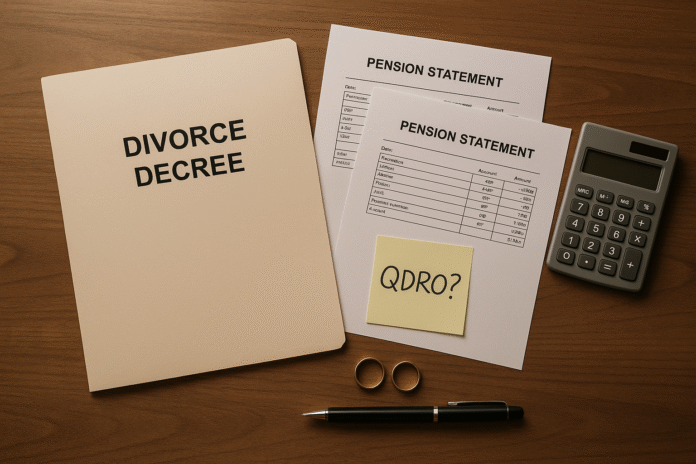

When a marriage ends, retirement money is often the largest asset on the table—and the rules to split it are not intuitive. This guide breaks down Divorce and pension benefits: QDROs explained into everyday language so you can protect what you’ve earned and avoid costly mistakes. It’s written for spouses, ex-spouses, and advisors who need a precise, step-by-step understanding. Quick definition: A Qualified Domestic Relations Order (QDRO) is a court order that directs an ERISA-governed retirement plan (like a 401(k) or a traditional corporate pension) to pay a portion of a participant’s benefit to an alternate payee (often the former spouse) as part of property division, support, or both. In short: without a QDRO, many plans legally can’t pay you.

Brief disclaimer: This is general education, not legal or tax advice. Plans and state laws differ; consult your attorney/tax professional and your plan administrator.

1. What a QDRO Is—and the Fastest Way to Know If You Need One

A QDRO is the only way most private employer retirement plans can pay benefits directly to an ex-spouse or dependent after divorce. If you’re dividing a 401(k), 403(b), 457(b) governmental plan sponsored by a private employer (or a corporate pension), you almost certainly need a QDRO to make the split happen and to ensure the plan recognizes the alternate payee’s rights. The order has to be approved by the court and then qualified by the plan administrator before any money moves. If you skip this step, the plan will continue to treat all assets and monthly payments as belonging solely to the participant, leaving the ex-spouse to chase payment privately—risky, slow, and often uncollectible.

1.1 Why it matters

- It converts a divorce agreement into directions the plan can actually follow.

- It locks in a share for the alternate payee, even if the participant later quits, retires, remarries, or dies (subject to survivor rules you specify).

- It can prevent “asset leakage” if markets move by capturing gains/losses from a chosen date.

- It can avoid the 10% early withdrawal penalty on certain distributions to the ex-spouse.

1.2 Quick diagnostic checklist

- Is the account a 401(k), 403(b) (private), or corporate pension? → Likely QDRO.

- Is it an IRA? → No QDRO; use a transfer incident to divorce.

- Government/military/federal pension? → QDRO-like order under separate rules.

- Do you want direct payment to the ex-spouse? → You need the order.

Synthesis: If the account is an ERISA plan and you want the plan to pay anyone other than the participant, a QDRO is your gateway—plan rules won’t budge without it.

2. Which Plans Use QDROs—and Which Don’t (IRAs, Military, Federal, PBGC)

QDROs apply to ERISA-governed plans—think employer 401(k)s, profit sharing, cash balance, and traditional defined benefit pensions at private employers. They do not apply to IRAs (traditional or Roth); an IRA split is done via a transfer incident to divorce under tax code §408(d)(6). Governmental plans and certain church plans are generally not under ERISA, but most have their own court-order frameworks: the Department of Defense (DFAS) for military retired pay (USFSPA), OPM for CSRS/FERS federal pensions (a “court order acceptable for processing”), and PBGC for pensions of terminated corporate plans it trustees. Each has unique forms, terminology, and survivorship rules.

2.1 Plan categories at a glance

- ERISA private plans (QDRO required): 401(k), 403(b) private-employer, profit sharing, cash balance, corporate DB pensions.

- Non-ERISA with special rules (QDRO-like): Military retired pay (DFAS), federal CSRS/FERS (OPM), some state/local plans.

- IRAs (no QDRO): Traditional or Roth IRA split by decree/separation agreement—title transfer, not plan payout.

2.2 Region-specific note

- Property division is state-law driven (equitable distribution vs. community property), but plan payment mechanics are federal (ERISA/Code) or agency-specific (DFAS/OPM/PBGC). Your decree splits the asset; the QDRO (or agency order) tells the plan how to pay.

Synthesis: Identify the plan type first. Apply the right tool—QDRO for ERISA, agency-specific orders for public/military/federal, and title transfer for IRAs.

3. Defined Contribution vs. Defined Benefit: Smart Ways to Divide Them

You divide defined contribution plans (401(k)/403(b)) by assigning a dollar amount or percentage (often with gains/losses from a valuation date to distribution). You divide defined benefit pensions (traditional annuities, cash balance nuances) by allocating a separate interest (an actuarial carve-out creating the ex-spouse’s own benefit) or a shared payment (ex-spouse receives a slice of what the participant receives when paid).

3.1 How to do it (DC plans)

- Choose a valuation date (e.g., date of separation, filing, or distribution).

- Direct the plan to include pro-rata investment gains/losses from that date.

- Clarify loans (include/exclude) and fees (who pays).

- Allow an immediate rollover to an IRA to preserve tax deferral.

3.2 How to do it (DB pensions)

- Separate interest: Ex-spouse’s annuity is calculated from the participant’s accrued benefit and actuarial factors; it can start at the alternate payee’s earliest retirement age under the plan.

- Shared payment: Payments only when the participant starts; alternate payee’s share rides along and ends when participant’s payment ends (watch survivor elections).

- Use a marital coverture fraction (marital service ÷ total service) to isolate the marital portion.

3.3 Mini example

- Defined benefit: Participant accrues $3,000/month at retirement; 15 marital years out of 25 total → coverture = 15/25 = 60%. Marital portion = $1,800. If parties split marital portion 50/50, alternate payee share = $900/month, adjusted per plan factors.

Synthesis: Pick the division method that fits the plan type and your timing goals. Separate interest gives independence; shared payment tracks the participant.

4. Valuation Dates, Gains/Losses, and Language that Protects You

The most common source of disputes is what date you measure the account and whether market changes count. For a 401(k), your order can say “50% of the account as of 6/30/2026 plus or minus investment gains/losses to the date of distribution.” That ensures neither side is unfairly harmed by market swings during processing. For pensions, the order should fix the accrued benefit at a stated date and apply a coverture fraction to the marital portion.

4.1 Numbers & guardrails

- Precision matters: Use one valuation date.

- Include gains/losses: Say “pro-rata investment earnings from [date] to distribution.”

- Avoid double counting: If you use a coverture fraction, don’t also cap with an unrelated percentage that contradicts it.

- Fees: Specify who pays plan QDRO review/processing fees.

4.2 Mini case

- A 401(k) worth $200,000 on separation is awarded 50% with gains/losses. Markets rise 7% before distribution. Alternate payee receives $100,000 × 1.07 = $107,000, preserving the economic deal.

Synthesis: Clear drafting on valuation and gains/losses prevents windfalls and protects the bargain you made in the decree.

5. Survivor Benefits: Protecting Payments if Someone Dies (Pre- and Post-Retirement)

If you’re dividing a pension, survivor elections are make-or-break. Without them, payments can stop at death and the alternate payee could get nothing. A solid order explicitly addresses QJSA/QPSA (qualified joint & survivor annuity and pre-retirement survivor annuity). With separate interest divisions, the alternate payee often doesn’t need the participant’s survivor election; with shared payment, you usually must secure a survivor percentage (e.g., 50% or 75%) so payments continue after the participant’s death.

5.1 What to include

- Pre-retirement survivor annuity (QPSA): Ensure the alternate payee is treated as surviving spouse for that benefit to avoid a wipeout if the participant dies before starting benefits.

- Post-retirement survivor annuity (QJSA): State the percentage and who pays the actuarial “cost.”

- Benefit maximums: Some systems cap survivor percentages (e.g., federal CSRS/FERS have statutory limits).

- Death-before-qualification: Require the plan to treat the order as effective if submitted before death, where permitted.

5.2 Mini checklist

- Identify survivor benefit type and percentage.

- State cost allocation (reduced monthly amounts).

- Clarify effect of remarriage where relevant (agency rules vary).

Synthesis: Survivor language turns a fragile right into a durable income stream—skip it and you may accidentally zero-out benefits.

6. Taxes, Rollovers, and the 10% Early-Withdrawal Penalty Exception

A QDRO doesn’t change who owes tax—it changes who receives the check. A cash distribution made to an alternate payee under a QDRO is taxed to the alternate payee, not the participant, and—critically—the 10% early withdrawal penalty generally does not apply to that alternate payee distribution. If the alternate payee rolls the distribution to an IRA or another qualified plan in a direct rollover, tax is deferred. For Roth 401(k) amounts, rollovers should go to a Roth IRA or designated Roth account to preserve tax character.

6.1 How to handle tax smartly

- Prefer a trustee-to-trustee transfer (direct rollover) to avoid withholding and preserve tax deferral.

- If cash is needed, know that the 10% penalty exception can apply to alternate payees—but income tax still applies to pre-tax funds.

- Confirm withholding with the plan; you may be able to adjust on your return.

- Mind basis and Roth components when splitting.

6.2 Practical example

- Alternate payee receives $60,000 from a pre-tax 401(k) via QDRO. A direct rollover to her IRA defers tax. If she takes $10,000 in cash for legal costs, she owes income tax on $10,000 but no 10% penalty as the QDRO alternate payee. The remaining $50,000 rolls over tax-deferred.

Synthesis: Use QDRO mechanics to avoid penalties and preserve tax deferral; a well-timed rollover keeps more of the money working for you.

7. Drafting Essentials: The Required Elements—and Why Pre-Approval Saves Time

Plans can only qualify an order that meets statutory content and plan-specific rules. Your order must include the participants’ and alternate payees’ names and last known addresses, the plan’s exact legal name, and the amount or percentage (or the method to compute it). It cannot require a form of benefit the plan doesn’t offer or exceed the participant’s accrued benefit. The fastest route is to request the plan’s QDRO procedures and model language and pursue administrator pre-review before submitting to the court.

7.1 Must-have elements

- Plan’s exact name (as in the Summary Plan Description).

- Participant and alternate payee identifying info (no full SSNs in public filings, use last four if required).

- Clear formula: amount/percentage, valuation date, gains/losses, loans/fees.

- Payment form (separate interest vs. shared payment) and survivor terms.

7.2 Common mistakes

- Naming the wrong plan or using generic “all plans” language.

- Omitting gains/losses language for DC plans.

- Forgetting survivor benefits on DB plans.

- Failing to submit for plan pre-approval, leading to re-drafts.

Synthesis: Draft to the statute and the plan’s playbook—pre-approval cuts weeks off and avoids costly do-overs.

8. Loans, Processing Fees, and Other Plan Mechanics You Shouldn’t Ignore

QDROs intersect with real-world plan mechanics: participant loans, administrative fees, blackout periods, and processing queues. Your order should state whether participant loans are included or excluded in the divisible balance; many plans subtract loan balances from the account’s fair market value when calculating the alternate payee’s share. Plans may charge $300–$1,000+ for QDRO review and processing—decide who pays. Some recordkeepers impose a segregation period while qualifying the order, during which trading is limited and earnings continue to accrue.

8.1 Mini-checklist

- Loans: Specify include/exclude and define how valued.

- Fees: Assign responsibility explicitly (participant, alternate payee, or split).

- Trading/Blackout: Acknowledge temporary restrictions; capture earnings to distribution.

- Multiple plans: Use one order per plan if required.

8.2 Numeric example

- Account: $180,000 with a $20,000 loan outstanding. If you exclude loans, the divisible balance is $180,000. If you include loans at face value, the divisible balance is $160,000, potentially reducing the alternate payee’s share substantially.

Synthesis: Name the moving parts in your order; ignoring loans/fees often shifts thousands of dollars unintentionally.

9. Timing, Segregation Rules, and What Happens If Someone Retires—or Dies—Before Qualification

Timing can be critical. Plans must segregate the amounts payable to an alternate payee for a period while they determine whether an order is qualified, protecting the money during review. Some divorces finalize without a QDRO; that’s risky. Regulations clarify that a domestic relations order may still be qualified after events like retirement or another order, but late drafting can complicate survivor rights or benefit forms already chosen. If the participant retires before the QDRO is in place and elects a single-life annuity, the alternate payee may lose survivor protection unless the order and plan allow a fix.

9.1 Practical guardrails

- Submit draft language to the plan before finalizing the divorce; incorporate feedback.

- Ask the administrator to segregate the disputed amount on receipt of the order.

- If the participant is near retirement, lock down survivor elections in the decree and the QDRO now.

- Confirm deadlines in the plan’s procedures to avoid lapses.

9.2 Mini case

- Participant retires and starts a single-life annuity. A later order tries to grant survivor benefits to the ex-spouse; the plan refuses because the form of benefit is irrevocable at annuity start. Result: no survivor income for the alternate payee.

Synthesis: Treat timing as strategy—early, coordinated drafting preserves options that can’t be recreated later.

10. Special Cases: PBGC-Trusteed Plans, Military Retired Pay, and Federal Pensions

When a corporate pension fails and PBGC takes over, PBGC must qualify domestic relations orders under ERISA and its policies. PBGC publishes model QDROs and guidance; benefits and survivor options may be limited by PBGC rules. Military retired pay is divided under the USFSPA; DFAS pays former spouses directly if the order meets statutory criteria, with formulas for hypothetical awards if divorce precedes retirement. Federal civil service pensions (CSRS/FERS) use an OPM “court order acceptable for processing”; language and survivor percentages are set by statute (e.g., up to 50% FERS, 55% CSRS survivor annuity caps).

10.1 Tools/Examples

- PBGC: Use PBGC’s model language for separate interest or shared payment and follow its submission checklist.

- DFAS (USFSPA): Orders can award a fixed dollar, percentage, or formula share of disposable retired pay; DFAS direct pay is prospective, not retroactive.

- OPM: No “QDRO”—use OPM’s accepted formats and apply within OPM’s timelines; survivor elections follow CSRS/FERS rules.

10.2 Region-specific notes

- State courts can divide military retired pay but must follow USFSPA limits; some elements (like VA disability offsets) have special treatment.

- Federal pensions require exact OPM language; QDRO jargon can cause rejection.

Synthesis: For PBGC, DFAS, and OPM, don’t recycle standard QDROs—download the agency’s guide and mirror it line-by-line.

11. A Practical, End-to-End Workflow (and What It Usually Costs/How Long It Takes)

The smoothest path is intentional: start with plan procedures, draft to the model language, and lock in valuation, gains/losses, and survivor terms. Coordinate attorney and, if needed, an actuary for pension valuations. Many couples spend a few hundred to a few thousand dollars on drafting/review; complex pensions can cost more. Timelines vary by plan and court, but expect multiple checkpoints: decree, draft order, plan pre-review, court entry, plan qualification, then payout/rollover.

11.1 Mini-checklist

- Inventory plans (get SPDs, procedures, and model QDRO language).

- Pick valuation dates, gains/losses, and address loans/fees.

- Choose division method (DC vs. DB, separate interest vs. shared).

- Hard-code survivor benefits and who bears cost.

- Send for plan pre-review, revise, then get the court’s signature.

- Submit to plan/agency, monitor for qualification, and complete rollover or start payments.

11.2 Tools & professionals

- Plan administrator/recordkeeper (procedures, forms).

- Actuary (DB pension present value, coverture fractions).

- Tax pro (rollover vs. cash, withholding).

- Attorney/QDRO specialist (drafting, agency-specific orders).

Synthesis: Treat the QDRO as a mini-project with a checklist—clear roles, precise language, and steady follow-up lead to faster approval and fewer surprises.

FAQs

1) What exactly does a QDRO do?

A QDRO instructs an ERISA plan to pay part of a participant’s retirement benefit to an alternate payee (typically an ex-spouse). It translates the divorce settlement into plan-ready directions and can secure survivor protections, capture gains/losses, and allow direct rollovers.

2) Do I need a QDRO to split an IRA?

No. IRAs (traditional or Roth) are not covered by ERISA’s QDRO rules. Instead, the divorce instrument directs a transfer incident to divorce, which changes ownership without triggering tax if done properly. Get the custodian’s transfer form and follow its process precisely.

3) Does the 10% early withdrawal penalty apply if I take cash as the alternate payee?

Generally, no—the QDRO exception lets an alternate payee take a distribution without the 10% penalty, though income tax still applies to pre-tax amounts. You can often avoid any immediate tax by doing a direct rollover to an IRA.

4) How are 401(k)s split—by dollar or percentage?

Either works. Most orders use a percentage as of a valuation date with gains/losses until distribution. That keeps market risk neutral for both sides while the order is processed.

5) What’s the difference between separate interest and shared payment for pensions?

Separate interest creates the alternate payee’s own benefit and may allow earlier commencement. Shared payment pays only when the participant is paid and ends when those payments end unless survivor benefits are elected. Survivor language is crucial in shared setups.

6) Can a QDRO be entered after the divorce is final—or after retirement?

Often yes, but late orders can limit options (e.g., you may not be able to add survivor benefits after annuity start). Plans must segregate amounts during qualification, but you’ll have fewer levers after key events. Act early.

7) Who pays QDRO fees?

Plans may charge review/processing fees (hundreds of dollars or more). Your order can assign who pays—participant, alternate payee, or split. Attorney/actuary fees are separate and negotiated.

8) How do military and federal pensions fit in?

They use agency-specific orders: DFAS for military retired pay (USFSPA), OPM for CSRS/FERS. These aren’t ERISA QDROs, and each agency has strict language and caps (e.g., statutory survivor percentages). Use the official guides and forms.

9) Will Social Security require a QDRO?

No. Social Security benefits are governed by federal law and don’t use QDROs. Some divorced spouses can claim benefits on an ex-spouse’s record if eligibility rules are met; that’s handled directly with the SSA.

10) What about Roth 401(k) money?

Roth 401(k) amounts keep their Roth character. Roll Roth amounts into a Roth IRA or another designated Roth account to avoid creating taxable income; early cash-outs can still tax earnings if not qualified.

11) How long does qualification take?

It varies—some plans turn reviews in weeks, others longer. Speed depends on how closely your draft follows the plan’s procedures, whether survivor and valuation terms are crystal-clear, and the court’s schedule. Pre-review with the administrator typically shortens the cycle.

Conclusion

Retirement money is too valuable—and too rule-bound—to wing it. A QDRO is the bridge between your divorce settlement and real dollars: it tells a plan exactly what to pay, when, and to whom. The most reliable path starts with identifying the plan type, then drafting to the plan’s procedures with precise valuation, gains/losses, and survivor terms. For pensions, decide early between separate interest and shared payment, and don’t leave survivor protections to chance. For taxes, use direct rollovers where possible and understand when the 10% penalty exception applies. Special systems—PBGC, DFAS, and OPM—require their own playbooks; mirror their language and timelines. If you approach the QDRO like a project, with the checklists above, you’ll convert a fragile right into a durable benefit stream.

Ready to move forward? Gather your plan procedures, pick your valuation date, and request a pre-review—then draft with confidence.

References

- QDROs: The Division of Retirement Benefits Through Qualified Domestic Relations Orders, U.S. Department of Labor (EBSA). DOL

- Retirement Topics – QDRO (Qualified Domestic Relations Order), Internal Revenue Service. IRS

- Retirement Topics – Exceptions to Tax on Early Distributions, Internal Revenue Service. IRS

- Publication 590-A (2024): Contributions to Individual Retirement Arrangements (IRAs) — Transfers Incident to Divorce, Internal Revenue Service, 2024. IRS

- Publication 504 (2024): Divorced or Separated Individuals, Internal Revenue Service, 2024. IRS

- 29 U.S.C. § 1056 (ERISA §206) – Form and Payment of Benefits, Legal Information Institute (Cornell Law School), current through 2024 compilation. Legal Information Institute

- Final Rule: Time and Order of Issuance of Domestic Relations Orders, U.S. Department of Labor (Federal Register), June 10, 2010. Federal Register

- Qualified Domestic Relations Orders and PBGC, Pension Benefit Guaranty Corporation. Pension Benefit Guaranty Corporation

- Qualified Domestic Relations Orders & PBGC (Booklet), Pension Benefit Guaranty Corporation. Pension Benefit Guaranty Corporation

- USFSPA – Court Orders & Former Spouse Payments (FAQs), Defense Finance and Accounting Service (DFAS). Defense Finance and Accounting Service

- Court-Ordered Retirement Benefits (CSRS/FERS), U.S. Office of Personnel Management. U.S. Office of Personnel Management

- Form SSA-2 – Apply for Spouse’s or Divorced Spouse’s Benefits, Social Security Administration. ssa.gov