Inflation eats away at purchasing power, which means every dollar in your 401(k) must work harder to buy the same retirement lifestyle. The good news: you can design your plan to fight back. In this guide, you’ll learn nine practical, numbers-backed moves to help your savings keep pace with rising prices—without turning investing into a second job. If you’re building a nest egg, nearing retirement, or already drawing from your plan, you’ll find ways to reduce fee drag, optimize contributions, and build inflation-aware income. In one line: protecting a 401(k) from inflation means maximizing real (after-inflation) returns, lowering costs, and matching withdrawals to markets and rules.

This article is educational and not individualized financial, tax, or legal advice. Confirm plan rules and current limits with your provider and the IRS.

1. Max your contribution—and capture every employer dollar

The most reliable inflation hedge inside a 401(k) is surprisingly simple: save more, sooner, and never leave a match on the table. Every matched dollar is an instant, risk-free return that compounds for decades. For now, employees can defer up to $23,500 to a 401(k); those age 50+ can add a $7,500 catch-up, and savers age 60–63 get a special “super catch-up” of $11,250 (instead of $7,500) under SECURE 2.0. Total employer + employee “annual additions” can reach $70,000 (or more with catch-ups). If rising prices tempt you to pause contributions, remember that the match and tax advantages typically beat cash sitting idle. Auto-escalation—nudging your deferral up 1% each year—can get you to a combined 15%+ savings rate without friction.

1.1 Numbers & guardrails

- Employee deferral limit: $23,500.

- Age 50+ catch-up: $7,500.

- Age 60–63 “super catch-up”: $11,250.

- Employer + employee annual additions cap: $70,000 (excludes catch-ups).

- Many plans auto-enroll and auto-escalate by default starting in this year if newly established.

1.2 Quick steps

- Contribute at least to the full match—e.g., if your plan matches 50% of the first 6%, target ≥6%.

- Turn on auto-escalation (1% each year until you hit your target savings rate).

- If you’re 50+ (or 60–63), update your deferral to use the full catch-up.

- Check your plan’s payroll schedule—front-loading early in the year can miss match dollars in some plans.

Mini example: A saver earning $90,000 contributes 10% ($9,000) and gets a 4.6% average match (~$4,140). That’s $13,140 per year invested before any market growth—powerful compounding against inflation. Bankrate

Bottom line: In an inflationary world, disciplined contributions plus the full employer match give you the “head start” that markets alone can’t guarantee.

2. Keep an inflation-aware asset mix that can actually outpace prices

Asset allocation does the heavy lifting against inflation over long horizons. Equities historically offer the best chance of real (after-inflation) growth; high-quality bonds add stability; and inflation-linked bonds reduce surprise. The simplest way many savers achieve this is with target-date funds (TDFs), which automatically adjust stock/bond mix as you age. As of year-end 2024, 96% of Vanguard-recordkept plans offered TDFs and 84% of participants used them; 71% of TDF investors held a single fund—evidence that “set-and-adjust” design has gone mainstream. If your plan lacks a TDF or you prefer to build your own, aim for broad U.S. and international stock exposure paired with high-quality bonds, and add TIPS where offered.

2.1 How to do it

- Default smartly: Consider a low-cost TDF that matches your anticipated retirement year.

- DIY? Pair a total U.S. stock fund, a total international fund, and a core bond fund; add TIPS if available.

- Glide path check: As you near retirement, ensure your equity share tapers to a sleep-well level.

2.2 Common mistakes

- Chasing last year’s winners; ignoring fees; and mixing multiple TDFs with extra funds (dilutes the glide path).

Mini example: A 45-year-old with 70/30 stocks/bonds expects 2.5–3% inflation. If equities return 6–7% and bonds 3–4% over time, the blended portfolio can still target 3–4% real—ample room to outrun rising prices if costs stay low.

Bottom line: A diversified, low-cost allocation—often via a single TDF—keeps you positioned for real growth without constant tinkering.

3. Add TIPS for direct inflation protection (and keep duration sensible)

Treasury Inflation-Protected Securities (TIPS) are built to track CPI: their principal increases with inflation and decreases with deflation, while interest is paid on the adjusted principal. That means the real (inflation-adjusted) value of your bond is designed to hold up even when prices climb. In practice, TIPS funds can be a strong ballast alongside stocks, especially near and in retirement. Many 401(k)s offer TIPS index funds—check your lineup. If yours doesn’t, keep the idea in mind for IRAs. Pairing short-duration nominal bonds with TIPS can further reduce interest-rate sensitivity during inflation spikes.

3.1 Why it matters

- TIPS track CPI directly—unlike nominal bonds that lose real value when inflation surprises.

- They help stabilize withdrawal math because your “bond bucket” better preserves purchasing power.

3.2 Implementation tips

- Use a broad TIPS fund in the 401(k) if available.

- If building buckets, keep 1–3 years of spending in cash/ultrashort, 3–7 years in TIPS/short bonds, and the rest in growth assets.

- Revisit allocation annually and after big market moves.

Mini case: A retiree drawing $60,000/yr shifts 30% of fixed income to TIPS. During a year when CPI prints ~3% (12-month CPI-U +2.9%), their TIPS component adjusts upward, cushioning real spending.

Bottom line: When inflation is the enemy, TIPS help your safer assets fight on your behalf instead of quietly eroding.

4. Rebalance on schedule and crush fee drag

Inflation is hard enough—don’t let fees and drift do extra damage. Rebalancing nudges your portfolio back to target weights, selling what ran and buying what lagged, which systematically enforces “buy low, sell high.” Meanwhile, even a 1% all-in fee can devastate long-term growth. The U.S. Department of Labor shows that over 35 years, a 1% higher fee can cut your ending balance by about 28% (e.g., $227,000 vs. $163,000 on a $25,000 starting balance at a 7% gross return). That’s pure fee drag—not market risk. Favor index funds and watch plan admin charges; small percentages compound.

4.1 Mini-checklist

- Set a cadence: rebalance once or twice a year or when any major sleeve drifts 5–10% from target.

- Prefer low-cost core funds: total market stock/bond; TIPS index if available.

- Audit fees: review each fund’s expense ratio and the plan’s administrative fees annually.

4.2 Tools & examples

- Many recordkeepers let you auto-rebalance.

- Vanguard’s plan data shows widespread use of professionally-managed allocations (TDFs/managed accounts), which naturally rebalance.

Synthesis: Consistent rebalancing plus low fees preserves more of your return—exactly what you need when inflation takes a cut of purchasing power every year.

5. Use Roth vs. pre-tax strategically—now with easier RMD rules

Inflation and taxes interact. Higher nominal income and withdrawals can push you into higher brackets over time, so Roth contributions (tax now, tax-free later) can hedge future tax-rate risk. Since 2024, Roth 401(k) dollars are exempt from lifetime RMDs, aligning them with Roth IRAs. Traditional 401(k)s still face RMDs at age 73, though many workers can delay until retirement under the “still-working” exception. Choosing Roth vs. pre-tax starts with your current vs. expected future tax rate, but inflation nudges more savers to split contributions, especially earlier in careers.

5.1 How to decide

- Lower bracket now? Tilt to Roth.

- Higher bracket now? Pre-tax may win—revisit annually.

- Consider bracket-filling Roth conversions in low-income years before RMDs begin.

5.2 New catch-up wrinkle (watchlist)

- The SECURE 2.0 Roth-only catch-up for high earners (prior-year wages ≥$145,000) starts in 2026 per final IRS regulations. Ensure your plan offers a Roth feature. IRS

Mini example: A 40-year-old in the 22% bracket splits 401(k) savings 50/50 Roth/pre-tax. If later inflation pushes brackets up (or their real income rises), a tax-diversified nest egg gives flexibility to manage future taxes.

Bottom line: With Roth 401(k) RMDs eliminated, blending Roth and pre-tax has become an even more attractive way to future-proof against inflation-driven bracket creep.

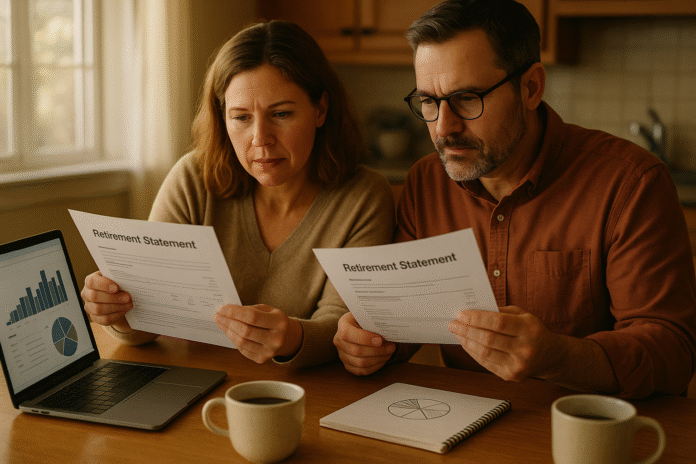

6. Build a flexible “retirement paycheck” to manage sequence-of-returns risk

Inflation often shows up alongside market volatility, and the worst time to sell stocks is after a drop—especially early in retirement. That timing danger is sequence-of-returns risk: poor returns in the first 5–10 years of withdrawals can permanently dent a portfolio. Research suggests flexible withdrawal rules beat rigid ones. Morningstar’s 2024 analysis pegs a baseline 3.7% starting withdrawal rate for a 30-year horizon using forward-looking returns; adjusting withdrawals with markets and inflation can improve outcomes. Pair that with a bucket approach—cash/short bonds for near-term spending, TIPS/cores for mid-term, stocks for long-term growth—and you can ride out rough patches without panic-selling.

6.1 How to do it

- Set buckets: 1–2 years spending in cash/ultrashort; 3–7 in high-quality/TIPS; the rest in diversified stocks.

- Adjust withdrawals: Consider a guardrail (e.g., trim 10% after a large down year; give yourself a raise after strong years).

- Inflation check: Base annual raises on CPI, but cap them if markets are weak.

6.2 Quick numeric example

- $1,000,000 portfolio starts at 3.7% = $37,000 first-year withdrawal.

- If markets drop 15% in year 1, reduce year-2 spending by 10% to $33,300 while your cash/TIPS buckets cover needs—letting stocks recover.

Synthesis: Flexible withdrawals—backstopped by cash and TIPS—turn inflation and volatility into manageable variables instead of portfolio killers.

7. Leverage Social Security’s inflation-adjusted income

Social Security is the largest, fully inflation-indexed annuity most retirees will ever own: benefits adjust annually via the CPI-W cost-of-living-adjustment (COLA). Delaying claiming (up to age 70) raises the permanent benefit, which in turn raises every future COLA on a higher base. In periods of above-trend inflation, that indexing can be a crucial hedge—especially if your portfolio is conservative. Coordinating claiming age with 401(k) withdrawals often improves the odds your savings last, because a larger inflation-protected check reduces sequence risk and the need to sell assets in down markets.

7.1 Why it matters

- COLA ties benefits to CPI-W—not the broader CPI-U—so increases can differ slightly from headline CPI.

- A higher starting benefit means larger dollar COLAs for life.

7.2 Practical steps

- Get your my Social Security estimate; test claiming at 62 vs. FRA vs. 70.

- Consider Roth conversions before claiming to manage brackets.

- Coordinate with a spouse: optimize survivor benefits by delaying the higher earner’s benefit.

Bottom line: Treat Social Security like an inflation-indexed bond in your plan—it’s foundational income that rises with prices and lowers pressure on your 401(k).

8. Add outside hedges: HSA dollars, I Bonds, and smart debt moves

Your 401(k) doesn’t exist in a vacuum. A Health Savings Account (HSA)—if you have a high-deductible health plan—offers triple tax advantages and can be invested for future healthcare costs, which often rise faster than CPI. Series I Savings Bonds (outside the 401(k)) also index to inflation and can add an extra layer of protection; individuals can buy up to $10,000 per calendar year electronically. Finally, consider how fixed-rate debt interacts with inflation: paying off high-rate debt is usually smart, but low-rate, fixed mortgages can be more manageable in an inflationary environment as wages and prices rise.

8.1 How I Bonds work (snapshot)

- Rate = fixed rate + inflation rate, reset each May/Nov; interest compounds and is state-tax-free.

- Lock-up: no redemption in first 12 months; 3-month interest penalty if redeemed within five years.

- Buy directly at TreasuryDirect.gov; consider them part of your safety bucket outside the plan. treasurydirect.gov

8.2 Mini-checklist

- Max HSA (if eligible) and invest excess after building a small cash buffer.

- Use I Bonds for near-to-mid-term inflation hedging.

- Refinance or accelerate payoff only when it materially improves your cash flow and risk.

Synthesis: Strategic moves outside the 401(k) strengthen your overall inflation defenses and can reduce pressure on plan withdrawals later.

9. Know the rule changes that can help—or trip you up

Rules shift, and inflation years tend to bring big policy updates. For now, the IRS increased 401(k) limits and set super catch-ups for ages 60–63; many new plans must include auto-enrollment starting in this year, boosting default savings. SECURE 2.0 also enabled student-loan matching (employers can match loan payments as if they were deferrals), and it raised the QLAC purchase limit to $210,000—a way to insure against late-life longevity risk (payments aren’t inflation-linked unless you choose an inflation rider, but they can stabilize a floor of income). High-earner Roth catch-ups start in 2026, so make sure your plan offers a Roth feature. Staying current prevents accidental misses that inflation would otherwise magnify.

9.1 Highlights to watch

- Limits: $23,500 deferral; $7,500 catch-up (50+); $11,250 super catch-up (60–63); $70,000 annual additions.

- Auto-enroll: generally required for newly established plans starting in the current year plan year.

- Student-loan match: effective for plan years beginning after 12/31/2023; guidance issued in Notice 2024-63.

- QLAC cap: $210,000.

- Roth catch-ups for high earners: commence 2026; get your Roth feature set.

9.2 Action steps

- Update deferral elections now to the new limits.

- Ask HR if your plan supports Roth, student-loan matching, and auto-escalation.

- If you want a late-life income floor, price QLACs through your plan or IRA provider. Fidelity

Bottom line: Policy tweaks can either accelerate or stall your inflation defense. A quick annual checklist keeps your plan aligned with the latest rules.

FAQs

1) What does “inflation-proofing” a 401(k) really mean?

It means designing contributions, investments, and withdrawal rules to preserve real (after-inflation) purchasing power. That includes saving enough to harness compounding, holding growth assets (equities) for long-term real returns, adding TIPS for direct CPI linkage, and keeping costs low. It also means coordinating Social Security and flexible withdrawals so you aren’t forced to sell in down markets when inflation is high.

2) How much should I be saving right now?

A widely cited target is ~15% of pay between you and your employer. Many plans auto-enroll and auto-escalate to help you get there, but confirm your match formula and make sure your own deferral reaches the full match at minimum. Adjust for your timeline, debt, and emergency fund. Catch-ups (50+ and 60–63) can accelerate progress when inflation is elevated. Fidelity

3) Are TIPS better than regular bonds if I’m worried about inflation?

TIPS are designed to adjust with CPI, so they directly protect purchasing power. Nominal bonds can lose real value when inflation surprises to the upside. In diversified portfolios, a blend—stocks, nominal bonds, and some TIPS—often balances growth and stability across cycles. Inside a 401(k), pick a TIPS fund if available; otherwise consider TIPS in an IRA.

4) What’s a realistic withdrawal rate now? Is the “4% rule” dead?

It’s not “dead,” but forward-looking research suggests ~3.7% is a more conservative starting rate for a 30-year horizon today, with better outcomes when withdrawals flex up/down based on markets and inflation. Using buckets (cash/short bonds, TIPS/core bonds, stocks) can help you stay invested while covering near-term spending.

5) Should I prioritize Roth or pre-tax contributions?

If you expect to be in a higher bracket later—or want tax diversification—Roth can be compelling, especially now that Roth 401(k) dollars have no lifetime RMDs. If your current tax rate is high, pre-tax contributions may still make sense. Many savers split contributions and revisit annually, factoring in inflation’s push on future brackets.

6) How do fees really affect me?

A lot. Over decades, even a 1% higher all-in fee can reduce your ending balance by ~28%, per the Department of Labor’s example. Prefer low-expense index funds and review plan admin fees every year. Small differences compound—especially when inflation already nibbles at returns.

7) Does Social Security fully protect me from inflation?

It helps a lot: benefits are indexed to CPI-W, so your check typically rises each year when prices do. But COLAs may not match your personal inflation basket (e.g., healthcare). Treat Social Security as an inflation-indexed income floor and invest the rest to grow above inflation.

8) Can I buy I Bonds in my 401(k)?

No—I Bonds are purchased outside employer plans at TreasuryDirect. They can still be part of your overall inflation hedge: you can buy up to $10,000 electronically per person per year, rates reset every six months, and interest is state-tax-free. Mind the 12-month lockup and potential early-redemption penalty.

9) What’s new for that I should act on?

Higher contribution limits ($23,500 deferral; $11,250 super catch-up for ages 60–63), broader use of auto-enrollment in new plans, and guidance enabling student-loan matches. Verify that your plan supports Roth, since high earners will need Roth catch-ups starting in 2026.

10) Do target-date funds work in high inflation?

TDFs can be effective because they diversify across stocks and bonds, rebalance automatically, and often include TIPS in the bond sleeve. Their widespread adoption—96% of plans offer them; 84% of participants use them—suggests they’re a practical “default” even through inflation cycles.

11) When do RMDs start, and does inflation change anything?

Traditional 401(k)s generally require RMDs at age 73, though you can often delay until you retire if you’re not a 5% owner. Inflation doesn’t change the start age, but it can affect the dollar amounts you withdraw and your tax bracket planning. Roth 401(k) dollars have no lifetime RMDs starting in 2024.

12) Should I consider an annuity in my 401(k) for inflation?

A QLAC can provide late-life income and reduce required withdrawals on the rest of your savings. The cap is $210,000. Note: payments aren’t automatically inflation-indexed unless you choose that feature (which may reduce the initial payout). If offered in-plan, get quotes and compare to your needs.

Conclusion

Inflation is a relentless opponent, but it’s not unbeatable. Inside your 401(k), the most durable defense is a combination of higher savings, sensible allocation, and lower costs—augmented by TIPS for direct CPI linkage and a flexible, rules-based withdrawal plan. Coordinating Social Security, Roth vs. pre-tax choices, and new SECURE 2.0 features gives you more levers to preserve purchasing power. And a few smart moves outside your plan—like HSAs and I Bonds—can reduce pressure on the portfolio when prices are running hot. The thread connecting all of this is discipline: automatic contributions, scheduled rebalancing, and annual check-ins on fees and rules. Do that, and inflation becomes a planning factor—not a derailment.

Next step: Increase your deferral to capture the full match, verify your limits, and check your lineup for a TIPS fund or a low-cost TDF—then set a calendar reminder to rebalance in six months.

References

- 401(k) limit increases to $23,500 IRA limit remains $7,000, Internal Revenue Service. https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000 IRS

- Notice 2024-80: Amounts Relating to Retirement Plans and IRAs, Internal Revenue Service. https://www.irs.gov/pub/irs-drop/n-24-80.pdf IRS

- Treasury Inflation-Protected Securities (TIPS), U.S. Treasury — TreasuryDirect. https://www.treasurydirect.gov/marketable-securities/tips/

- Consumer Price Index — August Summary, U.S. Bureau of Labor Statistics. Bureau of Labor Statistics

- Consumer Price Index Overview, U.S. Bureau of Labor Statistics. Bureau of Labor Statistics

- A Look at 401(k) Plan Fees, U.S. Department of Labor, EBSA (publication; example on fee impact). https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/401k-plan-fees.pdf DOL

- How America Saves, Vanguard. https://corporate.vanguard.com/content/dam/corp/research/pdf/how_america_saves_report_2025.pdf Vanguard

- Retirement plan and IRA required minimum distributions (RMDs) FAQs, Internal Revenue Service. IRS

- IRS urges many retirees to make required withdrawals… (RMD update noting Roth 401(k) RMD elimination), Internal Revenue Service (Dec. 10, 2024). IRS

- The State of Retirement Income 2024, Morningstar. assets.contentstack.io

- Retiring into a down market: How to make your savings last, T. Rowe Price. T. Rowe Price

- FAQs: Cost-of-Living Adjustment (COLA), Social Security Administration. https://www.ssa.gov/oact/COLA/colasummary.html

- Proposed regulations on mandatory automatic enrollment for new 401(k)/403(b) plans, Internal Revenue Service. IRS

- IRS Notice 2024-63: Student-loan matching contributions guidance, Internal Revenue Service. IRS

- User Guide: Purchase limits for electronic I and EE Savings Bonds, U.S. Treasury — TreasuryDirect. treasurydirect.gov