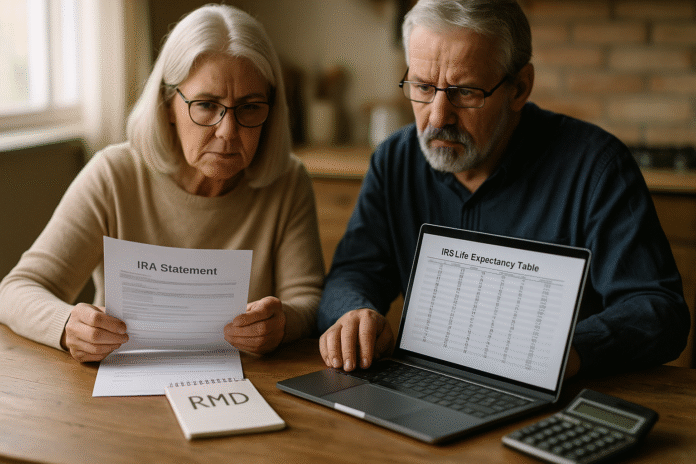

Traditional IRA Required Minimum Distributions (RMDs) are mandatory withdrawals from tax-deferred IRAs once you reach a specific “start age.” In plain terms, your annual RMD equals last year’s December 31 balance divided by an IRS life-expectancy factor. This guide walks through 12 rules that nail the “when” and “how much,” plus tax-smart tactics, penalties, and planning moves. It’s written for U.S. savers who hold traditional IRAs (including SEP and SIMPLE IRAs). This is educational information only—talk with a qualified tax or financial pro before acting.

Within the first few minutes, you’ll learn your RMD start age and exact deadlines, how to compute the amount using the Uniform Lifetime Table (or Joint Life table if your spouse is more than 10 years younger and sole beneficiary), and how to avoid penalties. You’ll also see practical strategies—QCDs, Roth conversions, and QLACs—that can trim taxes while keeping you compliant. If you’ve got multiple IRAs, inherited accounts, or complex beneficiaries, the steps and examples below will keep you out of trouble and in control.

1. Know Your Start Age and Deadlines—That’s Your “Required Beginning Date”

Your RMD starts at age 73 if you haven’t already started under earlier rules, and you must take your first IRA RMD by April 1 of the year after you turn 73. After that, you must take each year’s RMD by December 31. For people born 1960 or later, current law schedules the start age to rise to 75 in 2033; for those born 1951–1959, it’s 73. The very first deadline is often called your required beginning date (RBD). If you delay that first distribution until the following year (by April 1), remember you’ll also owe the second RMD by December 31 of that same year—two taxable withdrawals in one tax year, which can bump your bracket and affect Medicare IRMAA and Social Security taxation.

Why it matters: Missing an RMD triggers an excise tax on the shortfall. Under current law, the penalty is 25%, potentially reduced to 10% if you correct it within two years and file Form 5329 to request relief. Because the still-working exception is for workplace plans—not IRAs—you cannot delay a traditional IRA RMD just because you’re employed.

1.1 Dates & guardrails

- Start age: 73 now; 75 scheduled beginning 2033 (born 1960+).

- First IRA RMD deadline: April 1 of the year after you turn the start age.

- All later IRA RMDs: December 31 each year.

- Two-in-one-year trap: Delaying the first RMD means two distributions in that next year (April 1 and Dec 31).

- Still-working exception: Does not apply to IRAs (it’s for certain employer plans).

1.2 Mini-case

You turn 73 on September 10, 2026. Option A: take the first RMD anytime in 2026(keeps it in 2026 income). Option B: wait until April 1, 2026, but then you’ll also owe the 2027 RMD by Dec 31, 2027, stacking two RMDs into your 2026 income. For many, taking the first one smooths taxes.

Bottom line: Put your RBD on a calendar now and coordinate with your tax plan so you don’t trigger unnecessary brackets or IRMAA surcharges.

2. Calculate the Amount: Prior-Year 12/31 Balance ÷ IRS Life-Expectancy Factor

The RMD formula is simple: RMD = prior-year December 31 IRA balance ÷ your distribution period. For most IRA owners, you use the Uniform Lifetime Table. If your spouse is more than 10 years younger and is your sole beneficiary for the entire year, you use the Joint Life and Last Survivor Table, which results in smaller RMDs (a longer assumed payout). Your IRA custodian may estimate your RMD, but you are responsible for accuracy.

Key steps: Confirm your prior-year 12/31 balance(s), identify the correct IRS table, find your age-specific factor, and divide. If you did late-year rollovers or transfers that landed after January 1, you may need to adjust the 12/31 balance for outstanding rollovers to avoid under-withdrawing—this nuance trips people up.

2.1 How to do it

- Find the table:

- Most owners: Uniform Lifetime Table.

- Spouse >10 years younger and sole beneficiary: Joint Life table.

- Pull balances: Use each IRA’s 12/31 value from the prior tax year.

- Adjust if needed: Add outstanding rollovers/transfers that left one account late in the year and arrived after Jan 1.

- Compute: Balance ÷ factor = RMD. Round sensibly to the nearest dollar and withdraw at least that much.

2.2 Numbers & guardrails

- Sample factor snapshots from the Uniform Lifetime Table (distribution period): age 73 = 26.5, 74 = 25.5, 75 = 24.6.

- Example: You’re 73 in with a $500,000 12/31/2024 balance. $500,000 ÷ 26.5 = $18,868 (minimum).

- If spouse is 11 years younger and sole beneficiary, your Joint Life factor will be larger, lowering the RMD.

Close-out: Run the math annually; factors shift every year with your age and beneficiary status.

3. Multiple IRAs? You Can Aggregate the Amount—But Only Across IRAs

If you own multiple traditional IRAs (including SEP and SIMPLE IRAs), you must calculate an RMD for each account, but you may satisfy the total by taking the withdrawal(s) from one or any combination of your IRAs. That’s called aggregation. However, you cannot satisfy an IRA RMD from a 401(k) or vice versa; account types don’t mix for RMD purposes. Separately, Roth IRAs have no lifetime RMD for the original owner.

Why it matters: Consolidating where you take the cash can simplify logistics, minimize trading costs, or help with tax-lot planning (e.g., distributing highly appreciated shares in-kind from a single IRA).

3.1 Common mistakes

- Mixing account types: Trying to satisfy a 401(k) RMD using an IRA distribution (not allowed).

- Forgetting SEP/SIMPLE IRAs: They follow the same RMD rules as traditional IRAs and can be aggregated with them.

- Inherited IRAs: Do not aggregate inherited RMDs with your own IRAs; inherited accounts follow different rules.

3.2 Mini-checklist

- Compute each IRA’s RMD.

- Add them up.

- Decide from which IRA(s) to distribute.

- Keep records of which account(s) you used.

- Verify year-end 1099-R totals match your plan.

Close-out: Aggregate strategically within the IRA family only; never cross the boundary into employer plans.

4. Taxes, Withholding, Basis, and In-Kind Distributions: How RMD Dollars Are Treated

Traditional IRA RMDs are generally taxed as ordinary income at the federal level. You can ask your custodian to withhold federal and/or state taxes from the payout. If your IRA includes after-tax (nondeductible) contributions, your distributions are pro-rata: a portion is tax-free return of basis and the rest taxable. You track this basis on Form 8606. Distributions can be taken in cash or in-kind (e.g., transfer of shares); either way, the fair market value on the date of distribution counts toward the RMD and taxable income (subject to basis rules).

Why it matters: RMD income can increase your AGI, potentially nudging up Medicare IRMAA surcharges and the taxable portion of Social Security. Smart timing and techniques like QCDs can reduce AGI-related ripple effects.

4.1 Tools/Examples

- Form 8606 tracks nondeductible IRA basis and computes the pro-rata taxable share of distributions and conversions.

- 1099-R reports your IRA distributions; confirm coding and withholding.

- In-kind example: You transfer $20,000 of ETF shares to a taxable account to satisfy part of the RMD. The $20,000 FMV counts toward the RMD and is taxable (except any portion attributable to basis).

4.2 Common pitfalls

- Skipping Form 8606 when you have after-tax basis (can lead to double taxation).

- Forgetting state tax nuances (some states exempt all or part of retirement income).

- Assuming in-kind avoids tax (it doesn’t; it just avoids selling the holding).

Close-out: Plan RMD withholding alongside other income to avoid surprises next April—and keep your basis documentation bulletproof.

5. First-Year Timing Strategy: Take It This Year or Wait Until April 1?

When you reach the RMD start age, you can take the first RMD in that year or wait until April 1 of the next year. The math is identical; the difference is tax timing. If you delay, you’ll owe two RMDs in the next calendar year (first-year by April 1, second-year by December 31). That can push you into a higher bracket, increase IRMAA, and affect credits/deductions. If your income will drop next year (retire mid-year, business sale wraps up, etc.), delaying can make sense; otherwise, many choose to take it in the start year.

5.1 Compare scenarios (illustrative)

- Take in start year: income includes one RMD. 2026 includes one. Smoother AGI; potentially fewer IRMAA impacts.

- Delay to April 1: includes zero RMD. 2026 includes two—which could bump marginal rates or phaseouts.

5.2 Mini-checklist

- Forecast 2–3 years of income.

- Check IRMAA thresholds and Social Security taxation bands.

- Coordinate charitable plans (QCDs) and/or Roth conversions.

- Decide monthly, quarterly, or lump sum cadence.

Close-out: Timing isn’t about beating the system—it’s about smoothing your tax profile.

6. Missed an RMD? Fix It Fast and File for Penalty Relief

If you miss all or part of your RMD, correct it as soon as possible. Withdraw the shortfall, then file Form 5329 with your tax return. The statutory excise tax on the shortfall is 25%, but can drop to 10% if you correct within two years. You can also request a waiver for “reasonable error” if you promptly fix the mistake and explain the circumstances (e.g., illness, custodian error, disaster).

6.1 How to repair

- Calculate the missed amount plus any remaining RMD due this year.

- Withdraw the shortfall promptly (mark the distribution as a prior-year correction in your files).

- File Form 5329 and attach an explanation letter if requesting a waiver.

6.2 Common reasons accepted

- Documented custodian error or miscommunication.

- Health crises or incapacity.

- Demonstrable confusion after rollovers/asset transfers.

Close-out: Act quickly, keep documentation, and be thorough on Form 5329; timely correction dramatically improves outcomes.

7. Use Qualified Charitable Distributions (QCDs) to Cut Taxes (and Satisfy RMDs)

If you’re age 70½ or older, you can donate directly from your IRA to eligible charities via a Qualified Charitable Distribution (QCD). A QCD counts toward your RMD and is excluded from AGI (a powerful advantage versus taking the income and claiming a deduction). As of tax year, the annual QCD cap is $108,000 per person (indexed), and a one-time $54,000 QCD can fund certain life-income gifts (e.g., CGA/CRT). QCDs cannot go to donor-advised funds, private foundations, or most supporting organizations.

7.1 How to execute

- Confirm you’re 70½+ on the date of the transfer.

- Instruct your custodian to send funds directly to the charity; checks written to you generally don’t qualify.

- Keep the charity’s acknowledgment letter.

- Track your annual limit ($108,000).

7.2 Example

You owe a $18,000 RMD and plan to give anyway. You direct a $18,000 QCD to a 501(c)(3). Result: RMD satisfied, AGI unchanged by that $18,000, which can help with IRMAA and Social Security thresholds. You cannot also claim a charitable deduction for that same $18,000.

Close-out: If you give charitably and don’t need the cash, QCDs are one of the cleanest ways to meet RMDs tax-efficiently.

8. Special Spouse Rules: The “>10 Years Younger & Sole Beneficiary” Advantage

When your spouse is more than 10 years younger and the sole beneficiary of your IRA for the entire year, you must use the Joint Life and Last Survivor table instead of the Uniform table. Because this table assumes a longer combined lifespan, your factor is larger and your RMD is smaller. If beneficiary status changes mid-year (e.g., divorce, death), confirm the rules for the entire distribution calendar year.

Why it matters: The difference in divisors can be meaningful, especially for large balances. Keeping spousal beneficiary designations current—and understanding “sole beneficiary for the entire year”—protects the benefit.

8.1 How to do it

- Confirm sole beneficiary and age spacing (>10 years).

- Use the Joint Life table to find the factor at your age and your spouse’s age (both as of that tax year).

- Re-evaluate annually; beneficiary status is assessed each year.

8.2 Mini-case

Owner turns 75; spouse turns 64 and is sole beneficiary. The Joint Life factor (illustrative) may be around 25.3 rather than the Uniform table’s 24.6, lowering the RMD. On a $750,000 balance, that’s roughly $29,644 vs $30,488—modest yearly savings that compound over time.

Close-out: If you qualify, the Joint Life route is a built-in, IRS-approved way to slow RMDs.

9. Inherited IRAs at a Glance: The 10-Year Rule and Who Takes Annual RMDs

If you inherit a traditional IRA, your RMD rules depend on who you are and when the original owner died. Since 2020, most non-spouse designated beneficiaries must empty the account by December 31 of the 10th year after death. Some heirs—called Eligible Designated Beneficiaries (EDBs) (e.g., surviving spouse, minor child of the decedent, disabled/chronically ill individuals, certain close-in-age beneficiaries)—may stretch distributions over life expectancy. There has been evolving IRS guidance on whether annual RMDs are also required within the 10-year window when the decedent died on or after their RBD, so beneficiaries should check the latest rules and relief before year-end.

9.1 Key distinctions

- Spouse beneficiaries have multiple options (treat as own, remain beneficiary, or roll to inherited IRA)—each with different timing.

- Non-spouse beneficiaries: Typically the 10-year rule; annual RMDs may apply in some cases (especially when the decedent had begun RMDs).

- Successor beneficiaries: Often limited to the remainder of the original 10-year period.

9.2 Practical steps

- Identify date of death, whether the decedent was in RMD status, and your beneficiary class.

- Set up the inherited IRA title correctly.

- Use the Single Life table (if stretching) and track the 10-year deadline.

Close-out: Inherited IRA rules are nuanced; confirm your category and deadlines early each year to avoid penalties.

10. Conversions, Rollovers, and QLACs: What You Must Do Before Strategizing

In any year an RMD is due, you must take the RMD first before doing a Roth conversion or a 60-day rollover from an IRA. The RMD portion is not eligible to convert or roll over. For savers looking to lower future RMDs, two planning levers stand out: Roth conversions (often before RMD age, or after satisfying that year’s RMD) and qualified longevity annuity contracts (QLACs), which can defer income on a slice of IRA funds until as late as age 85. The QLAC premium cap is $210,000 (indexed), and the old 25% of account cap is gone.

10.1 Strategy menu

- Roth conversions: Consider in low-income or gap years; coordinate with brackets and IRMAA.

- QLACs: Exchange part of IRA into a QLAC to exclude that amount from RMD calculations until income begins.

- Direct transfers vs 60-day rollovers: Prefer trustee-to-trustee moves; the one-per-year rollover rule is a common trap.

10.2 Mini-case

You owe a $12,000 RMD and want to convert $50,000 to Roth. First, distribute (or QCD) the $12,000. Only after that can you convert the $50,000. Trying to convert first can cause excess-contribution problems in the Roth that require cleanup.

Close-out: Sequence matters—RMD first, then convert/roll.

11. Coordinating Accounts, Transfers, and In-Kind Moves Without Losing the Thread

Real life is messy—multiple custodians, transfers in flight, and asset moves can distort your 12/31 balances. If you did a distribution in the last 60 days of the year and rolled it over after January 1, or a trustee-to-trustee transfer that spanned New Year’s, you may need to adjust the prior-year balance for RMD purposes. Custodian RMD notices typically don’t include these adjustments; the IRS expects you to get this right.

11.1 Practical playbook

- Track late-year distributions and rollovers; add back any outstanding amounts to the 12/31 balance when computing the RMD.

- Prefer in-kind distributions when you don’t want to sell—record the FMV on the distribution date.

- Keep a single RMD worksheet that lists each IRA’s balance, factor, computed RMD, and where you satisfied it.

11.2 Tools/Examples

- Use IRS RMD worksheets (Uniform table and spouse-10-years-younger variants).

- Third-party RMD calculators (from major providers) are helpful, but verify with IRS factors.

- Example: You moved $100,000 out on December 20 and completed the rollover on January 5. Add $100,000 back to the 12/31 balance when calculating this year’s RMD.

Close-out: Paperwork discipline avoids under-withdrawing and penalty headaches.

12. Your Year-by-Year RMD Checklist (Simple, Repeatable, Stress-Free)

RMDs repeat every year, so build a cadence that meshes with taxes, investments, and philanthropy. The best systems are boring: a calendar block, a worksheet, and one or two strategic decisions decided early.

12.1 Mini-checklist (annual cycle)

- January–February: Pull 12/31 balances; confirm beneficiaries; decide monthly vs lump sum; map QCDs and any Roth conversion plans.

- March–June: If it’s your first RMD year, decide whether to take it now or delay to April 1 of next year; test tax outcomes both ways.

- July–September: Re-check income (brackets, IRMAA projections); adjust withholding; execute QCDs if using them.

- October–November: Confirm nothing is outstanding (rollovers, transfers, in-kind valuations); top up partial RMDs.

- December: Complete any remaining RMD by Dec 31; keep confirmations and the charity’s letters if doing QCDs.

12.2 Guardrails

- Never assume the custodian’s RMD estimate includes outstanding rollovers.

- If your spouse’s status or age spacing changes, re-evaluate the Joint Life eligibility for the entire year.

- If you miss something, correct quickly and file Form 5329 for relief.

Close-out: A simple annual ritual beats last-minute scrambles—your taxes (and blood pressure) will thank you.

FAQs

1) What exactly are Traditional IRA Required Minimum Distributions?

They’re mandatory withdrawals you must take from traditional, SEP, and SIMPLE IRAs each year after you reach the RMD start age (currently 73). Your annual RMD equals the prior-year 12/31 balance divided by an IRS life-expectancy factor. Missed amounts can trigger an excise tax, so calendar discipline is essential.

2) Do Roth IRAs have RMDs?

Not for the original owner—Roth IRAs have no lifetime RMDs. After death, beneficiaries of Roth IRAs are subject to post-death distribution rules (e.g., the 10-year rule for most non-spouse beneficiaries). Note: Roth accounts in employer plans also have no pre-death RMDs starting in 2024.

3) I’m still working—can I skip IRA RMDs?

No. The “still-working” exception can allow employer plans (like a current 401(k)) to delay RMDs if the plan permits and you’re not a 5% owner, but it doesn’t apply to IRAs. You must start IRA RMDs when the law says—even if you have a paycheck.

4) How do I handle multiple IRAs?

Compute each IRA’s RMD separately, then you may aggregate and take the total from one or any mix of your IRAs (including SEP/SIMPLE). You cannot use an IRA withdrawal to satisfy a 401(k) RMD. Keep a worksheet listing each account’s balance, factor, and distribution taken.

5) What if my IRA includes nondeductible (after-tax) contributions?

Your distributions are pro-rata between basis and pre-tax funds. Track basis on Form 8606 so you don’t pay tax twice. Example: If 10% of your total IRA value is basis, roughly 10% of each distribution is non-taxable, with the rest taxed as ordinary income.

6) Can I take my RMD in-kind rather than cash?

Yes. You can transfer shares or other assets in-kind to a taxable account. The FMV on the distribution date counts toward your RMD and is taxable (subject to basis). This can preserve your market exposure without selling.

7) If I miss an RMD, how bad is the penalty—and can it be waived?

The law imposes a 25% excise tax on the shortfall (potentially 10% if corrected within two years). Take the missed amount ASAP and file Form 5329. If the failure was due to reasonable error and you acted promptly, the IRS may waive the penalty.

8) What are QCDs and why do retirees love them?

A Qualified Charitable Distribution lets IRA owners 70½+ send funds directly to charities. It counts toward your RMD but doesn’t increase AGI, which can reduce IRMAA and other AGI-based effects. The cap is $108,000 per person, indexed for inflation. You can’t double-dip with a charitable deduction.

9) How do inherited IRA RMDs work now?

Most non-spouse beneficiaries must empty the account by year 10 after death. Some heirs (EDBs) may use life expectancy. Whether annual RMDs are required inside the 10-year period depends on factors like whether the decedent had begun RMDs; check current IRS guidance each year.

10) Can I convert to a Roth in an RMD year?

Yes—but only after you’ve satisfied that year’s IRA RMD. The RMD amount itself cannot be converted or rolled over. Many plan conversions in low-income years to reduce future RMDs and diversify tax buckets.

11) What about QLACs—do they really reduce RMDs?

A Qualified Longevity Annuity Contract can push income from part of your IRA out to as late as age 85, and the money allocated to a QLAC is excluded from RMD calculations until payouts begin. The premium cap is $210,000 for now (indexed). This is a specialized tool; compare costs, flexibility, and longevity risk coverage.

12) My IRA dipped after year-end. Can I recalc my RMD lower?

No. Your RMD is based on the prior-year 12/31 balance, regardless of subsequent market moves. You can manage how you take it (monthly, in-kind, etc.), but the computed total doesn’t change due to market fluctuation.

Conclusion

RMDs aren’t complicated once you break them into the 12 rules above: confirm your start age and deadlines, compute the amount using the right table, and coordinate where and how you take the money. The planning edge lives in the details: timing your first year, using QCDs to satisfy RMDs without raising AGI, leveraging Roth conversions (after satisfying the RMD) to lower future obligations, and considering QLACs if longevity insurance fits your plan. Keep tight records—especially around outstanding rollovers, in-kind transfers, and basis on Form 8606—and always revisit beneficiary designations, particularly if you might qualify for the Joint Life table.

With a simple annual checklist, you’ll meet the IRS rules and shape when and how the income hits your return. That’s the whole game: compliance without overpaying on taxes. If you want personalized help, sit down with a fiduciary advisor or tax pro and walk through your balances, brackets, and charitable goals.

Ready to take the next step? Build your one-page RMD plan for this year and set a calendar reminder to review it every January.

References

- Retirement Topics—Required Minimum Distributions (RMDs), Internal Revenue Service, updated examples and guidance. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

- Publication 590-B (2024): Distributions from Individual Retirement Arrangements (IRAs), Internal Revenue Service (PDF). https://www.irs.gov/pub/irs-pdf/p590b.pdf

- IRA FAQs—Distributions (Withdrawals), Internal Revenue Service. https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras-distributions-withdrawals

- RMD Comparison Chart (IRAs vs. Defined Contribution Plans), Internal Revenue Service. https://www.irs.gov/retirement-plans/rmd-comparison-chart-iras-vs-defined-contribution-plans

- Instructions for Form 5329 (Additional Taxes on Qualified Plans), Internal Revenue Service. https://www.irs.gov/instructions/i5329

- IRS Newsroom: Give More, Tax-Free—Eligible IRA Owners Can Donate up to $105,000 to Charity in 2024 (QCDs), Internal Revenue Service, Nov. 14, 2024. https://www.irs.gov/newsroom/give-more-tax-free-eligible-ira-owners-can-donate-up-to-105000-to-charity-in-2024

- Instructions for Form 8606 (Nondeductible IRAs), Internal Revenue Service (PDF). https://www.irs.gov/pub/irs-pdf/i8606.pdf

- Uniform Lifetime Table (Summary), Capital Group (reflecting IRS 2022+ table). https://www.capitalgroup.com/individual/service-and-support/rmd/how-to-calculate/irs-uniform-lifetime-table.html

- Required Minimum Distributions—What You Should Know, Charles Schwab, Dec. 13, 2024. https://www.schwab.com/learn/story/required-minimum-distributions-what-you-should-know

- IRS Newsroom: April 1 Final Day to Begin Required Withdrawals from IRAs and 401(k)s (deadline reminder & still-working exception for plans), Internal Revenue Service. https://www.irs.gov/newsroom/irs-reminds-retirees-april-1-final-day-to-begin-required-withdrawals-from-iras-and-401ks

- Notice 2024-80: Amounts Relating to Retirement (includes QLAC and other COLA adjustments; notes QLAC limit indexing to $210,000), Internal Revenue Service, Nov. 2024 (PDF). https://www.irs.gov/pub/irs-drop/n-24-80.pdf

- IRS RMD Worksheets (Uniform & Spouse-More-Than-10-Years-Younger), Internal Revenue Service. https://www.irs.gov/retirement-plans/plan-participant-employee/required-minimum-distribution-worksheets