Keeping track of your pension is simpler—and more powerful—than most people think. This guide shows how to track your pension in 10 practical steps using official statements and trusted online tools, whether your savings are in a workplace plan, personal pension, government program, or superannuation. It’s written for anyone who’s ever changed jobs, moved house, or just lost the thread on an old pot. Quick disclaimer: this is general education, not personalized financial advice; consider speaking to a regulated adviser for one-to-one recommendations.

In one line: Tracking your pension means regularly reading your statements and using official portals to verify balances, contributions, fees, and projected income—then fixing gaps early.

At a glance, the 10 steps: inventory every pot → turn on official portals → read your statements like a pro → check government pension forecasts → secure provider logins → trace and reclaim lost pots → decide if consolidating helps → model your future income → tidy records and credits → set a lightweight review routine and watch for dashboards.

1. Make an Inventory of Every Pension You’ve Ever Touched

Start by building a complete list of pensions you’ve had—no guesswork, no “I’ll remember later.” Write down each employer, the plan/provider, dates worked, and any member or policy numbers you can find. If you’re missing details (common!), track them down systematically: search old emails for “pension,” “401(k),” “super,” “provider,” and your former employer’s name; check old payslips for contributions; and scan your credit file for historic addresses that might connect to lost statements. If you worked in the UK and can’t remember a provider, use the Pension Tracing Service to find contact details; it won’t tell you the value, but it will tell you whom to call. In the US, look up the PBGC Missing Participants database and the DOL Abandoned Plan Search; in Canada, line up your My Service Canada account to see CPP/OAS context; and in Australia, your myGov → ATO view will reveal “lost” or ATO-held super. This first pass is about visibility: a clean map of all the places your retirement money could be.

1.1 Mini-checklist

- List every employer and dates; note job titles (helps providers identify you).

- Search inbox/drives for “statement,” “pension,” “401(k),” “superannuation,” “scheme.”

- Note provider names, policy/member numbers, and last known balances.

- Flag “unknown provider” items for tracing via official tools.

- Record addresses and name changes to help with identity matching.

1.2 Region notes

- UK: Use the official Find pension contact details service; it’s free and government-run.

- US: Try PBGC Find Unclaimed Retirement Benefits and the DOL Abandoned Plan Search to discover terminated or orphaned plans.

Bottom line: you can’t track what you haven’t listed—build the map first, then verify each entry.

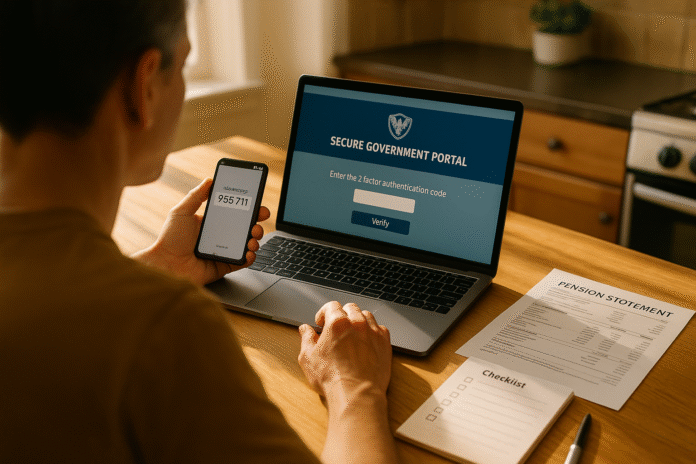

2. Turn On Your Official Government Portals (They’re Gold Mines)

The fastest way to keep tabs on entitlements is to activate your official government logins. In the UK, check your State Pension forecast (and NI record) online or via the HMRC app; the forecast shows how much you’re on track to get and when. In the US, create (or migrate to) a my Social Security account via Login.gov or ID.me to view your Social Security Statement and earnings record—mailed statements are now only routine for certain older workers, and online is the standard. In Canada, log into My Service Canada (MSCA) to view your CPP Statement of Contributions and estimated benefits. In Australia, use myGov → ATO online services to view and combine super, and to search for lost/ATO-held super. Always enable multi-factor authentication (2FA/MFA) on these accounts—most of these portals require or strongly encourage it.

2.1 How to do it (quick)

- UK: Check State Pension and NI record; the HMRC app also surfaces gaps.

- US: Create my Social Security with Login.gov/ID.me; view your Statement online. Social Security

- Canada: Use MSCA to see CPP contributions and estimates.

- Australia: In myGov open ATO online services to find and consolidate super.

2.2 Security guardrails

- Turn on MFA/2FA and add a backup factor (authenticator app or security key).

- Verify you’re on an official .gov domain before entering credentials.

Bottom line: your official portals are the single source of truth—switch them on, secure them, and check them first.

3. Read Your Pension Statements Like a Pro (and Know the Legal Rhythm)

Your annual or quarterly statements aren’t just paperwork; they’re your early-warning system. Make it a habit to download and read every statement, noting contributions, fees, investment mix, performance, and any changes to contact details or beneficiaries. In the US, the law sets a cadence: defined contribution plans that let you direct investments (most 401(k)s) must provide statements quarterly, others annually, and traditional defined benefit plans at least once every three years (with alternatives). In the UK, “simpler annual benefit statements” aim to standardize key information on one double-sided A4 sheet for auto-enrolment DC schemes—use that format to quickly check pot size, contributions, and projected income. Public service schemes publish statements annually by 31 August. The key is to compare this year’s statement to last year’s: if contributions dropped, fees rose, or data looks wrong, investigate now.

3.1 What to check, every time

- Contributions: employer + employee match; any missed months?

- Fees & charges: % and £/$; watch for increases affecting long-term growth.

- Investments: default fund vs. chosen funds; risk level vs. age/timeline.

- Projections/illustrations: the “income at retirement” figure and its assumptions.

- Personal data: address, email, beneficiaries—keep them current.

3.2 Common mistakes

- Ignoring statements because “it’s long”—the first page usually shows what matters.

- Letting outdated addresses persist—this is how pots go missing.

- Assuming projections are guarantees—they’re not.

Bottom line: statements are your dashboard today; read them, mark anomalies, and fix issues before they snowball. MaPS

4. Check Your Government Pension Forecast (State Pension, Social Security, CPP, Age Pension)

Government pensions form the backbone of many retirements, so give them the same discipline. In the UK, use Check your State Pension to see how much you could get and your earliest date; pair it with your NI record to spot gaps that may reduce your entitlement. In the US, your Social Security Statement shows lifetime earnings and benefit estimates at different claiming ages; it’s updated regularly in your online account (mailed to some 60+ non-online users). In Canada, your CPP Statement of Contributions details pensionable earnings and contributions; it feeds estimates in the Canadian Retirement Income Calculator. In Australia, the Moneysmart Retirement Planner models your expected income including super and potential Age Pension under current rules. Understanding these forecasts lets you set a realistic “floor” income and decide how much your private pensions need to add.

4.1 Why it matters

- Government pensions are inflation-linked in many systems—knowing the baseline helps you size your drawdown from private pots.

- Forecasts change if you fill contribution gaps, work longer, or defer claiming (country-specific rules apply).

4.2 Quick steps

- UK: View your forecast and NI record; note any recommendations to pay voluntary NI (if appropriate).

- US: Review your Social Security Statement and earnings history for errors.

- Canada: Download your CPP Statement of Contributions and run the CRIC.

- Australia: Use Moneysmart tools to project super + Age Pension. Moneysmart

Bottom line: your government forecast is the anchor—keep it current, and plan your private pensions around it.

5. Secure Your Provider Logins and Set Smart Alerts

Once portals are active, harden your defenses and automate your oversight. Turn on MFA for every pension provider login; add an authenticator app and a backup method in case you lose your phone. Use provider notifications to alert you when contributions land, fees change, or personal details are updated. Phishing is a real risk—official agencies stress not to click links in unexpected emails; instead, navigate directly to .gov addresses or your provider’s site. In the UK, the NCSC and Action Fraud advise forwarding suspicious messages and using 7726 to report scam texts; MoneyHelper and The Pensions Regulator publish scam warning lists and guidance. The US my Social Security program requires stronger sign-in via Login.gov or ID.me (as of now), underscoring the shift to verified identities for benefit portals. Social SecurityNCSCGOV.UK

5.1 Mini-checklist

- Turn on 2FA/MFA at every pension and government portal. Login.gov

- Add at least one backup factor (authenticator app or security key). Login.gov

- Bookmark official login pages; avoid email links. Social Security

- Enable contribution and profile-change alerts, if available.

- Keep provider contact details up to date (email, phone, address).

5.2 If you get a suspicious message

- Don’t click; report phishing to the official channels and your provider.

Bottom line: good security is part of good tracking—if crooks can’t get in, your future self will thank you.

6. Trace and Reclaim Lost or Missing Pots (Before They Go Cold)

Job changes and house moves cause pots to drift. Reclaim them now. In the UK, if you can’t remember a provider, the government’s Find pension contact details service will give you the right place to ask, and MoneyHelper outlines the tracing steps (list employers → find provider → contact provider). In the US, check the PBGC’s searchable databases for unclaimed benefits and the DOL Abandoned Plan search for terminated or orphaned plans; some states also list unclaimed property. In Australia, your ATO view shows lost or ATO-held super you can consolidate online via myGov. The sooner you trace, the easier it is; old addresses and dormant email accounts make verification harder with time. Keep your ID handy: providers often request certified copies for older policies.

6.1 Steps to follow

- Compile employer list and approximate dates.

- Use official tracing tools (gov sites first; avoid fee-charging “search” sites).

- Contact providers, verify identity, and request up-to-date statements.

- Ask about exit fees, guarantees, or special features before moving anything.

6.2 Mini case

You left a job in 2016 and moved twice. You can’t recall the scheme. The Pension Tracing Service gives you the provider’s current contact. They confirm a £12,000 pot. You update your address, switch on online access, and link alerts. A 15-minute trace prevents a pot from going lost for another decade.

Bottom line: tracing is mostly admin, not detective work—use the official tools and close the loop.

7. Decide Whether to Consolidate (Or Leave Pots Where They Are)

Consolidation can make tracking far easier—one login, one set of fees, one statement—but it’s not automatically best. If any pot includes valuable guarantees (e.g., defined benefits, guaranteed annuity rates, protected tax features, or employer-specific perks), think twice; you could lose benefits by moving. UK guidance explains when transferring DC pots is straightforward and when regulated advice may be needed, while Australia’s ATO/Moneysmart resources show how and when to consolidate super and what to check. If you do consolidate, choose a destination with transparent, low fees, diversified default investments, and strong tools/alerts. Document every transfer; keep before/after statements and letters in one folder (paper or digital).

7.1 Pros and cons

- Pros: fewer logins, easier oversight, potential lower fees, coherent asset mix.

- Cons: possible loss of guarantees, exit fees, transfer timing risk, admin hassle.

- Guardrail: never transfer a DB/final salary benefit without understanding trade-offs; many jurisdictions require advice.

7.2 Quick process

- Inventory features/fees → request transfer info → compare → move (or not).

- In Australia, consolidate inside myGov → ATO (it’s built in).

Bottom line: consolidate for clarity—unless a pot’s features make it worth keeping separate.

8. Model Your Future Income (And Stress-Test the Plan)

Forecasts turn tracking into action. Use trusted calculators—MoneyHelper’s Pension Calculator in the UK, SSA calculators in the US, CRIC in Canada, and Moneysmart in Australia—to test retirement ages, contribution rates, and investment assumptions. Start with today’s balances from your statements and portal data, then run scenarios: what if you increased contributions by 2%? What if you delayed retirement by two years? What if fees rose by 0.3%? Capture the results and pick a default plan plus a “stretch” plan. Re-run after each annual statement to catch drift and market changes; if rules or calculators update, that’s a natural recheck trigger.

8.1 Tools/Examples

- UK: MoneyHelper Pension Calculator; workplace contribution calculator.

- US: SSA Quick Calculator and Detailed/Online calculators. Social Security

- Canada: Canadian Retirement Income Calculator (CRIC). Canada.ca

- Australia: Moneysmart Super/Retirement calculators. Moneysmart

8.2 Numeric mini-example

- Today’s total pots: £180,000; contributions: 10% on £45,000 salary; fees: 0.6%.

- Increase contributions by +2% (to 12%) for 10 years → projected income +£220–£280/month (assumptions vary; check your local calculator).

- Lower fees by –0.2% via consolidation → +£24,000–£35,000 more over 25 years (fees compound—model it).

Bottom line: calculators turn “I think” into “I know”—make them part of your annual ritual. MaPS

9. Tidy the Admin: Beneficiaries, Addresses, and Contribution Credits

The unglamorous bits prevent heartbreak. Confirm beneficiary designations on every pot; marriages, divorces, and new children can make old choices wrong. Keep your postal/email addresses current everywhere to prevent pots going “lost.” In the UK, check your National Insurance (NI) record and follow official guidance on whether voluntary contributions would improve your State Pension; as of now, the special window to fill older gaps ended, and the default rule typically lets you pay for the past six tax years—always verify with HMRC before paying. In the US, make sure employer plans still list your current address and that your Social Security earnings history has no gaps or errors. Small admin tasks now close big holes later.

9.1 Quick fixes

- Update beneficiaries and emergency contacts on every plan.

- Update address/email/phone across providers and with tax/benefit agencies.

- UK: Check NI record; consider voluntary NI only if HMRC suggests it’s beneficial.

9.2 Paper trail

Keep PDFs of statements, transfer confirmations, and beneficiary updates in a clearly named folder (plus a secure cloud backup). It makes any future tracing or claims painless.

Bottom line: admin discipline is your insurance policy—future you will never regret it.

10. Set a Light Review Routine—and Watch for Dashboards

Tracking sticks when it’s scheduled. Create a simple rhythm: a 30-minute quarterly check for contributions/alerts and a 90-minute annual deep dive after statements and tax documents arrive. Keep a one-page tracker with each pot’s current balance, fees, and target mix. In the UK, keep an eye on the Pensions Dashboards Programme: as of now, providers are connecting in stages with a final connection deadline of 31 October 2026—public dashboards will let you see pension information in one place once the ecosystem opens. Until then, your own tracker is the next best thing. If your country launches a similar dashboard or lost-and-found tool (e.g., the US DOL’s Retirement Savings Lost & Found), add it to your routine.

10.1 Your repeatable routine

- Q1, Q2, Q3 (15–30 min): log in, confirm contributions and recent changes; glance at fund mix.

- Q4 (60–90 min): read every statement; update your spreadsheet; run calculators; set next year’s contribution rate.

- Watch official dashboard timelines and connect features when available. pensionsdashboardsprogramme.org.uk

Bottom line: a little structure beats great intentions—put tracking on autopilot, and you’ll stay on course.

FAQs

1) What does “tracking your pension” actually mean?

It means maintaining a current list of every pot, reading each statement, using official portals to verify balances and projections, and fixing gaps (missing contributions, wrong addresses, lost pots) promptly. It’s a repeatable routine, not a one-off chore, and it leans heavily on government and provider tools rather than spreadsheets alone.

2) How often should I read my statements?

Read every statement when it arrives. In the US, most participant-directed 401(k)s provide quarterly statements, while other plans provide them annually or every three years for certain DB plans. In other countries, expect at least annual statements. Use the first page for a quick triage, then compare to last year for trend changes.

3) Is there a safe way to find a lost pension or 401(k)?

Yes—start with official services. UK savers should use the Pension Tracing Service. US savers should search PBGC for unclaimed or missing participants and the DOL Abandoned Plan database for terminated plans. Australians can see lost super via myGov → ATO. These tools are free and government-run.

4) Should I consolidate multiple pensions into one?

Often—but not always. Consolidation simplifies tracking and can reduce fees, but you might give up valuable guarantees or protections. Before moving, read each statement’s small print and consult official guidance (e.g., UK MoneyHelper on transfers, ATO/Moneysmart for super). If in doubt, seek regulated advice. MaPSAustralian Taxation Office

5) Are pension dashboards available yet in the UK?

Not for the general public. As of now, schemes and providers are connecting in phases, with a legal final connection deadline of 31 October 2026. Public access is expected after broader connection; follow PDP and DWP updates.

6) How do I protect my accounts from scams?

Enable MFA/2FA on every portal, bookmark official .gov sites, and forward suspicious emails/texts to government phishing reporting services. UK guidance is clear on reporting and using 7726 for scam texts; the SSA also publishes security tips and requires Login.gov/ID.me for access.

7) What’s in a UK State Pension forecast or US Social Security Statement?

A UK forecast shows your estimated weekly amount and the earliest date, based on your NI record. A US Social Security Statement lists your lifetime earnings and projected benefits at different claiming ages. Both are available online and are core to your retirement income plan.

8) I’ve moved countries—how do I keep track?

Keep your home country’s government account active (e.g., HMRC app, my Social Security, MSCA, myGov) and update addresses in each provider portal. Many official tools work from abroad, but identity checks may take longer. Focus on government portals and official tracing services first. myGovGOV.UKSocial Security

9) Can topping up missing contributions help?

Sometimes. In the UK, HMRC guidance explains when voluntary NI fills gaps; as of now, the extended window to buy older years has ended and the standard rule generally limits top-ups to the past six tax years—check your NI record first to see if paying helps.

10) What calculators should I trust?

Prefer official tools: MoneyHelper’s Pension Calculator (UK), SSA calculators (US), the Canadian Retirement Income Calculator, and Australia’s Moneysmart tools. They’re transparent about assumptions and kept current with regulations.

11) Do statements include “lifetime income” projections?

In the US, ERISA now requires lifetime income illustrations on DC statements at least annually, translating your pot into an estimated monthly payment; the DOL explains the rules for these disclosures. Treat them as educational estimates, not guarantees. Federal Register

12) How will dashboards change tracking once live?

Dashboards should aggregate your pension information across providers in one secure view. UK regulators are moving providers onto the ecosystem now, prioritizing connection by Oct 2026. Until then, your best “dashboard” is a neat spreadsheet plus provider portals.

Conclusion

You don’t need perfect memory—or a filing cabinet the size of a fridge—to stay on top of your retirement. A simple, repeatable system works: list every pot, activate official portals, read your statements, and act on what you see. Use calculators to pressure-test your plan and adjust contributions, keep your details and beneficiaries current, and trace any strays via government tools before they go cold. Layer in basic security (MFA, bookmarks to official sites), and your tracking routine will hum along in the background while your money does the heavy lifting. As dashboards and lost-and-found tools mature, tracking will get even easier; you’ll already be ready to plug in.

If you do one thing today, make it this: activate your government portal and download your latest statement—then set your quarterly reminder. Your future self will be very glad you did.

CTA: Ready to begin? Open your official portal now, pull your latest statement, and tick off Step 1.

References

- Check your State Pension forecast, GOV.UK, n.d., GOV.UK

- Find pension contact details (Pension Tracing Service), GOV.UK, n.d., GOV.UK

- my Social Security – Create an account, Social Security Administration, n.d., Social Security

- Get Your Social Security Statement, Social Security Administration, n.d., Social Security

- Pension Benefit Statements—Lifetime Income Illustrations (Fact Sheet), U.S. Department of Labor (EBSA), Aug 18, 2020, DOL

- 29 U.S. Code § 1025 – Reporting of participant’s benefit rights, Cornell Law School Legal Information Institute, n.d., Legal Information Institute

- Statement of contributions to the Canada Pension Plan, Government of Canada, Canada.ca

- Managing your super (ATO online via myGov), myGov (Australia), myGov

- Keeping track of your super / Transferring or consolidating your super, Australian Taxation Office, Aug 2, 2023, Australian Taxation Office

- Statutory guidance: Simpler annual pension benefit statements, UK Department for Work and Pensions, Oct 19, 2021, GOV.UK

- Publishing annual benefit statements (Public service schemes), The Pensions Regulator, n.d., The Pensions Regulator

- Pensions dashboards: guidance on connection (staged timetable), GOV.UK, GOV.UK

- Connection deadline, UK Pensions Dashboards Programme, n.d., pensionsdashboardsprogramme.org.uk

- Find unclaimed retirement benefits (Search), Pension Benefit Guaranty Corporation, n.d., Pension Benefit Guaranty Corporation

- Abandoned Plan Search, U.S. Department of Labor (EBSA), n.d., DOL

- Pension calculator, MoneyHelper (Money and Pensions Service), n.d., MaPS

- How to spot a pension scam, MoneyHelper, n.d., MaPS

- Report internet scams and phishing, GOV.UK, n.d., GOV.UK

- Check your National Insurance record, GOV.UK, n.d., GOV.UK

- Voluntary National Insurance contributions – deadlines, GOV.UK, n.d., GOV.UK