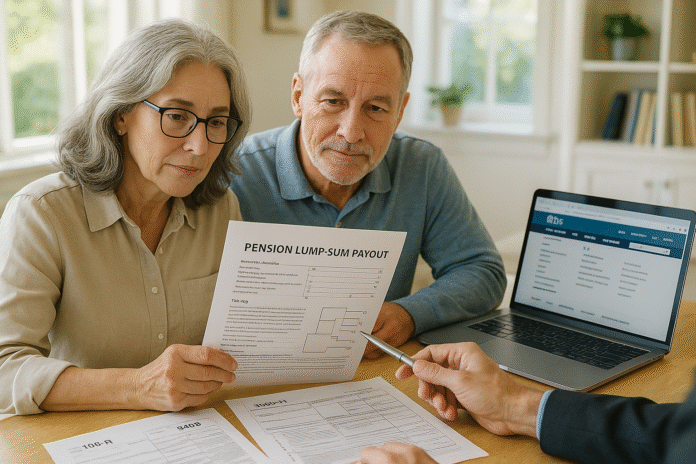

Choosing a lump-sum from a pension is one of those “measure twice, cut once” moments. This guide translates the tax rules into plain English and gives you a clear playbook to lower avoidable taxes and plan smart conversions. You’ll learn how to avoid mandatory withholding, spread income across brackets, decide when (and whether) to convert to Roth, and use tools like QLACs without tripping penalties. Quick answer up front: a lump-sum you take in cash is generally taxed as ordinary income in the year received, but a direct rollover to an IRA or another plan can defer taxes; timing and method are everything.

Fast path (skim list):

1) Elect a direct rollover, 2) Map your brackets and stagger conversions, 3) Decide Roth vs. traditional at the account level, 4) Consider a QLAC/annuity carve-out, 5) Mind early-withdrawal exceptions, 6) Watch Social Security & Medicare effects, 7) Use NUA only when employer stock is involved, 8) Plan state taxes and estimated payments, 9) Get the paperwork right (1099-R, 5498, 8606).

Brief, important note: This guide is educational and not individualized tax advice. Confirm specifics with a qualified tax professional before acting.

1. Elect a Direct Rollover (Not a Check to You)

A direct rollover sends your lump-sum straight from the pension plan to a traditional IRA or another eligible plan, deferring taxes and sidestepping the mandatory 20% withholding that applies when a check is paid to you. If you receive the money personally, the plan must withhold 20% federal tax, and you have just 60 days to redeposit the full amount (including the 20% withheld) to avoid taxation and potential penalties. The simplest way to avoid this scramble is to have the plan transfer the funds directly to the receiving IRA or plan—no stop at your bank account, no 20% haircut. If a check is used, make it payable to the new trustee (for your benefit), which is treated as a direct rollover and avoids withholding.

1.1 Why it matters

- Avoids forced withholding: Employer plan distributions paid to you trigger mandatory 20% federal withholding. Direct rollovers do not.

- Preserves full principal: You don’t have to “top up” the withheld 20% from cash on hand to keep the entire balance tax-deferred.

- Protects the 60-day deadline: Direct trustee-to-trustee moves remove the 60-day rollover risk entirely.

1.2 Mini example

You’re due a $300,000 lump-sum. If it’s paid to you, $60,000 is withheld and you receive $240,000. To defer taxes, you must deposit $300,000 into an IRA within 60 days—meaning you’d need to front the missing $60,000 from savings. A direct rollover avoids all of this.

Bottom line: Ask for a direct rollover (trustee-to-trustee). It’s the cleanest, safest route to preserve tax deferral and flexibility for later conversions.

2. Map Your Tax Brackets and Stagger Conversions Over Multiple Years

The single biggest lever after you secure a direct rollover is timing. Converting some or all of that traditional IRA to a Roth IRA can make sense—but how much, and when, determines the tax bill. A large, one-year conversion can push you into higher brackets, phaseouts, and Medicare premium surcharges; smaller, staged conversions (“fill the bracket”) can keep you within targeted marginal rates. As of now, required minimum distributions (RMDs) begin at age 73 for most taxpayers—converting earlier may reduce future RMDs and lifetime taxes. Conversions add to adjusted gross income but aren’t “investment income” for the NIIT (3.8% surtax) calculation—useful when planning around that 3.8% tax.

2.1 Numbers & guardrails

- Bracket targeting: Decide an annual “tax ceiling” (e.g., top of the 22% or 24% bracket) and convert only up to that line.

- RMD interaction: You cannot convert RMD amounts; in RMD years you must take the RMD first before converting any remainder.

- NIIT: Roth conversions increase AGI but do not count as net investment income for NIIT purposes.

- Once-per-year 60-day IRA rollover rule: This limit applies to IRA-to-IRA 60-day rollovers—not to direct trustee transfers and not to plan-to-IRA rollovers.

2.2 Mini case

Assume a married couple with $100,000 of other taxable income and a $400,000 IRA from a pension rollover. Converting $200,000 in one year might push them into higher brackets and trigger IRMAA two years later. Converting $50,000 x 4 years keeps them in a preferred bracket, lowers future RMDs, and reduces cumulative taxes across retirement. (See Section 6 for the IRMAA ripple.)

Bottom line: Pick a multi-year conversion plan aligned with your brackets and benefits. Don’t chase one-year “all-in” conversions unless the math truly favors it.

3. Decide Roth vs. Traditional IRA—Know the Five-Year Rule, RMD Rules, and Recharacterization Limits

Here’s the quick decision tree: funds in a traditional IRA grow tax-deferred with taxable RMDs later; a Roth IRA conversion creates a tax bill now but can produce tax-free qualified withdrawals later and no RMDs during your lifetime. The catch is the five-year rule for each conversion: withdrawing converted amounts within five years and before age 59½ can trigger a 10% penalty. Also, any RMD that is due cannot be converted to Roth—you must take it first. Since 2018, Roth conversions cannot be recharacterized (no “undo”). Understanding these mechanics reduces surprises and keeps your plan compliant.

3.1 How to do it

- Sequence in RMD years: Take the RMD first, then convert any remaining amount you choose.

- Five-year clocks: Each conversion has its own 5-year penalty clock for early withdrawals; track them separately.

- No recharacterization: Conversions on/after Jan 1, 2018 cannot be reversed. Commit with care. IRS

3.2 Mini example

You convert $60,000 to Roth at age 58. If you withdraw that $60,000 at age 60 (within five years), a 10% penalty applies to the converted amount unless an exception fits. Wait until both age 59½ and the conversion’s five-year clock, and the penalty disappears (earnings still need a qualified distribution to be tax-free).

Bottom line: Conversions can be powerful—but respect the five-year rule and RMD-first sequencing to avoid penalties and excess-contribution headaches.

4. Use a QLAC or Partial Annuity Carve-Out to Tame Future RMDs

If your aim is to flatten taxable income in your 70s and 80s, carving out part of your IRA to buy a Qualified Longevity Annuity Contract (QLAC) can help. The amount you allocate to a QLAC is excluded from your IRA balance used to calculate RMDs until payouts begin (often at or before age 85), reducing mandatory withdrawals in the meantime. Under SECURE 2.0 and subsequent guidance, the lifetime QLAC premium limit is indexed: it rose from $200,000 to $210,000. QLACs must meet strict IRS design rules (including specific contract features and reporting via Form 1098-Q), so shop carefully and compare insurer quotes.

4.1 Numbers & guardrails

- What it does: Excludes the QLAC’s value from RMD calculations until annuity start—lowering taxable RMDs in the interim.

- Limits: Indexed premium cap $210,000; 25% cap removed under SECURE 2.0.

- Due diligence: QLACs are irrevocable insurance; verify insurer strength and payout options (single/joint life, return of premium).

4.2 Mini case

From a $600,000 IRA, you allocate $150,000 to a QLAC at 69. Your RMDs at 73 are calculated on $450,000 (plus growth), not $600,000, trimming taxable income. Later, the QLAC income turns on, replacing some RMD income with annuity payments you budgeted for longevity risk.

Bottom line: For those prioritizing income smoothing and longevity insurance, a QLAC can be a targeted way to shrink near-term RMDs and control tax peaks.

5. Avoid Early-Withdrawal Penalties—Or Use Exceptions (Rule of 55, 72(t), and More)

Cash from a pension or IRA taken before 59½ can trigger a 10% additional tax unless an exception applies. Defined-benefit pensions and 401(k)-type plans have a key exception—the so-called Rule of 55—allowing penalty-free distributions if you separate from service in or after the year you turn 55 (age 50 for certain public safety employees). IRAs have their own set of exceptions; notably, Roth conversions themselves aren’t penalized, but the converted dollars are subject to the conversion five-year rule for penalty-free access before age 59½. When exceptions don’t fit, Substantially Equal Periodic Payments (72(t)) can create a penalty-free stream from IRAs with strict schedules.

5.1 Common exceptions to know

- Age 59½ or older: no early-distribution penalty.

- Separation from service at 55+ (qualified plans): plan-based exception; does not apply to IRAs.

- Disability, death, certain disasters, qualified births/adoptions, domestic abuse distributions, emergency personal expenses (as updated).

5.2 Mini checklist

- If under 59½ and still working, avoid cashing out the pension—roll over instead.

- If retired at 55–59, consider plan distributions under Rule of 55 before rolling to an IRA (the exception can be lost in the IRA).

- If liquidity is needed, evaluate 72(t) only with professional guidance.

Bottom line: Penalties are avoidable if you sequence correctly and know which plan vs. IRA exceptions fit your situation.

6. Coordinate With Social Security and Medicare (IRMAA) to Prevent Costly Surprises

Big conversions and one-time payouts raise MAGI, which can trigger the Income-Related Monthly Adjustment Amount (IRMAA) surcharges for Medicare Part B and Part D—applied using tax returns from two years prior. For now, the standard Part B premium is $185.00, and higher-income tiers pay more based on MAGI thresholds; if your current MAGI crosses a tier, you’ll feel the surcharge in 2027. You can appeal IRMAA after a qualifying life event using Form SSA-44. Conversions do not count as “net investment income” for NIIT, but they do count toward MAGI for IRMAA. Plan multi-year conversions to avoid hopping tiers.

6.1 How to keep premiums in check

- Bracket + IRMAA map: Run both tax brackets and IRMAA thresholds when sizing conversions.

- Use low-income years: Early retirement years before claiming Social Security often make prime conversion windows.

- QCDs at 70½+: If charitably inclined, Qualified Charitable Distributions can reduce IRA balances and satisfy RMDs without raising MAGI. IRS

6.2 Mini example

You plan a $120,000 conversion in 2026. That could push 2026 MAGI into a higher IRMAA tier, raising 2027 Medicare premiums. Spreading the conversion across 2026–2027 may keep you under a threshold and lower cumulative tax + premium costs.

Bottom line: Treat IRMAA like a cliff, not a slope; tier jumps are expensive. Align conversions with Social Security and Medicare timing.

7. Only Use NUA Rules If Employer Stock Is Involved (Often Not in Pensions)

“Net Unrealized Appreciation” (NUA) can be a powerful tax break only when your distribution includes employer stock from a qualified plan (e.g., 401(k)). Many defined-benefit pension lump sums don’t involve employer stock, so NUA often doesn’t apply. If it does, distributing employer shares to a taxable account can cause you to pay ordinary income tax only on the shares’ cost basis now; the NUA portion is taxed as long-term capital gains when you eventually sell, potentially at lower rates than ordinary income rates. NUA has strict eligibility, sequencing, and “triggering event” requirements—treat it as a special-case strategy when stock is present.

7.1 Tools/Examples

- When it fits: Significant employer stock with low basis in a 401(k) that you’re distributing after a triggering event (e.g., separation from service).

- When it doesn’t: Pure pension lump sums without employer stock—rollover rules apply, but NUA is typically irrelevant.

- Documentation: Your 1099-R should show NUA in Box 6 when applicable.

7.2 Mini case

$200,000 of employer stock with a $50,000 basis leaves the plan to a brokerage account under NUA. You pay ordinary tax on $50,000 this year; the $150,000 NUA is deferred and later taxed as long-term capital gains upon sale—versus taxing the entire $200,000 as ordinary income if you rolled it to an IRA and distributed later.

Bottom line: NUA is niche but valuable—use it only when employer stock is part of the distribution. Otherwise, it’s a distraction.

8. Don’t Ignore State Taxes and Estimated Payments (Safe Harbor Rules Help)

Even a perfectly managed federal plan can go sideways at the state level. Some states fully tax pension and IRA income; others offer exclusions or credits; a few have no income tax at all. If you take cash, convert large amounts, or have RMDs plus other income, plan for withholding or estimated tax to avoid penalties. The IRS “safe harbor” generally waives underpayment penalties if you pay at least 90% of the current year’s tax (or 100% of last year’s tax; 110% for higher-income filers). Coordinate state safe harbors too, which often rhyme with the federal rules but vary in details. For those moving or establishing domicile in a new state, track days, registrations, and filings meticulously.

8.1 Mini-checklist

- Update withholding: Ask the IRA custodian to withhold at a rate that fits your plan, or make quarterly estimates.

- Use safe harbors: Aim for the 90%/100%/110% federal thresholds to minimize penalty risk; mirror at the state level where applicable.

- Relocation: If you’re changing states, document ties (home, license, voter registration) and confirm how each state taxes pensions.

8.2 Quick example

You convert $120,000 mid-year and owe more than your paycheck withholding will cover. By making timely quarterly estimates to meet the safe harbor, you avoid underpayment penalties even if your final tax bill is large when you file. IRS

Bottom line: Cash and conversions change your pay-as-you-go obligations. Use safe harbors and state-specific rules so tax management doesn’t become a penalty story.

9. Get the Paperwork and Timelines Right (1099-R, 5498, 8606, 60-Day Waivers)

Paperwork proves intent—and saves headaches. Expect a Form 1099-R for any distribution (including Roth conversions) and a Form 5498 from the receiving IRA reporting rollovers/conversions. If you convert to a Roth or have nondeductible basis, file Form 8606 to track basis and avoid paying tax twice. If a 60-day rollover deadline is missed due to circumstances beyond your control, the IRS may grant a waiver, but it’s far better to avoid this with direct transfers. Keep confirmation letters, account statements, and any plan election forms for your records.

9.1 Quick checklist

- 1099-R codes & boxes: Verify distribution code, taxable amount, and Box 6 (NUA) if employer stock was involved.

- 5498 arrivals: Custodians issue Form 5498 in May showing rollovers and conversions—stash it with your return.

- 8606 basis: File Form 8606 in any year with nondeductible contributions or Roth conversions. IRS

- Missed 60-day window? Review self-certification or PLR options; see the IRS guidance on waivers.

9.2 Mini example

You roll a pension lump-sum directly to a traditional IRA in January. In May, your IRA custodian issues Form 5498 confirming the rollover. In August, you convert $40,000 to Roth; you’ll receive a 1099-R next January and should file Form 8606 with your return to record the conversion basis.

Bottom line: Clean paperwork is the backbone of clean taxes. Match 1099-R to 5498, file 8606 when needed, and prefer direct transfers to avoid 60-day drama.

FAQs

1) Are taxes on lump-sum pension payouts always due immediately?

No. If you elect a direct rollover to an IRA or another eligible plan, you defer income taxes; if the plan pays you directly, taxes are due on the taxable portion and employer plans must withhold 20% up front.

2) What’s the simplest way to avoid penalties on a lump sum before 59½?

Leave the money in a retirement account—do a direct rollover—and avoid cashing out. If you separated from service at 55 or later, a qualified plan might allow penalty-free withdrawals (Rule of 55), but this exception doesn’t carry over to IRAs.

3) Do Roth conversions trigger the 3.8% Net Investment Income Tax (NIIT)?

Conversions increase MAGI, but distributions from IRAs and qualified plans are not net investment income; NIIT applies to items like interest, dividends, and capital gains.

4) Can I convert my RMD to a Roth IRA?

No. In any year an RMD is due, you must take it first; RMD dollars themselves aren’t eligible for rollover or conversion. IRS

5) What is the five-year rule for Roth conversions?

Each conversion has its own five-year clock for penalty-free access if you’re under 59½. Withdraw before the clock and age threshold, and a 10% penalty can apply to the converted principal (exceptions may apply). IRS

6) How do QLACs reduce taxes?

A QLAC purchased within an IRA (or plan) is excluded from the balance used to calculate RMDs until its income begins, shrinking taxable RMDs during the deferral period. Limits are indexed; for now the cap is $210,000.

7) Is NUA relevant to pension lump sums?

Only if employer stock from a qualified plan is part of the distribution. Many pension lump sums don’t include employer stock. When NUA applies, the stock’s basis is taxed now and the appreciation is taxed as long-term capital gains when sold.

8) How do Medicare premiums (IRMAA) factor into conversion timing?

IRMAA tiers are based on MAGI from two years prior and can raise Part B and D premiums significantly. Model conversions against these tiers and note you can appeal after qualifying life events with Form SSA-44.

9) What if I miss the 60-day rollover deadline after taking a check?

The IRS may waive the 60-day rule in certain hardship circumstances, but relief isn’t guaranteed. Direct rollovers are safer. IRS

10) Which forms should I expect and keep?

Form 1099-R reports distributions (including conversions), Form 5498 confirms rollovers/conversions, and Form 8606 tracks nondeductible IRA basis and conversions on your tax return. Save plan election documents and transfer confirmations too.

Conclusion

A lump-sum pension payout doesn’t have to become a tax ambush. The key is sequencing: choose a direct rollover, then pace any Roth conversions to fill brackets without tripping IRMAA cliffs or penalties. Consider whether a QLAC or partial annuity carve-out supports your income and longevity goals. Be thoughtful about early-withdrawal exceptions, especially the plan-only Rule of 55, and resist the temptation to pull cash unless a clear exception fits. Coordinate federal and state tax planning by using withholding and estimated-tax safe harbors. Finally, keep your paperwork immaculate—1099-R, 5498, and 8606 tell the tax story you want the IRS to see. With a clear map and steady execution, you can turn a once-in-a-lifetime decision into a durable plan that lowers lifetime taxes and increases retirement flexibility.

Ready for next steps? Draft a one-page action plan: election type, target bracket, annual conversion amount, withholding/estimates, and a check on IRMAA—then execute.

References

- Publication 575: Pension and Annuity Income (2024) — IRS; discusses taxation of pension distributions, periodic vs. nonperiodic payments. IRS

- Rollovers of Retirement Plan and IRA Distributions — IRS page; mandatory 20% withholding; direct rollovers; 60-day rule; one-per-year IRA rollover. IRS

- Topic No. 413: Rollovers from Retirement Plans — IRS; direct rollover avoids 20% withholding. IRS

- Topic No. 558: Additional Tax on Early Distributions — IRS; 10% penalty, exceptions including separation at age 55+. IRS

- Exceptions to the 10% Early Distribution Tax — IRS; detailed list of plan and IRA exceptions. IRS

- Publication 590-B: Distributions from IRAs (2024) — IRS; five-year rules, early-distribution penalties, updates. PDF IRS

- Retirement Plan and IRA RMDs — FAQs — IRS; RMD age 73 and deadlines. IRS

- NIIT Q&As — IRS; distributions from certain qualified plans and IRAs are not Net Investment Income. https://www.irs.gov/newsroom/questions-and-answers-on-the-net-investment-income-tax IRS

- Form 4972 (2024): Tax on Lump-Sum Distributions — IRS; special 10-year averaging/capital gain election for certain older participants. IRS

- IRMAA Premiums — SSA; Part B standard premium and tiering by MAGI. Social Security

- Form SSA-44: Appeal to Lower IRMAA — SSA; two-year lookback and life-event appeal process. Social Security

- Form 1099-R & 5498 Instructions — IRS; reporting for distributions, conversions, and NUA box. IRS

- Estimated Taxes & Safe Harbor Rules — IRS; how to avoid underpayment penalties (90%/100%/110%). IRS

- Qualified Longevity Annuity Contracts (QLAC) — Form 1098-Q Instructions — IRS; RMD exclusion for QLACs. IRS

- Notice 2024-80 (Amounts Relating to Retirement Plans) — IRS; QLAC premium limit indexed to $210,000. IRS

- Topic No. 412: Lump-Sum Distributions (NUA) — IRS; how NUA works with employer securities. IRS