do Today:

- Look back at the last 30 days: Look at your bank statements or digital receipts. Put each transaction into the categories of needs and wants.

- Make a list of what matters most: Write down what you want to do with your money in the next 6 to 12 months. This clarity will help you figure out if some of your costs really fit with your long-term goals.

- Use a notebook or a spreadsheet: Begin with the basics. Before adding more complicated tools, the goal is to get used to the process.

By clearly separating your needs from your wants, you set the stage for a successful budgeting plan. This process not only makes things clearer, but it also helps you keep track of where your money is going. Accept the honesty that comes with making a realistic budget, and you’ll see that small changes can make a big difference over time.

Tip #2: Use budgeting tools to keep track of your categories automatically.

Tracking your spending by hand can help you learn more about yourself, but in today’s digital age, automating the process can save you time and make mistakes less likely. There are a lot of easy-to-use budgeting tools that can help you keep track of your spending according to the 50/30/20 rule, which is a good thing. Apps like YNAB (You Need a Budget), Mint, PocketGuard, and even simple spreadsheets can be very helpful as you work on your finances.

Benefits of using budgeting tools:

- Automatic sorting: These apps link directly to your credit cards and bank accounts and automatically put transactions into categories that you set up ahead of time. You can keep track of your grocery, entertainment, and bill payments in real time with a quick setup.

- Dashboards that show pictures: Enjoy clear graphs, pie charts, and progress bars that show how well you’re sticking to your budget. Visual feedback not only encourages but also shows patterns or areas that need work.

- Personalization: The 50/30/20 rule gives you general categories, but many tools let you change the settings and make your own subcategories. Because of this flexibility, you can make the tool fit perfectly with your financial planning strategy.

- Notifications and Reminders: Many budgeting apps let you set alerts or reminders to let you know when you’re getting close to your spending limit in a certain category. This constant check-in helps you stay on track and avoid buying things on a whim.

How to Set Up Your Budgeting App in Steps:

- Pick the Right Tool: Figure out what you need. Mint might be perfect for you if you want a simple interface that keeps track of your transactions automatically. YNAB might be the best choice for you if you want to be more hands-on with your budgeting.

- Link Your Accounts: You just connect your bank and credit card accounts for most apps. This step lets the tool download your transaction history and sort your expenses into categories based on their descriptions.

- Set the limits of your budget: Put in your monthly income and use the 50/30/20 rule to figure out how much of it to spend:

- Needs: 50%

- Wants: 30%

- Savings and debt: 20%

- For example: If you make $3,000 a month, your budget would automatically set aside $1,500 for needs, $900 for wants, and $600 for savings and debt.

- Look over and change: Check the automated categorization as transactions come in. If there are a few mistakes, don’t worry. Most apps let you move a transaction to the right category.

- Check-Ins on a regular basis: Take some time each week or month to look over your spending. Use the visual dashboards to find areas where you are spending too much money and see patterns.

Things to Avoid Doing Wrong:

- Relying only on automation: Tools can be very helpful, but you still need to know how you spend your money. Regular manual checks make sure that the information stays accurate and useful.

- Not caring about data privacy: When you connect your bank accounts, make sure the app has strong security features. Before you buy, read the privacy policy and reviews from other users.

- Making Your Budget Too Complicated: The 50/30/20 rule is powerful because it is so easy to understand. Instead of adding too many subcategories that could confuse you, stick to the main ones.

Steps to Take Today:

- Get a budgeting app: Choose an app that meets your needs and connect your accounts. Take a look at what it can do.

- Set budget limits at first: According to the 50/30/20 rule, enter your income and set percentage limits. Check to see if the automatic categorization matches what you know about money.

- Set up a weekly budget review: Set up a recurring calendar event to check your dashboards and change the categories if you need to.

You can make what seems like a boring job easier by using technology. When technology does the hard work of keeping track of your money, simple budgeting tips work even better. Use these digital tools to free up your time so you can focus on what really matters: reaching your financial goals.

Tip #3: Change the Percentages for a Short Time if Necessary and Keep an Eye on Trends

There is no one-size-fits-all budgeting model, but the 50/30/20 rule is great because it can be changed to fit your needs. Life is full of surprises, like when your rent goes up suddenly, you have to pay for an unexpected medical bill, or your utility bills change with the seasons. This tip stresses how important it is to be flexible and reminds you that a 50/30/20 allocation is great, but changes are okay and sometimes even needed.

How to Understand Temporary Changes:

- When to Change: There will be times when you can’t stick to the 50/30/20 rule all the time. For example, if you have an unexpected cost, like a car repair or a medical emergency, it might be a good idea to put a little more than 50% of your money into “Needs” or even take a little bit out of your “Savings/Debt” category.

- Keeping an eye on trends: Don’t think of temporary changes as failures; think of them as ways to learn more about your spending habits and needs. Keep an eye on these changes to find problems that keep coming up. This could mean that your “standard” percentages need to be adjusted over time.

How to Change Your Budget Step by Step:

- Look at the situation: Look over your budget at the end of each month. If a category went over its limit, ask yourself:

- Was this a one-time thing or a problem that kept coming up?

- What made you spend too much?

- Write down the changes: Write down why you didn’t stick to the standard percentages in a simple log, like a spreadsheet, a journal, or a note in your budgeting app.

- For example: Write down that your “Needs” went up to 55% one month because of repairs you didn’t expect. This record will help you figure out if this change is only temporary or if you need to try something new.

- Look at your financial goals again: After recognizing the changes, change your goals if you need to. If your income changes because you work seasonally or as a freelancer, you might want to set a slightly different percentage for a short time (like 55/25/20 or 50/35/15) until things settle down.

- Plan for a Catch-Up: If you have to take money out of your savings because an expense was bigger than you thought it would be, make a plan to catch up. This could mean cutting back on “Wants” for a month to make sure you stay on track with your long-term savings goals.

- Tell others about your changes: Talking to a financial advisor or even a close friend about these short-term changes can be helpful. Getting an outside opinion can help you make sure that your changes are reasonable and not a sign of bigger financial problems.

Things You Shouldn’t Do:

- Giving yourself too many penalties: Managing money means making short-term changes. Don’t be hard on yourself for a short-term imbalance. Accept it, learn from it, and move on.

- Not Keeping Track of Changes: You could miss patterns that show you need to rethink your budgeting strategy if you change your percentages without keeping track of why.

- Not paying attention to long-term goals: It’s important to be flexible, but make sure that short-term changes don’t get in the way of your long-term financial goals. Always plan a way to get back to the 50/30/20 model once the immediate pressures go away.

Steps You Can Take Today:

- Look over the budget from last month: Make a note of any changes from the 50/30/20 percentages and write down the reasons in a separate log or journal.

- Make a Trend Tracker: Make a simple chart or spreadsheet that shows how much money you get each month and any problems that keep coming up.

- Make a plan for a “mini budget audit”: At the end of each month, do a quick audit to see if a temporary change is needed. If it is, write down how you’ll go back to the normal percentages in the next few months.

Being open to changing your budget not only lowers your stress levels, but it also helps you learn more about how you spend your money. Keep in mind that being consistent in how you act is more important than making sure every monthly budget is perfect. You can keep your budget useful instead of stressful by keeping an eye on trends and making small changes when necessary.

Tip #4: Put emergency savings and high-interest debt at the top of the 20% list.

The “20%” part of the 50/30/20 rule is all about your financial future. This includes both paying off debt and saving money, but it’s important to set your priorities straight in this area. The two main goals are to pay off high-interest debt and build up a strong emergency fund. In a few years, you’ll be glad you saved every dollar you could to protect yourself from unexpected costs or make high-interest loans less of a burden.

Breaking Down the 20% Group:

- Savings for emergencies: Things happen in life that you can’t plan for. Having an emergency fund can save your life in a medical emergency, a car breakdown, or losing your job. Financial experts often say that you should save up enough money to cover your living costs for at least three to six months. But if you’re just starting out, set a smaller, more achievable goal, like the first $1,000.

- Debt with High Interest: Credit card balances or loans with high interest rates can get out of hand very quickly. Putting some of that 20% toward paying off that debt quickly can lower the total amount of interest you pay over time, giving you more money to spend on your future goals.

A step-by-step plan for setting priorities:

- Start with a small amount: Start with a small goal. If you’re new to budgeting, make sure you pay the minimum on all of your debts and save up $500 to $1,000 for emergencies.

- Split and Conquer: After you have your first cushion, divide the 20% between savings and debt. You could try the debt snowball (paying off the smallest debt first) or the debt avalanche (paying off the debt with the highest interest first) to see which one works better for you.

- Set up automatic payments and savings: Set up automatic payments for your credit cards or loans and automatic transfers to your savings account. This way, you won’t want to spend the money you set aside for your future.

- Look at the interest rates: If you have debt, make a list of all of your debts and the interest rates on each one. Make it a priority to pay off the ones with the highest interest rates while still putting money into your emergency fund.

- Keep an eye on your progress: It’s very motivating to see your emergency fund grow or your debt go down. Use a digital tool or a personal finance journal to keep track of your progress. Celebrate small wins; every little bit helps you get closer to financial security.

Things to Avoid:

- Not Saving for Emergencies: When you have a lot of debt, it can be tempting to pay it off quickly, especially if you’re feeling the pressure of high interest. But if you don’t have a safety net, you might have to take on more debt in an emergency.

- Taking on too much debt to pay off: Paying off debt quickly is a good idea, but make sure you’re not giving up a healthy emergency fund. Keep a balanced approach that keeps you from being surprised by money issues in the future.

- Not paying attention to debts with low interest rates: It’s not always as important to pay off low-interest student loans or mortgages early. Pay off your high-interest debts first, and then use the extra money to save.

Things You Can Do Today:

- Look over your debts: Write down all of your debts and the interest rates on them. Find out which ones are costing you the most.

- Make a goal for your emergency fund: Set a reasonable goal for how much money you want to save for emergencies. If you’re new to this, start with $1,000.

- Make your finances automatic: Set up automatic transfers from your checking account to your savings account and payments on your highest-interest debt using your banking app or budgeting tool.

You can build a strong foundation for long-term financial stability by putting emergency savings and high-interest debt at the top of your 20% list. This balanced approach keeps you safe during hard times and also makes it possible for you to grow and invest in the future. You’re building the money habits that will help you in the future with every small goal you reach.

Tip #5: Every three months, look over and rebalance based on changes in your life.

A budget that doesn’t change with life rarely lasts. Regular reviews are important to make sure that your budgeting system still works, whether you get a raise, get a new job, move, or have to pay for something you didn’t expect. You can quickly adapt to changes and keep your financial goals in line with reality by getting into the habit of rebalancing your 50/30/20 allocation every three months.

How to Review Your Quarterly Budget:

- Make a Reminder on Your Calendar: Put “Budget Review Day” on your calendar for the first day of a new quarter. Take this appointment as seriously as you would a doctor’s appointment.

- Collect Financial Information: Get your monthly bank statements, receipts, and any digital records from your budgeting apps or tools. Look at how much you actually spent compared to how much you planned to spend.

- Look at changes in your life: Think about any changes in your income, expenses, or personal goals. Did you get a pay raise? Did your commute change because you got a new job? Have you made a big purchase or started paying for something on a regular basis that wasn’t in your original budget?

- Change the percentages: Change your percentages if you notice that one category always goes over budget and another is never used enough. If your “Wants” category is always going over the 30% mark because you eat out a lot, you might want to lower this percentage and move the money to your “Savings/Debt” category.

- Make new plans: Set short-term goals for the next three months during your quarterly review. Setting clear, achievable goals will keep you motivated and on track, whether you want to add to your emergency fund or cut back on extra costs.

Things You Shouldn’t Do:

- Not Reading Reviews: Life moves quickly, and if you don’t make a point of reviewing your budget every so often, it can quickly get out of sync with what you really need.

- Reacting emotionally: It’s important to be honest about how you spend your money, but don’t be too hard on yourself during these reviews. Take the chance to learn and get better instead of feeling down.

- Not making plans for the future: A quarterly review isn’t just about fixing mistakes from the past; it’s also about planning for the future. Make sure your review includes both looking at past performance and setting goals for the future.

What to Do Today:

- Make an appointment for your next review: Put three months from today on your calendar as the day you will look over your budget again.

- Make a Template for Reviews: Make a simple document or spreadsheet with parts for needs, wants, and savings and debt. Use this template every month so that you have all the information in one place when it’s time to review.

- Talk to a partner about: Set up a meeting to go over your finances with your partner or family members if you share them. Working together on your financial goals can help you stay accountable and get help.

Regular reviews every three months help you keep track of your money and make sure that your budgeting method changes with you. This routine not only helps you find problems early on, but it also keeps you motivated by showing you how far you’ve come over time. You can be more flexible and determined when life changes if you treat your budget like a living document.

The Case Study Section: “How This Rule Helped Me Save $10,000 in a Year”

Real-life stories of change can sometimes be the best source of inspiration. Take Alex, for example. He was a young professional who had a hard time keeping up with his growing bills even though he didn’t make a lot of money. Alex’s money often disappeared each month without him knowing where it was going. That changed when he learned about the 50/30/20 rule. This caused stress, a lot of credit card debt, and a savings account that wasn’t growing.

Everything changed when Alex agreed to the 50/30/20 rule. Alex was able to cut back on unnecessary spending by clearly defining “needs” and “wants” and using budgeting tools to keep track of every purchase. For instance, a subscription service that used to seem necessary was canceled, and eating out costs were kept down by planning meals at home. Alex slowly moved money from the “Wants” category to the “Savings/Debt” category.

Alex carefully looked over the budget every three months for a whole year, making sure that emergency savings and high-interest debts got the attention they needed. Alex was able to save an impressive $10,000 by always paying off debt and saving money. It wasn’t just the numbers that changed; it was a whole new way of thinking. Alex started to see each purchase as a step toward being financially free and safe in the long run.

Alex sums it up in a personal testimony box below: “The 50/30/20 rule changed my financial life. I went from feeling overwhelmed by my bills to actively working toward a future where I control my money, not the other way around.”

Alex’s story is a strong reminder that even small incomes can lead to big savings over time if you are disciplined, honest, and make changes regularly. This case study shows how a simple but effective budgeting plan can help you feel more in control of your money and achieve your goals.

Things You Shouldn’t Do When Using the 50/30/20 Rule

Even the best ways to budget can be hurt by common mistakes. Here are some common mistakes people make when they use the 50/30/20 rule:

- Putting Wants into the Needs Category: Many people wrongly think that discretionary spending is necessary in order to justify some costs. This mistake can throw off your budget, leaving you with less money for real needs or savings.

- Not remembering irregular costs: Costs like yearly subscriptions, car repairs, or gifts for the holidays often go unnoticed. If you don’t plan for these extra costs, you might not have enough money in some months.

- Using credit cards to buy things you don’t need: Using credit to pay for luxuries can cause you to get into more debt, which defeats the purpose of having a structured budget.

- Not Changing When Your Income Changes: If you get a raise, a bonus, or even a pay cut, a static budget can quickly become out of date. Regular reviews and rebalancing are very important.

Knowing about these problems and making plans to avoid them will help you use the 50/30/20 rule to feel more in control of your money instead of making you more stressed about it.

In conclusion

The 50/30/20 rule is a simple, flexible way for anyone to take charge of their money. You can get through even the toughest financial problems by dividing your after-tax income into 50% for needs, 30% for wants, and 20% for savings or debt. This budgeting system lets you keep track of your spending, adapt to the changes that life throws at you, and save for a better future.

As we’ve said in this post, you don’t have to change your whole life to follow the 50/30/20 rule. Instead, it’s about making small, planned changes, like better categorizing your expenses, using budgeting tools, making easy temporary changes, focusing on building a safety net and paying off high-interest debt, and regularly reviewing your progress to make sure you’re still on track with your goals.

Every little thing you do brings you closer to being financially secure. The path to financial freedom isn’t perfect; it’s made up of consistency, flexibility, and a promise to learn from both your successes and failures. You can start today, whether you’re a student just starting out, a young professional, or a family that wants to change how they spend their money. All you need is a notebook or a budgeting app.

Now is the best time to start using simple budgeting tips to change your financial life. Download our free budgeting spreadsheet or set up one of the suggested apps to take the first step. Then, promise to change your plan as your life changes. Your future self will be grateful for the clarity, discipline, and power that come from learning the 50/30/20 rule.

Section of Frequently Asked Questions

Here are some common questions that people have to help clear up any confusion and show you how to use the 50/30/20 rule in your own life:

- Is the 50/30/20 rule possible to follow if you make a minimum wage or low income? Yes, it is. The percentages are just a rough guide. If you don’t make a lot of money, your “Needs” category might take up more than 50% at first. If this happens, you might want to change your percentages for a short time and focus on cutting back on “Wants” that aren’t necessary so you can build an emergency fund and pay off your debt. The most important thing is to change the rule to fit your situation while keeping long-term financial stability in mind.

- Should I add taxes to the percentages I use to plan my budget? The framework is meant for income after taxes. Before you use the 50/30/20 rule, be sure to take out taxes and other payroll deductions. This makes sure that you are making a budget based on the money you really have to spend and save.

- What if my rent is more than half of what I make? In many cities or places with high costs of living, rent or other necessary costs may be more than 50% of income. In these situations, you could try changing the budget model by lowering the “Wants” percentage, or you could look for ways to lower your rent by making smart choices, like getting a roommate or moving. The goal is to be open to change while still working to save money and pay off debt.

- How do I keep track of my spending if I use cash? Keeping track of cash expenses can be hard, but it’s very important. Use a small notebook or a cash tracking app on your phone. As soon as you can, write down every cash purchase. You could also use budgeting apps that let you enter data by hand to get a full picture of your cash and digital transactions.

- Is it possible to use this rule to pay off debt faster? Of course. The 20% category is usually for both savings and paying off debt, but if your main goal is to get out of debt, you might want to move money from the “Wants” category or change the percentages for a short time. This focused approach can help you pay off your debts faster. Once the balances are lower, you can slowly go back to a balanced 50/30/20 approach.

Each of these questions brings up a problem that a lot of people have when they try to follow the rule. If you have to change these rules to fit your situation, don’t give up. The 50/30/20 rule and other financial planning tools are powerful because they are easy to understand and use. This makes budgeting easy for both beginners and experts.

Last Thoughts

Following the 50/30/20 rule is more than just using a formula; it’s about adopting a way of thinking that values balance, flexibility, and a clear focus on both the present and the future. You’re taking steps to get your finances back on track by figuring out what you need versus what you want, using digital tools, making temporary changes, putting necessities first in the savings/debt category, and reviewing your budget regularly.

It’s time to use these ideas now. These tips will help you save for a dream vacation, pay off a lot of debt, or just learn how to manage your money better. Begin with small steps, make changes as needed, and stay committed to the process. Being financially free isn’t just a dream; it’s possible if you work hard and are open to learning from every step of the way.

Thanks for taking the time to read this full guide on how to use the 50/30/20 rule the right way. Keep in mind that budgeting is a process, and every small step forward is a win. Follow these easy budgeting tips and let them help you build a better and more secure financial future.

You are setting yourself up for a life where your money works for you, not against you, by taking charge of your finances with these useful tips and steps. Happy budgeting, and here’s to your money success!

Stay tuned for our next posts, in which we will go into more detail about different ways to plan your money. If you want more tips, resources, or downloadable budgeting templates, please check back. You are just starting your journey to financial freedom. Keep learning, exploring, and growing.

Very great post. I simply stumbled upon your blog and wished

to say that I have really enjoyed surfing around your blog posts.

After all I will be subscribing in your feed and I’m hoping you write once more very soon!

Excellent article. I absolutely appreciate

this site. Continue the good work!